Aroon indicator

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Aroon indicator ek technical analysis tool hai jo trend direction aur trend strength ko measure karne ke liye istemal hota hai. Ye indicator market volatility aur price movements ko analyze karke traders aur investors ko entry aur exit points identify karne mein madad karta hai. Yahan par Aroon indicator ke fayde aur nuksan ke baare mein kuch points hain: Fayde: 1. Trend Identification: Aroon indicator trend direction ko identify karne mein madad karta hai. Ye indicator uptrend, downtrend, ya sideway market conditions ko detect karne mein helpful hota hai. Isse traders ko trend ke saath trade karne aur trend changes ko capture karne mein help milti hai. 2. Entry and Exit Points: Aroon indicator price movements aur trend ke based par entry aur exit points identify karne mein madad karta hai. Jab Aroon Up line Aroon Down line ko cross karke upar jaata hai, tab ye bullish signal deta hai aur traders ko long position lene ka indication deta hai. Jab Aroon Down line Aroon Up line ko cross karke upar jaata hai, tab ye bearish signal deta hai aur traders ko short position lene ka indication deta hai. 3. Trend Strength: Aroon indicator trend strength ko measure karta hai. Isse traders ko pata chalta hai ki kis extent tak trend strong hai aur kis extent mein weak ho raha hai. Trend strength ke analysis se traders apne trading strategies ko refine kar sakte hain. 4. Divergence: Aroon indicator divergence spotting mein help karta hai. Agar price trend higher highs banata hai lekin Aroon indicator lower highs banata hai, ya agar price trend lower lows banata hai lekin Aroon indicator higher lows banata hai, tab ye divergence signal hai. Divergence traders ko trend reversal ka indication deta hai. Nuksan: 1. Lagging Indicator: Aroon indicator price movements ke based par calculations karta hai, isliye ye ek lagging indicator hai. Ye indicator trend changes ko confirm karta hai, lekin isse pehle trend reversal hone ki confirmation nahi mil sakti. Isliye, isko dusre leading indicators aur price action patterns ke saath combine karna important hai. 2. False Signals: Jaise ki har indicator, Aroon indicator bhi false signals generate kar sakta hai. Market volatility aur price fluctuations ke wajah se, ye indicator kabhi kabhi inaccurate signals bhi de sakta hai. Isliye, isko confirm karne ke liye dusre technical indicators aur analysis tools ka istemal karna zaroori hai. 3. Single Indicator Reliance: Aroon indicator ek tool hai aur ispar pura rely karna sahi nahi hota hai. Market mein hamesha risk hota hai aur kisi single indicator par depend karna advisable nahi hota hai. Isliye, Aroon indicator ko dusre technical analysis tools aur indicators ke saath istemal karke trading decisions lena important hai. Mujhe umeed hai ke aapko Aroon indicator ke fayde aur nuksan samajh mein aaye honge. Agar aapko aur koi sawal ho, toh aap pooch sakte hain. -

#3 Collapse

AROON INDICATOR IN FOREX TRADING INTRODUCTION Aroon indicator forex trading mein istemal hone wala aik technical indicator hai jo market trend ko samajhne aur trading decisions banana mein madadgar hota hai. Aroon indicator trend strength aur trend reversal ko identify karne mein madadgar hota hai. Aroon indicator ko tijarat karne mein istemal karne se pehle, iske do main components hote hain: Aroon Up aur Aroon Down. Yeh dono components 0 se 100 tak ke values mein hoti hain. AROON UP. Aroon Up market mein trend ki strength ko darust karta hai. Agar Aroon Up 100 ke qareeb hai, to yeh dikhata hai ke uptrend bohat strong hai. Isse traders ko samajh mein aata hai ke khareedari (buying) ki mumkin hai. AROON DOWN Aroon Down market mein trend ki kami ko darust karta hai. Agar Aroon Down 100 ke qareeb hai, to yeh dikhata hai ke downtrend bohat strong hai. Isse traders ko samajh mein aata hai ke farokht (selling) ki mumkin hai. TREND REVERSAL INTERPRETATION Aroon indicator aksar trend reversal ko pechanna mein madadgar hota hai. Jab Aroon Up Aroon Down se oper uth kar chala jata hai aur Aroon Down Aroon Up se oper uth kar chala jata hai, to yeh trend reversal ko indicate karta hai. Isse traders ko samajh mein aata hai ke market ka trend badal raha hai. Aroon indicator ek trader ki tijarat mein ek aur tool ho sakta hai jo market analysis mein madadgar hota hai. Lekin, iska istemal dosre indicators aur tijarat ki strategies ke saath karna zaroori hota hai. Hamesha yaad rahe ke kisi bhi indicator ki buniyad par tijarat na ki jaye, balke mukhlis tijarat ki strategy par amal kiya jaye. AROON INDICATOR TECHNICAL STRATEGIES Aroon indicator ko samajhdari se istemal karna mahatvapurn hai. Isse pehle isko demo account par istemal karke practice karein aur tijarat karne se pehle market ki tezi ya mandi ko samajhne ki koshish karein.Aroon Down market mein trend ki kami ko darust karta hai. Agar Aroon Down 100 ke qareeb hai, to yeh dikhata hai ke downtrend bohat strong hai. Isse traders ko samajh mein aata hai ke farokht (selling) ki mumkin hai. -

#4 Collapse

### Aroon Indicator: Ek Wazahat

Aroon Indicator ek technical analysis tool hai jo market ke trend ki strength aur direction ko samajhne ke liye istemal hota hai. Is indicator ko Tushar Chande ne 1995 mein introduce kiya tha, aur yeh traders ko bullish aur bearish trends ko identify karne mein madad karta hai. Aroon Indicator ka istemal khas tor par forex, stocks, aur commodities markets mein hota hai. Is post mein, hum Aroon Indicator ki buniyadi asal, kaam karne ka tareeqa, aur trading signals par nazar dalenge.

**Aroon Indicator Ka Concept**

Aroon Indicator do lines par mabni hota hai: Aroon Up aur Aroon Down. Aroon Up market ke highest points ko measure karta hai, jabke Aroon Down lowest points ko measure karta hai. Dono lines ko ek hi chart par plot kiya jata hai, jisse traders ko trend direction aur strength ka andaza hota hai.

1. **Aroon Up**: Yeh line market ke highest point ko dikhata hai aur yeh indicate karta hai ke kitne waqt se price apne highest point par hai.

2. **Aroon Down**: Yeh line market ke lowest point ko dikhata hai aur yeh indicate karta hai ke kitne waqt se price apne lowest point par hai.

**Indicator Ki Calculation**

Aroon Indicator ko calculate karne ka formula kuch is tarah hai:

- **Aroon Up** = [(N - Days since last High) / N] × 100

- **Aroon Down** = [(N - Days since last Low) / N] × 100

Yahan "N" ka matlab hai period ya time frame, jo aap analysis ke liye istemal kar rahe hain.

**Trading Signals**

1. **Bullish Signal**: Jab Aroon Up line 30 se upar hoti hai aur Aroon Down line 30 se neeche, to yeh bullish signal hota hai. Is waqt traders ko buy positions lene ka sochna chahiye.

2. **Bearish Signal**: Jab Aroon Down line 30 se upar hoti hai aur Aroon Up line 30 se neeche, to yeh bearish signal hota hai. Is waqt traders ko sell positions lene ka sochna chahiye.

**Market Sentiment**

Aroon Indicator market ke sentiment ko samajhne mein madad karta hai. Agar Aroon Up line continuously upar ja rahi hai, to iska matlab hai ke bullish momentum barh raha hai, jabke Aroon Down line ka upar jaana bearish momentum ki nishani hoti hai.

**Risk Management**

Risk management Aroon Indicator ka istemal karte waqt zaroori hai. Traders ko stop-loss orders ko recent swing high (bullish trades) ya swing low (bearish trades) ke aas paas rakhna chahiye. Yeh aapko unexpected market movements se bachata hai.

**Conclusion**

Aroon Indicator ek effective tool hai jo traders ko market ki trend strength aur direction samajhne mein madad karta hai. Is indicator ka sahi istemal karte hue, traders profitable trades le sakte hain. Hamesha risk management ka khayal rakhein aur comprehensive market analysis karte rahein taake behtar results hasil kar sakein.

-

#5 Collapse

Aroon Indicator

Aroon indicator ek technical analysis tool hai jo market trends aur momentum ko measure karne ke liye use hota hai. Yeh indicator khas taur par identify karta hai ke koi asset kitni der tak apne high ya low ke qareeb raha hai, aur is se traders ko trend reversals aur strength ko samajhne mein madad milti hai. Aroon indicator ko 1995 mein Tushar Chande ne introduce kiya tha, aur yeh market ke trend timing aur potential turning points ko detect karne ke liye ek popular tool ban gaya hai.Aroon indicator do main lines par mabni hota hai – Aroon Up aur Aroon Down. Aroon Up measure karta hai ke recent period mein asset ne apna highest high kab achieve kiya, jabke Aroon Down measure karta hai ke asset ne apna lowest low kab record kiya. Yeh dono lines ek specific period ke andar calculate ki jati hain, jo aam tor par 25 days ya 25 bars hota hai, lekin traders apne time frame ke hisaab se period adjust kar sakte hain. Aroon indicator ka mqsad yeh hai ke market ke trend ki shiddat aur direction ko samjha jaye aur potential reversals ko pehchana jaye.

Calculation Method

Aroon Up ko calculate karne ke liye, hum dekhte hain ke past specified period mein asset ne apna highest high kab achieve kiya. Formula ke mutabiq, Aroon Up value nikalne ke liye, yeh dekhte hain ke kitne periods guzray hain jab se highest high form hua. Is value ko percentage mein convert kiya jata hai. Isi tarah, Aroon Down ke liye, hum count karte hain ke kitne periods guzray hain jab se lowest low form hua hai. Formula dono ke liye yeh hota hai:

Aroon Up = [(Period - Number of periods since highest high) / Period] x 100

Aroon Down = [(Period - Number of periods since lowest low) / Period] x 100

In formulas se pata chalta hai ke agar Aroon Up 100 hai to asset ne bilkul recent period mein highest high achieve kiya hai, aur agar Aroon Down 100 hai to bilkul recent period mein lowest low achieve hua hai. Iss tarah se, in percentages ko dekh kar traders market ke momentum aur trend reversals ke bare mein andaza laga sakte hain.

Interpretation of Aroon Up and Aroon Down

Aroon Up aur Aroon Down ki values 0 se 100 ke darmiyan hoti hain. Agar Aroon Up ki value zyada hai, jaise 70 ya us se upar, to iska matlab hai ke asset ne apna recent high achieve kiya hai, jo ke bullish signal hota hai. Wahi, agar Aroon Down ki value zyada hai, jaise 70 ya us se upar, to yeh indicate karta hai ke asset ne apna recent low form kiya hai, jo ke bearish signal hai. Jab dono lines ek dusre ke qareeb ho, to iska matlab market mein consolidation ho rahi hai aur trend weak ho sakta hai. Agar Aroon Up aur Aroon Down ek dusre ko cross karte hain, to yeh potential reversal ya trend change ka signal ho sakta hai. Misal ke taur par, agar market downtrend mein hai aur Aroon Down high value show kar raha hai, lekin phir Aroon Up cross kar ke upar chala jata hai, to yeh indicate karta hai ke buyers market mein entry le rahe hain aur reversal ke chances barh sakte hain.

Using Aroon Indicator in Forex Trading

Forex market mein Aroon indicator ko use karke trend strength aur potential reversals ko identify kiya jata hai. Traders aksar Aroon indicator ko moving averages, oscillators jaise RSI ya MACD ke sath combine karte hain taake confirmation mile aur signal ki reliability barhe. Forex trading mein, agar Aroon Up continuously high values dikha raha hai, to yeh indicate karta hai ke market strong uptrend mein hai, aur aise mein long positions consider ki jati hain. Agar Aroon Down continuously high value dikha raha hai, to yeh indicate karta hai ke market downtrend mein hai, aur short positions par focus kiya jata hai. Aroon indicator, timeframes ke hisaab se adjust kiya ja sakta hai, is liye aap scalping se le kar swing trading tak har style mein is ka istemal kar sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi indicator ki tarah, Aroon indicator bhi false signals de sakta hai, is liye additional confirmation tools ka istemal zaroori hai.

Advantages of Aroon Indicator

Aroon indicator ka sab se bara faida yeh hai ke yeh trend ki shiddat aur timing ko clearly measure karta hai. Is se aap ko pata chal jata hai ke market mein bullish momentum ya bearish momentum kitna hai. Yeh indicator beginners ke liye bhi samajhna asaan hai kyun ke iska concept simple hai – recent high aur low ko dekhna. Iske ilawa, Aroon indicator flexible hai aur different timeframes mein apply kiya ja sakta hai, jo har tarah ke traders ke liye mufeed hai. Jab aap multiple indicators ke sath combine karte hain, to Aroon indicator aapko additional confirmation provide karta hai jo aap ke overall strategy ko mazboot banata hai. Yeh indicator market ke cycles ko behtar samajhne mein madad karta hai aur aap ko timely entry aur exit points suggest karta hai.

Disadvantages of Aroon Indicator

Har indicator ki tarah, Aroon indicator ke kuch nuqsanat bhi hain. Sab se pehla nuqsan yeh hai ke yeh indicator price ke trend ko piche se dekh kar calculate karta hai, is liye kabhi kabhi late signals de sakta hai. Agar market suddenly reverse ho jaye, to Aroon indicator thoda late respond karta hai. Dusra, market mein sideways ya non-trending conditions ke dauran yeh indicator false signals generate kar sakta hai, jis se trader confuse ho sakte hain. Aroon indicator ko sirf ek independent tool ke taur par use karna risk barha sakta hai, is liye hamesha additional technical analysis tools ke sath combine karna chahiye. Is ke ilawa, parameter settings jaise period length trader ke analysis par bohat asar daalte hain, aur sahi period ka intekhab karna zaroori hai taake indicator ki accuracy barh sake.

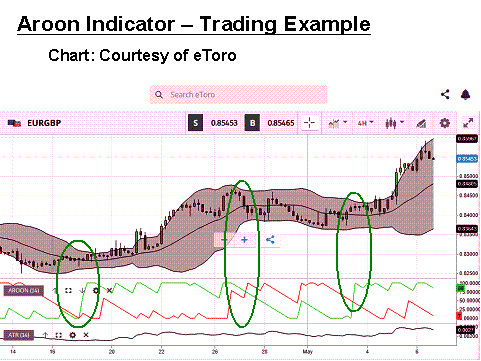

Practical Example of Aroon Indicator

Maan lijiye aap EUR/USD pair ka chart dekh rahe hain aur aapne 25-period Aroon indicator apply kiya hai. Agar aap dekhte hain ke Aroon Up 80 ya us se zyada value par hai aur Aroon Down 20 ya us se kam, to yeh indicate karta hai ke market strong uptrend mein hai. Is surat mein aap long positions consider kar sakte hain. Agar market mein trend reversal ke signals dikhai den, jaise Aroon Down value barhna shuru ho jati hai aur Aroon Up decline karne lagta hai, to yeh aap ko signal deta hai ke reversal hone ka imkaan hai, jis se aap apni position adjust ya exit kar sakte hain. Isi tarah, agar aap short term trading ya scalping kar rahe hain to aap lower timeframes, jaise 15-minute ya 30-minute charts par bhi Aroon indicator ka istemal kar sakte hain. Aroon indicator ko aur behtar interpret karne ke liye, aap support aur resistance levels, trendlines, aur additional oscillators ka bhi sahara le sakte hain.

Tips for Using Aroon Indicator Effectively

Aroon indicator ko effective tareeke se use karne ke liye kuch tips yaad rakhain. Pehla, hamesha multiple timeframes par analysis karein taake market ke trend ka overall perspective mil sake. Dusra, Aroon indicator ko dusre indicators jaise moving averages ya RSI ke sath combine karain taake false signals se bach sakein. Teesra, market ke overall context ko nazar mein rakhein – agar market sideways chal rahi ho, to Aroon indicator ke signals utne reliable nahi honge. Chautha, backtesting aur demo trading se apni strategy ko test karain taake aap samajh saken ke Aroon indicator aapke specific trading style ke liye kitna mufeed hai. Aur aakhri tip yeh ke position sizing aur risk management ko hamesha priority dein, kyun ke har indicator ke sath uncertainty rehti hai.

Aroon indicator ek powerful tool hai jo market ke trend strength aur timing ko measure karta hai. Yeh indicator, jo ke do main lines – Aroon Up aur Aroon Down – par mabni hai, aap ko batata hai ke asset ne apna recent high ya low kab achieve kiya hai. Aroon indicator ke zariye aap market ke bullish aur bearish momentum ko asani se pehchan sakte hain aur timely trading decisions le sakte hain. Lekin, is tool ke sath sath additional confirmation aur risk management techniques ko adopt karna bohat zaroori hai. Har indicator ki tarah, Aroon indicator bhi kuch limitations rakhta hai, magar agar aap use multiple timeframes, additional indicators, aur proper risk management ke sath integrate karen to yeh aap ke trading strategy ko mazboot banata hai. Forex trading mein trend identification aur reversal detection ke liye Aroon indicator bohat mufeed sabit hota hai, jo aap ko market ke turning points ko samajhne mein madad karta hai. Consistency, discipline, aur continuous learning se aap Aroon indicator ke signals ko apne advantage ke liye use kar sakte hain aur sustainable profits hasil kar sakte hain. -

#6 Collapse

Aroon Indicator: Ek Jhalak

Aroon Indicator ek popular technical analysis tool hai jo traders aur investors ko market trends aur momentum ki pehchaan karne mein madad karta hai. Is indicator ko Tushar Chande ne 1995 mein introduce kiya tha. Aroon ka matlab hai “suriya,” jo ke nayi shuruaat aur trends ki taraf ishara karta hai. Aayiye, is indicator ke kaise kaam karta hai aur iske istemal karne ke tareeqon par ghor karte hain.

Aroon Indicator Kaise Kaam Karta Hai

Aroon Indicator do lines par mabni hota hai: Aroon Up aur Aroon Down. Inka calculation is tarah kiya jata hai:

1. Aroon Up:

- Yeh show karta hai ke kitne din pehle stock apne highest price ko touch kiya tha.

- Formula: \(Aroon Up = \left( \frac{N - \text{Days since highest high}}{N} \right) \times 100\)

2. Aroon Down:

- Yeh dikhata hai ke kitne din pehle stock ne apna lowest price touch kiya tha.

- Formula: \(Aroon Down = \left( \frac{N - \text{Days since lowest low}}{N} \right) \times 100\)

Yahan N ka matlab hai wo number of periods jo aap analyze kar rahe hain, aksar ye 14 dino ka set hota hai.

Aroon Indicator Ka Istemal

Aroon Indicator ko market ke different trends aur momentum ko samajhne ke liye istemal kiya jata hai. Yahaan kuch key signals diye gaye hain jo trader ko madad karte hain:

1. Trend Reversal:

- Agar Aroon Up line Aroon Down line ko cross karti hai, to yeh bullish trend ka ishara ho sakta hai.

- Isse pehle agar Aroon Up 50 se zyada hai to yeh confirmation hota hai ke market strong bullish trend mein hai.

2. Bearish Signals:

- Agar Aroon Down line Aroon Up line ko cross karti hai, to yeh bearish trend ka indication hota hai.

- Agar Aroon Down 50 se zyada hai, to yeh dikhata hai ke market mein bearish momentum hai.

3. Market Strength:

- Jab Aroon Up 70 ya us se zyada hai to iska matlab market mein strong bullish momentum hai.

- Jab Aroon Down 70 ya us se zyada hai, to ye bearish momentum ka dikhawa karta hai.

Limitations

Aroon Indicator ke kuch limitations bhi hain:

- Lagging Indicator:

Yeh typically ek lagging indicator mana jata hai, yani yeh market ke trends ko late show karta hai.

- False Signals:

Kabhi kabhi yeh false signals bhi de sakta hai, isliye isse doosre indicators ke sath istemal karna behtar hota hai.

Conclusion

Aroon Indicator ek valuable tool hai jo traders ko market ki trends ko samajhne aur trade decisions lene mein madad karta hai. Yeh simplicity aur effectiveness ke liye jana jata hai. Agar aap technical analysis mein naye hain, to Aroon Indicator ko apne trading toolkit mein shamil karna ek achha idea hai. Is indicator ka sahi istemal aapko zyada profitable trades lene mein madad kar sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

1. What is the Aroon Indicator?

The Aroon Indicator consists of two lines:

✅ Aroon Up – Measures how long it has been since the highest price in a given period (usually 14 or 25 days).

✅ Aroon Down – Measures how long it has been since the lowest price in the same period.

💡 The values range from 0 to 100. Higher values indicate a stronger trend.

2. How to Read the Aroon Indicator?

🔹 Strong Uptrend: Aroon Up is above 70, and Aroon Down is below 30.

🔹 Strong Downtrend: Aroon Down is above 70, and Aroon Up is below 30.

🔹 Sideways Market (No Trend): Both Aroon Up and Aroon Down are below 50 or moving close together.

📌 Example: If Aroon Up is 90 and Aroon Down is 10, the market is in a strong uptrend.

3. How to Use Aroon Indicator in Trading?

1️⃣ Identifying Trend Strength 🔥- If Aroon Up stays near 100, the asset is in a strong bullish trend.

- If Aroon Down stays near 100, the asset is in a strong bearish trend.

📌 Strategy: Trade in the direction of the stronger Aroon line.

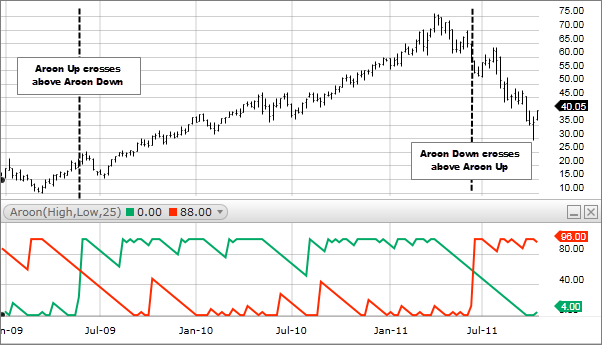

2️⃣ Detecting Trend Reversals ⚠️- If Aroon Up crosses above Aroon Down, it signals a bullish reversal (buy signal).

- If Aroon Down crosses above Aroon Up, it signals a bearish reversal (sell signal).

📌 Strategy: Enter a trade when the crossover confirms a new trend.

3️⃣ Spotting Breakouts 🚀- If Aroon Up moves above 70 while Aroon Down falls below 30, it suggests strong bullish momentum.

- If Aroon Down moves above 70 while Aroon Up falls below 30, it suggests strong bearish momentum.

📌 Strategy: Enter a trade early in the breakout phase.

4. Aroon Indicator Trading Strategy ✅

📌 Buy Signal (Long Trade):

✔ Aroon Up crosses above Aroon Down.

✔ Aroon Up stays above 70 while Aroon Down moves below 30.

📌 Sell Signal (Short Trade):

✔ Aroon Down crosses above Aroon Up.

✔ Aroon Down stays above 70 while Aroon Up moves below 30.

5. Aroon vs. Other Trend Indicators

Aroon Indicator Identifies trends and reversals Works in all markets, Simple & Effective Can lag in highly volatile markets Moving Averages (MA, EMA) Shows trend direction Smooths price action Lagging indicator MACD Measures momentum Good for confirmations Complex for beginners RSI Identifies overbought/oversold levels Works well in ranging markets Less effective in strong trends

6. Conclusion 🎯

The Aroon Indicator is a powerful trend-following tool that helps traders spot trend strength, reversals, and breakouts. By combining it with other indicators like RSI, MACD, or Moving Averages, traders can increase accuracy and improve their trading decisions. 🚀

⚡ "Profit is the reward for patience, loss is the fee for learning." 💡

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:26 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим