what is Aroon Indicator

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

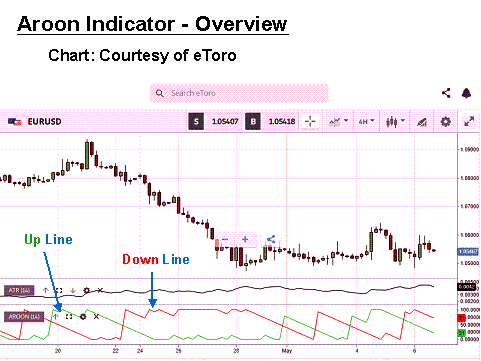

Introduction forex market mein Aroon indicator aik kesam ka technical indicator hey jo keh forex market mein aya keh trend ko indicate karnay mein madad karta hey or forex market mein trend ketna he strong hota hey yeh indicator forex market mein sab say maqbol hota hey ese tarah aap es ko meta trader mein default install nahi kar pain gay ap es ko khod install karnay ke zarorat hote hey es ko estamal karnay kay bad ap daikhen gay es mein mkhtalef rangon ke 2 lines hote hein forex market mein en lines ko Aroon up or Aroon Down kay naam say bhe jana jata hey aik mesal nechay de gay hey es mesal ko Aroon Up kay naam say bhe jana jata hey jo keh red rang mein dekhaya geya hey Aroon down purple rang mein hey es ko nechay ke tasweer mein bhe ap daikh saktay hein mesal kay tor par 25 kay period kay sath aik Aroon indicator en dono ke trend ke pemaish karta hey kese assert kay deno mein es indicator ke oper ya nechay ke pemaish ese tarah indicator assert kay deno mein different kesam ka tha kunkeh yeh forex market mein volume par focus nahi karta hey Day Trader Aroon Indicator mesal kay tor par 25 kay period kay sath Aroon indicator forex market men en days ke tadad ke pemaish karta hey jes mein kese assert kay den es period kay per ya nechay thay ese tarah indicator dosray oscillator say mokhtalef tha kunkeh yeh forex market mein volume par focus nahi karta hey forex market mein koi Horizontal line nahi hote hey jo keh 50% ke level par draw nahi ke gay hey forex market mein ine tool ka estamal karen or es ko draw bhe karna chihay forex market mein ap ko input period ko bhe daikhna chihay or forex market ap ko yeh strategy bhe batana chihay keh ap forex arket mein 25 ko batr default period samajhna chihay forex market mein bohut low gap kay samajhnay say indicator ka period default ho sakta hey jaisa keh nechay dekhaya geya forex market jaisa keh GBP/USD pair low ho raha hey Aroon down 100% ke level kay sath down the Aroon up nechay ke taraf barah raha tha ese tarh jaisa keh price price oper ke taraf barah rehe the Aroon 0% par tha jabkeh Aroon Down ke taraf barah raha tha dosray indicator ke tarah Aroon indicator aik best technical tool hey yeh RSI kay sath best combination hota hey or commodity channelindex ay sath mel kar estamal keya ja sakta hey Conclusion Forex market mein Aroon aik kesam ka aam indicator hey reality bohut he kam new trader estamal kartay hein phir bhe wall street kay trader nay es indicator ka estamalkamyaby kay sath keya hey aik tradr kay tor par hum tajweez kartay hein or analysis kartay hein keh yeh trading strategy kes tarah fit ho ge or kes tarah es ka estamal bhe kar saktay heinدیتے جائیںThanksحوصلہ افزائی کے لیے -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

AROON INDICATOR:-Forex me Aroon Indicator ek technical analysis tool hai jo market trend aur trend reversal ko identify karne ke liye istemal hota hai. Aroon Indicator ek oscillator hai aur do components se mil kar banta hai: Aroon Up aur Aroon Down. AROON INDICATOR K COMPONENTS:-Aroon Up: Ye indicator market me ek specific time period ke andar highest high price ko measure karta hai aur usko ek percentage form me represent karta hai. Isse trader ko ye pata chalta hai ki market me highest high kab hua tha. Aroon Down: Is indicator ka kaam market me ek specific time period ke andar lowest low price ko measure karna hota hai aur usko percentage form me represent karna hota hai. Isse trader ko ye pata chalta hai ki market me lowest low kab hua tha.AROON INDICATOR K STEPS:-Aroon Oscillator: Aroon Oscillator Aroon Up aur Aroon Down ke difference ko represent karta hai. Isse market ke trend strength ko determine karne me madad milti hai. Positive Aroon Oscillator bullish trend ko indicate karta hai, jabki negative Aroon Oscillator bearish trend ko show karta hai. Isse trader ko market me trend ke hone aur weak hone ke bariqeen pata chalta hai. Time Frame Selection: Aroon Indicator ka performance time frame par depend karta hai, isliye aapko sahi time frame choose karna hoga. Short-term trading ke liye choti time frames (jaise ki 15-minute ya 1-hour) aur long-term trading ke liye bade time frames (jaise ki daily ya weekly) consider kiye ja sakte hain. Confirmatory Tools: Aroon Indicator ko dusre confirmatory technical indicators ke saath istemal karke trading decisions ko validate kiya ja sakta hai. Example ke liye, Moving Averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ko Aroon ke saath istemal kiya ja sakta hai. Stop Loss aur Take Profit Levels: Aroon Indicator se milne wale signals ko trading plan me shamil karke stop loss aur take profit levels set kiye ja sakte hain. Isse risk management aur profit booking me madad milti hai. False Signals ka Dhyan: Aroon Indicator kabhi-kabhi false signals generate kar sakta hai, isliye iske signals ko dusre technical analysis tools aur market context ke saath consider karna important hai. Practice aur Backtesting: Aroon Indicator ka istemal karne se pehle practice aur backtesting kiya ja sakta hai. Isse aapko is indicator ki behavior aur accuracy ke baare me better understanding hogi. Educational Resources: Aroon Indicator aur trading strategies ko samajhne ke liye educational resources aur books ka istemal kar sakte hain. Technical analysis ki books aur online courses trading skills ko improve karne me madadgar ho sakte hain. Yaad rahe ki trading me risk hota hai, aur aapko hamesha apne risk tolerance aur financial goals ko madde nazar rakhte hue trading karni chahiye. Trading decisions lene se pehle thorough analysis aur risk management ka istemal karna zaroori hai.

AROON INDICATOR K COMPONENTS:-Aroon Up: Ye indicator market me ek specific time period ke andar highest high price ko measure karta hai aur usko ek percentage form me represent karta hai. Isse trader ko ye pata chalta hai ki market me highest high kab hua tha. Aroon Down: Is indicator ka kaam market me ek specific time period ke andar lowest low price ko measure karna hota hai aur usko percentage form me represent karna hota hai. Isse trader ko ye pata chalta hai ki market me lowest low kab hua tha.AROON INDICATOR K STEPS:-Aroon Oscillator: Aroon Oscillator Aroon Up aur Aroon Down ke difference ko represent karta hai. Isse market ke trend strength ko determine karne me madad milti hai. Positive Aroon Oscillator bullish trend ko indicate karta hai, jabki negative Aroon Oscillator bearish trend ko show karta hai. Isse trader ko market me trend ke hone aur weak hone ke bariqeen pata chalta hai. Time Frame Selection: Aroon Indicator ka performance time frame par depend karta hai, isliye aapko sahi time frame choose karna hoga. Short-term trading ke liye choti time frames (jaise ki 15-minute ya 1-hour) aur long-term trading ke liye bade time frames (jaise ki daily ya weekly) consider kiye ja sakte hain. Confirmatory Tools: Aroon Indicator ko dusre confirmatory technical indicators ke saath istemal karke trading decisions ko validate kiya ja sakta hai. Example ke liye, Moving Averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ko Aroon ke saath istemal kiya ja sakta hai. Stop Loss aur Take Profit Levels: Aroon Indicator se milne wale signals ko trading plan me shamil karke stop loss aur take profit levels set kiye ja sakte hain. Isse risk management aur profit booking me madad milti hai. False Signals ka Dhyan: Aroon Indicator kabhi-kabhi false signals generate kar sakta hai, isliye iske signals ko dusre technical analysis tools aur market context ke saath consider karna important hai. Practice aur Backtesting: Aroon Indicator ka istemal karne se pehle practice aur backtesting kiya ja sakta hai. Isse aapko is indicator ki behavior aur accuracy ke baare me better understanding hogi. Educational Resources: Aroon Indicator aur trading strategies ko samajhne ke liye educational resources aur books ka istemal kar sakte hain. Technical analysis ki books aur online courses trading skills ko improve karne me madadgar ho sakte hain. Yaad rahe ki trading me risk hota hai, aur aapko hamesha apne risk tolerance aur financial goals ko madde nazar rakhte hue trading karni chahiye. Trading decisions lene se pehle thorough analysis aur risk management ka istemal karna zaroori hai. -

#4 Collapse

Aroon indicator : Aroon indicator ek trend-following technical indicator hai jo price ki trend ki strength aur direction ko identify karne mein madad karta hai. Ye indicator Aroon up line aur Aroon down line se bana hota hai. Aroon up line, highest high price ko calculate karta hai aur Aroon down line, lowest low price ko calculate karta hai. In lines ki crossover aur level readings se traders trend reversal aur trend continuation ko identify kar sakte hain. Aroon indicator ko Tushar Chande ne 1995 mein banaya. Is indicator ka upyog trend ki strength aur direction ko samajhne ke liye kiya jata hai. Aroon indicator Formula : Aroon indicator ka formula hai: Aroon Up = ((N - Periods since highest high) / N) * 100 Aroon Down = ((N - Periods since lowest low) / N) * 100 Yahan "N" time period hai aur "Periods since highest high" aur "Periods since lowest low" highest high aur lowest low prices ke periods ko represent karte hain. Trade with Aroon indicator : Aroon indicator ke sath trade karne ke liye aap ye steps follow kar sakte hain: 1. Trend identification: Aroon indicator se trend ki strength aur direction ko identify karein. Aroon up line aur Aroon down line ke crossovers aur level readings se trend reversal aur continuation ko samjhein. 2. Entry point: Aroon indicator ki readings ke hisab se entry point determine karein. Jab Aroon up line Aroon down line ko cross karke upar se neeche aata hai, toh long position le sakte hain. Aur jab Aroon down line Aroon up line ko cross karke neeche se upar aata hai, toh short position le sakte hain. 3. Confirmation: Aroon indicator ke readings ko dusre indicators aur price action ke sath confirm karein. Isse aapko trade ki validity aur strength ka pata chalega. 4. Risk management: Stop loss aur take profit levels set karein, jisse aap risk ko manage kar sakein. Aroon indicator ke readings ko use karke aap stop loss aur take profit levels ko adjust kar sakte hain. 5. Exit strategy: Aroon indicator ki readings ke hisab se exit point determine karein. Jab Aroon up line Aroon down line ko cross karke neeche aata hai ya Aroon down line Aroon up line ko cross karke upar aata hai, toh exit karein. Aroon indicator ke sath trade karte waqt hamesha market conditions aur apne risk tolerance ko consider karein. Practice karke aur trading strategies ko test karke apne trading skills ko improve karein. Characteristics of Aroon indicator : Aroon indicator ke kuch characteristics hain: - Aroon indicator trend ki strength aur direction ko measure karta hai. - Ye indicator Aroon up line aur Aroon down line se bana hota hai. - Aroon up line highest high price ko calculate karta hai aur Aroon down line lowest low price ko calculate karta hai. - Crossovers aur level readings se traders trend reversal aur trend continuation ko identify kar sakte hain. - Aroon indicator price action aur dusre indicators ke sath combine karke trading decisions lene mein madad karta hai. -

#5 Collapse

Aroon Indicator, also known as the Aroon Oscillator or Aroon Index, is a technical analysis tool used to measure the strength and direction of a trend in a financial market, such as stocks, commodities, or currencies. It was developed by Tushar Chande in 1995. The Aroon Indicator consists of two lines: Aroon Up: This line measures the strength and time since the highest price within a given period (usually 25 periods). It quantifies how many periods have passed since the highest high price occurred. A high Aroon Up value suggests a strong upward trend. Aroon Down: This line measures the strength and time since the lowest price within the same period (usually 25 periods). It quantifies how many periods have passed since the lowest low price occurred. A high Aroon Down value suggests a strong downward trend. The Aroon Indicator is typically plotted as two lines on a chart, with values ranging from 0 to 100. The crossing of these two lines and their relative positions can provide traders and analysts with signals about the strength and direction of a trend: When Aroon Up is above Aroon Down and both are above 50, it is considered a bullish signal, indicating a strong uptrend. When Aroon Down is above Aroon Up and both are above 50, it is considered a bearish signal, indicating a strong downtrend. When both Aroon Up and Aroon Down are below 50, it suggests a lack of a strong trend or a consolidation phase. Crossovers between Aroon Up and Aroon Down can signal potential trend changes. For example, when Aroon Up crosses above Aroon Down, it may indicate a potential shift from a downtrend to an uptrend, and vice versa. Traders and analysts often use the Aroon Indicator in conjunction with other technical indicators and analysis methods to make more informed trading decisions. It can help identify potential entry and exit points in the market and assist in trend-following strategies. However, like all technical indicators, it should be used in combination with other tools and not relied upon in isolation. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex mein Aroon Indicator ek technical analysis tool hai jo currency exchange market mein price trends aur reversals ko identify karne mein istemal hota hai. Yeh indicator market mein hone wale potential trading opportunities ko samjhne aur trading decisions lene mein madadgar hota hai. Aroon Indicator do mukhya components se milta hai - Aroon Up aur Aroon Down. In dono components ka main uddeshya market mein hone wale trends ko measure karna hai. Aroon Up, ek specific time period ke andar recent highest price ko darust karta hai, jabki Aroon Down recent lowest price ko darust karta hai. Jab Aroon Up Aroon Down se upper hota hai, yani Aroon Up 100 ke paas hota hai, to iska arth hota hai ki market mein uptrend hai. Isse traders ko ye signal milta hai ki long positions (khareedne ki positions) consider ki ja sakti hain. Vahi par, jab Aroon Down Aroon Up se upper hota hai, yani Aroon Down 100 ke paas hota hai, to iska matlab hota hai ki market mein downtrend hai. Isse traders ko ye suchana milti hai ki short positions (bechne ki positions) consider ki ja sakti hain. Aroon Indicator ki madad se traders market mein hone wale reversals bhi anticipate kar sakte hain. Jab Aroon Up ya Aroon Down kisi specific level (jaise ki 70 ya 30) ke paas aata hai aur phir wapas opposite direction mein move karta hai, to isse reversal signal milta hai. Yeh important hai ki Aroon Indicator ko dusre technical indicators aur market analysis tools ke saath milakar istemal kiya jaye, kyun ki iske signals kabhi-kabhi false bhi ho sakte hain. Iske alawa, trading strategies aur risk management bhi mahatvapurn hain forex trading mein safalta paane ke liye. Traders ko Aroon Indicator ke signals ko dhyanpurvak samjhna aur verify karna chahiye, aur hamesha apni risk tolerance aur trading goals ko dhyan mein rakhna chahiye. -

#7 Collapse

### Aroon Indicator Kya Hai?

Aroon Indicator ek technical analysis tool hai jo market ki trend strength aur direction ko samajhne mein madad karta hai. Iska istemal traders ke liye yeh jaanne ke liye hota hai ke kisi currency ya asset ki price movement kis taraf ja rahi hai. Aroon Indicator ko 1995 mein Tushar Chande ne develop kiya tha aur yeh khas tor par forex aur stock markets mein kaam aata hai.

**Aroon Indicator Ka Structure**

Aroon Indicator do lines par mabni hota hai: Aroon Up aur Aroon Down.

- **Aroon Up**: Yeh line market ki highest price ko track karti hai aur yeh dikhati hai ke price kitne dinon tak apni highest level par raha.

- **Aroon Down**: Yeh line market ki lowest price ko track karti hai aur yeh batati hai ke price kitne dinon tak apni lowest level par raha.

In dono lines ki values 0 se 100 ke darmiyan hoti hain. Agar Aroon Up line 70 se zyada hai, to yeh bullish trend ki nishani hai, jabke agar Aroon Down line 70 se zyada hai, to yeh bearish trend ko darust karta hai.

**Kaise Kaam Karta Hai?**

Aroon Indicator ko istemal karte waqt, traders in dono lines ke beech ke intersections aur values par tawajjo dete hain. Jab Aroon Up line Aroon Down line ko upar cross karti hai, to yeh bullish reversal ka signal hota hai. Iske baraks, agar Aroon Down line Aroon Up line ko cross karti hai, to yeh bearish reversal ka signal hota hai.

**Trading Signals**

1. **Bullish Signal**: Agar Aroon Up line 70 ke upar ho aur Aroon Down line 30 ke neeche ho, to yeh bullish trend ki nishani hoti hai.

2. **Bearish Signal**: Jab Aroon Down line 70 ke upar ho aur Aroon Up line 30 ke neeche ho, to yeh bearish trend ka signal hota hai.

**Advantages**

Aroon Indicator ka sabse bada faida yeh hai ke yeh traders ko market ki trend strength aur momentum ko asan tareeqe se dikhata hai. Iska istemal akele ya kisi aur technical analysis tool ke sath milakar kiya ja sakta hai, jaise Moving Averages ya RSI, taake aapki trading strategies ko behtar banaya ja sake.

**Limitations**

Lekin, Aroon Indicator ki kuch limitations bhi hain. Yeh hamesha accurate nahi hota aur kabhi kabhi false signals de sakta hai. Isliye, is indicator ka istemal kisi aur analysis ke sath milakar karna behtar hota hai.

**Conclusion**

Aroon Indicator forex trading mein ek valuable tool hai jo market ki trend aur momentum ko samajhne mein madad karta hai. Is indicator ka sahi istemal aapko profitable trading decisions lene mein madad de sakta hai. Hamesha risk management ka khayal rakhein aur kisi bhi trading decision se pehle comprehensive analysis karein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

**Aroon Indicator kya hai?**

- **Taqreeban Definition:**

Aroon Indicator aik technical analysis tool hai jo market ke trend direction aur strength ko measure karne ke liye use hota hai. Isay Tushar Chande ne 1995 mein develop kiya tha. "Aroon" ka matlab Sanskrit mein "Dawn" yaani subah ka aghaaz hota hai, jo new trends ko indicate karta hai.

- **Do Major Components:**

Aroon indicator do alag lines par mabni hota hai:

1. **Aroon Up**

2. **Aroon Down**

Yeh dono lines last high aur low ka time duration measure karti hain. Aroon Up wo time period bataata hai jab last high bana tha, aur Aroon Down wo time period batata hai jab last low bana tha.

- **Calculation Formula:**

- **Aroon Up:**

(Days Since Last High / Total Days) x 100

- **Aroon Down:**

(Days Since Last Low / Total Days) x 100

Yeh dono values 0 se 100 ke darmiyan hoti hain.

- **Trend Identification:**

Agar Aroon Up ki value 70 ya 100 ke qareeb ho, to yeh strong uptrend ko indicate karta hai.

Agar Aroon Down ki value 70 ya 100 ke qareeb ho, to yeh strong downtrend ka ishara hai.

- **Crossovers ka Maqsad:**

Jab Aroon Up Aroon Down ko cross karta hai (upar se neeche ya neeche se upar), to yeh trend reversal ka signal hota hai.

- Aroon Up ka Aroon Down se upar hona bullish trend ka signal hai.

- Aroon Down ka Aroon Up se upar hona bearish trend ka ishara hai.

- **Sideways Market:**

Jab dono Aroon lines 30 se neeche hoti hain, to yeh sideways market ya trendless condition ko show karta hai.

- **Time Frame ka Asar:**

Aroon indicator ko mukhtalif time frames par istimaal kiya ja sakta hai. Short-term traders isay 14-day period ke sath use karte hain, jabkay long-term traders isay zyada extended time periods ke liye lagate hain.

- **Forex Trading mein Istemaal:**

Aroon indicator forex trading mein madad karta hai market ke new trends ko jaldi se identify karne mein. Is indicator ke zariye traders ko trend ke continuation ya reversal signals milte hain.

- **Trend Strength ka Pata Lagana:**

Aroon Up aur Aroon Down dono ki high values trend ki strength ko confirm karti hain. Agar Aroon Up 100 ke qareeb ho aur Aroon Down bohot low, to strong uptrend ka indication milta hai.

- **Limitations:**

Aroon indicator bhi galat signals de sakta hai, khas tor par sideways markets mein. Is liye doosray indicators ke saath isay combine karna faidemand hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:24 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим