Details Of VDX Indicator.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

1. VDX Indicator: Forex trading mein VDX indicator aik ahem tool hai jo traders ko market analysis mein madadgar hota hai. Is article mein, hum VDX indicator ke mukhtalif pehluon par baat karenge. VDX indicator ek volatility-based indicator hai jo market ke trends ko samajhne mein madadgar hota hai. Iska maqsad market volatility ko measure karna hai, jisse traders trends aur reversals ko behtar tariqe se samajh saken. 2. VDX Indicator Ki Calculation: VDX indicator ki calculation market volatility ko base par hoti hai. Ismein historical price data aur standard deviation ka istemal hota hai. Isse current volatility ka andaza lagaya ja sakta hai. 3. VDX Indicator Ka Istemal: Traders VDX indicator ko market analysis mein istemal karke trend changes aur potential reversals ko pehchan sakte hain. Yeh unko samajhne mein madadgar hota hai ke market mein kitni volatility hai aur kis tarah ke trades ki taraf ishara kar raha hai. 4. VDX Indicator Ki Reading: VDX indicator ki reading usually ek line ke form mein hoti hai jo zero ke aas paas hoti hai. Positive values indicate bullish volatility aur negative values bearish volatility ko darust karti hain. 5. VDX Indicator Ke Fayde : VDX indicator traders ko market ki samajhne mein madadgar hota hai aur unko trading decisions lene mein madad deta hai. Isse traders apne risk management ko behtar tariqe se handle kar sakte hain. 6. VDX Indicator Ke Nuksanat: Is indicator ka istemal keval dusre indicators ke sath hi behtar hota hai. Sirf VDX indicator par pura bharosa na karen, kyun ke yeh ek hi indicator ke sath puri trading strategy nahi hai. 7. Trading With VDX Indicator: VDX indicator ka istemal aik trading platform par install karke kiya ja sakta hai. Isko apne trading strategy ke sath istemal karein aur practice karke hi live trading mein shamil hon. In conclusion, VDX indicator forex trading mein ek ahem tool hai jo market volatility ko measure karta hai aur traders ko trading decisions lene mein madadgar hota hai. Lekin, yeh aik hi indicator ke sath puri trading strategy nahi hai, isliye dusre indicators aur analysis tools ke sath istemal karein. -

#3 Collapse

VDX INDICATOR IN FOREX TRADING INTRODUCTION Forex trading mein VDX indicator ek ahem tool hai jo traders ko market analysis mein madadgar hota hai. Is article mein, hum VDX indicator ke bare mein tafseel se bat karenge. VDX indicator ek technical analysis tool hai jo forex traders istemal karte hain. Iska maqsad market ki trend aur price direction ko samajhna hai. VDX indicator trading strategies mein istemal hota hai, jahan traders iska istemal market ke trends ko samajhne aur price predictions banane ke liye karte hain. VDX INDICATOR KEY FEATURES VDX indicator ki kuch ahem features hain: TREND IDENTIFICATION VDX indicator traders ko market ke current trend ko identify karne mein madadgar hota hai. ENTRY AND EXIT POINTS Is indicator ki madad se traders entry aur exit points tay kar sakte hain, jisse unka trading risk kam ho. VOLATILITY ANALYSIS VDX indicator volatility ko bhi analyze karta hai, jo trading decisions par asar dalta hai. VDX INDICATOR WORKING PROCEDURE VDX indicator ka istemal trading platform par karte hain. Yahan kuch steps hain jo iska istemal karne mein madadgar ho sakte hain: - Indicator ko trading platform par add karen. - Indicator ki settings ko customize karen, jaise ki time frame aur parameters. - Indicator ki signals ko samajh kar trading decisions banayein. VDX INDICATOR LIMITATIONS VDX indicator bhi kisi bhi technical tool ki tarah mehdoodiyein rakhta hai. Iska matlab hai ki yeh kabhi bhi 100% accurate nahi hota, aur traders ko apni analysis aur risk management par bhi amal karna chahiye. VDX indicator ko trading strategy mein shamil karne se pehle traders ko iski samajh aur practice hasil karni chahiye. Isse hi wo isse behtar tareeqe se istemal kar sakte hain. Is article mein humne VDX indicator forex trading mein Roman Urdu mein samjhaya. Yad rahe ke forex trading high risk hoti hai, aur ismein khudara mehnat aur research ki zarurat hoti hai. Trading decisions lene se pehle hamesha apne financial goals aur risk tolerance ko madde nazar rakhein. -

#4 Collapse

### VDX Indicator Ki Tafseel

VDX indicator, yaani Volatility Directional Index, ek important tool hai jo traders ko market ki volatility aur trend direction samajhne mein madad karta hai. Yeh indicator khas tor par forex trading mein istemal hota hai, lekin isse stock aur commodities markets mein bhi dekha ja sakta hai. Is post mein, hum VDX indicator ke features, kaam karne ka tareeqa, aur trading signals par roshni daalenge.

**VDX Indicator Ka Concept**

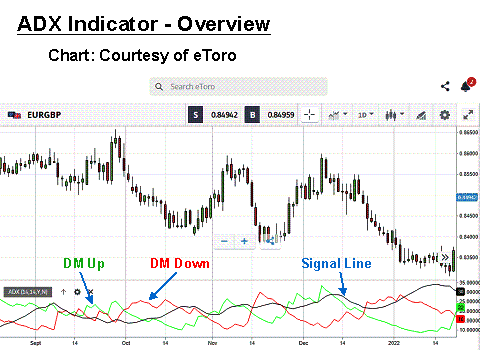

VDX indicator market ki volatility aur trend strength ko measure karta hai. Yeh indicator traders ko yeh samajhne mein madad karta hai ke market kis taraf ja raha hai—bullish ya bearish. VDX indicator do main components par mabni hota hai: VDX line aur Average Directional Index (ADX) line.

1. **VDX Line**: Yeh line market ki volatility ko darust karti hai. Jab VDX line upar jati hai, to yeh indicate karta hai ke market mein volatility barh rahi hai, jo trading opportunities ka mauqa de sakta hai.

2. **ADX Line**: ADX line market ki trend strength ko measure karti hai. Agar ADX line 20 se 25 ke darmiyan hai, to yeh weak trend ki nishani hoti hai, jabke agar ADX 25 se upar hai, to yeh strong trend ko darust karta hai.

**Kaise Kaam Karta Hai**

VDX indicator ko chart par add karne ke baad, traders ko yeh dekhna hota hai ke VDX aur ADX lines kaise move kar rahi hain. Jab VDX line ADX line ko cross karti hai, to yeh trading signal hota hai. Is signal ke zariye, traders ko pata lagta hai ke market kis taraf jata hai.

**Trading Signals**

1. **Bullish Signal**: Jab VDX line ADX line ko upar cross karti hai, to yeh bullish signal hota hai. Is waqt traders ko buy positions lene ka sochna chahiye.

2. **Bearish Signal**: Jab VDX line ADX line ko neeche cross karti hai, to yeh bearish signal hota hai. Is waqt traders ko sell positions lene ka sochna chahiye.

**Risk Management**

Risk management is indicator ka istemal karte waqt zaroori hai. Traders ko stop-loss orders ko recent swing high (bullish trades) ya swing low (bearish trades) ke aas paas rakhna chahiye. Yeh unexpected market movements se bachne mein madadgar hota hai.

**Conclusion**

VDX indicator ek valuable tool hai jo traders ko market ki volatility aur trend strength ko samajhne mein madad karta hai. Is indicator ka sahi istemal karte hue, traders profitable trades le sakte hain. Hamesha risk management ka khayal rakhein aur market ki analysis karein taake behtar results hasil kar sakein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

VDX Indicator

VDX indicator ek advanced technical tool hai jo traders ko market ki volatility ko measure karne aur samajhne mein madad deta hai. Yeh indicator aksar commodities, indices aur currencies ke price movements ke risk aur uncertainty ko quantify karne ke liye use hota hai. VDX indicator se aap ko yeh andaza lagane ka mauqa milta hai ke market kitni tezi se move kar sakti hai aur kis had tak uncertainty hai. VDX indicator, jise aam tor par “Volatility Index” bhi kaha jata hai, market ke volatility ko measure karta hai. Yeh indicator options market se derive ki gayi values ko use karta hai, jisse pata chalta hai ke market participants future price fluctuations ke bare mein kitna expect kar rahe hain. VDX indicator aap ko yeh batata hai ke agar market mein high volatility hai to risk bhi zyada hai, aur agar low volatility hai to market comparatively calm rehti hai. Is indicator ki values aam tor par 0 se 100 ke darmiyan hoti hain; high value ka matlab zyada uncertainty aur risk, jabke low value ka matlab stable aur predictable price movements.

Calculation Method

VDX indicator ka calculation complex formulas par mabni hota hai jo options ke implied volatility data se liye jate hain. Options premiums, strike prices aur time to expiration jaise factors use kiye jate hain taake market ke future price fluctuations ka andaza lagaya ja sake. Although exact formula har trader ke liye zaroori nahi, lekin yeh samajhna aham hai ke VDX indicator market ke risk perception ko quantify karta hai. Is indicator ko calculate karne ka maqsad yeh hota hai ke aap market ke mood ko objectively measure kar saken, jisse aap ko pata chal sake ke price kitni tezi se change ho sakti hai.

Interpretation of VDX Indicator

VDX indicator ko interpret karna trading decisions ke liye bohat aham hai. Agar VDX indicator high values, jaise 70 ya us se zyada, show karta hai, to iska matlab hai ke market mein extreme volatility aur uncertainty hai. Aise dauran, market ke prices rapid aur unpredictable movements de sakte hain, jis se risk barh jata hai. Dusri taraf, agar VDX low values, jaise 30 ya us ke neeche, dikhata hai, to market comparatively calm hai aur price movements me stability hai. Is se yeh signal milta hai ke aap trend following strategies, long-term positions ya swing trading ke liye favorable conditions mein hain. VDX indicator ke crossovers, divergence aur sudden changes ko dekh kar bhi aap market ke reversal ya breakout ke signals ko identify kar sakte hain.

Application in Forex Trading

Forex market mein volatility ek bohat important factor hai, kyun ke currencies ki price movements tezi se change ho sakti hain. VDX indicator forex traders ko yeh samajhne mein madad deta hai ke market kitni unpredictable ho sakti hai. Agar VDX high values dikha raha ho, to iska matlab hai ke forex market mein uncertainty zyada hai aur aapko apne trades ke liye tighter stop loss aur cautious position sizing adopt karna chahiye. Agar VDX low hai to market stable hai aur aap trend following strategies, breakouts aur momentum trades ko consider kar sakte hain. Aksar forex traders VDX indicator ko doosre technical indicators, jaise moving averages, RSI ya MACD ke sath combine karte hain, taake unke signals ko confirm kiya ja sake aur entry aur exit points behtar tareeke se define kiye ja sakein.

Advantages of VDX Indicator

VDX indicator ke bohat se faide hain. Sab se pehla faida yeh hai ke yeh market ki volatility ko objectively measure karta hai, jis se aap ko pata chal jata hai ke market kitni unpredictable hai. Is se risk management aur position sizing mein madad milti hai. Doosra, VDX indicator market sentiment ko samajhne ka ek effective zariya hai; yeh aap ko batata hai ke traders kitna uncertainty expect kar rahe hain aur future price moves kis had tak extreme ho sakte hain. Teesra, VDX indicator ko multiple timeframes par adjust kiya ja sakta hai, jis se aap short-term scalping se le kar long-term swing trading tak har style mein is ka istemal kar sakte hain. Is ke alawa, VDX indicator ko additional confirmation ke liye dusre tools ke sath combine karne se aap ke overall trading decisions aur reliable ho jate hain.

Limitations of VDX Indicator

Har technical indicator ki tarah, VDX indicator ke kuch nuqsanat bhi hain. Sab se bara limitation yeh hai ke yeh indicator options market data par depend karta hai, jo har asset ya market ke liye available nahi hota. Forex market mein, har broker ya trading platform VDX indicator ko support nahi karta, jis se accessibility mein issues aa sakte hain. Dusra, VDX indicator past data par based hota hai aur market ke sudden changes ya black swan events ko accurately predict nahi kar sakta. Market conditions tezi se badal sakti hain, jis se VDX indicator ke signals kabhi kabhi delayed ho jate hain. Is liye, is indicator ko standalone tool ke taur par use karna risk barha sakta hai; additional technical analysis tools ka istemal zaroori hai.

Trading Strategies Using VDX Indicator

VDX indicator ko trading strategies mein integrate karke aap apne risk management aur entry/exit decisions ko behtar bana sakte hain. Agar VDX high values show karta hai, to market mein volatility zyada hai, is liye aap apni position sizes choti rakhein aur stop loss ko tight set karein. High volatility conditions mein aap scalping ya short-term momentum trades ko consider kar sakte hain, lekin caution se kaam len. Agar VDX low values par hai to market stable hai, aur aap trend following strategies, breakouts aur longer-term positions le sakte hain. VDX indicator ke divergence signals ko monitor karke aap potential reversals ke bare mein bhi andaza laga sakte hain. Multiple indicators ke sath combine karne se, jaise moving averages aur RSI, aapko signal confirmation milta hai aur aap apni trading strategy ko zyada robust bana sakte hain.

Risk Management with VDX Indicator

Trading mein risk management sab se important element hai. VDX indicator aap ko market ki volatility ke bare mein real-time information provide karta hai, jis se aap apne trades ko adjust kar sakte hain. Agar indicator high values dikha raha ho to market unpredictable hai aur aapko leverage kam rakhna chahiye, position sizes choti rakhni chahiye, aur stop loss orders ko strict follow karna chahiye. Is ke ilawa, market ke sudden moves se bachne ke liye proper risk-reward ratio ko maintain karna bohat zaroori hai. Har trade ke sath risk ko limited rakhne ke liye position sizing aur disciplined exit strategies ka istemal karna chahiye. VDX indicator aap ko ek overall risk gauge provide karta hai, jis se aap apni trades ko timely adjust kar sakte hain.

Practical Example of VDX Indicator

Maan lijiye aap EUR/USD pair ke chart par trading kar rahe hain aur aap ne 25 period ka VDX indicator apply kiya hai. Agar aap dekhte hain ke VDX indicator ki value 75 ya us se upar hai, to iska matlab hai ke market mein high volatility hai. Aise mein aap apni long ya short positions ko cautiously enter karenge aur stop loss ko tight rakhenge, kyun ke market unpredictable ho sakti hai. Dusri taraf, agar VDX indicator 30 ke aas paas hai, to market stable hai aur aap trend following ya breakout strategies use kar sakte hain. Additional confirmation ke liye aap moving averages ya RSI ka sahara le sakte hain, jisse aap ko pata chale ke market mein entry aur exit points kya hone chahiye.VDX indicator ek powerful tool hai jo market ki volatility ko objectively measure karta hai. Yeh indicator aap ko batata hai ke market mein uncertainty kitni hai aur price movements kitni tezi se ho sakti hain. Is se aap apni trading strategies, risk management aur position sizing ko behtar bana sakte hain. High volatility ke dauran aapko caution baratna chahiye, jabke low volatility ke dauran aap trend following strategies use kar sakte hain. Har trader ko chahiye ke woh VDX indicator ko apni overall strategy ka hissa banaye aur additional technical tools ke sath integrate kare, taake trading decisions zyada reliable ho sakein. Consistency, disciplined risk management, aur continuous learning se aap VDX indicator ke signals ko effectively utilize kar sakte hain aur market ke turning points se profit hasil kar sakte hain. Trading ke is advanced tool ko samajhne aur implement karne se aap apni trading performance ko next level par le ja sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:33 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим