bearish continuation pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members!- umeed ha ap sb khairiat se hn gy or apki trading bhht achi jaa rhi ho ge.

- aj ki post ka topic ha bearish continuation patterns to aj hum inko study karen gy or dekhen gy k inko kesy trade kia jata ha.

- agr ap ko NHI pata k continuation pattern kia hota ha to phly hum usko dkh lety hain.

- Dear members jesa k nam se wazeh ha k continuation ka mtlb ha jari rhny wala to ye aiys pattern hoty hain jo ksi trend k darmyan main banty hain or in k breakout k bad wohi trend jari rhta ha.

- Dear members bearish ka mtlb hota ha qemton ka km hona or market ka nechy girna. Jb market downtrend main ho to us main ye pattern banty hain or in k breakout k bad qeemten mazeed km hoti hain or market nechy jati ha.

- bearish continuation patterns mulhtalif aksam k hoty hain jo k nechy bayan kiye gay hain.

- Bearish flag pattern.

- Descending Triangle pattern.

- bearish pennant pattern.

- Dear members jb market down trend main ho or kafi nechy jaa chuki to ksi support area py market retracement leti ha or estrha ka pattern bnati ha.

- Es main market apni support se tkra k thora opr ati ha or wapis apni support py jati ha estrha market higher highs or hogher lows bnati ha.

- agr lows ko lows se milaya jay

- or highs ko highs se milaya jay to 2 trend lines bnti hain jn k darmyan market move karti ha or in trendlines se banny waly structure ko bearish flag kaha jata ha.

- Dear members bearish flag pattern main trade leny k lye hamen es pattern ki completion or es k breakout ka wait karna chahye.

- jb ye pattern complete hota ha to us k bad market flag ki lower trend line ko break karti ha or breakout ki confirmation k bad es main sell ki trade li jati ha.

- es main hmara stop loss flag ki lower trend line ya us se opr ho ga jb k profit target flag k pole ki height k equal ho ga.

- Dear members ye pattern bhi downtrend main banta ha or es k breakout k bad market down jati ha mazeed.

- Jb downtrend main market kafi nechy gir chuki hoti ha to ksi support se takra k wpis opr ki trf jati ha or phr nechy wapis previous support py ja k opr ati ha jb k es bar market lower high bnati ha.

- estrha base wohi support hoti ha jb k market lower highs bnati jati jin ko mila k aik downward sloping trend line bnti ha or base ko es se Milan to Descending Triangle bnti ha.

- Dear members descending triangle pattern main trade leny se phly hamen es ki completion or breakout ka wait karna chahye jb eska breakout ho jy or eski confirmation bhi ho jy to hum es main sell ki trade le skty hain.

- q k es k breakout k bad market mazeed nechy jati ha.

-

#3 Collapse

Bearish Continuation Pattern -

1. Tanasubat Ki Tafsilaat (Details of Continuation Patterns):- Bearish continuation pattern, market mein mojood downtrend ko jari rakhne ka ishara hota hai.

- Yeh patterns market ke bearish momentum ko confirm karte hain.

2. Head and Shoulders Pattern:- Head and Shoulders bearish continuation pattern mein shamil hai, jise "head and shoulders" kehte hain.

- Is pattern mein market pehle ek high banti hai (left shoulder), phir aur tezi ke baad ek aur high (head), aur phir kamzori ke baad doosri high (right shoulder) banati hai.

- Jab yeh pattern complete hota hai, toh bearish breakout hone ka imkan hota hai.

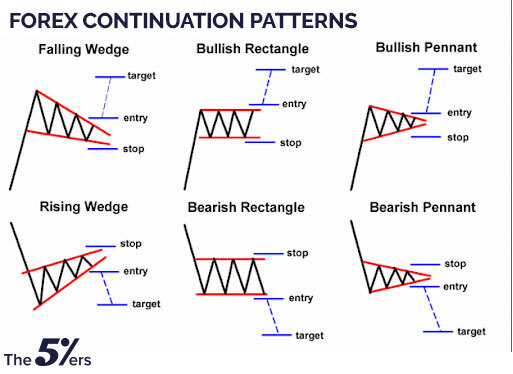

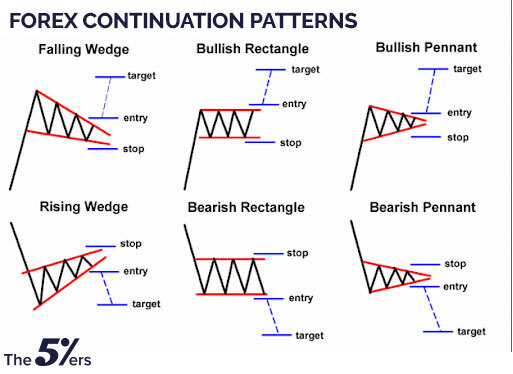

3. Falling Wedge Pattern:- Falling wedge bearish continuation pattern ek descending triangle ka hissa hai.

- Is pattern mein price ek contracting range mein chalti hai jisme high aur low levels gradually kam hote hain.

- Jab falling wedge complete hota hai, toh downtrend resume hone ka chance hota hai.

4. Rectangle Pattern:- Rectangle pattern bearish continuation pattern mein shaamil hai aur market mein range-bound movement ko darust karta hai.

- Rectangle mein price horizontal support aur resistance lines ke darmiyan move karta hai.

- Jab rectangle pattern complete hota hai, toh market mein downtrend ka extension ho sakta hai.

5. Flag Pattern:- Flag bearish continuation pattern hota hai jo market ke strong downtrend ke doran ban sakta hai.

- Is pattern mein price ek tight range mein move karta hai, jo ki flag ki tarah dikhta hai.

- Jab yeh pattern complete hota hai, toh bearish trend continue ho sakta hai.

6. Descending Triangle Pattern:- Descending triangle bearish continuation pattern hai, jisme price lower highs aur horizontal support line ke darmiyan move karta hai.

- Is pattern mein selling pressure zyada hoti hai, aur jab price triangle ke neeche break karta hai, toh bearish trend ka extension ho sakta hai.

7. Trading Strategies:- Bearish continuation patterns ko samajh kar traders apni trading strategies ko plan karte hain.

- In patterns ke breakout ke baad short positions lekar traders apne trades ko manage karte hain.

8. Hoshiyari Aur Tajaweez (Caution and Tips):- Hamesha yaad rakhein ke koi bhi pattern ya indicator 100% confirm nahi hota.

- Har trade ke liye apne risk tolerance ke mutabiq hoshiyari se trading karna zaroori hai.

Note: Bearish continuation patterns ka istemal karne se pehle, aapko market analysis aur risk management ko samajhna zaroori hai. Har trading decision ko careful taur par lena chahiye.

-

#4 Collapse

!!!!Forex Trading Mein Bearish Continuation Pattern!!!!!

Forex trading mein bearish continuation pattern ek chart pattern hai jo indicate karta hai ki ek downtrend mein price ka movement continue hone wala hai. Ye pattern traders ko current downtrend mein entry point dhoondhne mein madad karta hai.

!!!!Forex Trading Mein Bearish Continuation Mein Mash`Hoor Patterns!!!!!

Kuch popular bearish continuation patterns hain:- Bearish Flag: Ye pattern ek flag shape mein hota hai jismein price ek downtrend ke baad consolidation phase mein hoti hai aur phir downtrend ke continuation ki possibility hoti hai.

- Bearish Pennant: Ye pattern bhi flag pattern jaisa hota hai, lekin ismein price ek small triangle ke andar consolidate hoti hai, jise hum pennant kehte hain. Price jab pennant ke breakout ke neeche jaati hai, toh downtrend ka continuation hota hai.

- Descending Triangle: Is pattern mein price ek horizontal support level se neeche jaata hai aur ek descending trendline se upper move karta hai, creating a triangle shape. Breakout ke baad, price ka downtrend continue hota hai.

- Head and Shoulders: Ye pattern ek reversal pattern ke roop mein bhi dekha ja sakta hai, lekin jab ye downtrend ke baad aata hai, toh ye bearish continuation pattern bhi ho sakta hai. Ismein price ka ek shoulder, ek head aur phir doosra shoulder banta hai. Jab price head ke neeche jaata hai, toh downtrend continue hota hai.

- Bearish Rectangle: Is pattern mein price ek horizontal support level se consolidate hoti hai aur phir breakout ke baad downtrend continue hota hai.

-

#5 Collapse

Bearish Continuation Pattern:

jab koi tajir kisi stock ki qeemat ke chart ko daikhta hai, to yeh mukammal tor par be tarteeb harkat dikhayi day sakta hai. yeh aksar sach hota hai aur phir bhi, un qeematon ke andar patteren hotay hain.

chart patteren qeemat ke adaad o shumaar mein payi jane wali hindsi shakalain hain jo aik tajir ko qeemat ki karwai ko samajhney mein madad kar sakti hain, aur sath hi is baray mein pishin goyyan kar sakti hain ke qeemat kahan jane ka imkaan hai .

tajir aksar yeh farz karte hain ke tasalsul ke patteren ki mojoodgi is baat ki nishandahi karti hai ke qeemat ka rujhan jari rehne ka imkaan hai, lekin tajurbah car tajir is khayaal ko qubool karte hain ke koi bhi patteren pishin goi ke maqasid ke liye mukammal tor par qabil aetmaad nahi hai.

yeh mazmoon tasalsul ke namonon ka taaruf faraham karta hai, is baat ki wazahat karta hai ke yeh namoonay kya hain aur inhen kaisay pehchana jaye .

Bearish Continuation Pattern ek technical analysis concept hai jo market mein ek downtrend ke dauran hone wale temporary pauses ya consolidations ko represent karta hai. Jab ek bearish continuation pattern dekha jata hai, to yeh indicate karta hai ke market ka trend continue hone ka zyada chance hai aur price phir se neeche jaane ki possibility hai.

Kuch common bearish continuation patterns mein include hain:

1. Bearish Flag: Bearish flag pattern ek small price consolidation period hota hai ek downtrend ke baad. Is pattern mein price ek flagpole ki tarah neeche jaata hai phir ek small rectangular flag banata hai. Agar price flag ke neeche break karta hai, to yeh bearish continuation signal provide karta hai.

2. Bearish Pennant: Bearish pennant pattern ek small symmetrical triangle shape hota hai jo ek downtrend ke beech mein form hota hai. Is pattern mein price ek flagpole ki tarah neeche jaata hai phir ek triangle banata hai. Agar price triangle ke neeche break karta hai, to yeh bearish continuation indicate karta hai.

3. Descending Triangle: Descending triangle pattern ek bearish continuation pattern hai jo ek downtrend ke dauran form hota hai. Is pattern mein price horizontal support line aur descending resistance line ke beech mein move karta hai. Agar price support line ko break karta hai, to yeh bearish continuation signal provide karta hai.

Aham Nukaat:

1. tasalsul ke namoonay aik ishara hain jo tajir is baat ka ishara dainay ke liye talaash karte hain ke qeemat ka rujhan barqarar rehne ka imkaan hai .

2. tajir mojooda rujhan ke beech mein un namonon ko talaash karne ki koshish karte hain, aur woh andaza lagayen ge ke patteren mukammal honay ke baad rujhan dobarah shuru ho jaye ga .

3. har qisam ke time frames ko tasalsul ke namonon ke liye score kya ja sakta hai, jaisay tik chart, rozana ya hafta waar chart .

4.masalas, jhanday, qalam, aur mustateel tasalsul ke namonon ki misalein hain jin ke sath market ke tajir aksar kaam karte hain .

Khulaasa:

Bearish continuation patterns traders ko current downtrend ke continuation ka indication dete hain aur price ke further decline ki possibility ko highlight karte hain. Traders in patterns ko samajh kar apne trading decisions ko better banate hain aur market trends ko predict karne mein madad milti hai. Lekin, jaise har technical analysis tool, bearish continuation patterns bhi kabhi-kabhi false signals de sakte hain, isliye traders ko proper risk management ke saath in patterns ka istemal karna chahiye.

- CL

- Mentions 0

-

سا2 likes

-

#6 Collapse

Bearish Continuation Pattern:

Bearish continuation pattern yeh ek technical analysis concept hai jo market mein bearish trend ke doran dekha jata hai. Yeh pattern market mein already exist kar rahe bearish trend ko continue karne ki tendency dikhata hai. Is pattern mein price chart par kuch specific shapes ya formations hote hain jo indicate karte hain ke market ka bearish trend continue hone wala hai.

Yeh pattern traders aur investors ke liye important hota hai kyunki isse market ka future direction predict kiya ja sakta hai. Agar bearish continuation pattern detect hota hai to traders apne positions ko adjust kar sakte hain ya phir short selling karke profit earn kar sakte hain.

Head and Shoulders Pattern:- Head and Shoulders bearish continuation pattern mein shamil hai, jise "head and shoulders" kehte hain.

- Is pattern mein market pehle ek high banti hai (left shoulder), phir aur tezi ke baad ek aur high (head), aur phir kamzori ke baad doosri high (right shoulder) banati hai.

- Jab yeh pattern complete hota hai, toh bearish breakout hone ka imkan hota hai.

Continuation Pattern ky aham Nukaat:

1.tasalsul ke namoonay –apne asal course ko dobarah shuru karne se pehlay qeemat mein aik earzi tawaquf ya istehkaam ki nishandahi karte hain .

2.tajir un ka istemaal mumkina dakhlay ya kharji raastoon ki nishandahi karne aur bakhabar tijarti faislay karne ke liye karte hain .

3.masalas ( matawazi, صعودی, nuzool ), jhanday, qalam, aur mustateel aam tasalsul ke namoonay hain .

4.tasalsul ke namoonay kaar amad ho satke hain, lekin woh hamesha qabil bharosa nahi hotay, aur rujhanaat jari rakhnay ke bajaye ulat satke hain .

Akhri Alfaz

Overall, bearish continuation pattern market analysis ka ek important aspect hai jo traders ko market trends ke bare mein insights provide karta hai. Isse traders apne trading decisions ko better inform kar sakte hain aur market volatility ka better handle kar sakte hain. -

#7 Collapse

Bearish Continuation Pattern -

Bearish Continuation Pattern ek technical analysis concept hai jo market mein bearish trend ke doran develop hota hai aur existing downtrend ko confirm karta hai.

Ye patterns typically sideways consolidation ya retracement ke baad dikhte hain aur bearish trend ke continuation ko darust karte hain.

Neeche kuch bearish continuation patterns ki mukhtasir tafseelat roman Urdu mein di gayi hai:

Descending Triangle (Girte Hue Triangle):

Descending Triangle ek bearish continuation pattern hai jo market mein downtrend ke doran develop hota hai.

Is pattern mein ek horizontal support line aur ek descending trend line hoti hai.

Price lower highs aur support line ke qareeb repeatedly test karta hai, jisse ek triangle shape banta hai.

Triangle ke breakout ke baad, market typically downtrend mein continue karta hai.

Bearish Flag (Girte Hue Jhanda):

Bearish Flag pattern ek short-term bearish continuation pattern hai jo market mein develop hota hai.

Is pattern mein ek sharp price decline ke baad ek small rectangular consolidation phase hota hai, jise flag kehte hain.

Flag ke baad price typically phir se decline karta hai, continuation of the existing downtrend mein.

Bearish Pennant (Girte Hue Pannu):

Bearish Pennant pattern ek short-term bearish continuation pattern hai jo market mein develop hota hai.

Is pattern mein ek sharp price decline ke baad ek small pennant-shaped consolidation phase hota hai.

Pennant ke baad price typically phir se decline karta hai, continuation of the existing downtrend mein.

Ye patterns bearish trend ke continuation ko indicate karte hain aur traders ko existing downtrend ke saath trade karne ki madad karte hain. Lekin, iska istemal karne se pehle mukammal analysis aur risk management ka dhyan rakha jana chahiye.

-

#8 Collapse

1. Introduction: Market mein har kisam ke patterns aur trends hotay hain jo traders aur investors ke liye ahem hotay hain. Ek aham pattern jo market mein dekha jata hai woh "bearish continuation pattern" hai. Ye pattern market mein bearish trend ke baad aik temporary pause ka sign deta hai jo phir se bearish trend ke continuation ki expectation ko indicate karta hai. Is article mein, hum bearish continuation pattern ke hawale se mukhtalif pehluo ko ghor karenge.

2. Bearish Continuation Pattern Kya Hai? Bearish continuation pattern market mein ek aham technical analysis tool hai jo bearish trend ke doran dekha jata hai. Ye pattern market mein down trend ke doran jab price mein temporary pause hoti hai aur phir se neeche ki taraf move hone ki expectation hoti hai. Traders is pattern ko identify kar ke apne trading strategies ko enhance karte hain.

3. Mukhtalif Types ke Bearish Continuation Patterns: Market mein kai mukhtalif types ke bearish continuation patterns dekhe jate hain. Kuch common bearish continuation patterns include "Descending Triangle", "Bearish Pennant", aur "Bearish Flag". Ye patterns market mein bearish trend ke doran dekhe jate hain aur traders ko bearish trend ke continuation ka idea dete hain.

4. Kaise Identify Karein Bearish Continuation Pattern: Bearish continuation pattern ko identify karne ke liye traders ko market ke price action aur volume ke movements ko closely observe karna hota hai. Agar price down trend mein hai aur phir ek specific pattern banata hai jo bearish continuation ko indicate karta hai jaise ki descending triangle ya phir bearish pennant, toh traders ko bearish trend ke continuation ka expectation hota hai.

5. Trading Strategies with Bearish Continuation Pattern: Bearish continuation pattern ke identification ke baad, traders apni trading strategies ko adjust karte hain. Agar bearish continuation pattern confirm hota hai, toh traders short positions lete hain ya phir existing short positions ko hold karte hain. Stop loss aur target levels ko set kar ke traders apne risk ko manage karte hain.

Conclusion: Bearish continuation pattern market mein bearish trend ke doran ek useful tool hai jo traders ko trend ke continuation ka idea deta hai. Is article mein humne bearish continuation pattern ke mukhtalif pehluo ko discuss kiya aur ye samjha ke traders ko kaise is pattern ko identify aur trade karne mein istemal karna chahiye. Samajhdari aur technical analysis ke saath, traders bearish continuation pattern ka istemal kar ke apni trading performance ko improve kar sakte hain.

-

#9 Collapse

Market mein dheel ka silsila ek aam phenomenon hai jo traders ko naye opportunities ke talash mein rakhta hai. Yeh dheel market ke patterns mein se ek hai jo bearish trend ke continuation ko darust karta hai. Is article mein hum bearish continuation pattern ke bare mein tafseel se guftagu karenge.

1. Bearish Continuation Pattern Kya Hai?

Bearish continuation pattern market mein bearish trend ke dauran paaye jaate hain. Ye patterns tab dikhte hain jab market ke sellers apne control ko barqarar rakhne ki koshish karte hain. In patterns mein price action ka ek specific configuration hota hai jo bearish momentum ko indicate karta hai.

2. Mukhtalif Bearish Continuation Patterns

a. Bearish Flag: Bearish flag ek rectangle shape ka pattern hota hai jo downward trend ke dauran ban sakta hai. Isme price action mein ek chhota sa consolidation period hota hai jise flagpole kehte hain, phir ek downward sloping trend line banati hai jo flag ko form karti hai.

b. Bearish Pennant: Bearish pennant flag ki tarah hota hai, lekin ismein consolidation period triangular shape mein hota hai. Yeh pattern market mein tezi se girne ke baad banta hai aur ek chhote triangle ke andar price action ko shamil karta hai.

c. Descending Triangle: Descending triangle ek bearish continuation pattern hai jo price action mein ek descending trend line aur ek horizontal support line ko shamil karta hai. Is pattern mein price action neeche ki taraf chalne ki tendency dikhaati hai.

3. Bearish Continuation Pattern Ke Fawaid

Bearish continuation pattern ke istemal se traders ko kuch fawaid mil sakte hain:

a. Identifying Opportunities: Bearish continuation patterns ko pehchaan kar traders ko selling opportunities mil sakti hain jab market mein already downward trend hai.

b. Stop Loss Placement: In patterns ko samajh kar traders apne stop loss levels ko sahi taur par place kar sakte hain, jisse unka risk management behtar ho.

c. Profit Targets: Bearish continuation patterns ke istemal se traders apne profit targets ko define kar sakte hain, jisse unka trading plan mazboot hota hai.

4. Bearish Continuation Pattern Ka Istemal

Bearish continuation patterns ka istemal karne ke liye traders ko kuch asoolon ka khayal rakhna zaroori hai:

a. Confirmation: Pattern ko trade karne se pehle confirmation ka intezar karna zaroori hai taake false signals se bacha ja sake.

b. Risk Management: Har trade mein risk management ka khayal rakhna zaroori hai. Stop loss aur profit targets ko sahi taur par define karna hamesha zaroori hai.

c. Patience: Sabar se kaam lena bhi trading mein ek ahem factor hai. Patterns ka intezar karte waqt patience se kaam lena zaroori hai.

5. Conclusion

Bearish continuation patterns market mein bearish trends ke continuation ko darust karne mein madadgar sabit ho sakte hain. In patterns ko samajh kar aur unka istemal karke traders apne trading strategies ko mazboot kar sakte hain. Lekin, har trade ko samajhdari aur risk management ke saath kiya jana chahiye taake nuksan se bacha ja sake.

-

#10 Collapse

Bearish Continuation Pattern

Bearish continuation patterns woh chart formations hain jo ek downtrend ko indicate karte hain aur suggest karte hain ke price abhi bhi neeche ki taraf move kar sakti hai. Ye patterns tab develop hote hain jab market ek temporary consolidation ya correction phase se guzarti hai aur phir se bearish trend ko continue karti hai. In patterns ko samajhna traders ko help karta hai ke woh market ke bearish momentum ka faida utha sakein aur apni trading decisions ko behtar bana sakein.

Major Bearish Continuation Patterns

1. Bearish Flag

Bearish Flag ek short-term consolidation pattern hai jo ek sharp downtrend ke baad banta hai.

Formation: Is pattern mein, price ek steep downtrend ke baad ek parallel channel ya rectangle formation mein consolidate karti hai. Is consolidation ke dauran, price sideways movement show karti hai.

Identification: Flag ka pattern tab complete hota hai jab price flag ki lower boundary ko break karti hai, jo ke ek bearish signal hai.

Trading Strategy: Trader flag ki lower boundary ke break hone ke baad sell trade initiate karte hain aur stop-loss ko flag ke upper boundary ke upar set karte hain.

2. Bearish Pennant

Bearish Pennant bhi ek continuation pattern hai jo ek strong downtrend ke baad banta hai.

Formation: Pennant pattern ek downtrend ke baad chhota triangle banata hai, jahan converging trendlines hoti hain jo ke consolidation phase ko show karti hain.

Identification: Pattern tab complete hota hai jab price pennant ke lower boundary ko break karti hai. Ye pattern indicate karta hai ke downtrend continue ho sakta hai.

Trading Strategy: Traders generally pattern ke completion ke baad selling position initiate karte hain, aur stop-loss ko pennant ke upper trendline ke upar set karte hain.

3. Bearish Rectangle

Bearish Rectangle pattern bhi ek consolidation pattern hai jo ek downtrend ke baad develop hota hai.

Formation: Is pattern mein, price ek rectangle formation banati hai jahan price ek upper aur lower boundary ke beech range-bound rehti hai.

Identification: Rectangle pattern tab bearish signal generate karta hai jab price lower boundary ko break karti hai.

Trading Strategy: Traders rectangle ke lower boundary ke breakout ke baad sell position initiate karte hain aur stop-loss ko rectangle ke upper boundary ke upar set karte hain.

4. Bearish Rising Wedge

Bearish Rising Wedge ek bearish continuation pattern hai jo ek uptrend ke dauran banta hai.

Formation: Is pattern mein, price progressively higher highs aur higher lows banati hai, lekin slope of the wedge ke andar. Wedge ka shape usually upward-sloping hota hai.

Identification: Wedge tab bearish signal produce karta hai jab price wedge ke lower boundary ko break karti hai.

Trading Strategy: Traders is pattern ke lower boundary ke breakout ke baad selling position lete hain aur stop-loss ko wedge ke upper boundary ke upar set karte hain.

How to Use Bearish Continuation Patterns in Trading

Bearish continuation patterns ko effectively use karne ke liye, traders ko kuch key points yaad rakhne chahiye:

Confirmation: Pattern ke breakout ke baad confirmation zaroori hota hai. Confirmation se muraad hai ke price breakout ke baad us direction mein continue kare.

Volume Analysis: Bearish continuation patterns ke breakout ke time volume ka analysis karna bhi zaroori hai. Increased volume breakout ke confirmatory signal hota hai.

Risk Management: Stop-loss aur target prices ko set karna zaroori hai taake potential losses ko manage kiya ja sake.

Conclusion

Bearish continuation patterns ek strong bearish trend ko continue karne ka signal dete hain. Traders in patterns ko identify karke aur sahi strategy ke saath market mein enter kar sakte hain, jisse woh apni trading positions ko maximize kar sakte hain aur losses ko minimize kar sakte hain. Har pattern ki apni characteristics hoti hain aur inhe samajhna aur unka sahi use karna trading ke success mein important role play karta hai.

-

#11 Collapse

### Bearish Continuation Pattern: Ek Jaiza

Bearish continuation patterns technical analysis mein wo patterns hain jo market ke downward trend ko continue karne ka indication dete hain. Ye patterns market ke bearish momentum ko sustain karte hain aur traders ko potential selling opportunities provide karte hain. Aaiye, in bearish continuation patterns ko detail mein samjhte hain aur unka trading strategies mein kaise istemaal hota hai:

**1. Bearish Continuation Patterns Ki Pehchaan:**

Bearish continuation patterns woh chart formations hain jo ek established downward trend ke baad bante hain aur trend ko continue karne ka signal dete hain. In patterns ki pehchaan se traders ko ye idea milta hai ke market mein bearish momentum continue rahega aur additional selling pressure barhega. Common bearish continuation patterns mein "Flag", "Pennant", aur "Descending Triangle" shamil hain.

**2. Flag Pattern:**

Flag pattern ek short-term consolidation pattern hai jo ek strong bearish move ke baad banta hai. Is pattern mein price ek parallel channel ke andar move karti hai jo ek flag ki tarah dikhta hai. Flag pattern typically ek consolidation phase ko show karta hai, jahan market choti-range mein trade karta hai. Jab price flag ke lower boundary ko break karti hai, to bearish trend continue hota hai aur traders ko selling opportunities milti hain.

**3. Pennant Pattern:**

Pennant pattern bhi ek consolidation pattern hai jo ek strong bearish move ke baad develop hota hai. Is pattern mein price ek converging triangle shape mein move karti hai, jahan upper aur lower trendlines converge hoti hain. Pennant pattern market ke temporary pause ko show karta hai aur jab price pattern ke lower trendline ko break karti hai, to bearish trend ka continuation signal milta hai.

**4. Descending Triangle Pattern:**

Descending Triangle pattern ek bearish continuation pattern hai jo ek downtrend ke baad banta hai. Is pattern mein upper trendline horizontal hoti hai aur lower trendline descending hoti hai. Price is pattern ke andar lower lows aur constant highs banati hai. Jab price descending triangle ke lower trendline ko break karti hai, to bearish trend continue hota hai aur selling pressure barhta hai.

**5. Trading Strategy:**

Bearish continuation patterns ko trading strategy mein shamil karte waqt, traders ko pattern ke completion aur breakout ka wait karna chahiye. Jab price pattern ke boundaries ko break karti hai aur strong volume ke sath close hoti hai, to ye bearish continuation ka signal hota hai. Traders is breakout ke baad sell positions open kar sakte hain aur target aur stop-loss levels set kar sakte hain.

**6. Precautions:**

- **Pattern Confirmation:** Bearish continuation patterns ki reliability ko confirm karna zaroori hai. Additional technical indicators aur volume analysis ko consider karna chahiye taake pattern ke signal ko verify kiya ja sake.

- **Market Conditions:** Market conditions aur broader trend analysis ko bhi dhyan mein rakhna chahiye. Agar market trendless ya choppy hai, to pattern ke signals kam reliable ho sakte hain.

**Conclusion:**

Bearish continuation patterns trading mein valuable tools hain jo market ke downward trends ko identify karne aur capitalize karne mein madad karte hain. In patterns ki accurate identification aur confirmation se traders ko effective trading decisions lene aur profitable opportunities capture karne mein madad milti hai. Proper analysis aur risk management ke sath, bearish continuation patterns ko successful trading strategy mein integrate kiya ja sakta hai.

-

#12 Collapse

**Bearish Continuation Pattern: Market Trend Ko Samajhne Ka Zariya**

Stock market aur forex trading mein, bearish continuation patterns bohot zaroori hain kyun ke ye current downward trend ke continuation ka signal dete hain. In patterns ko samajhne se traders ko market trends aur potential price movements ka andaza lagane mein madad milti hai. Aaj hum kuch common bearish continuation patterns ke baare mein baat karenge.

### Bearish Continuation Patterns Kya Hain?

Bearish continuation patterns wo chart patterns hain jo downward trend ke continuation ko depict karte hain. Ye patterns market mein temporary consolidation ke baad selling pressure ke wapis aane ka signal dete hain.

### Common Bearish Continuation Patterns

#### 1. **Bearish Flag Pattern**

Bearish flag pattern ek short-term consolidation phase ko depict karta hai jo ek steep downtrend ke baad form hota hai. Is pattern mein parallel trendlines hoti hain jo flag shape banati hain.

- **Identify**: Ek steep downtrend ke baad price temporarily consolidate hota hai aur parallel trendlines ke beech move karta hai.

- **Breakout**: Jab price flag pattern se neeche breakout karta hai, to downward trend continue hota hai.

#### 2. **Bearish Pennant Pattern**

Bearish pennant pattern bhi ek steep downtrend ke baad form hota hai lekin ye symmetrical triangle shape banata hai.

- **Identify**: Ek sharp downtrend ke baad price consolidation phase mein aata hai aur converging trendlines ke beech move karta hai.

- **Breakout**: Jab price pennant pattern se neeche breakout karta hai, to downward trend continue hota hai.

#### 3. **Descending Triangle Pattern**

Descending triangle pattern ek strong bearish continuation pattern hai jo lower highs aur horizontal support line ko depict karta hai.

- **Identify**: Horizontal support line draw karein aur descending trendline jo lower highs ko connect kar rahi ho.

- **Breakout**: Jab price horizontal support line ko breach karta hai, to downward trend continue hota hai.

### Trading Strategy

Bearish continuation patterns ko trading strategy mein incorporate karne ke liye kuch steps follow kiye ja sakte hain:

1. **Identify the Pattern**: Pehle pattern ko identify karein aur dekhein ke ye current downward trend ke continuation ka signal de raha hai.

2. **Wait for the Breakout**: Jab tak price breakout na kare, tab tak trade enter na karein. Breakout ke direction mein strong move ki expectation hoti hai.

3. **Entry Point**: Breakout candle ke close par entry karein.

4. **Stop Loss**: Stop loss ko breakout point ke opposite side par place karein taake risk minimize ho.

5. **Target Price**: Target price ko measure karne ke liye previous support levels ya Fibonacci extension levels ka use kar sakte hain.

### Conclusion

Bearish continuation patterns trading mein bohot valuable tools hain jo traders ko market trends aur potential price movements ka andaza lagane mein madad dete hain. In patterns ko sahi tarah se identify aur use karne se profitable trades generate kiya ja sakta hai. Hamesha yad rakhein ke technical analysis mein koi bhi pattern 100% accurate nahi hota, isliye risk management strategies ko zaroor incorporate karein. Trading mein disciplined approach aur proper risk management hi success ki guarantee hai.

-

#13 Collapse

**Bearish Continuation Pattern**

Trading ki dunia mein, "bearish continuation pattern" ek aisa concept hai jo traders ko market ki current trend ko samajhne mein madad deta hai. Yeh pattern tab samne aata hai jab market ki direction downward ho aur yeh signal deta hai ke yeh trend aage bhi jaari rehne wala hai. Isse samajhna aur pehchanna kisi bhi trader ke liye bohot zaroori hai, khas tor par un logon ke liye jo short selling ya bearish positions lena pasand karte hain.

### Bearish Continuation Pattern Ki Samajh

Bearish continuation pattern basically yeh dikhaata hai ke selling pressure abhi bhi market mein maujood hai. Iska matlab yeh hai ke market ne kuch arse ke liye consolidation ya pause liya, magar ab dubara se ussi direction mein jaane ko tayyar hai. Is pattern ki pehchaan karne se traders ko market entry aur exit ke behtareen moqay milte hain.

### Aam Bearish Continuation Patterns

1. **Bear Flag:**

Bear flag ek chhoti si consolidation hai jo ek steep downtrend ke baad aati hai. Is pattern mein price ek rectangle ya channel ki shakal mein move karti hai aur uske baad dubara se breakdown hota hai. Yeh signal deta hai ke downtrend aage barhne wala hai.

2. **Descending Triangle:**

Yeh pattern jab banta hai jab price lower highs aur horizontal support line ke beech trap ho jati hai. Iska breakdown signal deta hai ke market mein bearish sentiment strong ho raha hai aur prices aur neeche jaane ka imkaan hai.

3. **Rising Wedge:**

Rising wedge pattern mein price ek narrowing range ke andar move karti hai jo ke upar ki taraf inclined hoti hai. Iska breakdown yeh signal deta hai ke market ab downward trend ki taraf jaane ko tayyar hai.

### Bearish Continuation Pattern Kaise Trade Karein

1. **Confirmation Ka Intezar Karein:**

Hamesha confirmation ka intezar karein jab tak ke pattern complete na ho jaye. Jaise hi pattern breakdown hota hai, yeh bearish sentiment ko confirm karta hai.

2. **Stop Loss Set Karein:**

Bearish continuation pattern trade karte waqt stop loss lagana bohot zaroori hai. Yeh aapko kisi bhi unexpected market reversal se bachata hai. Stop loss ko pattern ke upar ya nearest resistance par set karein.

3. **Target Setting:**

Apne profit target ko pehle se define karna behtar hai. Yeh aapko disciplined rahne mein madad deta hai. Target ko support levels ya fibonacci extensions par set karein.

### Conclusion

Bearish continuation patterns market ki direction ko samajhne ka ek powerful tool hain. Yeh patterns traders ko precise entry aur exit points de sakte hain. Magar yaad rahe ke koi bhi pattern hamesha accurate nahi hota, isliye hamesha risk management ka khayal rakhein. Technical analysis aur market sentiment ko mix karke aap apni trading ko improve kar sakte hain aur profitable positions le sakte hain. -

#14 Collapse

### Bearish Continuation Pattern

Forex trading mein, different chart patterns ka istemal karke traders market ke trends aur future price movements ko samajhte hain. In patterns mein se ek important pattern "bearish continuation pattern" hai. Ye pattern traders ko ye batata hai ke market ke downtrend jaari rahega aur price aur neeche ja sakti hai. Bearish continuation patterns market ke overall bearish sentiment ko confirm karte hain aur traders ko sahi trading decisions lene mein madadgar hote hain. Aayiye, bearish continuation pattern ke baare mein detail se samajhte hain.

#### Bearish Continuation Pattern Kya Hai?

Bearish continuation pattern wo chart pattern hai jo market ke ongoing downtrend ko indicate karta hai. Iska matlab hai ke price kuch waqt ke liye consolidate ya pullback kar sakti hai, magar phir wapas downtrend ki taraf move karegi. Ye patterns trading charts pe tab bante hain jab market ke sellers dominate karte hain aur price neeche girti hai.

#### Bearish Continuation Patterns Ki Ahmiyat

1. **Trend Confirmation:**

Bearish continuation pattern se traders ko existing downtrend ko confirm karne mein madad milti hai. Ye pattern dikhata hai ke price temporarily consolidate hone ke baad wapas neeche girne wali hai. Is confirmation ke zariye traders confidently apne short positions hold kar sakte hain.

2. **Breakout Signals:**

Ye pattern traders ko breakout signals bhi provide karta hai. Jab price consolidation ke baad previous support level ko break karti hai, toh ye strong bearish signal hota hai. Is signal ke zariye traders apni short positions initiate ya add kar sakte hain.

3. **Risk Management:**

Bearish continuation pattern se traders ko apne risk ko manage karne mein madad milti hai. Ye pattern clear stop-loss levels provide karta hai. Agar price pattern ke upper boundary ko break kare toh ye indication hoti hai ke bearish sentiment khatam ho sakta hai, aur traders ko apni positions exit kar leni chahiye.

4. **Trading Opportunities:**

Ye patterns new trading opportunities ko identify karne mein bhi madadgar hote hain. Jab bearish continuation pattern banta hai, toh traders apne technical analysis ko use karke ideal entry points identify kar sakte hain. Isse unhein profitable trades initiate karne ka mauka milta hai.

#### Common Bearish Continuation Patterns

1. **Bearish Flag:**

Bearish flag pattern ek sharp downtrend ke baad banta hai jisme price consolidate hoti hai. Consolidation period ke baad price wapas downtrend ki taraf move karti hai.

2. **Bearish Pennant:**

Bearish pennant pattern bhi ek sharp downtrend ke baad banta hai, lekin isme consolidation period ek symmetrical triangle ki form mein hoti hai.

3. **Descending Triangle:**

Descending triangle pattern horizontal support line aur descending resistance line ke saath banta hai. Jab price support line ko break karti hai, toh ye strong bearish signal hota hai.

#### Conclusion

Bearish continuation patterns forex trading mein bohot important hain kyunki ye existing downtrends ko confirm karte hain aur traders ko profitable trading opportunities identify karne mein madad karte hain. In patterns ka sahi istemal karke traders apne risk ko manage kar sakte hain aur apni profitability ko improve kar sakte hain. Forex trading mein success hasil karne ke liye in patterns ko samajhna aur effectively use karna bohot zaruri hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

## Bearish Continuation Pattern

Forex trading mein bearish continuation patterns kaafi ahmiyat rakhte hain. Yeh patterns market ki bearish momentum ko darshate hain aur traders ko yeh signal dete hain ke market neechi taraf jaane wala hai. Aaiye, in patterns ki pehchan, unki types, aur trading strategies par nazar dalte hain.

### Bearish Continuation Patterns Ki Pehchan

Bearish continuation patterns wo formations hain jo pehle se maujood downtrend ko mazid continue karte hain. Yeh patterns aksar bullish retracements ke doran bante hain, jahan price temporarily upar jati hai lekin phir neechi taraf wapas aati hai. Is se yeh samajh aata hai ke sellers ab bhi market par control rakhte hain.

### Popular Bearish Continuation Patterns

1. **Descending Triangle**: Is pattern ka structure do trendlines par mabni hota hai. Upper trendline flat hoti hai jabke lower trendline neechi ki taraf slope karti hai. Yeh pattern price ke support level ko test karte hue banta hai, aur jab price support level ko todti hai, to yeh bearish signal hota hai.

2. **Bear Flag**: Bear flag pattern aksar ek steep downtrend ke baad banta hai. Is pattern mein price pehle ek sharp decline karti hai, phir ek consolidation phase mein chali jati hai, jo flag ki tarah nazar aata hai. Jab price is consolidation se nikalti hai to yeh bearish continuation ka signal hota hai.

3. **Head and Shoulders**: Yeh pattern bearish reversal ka bhi darshata hai lekin iski ek type "Inverted Head and Shoulders" ko bearish continuation pattern ke tor par bhi samjha ja sakta hai. Yeh pattern teen peaks par mabni hota hai, jahan middle peak sabse unchi hoti hai. Jab price is pattern ke neckline ko todti hai to bearish continuation hota hai.

### Trading Strategy

Bearish continuation patterns ko samajhne aur trading mein istemal karne ke liye kuch ahmiyat rakhne wali strategies hain:

1. **Confirmation**: Bearish continuation pattern ki pehchan ke baad confirmation ka intezar karein. Iske liye aap volume analysis ya momentum indicators ka istemal kar sakte hain.

2. **Stop Loss**: Trading karte waqt stop loss zaroor set karein. Yeh aapki capital ko bacha sakta hai. Stop loss ko pattern ke recent high ke thoda upar rakhein.

3. **Target Price**: Target price ko pehle ke swing low ya support level par set karein. Yeh aapko risk-reward ratio behtar karne mein madad dega.

### Conclusion

Bearish continuation patterns Forex trading mein ek zaroori role ada karte hain. In patterns ki pehchan aur trading strategies ko samajhne se traders ko market ke bearish trends ko behtar tareeqe se exploit karne ka mauqa milta hai. Hamesha yaad rakhein ke kisi bhi technical analysis tool ko dusre indicators ke sath milakar istemal karna chahiye, taake aapki trading decisions zyada maqbool aur effective hon. Bearish continuation patterns ko samajh kar aap apne trading experience ko behtar bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:05 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим