What is the counterattack line pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

OVERVIEW OF THE COUNTERATTACK LINE PATTERN: Counterattack Line pattern forex trading mein ek aam maani jaane wali chart pattern hai. Ye pattern tab banta hai jab ek candlestick puri tarah se pichhle candlestick ko ghira leti hai, jisse market direction mein ek possible reversal ka sanket hota hai. Is pattern ka matlab hai ki pahle buyers control me hote hai, lekin ab sellers kaafi takatvaan ho rahe hai. Traders is pattern ko ek signal ke roop mein dekhte hai aur short positions enter karne ya long positions ko close karne ke liye istemaal karte hai, yani wo price ki neeche ki taraf jaane ka intezaar karte hai. IDENTIFYING THE COUNTERATTACK LINE PATTERN: Counterattack Line pattern ko pehchanne ke liye, traders ko candlestick chart ko dhyan se analyze karna hota hai. Ye pattern aam taur par ek lambe samay tak chalne wale uptrend ke baad hota hai, jisme ek strong bullish candlestick ke baad ek bearish candlestick aati hai, jo pichhle candlestick ko ghira leti hai. Bearish candlestick ko puri tarah se bullish candlestick ke body aur wicks se ghira hona chahiye, jisse higher prices ke strong reject ka pata chalta hai. Traders dusre technical indicators ya chart patterns ki confirmation bhi dekh sakte hai, jisse signal ki reliability badh jati hai. UNDERSTANDING THE IMPLICATIONS OF THE COUNTERATTACK LINE PATTERN: The Counterattack Line pattern is considered a reliable reversal signal in forex trading. It suggests that the previous bullish momentum is losing steam, and sellers are gaining control in the market. Traders often interpret this pattern as a potential trend reversal, with the likelihood of a downward move in price. It is important to note that while the Counterattack Line pattern is highly regarded, it should not be traded in isolation. Traders should consider other factors such as support and resistance levels, trendlines, and other technical indicators to confirm the validity of the pattern and make informed trading decisions. ENTRY AND EXIT STRATEGIES WHEN TRADING THE COUNTERATTACK LINE PATTERN: When trading the Counterattack Line pattern, traders often look for entry opportunities to initiate short positions. They may enter the trade on the close of the bearish candle that engulfs the previous bullish candle. Stop-loss orders can be placed above the high of the engulfing bearish candle to manage risk. As for exit strategies, traders may choose to exit the trade when a certain profit target is achieved or when there are signs of a bullish reversal pattern forming. It is crucial to monitor the price action closely and adjust the trading plan accordingly to maximize profits and minimize losses. COMBINATION WITH OTHER TECHNICAL ANALYSIS TOOLS: To increase the probability of successful trades when using the Counterattack Line pattern, traders often combine it with other technical analysis tools. This may include support and resistance levels, trendlines, moving averages, and oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator. The use of multiple indicators can help validate the Counterattack Line pattern and provide additional insights into market trends, potential reversals, and entry and exit points. However, it is essential to find a balance between using too many indicators, which can lead to analysis paralysis, and using too few, which may result in inaccurate signals. Experimentation and practice are key to finding the right combination of tools that complement the Counterattack Line pattern and align with individual trading strategies. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Counterattack Line Pattern -

1. Pattern Ki Tafseelat (Details of the Pattern):- Counterattack Line pattern, candlestick patterns mein se aik hai jise traders chart analysis mein istemal karte hain.

- Yeh pattern bearish ya bullish trend ke doran aata hai aur trend reversal ko darust karta hai.

2. Counterattack Line Ka Tareeqa (How the Counterattack Line Works):- Jab market mein strong bullish trend ho aur ek uptrend ke baad doosra bullish candle ata hai, lekin doosra candle pehle candle ke close se neeche hota hai, toh yeh pattern counterattack line kehlata hai.

- Agar yeh pattern bearish trend ke doran aata hai, toh pehla candle bearish hota hai aur doosra bullish hota hai, lekin doosra candle pehle candle ke close se oopar hota hai.

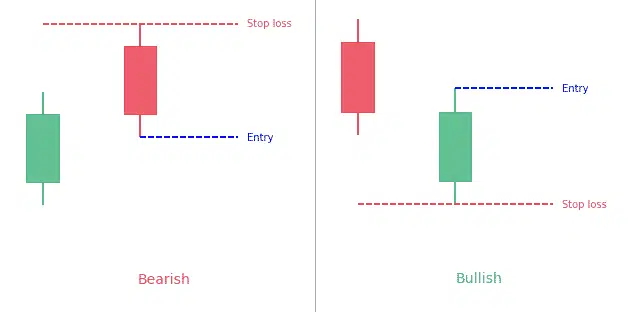

3. Bullish Counterattack Line (Bullish Counterattack Line):- Bullish counterattack line pattern mein pehla candle bearish hota hai aur doosra candle bullish hota hai.

- Doosra candle pehle candle ke neeche open hota hai, lekin trading session ke dauran price recover karke pehle candle ke close ke oopar close hota hai.

4. Bearish Counterattack Line (Bearish Counterattack Line):- Bearish counterattack line pattern mein pehla candle bullish hota hai aur doosra candle bearish hota hai.

- Doosra candle pehle candle ke oopar open hota hai, lekin trading session ke dauran price recover karke pehle candle ke close ke neeche close hota hai.

5. Trading Signals (Trading Signals):- Counterattack line pattern, trend reversal ko darust karta hai, lekin iska confirmation zaroori hai.

- Traders is pattern ko dekhte hain jab market mein trend exhaustion hone ke signs nazar aate hain.

6. Confirmation Aur Risk Management (Confirmation and Risk Management):- Counterattack line pattern ki confirmation ke liye traders doosre technical indicators aur analysis tools ka bhi istemal karte hain.

- Risk management ke liye, stop-loss orders ka istemal kiya jata hai taki nuksan ko minimize kiya ja sake.

7. Market Analysis Mein Istemal (Usage in Market Analysis):- Traders counterattack line pattern ko market analysis mein istemal karte hain trend reversal ka early indication hasil karne ke liye.

- Is pattern ki madad se wo sahi waqt par trading decisions lete hain.

8. Limitations (Hadood):- Jaisa ke har technical indicator ya pattern ki kuch hadood hoti hain, counterattack line pattern ki bhi limitations hoti hain.

- Is liye, hamesha mukammal analysis aur risk management ko tawajju dena zaroori hai.

Note: Counterattack Line pattern ka istemal karne se pehle, traders ko iske tafseelat ko samajhna hoga aur market ke overall context ko bhi madde nazar rakhna chahiye. Trading mein hamesha cautious aur informed taur par amal karna chahiye.

-

#4 Collapse

Counterattack Line Candlestick PatternCounterattack Line Candlestick Pattern, bazaar mein istemal hone wale aham candlestick patterns mein se ek hai. Ye pattern market ke trend reversal ko darust karnay mein madad karta hai. Counterattack Line, do candlesticks se mil kar banta hai aur buyers aur sellers ke darmiyan ki taqat ka andaza lagane mein madad karta hai.Ye pattern typically trend reversal ko identify karne ke liye istemal hota hai. Counterattack Line Candlestick Pattern ka naam is liye hai kyunki ye ek candlestick pattern hai jo existing trend ke against ki taraf ek counterattack darust karta hai. Chaliye isko detail mein samjhte hain.

Counterattack Line Candlestick Pattern Kya Hai:

Counterattack Line ek trend reversal pattern hai jo market ke current trend ko change hone ki soorat mein dikha sakta hai. Is pattern mein do consecutive candlesticks shamil hote hain - ek bearish (girawat wala) candlestick aur dusra bullish (barhne wala) candlestick.

Counterattack Line Pattern Ki Pehchan:- Pehla Candlestick (Bearish): Pattern ki shuruaat ek bearish candlestick se hoti hai. Ye candlestick market mein selling pressure ko darust karta hai aur indicate karta hai ke sellers control mein hain.

- Dusra Candlestick (Bullish): Iske baad aata hai ek bullish candlestick, jo ke pehle candlestick ke neeche close hota hai. Ye candlestick market mein buyers ka comeback darust karta hai aur indicate karta hai ke buyers apna control dobara hasil kar rahe hain.

Counterattack Line Pattern Ka Tafsili Istemal:- Confirmation: Counterattack Line ko confirm karna mahatva purna hai. Iske liye traders ko doosre technical indicators ka bhi istemal karna chahiye, jaise ke RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence).

- Volume Analysis: Volume ki analysis bhi important hai. Agar counterattack line ke sath tezi badh rahi hai aur volume bhi badh raha hai, to ye confirm karta hai ke trend reversal hone ke chances hain.

- Support aur Resistance Levels: Counterattack Line pattern ko samajhne mein aur bhi madadgar hota hai jab aap support aur resistance levels ko consider karte hain. Agar ye pattern kisi important support ya resistance level ke paas dikhe, to iska impact aur bhi strong hota hai.

- Trend Analysis: Trend analysis karna bhi zaroori hai. Agar market mein strong downtrend hai aur counterattack line pattern dikhai deta hai, to iska matlab hai ke trend reversal hone ke chances hain. Lekin, ye pattern sirf trend reversal ko indicate karta hai, isay confirm karne ke liye doosre factors ko bhi madde nazar lena zaroori hai.

Counterattack Line Pattern Ka Istemal Karne Ke Faide:- Early Trend Reversal Signal: Ye pattern early trend reversal ko indicate kar sakta hai, jise traders early entry points ke liye istemal kar sakte hain.

- Risk Management: Counterattack Line pattern traders ko market trend ke change hone ke advance signals deta hai, jisse unka risk management behtar ho sakta hai.

- Confidence Boost: Is pattern ko samajhna aur istemal karna traders ko confidence deta hai, kyun ke ye unhe market ke potential reversal ke baare mein advance mein bata sakta hai.

Is pattern ka istemal karke traders aur investors price reversals ko predict kar sakte hain aur apni trading strategies ko improve kar sakte hain. Ye pattern ek potential entry point ya exit point provide karta hai. Lekin, jaise har technical analysis tool, ye bhi 100% accurate nahin hota aur dusre factors ko bhi consider karna zaroori hai.

Ek example ke tor par, agar ek stock ka price downtrend mein hai aur ek Counterattack Line Candlestick Pattern form hota hai, toh ye indicate karta hai ke price trend change hone wala hai aur bullish movement shuru ho sakta hai. Is situation mein, traders long positions le sakte hain ya existing short positions ko cover kar sakte hain.

Example:

Conclusion:

Counterattack Line Candlestick Pattern, market ke trend reversal ko identify karne mein madadgar hone ke liye ek useful tool hai. Lekin, is pattern ko as a standalone indicator nahi lena chahiye, balki doosre technical analysis tools aur indicators ke saath mila kar istemal karna chahiye. Is pattern ki sahi samajh aur istemal se traders apne trading strategies ko aur bhi mazboot bana sakte hain.

-

#5 Collapse

What is the counterattack line pattern in forex?

Answer:

Counterattack Line Pattern Kya Hai:

Counterattack line pattern ek candlestick pattern hai jo forex trading mein istemal hota hai aur ye trend reversals ko anticipate karne mein madad karta hai. Is pattern mein do consecutive candlesticks hote hain, jinme se pehla candlestick ek trend mein move karta hai lekin doosra candlestick us trend ke against move karta hai aur pehle wale candlestick ko partially cover karta hai.

Kis Tarah Kaam Karta Hai:

1. Banawat:

Counterattack line pattern mein pehla candlestick ek trend mein move karta hai, jaise ki uptrend mein bullish candlestick ya downtrend mein bearish candlestick. Doosra candlestick pehle wale candlestick ko partially cover karta hai lekin poori tarah se engulf nahi karta.

2. Confirmation:

Is pattern ke confirmation ke liye, traders doosre technical indicators aur price action ka istemal karte hain. Agar pattern ke formation ke baad price mein opposite direction ka movement dekha jata hai, toh yeh pattern confirm hota hai.

Tabeer aur Trading:

1. Trend Reversal Signal:

Counterattack line pattern ko dekh kar traders ko signal milta hai ke current trend khatam hone wala hai aur opposite trend ka start hone ka indication hai. Agar uptrend mein ye pattern form hota hai, toh yeh bearish trend ka start signal ho sakta hai, aur agar downtrend mein form hota hai, toh yeh bullish trend ka start signal ho sakta hai.

2. Entry Aur Exit Points:

Traders is pattern ke completion ke baad entry aur exit points tay karte hain. Agar pattern confirm ho jata hai, toh traders trend ke direction mein positions enter karte hain.

Trading Strategy:

1. Confirmation Ki Zarurat:

Counterattack line pattern ke signals ko confirm karne ke liye, traders doosre technical indicators aur price action ka istemal karte hain. Confirmatory signals ke bina trading avoid kiya jana chahiye.

2. Risk Management:

Har trading strategy mein risk management ka ek crucial hissa hota hai. Counterattack line pattern ke signals ke saath, stop-loss aur take-profit levels tay karna zaroori hai.

Natteja:

Counterattack Line Pattern, forex traders ke liye trend reversals ko anticipate karne mein ek useful tool hai. Lekin, hamesha market context aur doosre confirmatory indicators ko bhi tajziya karna zaroori hai trading decisions ke liye.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is the counterattack line pattern?

Counterattack Line Pattern forex trading mein ek candlestick pattern hai jo market mein potential trend reversals ko indicate karta hai. Ye pattern typically ek single candlestick se bana hota hai.

Counterattack Line Pattern ka formation ek bullish candlestick aur ek bearish candlestick ke beech mein hota hai:

Pehla Candlestick: Pehla candlestick ek trend ke doran dikhai deta hai aur bullish hota hai. Is candlestick ka body bara hota hai aur typically upward movement ko represent karta hai.

Doosra Candlestick: Doosri candlestick bhi trend ke doran dikhai deti hai, lekin iski characteristics alag hoti hain. Doosri candlestick ka body chhota hota hai aur typically pehle candlestick ke body ke andar hota hai. Agar doosri candlestick pehle candlestick ko completely cover nahi karta, lekin uske upper side mein open hota hai aur lower side mein close hota hai, toh ye pattern counterattack line pattern kehlata hai.

Counterattack Line Pattern ka appearance market mein potential trend reversal ko suggest karta hai, specifically jab doosri candlestick bullish trend ke doran bearish reversal ke taur par aata hai.

Traders typically Counterattack Line Pattern ko confirm karne ke liye next candlestick ki price action ka wait karte hain. Agar next candlestick bhi bearish movement show karta hai, toh ye Counterattack Line Pattern ki validity ko confirm karta hai.

Counterattack Line Pattern ka istemal traders trend reversal points ko identify karne ke liye karte hain. Is pattern ke appearance ke saath saath, traders ko market conditions aur additional technical indicators ka bhi analysis karna chahiye. Ye pattern sirf ek indicator hai aur iski accuracy aur reliability ko confirm karne ke liye additional research aur analysis ki zarurat hoti hai.

-

#7 Collapse

Counterattack Line Pattern -

"Counterattack Line Pattern" ek technical analysis chart pattern hai jo financial markets, jaise ke stocks ya forex, mein istemal hota hai. Ye ek reversal pattern hai, jo market mein hone wale trend ke opposite direction ko darust karti hai. Yeh pattern candlestick charts par dikhai deta hai aur traders use karte hain taake woh market mein hone wale trend changes ko anticipate kar sakein.

Counterattack Line Pattern ka tafseeli izhaar:- Pehli Candlestick:

- Pehli candlestick downtrend ya uptrend ke dauran aati hai. Agar trend downward hai, to pehli candlestick green (bullish) hoti hai aur agar trend upward hai, to red (bearish) hoti hai.

- Dusri Candlestick:

- Dusri candlestick opposite direction mein move karti hai pehli candlestick ke mukhalif. Is candlestick ki closing price, pehli candlestick ki body ke andar ya uske kareeb hoti hai.

- Pattern Confirmation:

- Counterattack Line Pattern ki confirmation ke liye, teesri candlestick ka wait kiya jata hai. Agar teesri candlestick bhi opposite direction mein move karti hai aur trend continue hota hai, to ye pattern confirm hota hai.

- Volume Ka Tafseel:

- Volume ki bhi tafseel dekhi jati hai pattern ko confirm karne mein. Agar volume teesri candlestick ke sath badhta hai, toh ye ek aur confirmation factor hota hai.

Counterattack Line Pattern ke Istemal:- Reversal Signal:

- Counterattack Line Pattern ko dekh kar traders ko lagta hai ke market mein hone wala trend change hone wala hai. Agar downtrend mein ye pattern dikhe, toh ye ek bullish reversal signal ho sakta hai, aur agar uptrend mein dikhe, toh ye ek bearish reversal signal ho sakta hai.

- Risk Management:

- Traders ise apne risk management strategy mein shamil karte hain. Stop loss orders ko set karke, woh apne trades ko protect karte hain, au is pattern ke mukhalif movement hone par exit ka faisla kar sakte hain.

- Market Entry Point:

- Agar traders ko lagta hai ke trend change hone wala hai, toh ye pattern unko entry point provide kar sakta hai. Lekin, hamesha yaad rahe ke kisi bhi pattern ko istemal karne se pehle, aur bhi technical aur fundamental analysis ki zarurat hoti hai.

Counterattack Line Pattern ek useful tool ho sakta hai, lekin market mein hone wale trend changes ko accurately predict karna hamesha challenging hota hai. Isliye, traders ko is pattern ko dusri confirming signals ke sath milake istemal karna chahiye.

- Pehli Candlestick:

-

#8 Collapse

Counterattack Line Pattern

Counterattack Line Pattern: A Strategic Analysis

Ta'aruf (Introduction):

Counterattack Line Pattern ek strateji hay jo jang mein istemal hoti hai. Is tajaweez mein dushman ke hamle ka tez aur maqsood jawab diya jata hai, maqsad yeh hota hai ke jang ke maidaan mein control ko dobara hasil kiya jaye. Jadeed jangon ki raushan mein, counterattack line pattern ko samajhna aur istemal karna hamare askari kamyabi ke liye ahem hai.

Tareekhi Tanazur (Historical Perspective):

Counterattack Line Pattern ki ahmiyat ko samajhne ke liye is strateji ke tareekhi namoone par ghor karna zaroori hai. Qadeem muqadmon se le kar moaasir tanazur tak, askari kommandaron ne maarekhe mein tezabiat ko palatne ke liye counterattacks ka istemal kia hai. In tareekhi misalon ko tajzia karke is tajaweez ki tashkeel aur uski asar-afraat ko samajhna mumkin hai.

Counterattack Line Pattern ke Bunyadi Hissay:- Strateji Waqt (Strategic Timing):

Waqt counterattack ko kamyabi se anjaam dene ke liye ahem hai. Askari leaderon ko hawalaati soorat-e-haal ko tashreef laane, dushman ki position mein kamzoriyan pehchanne aur moqa par hamle karne ke liye tayyar rehna chahiye. Acha waqt par counterattack, dushman ko herat mein daal sakta hai, unke plans ko bigaar kar muqabla karne mein madadgar hota hai. - Lachak aur Haazirgi (Flexibility and Adaptability):

Counterattack line pattern lachak aur haazirgi ki zarurat ko stress karta hai. Maarekhe ki dynamics jald tabdeel ho sakti hain, is liye askari kommandaron ko apni strateji ko tez taur par badalne ke liye tayyar rehna chahiye. Ye haazirgi yeh saabit karta hai ke counterattack bina tawajjuh ke maqboozion ke bawajood bhi kamyab reh sakta hai. - Maqami Istemaal (Terrain Utilization):

Maqami asoolo ka samajhna ek kamyabi se full counterattack ke liye zaroori hai. Askari foujain apne jawab mein fitri sifat aur jughrafiyai fawaid ka istemal karti hain. Chahe woh maqami bulandiyon ko maqami faida hasil karne ke liye istemal karein ya surprise hamlaat ke liye chhupne ka faida uthayein, maqam counterattack line pattern ko shape karne mein ahem kirdar ada karta hai.

Jadeed Istemal (Modern Applications):

Moasire dor mein, counterattack line pattern taqat-e-askari mein tabdeel hone ke sath sath, technology mein izafay aur jang ke dynamics mein tabdeel hone ke sath sath, izhar hai. Cyber jang se le kar tez raftar hamlay tak, jadeed askari strateji mein mukhtalif chehron ko shamil karne ke liye modern tajaweezat shamil hain. Haal hi mein hue jangon ko jaanch karke, hum dekhte hain ke qoumi jangalon ne kis tarah se is pattern ko naye khatrat ke jawab dene ke liye istemal kia hai.

Chunautiyan aur Ghor O Fikr (Challenges and Considerations):

Counterattack line pattern chand mushkilaat ke bawajood aik taqatwar strateji hai. Lojistik, tabadlaat, aur istikhbarat ikhathay karna is strateji ke kamyabi par asar daal sakti hai. Iske ilawa, etihasik soorat-e-haal aur collateral damage ke liye etihaat baratna bhi is strateji ko amal karne par ghor karne ke liye zaroori hai.

Ikhtitam (Conclusion):

Akhiri alfaz mein, counterattack line pattern hamare askari strateji ka ek bunyadi hissa hai, jo jang mein dinamik aur jawabi nazariye ko pesh karta hai. Tareekhi nazriyat aur moasire misalen dekhtay hue, hum is tajaweez ki complexity aur asar ko qadr kar sakte hain. Jab ke askari technology aur qoumi manazir barhte ja rahe hain, counterattack line pattern ko samajhna aur isay sahih karna, maidan-e-jang mein maqsad hasil karne ke liye mustaqil hai.

- Strateji Waqt (Strategic Timing):

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

INTRODUCTION.

Dear friends Counterattack Line pattern forex trading mein ek aam maani jaane wali chart pattern hay. Ye pattern tab banta hay jab ek candlestick puri tarah se pichhle candlestick ko ghira leti hay, jisse market direction mein ek possible reversal ka sanket hota hay.espattern ka matlab hay ki pahle buyers control me hote hay, lekin ab sellers kaafi takatvaan ho rahe ha. Counterattack Line pattern, candlestick patterns mein se aik hay jise traders chart analysis mein istemal karte hain. Tradersespattern ko dekhte hain jab market mein trend exhaustion hone ke signs nazar aate hain.

FORMATION.

Market men iski first candle ki starting ek bearish candlestick se hoti hay. Ye candlestick market mein selling pressure ko darust karta hay aur indicate karta hay ke sellers control mein hayn. Iske baad aata hay ek bullish candlestick, jo ke pehle candlestick ke neeche close hota hay. Ye candlestick market mein buyers ka comeback darust karta hay aur indicate karta hay ke buyers apna control dobara hasil kar rahe hayn.espattern ka istemal karke traders aur investors price reversals ko predict kar sakte hayn aur apni trading strategies ko improve kar sakte hayn. Ye pattern ek potential entry point ya exit point provide karta hay.

TRADING ANALYSIS.

Ye pattern early trend reversal ko indicate kar sakta hay, jise traders early entry points ke liye istemal kar sakte hayn.Is pattern ko samajhna aur istemal karna traders ko confidence deta hay, kyun ke ye unhe market ke potential reversal ke baare mein advance mein bata sakta hay.Tradersespattern ke completion ke baad entry aur exit points tay karte hayn. Agar pattern confirm ho jata hay, toh traders trend ke direction mein positions enter karte hayn. jis say easily profit earning ki ja sakti hay.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

Forex mein counterattack line pattern

Counterattack line pattern forex mein ek candlestick chart pattern hai. Is pattern mein do candlesticks hote hain jin mein se pehla candlestick bearish hota hai aur doosra candlestick bullish hota hai. Ye pattern normally bearish trend ke baad dekha jata hai aur bullish trend ki shuruat bhi ho sakti hai.ye pattern mukhtlif qisam k hty hen mtlb apko ahista ahista chlna prhta h jb ap aik step kr len gy is k bad dosra kr skty hen

Counterattack

Counterattack line pattern ka matlab hai ke bullish candlestick bearish candlestick ko counter attack karta hai aur price ko upar le jata hai. Is pattern mein bullish candlestick bearish candlestick ki poori body ko cover karta hai aur is tarah se bearish trend ko reverse kar deta hai.is ka mtlb ye h k counterattack me ap upr jaty hen aur profit gain krty hen.

Pattern importance

Ye pattern traders ke liye important hai kyunki iski help se wo trend reversal ko identify kar sakte hain aur apni trading strategies ko improve kar sakte hain. Lekin is pattern ko identify karna mushkil ho sakta hai,.

Chart patterns

traders ko candlestick chart patterns ko samajhna zaroori hai.is me mushkil kam b h lkn apko full tareeqa ana chaye ta k ap loss sy bach sken.aur jtna ap smjh kr kam kren gy itna ap earn kr skty hen aur dosrun ka b knowledge gain kr skty hen.

Conclusion

In conclusion, counterattack line pattern forex mein trend reversal ke liye important hai aur traders ko iski samajh hona chahiye.

-

#11 Collapse

What is the counterattack line pattern?

Counterattack Line Pattern: Forex Mein Candlestick Pattern Ki Tafseel Roman Urdu Mein

Forex trading mein candlestick patterns ka istemal market direction aur trend reversal ka pata lagane mein madadgar hota hai. Counterattack Line Pattern bhi ek aham candlestick pattern hai jo trend reversal ki alamat hai. Is article mein, hum Counterattack Line Pattern ke mutaliq tafseel se ghoor karenge aur dekheinge ke ye kis tarah se traders ko trading decisions mein guide karta hai.

1. Counterattack Line Pattern Ki Tafseel:

Counterattack Line Pattern ek single candlestick pattern hai jo typically downtrend ke doran appear hota hai. Is pattern mein pehli candlestick ek downtrend ke baad form hoti hai aur uski body lambi hoti hai. Doosri candlestick bhi downtrend ke doran form hoti hai, lekin uski body pehli candlestick ke body ke qareeb hoti hai aur uski direction opposite hoti hai.

2. Counterattack Line Pattern Ka Arth:

Counterattack Line Pattern ko dekh kar traders ko bullish reversal ki alamat milti hai. Ye pattern indicate karta hai ke market ka downtrend weaken ho sakta hai aur bullish reversal hone ka chance hai. Jab doosri candlestick pehli candlestick ke opposite direction mein close hoti hai, to ye bullish sentiment ko darust karta hai.

3. Counterattack Line Pattern Ki Alamat:

Pehli Candlestick: Pehli candlestick ek downtrend ke baad form hoti hai aur uski body lambi hoti hai. Ye bearish momentum ko reflect karti hai.

Doosri Candlestick: Doosri candlestick bhi downtrend ke doran form hoti hai, lekin uski body pehli candlestick ke body ke qareeb hoti hai aur uski direction opposite hoti hai. Ye bullish reversal ki confirmation hai.

4. Counterattack Line Pattern Ka Istemal:

Counterattack Line Pattern ka istemal trading decisions mein madadgar hota hai. Agar ye pattern strong downtrend ke baad appear hota hai, to ye bullish reversal ki possibility indicate karta hai. Traders is pattern ko confirm karne ke liye doosre technical indicators aur price action analysis ka bhi istemal kar sakte hain.

5. Counterattack Line Pattern Aur Risk Management:

Counterattack Line Pattern ke istemal mein risk management ka khaas khayal rakhna zaroori hai. Traders ko apne stop loss levels aur position sizes ko adjust karna chahiye taake unki trading positions ko protect kiya ja sake.

6. Akhri Alfaaz:

Counterattack Line Pattern ek aham bullish reversal pattern hai jo traders ko trend reversal ki alamat deta hai. Iska istemal karke, traders market direction ko samajh sakte hain aur apne trading strategies ko improve kar sakte hain. Demo account mein practice karke, traders is pattern ko effectively istemal kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction :

Counterattack Line pattern ek candlestick pattern hai jo price action analysis mein istemal hota hai. Yeh trend reversal pattern hota hai, jo market ki current trend ko badalne ka indication deta hai.

Counter Attack Line Pattern ek trading strategy hai jo forex market mein istemal hoti hai. Iska maqsad trend reversal ya trend continuation ka pata lagana hota hai.

Counterattack Line Pattern Identify:

Counterattack Line pattern mein do candlesticks shamil hote hain: pehla candlestick current trend ke mutabiq move karta hai, jabke doosra candlestick opposite direction mein move karta hai aur pehle candlestick ki range ko cover karta hai.

Counterattack Line Pattern Detail:

Bullish Counterattack Line:

Agar pehla candlestick downtrend mein hai aur doosra candlestick uski range ko cover karke upar ki taraf close karta hai, to yeh bullish counterattack line pattern hai.

Bearish Counterattack Line:

Agar pehla candlestick uptrend mein hai aur doosra candlestick uski range ko cover karke neeche ki taraf close karta hai, to yeh bearish counterattack line pattern hai.

Entry and Exit Points:

Counter Attack Line Pattern ko samajhne ke baad, traders entry aur exit points tay karte hain. Entry point ko confirm karne ke liye, traders doosre candlestick ke close ke barabar ya us se thoda upar ya neeche entry kar sakte hain. Exit points ko bhi defined kiya jata hai taake profit ya loss ko manage kiya ja sake.

Counterattack Line Pattern Uses:

Counterattack Line pattern ka istemal trend reversal ke signals ke liye kiya jata hai. Agar yeh pattern sahi waqt par pehchana jaye, to traders ko potential entry aur exit points ka pata chal jata hai.

Caveats and Risk Management:

Counterattack Line pattern ko sirf doosri confirmatory indicators ke saath istemal karna zaroori hai taake false signals ka risk kam ho. Additionally, risk management strategies ka istemal karna bhi zaroori hai taake nuqsaan se bacha ja sake. Har trading strategy mein risk management bohot ahem hai. Counter Attack Line Pattern ka istemal karte waqt, stop loss aur take profit levels ko sahi tarah se set karna zaroori hai taake trading positions ko protect kiya ja sake.

Conclusion :

Counter Attack Line Pattern ek mufeed trading strategy hai jo forex market mein istemal kiya ja sakta hai. Lekin, isko samajhne aur istemal karne se pehle thorough research aur practice ki zarurat hoti hai. -

#13 Collapse

Counterattack Line Pattern:

1. Introduction: Counterattack Line Pattern ek candlestick pattern hai jo market trends ko reverse hone ki possibility ko indicate karta hai.

2. Formation (Takhleeq): Counterattack Line Pattern do candlesticks se banta hai. Pehla candlestick current trend ke direction mein move karta hai, jabke doosra candlestick opposite direction mein move karta hai aur pehle candlestick ke zyada hisse ko cover karta hai.

3. Bullish aur Bearish Signals: Agar Counterattack Line Pattern downtrend ke doran form hota hai, to yeh bullish reversal signal deta hai, aur agar uptrend ke doran form hota hai, to yeh bearish reversal signal deta hai.

4. Confirmation (Tasdiq): Counterattack Line Pattern ke signals ko confirm karne ke liye, traders doosre technical indicators ya price action signals ko dekhte hain. Confirm hone ke baad hi traders apne positions ko adjust karte hain.

5. Entry aur Exit Points: Counterattack Line Pattern ko istemal karke, traders market mein entry aur exit points ko determine karte hain. Agar bullish reversal signal milta hai, to traders apne short positions ko close karke long positions enter kar sakte hain, aur agar bearish reversal signal milta hai, to opposite strategy follow ki ja sakti hai.

6. Risk aur Reward: Counterattack Line Pattern ke signals ko istemal karte hue, traders apne positions ke liye risk aur reward ko consider karte hain. Stop-loss aur profit targets ko set karke, wo apne trades ko manage karte hain.

7. Market Observation aur Practice: Counterattack Line Pattern ko effectively istemal karne ke liye, traders ko regular market observation aur practice ki zarurat hoti hai. Iske saath hi, patience aur discipline bhi maintain karna zaruri hai taki sahi waqt par sahi trading decisions liye ja sakein.

منسلک شدہ فائلیں -

#14 Collapse

What is the counterattack line pattern?

Tanazur ek taweel waqt ka ek hissa hai jismein tafteeshat, jaaizat, aur tajaweezat asoolon par mushtamil hoti hain. Counterattack Line Pattern is ek aisa tanazur hai jo kisi bhi tawun, hamlay, ya hamlah ke jawab mein istemaal hota hai. Ye nizaam ka maqsad asoolon aur hukmarani ke muamalon mein tabdeelion ko darust karna hai.

Tanazur Ki Bunyad:

Counterattack Line Pattern ki bunyad asoolon, jawabi tawun, aur muamalon ki tafteesh par mabni hoti hai. Ye ek taweel dour mein anay wale hadsat ke mutaliq raai aur tajaweezat jama karne ka ek tariqa hai. Iska maqsad hawalaat, malumat, aur tawunat ko bahas mein istemal karke aala aur sachi raai tashkeel dena hai.

Asoolon Ka Hami:

Counterattack Line Pattern, asoolon ko madde nazar rakhta hai aur inka istemal hamle ya tawun ke jawabi qadamat mein karta hai. Is tanazur ka aham hissa hai ke ismein asoolon ki mazbooti ko barqarar rakha jata hai taake jawabi tawunat mein hukmarani ka sath diya ja sake.

Hamlay Ki Tafteesh:

Counterattack Line Pattern mein hamle ki tafteeshat ka khaas khayal rakha jata hai. Is mein maqami aur qudrati tawunat ko pehchanna, unke maqasid ko samajhna aur uske jawabi qadamat ko anay wale asoolon ke mutabiq tajwez dena shamil hai.

Mazbooti Mein Izafa:

Counterattack Line Pattern ka ek maqsad mazbooti mein izafa hai. Ismein hamlay ke jawabi tawunat ko asoolon, qanoon aur insani haqooq ke tahaffuz ke mutabiq tashkil di jati hai. Isse mulk aur qawmi tawunat mein behtar mawafiqat barqarar rehti hai.

Amal Main Istemal:

Counterattack Line Pattern ko amal mein lane ke liye tajaweezat, raai aur asoolon ko hamle ya tawun ke baare mein tafteeshat ke doran tayyar kiya jata hai. Iske mutabiq, sarkar aur qawmi hukumat asoolon ko barqarar rakhte hue jawabi tawunat mein tajaweezat aur qadamat istemaal karti hain.

Ikhtitam:

Counterattack Line Pattern ek taweel waqt ka tanazur hai jo asoolon aur tawunat ke darmiyan barabari aur muqablay mein istemal hota hai. Iska maqsad hukmarani, insani haqooq aur asoolon ki peshrawi mein mazbooti aur barabari ko barqarar rakha jana hai. Is taweel dour mein, Counterattack Line Pattern hamlay aur tawunat ke jawabi qadamat mein istemal hota hai takay asoolon ki mazbooti aur qawmi mawafiqat ko barqarar rakha ja sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

counterattack line pattern?

Counterattack Line pattern ek candlestick pattern hai jo market mein trend reversals ko indicate karta hai. Ye pattern typically downtrend ke baad dekha jata hai aur bullish reversal ke indication ke roop mein istemal kiya jata hai.

Counterattack Line pattern ek do candlesticks se represent hota hai:- Pehla Candlestick (Bearish Candlestick): Pehla candlestick ek bearish candle hota hai jo current downtrend ko represent karta hai. Is candlestick ka range typically bara hota hai aur bearish momentum ko darust karta hai.

- Doosra Candlestick (Bullish Candlestick): Doosra candlestick ek bullish candle hota hai jo pehle candlestick ke range ke andar hota hai. Is candlestick ka open typically pehle candlestick ke open price ke neeche hota hai, lekin close price pehle candlestick ke body ke andar ya uske upper side ke qareeb hota hai, indicating ki bullish momentum shuru ho raha hai.

Is pattern ka analysis karne ke liye, kuch key points hote hain:- Previous Downtrend: Counterattack Line pattern ko identify karne se pehle, aapko dekhna hoga ki market mein pehle ek downtrend tha. Ye pattern usually downtrend ke baad dekha jata hai, jab bearish momentum weaken hone lagta hai.

- Two Candlesticks Formation: Counterattack Line pattern mein do candlesticks shamil hote hain. Pehla candlestick ek bearish candle hota hai jo downtrend ko continue karta hai. Doosra candlestick ek bullish candle hota hai jo pehle candlestick ke range ke andar hota hai. Is candlestick ka open typically pehle candlestick ke open price ke neeche hota hai, lekin close price pehle candlestick ke body ke andar ya uske upper side ke qareeb hota hai.

- Confirmation: Counterattack Line pattern ko confirm karne ke liye, traders dusre technical indicators aur confirmatory signals ka bhi istemal karte hain jaise ke volume analysis, price action indicators, aur trend lines. Agar is pattern ke baad ek bullish candle ya doosra bullish confirmation signal dikhai deta hai, toh ye pattern ko confirm karta hai.

- Risk Management: Har trading decision ke liye risk management important hota hai. Inverted Hammer pattern ke identification ke baad, aapko apne positions ke liye stop-loss orders set karna chahiye takay aapko nuksan se bachaya ja sake.

Counterattack Line pattern dekh kar, traders ko bullish reversal ka expectation hota hai aur iske basis par woh apni trading strategies ko adjust karte hain. Kuch traders long positions enter karte hain ya phir existing short positions ko close karke profit book karte hain.Counterattack Line pattern ko confirm karne ke liye, traders dusre technical indicators aur confirmatory signals ka bhi istemal karte hain jaise ke volume analysis, price action indicators, aur trend lines.Lekin, jaise ki har technical analysis concept, Counterattack Line pattern bhi kabhi-kabhi false signals generate kar sakta hai, isliye confirmatory indicators ka istemal karna zaroori hota hai. Traders ko doosre factors jaise ke market ki overall context, trend, aur volatility ko bhi dhyan mein rakhna chahiye jab woh Counterattack Line pattern ko interpret karte hain.Counterattack Line pattern bullish reversal ke indication ke roop mein istemal kiya jata hai.

Conclusion

Lekin, jaise ki har technical analysis concept, ye bhi kabhi-kabhi false signals generate kar sakta hai, isliye confirmatory indicators aur proper risk management ka istemal karna zaroori hota hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим