What's the Bullish kicker pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

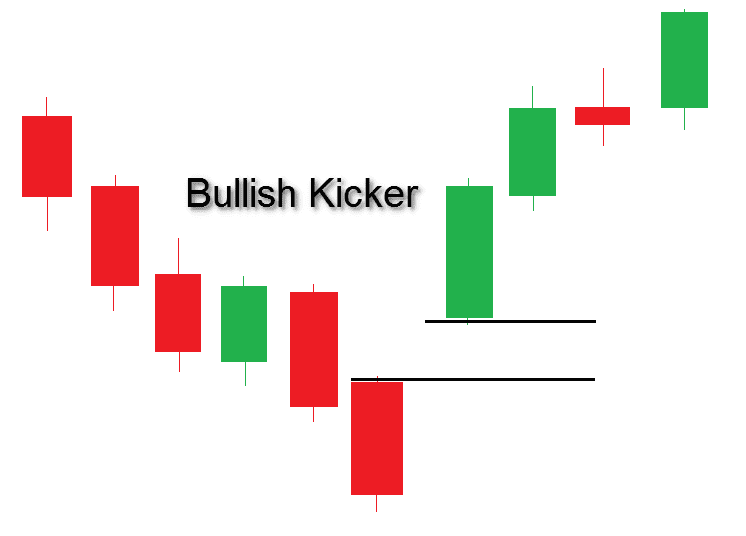

Introduction "Bullish kicker pattern" ek technical analysis concept hai jo stock market aur trading mein istemal hota hai. Isay Roman Urdu mein samjhane ki koshish karenge. Bullish kicker pattern ek candlestick pattern hai, jo traders aur investors ke liye ek signal provide karta hai ke market mein price trend ka palatna (reversal) hone ke chances hai aur stock ki keemat mein izafa hone ke imkaanat hai. Bullish kicker pattern ek do candlesticks se mil kar banta hai, aur iska matlab hota hai ke do consecutive days ke trading sessions mein price mein achanak izafa hota hai. Pehli candlestick red (girawat wali) hoti hai, jo ke market mein selling pressure ko darust karti hai. Dusri candlestick green (barhne wali) hoti hai, jo ke pehli candlestick ki range ke bahar open hoti hai, aur iska matlab hota hai ke buyers market mein qadam rakh chuke hain aur price ko upar le jana chahte hain. Is pattern ki pehchan karne ke liye traders ko candlestick charts ka istemal karte hue price movement ko dekhna hota hai. Jab pehli red candlestick ke baad dusri green candlestick form hoti hai, aur dusri candlestick pehli candlestick ki range ke bahar open hoti hai, to yeh bullish kicker pattern kehlata hai. Bullish kicker pattern ek strong reversal signal provide kar sakta hai, aur isay traders price ko upar jane ka moka samajhte hain. Lekin, yad rahe ke har ek technical indicator ya pattern ki tarah, yeh bhi kabhi galat ho sakta hai. Isliye, traders ko dusre technical analysis tools aur risk management ke principles ka bhi istemal karna chahiye. In conclusion, bullish kicker pattern ek candlestick pattern hai jo market mein price trend ka palatna signal karta hai. Yeh pattern do consecutive candlesticks se banta hai, jisme pehli candlestick red hoti hai aur dusri green hoti hai. Isay samajh kar traders price mein izafa ki taraf invest kar sakte hain, lekin hamesha yaad rahe ke trading mein risk hota hai, aur isay samajh kar aur dhyan se karna chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Bullish Kicker Pattern" yeh ek technical analysis term hai jo stock market mein use hoti hai. Yeh pattern ek uptrend ko indicate karta hai jab ek stock ya asset ke prices mein sudden increase hota hai. Is pattern ko describe karne ke liye Roman Urdu mein aik post ho sakti hai: "Stock Market Mein Bullish Kicker Pattern: Bullish Kicker Pattern ek powerful uptrend reversal signal hai. Is pattern ko identify karne mein do consecutive candlesticks ka use hota hai. 1. Pehla candlestick bearish (girawat ki taraf) hota hai aur existing downtrend ko represent karta hai. 2. Dusra candlestick, pehle wale candlestick se opposite direction mein hota hai aur ek strong uptrend ko signal deta hai. Is pattern ko dekhte hue traders ko yeh samjhna chahiye ke market sentiment mein tezi aane wali hai aur unhe long positions (kharidari) par consider karne ka mauka mil skya hai ips" Is tarah ki post traders ko Bullish Kicker Pattern ke bare mein basic information provide karegi. -

#4 Collapse

Bullish Kicker Candlestick Pattern ek technical analysis pattern hai jo financial markets mein price reversals ko identify karne ke liye istemal hota hai. Ye pattern typically bearish trend ke bad ek potential bullish reversal ko suggest karta hai. Iska name "kicker" se aata hai, kyun ki ye pattern ek strong reversal signal provide karta hai. Bullish Kicker Candlestick Pattern ko samajhne ke liye, aapko do key candlesticks ki sequence par dhyan dena hoga: 1. **Pehla Candlestick:** Pehla candlestick ek downtrend ke ant mein hota hai aur typically ek bearish (downward) candlestick hota hai, jo indicate karta hai ki sellers (bechne wale) control mein hain. 2. **Doosra Candlestick:** Doosra candlestick pehle candlestick ke close price se neeche open hota hai aur typically ek large bullish (upward) candlestick hota hai. Is candlestick ke open price pehle candlestick ke close price se neeche hota hai, isiliye ise "gap up" bhi kehte hain. Bullish Kicker Candlestick Pattern ek sudden reversal ko darust karta hai, aur ye traders ko batata hai ki market sentiment me ek strong shift hua hai. Is pattern ke appearance ke baad, uptrend ki shuruaat ho sakti hai ya bearish trend me kamzori aane ke chances hote hain. Traders Bullish Kicker Pattern ko dekhkar potential long (buy) positions le sakte hain. Lekin, ek single pattern par depend karke trading decisions na lein. Is pattern ko confirmatory signals aur risk management ke saath combine karke hi istemal karna behtar hota hai. Market mein hamesha risk hota hai, isliye traders ko apni trading strategy ko carefully plan karna aur stop-loss orders ka istemal karke apne risk ko minimize karna chahiye.

- Mentions 0

-

سا0 like

-

#5 Collapse

What is Bullish Kicker Chart Pattern: Bullish Kicker design ko recognize karne ke liye merchants ko cost outline examination karna hota hai. Is design mein dealers ko do candles ko dekhna hota hai jo ek dusre ke bilkul inverse hai. Is design mein pehli candle ka range dusri candle ke range se zyada hona chahiye. Kicker design ka istemal karne se pehle merchants ko market patterns ke baare mein pata hona zaroori hai. Agar market bullish pattern mein hai to brokers ko ye design bullish pattern inversion ka signal dega. Aur agar market negative pattern mein hai to ye design negative pattern inversion ka signal dega. Kicker design ko istemal karne ke liye merchants ko explicit passage aur leave focuses ke liye stand by karna hota hai. Hit ye design diagram standard dikhai deta hai to brokers ko market mein explicit passage point ke liye prepared rehna hota hai. Is point mein brokers ko stop misfortune aur target levels set karne ki zaroorat hoti hai. Stop misfortune level dealers ki speculation ki security ke liye bohot significant hota hai. Is level ko dealers apni exchanging system ke hisaab se set karte hain. Kicker Example specialized investigation ke liye accessible sabse zyada strong sign mein se ek hai design Ke Piche Two candle Nazar Aane wali ahmiyat rakhti Hain phale candle open Hoti Hai To latest things ki course Chalti Hai aur dusri flame Pichhle Day ke Usi open per khulati Hain Jo Pichhle day ke candles ke inverse heading Mein Jata Hai jismein bulls and bears control mein rahte hain candle ke bodies bahut se exchanging stage per inverse tone ke Hote Hain Jo financial backers ke opinion Mein dramai show banate hain Kyunki investers kicker design ke disposition mein monetary ekdamat dikhate Hain jismein market interest Ko Dekha jata hai light white variety ki hoti hai jo short position ki taraf Jaati Hai down pattern moving normal Mein paya jata hai dusri candle support levels ki taraf Jaati Hai Chart Pattern Works And Formation: Design two candle ke dauraniya Mein cost mein Bullish se inversion ki kasusiyat Rakhta hai Example security ke Hawale se financial backer ke demeanor Mein solid tabdili ki taraf Ishara karta hai Kicker design ek two bar wala candle design hai Jo Kisi ASsetT ki cost ke patterns the heading Mein tabdili ki anticipate karta hai dealers iska istemal is baat ka decide karne ke liye Karte Hain Ki market ke shares ka kaun sa bunch course ke control mein hai course Mein tabdili aamtaur per organization Industry economy ke exposed mein cost ki maloomat accessible ke uncovered mein hoti hain vah securities exchange contending purchasers bulls aur vender bears key on players mein hai Jo candles ke design banate hain Candles stick Kisi bhi monetary market Jese stock prospects Aur ghar Mulki money exchanging ke liye ek mazu method hai kicker design ko sabse zyada dependable inversion design mein se ek Samjha deta hai aur aamtaur per buniyadi rules mein dram\ic tabdili ke maloomat karta hai aur yah Ek hole pattern se different hai Jo Upar Ja specialty ke Fark ko zahar karta hai aur use design Mein rahata Hai

Kicker Example specialized investigation ke liye accessible sabse zyada strong sign mein se ek hai design Ke Piche Two candle Nazar Aane wali ahmiyat rakhti Hain phale candle open Hoti Hai To latest things ki course Chalti Hai aur dusri flame Pichhle Day ke Usi open per khulati Hain Jo Pichhle day ke candles ke inverse heading Mein Jata Hai jismein bulls and bears control mein rahte hain candle ke bodies bahut se exchanging stage per inverse tone ke Hote Hain Jo financial backers ke opinion Mein dramai show banate hain Kyunki investers kicker design ke disposition mein monetary ekdamat dikhate Hain jismein market interest Ko Dekha jata hai light white variety ki hoti hai jo short position ki taraf Jaati Hai down pattern moving normal Mein paya jata hai dusri candle support levels ki taraf Jaati Hai Chart Pattern Works And Formation: Design two candle ke dauraniya Mein cost mein Bullish se inversion ki kasusiyat Rakhta hai Example security ke Hawale se financial backer ke demeanor Mein solid tabdili ki taraf Ishara karta hai Kicker design ek two bar wala candle design hai Jo Kisi ASsetT ki cost ke patterns the heading Mein tabdili ki anticipate karta hai dealers iska istemal is baat ka decide karne ke liye Karte Hain Ki market ke shares ka kaun sa bunch course ke control mein hai course Mein tabdili aamtaur per organization Industry economy ke exposed mein cost ki maloomat accessible ke uncovered mein hoti hain vah securities exchange contending purchasers bulls aur vender bears key on players mein hai Jo candles ke design banate hain Candles stick Kisi bhi monetary market Jese stock prospects Aur ghar Mulki money exchanging ke liye ek mazu method hai kicker design ko sabse zyada dependable inversion design mein se ek Samjha deta hai aur aamtaur per buniyadi rules mein dram\ic tabdili ke maloomat karta hai aur yah Ek hole pattern se different hai Jo Upar Ja specialty ke Fark ko zahar karta hai aur use design Mein rahata Hai Bullish kicker design ko dusre specialized pointers aur cost activity ke saath affirm karna zaroori hai. Is design ke signals ko independent premise standard use karna unsafe ho sakta hai. Jaise har candle design ki tarah, bullish kicker design bhi bogus signs create kar sakta hai. Isliye isko dusre pointers aur cost activity ke saath affirm karna zaroori hai.Bullish kicker design ek apparatus hai, jo dealers ki system aur time period standard depend karti hai. Isko acche se samajhne aur apne exchanging methodology ke hisab se istemal karna zaroori hai. Aapko hamesha ek monetary counsel ya master se salah leni chahiye, agar aap exchanging choices standard vishwas nahi rakhte hain. Bullish kicker design pattern inversion ka solid sign karta hai. Agar ye design negative pattern ke baad structure hota hai, to ye bullish inversion signal produce karta hai.Is design ke through brokers section point ko decide kar sakte hain. Second candle ki open cost se passage karne se brokers ko potential benefit open doors mil sakti hain. Bullish Kicker Chart Pattern Trading: Target level dealers ke liye ek objective hota hai. Ye level dealers ki benefit booking ke liye zaroori hota hai. Dealers apni exchanging system ke hisaab se target level set karte hain. Kicker design ka istemal karne se merchants ko market patterns ke baare mein better comprehension milta hai. Ye design brokers ko market mein bullish aur negative pattern ko distinguish karne mein help karta hai. Is design ko use karne se dealers ko market developments ke baare mein better information ho jaati hai. Kicker design ko istemal karne se merchants ko risk the executives ke baare mein bhi clearness milta hai. Stop misfortune aur target levels set karne se merchants ki venture aur benefits ki wellbeing guarantee ho jaati hai. Kicker design, cost activity examination ka ek significant part hai. Ye design, do candles se bana hota hai, jismein pehli candle, bullish ya negative pattern ko show karti hai aur dusri candle, pattern inversion ko demonstrate karti hai. Agar ye design bullish pattern ke liye hai, to pehli candle negative pattern ko show karegi aur dusri candle bullish pattern ko, aur agar ye design negative pattern ke liye hai, to pehli candle bullish pattern ko demonstrate karegi

Candles Pattren plan ek baar design reversal plan hai Is vajah Se market Mein maujud design hona chahiye plan ki Pahli candle Ek marabo zoo white fire honi chahiye Jiske bilkul Piche dim candle Bani chahiye white or dim light Ke Darmiyan down Ek opening Blacklist Jana candles take ka Shadow be Mumkin Hai lajmi Nahi ke Merbouzo flame hi dim kicking plan Mein Shamil Ho second Badi certifiable body wali candle bhi ho sakti hai.Kicker Candles Pattren configuration market cost ki Kami ki taraf Ishara karti hai agar yah up Example ke banti hai to yah market reversal ka signal Degi aur Agar market pahle se hello negative chal rahi ho to feature Ka Tashan sul barkrar Rahega negative kicking candles take plan Mein Pehle Ek white light Hogi Jiske bilkul Piche Ek dim candle Is Tarah Banegi ke vah white candle ke opening position se down open Hogi aur Darmiyan Mein Ek opening Bana Degi..

Candles Pattren plan ek baar design reversal plan hai Is vajah Se market Mein maujud design hona chahiye plan ki Pahli candle Ek marabo zoo white fire honi chahiye Jiske bilkul Piche dim candle Bani chahiye white or dim light Ke Darmiyan down Ek opening Blacklist Jana candles take ka Shadow be Mumkin Hai lajmi Nahi ke Merbouzo flame hi dim kicking plan Mein Shamil Ho second Badi certifiable body wali candle bhi ho sakti hai.Kicker Candles Pattren configuration market cost ki Kami ki taraf Ishara karti hai agar yah up Example ke banti hai to yah market reversal ka signal Degi aur Agar market pahle se hello negative chal rahi ho to feature Ka Tashan sul barkrar Rahega negative kicking candles take plan Mein Pehle Ek white light Hogi Jiske bilkul Piche Ek dim candle Is Tarah Banegi ke vah white candle ke opening position se down open Hogi aur Darmiyan Mein Ek opening Bana Degi..

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

The Bullish Kicker pattern is a bullish reversal pattern in technical analysis used to identify potential trend reversals in financial markets, particularly in stock trading and candlestick chart analysis. This pattern consists of two consecutive candlesticks and is characterized by a significant change in market sentiment from bearish (downward) to bullish (upward). Here's how the Bullish Kicker pattern works: First Candlestick: The first candlestick in the pattern is a bearish (downward) candlestick, indicating a prevailing downtrend. This candle typically has a long black or red body, suggesting that sellers are in control of the market. Second Candlestick: The second candlestick is a bullish (upward) candlestick that immediately follows the first one. It has a long white or green body and opens higher than the previous candle's close. The key characteristic of the Bullish Kicker pattern is that the second candle completely engulfs the first one, meaning it covers the entire trading range (high to low) of the first candle. The Bullish Kicker pattern suggests a sudden and strong reversal of sentiment from bearish to bullish. It indicates that buyers have taken control and are likely to continue driving the price higher. Traders often see this pattern as a signal to enter long (buy) positions or to exit short (sell) positions, anticipating a bullish trend reversal. As with all technical patterns, it's essential to consider other factors, such as volume and overall market conditions, to confirm the validity of the signal. Additionally, it's a good practice to use stop-loss orders and risk management techniques when trading based on patterns like the Bullish Kicker to protect against potential losses if the reversal doesn't materialize as expected.

- Mentions 0

-

سا0 like

-

#7 Collapse

### Bullish Kicker Pattern Kya Hai?

Bullish Kicker Pattern ek powerful candlestick pattern hai jo bullish reversal ya bullish continuation ko darust karta hai. Yeh pattern traders ko is baat ka signal deta hai ke market mein buyers ka control barh raha hai, aur price movement upar ki taraf badh sakta hai. Is pattern ko samajhne aur istemal karne se aap apni trading strategies ko behtar bana sakte hain.

**Pattern Ki Pehchaan**

Bullish Kicker Pattern do candlesticks par mabni hota hai. Pehli candlestick bearish hoti hai, jo market ki downtrend ya selling pressure ko darust karti hai. Doosri candlestick bullish hoti hai aur yeh pehli candlestick ke close ke baad khulti hai. Is pattern ka sabse khas pehlu yeh hai ke doosri candlestick ki body pehli candlestick ki body ko puri tarah se engulf karti hai. Iska matlab hai ke buyers ne market par zordaar qabza kar liya hai.

**Market Sentiment**

Bullish Kicker Pattern ka matlab yeh hai ke market mein sellers ka control kam ho raha hai aur buyers ab market ki taraf aaghe barh rahe hain. Yeh signal un traders ke liye hai jo bullish trend ki talash mein hain. Is pattern ki confirmation ke liye, doosri candlestick ki body lambi honi chahiye aur uska close pehli candlestick se upar hona chahiye.

**Trading Signals**

1. **Entry Point**: Jab aap is pattern ko dekhte hain, to aap doosri candlestick ke high par entry le sakte hain. Yeh aapko potential upward movement ka fayda uthane ka mauqa dega.

2. **Stop-Loss**: Stop-loss ko pehli candlestick ke low ke neeche rakhna behtar hota hai. Isse aapko unexpected price movements se bachne ka mauqa milega.

3. **Take Profit**: Take profit level ko aap resistance levels ya previous highs par set kar sakte hain, taake aap apne profits secure kar sakein.

**Limitations**

Yeh pattern hamesha reliable nahi hota. Isliye, is pattern ko dekhte waqt additional confirmation indicators, jaise volume analysis ya moving averages, ka istemal karna behtar hota hai. Kabhi kabhi market fundamentals ya news bhi price action ko affect kar sakti hain, isliye in par bhi nazar rakhni chahiye.

**Conclusion**

Bullish Kicker Pattern forex trading mein ek valuable tool hai jo traders ko market ki upward potential ko samajhne mein madad karta hai. Is pattern ka sahi istemal karke aap profitable trades le sakte hain. Hamesha risk management ka khayal rakhein aur kisi bhi trading decision se pehle comprehensive analysis karein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

**Bullish Kicker Pattern**

Bullish Kicker Pattern aik bohat hi strong reversal candlestick pattern hota hai jo trend ke direction ko abruptly change karta hai. Ye pattern usually market mein jab appearance hoti hai to iska matlab hota hai ke downtrend end hone wala hai aur uptrend start hoga. Is pattern ki kuch key features aur explanation ye hain:

1. **First Candle Bearish**

Pehli candle downtrend ko represent karti hai, jo ke ek lambi bearish candle hoti hai. Iska matlab ye hota hai ke market mein selling pressure hai aur prices neeche ja rahi hain.

2. **Second Candle Bullish**

Dusri candle pehli candle ke bilkul opposite hoti hai, ye ek strong bullish candle hoti hai jo ke pehli candle ke opening price ke upar se start hoti hai. Ye sudden reversal ko indicate karti hai.

3. **No Overlap**

Bullish Kicker Pattern ka ek important feature ye hota hai ke doosri bullish candle pehli candle ke body ke saath overlap nahi karti. Ye indicate karta hai ke sellers ne bilkul power lose kar di hai aur buyers control mein aa gaye hain.

4. **Gaps in Opening Price**

Is pattern mein usually opening price gap hota hai. Dusri candle pehli candle ke closing price se bilkul door, ek higher price se open hoti hai, jo market sentiment mein ek sharp change ko reflect karta hai.

5. **Strong Buying Signal**

Bullish Kicker Pattern ek bohot strong buying signal hota hai. Jab ye pattern chart par form hota hai to traders expect karte hain ke market ab bullish ho chuki hai, aur uptrend start hone wala hai.

6. **Volume Confirmation**

Is pattern ke effective hone ke liye zaroori hota hai ke dusri bullish candle mein volume high ho, jo ke buyers ki strong participation ko confirm kare. High volume se pata chalta hai ke buyers strongly market mein entry kar rahe hain.

7. **Psychological Shift**

Ye pattern market participants ke mindset mein ek psychological shift ko represent karta hai, jahan pehle selling pressure tha aur ab buyers dominate kar rahe hain.

8. **Best for Reversal Trading**

Bullish Kicker Pattern ko mostly reversal trading strategies mein use kiya jata hai. Ye downtrend ke end par ek naya uptrend start hone ki indication deta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:47 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим