Money Flow Index Indicator !

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

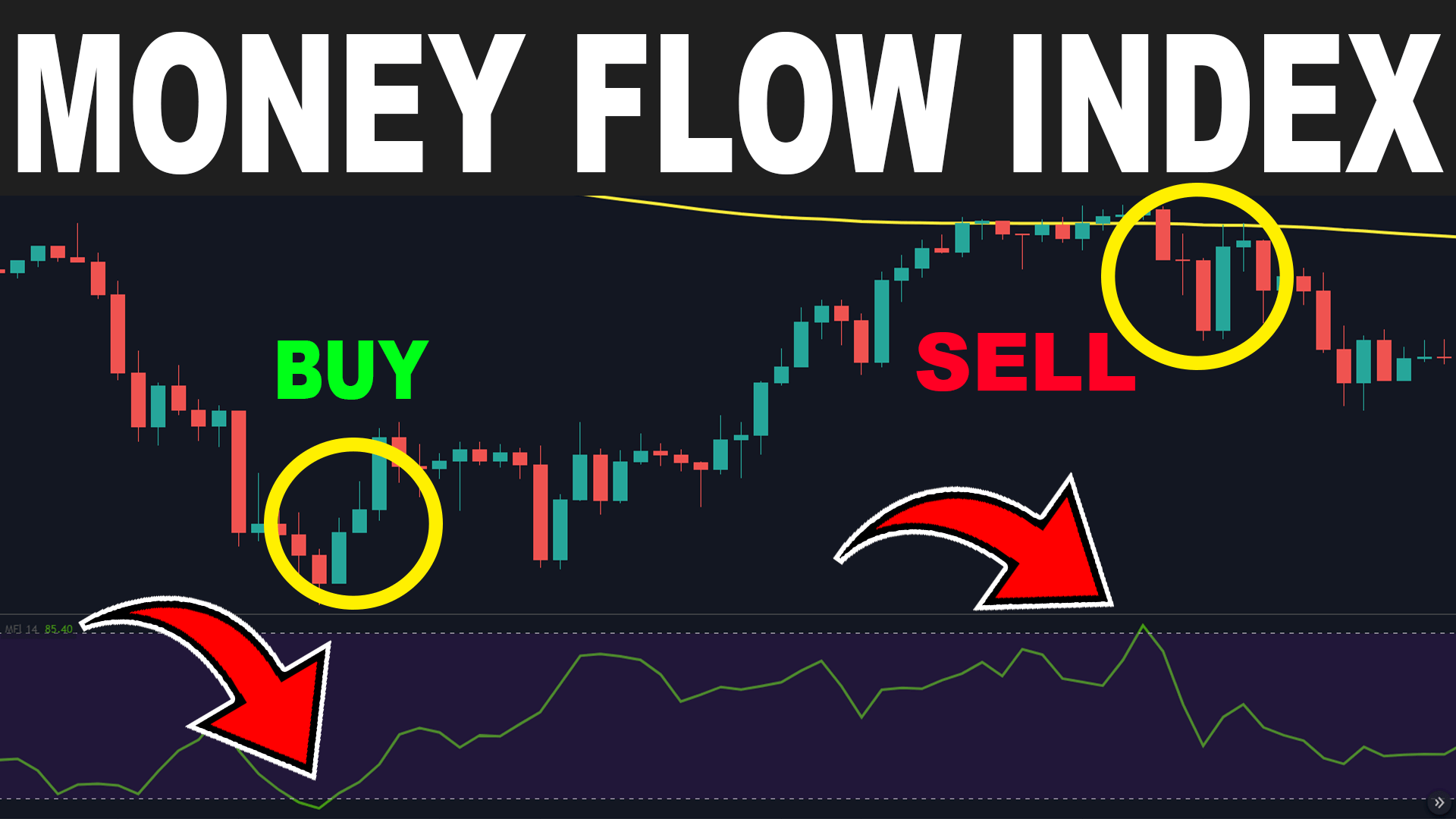

Assalamualaikum !! Money flow index indicator ! Money Flow Index Indicator ek ahem technical analysis tool hai jo kisi financial market ki maalumaat hasil karne mein madadgar hota hai. Yeh indicator traders aur investors ke liye aik aham zariya hai jisse woh market trends aur trading opportunities ko samajh sakte hain. Is article mein, hum Paisay ka Rukh Indeks ke baray mein mukhtasar maloomat dene wale hain aur samjhane wale hain ke yeh kis tarah kaam karta hai aur trading mein kis tarah istemal hota hai.Money Flow Index Indicator ek aham tool hai jo market trends aur trading opportunities ko samajhne mein madadgar hota hai. Iska istemal traders aur investors apni trading strategies banane aur trading decisions tay karne mein karte hain. Yeh indicator market mein paisay ka rukh samajhne mein madadgar hota hai aur sahi waqt par entry aur exit points tay karne mein madad milti hai. Lekin, iska istemal acchi tarah se samajhne aur practice karne ki zaroorat hoti hai taake nuksan se bacha ja sake aur trading mein kamiyabi hasil ki ja sake. Details !! Money Flow Index Indicator (MFI) ek volume-based indicator hai jo trading volume aur price action ke darmiyan talluqat ko samajhne mein madadgar hota hai. Is indicator ka maqsad yeh hota hai ke woh measure kare ke kis tarah se paisay market mein aaraha hai ya nikal raha hai. MFI ka formula complex hota hai, lekin iski aam samajh se yeh nikalta hai ke agar MFI ki value 80 ke qareeb ho to market overbought ho sakti hai, jabke agar yeh 20 ke qareeb ho to market oversold ho sakti hai. Yani ke traders is indicator ke zariye samajh sakte hain ke market mein buying pressure ya selling pressure kitni hai. Working principal ! Money Flow Index Indicator MFI ka istemal trading strategies banane aur trading decisions ke liye hota hai. Agar MFI ki value high hai, to iska matlab hai ke market mein zyada buying pressure hai aur is se traders ko yeh idea milta hai ke ab selling ki bari aasakti hai. Isi tarah, agar MFI ki value low hai, to iska matlab hai ke market mein zyada selling pressure hai aur is se traders ko yeh samajhne mein madad milti hai ke ab buying ki bari aasakti hai. Yeh indicator traders ko trading entry aur exit points tay karne mein madadgar hota hai. Trading stratwgy !! Money Flow Index Indicator (MFI) ek powerful tool hai lekin iska istemal samajhne aur istemal karne mein practice aur research ki zaroorat hoti hai. Iske sath hi, MFI ko doosre technical indicators aur market analysis tools ke sath istemal karna bhi aham hota hai taki traders ko sahi trading decisions lenay mein madad milti rahe. Isliye, har trader ko MFI ko samjhne aur istemal karne mein waqt aur mehnat invest karna chahiye.Money Flow Index Indicator ek aham tool hai jo market trends aur trading opportunities ko samajhne mein madadgar hota hai. Iska istemal traders aur investors apni trading strategies banane aur trading decisions tay karne mein karte hain. Yeh indicator market mein paisay ka rukh samajhne mein madadgar hota hai aur sahi waqt par entry aur exit points tay karne mein madad milti hai. Lekin, iska istemal acchi tarah se samajhne aur practice karne ki zaroorat hoti hai taake nuksan se bacha ja sake aur trading mein kamiyabi hasil ki ja sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Money Flow Index (MFI) indicator trading mein ek bohot hi important aur useful tool hai jo traders aur investors ko market sentiment aur potential trend reversals ko identify karne mein madad karta hai. Ye ek volume-weighted oscillator hai jo price aur volume data ko use karta hai. Iska maksad ye hai ke overbought (zahadati khareedari) aur oversold (zahadati farokht) conditions ko identify karna. Money Flow Index indicator, jo ke 0 se 100 ke beech mein fluctuate karta hai, overbought aur oversold conditions ko measure karta hai. Jab MFI 80 se upar ho, to isko overbought condition consider kiya jata hai, aur jab MFI 20 se neeche ho, to isko oversold condition consider kiya jata hai.

Calculation

MFI calculate karne ka process kuch complicated hai, magar hum yahan par usko asan taur par samjhaenge. MFI ki calculation kuch stages mein hoti hai:- Typical Price Calculation: Typical price ko calculate karne ke liye high, low, aur close prices ka average liya jata hai.

- Raw Money Flow Calculation: Raw money flow ko typical price aur volume ko multiply karke calculate kiya jata hai.

- Positive and Negative Money Flow: Agar aaj ka typical price kal ke typical price se zyada hai, to usko positive money flow kaha jata hai, aur agar aaj ka typical price kal ke typical price se kam hai, to usko negative money flow kaha jata hai.

- Money Flow Ratio Calculation: Positive money flow aur negative money flow ke ratios ko calculate kiya jata hai.

- Money Flow Index Calculation: Akhir mein Money Flow Index ko calculate kiya jata hai.

MFI ka interpretation alag-alag levels par depend karta hai:- Overbought Level (80 ke upar): Jab MFI 80 se upar hota hai, to ye signal karta hai ke market overbought hai aur price reversal ya correction ka chance hai.

- Oversold Level (20 ke neeche): Jab MFI 20 se neeche hota hai, to ye signal karta hai ke market oversold hai aur price reversal ya bounce back ka chance hai.

- Divergence: MFI aur price action ke beech divergence bhi ek important signal hota hai. Agar price new high bana rahi hai magar MFI new high nahi bana raha, to ye bearish divergence hai aur price ke girne ka signal hai. Similarly, agar price new low bana rahi hai magar MFI new low nahi bana raha, to ye bullish divergence hai aur price ke upar jaane ka signal hai.

MFI ka use trading strategies mein kafi extensively hota hai. Kuch important strategies jo traders use karte hain:- Overbought and Oversold Levels: Jaise ke humne pehle discuss kiya, traders overbought aur oversold levels ko use karke trade decisions lete hain. Jab MFI overbought ho, to sell signal consider kiya jata hai, aur jab MFI oversold ho, to buy signal consider kiya jata hai.

- Divergence Trading: Divergence ko identify karke, traders potential reversals ko pehle se predict kar sakte hain. Ye ek kafi powerful signal hota hai jo bohot acche trading opportunities provide karta hai.

- Combining with Other Indicators: MFI ko dusre indicators ke sath combine karke zyada reliable signals liye ja sakte hain. Jaise ke Relative Strength Index (RSI), Moving Averages, aur MACD ke sath use karke complex trading strategies develop ki ja sakti hain.

Ek practical example ke zariye hum MFI ka use samajhte hain. Assume karen ke ek stock ka price action kuch is tarah se hai:- Day 1: High = 150, Low = 145, Close = 148, Volume = 1000

- Day 2: High = 152, Low = 147, Close = 151, Volume = 1200

- Day 3: High = 155, Low = 150, Close = 153, Volume = 1500

- Typical Price Calculation:

- Day 1: Typical Price = (150 + 145 + 148) / 3 = 147.67

- Day 2: Typical Price = (152 + 147 + 151) / 3 = 150

- Day 3: Typical Price = (155 + 150 + 153) / 3 = 152.67

- Raw Money Flow Calculation:

- Day 1: Raw Money Flow = 147.67 * 1000 = 147670

- Day 2: Raw Money Flow = 150 * 1200 = 180000

- Day 3: Raw Money Flow = 152.67 * 1500 = 229005

- Positive and Negative Money Flow:

- Day 1 to Day 2: Positive (150 > 147.67) = 180000

- Day 2 to Day 3: Positive (152.67 > 150) = 229005

(No Negative Money Flow in this case as typical prices are increasing.) - Money Flow Ratio Calculation:

- Money Flow Ratio = (180000 + 229005) / 0 = Infinity (since no negative flow in this example)

- Money Flow Index Calculation:

- MFI = 100 - (100 / (1 + Infinity)) = 100

Halaat mein, such extreme examples kam hi milte hain. Usually, markets me positive aur negative flows ka balance hota hai. Is wajah se, accurate aur realistic signals milte hain.

Strengths and Limitations

Strengths- Volume Incorporation: MFI volume ko consider karta hai jo ke price movements ka ek important component hai.

- Overbought/Oversold Conditions: Ye easily identify karne mein madad karta hai jo ke critical trading signals hain.

- Divergence: MFI divergence ko identify karne mein effective hai jo ke trend reversals ke indication deti hai.

- False Signals: Overbought ya oversold levels par false signals mil sakte hain, jo ke misleading ho sakte hain.

- Complex Calculation: New traders ke liye calculation thoda complex ho sakta hai, magar tools aur software ke zariye ye overcome kiya ja sakta hai.

- Lagging Indicator: Jaise ke bohot saare indicators, MFI bhi ek lagging indicator hai aur ye past data par based hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:02 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим