Introduction: Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Aj hum jis topic pr Baat Krny Ja Rhy Hyn woh Hai money flow index to Ayo aj Hum sub eske Bary me details Sy Discuss Kry Gy Define Money flow Index Indicator: Dear friends Money Flow Index Indicator ek ahem technical analysis tool hai jo kisi financial market ki maalumaat hasil karne mein madadgar hota hai Yeh indicator traders aur investors ke liye aik aham zariya hai jisse woh market trends aur trading opportunities ko samajh sakte hain Is article mein hum Paisay ka Rukh Indeks ke baray mein mukhtasar maloomat dene wale hain aur samjhane wale hain ke yeh kis tarah kaam karta hai aur trading mein kis tarah istemal hota hai Money Flow Index Indicator ek aham tool hai jo market trends aur trading opportunities ko samajhne mein madadgar hota hai Iska istemal traders aur investors apni trading strategies banane aur trading decisions tay karne mein karte hain Yeh indicator market mein paisay ka rukh samajhne mein madadgar hota hai aur sahi waqt par entry aur exit points tay karne mein madad milti hai Lekin iska istemal acchi tarah se samajhne aur practice karne ki zaroorat hoti hai taake nuksan se bacha ja sake aur trading mein kamiyabi hasil ki ja saky Details of Money flow Index: Dear friends Money Flow Index Indicator ek volume based indicator hai jo trading volume aur price action ke darmiyan talluqat ko samajhne mein madadgar hota hai Is indicator ka maqsad yeh hota hai ke woh measure kare ke kis tarah se paisy market mein araha hai ya nikal raha hai MFI ka formula complex hota hai lekin iski aam samajh se yeh nikalta hai ke agar MFI ki value 80 ke qareeb ho to market overbought ho sakti hai jabke agar yeh 20 ke qareeb ho to market oversold ho sakti hai Yani ke traders is indicator ke zariye samajh sakte hain ke market mein buying pressure ya selling pressure kitni hai  Working principals: Dear friends Money Flow Index Indicator MFI ka istemal trading strategies banane aur trading decisions ke liye hota hai Agar MFI ki value high hai to iska matlab hai ke market mein zyada buying pressure hai aur is se traders ko yeh idea milta hai ke ab selling ki bari aa sakti hai Isi tarah agar MFI ki value low hai to iska matlab hai ke market mein zyada selling pressure hai aur is se traders ko yeh samajhne mein madad milti hai ke ab buying ki bari aasakti hai Yeh indicator traders ko trading entry aur exit points tay karne mein madadgar hota hai Trading with Money flow index:

Working principals: Dear friends Money Flow Index Indicator MFI ka istemal trading strategies banane aur trading decisions ke liye hota hai Agar MFI ki value high hai to iska matlab hai ke market mein zyada buying pressure hai aur is se traders ko yeh idea milta hai ke ab selling ki bari aa sakti hai Isi tarah agar MFI ki value low hai to iska matlab hai ke market mein zyada selling pressure hai aur is se traders ko yeh samajhne mein madad milti hai ke ab buying ki bari aasakti hai Yeh indicator traders ko trading entry aur exit points tay karne mein madadgar hota hai Trading with Money flow index:  Dear friends Money Flow Index Indicator mfi ek powerful tool hai lekin iska istemal samajhne aur istemal karne mein practice aur research ki zaroorat hoti hai Iske sath ha MFI ko doosre technical indicators aur market analysis tools ke sath istemal karna bhi aham hota hai taki traders ko sahi trading decisions lenay mein madad milti rahe Isliye har trader ko MFI ko samjhne aur istemal karne mein waqt aur mehnat invest karna chahiye Money Flow Index Indicator ek aham tool hai jo market trends aur trading opportunities ko samajhne mein madadgar hota hai Iska istemal traders aur investors apni trading strategies banane aur trading decisions tay karne mein karte hain Yeh indicator market mein paisay ka rukh samajhne mein madadgar hota hai aur sahi waqt par entry aur exit points tay karne mein madad milti hai

Dear friends Money Flow Index Indicator mfi ek powerful tool hai lekin iska istemal samajhne aur istemal karne mein practice aur research ki zaroorat hoti hai Iske sath ha MFI ko doosre technical indicators aur market analysis tools ke sath istemal karna bhi aham hota hai taki traders ko sahi trading decisions lenay mein madad milti rahe Isliye har trader ko MFI ko samjhne aur istemal karne mein waqt aur mehnat invest karna chahiye Money Flow Index Indicator ek aham tool hai jo market trends aur trading opportunities ko samajhne mein madadgar hota hai Iska istemal traders aur investors apni trading strategies banane aur trading decisions tay karne mein karte hain Yeh indicator market mein paisay ka rukh samajhne mein madadgar hota hai aur sahi waqt par entry aur exit points tay karne mein madad milti hai

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

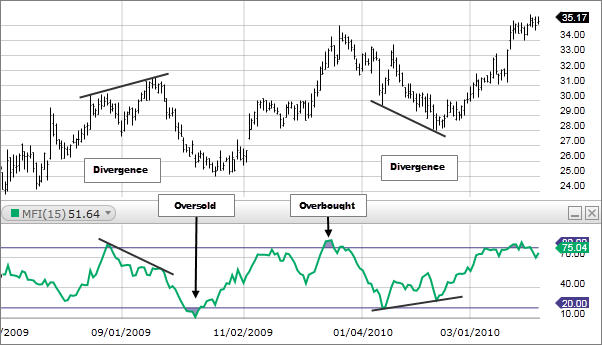

Money Flow Index (MFI) Indicator ek technical analysis tool hai jo market ke momentum aur price trends ko evaluate karne ke liye istemal hota hai. Ye indicator primarily overbought aur oversold conditions ko identify karne mein madadgar hota hai aur traders ko potential trend reversals ke signals provide karta hai. MFI ka calculation Money Flow aur Volume data par based hota hai. MFI ke important points aur tafseelat ye hain: **1. Money Flow Index Calculation:** - MFI ka calculation primarily Price aur Volume data par hota hai. - Money Flow (MF) ko calculate karne ke liye, har trading day ke closing price aur volume ko dekha jata hai. - Positive Money Flow (PMF) ko calculate karne ke liye, agar current day ka closing price previous day ke closing price se zyada hai to us din ke volume ko PMF ke saath add kiya jata hai. - Negative Money Flow (NMF) ko calculate karne ke liye, agar current day ka closing price previous day ke closing price se kam hai to us din ke volume ko NMF ke saath add kiya jata hai. - MFI formula: MFI = 100 - (100 / (1 + (PMF / NMF))) **2. MFI Interpretation:** - MFI 0 se 100 tak ek scale par hota hai. - Typically, MFI ke readings 80 ke upar overbought conditions ko indicate karte hain, jisse ek price reversal downside ki taraf hone ke chances hote hain. - MFI ke readings 20 ke neeche oversold conditions ko indicate karte hain, jisse ek price reversal upside ki taraf hone ke chances hote hain. - MFI ke readings 50 ke aas-paas indicate karte hain ki market me equilibrium hai. **3. Trading Signals:** - Overbought conditions me, traders ko sell signal mil sakta hai jab MFI 80 ke upar hota hai, indicating a potential trend reversal downward. - Oversold conditions me, traders ko buy signal mil sakta hai jab MFI 20 ke neeche hota hai, indicating a potential trend reversal upward. - MFI ke divergence aur convergence bhi traders ke liye important signals provide kar sakte hain. **4. Divergence aur Convergence:** - MFI divergence hoti hai jab indicator ke readings price ke trends ke opposite direction mein jaate hain. Yeh ek potential trend reversal signal ho sakta hai. - MFI convergence hoti hai jab indicator ke readings price ke trends ke sath move karte hain, jo ek existing trend ko confirm kar sakti hai. **5. Time Frame ka Istemal:** - MFI ko different time frames par apply kiya ja sakta hai, jaise ki daily, weekly, ya intraday charts par. - Longer time frames par MFI ke signals generally more reliable hote hain. **6. Limitations:** - MFI, jaise ki kisi bhi technical indicator, false signals de sakta hai aur iska istemal dusre indicators aur analysis tools ke saath kiya jana chahiye. - Isme price aur volume data ka use hota hai, jo kabhi-kabhi manipulated ho sakte hain. MFI ek powerful indicator ho sakta hai agar ise sahi tarah se samjha jaye aur dusre technical analysis tools ke saath istemal kiya jaye. Traders ko iska sahi tarah se istemal karne ke liye practice aur experience ki zarurat hoti hai. -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

MONEY FLOW INDEX INDICATOR:-Forex me Money Flow Index (MFI) ek technical indicator hai jo market ke momentum aur overbought ya oversold conditions ko samajhne me madad karta hai. MFI indicator market ke price aur volume ke based par kaam karta hai aur traders ko ye batata hai ki kisi asset ke price me kis tarah ka movement ho sakta hai. Money Flow Index ka main maqsad ye hota hai ki traders ko market me hone wale trend ke bare me jankari pradan kare aur potential reversals ko pehchanne me madad kare. MFI indicator price aur volume ke combination se ek oscillating indicator banata hai, jiska value 0 se 100 ke beech hota hai. MONEY FLOW INDEX INDICATOR KI TAFSEELAAT:-Overbought aur Oversold Conditions: MFI indicator 80 ke upar overbought aur 20 ke niche oversold conditions ko darust karti hai. Overbought conditions me asset ki price jyada ho sakti hai, aur oversold conditions me price kam ho sakti hai. Momentum: MFI indicator market ke momentum ko measure karta hai. Jab MFI value 50 ke upar hoti hai, to ye bullish momentum ko darust karti hai, aur jab 50 ke niche hoti hai, to ye bearish momentum ko darust karti hai. Divergence: Traders MFI indicator ka istemal price chart ke sath karke divergence detect karne me bhi karte hain. Divergence ye situation hoti hai jab MFI indicator ki movement price ke opposite direction me ja rahi hoti hai. Ye ek reversal signal ho sakta hai. Volume ke Sath Use: MFI indicator volume ke sath use hoti hai, kyunki volume market ke sentiment ko darust karti hai aur MFI me volume ka bhi impact hota hai. Is tarah se, Money Flow Index Indicator forex trading me ek important tool ho sakta hai jo traders ko market ke movement aur potential reversals ke bare me jankari pradan karta hai. Lekin yaad rahe ki kisi bhi indicator ka istemal karne se pehle, aapko proper risk management aur trading strategy ka bhi dhyan rakhna hoga.

MONEY FLOW INDEX INDICATOR KI TAFSEELAAT:-Overbought aur Oversold Conditions: MFI indicator 80 ke upar overbought aur 20 ke niche oversold conditions ko darust karti hai. Overbought conditions me asset ki price jyada ho sakti hai, aur oversold conditions me price kam ho sakti hai. Momentum: MFI indicator market ke momentum ko measure karta hai. Jab MFI value 50 ke upar hoti hai, to ye bullish momentum ko darust karti hai, aur jab 50 ke niche hoti hai, to ye bearish momentum ko darust karti hai. Divergence: Traders MFI indicator ka istemal price chart ke sath karke divergence detect karne me bhi karte hain. Divergence ye situation hoti hai jab MFI indicator ki movement price ke opposite direction me ja rahi hoti hai. Ye ek reversal signal ho sakta hai. Volume ke Sath Use: MFI indicator volume ke sath use hoti hai, kyunki volume market ke sentiment ko darust karti hai aur MFI me volume ka bhi impact hota hai. Is tarah se, Money Flow Index Indicator forex trading me ek important tool ho sakta hai jo traders ko market ke movement aur potential reversals ke bare me jankari pradan karta hai. Lekin yaad rahe ki kisi bhi indicator ka istemal karne se pehle, aapko proper risk management aur trading strategy ka bhi dhyan rakhna hoga. -

#19 Collapse

MONEY FLOW INDEX INDICATOR:-

Paisay Ka Jari Hissa (Money Flow Index) Indicator -

Paisay Ka Jari Hissa (Money Flow Index) Indicator ek mufeed aur ahem technical analysis tool hai jo traders ke liye market ke moolyon aur price trends ko samajhne mein madad karta hai. Yeh indicator trading charts par istemal kiya jata hai aur market ke buying aur selling pressure ko quantify karta hai. Yeh ek momentum oscillator hai jo price aur volume ke combination par mabni hota hai. Yahan hum is indicator ke tajziye ke faiday darj karte hain:

Heading: Paisay Ka Jari Hissa (Money Flow Index) Indicator - Faiday- Trend Reversals Ka Pata Lagana (Identifying Trend Reversals): Paisay Ka Jari Hissa (Money Flow Index) Indicator ka istemal karke traders trend reversals ko identify kar sakte hain. Jab MFI indicator extreme levels ko touch karta hai ya phir divergences dikhata hai, to yeh indicate karta hai ke market mein trend reversal hone ke imkanat hain.

- Overbought Aur Oversold Conditions Ka Pata Lagana (Identifying Overbought and Oversold Conditions): MFI indicator overbought aur oversold conditions ko darust karne mein madad karta hai. Jab MFI indicator 80 ke upar jaata hai, to market overbought hoti hai aur jab yeh 20 ke neeche jaata hai, to market oversold hoti hai. Traders is information ka istemal karke entry aur exit points tay karte hain.

- Market Momentum Ko Samajhna (Understanding Market Momentum): Paisay Ka Jari Hissa (Money Flow Index) Indicator market ke momentum ko quantify karta hai. Jab MFI indicator high values dikhata hai, to yeh indicate karta hai ke market mein strong buying pressure hai aur uptrend jari hai. Jab yeh low values dikhata hai, to yeh indicate karta hai ke market mein selling pressure hai aur downtrend jari hai.

- Volume Aur Price Movement Ka Comparison (Comparing Volume and Price Movement): MFI indicator volume aur price movement ke beech comparison karta hai. Iski madad se traders volume ke sath price movement ko dekh kar market ke direction ka andaza lagate hain. Agar price upar ja rahi hai lekin MFI down ja raha hai, to yeh bearish divergence hai aur trend reversal ka sign ho sakta hai.

- Trading Signals Faraham Karna (Providing Trading Signals): Paisay Ka Jari Hissa (Money Flow Index) Indicator traders ko trading signals faraham karta hai. Jab MFI indicator extreme levels ko touch karta hai ya phir divergences dikhata hai, to yeh traders ko entry aur exit points par amal karne ke liye guide karta hai.

Paisay Ka Jari Hissa (Money Flow Index) Indicator ka istemal karke traders market ke dynamics ko behtar samajh sakte hain aur trading strategies ko improve kar sakte hain. Lekin yaad rahe ke har ek indicator ki tarah, yeh bhi sirf ek tool hai aur uska istemal sahi tajziya aur samajhdari ke sath karna zaroori hai.

-

#20 Collapse

**Money Flow Index Indicator: Paise Ka Bahao Shinaakht**

**Muqaddima (Introduction)**

"Paise Ka Bahao Shinaakht" ya "Money Flow Index" (MFI) ek aham technical indicator hai jo market ki trading activity ko analyze karta hai. Ye indicator trading decisions ko samajhne mein madad karta hai aur market trends ka pata lagane mein istemal hota hai.

**Paise Ka Bahao Shinaakht Kya Hai?**

Paise Ka Bahao Shinaakht ek momentum oscillator hai jo trading volumes aur price movements ko ek saath dekhta hai. Ye indicator traders ko batata hai ke kis tarah ke buying aur selling activity market mein ho rahi hai. Is indicator ki calculation trading volumes aur price movements par mabni hoti hai.

**Paise Ka Bahao Shinaakht Ka Istemal Kaise Kiya Jata Hai?**

Ye indicator market trends ko samajhne mein madad karta hai. Agar MFI ki value high hoti hai to ye indicate karta hai ke market mein buying pressure zyada hai aur agar value low hoti hai to ye indicate karta hai ke selling pressure zyada hai. Traders is indicator ko istemal karke market mein trend ka pata lagate hain aur trading decisions lete hain.

**Paise Ka Bahao Shinaakht Ki Calculation**

MFI ki calculation trading volumes aur price movements par mabni hoti hai. Iska calculation kuch steps par mabni hota hai:

1. **Typical Price Calculation**: Pehle to har ek trading day ke liye typical price calculate kiya jata hai jo high, low, aur close prices ka average hota hai.

2. **Money Flow Calculation**: Phir, har ek trading day ke liye money flow calculate kiya jata hai jo typical price aur trading volume ke mutabiq hota hai.

3. **Positive Money Flow aur Negative Money Flow Calculation**: Positive money flow tab calculate hota hai jab current day ka typical price previous day ke typical price se zyada hota hai. Negative money flow tab calculate hota hai jab current day ka typical price previous day ke typical price se kam hota hai.

4. **Money Flow Ratio Calculation**: Money flow ratio ko calculate karne ke liye positive money flow ka sum negative money flow se divide kiya jata hai.

5. **Money Flow Index Calculation**: Phir, money flow index ko calculate karne ke liye ek specific period ka moving average money flow ratio se divide kiya jata hai aur hasil ko 100 se subtract kiya jata hai.

**Paise Ka Bahao Shinaakht Ka Istemal Trading Mein**

Paise Ka Bahao Shinaakht ka istemal trading mein market trends aur momentum ko samajhne ke liye hota hai. Agar MFI ki value 80 se zyada hai to ye indicate karta hai ke market overbought hai aur agar value 20 se kam hai to ye indicate karta hai ke market oversold hai. Traders is indicator ki madad se entry aur exit points decide karte hain.

**Paise Ka Bahao Shinaakht Ka Faida**

Paise Ka Bahao Shinaakht ka istemal karke traders market ki strength aur weakness ka pata lagate hain. Is indicator ki madad se traders market mein trend ko samajhte hain aur trading strategies ko improve karte hain. Ye indicator trading decisions ko samajhne mein madad karta hai aur traders ko market ki movements ko better analyze karne mein help karta hai.

**Ikhtitami Alfaz (Conclusion)**

Paise Ka Bahao Shinaakht ek aham technical indicator hai jo market ki trading activity ko analyze karta hai. Is indicator ki madad se traders market trends ko samajhte hain aur trading decisions lete hain. Paise Ka Bahao Shinaakht ka istemal karke traders market mein trend ka pata lagate hain aur trading strategies ko improve karte hain. -

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Money Flow Index Indicator: Paisay Ka Raqam Index Indicator

Introduction: Money Flow Index (MFI) ek technical indicator hai jo market ke momentum aur trend ke analysis mein istemal hota hai. Yeh indicator volume aur price ke combination ko use karta hai taake market ki strength ya weakness ka pata lagaya ja sake. MFI ka istemal traders ke liye trading signals generate karne aur overbought ya oversold conditions ko identify karne ke liye kiya jata hai.

MFI ka Calculation: MFI ka calculation price aur volume ke base par hota hai. Iska formula niche diya gaya hai: ���=100−1001+��������������MFI=100−1+MoneyFlowRati o100 Money Flow Ratio (MFR) ko calculate karne ke liye, sabse pehle Typical Price (TP) aur Money Flow (MF) nikala jata hai. Fir MFR calculate kiya jata hai: ��=(���ℎ+���+�����)3TP=3(High+Low+Close) ��=��×������MF=TP×Volume Fir, Positive Money Flow (PMF) aur Negative Money Flow (NMF) calculate kiya jata hai: ���=∑jo days mein TP increase huaPMF=∑jo days mein TP increase hua ���=∑jo days mein TP decrease huaNMF=∑jo days mein TP decrease hua Fir, MFR calculate kiya jata hai: ��������������=������MoneyFlowRatio=NMFPMF

MFI ka Interpretation: MFI ka interpretation 0 se 100 tak hota hai. Neeche diye gaye hain MFI ke kuch common interpretations:- MFI 80 se zyada hone par, market ko overbought condition samjha jata hai, jisse bearish reversal ka indication ho sakta hai.

- MFI 20 se kam hone par, market ko oversold condition samjha jata hai, jisse bullish reversal ka indication ho sakta hai.

- MFI ke divergences bhi significant hote hain. Agar price higher highs banata hai aur MFI lower highs, to ye bearish divergence hai. Aur agar price lower lows banata hai aur MFI higher lows, to ye bullish divergence hai.

MFI ka Istemal: MFI ka istemal market ke momentum aur trend ke analysis mein kiya jata hai. Traders MFI ka istemal karke overbought aur oversold conditions ko identify karte hain, aur trading signals generate karte hain. MFI ke saath aur technical indicators jaise ki moving averages, RSI, aur MACD ka istemal kiya jata hai trading decisions lene ke liye.

Nateeja: Money Flow Index (MFI) ek aham technical indicator hai jo market ke momentum aur trend ke analysis mein madadgar hota hai. Is indicator ka istemal karke traders market ke movements ko samajh sakte hain aur sahi waqt par trading decisions le sakte hain. Lekin, MFI ke saath aur technical aur fundamental analysis ka bhi istemal zaroori hai taake sahi trading signals generate kiye ja sakein.

-

#22 Collapse

MONEY FLOW INDEX INDICATOR: Ek Zarai Dariyaft Ka Ahem Zaria

Zarai daryaft ke ibtedai tareeqay mukhtalif hotay hain, lekin har aik tajziyaat aur asool apnay maqasid ko hasil karne ke liye mukhtalif hotay hain. Ek aham hissa jise traders aur investors apni faisla kun roshni mein istemal karte hain, wo hai "Money Flow Index" ya MFI. Ye indicator market ke jazbaat ko samajhne aur trend ki pesh guftagu mein madad karta hai. Is article mein, hum MFI ke hawale se mukhtalif pehluo ko ghoorte hain.

1. MFI Ka Tareeqa Kaar

Money Flow Index, ek technical indicator hai jo volume aur price ko combine karta hai takay market ke trend ko samajhne mein madad mil sake. Iski calculation, aam tor par 14 dinon ke liye ki jati hai. MFI 100 aur 0 ke darmiyan hota hai, jahan 80 se zyada hone par market overbought aur 20 se kam hone par oversold kehlaya jata hai. Ye tareeqa kaar traders ko market ke mizaj ko samajhne mein madad deta hai.

2. Money Flow Index Ka Istemal

MFI ka istemal market ki harkat ko samajhne aur trading ke faisle karne mein kiya jata hai. Agar MFI 80 se oopar hai, to yeh indicate karta hai ke market overbought hai aur shayad girawat ka imkaan hai. Jab MFI 20 se neeche jaata hai, to iska matlab hai ke market oversold ho sakti hai aur trend badalne ka mauka ho sakta hai. Traders aur investors is indicator ko istemal karke apne trading strategies ko improve kar sakte hain.

3. MFI Aur Divergence

Money Flow Index ko market ke trend ke sath sath divergence dekhne ke liye bhi istemal kiya jata hai. Agar market naye highs banata hai lekin MFI mein girawat hoti hai, to yeh bearish divergence kehlaya jata hai, jo market ki girawat ka ishara ho sakta hai. Umeed hai ke is tarah ke tajziyaat MFI ke zariye ki ja sakti hain.

4. MFI Aur Volume

Volume market ke trend ko samajhne mein ahem kirdar ada karta hai, aur MFI volume ke sath sath bhi kam karta hai. Agar price ke saath saath volume bhi barh raha hai aur MFI bhi 80 ke qareeb hai, to yeh bullish trend ka indication ho sakta hai. Isi tarah, agar volume gir raha hai aur MFI bhi 20 ke qareeb hai, to yeh bearish trend ka ishara ho sakta hai.

5. MFI Aur Trading Strategies

MFI ke istemal se kai trading strategies develop ki ja sakti hain. Ek aam tareeqa ye hai ke jab MFI 80 se zyada ho aur bearish divergence ho, to yeh behtar hai ke short positions lein. Jab MFI 20 se kam ho aur bullish divergence ho, to long positions le sakte hain. Iske ilawa, MFI ke sath sath moving averages aur other technical indicators bhi istemal kiye ja sakte hain trading strategies banane ke liye.

Ikhtitami Alfaaz

Money Flow Index ek ahem tool hai jo market ki harkat ko samajhne aur trading strategies develop karne mein madad deta hai. Is indicator ko samajhna aur istemal karna traders aur investors ke liye zaroori hai takay wo behtar faisle kar sakein aur market ke mizaj ko samajh sakein. Magar yaad rahe ke har indicator ki tarah, MFI bhi sirf ek hissa hai trading ke puzzle ka aur sirf is par pura bharosa nahi karna chahiye. -

#23 Collapse

Paisay Ka Nafiz Index Indicator:

1. Introducation (Mutaala): Paisay ka Nafiz Index (Money Flow Index) ek makhsoos technical analysis indicator hai jo market ki price aur volume ke darmiyan ke taluqat ko samajhne mein madad deta hai. Ye indicator traders ko market ke trend aur reversals ke bare mein maloomat faraham karta hai.

2. Background (Pechan): Paisay ka Nafiz Index (MFI) 1990s mein Gene Quong aur Avrum Soudack ne develop kiya tha. Ye ek volume-based oscillator hai jo market ke momentum ko measure karta hai. MFI ka maqsad hai samajhna ke market mein paisay kaise flow ho rahe hain.

3. Khasiyatayn (Characteristics): a. Volume aur Price Relationship: MFI volume aur price ke darmiyan ke taluqat ko analyze karta hai. Agar price aur volume dono barh rahe hain, toh MFI bhi barh sakta hai, aur agar price aur volume dono gir rahe hain, toh MFI bhi gir sakta hai. b. Overbought aur Oversold Levels: MFI overbought aur oversold levels ko identify karta hai. Typically, MFI 20 se kam hone par oversold aur 80 se zyada hone par overbought consider kiya jata hai. c. Divergence: MFI divergence market ke reversals ko predict karne mein madadgar hoti hai. Agar price higher highs banata hai lekin MFI lower highs, ya phir price lower lows banata hai lekin MFI higher lows, toh ye divergence indicator kehte hain aur ye reversals ka indication ho sakta hai. d. Calculation Method: MFI ka calculation price aur volume ke based hota hai. Typical calculation formula: MFI = 100 - (100 / (1 + Money Ratio)) where Money Ratio = Positive Money Flow / Negative Money Flow. Positive Money Flow hota hai jab current price previous price se zyada hoti hai aur Negative Money Flow hota hai jab current price previous price se kam hoti hai.

4. Trading Strategy (Trading Tadbeer): a. Overbought/Oversold Conditions: Traders overbought aur oversold conditions ko samajh kar trade karte hain. Agar MFI overbought hai, toh sell ki taraf ja sakte hain, aur agar oversold hai, toh buy ki taraf ja sakte hain. b. Divergence Analysis: Traders divergence analysis ke zariye reversals ko predict karte hain. Jab price aur MFI ke darmiyan divergence hoti hai, toh woh reversal ki possibility ka indication ho sakta hai. c. Confirmation ke Liye Aur Indicators: MFI ko confirmation ke liye aur indicators ke saath istemal kiya jata hai jaise ki moving averages, RSI, aur MACD.

5. Conclusion (Nateeja): Paisay ka Nafiz Index ek ahem technical analysis tool hai jo traders ko market ke trend aur reversals ke bare mein maloomat faraham karta hai. Isko samajhna aur istemal karna traders ke liye zaroori hai takay woh sahi trading decisions le sakein aur market mein successful ho sakein.

- CL

- Mentions 0

-

سا0 like

-

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Money Flow Index (MFI) Indicator Kya Hai?

Money Flow Index (MFI) ek powerful technical indicator hai jo market ki liquidity aur buying-selling pressure ko measure karta hai. Yeh indicator volume aur price data ko combine karke market ki overall health aur potential reversals ko identify karta hai. Forex aur stock trading mein MFI ka use karke traders market trends aur potential trading opportunities ko accurately assess kar sakte hain. Is post mein, hum MFI ke concept, calculation, aur trading implications ko detail mein samjhenge.

**MFI Ka Concept**

MFI, ek momentum oscillator hai jo 0 se 100 ke scale par plot hota hai. Yeh indicator volume aur price movements ko combine karke market ke money flow ko measure karta hai. MFI ka primary goal market ke overbought aur oversold conditions ko identify karna hai aur potential reversal points ko signal karna hai.

**MFI Ka Calculation**

MFI calculate karne ke liye, kuch specific steps follow kiye jate hain:

1. **Typical Price (TP) Calculation:**

- TP = (High + Low + Close) / 3

2. **Money Flow (MF) Calculation:**

- MF = TP × Volume

3. **Positive aur Negative Money Flow Calculation:**

- Agar TP current period ke liye previous period ke TP se zyada hai, toh yeh Positive Money Flow (PMF) hota hai.

- Agar TP current period ke liye previous period ke TP se kam hai, toh yeh Negative Money Flow (NMF) hota hai.

4. **Money Flow Ratio Calculation:**

- Money Flow Ratio = (Sum of PMF over 14 periods) / (Sum of NMF over 14 periods)

5. **MFI Calculation:**

- MFI = 100 - (100 / (1 + Money Flow Ratio))

**MFI Ki Interpretation**

1. **Overbought aur Oversold Conditions:**

- MFI ka value 80 se zyada hone par market ko overbought consider kiya jata hai, jo potential bearish reversal ka signal hota hai.

- MFI ka value 20 se kam hone par market ko oversold consider kiya jata hai, jo potential bullish reversal ka signal hota hai.

2. **Divergences:**

- MFI aur price ke beech divergence bhi trading signals provide karte hain. Agar price new highs banati hai lekin MFI new highs nahi banata, toh yeh bearish divergence hota hai. Agar price new lows banati hai lekin MFI new lows nahi banata, toh yeh bullish divergence hota hai.

3. **Trend Confirmation:**

- MFI ke values aur trend analysis se traders market trends ko confirm kar sakte hain. High MFI values buying pressure aur strong uptrend ko indicate karti hain, jabke low MFI values selling pressure aur downtrend ko indicate karti hain.

**Trading Implications**

1. **Entry Points:** MFI se overbought aur oversold conditions ko identify karke, traders buy aur sell opportunities ko recognize kar sakte hain. Overbought conditions par sell aur oversold conditions par buy positions enter ki ja sakti hain.

2. **Stop-Loss Aur Take-Profit:** Risk management ke liye stop-loss aur take-profit levels ko MFI ke signals ke according adjust kiya jata hai, jo traders ko market movements se protect karne mein madad karta hai.

3. **Confirmation:** MFI ke signals ko confirm karne ke liye, traders additional technical indicators aur analysis ka use karte hain, jo trading decisions ki accuracy ko enhance karte hain.

**Summary**

Money Flow Index (MFI) indicator market ki liquidity aur buying-selling pressure ko measure karne ka ek effective tool hai. Is indicator ka use karke traders market ke overbought aur oversold conditions ko identify kar sakte hain aur potential reversals ko signal kar sakte hain. MFI ke accurate calculation aur interpretation se, traders informed trading decisions le sakte hain aur market trends ko better samajh sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#25 Collapse

**Money Flow Index Indicator**

Money Flow Index (MFI) indicator aik momentum oscillator hai jo price aur volume data ko use karta hai taake buying aur selling pressure ka pata lagaya ja sake. Yeh indicator traders aur investors ke liye bohat ahmiyat rakhta hai, kyun ke yeh market ka trend samajhne mein madad karta hai. MFI ko kai log "volume-weighted RSI" bhi kehte hain kyun ke yeh Relative Strength Index (RSI) ki tarah kaam karta hai, magar ismein volume ka bhi asar hota hai.

MFI ka calculation price aur volume data ke zariye hota hai. Sab se pehle, "typical price" calculate ki jati hai jo high, low, aur close prices ka average hota hai. Phir, money flow calculate kiya jata hai, jo typical price ko volume se multiply kar ke nikaala jata hai. Positive money flow tab hota hai jab aaj ka typical price kal se zyada hota hai, aur negative money flow tab hota hai jab aaj ka typical price kal se kam hota hai.

MFI ka value 0 se 100 tak hota hai. Agar MFI 80 se zyada ho, toh market "overbought" condition mein samjha jata hai, yaani ke prices bohat zyada barh chuki hain aur girne ka chance hai. Agar MFI 20 se kam ho, toh market "oversold" condition mein hota hai, yaani ke prices bohat kam ho chuki hain aur barhne ka chance hai.

MFI indicator ka use kar ke traders trading signals generate karte hain. Agar MFI 80 ke upar ho aur neeche aane lage, toh yeh sell signal hota hai, aur agar MFI 20 ke neeche ho aur upar jaane lage, toh yeh buy signal hota hai. Yeh signals RSI ke signals ki tarah kaam karte hain, magar MFI ke signals zyada reliable hote hain kyun ke yeh volume ko bhi shamil karta hai.

Traders divergence ke through bhi MFI ka use karte hain. Agar price barh raha ho magar MFI gir raha ho, toh yeh bearish divergence hota hai aur market mein reversal ka ishara hota hai. Agar price gir raha ho magar MFI barh raha ho, toh yeh bullish divergence hota hai aur market mein reversal ka chance hota hai.

MFI ek powerful tool hai jo traders ko market ke trend aur potential reversals ke bare mein valuable insights deta hai. Lekin, doosre indicators ke saath combine kar ke iska use karna behtar hota hai taake accurate decisions liye ja sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:26 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим