Difference Between Morning And Evening Star Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Morning Star Candlestick Pattern Identification Morning Star ek bullish reversal pattern hai jo downtrend ke aakhir mein dekha jata hai. Is mein teen candles shamil hain: aik lambi bearish candle (Day 1), aik doji ya choti bullish candle (Day 2), aur aik mazboot bullish candle (Day 3). Yeh pattern bearish se bullish sentiment ki taraf aik potential shift ko darust karta hai. Significance Morning Star traders ke liye bohat ahmiyat rakhta hai. Iska matlab hai ke mojooda downtrend ka possible reversal aur bullish trend ki paidaish hone ka ishara hai. Is sentiment mein tabdeeli traders ke liye aik ahem moadat ban sakti hai jo long positions mein dakhil hone ke liye tayyar hain. Confirmation Pattern ki reliability ko barhane ke liye, traders ko pattern ke teesre din mein trading volumes ko ziada dekhna chahiye. Is volume confirmation se signal mazboot hota hai aur ek taqwiyat shudah bullish reversal ko ishara karta hai. Entry and Stop-Loss Traders aksar Morning Star pattern ke baad aane wale candle ke opening mein long positions mein dakhil hote hain. Risk ko manage karne ke liye, pehli bearish candle ki kam se kam value ke neeche aik stop-loss order set karen. Is level ne is surat-e-haal mein ek hifazi bari ka kaam karta hai ke agar trade as expected nahi jati to. Take Profit aur Risk Management Apni risk-reward ratio aur ahem support aur resistance levels ke tajziye ke adhar par apna take-profit target tay karen. Jab trade aap ki taraf barhti hai, to faida hasil karne aur risk ko kam karne ke liye apna stop-loss trail karna ka tasavvur karen. Ye dynamic approach faiday ko mahfooz karne mein madadgar hota hai. Exit Strategy Take-profit level pohnchne par ya agar aap trend mein ya trend exhaustion ke isharon ko dekhte hain to trade se nikal jayen. Chaukasi banaye rakhne aur trade ki progress ko dekhte rehne se faislay mein ahem hai. Evening Star Candlestick Pattern

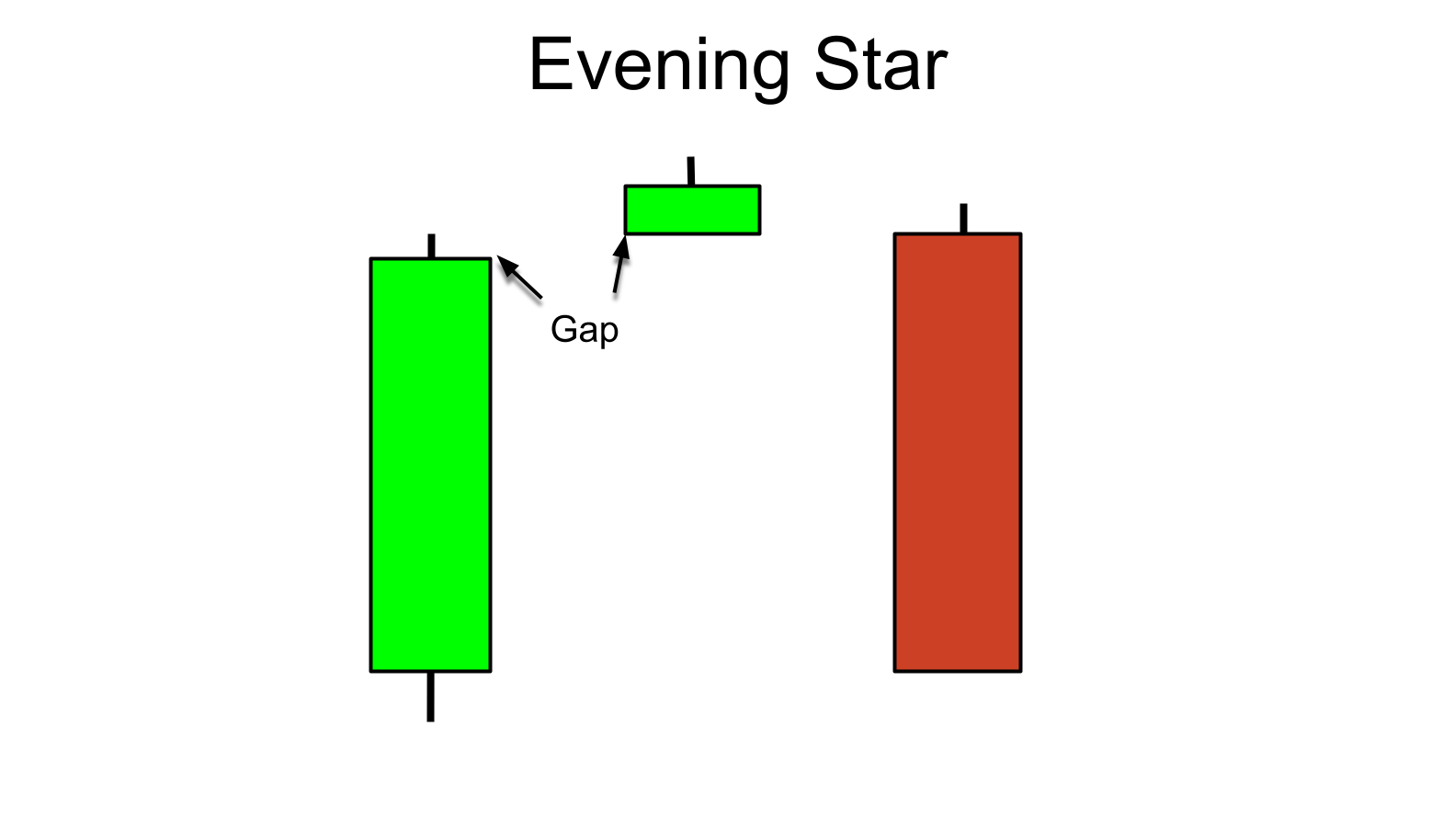

Identification Morning Star ek bullish reversal pattern hai jo downtrend ke aakhir mein dekha jata hai. Is mein teen candles shamil hain: aik lambi bearish candle (Day 1), aik doji ya choti bullish candle (Day 2), aur aik mazboot bullish candle (Day 3). Yeh pattern bearish se bullish sentiment ki taraf aik potential shift ko darust karta hai. Significance Morning Star traders ke liye bohat ahmiyat rakhta hai. Iska matlab hai ke mojooda downtrend ka possible reversal aur bullish trend ki paidaish hone ka ishara hai. Is sentiment mein tabdeeli traders ke liye aik ahem moadat ban sakti hai jo long positions mein dakhil hone ke liye tayyar hain. Confirmation Pattern ki reliability ko barhane ke liye, traders ko pattern ke teesre din mein trading volumes ko ziada dekhna chahiye. Is volume confirmation se signal mazboot hota hai aur ek taqwiyat shudah bullish reversal ko ishara karta hai. Entry and Stop-Loss Traders aksar Morning Star pattern ke baad aane wale candle ke opening mein long positions mein dakhil hote hain. Risk ko manage karne ke liye, pehli bearish candle ki kam se kam value ke neeche aik stop-loss order set karen. Is level ne is surat-e-haal mein ek hifazi bari ka kaam karta hai ke agar trade as expected nahi jati to. Take Profit aur Risk Management Apni risk-reward ratio aur ahem support aur resistance levels ke tajziye ke adhar par apna take-profit target tay karen. Jab trade aap ki taraf barhti hai, to faida hasil karne aur risk ko kam karne ke liye apna stop-loss trail karna ka tasavvur karen. Ye dynamic approach faiday ko mahfooz karne mein madadgar hota hai. Exit Strategy Take-profit level pohnchne par ya agar aap trend mein ya trend exhaustion ke isharon ko dekhte hain to trade se nikal jayen. Chaukasi banaye rakhne aur trade ki progress ko dekhte rehne se faislay mein ahem hai. Evening Star Candlestick Pattern Identification Evening Star Morning Star ka bearish counterpart hai aur yeh uptrend ke aakhir mein dekha jata hai. Is mein bhi teen candles shamil hain: aik lambi bullish candle (Day 1), aik doji ya choti bearish candle (Day 2), aur aik mazboot bearish candle (Day 3). Yeh pattern bullish se bearish sentiment ki taraf aik potential shift ko darust karta hai. Significance Evening Star pattern traders ke liye ahem hai jo uptrend mein potential reversals ko pehchan'ne ke liye tayyar hain. Is se yeh ishara hota hai ke market sentiment bullish se bearish mein tabdeel ho rahi hai, jo short positions mein ruchi rakhne walon ke liye aik maziati lamha ho sakta hai. Confirmation Morning Star ki tarah, Evening Star pattern ke teesre din trading volumes ki tasdeeq talash karne ke liye mashwara diya jata hai. Yeh tasdeeq signal ki mazbooti ko barhata hai. Entry and Stop-Loss Traders aksar Evening Star pattern ke baad aane wale candle ke opening mein short positions mein dakhil hote hain. Risk ko manage karne ke liye, pehli bullish candle ki unchi value ke oopar aik stop-loss order set karen. Yeh suraksha ki bunyad banati hai agar trade expected taur par nahi jati. Take Profit aur Risk Management Apni risk-reward ratio aur ahem support aur resistance levels ke tajziye ke adhar par take-profit target tay karen. Jab trade aap ki taraf barhti hai, to faida hasil karne aur risk ko kam karne ke liye apna stop-loss trail karna ka tasavvur karen. Exit Strategy Apna take-profit level pohnchne par ya jab aap trend mein ya trend ki exhaustion ke isharon ko mehsoos karte hain, to trade se nikal jayen. Trade ki monitoring aur exit strategy ko moaziz rahne aur uss par amal karne ke liye ahem hai.

Identification Evening Star Morning Star ka bearish counterpart hai aur yeh uptrend ke aakhir mein dekha jata hai. Is mein bhi teen candles shamil hain: aik lambi bullish candle (Day 1), aik doji ya choti bearish candle (Day 2), aur aik mazboot bearish candle (Day 3). Yeh pattern bullish se bearish sentiment ki taraf aik potential shift ko darust karta hai. Significance Evening Star pattern traders ke liye ahem hai jo uptrend mein potential reversals ko pehchan'ne ke liye tayyar hain. Is se yeh ishara hota hai ke market sentiment bullish se bearish mein tabdeel ho rahi hai, jo short positions mein ruchi rakhne walon ke liye aik maziati lamha ho sakta hai. Confirmation Morning Star ki tarah, Evening Star pattern ke teesre din trading volumes ki tasdeeq talash karne ke liye mashwara diya jata hai. Yeh tasdeeq signal ki mazbooti ko barhata hai. Entry and Stop-Loss Traders aksar Evening Star pattern ke baad aane wale candle ke opening mein short positions mein dakhil hote hain. Risk ko manage karne ke liye, pehli bullish candle ki unchi value ke oopar aik stop-loss order set karen. Yeh suraksha ki bunyad banati hai agar trade expected taur par nahi jati. Take Profit aur Risk Management Apni risk-reward ratio aur ahem support aur resistance levels ke tajziye ke adhar par take-profit target tay karen. Jab trade aap ki taraf barhti hai, to faida hasil karne aur risk ko kam karne ke liye apna stop-loss trail karna ka tasavvur karen. Exit Strategy Apna take-profit level pohnchne par ya jab aap trend mein ya trend ki exhaustion ke isharon ko mehsoos karte hain, to trade se nikal jayen. Trade ki monitoring aur exit strategy ko moaziz rahne aur uss par amal karne ke liye ahem hai. Morning Star aur Evening Star candlestick patterns forex traders ke liye ahem asaas hain jo potential trend reversals ko pehchan'ne ki koshish mein hain. Ye patterns market sentiment mein tabdeeli ke waze signals faraham karte hain, jo inform ki gayi trading decisions banane ke liye istemal kiye ja sakte hain. Lekin yaad rahe ke koi bhi trading strategy 100% kamyaab nahi hoti aur risk management hamesha pehli priority honi chahiye. Traders ko chahiye ke ye patterns doosri technical aur fundamental analysis tools ke saath mila kar apni overall trading strategy ko behtar banane aur forex market mein kamyaabi hasil karne ke aapne chances ko barhane mein istemal karen.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Subah Star Aur Shaam Star Candlestick Patterns Ki FarqCandlestick charts trading mein aik ahem hissa hain aur traders ko market trends ko samajhnay mein madadgar hotay hain. Subah Star aur Shaam Star do ahem candlestick patterns hain, jo market trend reversal ko darust kartay hain. In dono patterns mein farq samajhnay ki zaroorat hoti hai taakay aap trading strategy ko behtar bana sakain.Subah Star Candlestick Pattern:1. Subah Star candlestick pattern market mein bearish trend ke bad hota hai.2. Pehli candlestick bearish hoti hai, jo downward movement ko darust karti hai.3. Dusri candlestick small body ki hoti hai, jo pehli candlestick ke neechay ya darmiyan hoti hai.4. Tisri candlestick bullish hoti hai aur pehli candlestick ke oopar close hoti hai, is se trend reversal ka signal milta hai.Shaam Star Candlestick Pattern:1. Shaam Star candlestick pattern market mein bullish trend ke bad hota hai.2. Pehli candlestick bullish hoti hai, jo upward movement ko darust karti hai.3. Dusri candlestick small body ki hoti hai, jo pehli candlestick ke oopar ya darmiyan hoti hai.4. Tisri candlestick bearish hoti hai aur pehli candlestick ke neechay close hoti hai, is se trend reversal ka signal milta hai.Dono patterns mein aik bearish ya bullish trend ke baad aik reversal pattern ati hai, lekin unka istemal karne se pehle confirmatory signals aur risk management ka khayal rakhna bohat zaroori hai. Trading mein safalta hasil karne ke liye practice aur research ka bhi aham role hota hai. -

#4 Collapse

Morning star Pattern : Dear my friends Morning star pattern 3 candlestick pattern per mabani Hota Hai candles mein jo pahle candle banti hai vah candle Barish bhi hoti hai aur long bhi hoti hain yah kya cal Hamen Iske bare mein information deti hai ki jo pahle candle Hai yah Barish Mein moment kar rahi hai aur jo second candle hai vah doji candle banti hai ya long hoti hain market Hamen iski ke bare mein yah batati Hai ke market ka trend change Hone ko hai. Importance of Morning star Pattern : Dear forex traders morning star candlestick pattern Ek bohot hi important candlestick pattern Hota Hai Jab market mein ek strong downtrend hota hai aur uske bad reversal trent banta hai to is candlestick pattern ko aap morning star candlestick pattern Kahate Hain Diya yah candlestick 3 different candlestick par depend kar raha hota hai jismein aapko market se related per factor analysis mil sakte hain aur aap apni trading co profitable bana sakte hain morning star ki proper recognition aur ismein complete calculation aapke profit ko maximize karne mein bahut jyada helpful hoti hai isliye aapko morning star candlestick patterns related complete information Hasil Karni chahie aur usko apni trading per reply karne chahiye agar aap is candlestick pattern ko avoid Karte Hain To usmein aapke liye kuch problem ho sakti hain aur aapko profit Hasil karne mein difficulties ho sakti hai. Evenings star candlestick : Dear forex members Evening star pattern bhi market mein bahut hi jyada important pattern Hota Hai is candlestick pattern mein bhi teen candle banti hai jo yah bullish hoti hai hai is mein 2nd candle doji candle banti hai Hamen important ke bare mein apne properly study ko complete karna chahiye yah pattern market mein bahut hi jyada important hote hain. Importance of Evenings star candlestick : Mere aziz sathiyon Evening star candlestick pattern bahut hi important candlestick pattern hota hai aur yah totally morning star candlestick pattern ke against hota hai dear jawab resistance level per market ko study kar rahe Hote Hain To Aisi situation main aapko yah candlestick pattern mil sakta hai is candlestick pattern Kolar karna bahut hi Aasan hota hai aur aap ko ismein bahut jyada advantages mil sakte hain.help se Ham market Mein Apni trade ko Kamyab bana sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Difference Between Morning And Evening Star Candlestick Pattern marning star aur evening star du aham mome betty ke namone hain joe technicality tajzia main istemal hote hain takeh tajiron ko qeematon ke rujhanat main mumkanah tabdiliyon kee nishandahi karne main madad mel sakay unhein aksar mumkanah rojhan kee tabdeeli ke isharay ke toor par dekha jata he yahan sabah ke satare aur evening star pettern ke darmiyan aham akhtalafat ka aik khulasa he: 1. Formation in a Downtrend vs. Uptrend: Morning Star: yah namona aam toor par down trend ke ikhtatam par tashkil pata he yah thin mome batiyon par mushtamil he: aik lambi mendy (niche kee taraf) mome batiye s ke baad aik chhoti mome betty jas ke niche aik khala he (tez ya mendy hosakta he) aur aakhir main aik lambi tez (oper kee taraf) mome batiye darmiyan main chhoti mome betty markets main adam faisla kee nishandahi karti he Evening Star: yah namona aam toor par ap trend ke ikhtatam par tashkil pata he yah thin mome batiyon par bhi mushtamil he ، lekin s ke bracks tarteeb main yah aik lambi tez mome betty se sharooh hotaa he ، s ke baad aik chhoti mome betty hoti he jas main aik khala hotaa he (phar ، tez ya mendy hosakti he) aur aakhir main ، aik lambi mendy walli mome batiye darmiyan main chhoti mome betty sabah ke satare kee tarh ghair faisla kan hone kee nishandahi karti he 3. Bullish vs. Bearsih Reversal: Morning Star: s namone ko tezi se palatne walla namona samjha jata he s se patah chalta he kah reecha (bechne walle) controlling kho rahe henni aur bell (kharidar) s par qabzah kor sakte henni jas kee wajah se mumkanah rojhan mendy se tezi kee taraf badh sakta he Evening Star: s ke bracks ، evening star aik mendy ke bracks namona he s se patah chalta he kah bell controlling kho rahe hain ، aur reecha s par qabzah karsakte hain ، jas se mumkanah toor par tezi se mendy kee taraf rojhan tabdeel hosakta he 3. Confirmation and Trading Signals: Morning Star: traders ke laye marning star pettern kee tasdiq par ghor karne ke laye ، wah aam toor par tashkil ke baad qimat ko ziyadah karne kee talash karte henni ase kharidari ke signal ke toor par dekha jata he ، aur tajir aksar tawil (kharidari) positions main dakhil hote hain jab wah marning star pettern dekhte henni Evening Star: traders evening star ko frocht ke signal ke toor par dekhte hain ، lekin tasdiq kee zarurat he tasdiq main aam toor par pettern kee tashkil ke baad qimat kom hoti he traders aksar mukhtasar (frocht) positions main dakhil hote hain jab wah evening star pettern dekhte henni 4. Importance of Gaps: donon namonon main khala ke saath chhoti mome batian shamel hain ، lekin un khala (oper ya niche) kee makhsoos noeiat mukhtalif hosakti he kachh tajir khala kee samat kee ahmit par zor dete hain ، jabkeh dosre majmooee pettern kee tashkil par ziyadah tawajah mercuz karte henni 5. Volume Consideration: kachh traders un namonon ka jaiza lete waqat trading ke hajm par bhi tawajah dete henni un namonon kee tashkil ke doran tejarati hajm main numayan izafah un kee sadaghat main izafah karsakta he yad rakhen kah koei aik trading pettern ya signal foll proff naheen he ، aur un namonon ko digar technicality tajzia ke auzar aur khatrey ke intazam kee hikmat amali wan ke saath mel kor istemal karna zarori he mazid bran markets ke halat aur siyaq we sabaq jas main yah namone waqi hote hain un kee qabil aitmadiyat par asar andaz hosaktay hain. traders ko sabah ke satare aur evening star jaise candle stick pettern kee bonyad par trading ke faislay karne se pahley ahtyat ka istemal karna chahiye aur mutadad awamil par ghor karna chahiyedon on namonon main khala ke saath chhoti mome batian shamel hain ، lekin un khala (oper ya niche) kee makhsoos noeiat mukhtalif hosakti he kachh tajir khala kee samat kee ahmit par zor dete hain ، jabkeh dosre majmooee pettern kee tashkil par ziyadah tawajah mercuz karte henni

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:39 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим