Reversal Candlestick Charts In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Understanding Reversal Candlestick ChartsReversal candlestick patterns ko samajhne ke liye candlestick charts ke bunyadi tajaweezat ko samajhna bohat ahem hai. Candlestick charts forex market mein mukhtalif waqt ke doran price movements ki aik tasveeri dastaweez faraham karte hain. Har candlestick char asli ahem components se mushtamil hoti hai: open, close, high, aur low prices us mukhtar waqt ke doran. Ye charts mukhtalif waqt framz mein dastiyab hote hain, jaise ke 1-minute, 15-minute, 1-hour, daily, weekly, aur mazeed, jo traders ko unke trading style aur maqsadon ke mutabiq waqt fram chunne mein madadgar hote hain. Halankay reversal candlestick patterns kisi bhi waqt frame par appear ho sakte hain, lekin unki ahmiyat waqt frame ke mutabiq mukhtalif ho sakti hai. The Significance of Reversal Candlestick Patterns Reversal candlestick patterns forex traders ke liye bohat ahem hote hain, kyun ke ye market sentiment aur trends mein tabdeeliyon ke potential pe maloomat faraham karte hain. Ye patterns aksar support aur resistance ke key levels par zahir hote hain, jis se inki ahmiyat aur barh jati hai. Traders apni trading decisions ke liye in patterns par bharosa karte hain, yani trading mein dakhil hone ya nikalne ke bare mein maloomat hasil karne ke liye. Reversal pattern ko jaldi pehchan lena forex market mein tez tawanai se bhari hue aur tezi se tabdeel hone wale mahaul mein aapko aik ahem faiyda faraham kar sakta hai.

The Significance of Reversal Candlestick Patterns Reversal candlestick patterns forex traders ke liye bohat ahem hote hain, kyun ke ye market sentiment aur trends mein tabdeeliyon ke potential pe maloomat faraham karte hain. Ye patterns aksar support aur resistance ke key levels par zahir hote hain, jis se inki ahmiyat aur barh jati hai. Traders apni trading decisions ke liye in patterns par bharosa karte hain, yani trading mein dakhil hone ya nikalne ke bare mein maloomat hasil karne ke liye. Reversal pattern ko jaldi pehchan lena forex market mein tez tawanai se bhari hue aur tezi se tabdeel hone wale mahaul mein aapko aik ahem faiyda faraham kar sakta hai. Common Types of Reversal Candlestick Patterns Forex market mein traders aksar aam tarah ke reversal candlestick patterns se miltay hain. Har pattern apni khasusiyat aur asrat rakhta hai. Yahan kuch mashhoor reversal candlestick patterns hain:

- Hammer aur Inverted Hammer: Hammer aik bullish reversal pattern hai jise aik choti body ke sath aik lambi lower shadow ki pehchan hoti hai, jis se ye zahir hota hai ke sellers ne prices ko kam karne ki koshish ki lekin buyers ne unko shikast di. Inverted hammer uska bearish counterpart hai, jo ek potential trend reversal ko niche ki taraf ishara karta hai.

- Doji: Doji candles ki body choti hoti hai aur market mein uncertainty ko darust karti hain. Ye woh waqt hoti hain jab opening aur closing prices aik dosray ke kareeb hoti hain, jis se ye cross ki tarah dikhti hain. Doji potential trend reversal ko darust kar sakti hai, khas kar jab ye aik strong price move ke baad aati hai.

- Engulfing Patterns: Engulfing patterns do candlesticks se miltay hain - aik choti aur phir aik bari candle jo pehli candle ko puri tarah se gher leti hai. Bullish engulfing pattern ek downtrend ke aik akhri hisse mein hoti hai aur upper ki taraf potential reversal ko darust karti hai. Ulta, bearish engulfing pattern aik uptrend ke akhri hisse mein hoti hai, jis se potential reversal ko niche ki taraf ishara hota hai.

- Shooting Star aur Hanging Man: Shooting star bearish reversal pattern hai jise aik choti body aur aik lambi upper shadow ki pehchan hoti hai. Ye aik uptrend ke baad aati hai aur upper ki taraf potential reversal ko darust karti hai. Hanging man, uska bearish counterpart hai, jo uptrend ke akhri hisse mein aata hai aur bhi potential reversal ko niche ki taraf ishara karta hai.

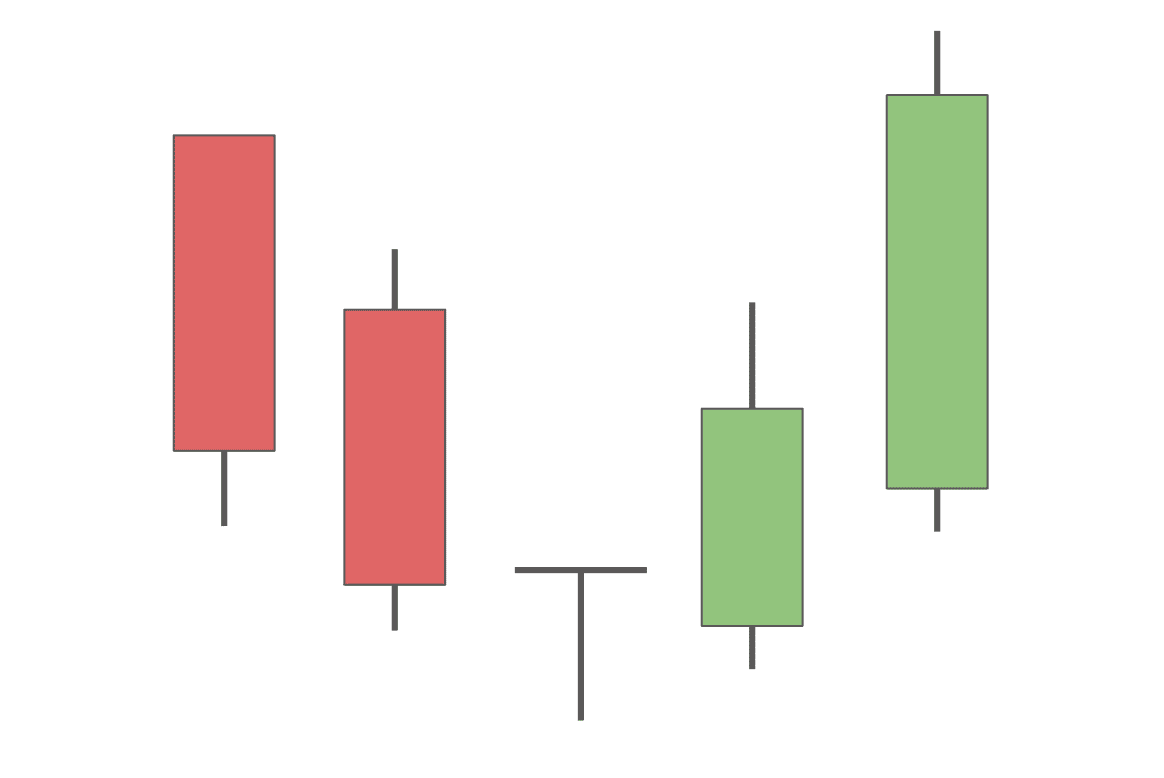

- Morning Star aur Evening Star: Morning star bullish reversal pattern hai jo teen candlesticks se milti hai - aik bearish candle, phir aik choti indecisive candle (doji ya spinning top), aur akhir mein aik bullish candle. Ye pattern upper ki taraf potential trend reversal ko darust karti hai. Ulta, evening star uska bearish counterpart hai, jo potential trend reversal ko niche ki taraf darust karti hai.

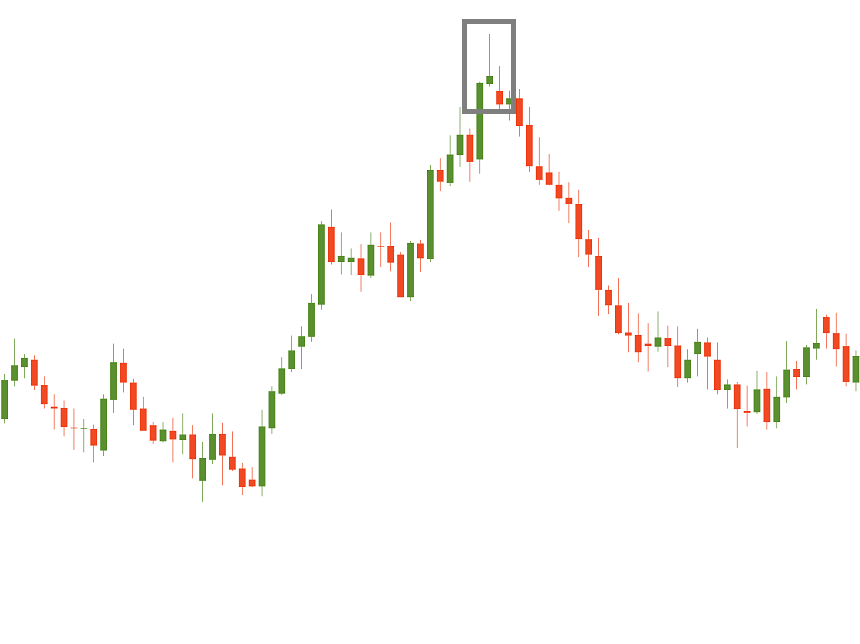

- Double Top aur Double Bottom: Ye single candlestick patterns nahi hain, balkay ye chart patterns hain jo mukhtalif candlesticks ko involve karte hain. Double top bearish reversal pattern hai jo aik uptrend ke baad hoti hai aur potential reversal ko darust karti hai. Double bottom bullish reversal pattern hai jo aik downtrend ke baad hoti hai aur upper ki taraf potential reversal ko darust karti hai.

Ye sirf kuch mashhoor reversal candlestick patterns hain jo forex trading mein aksar traders ko miltay hain. Traders aksar in patterns ko aur doosre technical analysis tools ko confirm karne ke liye istemal karte hain. Yaad rahe ke jabke ye patterns powerful indicators ho sakte hain, magar ye puri tarah yaqeeni nahi hote aur traders ko trading decisions banate waqt market conditions, trend strength, aur fundamental analysis jaisay doosre factors ko bhi madde nazar rakhna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Ye sirf kuch mashhoor reversal candlestick patterns hain jo forex trading mein aksar traders ko miltay hain. Traders aksar in patterns ko aur doosre technical analysis tools ko confirm karne ke liye istemal karte hain. Yaad rahe ke jabke ye patterns powerful indicators ho sakte hain, magar ye puri tarah yaqeeni nahi hote aur traders ko trading decisions banate waqt market conditions, trend strength, aur fundamental analysis jaisay doosre factors ko bhi madde nazar rakhna chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Reversal Candlestick Charts In Forex: reversal candlestick pettern farex trading main technicality tajzia ka aik aham jazu henni yah namone qeematon ke chart par mome betty ke intazam se tashkil pate hain aur tajiron ko currency markets main mumkanah rojhan kee tabdeeli wan kee nishandahi karne main madad karsakte henni farex main kachh aam reursal mome betty ke namone yah hain: 1. Hammer and Hanging Man:- Hammer:

- Hanging Man:

- Bullish Engulfing:

- Bearish Engulfing:

- aik doji aik mome betty he jas ka aik chhota saa haghighi jasm aur taqriba braber lambai ke opery aur nichlay saaye henni yah markets ke adam faislay kee akasi karta he aur mumkanah ullat palat kee nishandahi karsakta he ، khaas toor par jab yah tawil ap trend ya down trend ke baad zahir hotaa he

- Shooting Star:

- Inverted Hammer:

- Evening Star:

- Morning Star:

-

#4 Collapse

Reversal Candlestick Charts In Forex: Forex Mein Palatna Candlestick Charts Forex trading ek aisa shauq hai jis mein traders apne paisay lagate hain aur ummed karte hain ke woh munafa kamayen. Lekin, forex market mein trading karna asan nahi hota, aur traders ko market ke trends ko samajhna aur samjhna bohot zaroori hota hai. Ek aham tool jo traders istemal karte hain market ki muddaton ko predict karne ke liye, woh hai "Reversal Candlestick Charts." Yeh charts traders ko market ke palatne wale points ko pehchanne mein madadgar sabit ho sakte hain. Reversal Candlestick Charts, Japani technical analysis ki ek prakar hain. In charts mein har ek din ke trading activity ko ek candlestick se darust kiya jata hai. Har candlestick ke paas teen ahem elements hote hain: opening price (shuruaati daam), closing price (band daam), high price (zayada daam), aur low price (kam daam). In elements ka sahi tarah se interpretation karke, traders market ke palatne ke signs ko samajh sakte hain. Reversal Candlestick Charts mein, kuch specific candlestick patterns ya formations hoti hain jo traders ko market mein hone wale trend reversals ke baray mein batati hain. Inmein se kuch pramukh patterns hain:- Hammer: Hammer pattern ek bullish reversal pattern hai jo market mein bearish trend ke baad aata hai. Ismein candlestick ke upper shadow ke baad kam daam par lambi body hoti hai, jo indicate karta hai ke buyers ne control haasil kiya hai aur market palat sakta hai.

- Shooting Star: Shooting star pattern ek bearish reversal pattern hai. Ismein ek choti body hoti hai jo upper shadow ke baad hoti hai aur yeh suggest karta hai ke market mein bearish trend hone ke chances hain.

- Doji: Doji ek indecisive candlestick pattern hai. Ismein opening aur closing price barabar hoti hain, aur yeh market mein uncertainty ya trend reversal ke signs ho sakte hain.

- Bullish Engulfing: Bullish engulfing ek bullish reversal pattern hai jismein ek choti bearish candle ko ek lambi bullish candle engulf karti hai, yeh suggest karta hai ke market mein bullish trend hone ke chances hain.

- Bearish Engulfing: Bearish engulfing, bearish trend ke baad aane wala reversal pattern hai jismein ek choti bullish candle ko ek lambi bearish candle engulf karti hai, yeh bearish reversal ki taraf ishara karta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Reversal candlestick patterns forex trading mein use kiye jane wale technical analysis tools hain, jo price action analysis ke liye istemal hote hain. Ye patterns trend reversal points ko identify karne aur trading decisions banane mein madadgar hote hain. Yahan kuch pramukh reversal candlestick patterns diye gaye hain: Hammer: Hammer ek bullish reversal candlestick pattern hai. Isme ek small body hoti hai, jo upper shadow ke bina hoti hai, aur lower shadow lambi hoti hai. Hammer bottom (downtrend ke baad) par aati hai aur price ko upar le ja sakti hai. Inverted Hammer: Inverted Hammer bhi ek bullish reversal pattern hai. Isme ek small body hoti hai, jo lower shadow ke bina hoti hai, aur upper shadow lambi hoti hai. Inverted Hammer downtrend ke baad aati hai aur price ko upar le ja sakti hai. Shooting Star: Shooting Star ek bearish reversal pattern hai. Isme ek small body hoti hai, jo upper shadow lambi hoti hai, aur lower shadow ke bina hoti hai. Shooting Star uptrend ke baad aati hai aur price ko niche le ja sakti hai. Gravestone Doji: Gravestone Doji bhi ek bearish reversal pattern hai. Isme ek small body hoti hai, jo lower shadow lambi hoti hai, aur upper shadow ke bina hoti hai. Gravestone Doji uptrend ke baad aati hai aur price ko niche le ja sakti hai. Engulfing Pattern: Engulfing pattern ek strong reversal pattern hai. Isme do candles hote hain. Bearish engulfing pattern, uptrend ke baad aati hai aur isme pehli candle bullish hoti hai aur dusri candle usse engulf kar leti hai aur bearish hoti hai. Bullish engulfing pattern, downtrend ke baad aati hai aur isme pehli candle bearish hoti hai aur dusri candle usse engulf kar leti hai aur bullish hoti hai. Doji: Doji ek indecisive candlestick pattern hai, lekin jab ye trend ke baad aati hai, to ye reversal ko suggest kar sakti hai. Isme body nahi hoti, sirf ek line hoti hai jo open aur close prices ko represent karti hai. Three White Soldiers: Three White Soldiers ek bullish reversal pattern hai. Isme teen consecutive green candles hote hain, jo uptrend ke baad aati hain aur bullish trend ki shuruaat ko suggest karte hain. Three Black Crows: Three Black Crows ek bearish reversal pattern hai. Isme teen consecutive red candles hote hain, jo uptrend ke baad aati hain aur bearish trend ki shuruaat ko suggest karte hain.In reversal candlestick patterns ko traders chart analysis mein istemal karte hain, lekin yaad rahe ki ye patterns ek single indicator ki tarah kaam nahi karte. Aapko dusre technical indicators aur price analysis ke sath in patterns ko consider karna chahiye, aur trading decisions lene se pehle thorough research aur risk management bhi karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим