Volume Underlay Indicator ki details

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

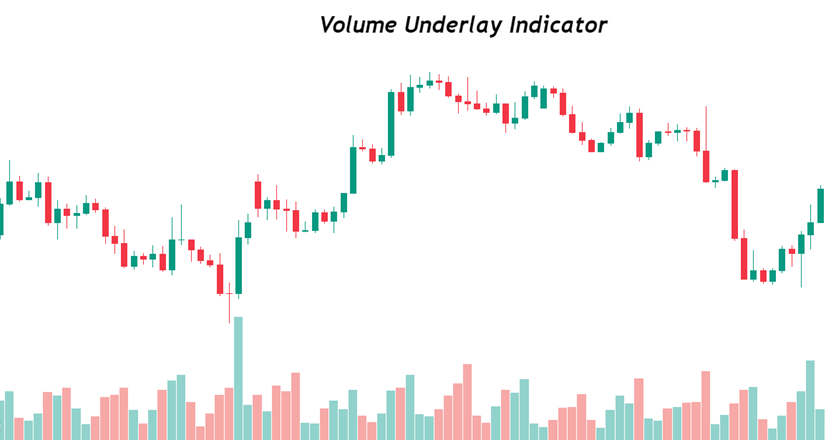

VOLUME UNDERLAY INDICATOR IN TRADINGIntroduction Volume Underlay Indicator trading mein aik ahem technical tool hai jo ke asal trading volume ko samajhnay aur trading decisions bananay mein madadgar hota hai. Iska istemal trading charts par kiya jata hai takay traders ko samajh mein aye ke market mein kis tarah ki activity ho rahi hai. Volume Underlay Indicator Ki Formula: Volume Underlay Indicator ka formula simple hota hai. Aap isay is tarah calculate kar saktay hain: a. Sab se pehlay, aapko decide karna hoga ke aap kis time frame par VUI calculate karna chahtay hain, jaise ke daily, hourly, ya minute-by-minute. B. Phir aap us time frame ke tamam candles ya bars ki trading volume ko add karain. c. Iske baad, aap is volume ko kisi moving average ya weighted moving average se divide karain. Yeh average volume ki calculation hai jo aapke trading strategy par depend karti hai. Guidelines for traders: Volume Underlay Indicator ka istemal market sentiment aur trading signals ko samajhnay mein hota hai. Isay traders do maqasid ke liye use karte hain: Market Activity Ka Pata Lagana: VUI se traders ko market mein kitni activity ho rahi hai, yani kitni trading volume generate ho rahi hai, iska pata lagta hai. Agar VUI high hai, toh yeh show karta hai ke market mein zyada activity hai aur traders active hain. Agar VUI low hai, toh yeh indicate karta hai ke market thanda hai aur traders cautious hain. Trading Signals Generate Karna: VUI ko trading strategy ke sath combine karke traders trading signals generate karte hain. Agar VUI moving average se above hai, toh yeh buy signal ho sakta hai. Jab VUI moving average se below hai, toh yeh sell signal ho sakta hai. Is tarah se, traders market entry aur exit points decide karte hain. Note for traders Traders VUI ko trading strategy ke sath combine karke trading signals generate karte hain. Agar VUI moving average se above hai, toh yeh buy signal ho sakta hai. Jab VUI moving average se below hai, toh yeh sell signal ho sakta hai. Is tarah se, traders market mein kab enter aur kab exit karna behtar samajhtay hain. Summary Volume Underlay Indicator trading mein ahem hai aur traders ko market activity aur trading signals ke liye important information deta hai. Isay samajh kar, traders apni trading decisions ko improve kar saktay hain aur market ko behtar tariqay se samajh saktay hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Break out Break out say murad punch kisi asast ki keemat mazahmati elaqy say oper jati roughage too ya identification region say nichy jati feed ya isy zeada oper chali jati feed. Break out keemat k break out framework fundamental rujhan shuru krny k imkan ki neshandahi karty hain .mesal k pinnacle pr diagram k example say oper ki taraf break out is bat ke neshandahi karta feed k keemat zeada trendline ki taraf jayegi . Break out jo zeada say zeada volume pr hoty hain. Zeada yaqeen zahir krty hain jis ja matlab feed k keemat ka is simat principal tayun r rujhan hony ka imkan bht zeada feed. What breaks out tell us Break out is liye hota roughage kiu k mazahmati satah say nichy ya identification level. Say oper hoti roughage. Mumkina pinnacle pr kch waqt k lye esa hota roughage. Mazahmat ya identification level rait principal ak lakerr boycott jata feed jisy bht say tajir passage focuses set krny ya nuqsan ki satah rokny k liye istmal karty hain punch keemat visa ya obstruction level droop child jati roughage to tajir break out ka intzar kar rhy hoty hain. Or then again wh log jo nahi chahty esa wh keemat k break out haony say bary sy bary nuqsan say bach jaty hain. Limits of utilizing break out Break out ko.istmal karny k 2 ehm nasail hain. Ehm masla nakam break out roughage keemat aksar mazahmati ya hemayat say agy barhy ge . Break out treaders ko lalach dey kr.zeada say zeada or break out simat principal agy barhna jari nai rkhti . Haqeqei break out hony say pehly ki.mazahamt ki sathen bhe mozoi hain. Sport mazahmat ki.sathen ki parwah ni karty r narket primary zeada say zeada nuqsan utha kr misfortune krty hain. outline hajam mein aik bara izafah dekhata hai, jo aamdani ke ajra se munsalik hota hai, kyunkay qeemat masalas graph patteren ke muzahmati ilaqay se guzarti hai. break out itna mazboot tha ke is ki wajah se qeematon mein farq para. qeemat musalsal barhti rahi aur asal break out point standard wapas nahi gayi. yeh aik bohat mazboot break out ki alamat hai. tajir mumkina pinnacle standard lambi pozishnon mein daakhil honay aur/ya mukhtasir pozishnon se bahar niklny ke liye break out ka istemaal kar satke thay. agar lamba daakhil ho raha hai to, aik stap nuqsaan masalas ki muzahmati satah ke bilkul neechay rakha jaye ga ( ya masalas support se bhi neechay ). chunkay qeemat mein bara farq tha, is liye yeh stap nuqsaan ka maqam misali nahi ho sakta. break out ke baad qeemat musalsal bherne ke baad khatray ko kam karne ya munafe mein band karne ke liye stap nuqsaan ko tril kya ja sakta hai . -

#4 Collapse

Presentation of Banner Diagram Example: Banner Diagram Example se related hit aap market mein study karte hain to usmein bhi aapko various sorts ki significant division karna hoti hai jismein aap bullish banner example aur negative banner example ko appropriately notice kar sakte hain dear ismein aap do line draw kar lete hain Jiske andar market ki development ho rahi hoti hai aisi circumstance ko aap banner example ka naam Dete hain jismein isko aap partition kar sakte hain. Bullish and Negative Banner Diagram Example: Dear Siblings Banner Diagram Example market mein Bullish ya Negative pattern dono mein structure ho sakta hai. Isi tarha yeh un designs mein usi pattern ki continuation ky signals deta hai. Yeh Inversions ki bjaye market mein same pattern ko follow karny ky signals deta hai. Is mein ek Flagpole ki development hoti hai jo ky smek long light hoti hai jo ky as per the pattern arrangement dikhati hai. Is ky terrible Banner example ki arrangement hoti hai jis mein by and large descending development dekhi jati hai. Is tarha descending development mein little negative aur Bullish candles banti rehti hain. Market mein ups and downs ko dekha jaye to advertise mein practically Negative development dekhi jati hai. Is ke badh Banner diagram design ki fruition ke terrible market dobara se abrupt upwards development dikhati hui opar jati hai. Is tarha market mein pattern continuation hoj ati hai. Dear Forex Individuals Banner Diagram design tab banta hai hit market principal achanak taizi a jaye aur market inside 1 to 3 hours fundamental bohot zyada development kary, iskay badh side way development start kar day aur phir inversion primary a jaye yani banner bana day. Banner Graph design primary exchanging kay liye hit sideway development say inversion start ho jaye to first ki bajaye second candle principal enter hon aur sideway development per stop misfortune laga dain ta keh hamari exchange safe rahy. -

#5 Collapse

Volume Underlay Indicator trading mein ek bohot useful tool hai jo traders ko market ki activity aur sentiment ko samajhne mein madad karta hai. Ye indicator price movements ke sath trading volume ko combine karta hai, jo market ki strength aur potential reversals ko indicate karne mein bohot effective hota hai. . Volume Underlay Indicator aik technical analysis tool hai jo price chart ke neeche volume bars ko display karta hai. Ye indicator show karta hai ke kis waqt market mein kitna volume trade ho raha hai, aur isse price movements ke sath compare kiya ja sakta hai taake market sentiment aur trend strength ko assess kiya ja sake.

Key Components of Volume Underlay Indicator- Volume Bars: Ye vertical bars hoti hain jo each time period mein traded volume ko represent karti hain. In bars ki height volume ko indicate karti hai - jitni badi bar hogi, utna zyada volume trade hua hoga.

- Price Chart Integration: Volume bars ko price chart ke neeche overlay kiya jata hai, jo traders ko price aur volume ka comparison karne mein madad karta hai.

Volume trading mein bohot important role play karta hai. High volume typically market interest aur activity ko indicate karta hai, jabke low volume market participants ki lack of interest ko show karta hai. Volume analysis se traders ko ye samajhne mein madad milti hai ke kis waqt trend strong hai aur kis waqt weak.

High Volume

High volume price movements ko validate karta hai. Agar kisi uptrend ya downtrend ke waqt high volume observe ho, to ye trend ki strength ko indicate karta hai. High volume typically significant market moves aur trend reversals ke waqt bhi dekha jata hai.

Low Volume

Low volume typically weak trends ko indicate karta hai. Agar price movements low volume ke sath ho, to ye indicate karta hai ke trend mein conviction nahi hai aur potential reversal ya consolidation ka chance ho sakta hai.

Uses of Volume Underlay Indicator

Volume Underlay Indicator ko trading strategies mein multiple tarikon se use kiya ja sakta hai. Ye indicator price movements ko context provide karta hai aur market sentiment ko assess karne mein madad karta hai. Kuch common uses ye hain:

1. Confirming Trends

Volume Underlay Indicator trends ko confirm karne mein madadgar hota hai. For example, agar price uptrend mein hai aur volume steadily increase ho raha hai, to ye trend ki strength ko confirm karta hai. Isi tarah, agar downtrend ke sath volume increase ho raha hai, to ye bearish sentiment ko validate karta hai.

2. Identifying Reversals

Volume Underlay Indicator trend reversals ko identify karne mein bhi madad karta hai. Agar uptrend ke waqt high volume ke sath sharp price drop observe ho, to ye potential trend reversal ko indicate kar sakta hai. Isi tarah, downtrend ke waqt high volume ke sath sharp price rise bhi trend reversal ka indication ho sakta hai.

3. Detecting Breakouts

Breakouts typically high volume ke sath hote hain. Volume Underlay Indicator se traders ko breakouts ko detect karne mein madad milti hai. Agar price key support ya resistance level ko high volume ke sath break karta hai, to ye breakout ko validate karta hai aur potential trend continuation ko indicate karta hai.

4. Gauging Market Interest

Volume Underlay Indicator se market interest aur participation ko gauge karna possible hota hai. High volume market participants ki strong interest ko show karta hai, jabke low volume lack of interest ko indicate karta hai. Ye information traders ko informed decisions lene mein madadgar hoti hai.

Implementing Volume Underlay Indicator

Volume Underlay Indicator ko implement karna relatively simple hai. Ye almost sabhi trading platforms aur charting software mein available hota hai. Indicator ko activate karne ke liye kuch basic steps ye hain:- Select Volume Indicator: Apne trading platform par Volume Indicator ko select karein. Ye option typically indicators list mein available hota hai.

- Apply to Chart: Volume Indicator ko apne price chart par apply karein. Ye usually chart ke neeche volume bars ko display karega.

- Customize Settings: Kuch platforms volume indicator ke settings ko customize karne ki option bhi dete hain. For example, aap volume bars ka color ya scale change kar sakte hain.

Volume Underlay Indicator ko effectively use karne ke liye kuch best practices ko follow karna zaroori hai:

1. Combine with Other Indicators

Volume Underlay Indicator ko doosre technical indicators ke sath combine karna useful hota hai. For example, moving averages, RSI, aur MACD ke sath volume ko combine karke zyada reliable trading signals generate kiya ja sakta hai.

2. Focus on Significant Volume Spikes

Significant volume spikes ko dhyan se observe karein. Ye spikes typically important market events ya breakouts ke waqt hote hain aur strong market sentiment ko indicate karte hain.

3. Avoid Over-Analyzing Low Volume Periods

Low volume periods ko over-analyze na karein. Low volume typically market indecision ya consolidation ko indicate karta hai. Is waqt zyada trades execute karna risky ho sakta hai.

4. Monitor Volume Patterns

Volume patterns ko monitor karna useful hota hai. Consistent high volume trends ko observe karna aur unke sath price movements ko analyze karna zyada accurate trading decisions mein madadgar hota hai.

Volume Underlay Indicator trading mein ek bohot valuable tool hai jo market sentiment aur trend strength ko assess karne mein madad karta hai. Ye indicator price movements ke sath volume ko compare karne ka opportunity provide karta hai, jo informed trading decisions lene mein help karta hai. Volume Underlay Indicator ko effectively use karne ke liye proper analysis, doosre indicators ke sath combination, aur best practices ko follow karna zaroori hai. Agar traders is tool ko accurately interpret kar sakein, to ye unke trading strategies ko enhance kar sakta hai aur profitable outcomes achieve karne mein madadgar sabit ho sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Volume Underlay Indicator ki Detail

Volume Underlay Indicator, trading mein ek ahem role play karta hai. Yeh indicator aapko price movements ke saath volume trends ko bhi samajhne mein madad deta hai. Volume Underlay Indicator ko samajhne se aap yeh andaza laga sakte hain ke kis tarah ki buying aur selling activity ho rahi hai, aur yeh kis had tak market trend ko support kar rahi hai. Is article mein hum Volume Underlay Indicator ke functions, use cases, aur trading strategies ko discuss karenge.

### Volume Underlay Indicator Kya Hai?

Volume Underlay Indicator ek graphical representation hai jo price chart ke niche display hota hai. Yeh indicator aapko yeh batata hai ke kitna volume (shares ya contracts) trade ho raha hai kisi bhi given time period mein. Volume ko bars ke form mein dikhaya jata hai, jahan higher bars zyada volume ko represent karte hain aur lower bars kam volume ko.

### Functions of Volume Underlay Indicator

1. **Trend Confirmation:** Agar price upar ja raha hai aur volume bhi increase ho raha hai, toh yeh ek strong trend ka indication hai. Isi tarah, agar price niche ja raha hai aur volume bhi increase ho raha hai, toh yeh downward trend ka signal hai.

2. **Reversals Ki Pehchaan:** Jab price ek level par pohanch kar volume ke sath stable ho jata hai ya volume decrease hone lagta hai, toh yeh reversal ka indication ho sakta hai. Yeh situation is baat ki taraf ishara kar sakti hai ke buying ya selling pressure khatam ho raha hai aur trend ulta ho sakta hai.

3. **Breakouts Ki Tashkeel:** Volume Underlay Indicator ko support aur resistance levels ke sath use karke, aap breakouts ko pehchan sakte hain. Agar price ek resistance level cross kar raha hai aur volume mein significant increase ho raha hai, toh yeh breakout ka indication hai.

### Use Cases of Volume Underlay Indicator

1. **Identifying Strong Moves:** High volume moves usually signify significant market interest. For example, agar koi stock ya currency pair ek specific level cross kar raha hai aur volume bhi high hai, toh yeh move kaafi significant ho sakta hai.

2. **Divergence Analysis:** Volume divergence ko analyze karna bhi helpful hota hai. Agar price upar ja raha hai magar volume decrease ho raha hai, toh yeh weak trend ka indication ho sakta hai.

3. **Volume Spikes:** Volume spikes ko identify karke aap unusual trading activity ko detect kar sakte hain. Yeh aapko potential market manipulation ya major news events ka signal de sakti hai.

### Trading Strategies Using Volume Underlay Indicator

1. **Volume Breakout Strategy:** Is strategy mein aap support aur resistance levels ko identify karte hain aur phir volume ko monitor karte hain. Jab price ek resistance level cross karta hai aur volume mein significant increase hota hai, toh yeh buying signal ho sakta hai. Isi tarah, support level ke breakdown ke sath volume increase hone par selling signal mil sakta hai.

2. **Volume Pullback Strategy:** Is strategy mein aap strong trends ke andar pullbacks ko trade karte hain. Agar price ek direction mein move kar raha hai aur phir pullback karta hai, lekin volume kam ho raha hai, toh yeh temporary pullback ka indication hai aur trend continue hone ki expectation ho sakti hai.

3. **Volume Confirmation Strategy:** Is strategy mein aap trend ke continuation ko volume se confirm karte hain. Agar price ek trend mein hai aur volume bhi consistently increase ho raha hai, toh yeh trend continuation ka signal hai.

### Conclusion

Volume Underlay Indicator ek valuable tool hai jo aapko market trends aur price movements ko better understand karne mein madad deta hai. Is indicator ko effectively use karke, aap strong trading decisions le sakte hain aur potential profit opportunities ko identify kar sakte hain. Hamesha yaad rakhein, trading mein risk management bhi utna hi important hai jitna ke analysis, is liye apni strategies ko bina proper risk assessment ke implement na karein.

-

#7 Collapse

Volume Underlay Indicator ki details

(taareef)

Volume Underlay Indicator, trading mein use hota hai aur stock market analysis ke liye helpful hota hai. Yeh indicator price chart ke niche volume data ko visualize karta hai, jo market ki activity aur liquidity ke baare mein insight provide karta hai.

Key Features:- Volume Representation: Yeh indicator trading volume ko horizontal bars ke zariye dikhata hai, jo price chart ke niche display hota hai.

- Trend Confirmation: Volume Underlay indicator market trends ko confirm karne mein madad karta hai. Jab volume bar badh raha hota hai, to yeh indicate karta hai ke market mein zyada activity hai, jo trend ko support kar sakta hai.

- Support and Resistance Levels: High volume points often indicate strong support or resistance levels, which traders use to make decisions.

- Divergence: Agar price chart aur volume bars ke darmiyan divergence hoti hai (e.g., price high hai par volume low hai), to yeh potential trend reversal ka signal ho sakta hai.

- Volume Spikes: Large spikes in volume can indicate potential breakouts or breakdowns in price levels.

Is indicator ka use karke traders market ki strength aur potential price movements ko better analyze kar sakte hain.

Volume Underlay Indicator ki mukammal wazahat

Volume Underlay Indicator, technical analysis mein ek aham tool hai jo price charts ke niche volume data ko visualize karta hai. Yeh indicator market ki activity aur liquidity ko samajhne mein madad karta hai. Iski mukammal wazahat yeh hai:

1. Volume Representation:- Visual Display: Volume Underlay Indicator price chart ke niche ek histogram ke form mein volume dikhata hai. Har bar volume level ko represent karti hai.

- Bar Heights: Volume bars ki height market activity ke level ko darshati hai. Lambe bars high volume aur chhote bars low volume ko indicate karte hain.

- Trend Confirmation: Volume bars ki movement market trends ko confirm karne mein madad karti hai. Agar volume bar price trend ke saath badh raha hai, to yeh trend ki strength ko indicate karta hai.

- Trend Reversals: Agar volume badh raha hai jab price trend mein change ho raha hai, to yeh trend reversal ka signal ho sakta hai.

- Volume at Key Levels: High volume points par price support ya resistance levels develop kar sakti hai. Yeh traders ko entry aur exit points identify karne mein madad karta hai.

- Volume Price Divergence: Agar price high points bana rahi hai lekin volume low hai, ya price low points bana rahi hai lekin volume high hai, to yeh divergence market trend reversal ka indication ho sakta hai.

- Breakouts/Breakdowns: Volume spikes ya sudden increase in volume usually significant price movements ke sath hota hai, jaise breakouts (price levels ko todna) ya breakdowns (price levels ko girana).

- Trading Strategy: Traders is indicator ko apne trading strategies mein integrate kar sakte hain, jaise trend following strategies, breakout strategies, aur reversal strategies.

- Decision Making: Volume Underlay Indicator trading decisions ko improve karne mein madad karta hai by providing insights into market strength and potential price movements.

In summary, Volume Underlay Indicator ek valuable tool hai jo trading volume ko visualize karke market ki activity aur liquidity ko samajhne mein madad karta hai, jo ultimately trading decisions ko enhance karta hai.

-

#8 Collapse

**Volume Underlay Indicator Ki Details:**

1. **Volume Underlay Indicator Ka Taaruf:**

- Volume Underlay Indicator ek technical analysis tool hai jo price chart ke neeche volume data ko display karta hai.

- Ye indicator trading volume ke trends aur price movements ke darmiyan relationship ko samajhne mein madad karta hai.

2. **Formation aur Tashreeh:**

- **Volume Bar:** Indicator price chart ke neeche volume bars ko show karta hai. Har bar trading volume ke size ko dikhati hai, jise color-coding ke zariye bullish (green) aur bearish (red) movements ke liye indicate kiya jata hai.

- **Volume Trend Lines:** Kuch versions mein volume bars ke sath trend lines bhi hoti hain jo volume ke trends aur patterns ko highlight karti hain.

3. **Ahemiyat:**

- **Trend Confirmation:** Volume Underlay Indicator market trends ko confirm karne mein madad karta hai. High volume ke saath price trend strong aur reliable hota hai.

- **Signal Strength:** Indicator volume spikes aur declines ko identify karta hai, jo potential trend reversals ya continuation signals de sakti hain.

- **Divergence Analysis:** Volume divergence ko identify karke, jab price aur volume trends ek dosre se conflict mein hote hain, traders ko early reversal signals mil sakte hain.

4. **Trading Strategy:**

- **Entry Point:** Entry points tab identify kiye jate hain jab volume bars increase hoti hain aur price trend ke sath match karti hain. Example ke taur par, rising volume ke saath price uptrend ko confirm karta hai.

- **Stop-Loss:** Stop-loss orders ko volume trend ke analysis ke madad se set kiya ja sakta hai, jo market ke unexpected movements se bacha sakta hai.

- **Profit Target:** Profit targets ko volume analysis ke basis par set kiya jata hai, jahan volume ke patterns strong signals provide karte hain.

5. **Risk Management:**

- **Volume Analysis:** High volume ke saath price movements ko monitor karna zaroori hai. Low volume ke saath price changes unreliable ho sakti hain.

- **Market Context:** Volume ke patterns ko samajhne ke liye broader market context ko bhi consider karna chahiye, jo overall trend aur sentiment ko samajhne mein madad karta hai.

- **Diversification:** Trading risk ko manage karne ke liye portfolio diversification zaroori hai, taki single trade se hone wale potential losses ko minimize kiya ja sake.

6. **Common Mistakes:**

- **Ignoring Volume Trends:** Volume ke changes ko ignore karna trading decisions ko inaccurate bana sakta hai. Volume trends ko always consider karna chahiye.

- **Misinterpreting Volume Spikes:** Kabhi-kabhi volume spikes misleading ho sakti hain. Confirmatory signals ke bina inhe rely karna risky ho sakta hai.

7. **Nihayat:**

- Volume Underlay Indicator trading volume aur price movements ko samajhne ke liye ek effective tool hai.

- Effective trading ke liye, volume analysis ke sath-saath additional technical indicators aur market context ka bhi dhyan rakhna zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Volume Underlay Indicator Ki Tafseel

Volume Underlay Indicator ek ahem tool hai jo traders ko market ki liquidity aur price movements ke pichay ke volume ko samajhne mein madad deta hai. Yeh indicator price chart ke neeche volume data ko visualize karta hai, jisse aapko market ki activity aur momentum ka behtar andaza hota hai. Is post mein hum Volume Underlay Indicator ki khasiyat, istemal, aur trading strategies par baat karenge.

#### Volume Underlay Indicator Kya Hai?

Volume Underlay Indicator price chart ke neeche ek histogram ki shakal mein dikhai deta hai. Yeh indicator har trading session ke dauran volume ke data ko represent karta hai. Volume ka matlab hai ke kisi asset ka kitna trade hua, aur yeh indicator is baat ka izhar karta hai ke kitni strength ke sath price movement ho rahi hai. Agar price ke sath volume bhi badh raha hai, to yeh signal hai ke market mein strong momentum hai.

#### Volume Underlay Indicator Ka Istemal

Volume Underlay Indicator ko istemal karne ke liye kuch important points hain:

1. **Volume Analysis**: Jab price ek specific level par pahunchti hai aur volume us waqt badh raha hota hai, to yeh signal hota hai ke price movement strong hai. Agar price badh rahi hai lekin volume kam hai, to yeh signal hai ke trend sustainable nahi hai.

2. **Breakout Confirmation**: Volume Underlay Indicator ko breakouts ke waqt bhi istemal kiya jata hai. Agar price kisi resistance ya support level ko break karti hai aur is dauran volume mein izafa hota hai, to yeh bullish ya bearish confirmation hota hai.

3. **Divergence Analysis**: Agar price aur volume ke beech divergence hoti hai, to yeh potential reversal ka signal hota hai. Misal ke taur par, agar price upar ja rahi hai lekin volume kam ho raha hai, to yeh market ke weak hone ka izhar karta hai.

#### Volume Underlay Indicator Ki Importance

Volume Underlay Indicator traders ke liye bohot zaroori hai kyunki yeh:

- **Market Sentiment**: Market ki sentiment ko samajhne mein madad karta hai. Agar volume high hai aur price increase ho raha hai, to market bullish sentiment dikhata hai.

- **Risk Management**: Yeh indicator risk management mein bhi madad karta hai. Agar aapko kisi asset ki volatility ke sath volume ka pata ho, to aap apne stop-loss aur take-profit levels ko behtar tarike se set kar sakte hain.

#### Conclusion

Volume Underlay Indicator trading mein ek powerful tool hai jo traders ko market ki dynamics samajhne mein madad deta hai. Iska sahi istemal aapki trading strategy ko mazboot bana sakta hai. Lekin hamesha yaad rahein ke kisi bhi trading decision se pehle thorough analysis aur dusre indicators ka istemal zaroor karna chahiye. Agar aap Volume Underlay Indicator ko achhe se samajh kar trading karte hain, to aapko market mein behtar opportunities mil sakti hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:09 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим