Consolidation in Forex Trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Consolidation in Forex TradingConsolidation, jise aksar sideways market ya range-bound market ke tor par zikar kia jata hai, isi waqt hoti hai jab kisi currency pair ki keemat ek maqsood trading range ke andar aik mukhlis trading range ke andar mukhtalif range mein chalti hai aur wazeh tor par upar ya niche ki taraf kisi wazeh trender manzil nazar nahi aati. Is trading range ko uss currency pair ki price levels ki manzil ke tor par pehchana jata hai jahan yeh currency pair mukhtalif levels par support aur resistance levels ke darmiyan bar bar takra kar wazeh trender levels ki taraf chaltee hai. Consolidation ke doran trading ke liye trading opportunities ki pehchan karna mushkil ho jata hai. Understanding Consolidation Consolidation Forex market ka natural hissa hai aur mukhtalif wajahon ki bina par hoti hai. Aam taur par yeh kisi bari keemat ki liye hoti hai, chahay woh up trend ho ya down trend. Traders aksar consolidation ko aik maqsood ki price "arazoo" ya "jama karna" se pehchaantay hain, pehle market apni aglay bari manzil ke baray mein faisla karne se pehle.

Understanding Consolidation Consolidation Forex market ka natural hissa hai aur mukhtalif wajahon ki bina par hoti hai. Aam taur par yeh kisi bari keemat ki liye hoti hai, chahay woh up trend ho ya down trend. Traders aksar consolidation ko aik maqsood ki price "arazoo" ya "jama karna" se pehchaantay hain, pehle market apni aglay bari manzil ke baray mein faisla karne se pehle.- Market Indecision: Consolidation aksar isi waqt hoti hai jab traders market ki aglay bari manzil ke baray mein be-sakun hote hain. Iska sabab ho sakta hai maliyat se mutalliq waqiat, geopolitics ki khabron, ya woh mukhtalif wajahat jo market mein be-sakuniyat peda karti hain.

- Profit Taking: Aik significant price move ke baad, traders jo munafa kamane mein kamiyab rahtay hain, woh trading trend mein aik waqti khatima ke liye rukawat dal sakte hain, jis se trend mein aik barqarar pause hota hai.

- Market Liquidity: Consolidation ke doran asal trading volume kam ho jata hai jab traders ziada ihtiyaat barat-ti hain. Is se trading range mein choti price movement ki istehsalat paida hoti hain.

- Market Sentiment: Market sentiment ke tabdeel hone se consolidation ho sakti hai. Misal ke taur par, agar aik mazeed up trend ko barqarar negative khabar mil jati hai, to traders market apni positions ko dobara tajwez karne se pehle khud ko dobara dekhte hain.

- Market News: Bari maliyat aik aik ahem maliyat announcement se paida ho sakti hai, jaise ke interest rate ke faislay ya rozgar ki reports. Traders announcement ki irtaqa se pehle ya badle mein trading tajwez karne se pehle consolidation ka intezar karte hain.

Identifying Consolidation

Identifying Consolidation- Price Range: Consolidation doran price aik mukhtalif trading range ke andar move karti hai, jo support aur resistance levels ke darmiyan bar bar takra kar wazeh trender range tay karti hai. Yeh levels consolidation channel ke liye borders ka kaam karte hain.

- Horizontal Patterns: Consolidation ki pehchan ke liye chart patterns ka istemal hota hai, jaise ke rectangles, flags, ya triangles. Yeh patterns aksar trend mein ek rukawat ke ishara karte hain.

- Decreased Volatility: Consolidation ke doran price volatility kam ho jati hai. Yeh narrow candlesticks aur kam trading volumes mein zahir hota hai.

- Moving Averages: Moving averages consolidation ko pehchanne mein madadgar ho sakte hain. Jab price sideways move karti hai, to moving averages flat ho jate hain aur aik dosre ke sath overlap kar sakte hain.

- Support Aur Resistance: Apne chart par support aur resistance lines draw karein. Consolidation ke doran price in levels ko respect karta hai, support aur resistance par bar bar takra kar wazeh trender range tay karta hai.

Trading Strategies for Consolidation

Trading Strategies for Consolidation- Range Trading: Range trading consolidation market mein aik mashhoor strategy hai. Traders support ke qareeb khareedte hain aur resistance ke qareeb bechte hain, range ke andar price ke oscillations se faida hasil karte hain. Is tareeqe ko amal mein lanay ke liye himmat aur sabr darkar hota hai, kyun ke traders ko support ya resistance levels ke qareeb wazeh signals ka intezar karna hota hai.

- Bollinger Bands: Bollinger Bands aik technical indicator hain jo consolidation ko pehchanne mein asar andaz hotay hain. Jab bands contract hoti hain, yani kam volatility ki ishara hoti hai, aur price bands ke andar trade karti hai, to yeh consolidation ka ishara hota hai. Traders bands phir se phailne ke dore mein breakout opportunities ki tafteesh kar sakte hain.

- Stochastic Oscillator: Stochastic oscillator bhi consolidation ke doran madadgar ho sakta hai. Is se traders range ke andar overbought aur oversold conditions ko pehchan sakte hain. Jab oscillator extreme levels par pohanchta hai aur ulta latk karne lagta hai, to traders consolidation channel ke andar hone wali mukhtalif reversals se faida hasil kar sakte hain.

- Fibonacci Retracement: Fibonacci retracement levels traders ko consolidation ke andar potential support aur resistance levels ko pehchane mein madadgar ho sakte hain. Traders mazeed confidence hasil karne ke liye Fibonacci levels aur dosre technical indicators mein confluence ko tafteesh kar sakte hain.

- Breakout Strategies: Jabke consolidation price ke range-bound trading ke darmiyan hoti hai, to breakouts kabhi kabhi wazeh trender range se bahar nikal sakti hain. Traders breakout opportunities ke liye entry orders ko resistance ke upar ya support ke neeche set kar ke tayyar ho sakte hain. Lekin breakouts mushkil ho sakte hain, is liye munasib risk management techniques ka istemal karna ahem hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Assalamu Alaikum Dosto!

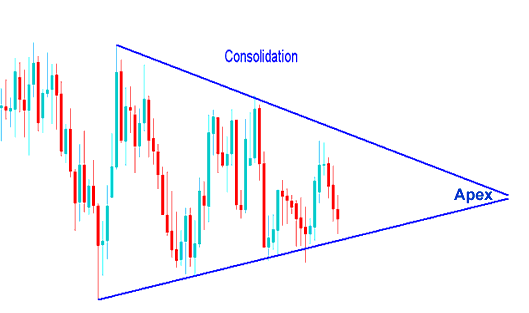

Consolidation Chart

Jab ek market trend continue tarah se upar ya neeche ki taraf ja raha hota hai, toh usko reversal hone ka khatra badh jata hai. Consolidation, yaani trend ke chote se break hone se pahle ki ek choti si rukawat, ye confirm karta hai ki trend wahi raste mein jaari hai. Jab consolidation hoti hai, toh traders ko mauka milta hai ki woh ek nayi position lein ya phir maujoodi position ko aur majboot karein.

Consolidation tab hoti hai jab market sideways move karti hai. Ab hume ye dekhna hai ki consolidation ko kaise samjhein aur uske aas-pass ek majboot trading strategy banayein. Price chart mein jahan par bhi ye patterns dikhte hai, consolidation candlestick patterns trend continuation ya trend reversal ka sanket dete hai.

Pehle hum market mein consolidation ka matlab samjhein. Consolidation, market mein samay-samay par doubt ke pal ko darshata hai, jab woh khud ko sahi karne ki koshish karta hai.

Consolidation patterns ko maloom karna ek tareeka hai jisse market trend ka badalne ka pata lagaya ja sakta hai. Jab traders consolidation candlesticks ki malomat karte hai, toh woh nayi position lena ya maujoodi position ko majboot karna chahte hai. Chahe aap naye trend ke liye ya phir maujoodi trend ko majboot karne ke liye ho, consolidation candlesticks ko samajhna zaroori hai agar aap mazboot trading strategies banana chahte hai.

Zyadatar samay market sideways move karti hai aur consolidation candlestick patterns is dauran dikhai dete hai. Jab ye dikhte hai, toh consolidation patterns ya toh trend continuation ka sanket dete hai ya phir ek naye trend ki shuruaat.

Consolidation Candlestick Formations

Hum sideways patterns, upward aur downward sloping ranges, aur triangular patterns par nazar dalenge. Chaliye alag-alag pattern formations ko dekhte hai.

- Ranges

Zyadatar samay market mein price ek range ke andar move karti hai, occasional breakouts ke saath. Range, price candlesticks ka ek formation hota hai jo average price ke aas-pass oscillate karta hai. Ye ek samay hota hai jab market stock price ke baare mein ek sahmati banati hai.

Range upward ya downward trends mein bhi banta hai, sath hi market sideways move karti hai, jisme top aur bottom par false breakouts bhi hote hai. Range mein trade karne ka sabse accha tarika confirmation ka intezaar karna hai. Range formation, market mein entry planning ke liye behad upyogi trade information prakat karti hai. - Symmetric Triangle

Symmetric triangle pattern ek common formation hai jisme slight slope wali upper boundary (resistance line) aur upward-moving support line hoti hai. Range ka wide opening hota hai lekin end mein contract hota hai, jisse range triangle ki tarah dikhti hai. Breakout aam taur par resistance aur support line ke milne se pahle hota hai. Traders trend upward hone par first relative high aur first relative low ke beech ke antar ko study karke, use breakout point mein add karke profit target estimate karte hai. Usi tarah, market trend downward hone par difference ko breakout se subtract karke profit target calculate karte hai. - Ascending Triangle

Ascending triangle formation mein price horizontal resistance line aur upward sloping support line ke beech bounce karti hai, jisse traders ke beech growing impatience dikhti hai ki woh resistance line ko break karein. Ye formation tab dikhti hai jab market mein kisi underlier ke liye strong demand hoti hai. Ek uptrend ke andar dikhai dene wala converging triangle pattern pehle se trending stocks ke liye zyada reliable hota hai. - Descending Triangle

Descending triangle pattern ascending pattern ka ulta hota hai, jo downtrend mein dikhta hai. Ek ghatte huye resistance line price triangle ke upper limit ko darshata hai jabki horizontal support line base create karta hai, jisme price kuch samay tak move karti hai phir breakout hota hai. Ye dikhta hai jab traders kisi underlier ke baare mein overwhelming bearish hote hai.

Existing downtrend ke andar dikhai dene wala descending triangle zyada reliable hota hai, aur aam taur par stock price new low (breakout) hit karti hai jab dono lines converge hote hai. Traders lower breakout ke lower boundary se relative high aur low ke beech ka difference subtract karke profit target set karte hai. - Rectangle or Flag Pattern

Rectangle ek aur consolidation pattern hai jisme resistance aur support line respective upper aur lower boundaries hote hai. Isse flag bhi kehte hai kyunki ye ek lambi candle ya pole ke baad dikhta hai. Price thoda samay tak dono lines ke beech bounce karti rahti hai, phir break karke pichhle trend ko resume karti hai.

Flag ka dikhai dena dhyan dena zaroori hai kyunki ye aam taur par high risk-reward situations hote hai. Flag aksar strong trend, tez advance ya decline ke baad dikhta hai, jise strong volume movement support karta hai.

Consolidation Trading Strategy

Consolidation mein trading karne se bade rewards hasil ho sakte hai. Ye market trend ke bade jump se pahle ki choti si rukawat hoti hai. Traders usually consolidation mein trade karte samay nimn teen cheezo par dhyan dete hai.

- Volume: Volume movement ko follow karna consolidation ki strength ke baare mein subtle clues deta hai. Aam taur par, consolidation phase mein volume low ya flat rehta hai aur breakout ke pahle potential breakout ke saath volume badh jata hai.

- Consolidation ka size: Consolidation ka size breakout ke liye pressure banane ka sanket deta hai. Lamba samay aur narrow boundaries usually strong breakout ke result mein aate hai. Halaanki, traders ko ye bhi dhyan mein rakhna chahiye ki ye false breakout ke chances ko bhi badhata hai. Lambi consolidation phases mein caution ke saath act karna chahiye aur entry karne se pahle asli breakout ka intezaar karna chahiye.

- Reset Confirmation: Breakout ke baad, ek underlier consolidation phase mein wapas ja sakta hai reaffirmation ke dauran. Ye foreign currency trading mein aam baat hai lekin kisi bhi underlier ke liye ho sakta hai.

Conclusion

Consolidation ek underlier ki price ke baare mein indecision se shuru hota hai lekin market consensus ke saath khatam hota hai. Technical analysts consolidation ko candlestick patterns ki madad se study karte hai taki agle market move ko samajh sake. Ek trader jo pehle consolidation pattern ko spot karta hai, aam taur par sabse zyada profit banata hai, lekin iska matlab ye bhi hai ki usko zyada risk ka saamna karna padta hai. Consolidation candlestick patterns ko study karna trading opportunity ko spot karne mein ek fayda deta hai jahan exact entry point ko identify karke kharidne ka samay taiyar kar sakte hai.

- Ranges

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Consolidation in Forex :

Forex market mein "consolidation" ek price action phenomenon hai jab price range-bound hota hai aur kisi specific trend ki jagah sideways movement show karta hai. Is mein price horizontal levels ke beech mein oscillate karta hai aur kisi specific direction mein clear trend nahi hota hai. Consolidation periods mein price usually support aur resistance levels ke beech mein fluctuate karta hai. Traders consolidation periods ko identify karke range-bound strategies istemal kar sakte hain, jaise ki range trading ya breakout trading, jab price range se bahar nikalta hai.

Identify Consolidation :

Forex market mein consolidation periods ko pehchanne ke liye aap kuch techniques istemal kar sakte hain:

1. Price Range:

Chart par price movement ko observe karein. Periods dhundhein jab price ek specific range ke andar sideways move kar rahi ho, bina kisi clear trend ke.

2. Support and Resistance Levels:

Chart par key support aur resistance levels ko pehchanein. Consolidation ke doran price in levels ke beech bounce karti hai, breakout nahi karti.

3. Moving Averages:

Moving averages ka istemal karein consolidation periods ko pehchanne ke liye. Jab price sideways move kar rahi ho, moving averages flatten ho jayenge aur kam directional movement dikhayenge.

4. Volume Analysis:

Alag alag periods mein trading volume ko analysis karein. Consolidation ke doran volume trending periods ke comparison mein kam hota hai, jisse market mein significant interest ki kami ka pata chalta hai.

Yaad rakhein, apni analysis ki accuracy badhane ke liye in techniques ko dusre technical analysis tools aur indicators ke saath combine karna zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:30 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим