Continuation wedge pattern discussion

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members!- umeed karta hun k aap sb khair khairiat se hn gy or apki trading achi jaa rahi ho ge.

- dear members aj ki post main hum wedge pattern ko study karen gy or eski continuation or reversal type ko bhi discs karen or sth sth eski trading strategy b dekhen gy.

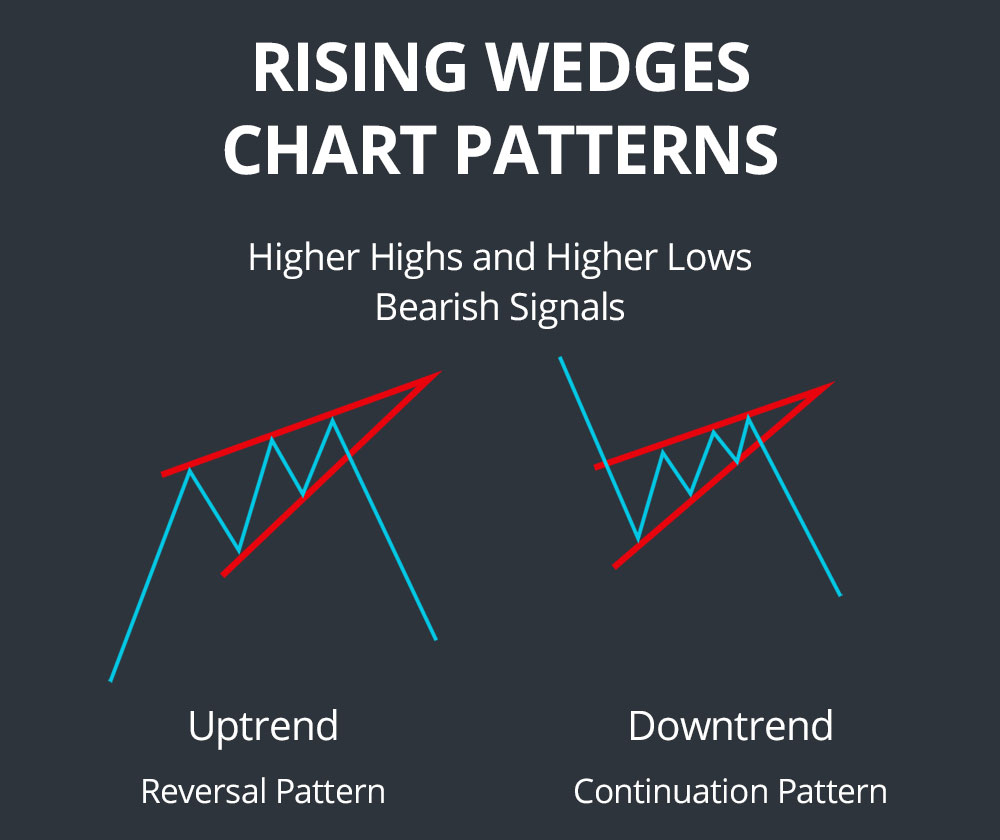

- dear members market jb ksi trend main consolidate karti ha ya retracement lyti ha yo market main highs or lows bnty hain.

- Agr in highs ko apas main milaya jay or lows ko apas main milaya jay to opr r nechy trendlines banti hain or trendlines se ml k aik wedge type shape banti ha.

- Continuation wedge pattern.

- reversal wedge pattern.

- dear members wedge pattern ki in 2 types ko nechy detail se discus kia gaya ha.

- Dear members continuation pattern wo hota ha jis k banny or breakout k bad market apna trend continue rakhti ha ya phr breakout kiye bina bhi market apny trend main expand hoti jati ha.

- aisa hi aik wedge pattern ha jisy expanding wedge pattern kaha jata ha or es main market higher highs or higher lows bnati ha jski waja se market expand hoti jati ha.

- agr highs ko highs se milta jay to aik rising trendline banti ha jb k agr lows ko lows se milaya jay to falling trendline banti ha.

- eska mu agy se khula hota ha or jesy jesy market agy barhti ha ye mazeed khula jata ha.

- Dear members es pattern main hum market k dono trf trade kar skty hain laikin es k lye hamen wait karna hota ha k market ya to upper trendline ko touch kary ya lower ko.

- or jb market upper trendline py ho to yahan se rejection k bad hum sell ki trade lety hain js main hmara stop loss trendline se opr hota ha.

- or jb market lower trend line k pas ati ha to yahan se rejection ki confirmation k bad hum buy ki trade lety hain es main hmara stop loss trendline se nechy hota ha jb k take proft next resisting trendline tk hota ha.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

- trading achi jaa rahi ho ge.

- dear members aj ki post main hum wedge pattern ko study karen gy or eski continuation or reversal type ko bhi discs karen or sth sth eski trading strategy b dekhen gy.

-

#4 Collapse

1. Introduction to the Wedge Pattern: Continuation Wedge pattern ek aham technical analysis pattern hai jo Forex trading mein istemal hota hai. Yeh pattern market mein hone wale trends ko pehchanne mein madadgar hota hai. Is pattern ki pehchan, price chart par ek vishesh shakal ki hoti hai jiska matlab hota hai ke market mein trend ka jari rehna mutawaqqa hai. 2. Formation of the Wedge Pattern: Wedge pattern do qisam ki hoti hai: Ascending Wedge aur Descending Wedge. Ascending Wedge mein, price highs aur lows ke darmiyan ek traingular shape banta hai, jabke Descending Wedge mein, yeh triangular shape ulta hota hai. Is pattern ki formation hoti hai jab market mein price moves ek specific direction mein, lekin phir yeh ek mukhalif direction mein muntaqil hojati hai, jaise ke upward trend ke baad downward move ya downward trend ke baad upward move. Uses of the Wedge Pattern: Wedge pattern traders ke liye ahem hai kyun ke iske istemal se unhon ko market ke future direction ka andaza lagane mein madad milti hai. Agar Ascending Wedge pattern banta hai to yeh ishara hota hai ke uptrend ke baad ek potential bearish reversal hone ka khatra ho sakta hai, jabke Descending Wedge pattern bearish trend ke baad potential bullish reversal ko darust karta hai. Traders is pattern ko istemal kar ke apni trading decisions ko refine karte hain. 4. Advantages in Forex Trading: Continuation Wedge pattern Forex trading mein kuch faidey mand hote hain. Is pattern ke istemal se traders ko market mein hone wale trend reversals ko samajhne mein madad milti hai. Isse unka trading strategy improve hota hai aur unko behtar entry aur exit points milte hain. Wedge pattern ke istemal se risk ko kam kiya ja sakta hai, aur traders apne positions ko behtar tarike se manage kar sakte hain. Iske alawa, yeh pattern asani se detect kiya ja sakta hai, jisse traders ko trading opportunities pehchane mein asani hoti hai. In conclusion, Continuation Wedge pattern ek ahem tool hai Forex trading mein jo traders ko market trends aur reversals ko samajhne mein madadgar hota hai. Is pattern ka sahi taur par istemal kar ke traders apni trading strategy ko sudhar sakte hain aur behtar trading decisions le sakte hain, jisse unki trading performance ko behtar banaya ja sakta hai. -

#5 Collapse

Continuation Wedge Pattern: Ek trading strategy hai jo stock market ya forex trading mein istemal hoti hai. Ye pattern ek trend continuation signal deta hai. Is pattern ko samajhna trading mein kafi madadgar ho sakta hai.Continuation wedge pattern do prakar ke hote hain: 1. Ascending Wedge: Jab stock ya currency pair ka price higher highs aur higher lows banata hai, lekin ye range narrow hota hai, to ye ascending wedge pattern kehte hain. Isse ek bullish trend ka continuation hone ka sanket milta hai.2. Descending Wedge: Is pattern mein price lower highs aur lower lows banata hai, lekin ye range narrow hota hai. Ye descending wedge pattern hai aur ise dekh kar traders ek bearish trend ke continuation ko anticipate kar sakte hain.Continuation wedge pattern ka istemal trading decisions par asar daal sakta hai, lekin hamesha yaad rahe ki trading mein risk hota hai, isliye prudent risk management ka palan karein. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Wedge Pattern: Continuation Wedge sample ek aham technical analysis pattern hai jo the Forex market buying and selling mein istemal hota hai. Yeh pattern market mein hone wale developments ko pehchanne mein madadgar hota hai. Is pattern ki pehchan, charge chart par ek vishesh shakal ki hoti hai jiska matlab hota hai ke marketplace mein fashion ka jari rehna mutawaqqa hai.Wedge sample buyers ke liye ahem hai kyun ke iske istemal se unhon ko marketplace ke future direction ka andaza lagane mein madad milti hai. Agar Ascending Wedge sample banta hai to yeh ishara hota hai ke uptrend ke baad ek potential bearish reversal hone ka khatra ho sakta hai, jabke Descending Wedge pattern bearish fashion ke baad ability bullish reversal ko darust karta hai. Traders is pattern ko istemal kar ke apni buying and selling selections ko refine karte hain.Formation of Wedge; Wedge pattern do qisam ki hoti hai: Ascending Wedge aur Descending Wedge. Ascending Wedge mein, price highs aur lows ke darmiyan ek traingular form banta hai, jabke Descending Wedge mein, yeh triangular shape ulta hota hai. Is pattern ki formation hoti hai jab marketplace mein price actions ek unique path mein, lekin phir yeh ek mukhalif course mein muntaqil hojati hai, jaise ke upward trend ke baad downward move ya downward trend ke baad upward move.Is sample mein price decrease highs aur decrease lows banata hai, lekin ye range slim hota hai. Ye descending wedge pattern hai aur ise dekh kar traders ek bearish trend ke continuation ko count on kar sakte hain.Continuation wedge pattern ka istemal buying and selling choices par asar daal sakta hai, lekin hamesha yaad rahe ki buying and selling mein danger hota hai, isliye prudent danger management ka palan karein. Advantages in Trading: Continuation Wedge sample Forex trading mein kuch faidey mand hote hain. Is sample ke istemal se investors ko marketplace mein hone wale fashion reversals ko samajhne mein madad milti hai. Isse unka trading strategy enhance hota hai aur unko behtar entry aur exit factors milte hain. Wedge pattern ke istemal se danger ko kam kiya ja sakta hai, aur investors apne positions ko behtar tarike se manipulate kar sakte hain. Iske alawa, yeh pattern asani se come across kiya ja sakta hai, jisse investors ko trading possibilities pehchane mein asani hoti hai.In end, Continuation Wedge pattern ek ahem device hai the Forex market trading mein jo traders ko market traits aur reversals ko samajhne mein madadgar hota hai. Is sample ka sahi taur par istemal kar ke investors apni buying and selling approach ko sudhar sakte hain aur behtar trading selections le sakte hain, jisse unki trading overall performance ko behtar banaya ja sakta hai.

-

#7 Collapse

Asslam-O-Alaikum! Dear members Me ummed kerti hoke ap sb ka forex trading py kam bht acha chl rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : Continuation wedge pattern discussion Continuation wedge patterns, jo kay technical analysis mein aik ahem cheez hain, traders aur investors kay liye khas tor par dilchaspi wali hoti hain. Ye patterns market ki movement aur trend ko samajhnay mein madadgar hoti hain. Chaliye, ham Continuation wedge pattern ki discussion ko mazeed gehraai se samjhein. Continuation wedge pattern aik price chart pattern hai jo market mein aik mojood trend ko confirm karti hai. Ye pattern trading aur investing mein aik powerful tool hai, jo traders ko market ki future movement ka andaza lagane mein madadgar hota hai. Continuation wedge pattern aksar market mein hoti hai jab kisi majood trend mein thori si rukawat aati hai. Is pattern mein, price ek triangular shape mein move karta hai jahan upper trend line aur lower trend line converge hoti hain. Jab ye lines milte hain, to ye ek signal deti hain ke market mein existing trend jari hai aur mazeed price movement ki umeed hai. Explanation : Continuation wedge pattern traders ko ye indication deta hai ke trend ke beech mein choti si pause hai, lekin trend ki jaari rehnumaai ki taraf ishara hota hai. Agar ye pattern sahi tarah se samjha jaye aur use kiya jaye to isse trading opportunities nikali ja sakti hain. Ismein entry aur exit points ko identify karna bhi aasan ho jata hai. Is pattern ki khas baat ye hai ke ye dono bullish aur bearish trends mein paya jata hai. Iska matlab hai ke market upar ya neeche ja sakti hai, aur traders ko is pattern se fayda uthane ka mauqa milta hai. To, agar aap trading ya investing mein interested hain, to Continuation wedge pattern ki study karke market ki movements ko samajhna aur anticipate karna aap ke liye faidemand ho sakta hai. Lekin yaad rahe, market mein risk hota hai, aur proper risk management aur research ke bina trading karne se nuksan ho sakta hai. Isliye, hamesha apne financial goals aur risk tolerance ko dhyan mein rakhte hue trading karein. Continuation wedge pattern ke istemal ka bohat faida hota hai trading aur investing mein. Is pattern ke kuch ahem faide yeh hain Continuation wedge pattern traders ko market mein price movement ko samajhne mein madadgar hoti hai. Isse existing trend ki jaari rehnumaai ki taraf ishara milta hai. Is pattern ki madad se traders ko entry points ka pata chalta hai. Jab price upper trend line ko break karta hai, to ye aik bullish entry point ho sakta hai. Jab price lower trend line ko break karta hai, to ye bearish entry point ho sakta hai. Continuation wedge pattern traders ko risk management mein madadgar hoti hai. Entry aur stop-loss levels ko set karke traders apne nuksan ko minimize kar sakte hain. Ye pattern current trend ko confirm karne mein madadgar hoti hai. Agar aap trend followers hain, to aap ko ye pattern useful ho sakta hai. Continuation wedge pattern dono bullish aur bearish trends mein paya jata hai, isliye ye versatile hoti hai. Market ki upar ya neeche jaane ki soorat mein isse fayda uthaya ja sakta hai. Is pattern ko short-term trading ke liye bhi istemal kiya ja sakta hai. Agar aap choti muddat ke trading positions hold karte hain, to ye aap ke liye faida mand ho sakta hai. Lekin yaad rahe ke market mein risk hota hai aur ye pattern bhi 100% guarantee nahi deta ke price kis tarah se move karega. Isliye, har trading decision ko dhyan se sochna aur risk management ko follow karna bohat ahem hai. -

#8 Collapse

CONTINUATION OF VEDGE PATTERN:-Continuation wedge patterns trading mein aik important tool hote hain jinhe traders chart analysis ke doran istemal karte hain. Ye patterns market mein hone wale future price movements ko samjhne mein madadgar sabit ho sakte hain. Mazeed maloomat ke liye, niche diye gaye kuch points par ghor karte hain: CONTINUATION OF VEDGE PATTERN KY COMPONENTS:-Bearish Continuation Wedge: Is pattern mein, wedge niche ki taraf slope karta hai, jahan par lower highs aur higher lows hoti hain. Isse samjha jata hai ke jo chal raha downtrend hai, woh consolidation phase ke baad bhi jari rahega. Traders aksar lower trendline ke niche breakout ko bearish continuation ki tasdeeq ke taur par dekhte hain. Confirmation of Breakout: Wedge pattern ke andar breakout ko confirm karne ke liye traders aksar volume aur price action ko dekhte hain. High trading volume ke sath breakout, uski credibility ko badhata hai. Breakout ke bad, traders market mein position le sakte hain. Stop-Loss Aur Target: Trading ke dauran, stop-loss aur target levels ko dhyan mein rakhna bhi mahatvapurn hota hai. Stop-loss aapke trade ko nuksan se bachane mein madadgar hota hai, jabki target level aapke trade ko profit mein bandhne mein madad karta hai. Risk Management: Trading ke liye risk management bahut ahem hai. Har trade ke liye kitna risk lena hai, ye traders apne risk tolerance aur trading strategy ke hisab se decide karte hain. Continuation wedge patterns ko samajhna aur sahi tarah se istemal karna traders ke liye mahatvapurn hota hai taaki woh market mein sahi decisions le saken aur trading ko safalta se kar saken. Iske alawa, ek trader hamesha naye patterns aur techniques ko sikhna aur apne trading skills ko sudharne mein lage rehna chahiye.

CONTINUATION OF VEDGE PATTERN KY COMPONENTS:-Bearish Continuation Wedge: Is pattern mein, wedge niche ki taraf slope karta hai, jahan par lower highs aur higher lows hoti hain. Isse samjha jata hai ke jo chal raha downtrend hai, woh consolidation phase ke baad bhi jari rahega. Traders aksar lower trendline ke niche breakout ko bearish continuation ki tasdeeq ke taur par dekhte hain. Confirmation of Breakout: Wedge pattern ke andar breakout ko confirm karne ke liye traders aksar volume aur price action ko dekhte hain. High trading volume ke sath breakout, uski credibility ko badhata hai. Breakout ke bad, traders market mein position le sakte hain. Stop-Loss Aur Target: Trading ke dauran, stop-loss aur target levels ko dhyan mein rakhna bhi mahatvapurn hota hai. Stop-loss aapke trade ko nuksan se bachane mein madadgar hota hai, jabki target level aapke trade ko profit mein bandhne mein madad karta hai. Risk Management: Trading ke liye risk management bahut ahem hai. Har trade ke liye kitna risk lena hai, ye traders apne risk tolerance aur trading strategy ke hisab se decide karte hain. Continuation wedge patterns ko samajhna aur sahi tarah se istemal karna traders ke liye mahatvapurn hota hai taaki woh market mein sahi decisions le saken aur trading ko safalta se kar saken. Iske alawa, ek trader hamesha naye patterns aur techniques ko sikhna aur apne trading skills ko sudharne mein lage rehna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Asslam O Alikum umeed karta hun k aap sb khair khairiat se hn gy or apki exchanging achi jaa rahi ho ge.dear individuals aj ki post primary murmur wedge design ko concentrate on karen gy or eski continuation or inversion type ko bhi circles karen or sth eski exchanging system b dekhen gy. what is wedge outline design? dear individuals market jb ksi pattern primary unite karti ha ya retracement lyti ha yo market fundamental highs or lows bnty hain.Agr in highs ko apas primary milaya jay or lows ko apas fundamental milaya jay to opr r nechy trendlines banti hain or trendlines se ml k aik wedge type shape banti ha.wedge design ki 2 sorts hoti hain jo nechy di gai hain.Continuation wedge design.inversion wedge design.dear individuals wedge design ki in 2 sorts ko nechy detail se disk kia gaya ha. Continuation wedge design: Dear individuals continuation design wo hota ha jis k banny or breakout k terrible market apna pattern proceed rakhti ha ya phr breakout kiye bina bhi market apny pattern principal extend hoti jati ha.aisa hello there aik wedge design ha jisy extending wedge design kaha jata ha or es primary market better upsides or more promising low points bnati ha jski waja se market grow hoti jati ha.agr highs ko highs se milta jay to aik rising trendline banti ha jb k agr lows ko lows se milaya jay to falling trendline banti ha.eska mu agy se khula hota ha or jesy market agy barhti ha ye mazeed khula jata ha. How to exchange extending wedge design? Dear individuals es design principal murmur market k dono trf exchange kar skty hain laikin es k lye hamen stand by karna hota ha k market ya to upper trendline ko contact kary ya lower ko.or then again jb market upper trendline py ho to yahan se dismissal k awful murmur sell ki exchange lety hain js principal hmara stop misfortune trendline se opr hota ha.or then again jb market lower pattern line k pas ati ha to yahan se dismissal ki affirmation k awful murmur purchase ki exchange lety hain es primary hmara stop misfortune trendline se nechy hota ha jb k take proft next opposing trendline tk hota ha.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:34 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим