Explanantion Of Tweezer Top And Tweezer Bottom Chart Patterns

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

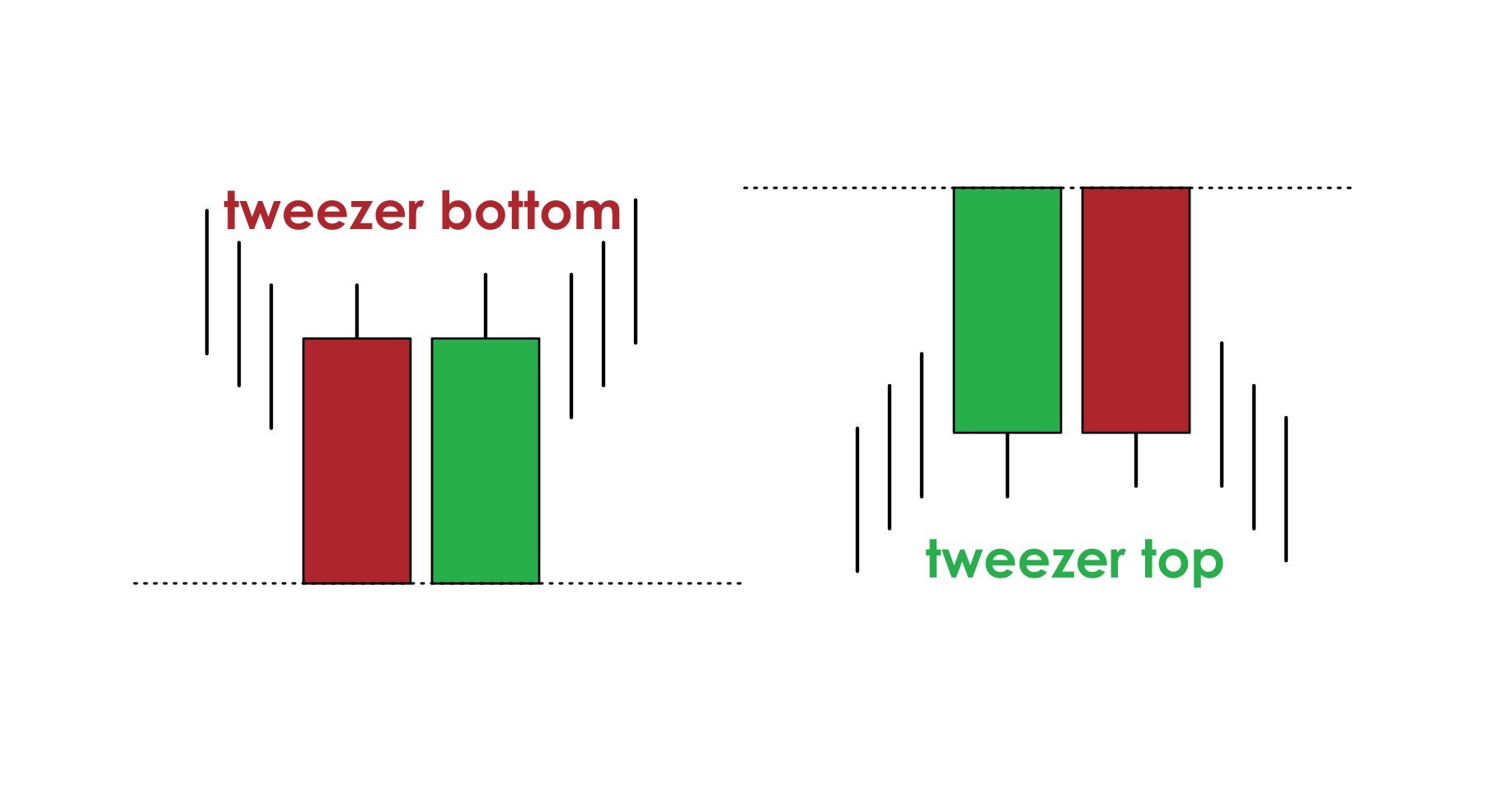

Tweezer Top and Tweezer Bottom Chart PatternsTweezer Top aur Tweezer Bottom chart patterns forex trading mein aham candlestick patterns hain jo insights trend reversal ki taraf ishara karte hain. Ye patterns tab paida hote hain jab do musalsal candlesticks mein mutradif ziada oonchaien (Tweezer Top) ya kam oonchaien (Tweezer Bottom) dikhati hain, jo ke market ke jazbat mein taqatwar tabdeeli ki alamat ho sakti hai. Tweezer Top Pattern Tweezer Top pattern aik uptrend ke ikhtitam par banta hai aur ek downtrend ki taraf palish ki mumkin alamat de sakta hai. Ismein do candlesticks hoti hain, aik bullish (sabz ya safed) aur aik bearish (surk ya kala), dono ke oonchay taqreeban barabar hotay hain. Is formation se yeh sabit hota hai ke market mein rujhan na honay ki soorat mein hai, jahan na to bulls (khareedne walay) aur na hi bears (farokht karne walay) qeemat ko kisi khas andaz mein barhate hain. Traders is pattern ko bearish tasawwur karte hain, khaas karke agar yeh lambi uptrend ke baad aaye. Tweezer Bottom Pattern Mukhalif tor par, Tweezer Bottom pattern aik downtrend ki intiha par ban jata hai aur aik uptrend ki taraf palish ki ishara deti hai. Ismein bhi do candlesticks hoti hain, lekin is dafa pehli candlestick bearish hoti hai (surk ya kala), aur dusri bullish hoti hai (sabz ya safed), dono ke oonchay taqreeban barabar hotay hain. Is pattern mein yeh dekha jata hai ke market mein faisla na honay ki soorat mein hai, jahan na hi bears aur na hi bulls qeemat ko kisi khas andaz mein nicha kar saktay hain. Traders isay bullish signal tasawwur karte hain, khaas karke agar yeh lambi downtrend ke baad aaye.

Tweezer Top Pattern Tweezer Top pattern aik uptrend ke ikhtitam par banta hai aur ek downtrend ki taraf palish ki mumkin alamat de sakta hai. Ismein do candlesticks hoti hain, aik bullish (sabz ya safed) aur aik bearish (surk ya kala), dono ke oonchay taqreeban barabar hotay hain. Is formation se yeh sabit hota hai ke market mein rujhan na honay ki soorat mein hai, jahan na to bulls (khareedne walay) aur na hi bears (farokht karne walay) qeemat ko kisi khas andaz mein barhate hain. Traders is pattern ko bearish tasawwur karte hain, khaas karke agar yeh lambi uptrend ke baad aaye. Tweezer Bottom Pattern Mukhalif tor par, Tweezer Bottom pattern aik downtrend ki intiha par ban jata hai aur aik uptrend ki taraf palish ki ishara deti hai. Ismein bhi do candlesticks hoti hain, lekin is dafa pehli candlestick bearish hoti hai (surk ya kala), aur dusri bullish hoti hai (sabz ya safed), dono ke oonchay taqreeban barabar hotay hain. Is pattern mein yeh dekha jata hai ke market mein faisla na honay ki soorat mein hai, jahan na hi bears aur na hi bulls qeemat ko kisi khas andaz mein nicha kar saktay hain. Traders isay bullish signal tasawwur karte hain, khaas karke agar yeh lambi downtrend ke baad aaye.  Identifying Tweezer Patterns Tweezer patterns ko pehchanay ke liye unke kuch khasosiyat ko samajhna ahem hai. Dono patterns mein do musalsal candlesticks mein ziada oonchaien (Tweezer Top) ya kam oonchaien (Tweezer Bottom) hoti hain. Candlestick rangat ka khas tarteeb hota hai: Tweezer Top ke liye bullish-bearish aur Tweezer Bottom ke liye bearish-bullish. Ideal taur par, candlesticks ki oonchaien barabar honi chahiye, lekin thori si farq sahoolat se qubool hai. Kuch traders volume ki tasdeeq talash karte hain, dusri candlestick par volume mein izafay ko dekhte hain taki pattern ki tasdeeq ko taqwiyat milay. In patterns ki tafseelat ko samajhna isharay ko sahi tarah samjhne ke liye ahem hai. Tweezer Top woh samjhati hai ke taqatwar uptrend ke baad bullish momentum kam ho raha hai, aur bearish candlestick trend reversal ki mumkin alamat de rahi hai. Yeh bullish se bearish jazbat ki tabdeeli ko ishara karti hai aur isse downtrend ya consolidation ki taraf le ja sakti hai. Mukhalif taur par, Tweezer Bottom woh samjhati hai ke lambi downtrend ke baad bearish control kam ho raha hai, aur bullish candlestick trend reversal ki mumkin alamat de rahi hai. Yeh bearish se bullish jazbat ki tabdeeli ko ishara karti hai aur isse uptrend ya consolidation ki taraf le ja sakti hai.

Identifying Tweezer Patterns Tweezer patterns ko pehchanay ke liye unke kuch khasosiyat ko samajhna ahem hai. Dono patterns mein do musalsal candlesticks mein ziada oonchaien (Tweezer Top) ya kam oonchaien (Tweezer Bottom) hoti hain. Candlestick rangat ka khas tarteeb hota hai: Tweezer Top ke liye bullish-bearish aur Tweezer Bottom ke liye bearish-bullish. Ideal taur par, candlesticks ki oonchaien barabar honi chahiye, lekin thori si farq sahoolat se qubool hai. Kuch traders volume ki tasdeeq talash karte hain, dusri candlestick par volume mein izafay ko dekhte hain taki pattern ki tasdeeq ko taqwiyat milay. In patterns ki tafseelat ko samajhna isharay ko sahi tarah samjhne ke liye ahem hai. Tweezer Top woh samjhati hai ke taqatwar uptrend ke baad bullish momentum kam ho raha hai, aur bearish candlestick trend reversal ki mumkin alamat de rahi hai. Yeh bullish se bearish jazbat ki tabdeeli ko ishara karti hai aur isse downtrend ya consolidation ki taraf le ja sakti hai. Mukhalif taur par, Tweezer Bottom woh samjhati hai ke lambi downtrend ke baad bearish control kam ho raha hai, aur bullish candlestick trend reversal ki mumkin alamat de rahi hai. Yeh bearish se bullish jazbat ki tabdeeli ko ishara karti hai aur isse uptrend ya consolidation ki taraf le ja sakti hai.  Trading Strategies Using Tweezer Patterns Traders Tweezer patterns istemal karte waqt mukhtalif strategies istemal karte hain. Dakhla aur nikalnay ke liye, uptrend ke ikhtitam par aane wala Tweezer Top short positions (farokht) ke liye zahir ho sakta hai, jahan downtrend ki taraf palish ki ummeed hai. Mukhalif tor par, downtrend ki intiha par aane wala Tweezer Bottom long positions (khareedari) ke liye zahir ho sakta hai, jahan uptrend ki taraf palish ki ummeed hai. Stop-loss orders aksar dusri candlestick ki oonchai (Tweezer Top) ya neechai (Tweezer Bottom) se thora sa ooper rakhe jate hain taake agar reversal signal nakam ho to nuksan ko roka ja sake. Take-profit levels pattern ki tasdeeq ke baad anay wali qeemat ke muntazir hone par mutasir kiye ja saktay hain. Tasdeeq ke liye moving averages, Relative Strength Index (RSI), ya Moving Average Convergence Divergence (MACD) jaise aur technical indicators istemal kiye jate hain jo Tweezer patterns ki tasdeeq mein madadgar hotay hain. Iske alawa, traders mukhtalif timeframes pe Tweezer patterns ki tafseelat kar saktay hain taake palishon ke potential baray mein ziada puri tasveer hasil ki ja sake. Agar Tweezer Bottom, misal ke liye, daily aur hourly charts dono pe dikh raha hai, to iska trading faisla qeemat mein izafa karne mein ziada ahmiyat rakhta hai. Akhir mein, Tweezer Top aur Tweezer Bottom patterns forex traders ke liye aham tools hain jo potential trend reversals ko pehchanne aur maqbool trading faislay karne mein madadgar sabit ho saktay hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Trading Strategies Using Tweezer Patterns Traders Tweezer patterns istemal karte waqt mukhtalif strategies istemal karte hain. Dakhla aur nikalnay ke liye, uptrend ke ikhtitam par aane wala Tweezer Top short positions (farokht) ke liye zahir ho sakta hai, jahan downtrend ki taraf palish ki ummeed hai. Mukhalif tor par, downtrend ki intiha par aane wala Tweezer Bottom long positions (khareedari) ke liye zahir ho sakta hai, jahan uptrend ki taraf palish ki ummeed hai. Stop-loss orders aksar dusri candlestick ki oonchai (Tweezer Top) ya neechai (Tweezer Bottom) se thora sa ooper rakhe jate hain taake agar reversal signal nakam ho to nuksan ko roka ja sake. Take-profit levels pattern ki tasdeeq ke baad anay wali qeemat ke muntazir hone par mutasir kiye ja saktay hain. Tasdeeq ke liye moving averages, Relative Strength Index (RSI), ya Moving Average Convergence Divergence (MACD) jaise aur technical indicators istemal kiye jate hain jo Tweezer patterns ki tasdeeq mein madadgar hotay hain. Iske alawa, traders mukhtalif timeframes pe Tweezer patterns ki tafseelat kar saktay hain taake palishon ke potential baray mein ziada puri tasveer hasil ki ja sake. Agar Tweezer Bottom, misal ke liye, daily aur hourly charts dono pe dikh raha hai, to iska trading faisla qeemat mein izafa karne mein ziada ahmiyat rakhta hai. Akhir mein, Tweezer Top aur Tweezer Bottom patterns forex traders ke liye aham tools hain jo potential trend reversals ko pehchanne aur maqbool trading faislay karne mein madadgar sabit ho saktay hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим