Discussion On Taweezer Top Candlesticks Pattren.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

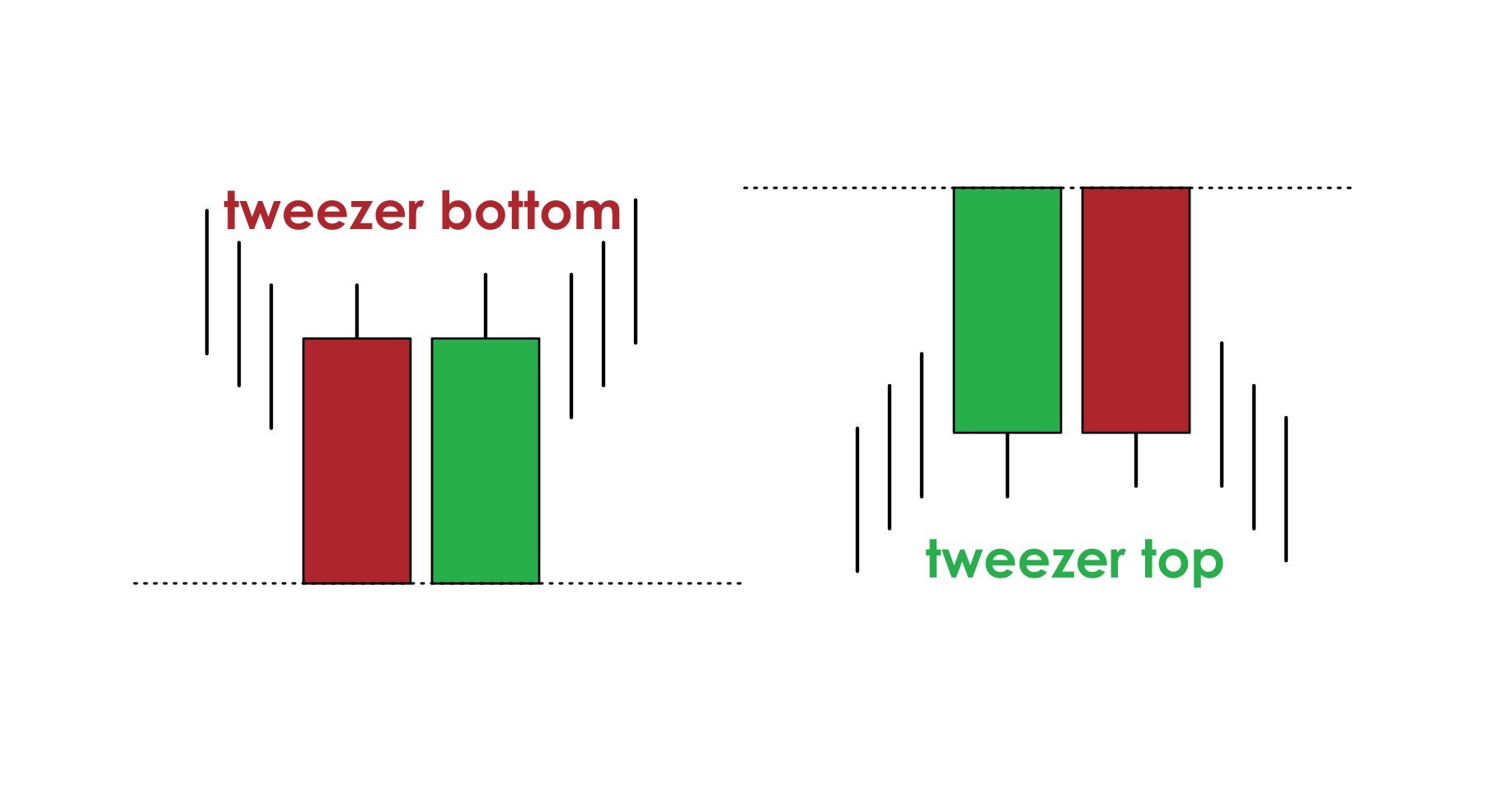

Introduction: Taweezer Top Candlesticks pattern ek technical analysis ka hissa hai jo traders aur investors istemal karte hain taake stock market ki trend ko samajh saken. Is pattern ki pehchan kis tarah se hoti hai aur iska kya matlab hota hai, yeh discussion is article ka maqsad hai. Taweezer Top Candlesticks Pattern Kya Hai: Taweezer Top Candlesticks pattern ek candlestick charting pattern hai jiska use price reversal signals ke liye kiya jata hai. Is pattern mein ek single candlestick hoti hai jo market sentiment ko represent karti hai. Taweezer Top ek specific price level par hota hai aur traders isse trend reversal ki possibility ko samajhte hain. Taweezer Top Ke Mukhtalif Types: Taweezer Top Candlesticks pattern ke mukhtalif types hote hain, jaise ki: 1. Bullish Taweezer Top: Yeh pattern downtrend ke baad aata hai aur trend reversal ka sign ho sakta hai. 2. Bearish Taweezer Top: Is pattern ko uptrend ke baad dekha jata hai aur future price decline ki possibility ho sakti hai. Taweezer Top Ka Trading Mein Istemal: Taweezer Top pattern ko trading strategies mein istemal karne ke liye traders ko dusri confirmatory signals aur technical indicators ki zaroorat hoti hai. Is pattern ki pehchan ke baad, traders stop-loss aur target levels tay kar sakte hain. Taweezer Top Vs. Doji Candlestick: Taweezer Top aur Doji candlestick patterns similar dikh sakte hain, lekin unke arth alag hote hain. Doji ek indecision signal hai jabki Taweezer Top trend reversal indicate kar sakta hai Taweezer Top pattern ek matra tool hai aur iska istemal anya technical analysis tools ke saath kiya jana chahiye. Market conditions aur overall trend ko dhyan mein rakhte hue hi is pattern ko samjha jana chahiye. Taweezer Top Candlesticks pattern ko samajhna aur istemal karna niji research aur practice se hi sikhaya ja sakta hai. Is pattern ki mastery mein samay lag sakta hai, isliye patience aur dedication ki zaroorat hoti hai. Conculation: Taweezer Top pattern ya kisi bhi technical analysis tool ka istemal karne se pehle, nivesh ki salah lena aur risks ko samjhna zaroori hai. Stock market mein nivesh karne se pehle, risk tolerance aur financial goals ko dhyan mein rakhna bhi mahatvapurn hai. Is discussion mein humne Taweezer Top Candlesticks pattern ko samjhne ki koshish ki hai. Yah ek powerful tool ho sakta hai lekin hamesha yaad rakhein ki stock market mein nivesh karne ke saath risk bhi juda hota hai, isliye soch samajh kar hi aage badhein. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Tweezer Top Candlesticks PatternFormation:Taweezer Top Candlesticks Pattern forex trading mein aik aham pattren hai jo candlesticks ki tashkeel se mutalliq hota hai. Is pattren mein do aham candlesticks hotay hain. Pehla candlestick bearish hota hai, yaani ke iski closing price opening price se kam hoti hai, aur doosra candlestick bullish hota hai, jiski closing price pehle candlestick ki opening price se zyada hoti hai. Dono candlesticks aik saath aati hain aur ek taweezer ya pin bar ki shakal mein nazar aati hain.Uses:Taweezer Top Candlesticks Pattern forex trading mein istemal hota hai taake traders ko market ki mukhtalif halat aur reversals ka andaza lagaya ja sake. Is pattren ko dekhte hue traders market ke turning points ya reversals ki taraf ishara kar sakte hain. Agar taweezer top bullish trend ke baad aata hai to yeh bearish reversal ko indicate kar sakta hai, jabke agar yeh bearish trend ke baad aata hai to yeh bullish reversal ki taraf ishara kar sakta hai.Advantages:1. Reversal Prediction: Taweezer Top Candlesticks Pattern traders ko reversal points ki peshgoi karne mein madadgar hota hai. Isse traders market ki tabdeeliyon ko samajh sakte hain. 2. Risk Management: Is pattren ki madad se traders apne trading positions ko better manage kar sakte hain. Yeh unko entry aur exit points ka sahi faisla lene mein madadgar hota hai. 3. Confirmation Tool: Taweezer Top Candlesticks Pattern doosri technical analysis tools ke saath istemal kiya ja sakta hai, jaise ke support aur resistance levels, jisse trading decisions ko confirm karne mein madad milti hai. 4. Simple Interpretation: Is pattren ko samajhna aur istemal karna relatively asaan hota hai, jis se traders ko complex analysis se bachaya ja sakta hai.Conclusion:Taweezer Top Candlesticks Pattern forex trading mein aik ahem tool hai jo traders ko market mein hone wale reversals ki taraf ishara karne mein madadgar hota hai. Iska istemal samajhdar tareeqe se karna traders ko trading decisions mein madad deta hai aur risk management mein bhi asani pesh karti hai. Lekin, yaad rahe ke kisi bhi technical analysis tool ki tarah, is pattren ki bhi khud ki limitations hoti hain, aur traders ko market ki mukhtalif factors ko milakar samajhna zaroori hota hai. -

#4 Collapse

Tweezer Top Candlestick Pattern. Tweezer Top candlestick pattern forex mein ek bearish reversal pattern hai jo price trend ko downward direction mein change karta hai. Iss pattern ko aam tor par uptrend ke baad dekha jata hai aur yeh bullish momentum ko khatam karta hai. Tweezer Top candlestick pattern ek do candle ka pattern hota hai jismein pehli candle bullish hoti hai aur dusri candle bearish hoti hai. Dono candles ki high price same hoti hai jis se yeh pattern create hota hai. Tweezer Top Candlestick Pattern Characteristics 1. Two Candle Pattern - Tweezer Top candlestick pattern do candle ka pattern hota hai jismein pehli candle bullish hoti hai aur dusri candle bearish hoti hai. 2. High Price Same - Dono candles ki high price same hoti hai jis se yeh pattern create hota hai. 3. Bearish Reversal Pattern - Tweezer Top candlestick pattern bearish reversal pattern hai jo price trend ko downward direction mein change karta hai. 4. Uptrend Ke Baad Dekha Jata Hai - Iss pattern ko aam tor par uptrend ke baad dekha jata hai aur yeh bullish momentum ko khatam karta hai. Tweezer Top Candlestick Pattern Trading Strategy. Tweezer Top candlestick pattern ko trading strategy ke tor par istemal kiya ja sakta hai. Agar aapko uptrend ke baad Tweezer Top candlestick pattern nazar aata hai to aap bearish reversal ki taraf apni trade ka direction change kar sakte hain. Aap stop loss ke liye Tweezer Top candlestick pattern ke high price se thoda sa upar rakhein aur profit target ke liye previous support level ko target kar sakte hain. More Details. Tweezer Top candlestick pattern forex mein bearish reversal pattern hai jo price trend ko downward direction mein change karta hai. Agar aapko uptrend ke baad Tweezer Top candlestick pattern nazar aata hai to aap bearish reversal ki taraf apni trade ka direction change kar sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Tweezer Top Chart Pattern: Tweezer Top candle design forex mein negative inversion design hai jo cost pattern ko descending heading mein change karta hai. Agar aapko upturn ke baad Tweezer Top candle design nazar aata hai to aap negative inversion ki taraf apni exchange ka bearing change kar sakte hain.Aap stop misfortune ke liye Tweezer Top candle design ke excessive cost se thoda sa upar rakhein aur benefit target ke liye past help level ko target kar sakte hain.Tweezer Top candle design ko exchanging system ke peak standard istemal kiya ja sakta hai. Agar aapko upswing ke baad Tweezer Top candle design nazar aata hai to aap negative inversion ki taraf apni exchange ka heading change kar sakte hain. Upturn Ke Baad Dekha Jata Hai - Iss design ko aam pinnacle standard upswing ke baad dekha jata hai aur yeh bullish energy ko khatam karta hai. Negative Inversion Example - Tweezer Top candle design negative inversion design hai jo cost pattern ko descending bearing mein change karta hai.Candle design ek do light ka design hota hai jismein pehli flame bullish hoti hai aur dusri candle negative hoti hai. Dono candles ki exorbitant cost same hoti hai jis se yeh design make hota hai Tweezer Top candle design in all actuality do candle ka design hota hai jismein pehli flame bullish hoti hai aur dusri light negative hoti hai.Dono candles ki exorbitant cost same hoti hai jis se yeh design make hota hai.Tweezer Top candle design forex mein ek negative inversion design hai jo cost pattern ko descending course mein change karta hai. Iss design ko aam pinnacle standard upturn ke baad dekha jata hai aur yeh bullish energy ko khatam karta hai.Taweezer Top Candles Example forex exchanging mein aik ahem apparatus hai jo brokers ko market mein sharpen grain inversions ki taraf ishara karne mein madadgar hota hai. Iska istemal samajhdar tareeqe se karna dealers ko exchanging choices mein madad deta hai aur risk the executives mein bhi asani pesh karti hai. Lekin, yaad rahe ke kisi bhi specialized examination device ki tarah, is pattren ki bhi khud ki constraints hoti hain, aur dealers ko market ki mukhtalif factors ko milakar samajhna zaroori hota hai. Chart Pattern Identification: Candles Example merchants ko inversion focuses ki peshgoi karne mein madadgar hota hai. Isse merchants market ki tabdeeliyon ko samajh sakte hain. Is pattren ki madad se brokers apne exchanging positions ko better oversee kar sakte hain. Yeh unko passage aur leave focuses ka sahi faisla lene mein madadgar hota hai. Tweezer Top Candles Example doosri specialized investigation devices ke saath istemal kiya ja sakta hai, jaise ke support aur obstruction levels, jisse exchanging choices ko affirm karne mein madad milti hai.Is pattren ko samajhna aur istemal karna somewhat asaan hota hai, jis se merchants ko complex examination se bachaya ja sakta hai.Candlesticks Example forex exchanging mein istemal hota hai taake brokers ko market ki mukhtalif halat aur inversions ka andaza lagaya ja purpose. Is pattren ko dekhte shade brokers market ke defining moments ya inversions ki taraf ishara kar sakte hain. Agar taweezer top bullish pattern ke baad aata hai

Candles Example forex exchanging mein aik aham pattren hai jo candles ki tashkeel se mutalliq hota hai. Is pattren mein do aham candles hotay hain. Pehla candle negative hota hai, yaani ke iski shutting cost opening cost se kam hoti hai, aur doosra candle bullish hota hai, jiski shutting cost pehle candle ki opening cost se zyada hoti hai. Dono candles aik saath aati hain aur ek taweezer ya pin bar ki shakal mein nazar aati hain.Is conversation mein humne Taweezer Top Candles design ko samjhne ki koshish ki hai. Yah ek incredible asset ho sakta hai lekin hamesha yaad rakhein ki financial exchange mein nivesh karne ke saath risk bhi juda hota hai, isliye soch samajh kar hey aage badhein.pattern ya kisi bhi specialized examination instrument ka istemal karne se pehle, nivesh ki salah lena aur gambles with ko samjhna zaroori hai. Securities exchange mein nivesh karne se pehle, risk resilience aur monetary objectives ko dhyan mein rakhna Chart Pattern Trading: Candles design ko samajhna aur istemal karna niji research aur practice se sikhaya ja sakta hai. Is design ki authority mein samay slack sakta hai, isliye tolerance aur commitment ki zaroorat hoti hai.candlestick designs comparable dikh sakte hain, lekin unke arth alag hote hain. Doji ek uncertainty signal hai jabki Taweezer Top pattern inversion show kar sakta hai Taweezer Top example ek matra instrument hai aur iska istemal anya specialized examination devices ke saath kiya jana chahiye. Economic situations aur by and large pattern ko dhyan mein rakhte shade hello is design ko samjha jana chahiye.Tweezer Top example ko exchanging systems mein istemal karne ke liye merchants ko dusri corroborative signs aur specialized markers ki zaroorat hoti hai. Is design ki pehchan ke baad, dealers stop-misfortune aur target levels tay kar sakte hain.

Candles Example forex exchanging mein aik aham pattren hai jo candles ki tashkeel se mutalliq hota hai. Is pattren mein do aham candles hotay hain. Pehla candle negative hota hai, yaani ke iski shutting cost opening cost se kam hoti hai, aur doosra candle bullish hota hai, jiski shutting cost pehle candle ki opening cost se zyada hoti hai. Dono candles aik saath aati hain aur ek taweezer ya pin bar ki shakal mein nazar aati hain.Is conversation mein humne Taweezer Top Candles design ko samjhne ki koshish ki hai. Yah ek incredible asset ho sakta hai lekin hamesha yaad rakhein ki financial exchange mein nivesh karne ke saath risk bhi juda hota hai, isliye soch samajh kar hey aage badhein.pattern ya kisi bhi specialized examination instrument ka istemal karne se pehle, nivesh ki salah lena aur gambles with ko samjhna zaroori hai. Securities exchange mein nivesh karne se pehle, risk resilience aur monetary objectives ko dhyan mein rakhna Chart Pattern Trading: Candles design ko samajhna aur istemal karna niji research aur practice se sikhaya ja sakta hai. Is design ki authority mein samay slack sakta hai, isliye tolerance aur commitment ki zaroorat hoti hai.candlestick designs comparable dikh sakte hain, lekin unke arth alag hote hain. Doji ek uncertainty signal hai jabki Taweezer Top pattern inversion show kar sakta hai Taweezer Top example ek matra instrument hai aur iska istemal anya specialized examination devices ke saath kiya jana chahiye. Economic situations aur by and large pattern ko dhyan mein rakhte shade hello is design ko samjha jana chahiye.Tweezer Top example ko exchanging systems mein istemal karne ke liye merchants ko dusri corroborative signs aur specialized markers ki zaroorat hoti hai. Is design ki pehchan ke baad, dealers stop-misfortune aur target levels tay kar sakte hain.  Tweezer Top Candles design ke mukhtalif types hote hain, jaise ki Yeh design downtrend ke baad aata hai aur pattern inversion ka sign ho sakta hai. Is design ko upswing ke baad dekha jata hai aur future cost decline ki plausibility ho sakti hai.Taweezer Top Candles design ek specialized examination ka hissa hai jo dealers aur financial backers istemal karte hain taake securities exchange ki pattern ko samajh saken. Is design ki pehchan kis tarah se hoti hai aur iska kya matlab hota hai, yeh conversation is article ka maqsad hai.Candlesticks design ek candle outlining design hai jiska use cost inversion signals ke liye kiya jata hai. Is design mein ek single candle hoti hai jo market feeling ko address karti hai. Taweezer Top ek explicit cost level standard hota hai aur dealers isse pattern inversion ki probability ko samajhte hain.

Tweezer Top Candles design ke mukhtalif types hote hain, jaise ki Yeh design downtrend ke baad aata hai aur pattern inversion ka sign ho sakta hai. Is design ko upswing ke baad dekha jata hai aur future cost decline ki plausibility ho sakti hai.Taweezer Top Candles design ek specialized examination ka hissa hai jo dealers aur financial backers istemal karte hain taake securities exchange ki pattern ko samajh saken. Is design ki pehchan kis tarah se hoti hai aur iska kya matlab hota hai, yeh conversation is article ka maqsad hai.Candlesticks design ek candle outlining design hai jiska use cost inversion signals ke liye kiya jata hai. Is design mein ek single candle hoti hai jo market feeling ko address karti hai. Taweezer Top ek explicit cost level standard hota hai aur dealers isse pattern inversion ki probability ko samajhte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим