Falling Window Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

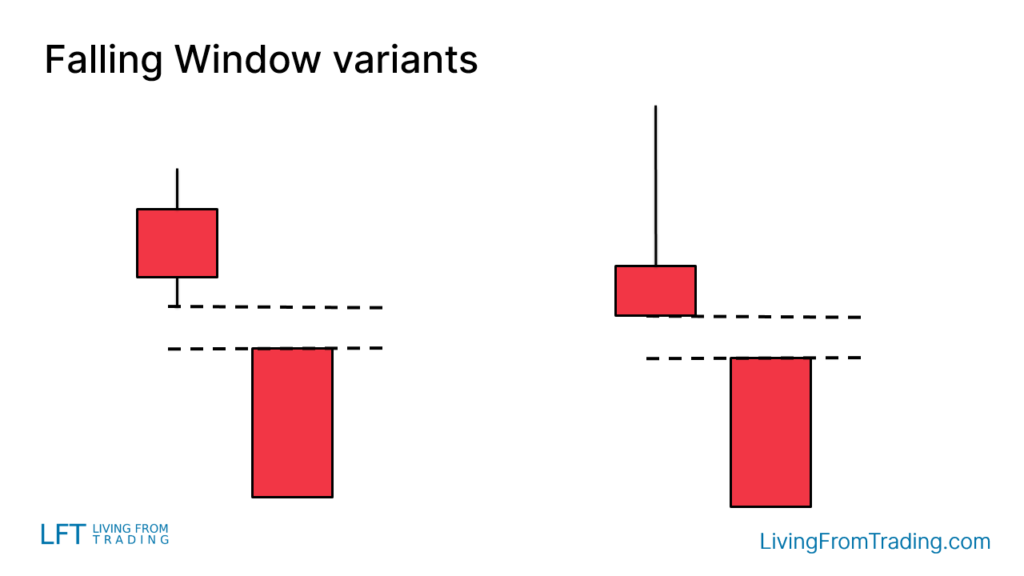

Falling Window Pattern Falling Window Pattern kya hai Falling Window Pattern ek technical analysis tool hai jo candlestick charts mein istemal hota hai. Ye pattern price action ko analyze karne ke liye use kiya jata hai aur bearish market ke signals provide karta hai. Falling Window Pattern kaise kaam karta hai Falling Window Pattern mein ek gap hota hai jahan price ka sudden drop hota hai. Is gap ke beech mein 2 candlesticks hote hain jinmein se pehla candlestick bullish hota hai aur dusra bearish hota hai. Is pattern mein bullish candlestick ki high price aur bearish candlestick ki low price gap ke beech mein rehti hai. Is pattern ko identify karne ke liye traders ko candlestick charts ko observe karna hota hai aur ek gap ko dekhna hota hai jahan price ka sudden drop hua hai. Falling Window Pattern ka istemal: Falling Window Pattern bearish market ke signals provide karta hai. Is pattern ko identify karne ke baad traders sell positions le sakte hain aur market mein profits earn kar sakte hain. Traders ko Falling Window Pattern ke signals ko confirm karne ke liye other technical analysis tools ka bhi use karna chahiye jaise ki moving averages, trend lines, aur momentum oscillators. Conclusion: Falling Window Pattern ek bearish market ke signal hai jo traders ko sell positions lene mein help karta hai. Is pattern ko identify karne ke liye traders ko candlestick charts ko observe karna hota hai aur gap ko dekhna hota hai jahan price ka sudden drop hua hai. Is pattern ko confirm karne ke liye other technical analysis tools ka bhi use karna chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Falling Window Pattern" Falling Window Pattern ek technical analysis ka term hai jo stock market mein istemal hota hai. Iska matlab hota hai jab ek stock ka price ek downtrend mein hota hai aur ek choti si gap down opening candlestick ke sath open hota hai. Yeh pattern traders ke liye important ho sakta hai kyunki isse future price movement ke predictions ki jaa sakti hain -

#4 Collapse

Aslamoalekum kesay hein ap sab members. Main umed krti hon ap sab thek hongay or apki posting behtreen ja rhi hogi isky sath apka trading session bhe acha ja raha hoga. Aj ka hmara discussion ka jo topic hay woh falling window candlestick pattern ky baray mein hey isy dekhty hein ky yh kia hy or hmen kia malomat faraham karta hai. falling window candlestick pattern Forex trading main falling window se murad ek technical analysis hay. Yeh ishara hota hai jab ek price chart par kisi currency ky joray ki price mein achanak tezi se ghatnay ka pattern nazar aata hai. Falling window ka matlab hota hai ke market mein price mein neeche ki taraf tezi se giraavat ho rahi hai. Yeh traders ke liye ek bearish signal ho sakta hai, jiska matlab hota hai ke mustaqbil mein price aur nichay gir sakti hai, aur is par trading strategies banayi ja sakti hain.Forex trading say mein falling window ya ka ahem nuqta hota hai kyunki yeh ek bearish signal muhaya karta hai. Iska matlab hota hai ke market mein price mein neeche ki taraf tezi se giraavat ho rahi hai. Falling window ko dekh kar traders samajh sakte hain ke current trend bearish price kam hone ki salahiyat ho sakta hai aur isse future mein price aur nichay girne ki mumkinat hoti hai. explanation of falling window candlestick pattern Traders is signal ko apni trading strategies mein istemal kar sakte hain, jaise ke short positions lena ya stoploss orders lagana takay nuksan se bhe bacha ja sake. Lekin, yaad rahe ke sirf falling window par bharosa na karein, aur doosre technical indicators aur market analysis tools ka bhi istemal karein taake aapkey trading decisions ko behtreen kar sakein.Forex trading mein falling window ka istemal nuksan se bachne ke liye kiya jata hai, lekin iski bhi kuch limitations hain. Or Kabhi kabhi falling window ek false signal bhi ho sakta hai, matlab ke yeh ho sakta hai ke price mein arzi tor par manfi ho, lekin phir market wapas upar ja sakta hai. Islie, is signal par pura bharosa na karein aur doosri indicators aur analysis tools ka bhi istemal karein. Falling window ke numaindgi ke baad, market mein price mein aur nichay giravat ho sakti hai. Iska matlab hai ke aap is signal ko pakadne mein deri ho sakti hai, aur aapko nuksan uthana pad sakta hai. Forex market volatile hoti hai, aur price mein sudden tabdelian hote rehte hain. Falling window ke signal par pura bharosa na karke market ki current situation aur overall trend ko bhi samjhein. Isliye, falling window ko ek tool ki tarah istemal karein, lekin yeh aapke trading decisions ka ek hissa hi hona chahiye. Pura samjh kar aur doosri analysis ke saath, aap behtar trading choices bana sakte hain. -

#5 Collapse

"Falling Window" pattern, jo ki "Exhaustion Gap" ke roop mein bhi jaana jaata hai, ek technical analysis pattern hai jo stock market ya anya financial markets mein paya jata hai. Is pattern ka main uddeshya market sentiment aur potential reversals ko samajhna hota hai. Falling Window pattern ko nimn roop mein samjha ja sakta hai: **1. Formation:** Falling Window pattern ek gap pattern hota hai. Iska formation tab hota hai jab ek security ka opening price lower hota hai compared to the previous day's closing price. Isse ek khula hua space ya gap market mein dikhai deta hai, jise falling window kehte hain. **2. Significance:** Falling Window pattern market mein bearish sentiment ko darust karta hai. Isse yeh sanket milta hai ki market mein sellers (bikri karne wale) dominance mein hain aur prices mein downward pressure ho sakta hai. **3. Potential Reversal Indicator:** Falling Window pattern ek potential reversal indicator ho sakta hai. Yadi is pattern ke baad prices downslide karte hain, toh yeh bearish trend ke continuation ki possibility ko darust karta hai. Lekin, agar prices is pattern ke baad recover karte hain, toh yeh trend reversal ki indication ho sakti hai. **4. Volume ka Mahatva:** Falling Window pattern ko analyze karte waqt trading volume ka bhi dhyan rakha jaata hai. Agar falling window pattern ke saath high trading volume hoti hai, toh yeh bearish signal ki validity ko badhata hai. **5. Confirmation:** Falling Window pattern ko dusre technical indicators aur chart patterns ke saath confirm kiya ja sakta hai. Yadi yeh pattern kisi support level ke paas aata hai ya kisi bearish candlestick pattern ke saath dikhta hai, toh yeh bearish outlook ko confirm karta hai. **6. Risk Management:** Traders falling window pattern ka istemal apni risk management strategy mein bhi kar sakte hain. Stop-loss levels aur entry/exit points ko is pattern ke signals ke hisab se set kar sakte hain. Yad rahe ki falling window pattern ek indicator hai aur iska istemal dusre analysis tools ke saath kiya jaata hai. Market conditions aur patterns ka samay-samay par review karna mahatvapurn hai kyunki yeh dynamic hoti hain. Is pattern ko samajhne aur istemal karne ke liye practice aur experience ki zarurat hoti hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction:- Falling Window Pattern forex trading mein ek ahem candlestick pattern hai jo market analysis mein istemal hota hai. Yeh pattern bearish trend ko darust karti hai. Falling Window Pattern Identify :- Falling Window Pattern tab banti hai jab do consecutive candlesticks aik dusre ke niche open hoti hain, aur doosri candlestick pehli wali candlestick ki range ke andar close hoti hai. Yani, do candlesticks ki opening prices ek dusre se neeche hoti hain. Is pattern ki pechan kar ke traders samajh sakte hain ke market mein bearish (girawat) sentiment hai. Falling Window ek signal hai ke prices mein neeche ki taraf pressure hai aur sellers control mein hain. Trading Strategy :- Falling Window Pattern ko trading strategy mein istemal karne ke liye, traders usually sell positions ya short positions banate hain. Iska matlab hai ke woh samajhte hain ke market girne wala hai, aur woh is opportunity ko istemal karke profit kamane ki koshish karte hain. Falling Window Pattern Limitations :- Yad rahe ke har ek technical analysis pattern ki tarah, Falling Window Pattern bhi 100% perfect nahi hoti. Sometimes false signals bhi aati hain, is liye isko confirm karne ke liye doosri indicators aur analysis ki zarurat hoti hai. Risks :- Hamesha yaad rahe ke kisi bhi trading pattern ya strategy ko istemal karte waqt market risks ko samajhna aur manage karna zaroori hai. Falling Window Pattern sirf ek indicator hai, aur iska istemal traders ki research aur risk management ke sath karna chahiye. Canculsion:- Falling Window Pattern ek bearish reversal pattern hai jo traders ke liye market ke trend change ko anticipate karne mein madadgar ho sakta hai. Lekin, iska istemal prudent risk management ke sath karna zaroori hai. Trading mein kamyaabi hasil karne ke liye practice aur knowledge ka bhi aham hissa hai. Falling Window Pattern forex trading mein ek ahem tool hai jo bearish trends ko identify karne mein madadgar hoti hai. Lekin, isko samajhne aur istemal karne ke liye practice aur doosri analysis techniques ki zarurat hoti hai. -

#7 Collapse

Falling Window Chart Pattern: Falling Window Example ek negative inversion design hai jo brokers ke liye market ke pattern change ko expect karne mein madadgar ho sakta hai. Lekin, iska istemal judicious gamble the board ke sath karna zaroori hai. Exchanging mein kamyaabi hasil karne ke liye practice aur information ka bhi aham hissa hai. Falling Window Example forex exchanging mein ek ahem device hai jo negative patterns ko recognize karne mein madadgar hoti hai. Lekin, isko samajhne aur istemal karne ke liye practice aur doosri examination procedures ki zarurat hoti hai.technical investigation design ki tarah, Falling Window Example bhi 100 percent amazing nahi hoti. In some cases bogus signs bhi aati hain, is liye isko affirm karne ke liye doosri pointers aur examination ki zarurat hoti hai kisi bhi exchanging design ya procedure ko istemal karte waqt market gambles with ko samajhna aur oversee karna zaroori hai. Falling Window Example sirf ek pointer hai, aur iska istemal dealers ki research aur risk the board ke sath karna chahiye. Design tab banti hai continuous candles aik dusre ke specialty open hoti hain, aur doosri candle pehli wali candle ki range ke andar close hoti hai. Yani, do candles ki opening costs ek dusre se neeche hoti hain. Is design ki pechan kar ke dealers samajh sakte hain ke market mein negative (girawat) opinion hai. Falling Window ek signal hai ke costs mein neeche ki taraf pressure hai aur venders control mein hain.Falling Window Example ko exchanging technique mein istemal karne ke liye, brokers for the most part sell positions ya short positions banate hain. Iska matlab hai ke woh samajhte hain ke market girne wala hai, aur woh is opportunity ko istemal karke benefit kamane ki koshish karte hain.Falling Window Example forex exchanging mein ek ahem candle design hai jo market investigation mein istemal hota hai. Yeh design negative pattern ko darust karti hai. Chart Pattern Formation: Falling Window design ko examine karte waqt exchanging volume ka bhi dhyan rakha jaata hai. Agar falling window design ke saath high exchanging volume hoti hai, toh yeh negative sign ki legitimacy ko badhata hai.Falling Window design ko dusre specialized pointers aur graph designs ke saath affirm kiya ja sakta hai. Yadi yeh design kisi support level ke paas aata hai ya kisi negative candle design ke saath dikhta hai, toh yeh negative standpoint ko affirm karta hai.Traders falling window design ka istemal apni risk the board technique mein bhi kar sakte hain. Stop-misfortune levels aur passage/leave focuses ko is design ke signals ke hisab se set kar sakte hain.falling window design ek marker hai aur iska istemal dusre investigation devices ke saath kiya jaata hai. Economic situations aur designs ka samay standard survey karna mahatvapurn hai kyunki yeh dynamic hoti hain. Is design ko samajhne aur istemal karne ke liye practice aur experience ki zarurat hoti hai.

Design tab banti hai continuous candles aik dusre ke specialty open hoti hain, aur doosri candle pehli wali candle ki range ke andar close hoti hai. Yani, do candles ki opening costs ek dusre se neeche hoti hain. Is design ki pechan kar ke dealers samajh sakte hain ke market mein negative (girawat) opinion hai. Falling Window ek signal hai ke costs mein neeche ki taraf pressure hai aur venders control mein hain.Falling Window Example ko exchanging technique mein istemal karne ke liye, brokers for the most part sell positions ya short positions banate hain. Iska matlab hai ke woh samajhte hain ke market girne wala hai, aur woh is opportunity ko istemal karke benefit kamane ki koshish karte hain.Falling Window Example forex exchanging mein ek ahem candle design hai jo market investigation mein istemal hota hai. Yeh design negative pattern ko darust karti hai. Chart Pattern Formation: Falling Window design ko examine karte waqt exchanging volume ka bhi dhyan rakha jaata hai. Agar falling window design ke saath high exchanging volume hoti hai, toh yeh negative sign ki legitimacy ko badhata hai.Falling Window design ko dusre specialized pointers aur graph designs ke saath affirm kiya ja sakta hai. Yadi yeh design kisi support level ke paas aata hai ya kisi negative candle design ke saath dikhta hai, toh yeh negative standpoint ko affirm karta hai.Traders falling window design ka istemal apni risk the board technique mein bhi kar sakte hain. Stop-misfortune levels aur passage/leave focuses ko is design ke signals ke hisab se set kar sakte hain.falling window design ek marker hai aur iska istemal dusre investigation devices ke saath kiya jaata hai. Economic situations aur designs ka samay standard survey karna mahatvapurn hai kyunki yeh dynamic hoti hain. Is design ko samajhne aur istemal karne ke liye practice aur experience ki zarurat hoti hai.  Design, jo ki "Depletion Hole" ke roop mein bhi jaana jaata hai, ek specialized investigation design hai jo securities exchange ya anya monetary business sectors mein paya jata hai. Is design ka primary uddeshya market feeling aur potential inversions ko samajhna hota hai. Falling Window design ko roop mein samjha ja sakta hai Falling Window design ek hole design hota hai. Iska arrangement tab hota hai punch ek security ka opening cost lower hota hai contrasted with the earlier day's end cost. Isse ek khula hua space ya hole market mein dikhai deta hai, jise falling window kehte hain. Falling Window design market mein negative opinion ko darust karta hai. Isse yeh sanket milta hai ki market mein venders (bikri karne rib) predominance mein hain aur costs mein descending tension ho sakta hai. design ek potential inversion pointer ho sakta hai. Yadi is design ke baad costs downslide karte hain, toh yeh negative pattern ke continuation ki plausibility ko darust karta hai. Lekin, agar costs is design ke baad recuperate karte hain, toh yeh pattern inversion ki sign ho sakti hai. Chart Trading View: Brokers is signal ko apni exchanging systems mein istemal kar sakte hain, jaise ke short positions lena ya stoploss orders lagana takay nuksan se bhe bacha ja purpose. Lekin, yaad rahe ke sirf falling window standard bharosa na karein, aur doosre specialized pointers aur market investigation apparatuses ka bhi istemal karein taake aapkey exchanging choices ko behtreen kar sakein.Forex exchanging mein falling window ka istemal nuksan se bachne ke liye kiya jata hai, lekin iski bhi kuch constraints hain. Or on the other hand kabhi falling window ek misleading sign bhi ho sakta hai, matlab ke yeh ho sakta hai ke cost mein arzi peak standard manfi ho, lekin phir market wapas upar ja sakta hai. Islie, is signal standard pura bharosa na karein aur doosri pointers aur examination apparatuses ka bhi istemal karein. Falling window ke numaindgi ke baad, market mein cost mein aur nichay giravat ho sakti hai. Iska matlab hai ke aap is signal ko pakadne mein deri ho sakti hai, aur aapko nuksan uthana cushion sakta hai. Forex market unstable hoti hai

Design, jo ki "Depletion Hole" ke roop mein bhi jaana jaata hai, ek specialized investigation design hai jo securities exchange ya anya monetary business sectors mein paya jata hai. Is design ka primary uddeshya market feeling aur potential inversions ko samajhna hota hai. Falling Window design ko roop mein samjha ja sakta hai Falling Window design ek hole design hota hai. Iska arrangement tab hota hai punch ek security ka opening cost lower hota hai contrasted with the earlier day's end cost. Isse ek khula hua space ya hole market mein dikhai deta hai, jise falling window kehte hain. Falling Window design market mein negative opinion ko darust karta hai. Isse yeh sanket milta hai ki market mein venders (bikri karne rib) predominance mein hain aur costs mein descending tension ho sakta hai. design ek potential inversion pointer ho sakta hai. Yadi is design ke baad costs downslide karte hain, toh yeh negative pattern ke continuation ki plausibility ko darust karta hai. Lekin, agar costs is design ke baad recuperate karte hain, toh yeh pattern inversion ki sign ho sakti hai. Chart Trading View: Brokers is signal ko apni exchanging systems mein istemal kar sakte hain, jaise ke short positions lena ya stoploss orders lagana takay nuksan se bhe bacha ja purpose. Lekin, yaad rahe ke sirf falling window standard bharosa na karein, aur doosre specialized pointers aur market investigation apparatuses ka bhi istemal karein taake aapkey exchanging choices ko behtreen kar sakein.Forex exchanging mein falling window ka istemal nuksan se bachne ke liye kiya jata hai, lekin iski bhi kuch constraints hain. Or on the other hand kabhi falling window ek misleading sign bhi ho sakta hai, matlab ke yeh ho sakta hai ke cost mein arzi peak standard manfi ho, lekin phir market wapas upar ja sakta hai. Islie, is signal standard pura bharosa na karein aur doosri pointers aur examination apparatuses ka bhi istemal karein. Falling window ke numaindgi ke baad, market mein cost mein aur nichay giravat ho sakti hai. Iska matlab hai ke aap is signal ko pakadne mein deri ho sakti hai, aur aapko nuksan uthana cushion sakta hai. Forex market unstable hoti hai  Falling Window Example ek negative market ke signal hai jo merchants ko sell positions lene mein help karta hai. Is design ko distinguish karne ke liye merchants ko candle graphs ko notice karna hota hai aur hole ko dekhna hota hai jahan cost ka abrupt drop hua hai. Is design ko affirm karne ke liye other specialized investigation instruments ka bhi use karna chahiye.Forex exchanging principal falling window se murad ek specialized examination feed. Yeh ishara hota hai hit ek cost outline standard kisi cash ky joray ki cost mein achanak tezi se ghatnay ka design nazar aata hai. Falling window ka matlab hota hai ke market mein cost mein neeche ki taraf tezi se giraavat ho rahi hai. Yeh brokers ke liye ek negative sign ho sakta hai, jiska matlab hota hai ke mustaqbil mein cost aur nichay gir sakti hai, aur is standard exchanging techniques banayi ja sakti hain.Forex exchanging say mein falling window ya ka ahem nuqta hota hai kyunki yeh ek negative sign muhaya karta hai. Iska matlab hota hai ke market mein cost mein neeche ki taraf tezi se giraavat ho rahi hai.

Falling Window Example ek negative market ke signal hai jo merchants ko sell positions lene mein help karta hai. Is design ko distinguish karne ke liye merchants ko candle graphs ko notice karna hota hai aur hole ko dekhna hota hai jahan cost ka abrupt drop hua hai. Is design ko affirm karne ke liye other specialized investigation instruments ka bhi use karna chahiye.Forex exchanging principal falling window se murad ek specialized examination feed. Yeh ishara hota hai hit ek cost outline standard kisi cash ky joray ki cost mein achanak tezi se ghatnay ka design nazar aata hai. Falling window ka matlab hota hai ke market mein cost mein neeche ki taraf tezi se giraavat ho rahi hai. Yeh brokers ke liye ek negative sign ho sakta hai, jiska matlab hota hai ke mustaqbil mein cost aur nichay gir sakti hai, aur is standard exchanging techniques banayi ja sakti hain.Forex exchanging say mein falling window ya ka ahem nuqta hota hai kyunki yeh ek negative sign muhaya karta hai. Iska matlab hota hai ke market mein cost mein neeche ki taraf tezi se giraavat ho rahi hai.

-

#8 Collapse

Introduction Falling Window Chart Pattern. A.O.A Me omeed karta ho ap sab khareyat say ho gay aj me ap ko Falling Window Example ek negative inversion design hai jo brokers ke liye market ke pattern change ko expect karne mein madadgar ho sakta hai. Lekin, iska istemal judicious gamble the board ke sath karna zaroori hai. Exchanging mein kamyaabi hasil karne ke liye practice aur information ka bhi aham hissa hai. Falling Window Example forex exchanging mein ek ahem device hai jo negative patterns ko recognize karne mein madadgar hoti hai. Lekin, isko samajhne aur istemal karne ke liye practice aur doosri examination procedures ki zarurat hoti hai.technical investigation design ki tarah, Falling Window Example bhi 100 percent amazing nahi hoti. In some cases bogus signs bhi aati hain, is liye isko affirm karne ke liye doosri pointers aur examination ki zarurat hoti hai kisi bhi exchanging design ya procedure ko istemal karte waqt market gambles with ko samajhna aur oversee karna zaroori hai. Falling Window Example sirf ek pointer hai, aur iska istemal dealers ki research aur risk the board ke sath karna chahiye ho ga. Design tab banti hai continuous candles aik dusre ke specialty open hoti hain, aur doosri candle pehli wali candle ki range ke andar close hoti hai. Yani, do candles ki opening costs ek dusre se neeche hoti hain. Is design ki pechan kar ke dealers samajh sakte hain ke market mein negative (girawat) opinion hai. Falling Window ek signal hai ke costs mein neeche ki taraf pressure hai aur venders control mein hain.Falling Window Example ko exchanging technique mein istemal karne ke liye, brokers for the most part sell positions ya short positions banate hain. Iska matlab hai ke woh samajhte hain ke market girne wala hai, aur woh is opportunity ko istemal karke benefit kamane ki koshish karte hain.Falling Window Example forex exchanging mein ek ahem candle design hai jo market investigation mein istemal hota hai. Yeh design negative pattern ko darust karti hay. Chart Pattern Formation. Falling Window design ko examine karte waqt exchanging volume ka bhi dhyan rakha jaata hai. Agar falling window design ke saath high exchanging volume hoti hai, toh yeh negative sign ki legitimacy ko badhata hai.Falling Window design ko dusre specialized pointers aur graph designs ke saath affirm kiya ja sakta hai. Yadi yeh design kisi support level ke paas aata hai ya kisi negative candle design ke saath dikhta hai, toh yeh negative standpoint ko affirm karta hai.Traders falling window design ka istemal apni risk the board technique mein bhi kar sakte hain. Stop-misfortune levels aur passage/leave focuses ko is design ke signals ke hisab se set kar sakte hain.falling window design ek marker hai aur iska istemal dusre investigation devices ke saath kiya jaata hai. Economic situations aur designs ka samay standard survey karna mahatvapurn hai kyunki yeh dynamic hoti hain. Is design ko samajhne aur istemal karne ke liye practice aur experience ki zarurat hoti hay.

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Falling Window Pattern**, jo ki "Gap Down" pattern ke roop mein bhi jaana jaata hai, ek bearish candlestick pattern hai. Is pattern mein ek price gap down ke saath open hota hai, jo market mein selling pressure ya bearish sentiment ko darust karta hai. Aaiye is pattern ki wazahat aur uske fayde aur nuksanat ko samjhein: **Kis Tarah Falling Window Pattern Banta Hai:** 1. **Background:** Falling Window pattern market mein existing trend ke beech develop hota hai, aur iska primary purpose bearish pressure ko highlight karna hota hai.2. **Gap Down Opening:** Pattern ki pehli candlestick ek bearish candle hoti hai aur price gap down ke saath open hoti hai. Yani ki current session ki opening price previous session ke closing price se neeche hoti hai, jisse ek gap create hota hai.3. **Follow-Through Selling:** Dusra candlestick typically bearish hoti hai, aur isme price mein further decline hota hai, jisse bearish sentiment aur strong hoti hai. **Fayde:** 1. **Bearish Sentiment:** Falling Window pattern bearish sentiment ko darust karta hai aur downtrend ke potential continuation ko indicate karta hai.2. **Entry Point:** Is pattern ko dekh kar traders ko bearish positions enter karne ka potential entry point mil sakta hai. **Nuksanat:** 1. **False Signals:** Jaise ki kisi bhi technical indicator ya pattern ke saath hota hai, Falling Window pattern bhi false signals dene ka risk rakhta hai.2. **Market Context:** Pattern ko samajhne ke liye market ke overall context aur doosre factors ko bhi madde nazar rakhna zaroori hai. Falling Window pattern ko confirm karne ke liye doosre analysis tools ka istemal kiya jata hai.3. **Risk Management:** Falling Window pattern ke istemal mein traders risk management ka bhi dhyan rakhna chahiye.Falling Window Pattern traders ke liye bearish pressure aur downtrend ke continuation ke potential signals provide kar sakta hai, lekin trading decisions lene se pehle, traders ko market analysis, risk management, aur overall market context ka bhi dhyan rakhna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим