What is the bullish wolf wave chart pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

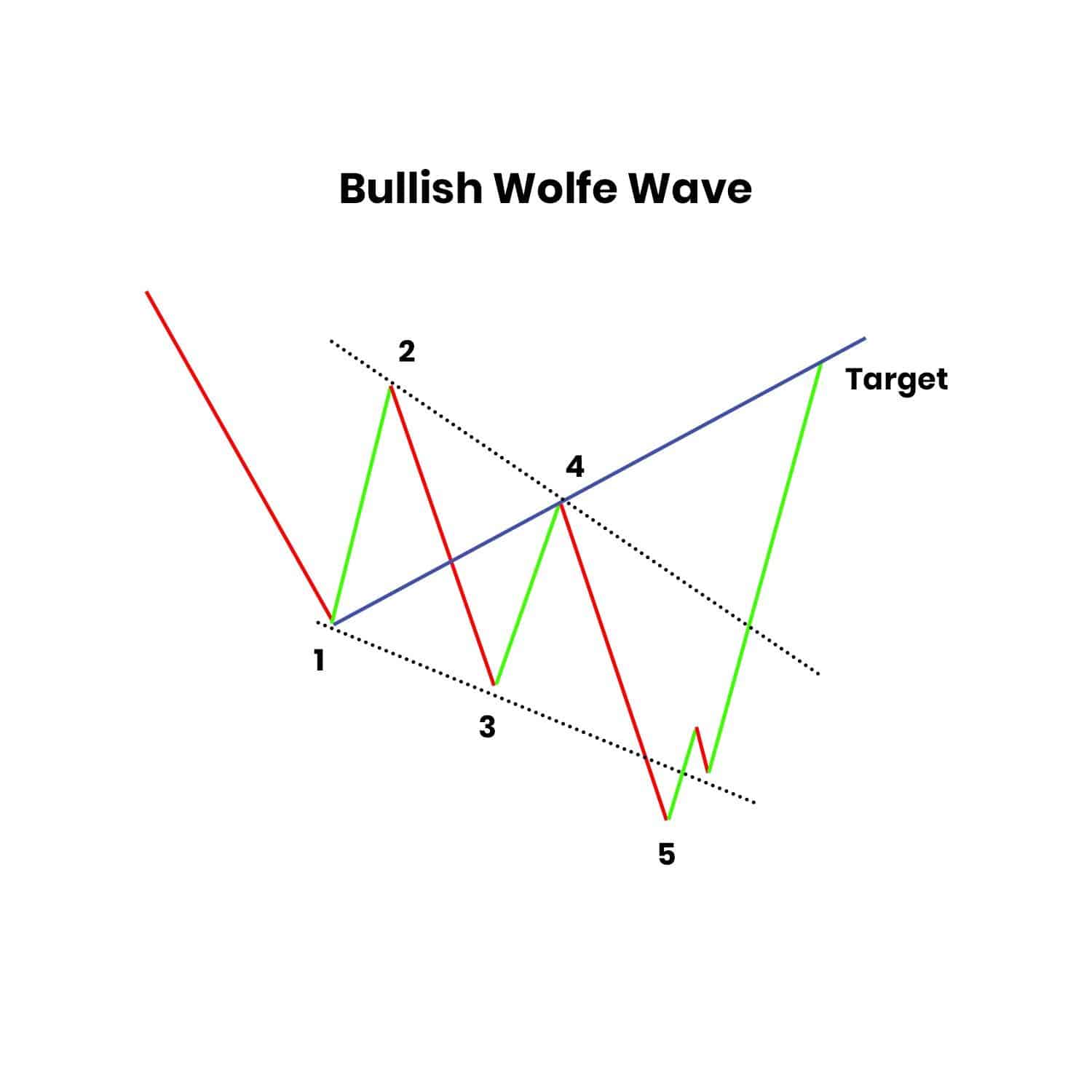

Introduction Assalamu alaikum sab theek honge Aaj ham aapko police wolf wave chart pattern ke bare mein baat karenge ki yah kya hai iske bare mein aap jitni jyada information hasil karna chahenge ham aapko Denge aur aap se kuchh fayda kar sake aur main aapko Bata dun Ki main jyada aap karenge utani jyada aap profit Kama sakenge to aaye ham is topic per batchit karte hain shukriya THE BULLISH WOLF WAVE: Bullish Wolf Wave ek aesi chart pattern hai yes bearish to bullish direction ki potential trend reversal ko indicate card hai. Ye ek rare aur kam jaani jaane wali patternhai lekin ye market dynamics ke baare mein valuable insights provide kar sakta hai. Ye pattern ek series of price movements ko represent card hai jo ek wolf ke sir ki shape ki tarah hoti hai. Ismein paanch alag alag waves hote hain, jismein pehle do wave bear phase ko represent karte hain, uske baad ek tez girao (wave 3), consolidation phase (wave 4), aur ant mein ek breakout upside ki taraf (wave 5). WAVE 1 AND 2: Bullish Wolf Wave pattern ka wave 1 aur 2 initial bear phase ko represent karte hain. Wave 1 mein price mein ek significant drop hota hai blow selling pressure in the market ko dominate the card hai. Iske saath hi volume mein bhi ek increase hota hai, yes strong bearish sentiment ko indicate card hai. Wave 2, dusri taraf, temporary help rally ko represent karta hai jahan buyers prices ko upar push karne mein aate hain. Lekin, ye rally typically short-lived hoti hai kyun ki overall bear trend abhi bhi barkarar hai. WAVE 3: Wave 3 Bullish Wolf Wave pattern ka ek fundamental syka hai kyun ki ye sharp decline ko represent card hai jo potential trend reversal ka signal deta hai. Ye wave price mein ek strong aur fast move down ke through characterize hota hai. Is decline mein increased selling pressure aur high volume of business bhi ho sakte hain. 3 ki wave sharpness indicates hai ki card bear market sentiment mein abhi bhi prevailing hai. WAVE 4: Wave 3 ke tez decline ke baad, wave 4 consolidation aur range-bound trading ka phase represent karta hai. Is phase mein market traders and investors to overall market sentiment rates karne ke liye time deta hai. Price range narrow hoti hai aur trading volume usually decreases hota hai jab taak market participants clear signal ka wait karte hain before taking any new positions. Important hai note karne ke liye ki wave 4 wave 1 ke starting point se zyada nahi pahunchna chahiye, kyun ki isse Bullish Wolf Wave pattern invalidate ho jata hai. WAVE 5: Wave 5 Bullish Wolf Wave pattern ka last wave hai jo breakout upside ko indicate card hai. Ye wave bear phase se bull phase ki transition ko represent karta hai. Ismein strong increase in buying pressure hota hai jo price ko consolidation phase (wave 4) ke during banaye gaye resistance level se upar push karta hai. Breakout often increased trading volume ke saath hota hai, which further confirmed the bullish sentiment in the market. Summary mein, Bullish Wolf Wave pattern ek rare lekin value chart pattern hai jo potential trend reversals ke baare mein insights provide kar sakta hai. Pattern ko banane wale alag alag waves ko samajh kar, traders aur investors potential buying opportunities ko identify kar sakte hain aur market dynamics mein potential shift ka faayda utha sakte hain -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

میں قیمتی بصیرت ÙراÛÙ… کر سکتا ÛÙˆÚºÛ” ÛŒÛ Ù¾ÛŒÙ¹Ø±Ù† ایک کارڈ ÛÛ’ جو بھیڑیے Ú©Û’ سر Ú©ÛŒ Ø´Ú©Ù„ میں قیمت Ú©ÛŒ نقل Ùˆ Ø*رکت Ú©ÛŒ ایک سیریز Ú©ÛŒ نمائندگی کرتا ÛÛ’Û” اسمان پنچ گرمی Ú©ÛŒ Ù„Ûروں Ú©Ùˆ الگ کرتا ÛÛ’Û” -

#4 Collapse

What is the bullish wolf wave chart pattern? Bullish wolf wave chart pettern aik technicality tajzia pettern he joe tajiron aur tajzia karon ke zariah maliati markets ، khaas toor par stock ، currenciyo ، ajnas aur crypto currenciyo main mumkanah tezi (oper) qeematon kee wapsi kee nishandahi karne ke laye istemal kia jata he yah namona kachh dosre chart pettern jaise sar aur kandhon ya double niche kee tarh mashhoor ya wasee pemane par istemal naheen hotaa he ، lekin yah be bhi kachh tajiron ke laye aik mofid aalah hosakta he tez bhediye kee lahar punch lahroo par mushtamil hoti he ، jas par 1 se 5 tek label lagaya jata he ، aur s kee shanakht aam toor par mandarjah zel ke toor par kee jati he: WAVE 1: yah qimat main ibtadai graut he yah mendy ke rojhan ya niche kee islaah kee numaindagi karta he WAVE 2: lahar 1 kee takmeel ke baad ، oper kee taraf thodi sea islaah hoti he wew 2 ko wew 1 ke zariah tay kardah faslay ke 50٪ se ziyadah ka saragh naheen lagana chahiye WAVE 3: lahar 3 pettern main sab se aham oper kee taraf harkat he ase wew 1 kee blende trin satah se tajaooz karna chahiye ، joe rojhan main mumkanah ullat palat kee nishandahi karta he WAVE 4: lahar 3 kee mazboot railway ke baad ، lahar 4 main halki niche kee taraf behtari aaye he wew 2 kee tarh ، wew 4 ko wew 3 ke zariah tay kardah faslay ke 50٪ se ziyadah ka saragh naheen lagana chahiye WAVE 5: aakhir main ، lahar 5 pettern main aakhri oper kee taraf harkat he ase lahar 3 kee blende trin satah se tajaooz karna chahiye ، jas se tezi ke ullat né kee tasdiq hoti he traders aksar wew 5 kee takmeel ko aik tawil (kharidari) position ke laye mumkanah intri point ke toor par dekhte hain ، kyunke s se patah chalta he kah mendy ka rojhan palat gaya he ، aur aik nia tezi ka rojhan ubhar sakta he taham ، kasi bhi technicality tajzia pettern kee tarh ، signals kee tasdiq karne aur khatrey ka intazam karne ke laye dosre isharay aur auzar istemal karna zarori he yah qabil ghor he kah bhediye kee lahar ka namona kasi had tek shakhsi hosakta he ، aur mukhtalif traders s kee qadre mukhtalif tashreeh karsakte henni tamaam technicality tajzia kee tarh ، ase tajzia aur khatrey ke intazam kee hikmat amali kee digar shaklon ke saath mel kor istemal kia jana chahiye tez bhediye kee lahar punch lahroo par mushtamil hoti he ، jas par 1 se 5 tek label lagaya jata he ، aur s kee shanakht aam toor par mandarjah zel ke toor par kee jati he:tez bhediye kee lahar punch lahroo par mushtamil hoti he ، jas par 1 se 5 tek label lagaya jata he ، aur s kee shanakht aam toor par mandarjah zel ke toor par kee jati he: -

#5 Collapse

What is the bullish wolf wave chart pattern?

Bullish Wolf Wave Chart Pattern - اونچا سیدھا خوف چارٹ پیٹرن

Bullish Wolf Wave ek technical analysis chart pattern hai jo market mein upward movement ko represent karta hai. Yeh pattern traders ko future price movements ke liye signals provide karta hai.

Wolf Wave Ki Khasiyat:- Wave Structure: Bullish Wolf Wave ek specific wave structure ko follow karta hai, jismein 1-4 waves hoti hain. Waves 1, 2, 3 aur 4 ke darmiyan geometry follow hoti hai, jo ek ascending order mein hoti hai.

- Symmetry: Pattern mein symmetry ek crucial element hai. Har wave ka size and time duration ek doosre ke saath balance maintain karta hai.

- Channel Lines: Bullish Wolf Wave ko identify karne ke liye traders channel lines ka use karte hain. Yeh lines market ke trend ko indicate karte hain.

Bullish Wolf Wave Kaise Identify Karein:- Wave 1: Sabse pehli wave ko identify karein, jo ek downtrend ke baad start hoti hai. Yeh wave negative price movement ko represent karegi.

- Wave 2: Wave 1 ke baad, Wave 2 mein price mein thoda sa recovery hota hai, lekin overall trend abhi bhi downward hai.

- Wave 3: Wave 3 ek strong bullish wave hoti hai, jismein significant price increase hota hai. Yeh wave market mein reversal ka indication deta hai.

- Wave 4: Wave 4 mein price mein thoda sa retracement hota hai, lekin overall trend abhi bhi bullish hai. Yeh wave bhi channel lines ke andar rehta hai.

- Wave 5: Wave 5 mein price ek aur upward movement show karta hai, jo overall pattern ko complete karta hai. Yeh wave market mein strong bullish sentiment ko highlight karta hai.

Trading Strategies:- Jab Bullish Wolf Wave complete hota hai, traders ko long positions lena consider kiya ja sakta hai, expecting further upward movement.

- Stop-loss orders ka istemal kiya ja sakta hai taki risk minimize ho sake.

- Confirmation ke liye, traders additional technical indicators ka bhi istemal kar sakte hain.

Bullish Wolf Wave chart pattern ek technical analysis tool hai, aur har trading decision se pehle thorough analysis aur risk management ki zarurat hoti hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

1. Muqadma: Bullish Wolf Wave Ka Ta'aruf

1.1 Bullish Wolf Wave Kya Hai: Bullish Wolf Wave ek technical analysis chart pattern hai jo market trends aur price movements ko identify karne ke liye istemal hota hai. Ye pattern market mein hone wale potential bullish reversals ko indicate karta hai aur traders ko long positions lene mein madad karta hai.

1.2 Bullish Wolf Wave Ki Pechan: Bullish Wolf Wave ki pechan chart par aise patterns se hoti hai jo market mein hone wale bullish reversals ko darust taur par show karte hain. Ye pattern multiple waves se milta hai, jo ki ek specific sequence aur structure ko follow karte hain.

2. Bullish Wolf Wave Ka Tareeqa:

2.1 Structure Aur Sequence: Bullish Wolf Wave ka primary characteristic ye hai ke ye ek specific structure aur sequence ko follow karta hai. Ismein 5 waves shamil hote hain, jinmein se 4 waves downtrend ko represent karte hain aur 1 wave uptrend ko.

2.2 Fibonacci Levels Ka Istemal: Bullish Wolf Wave mein Fibonacci retracement levels ka istemal hota hai taki traders ko potential reversal points ka pata lag sake. Fibonacci levels se ye maloom hota hai ke market mein bullish trend shuru hone ke chances kaise hain.

3. Bullish Wolf Wave Ke Fawaid:

3.1 Early Reversal Indication: Bullish Wolf Wave early reversal indication provide karta hai, jise traders apne favor mein istemal kar sakte hain. Ye pattern market ke potential trend changes ko advance mein signal karta hai.

3.2 Fibonacci Levels Ka Strategic Istemal: Fibonacci levels ka strategic istemal Bullish Wolf Wave mein traders ko entry aur exit points tay karne mein madad karta hai. Is taur par, wo market mein hone wale reversals ko sahi waqt par capture kar sakte hain.

4. Pakistan Ki Chat Language Mein Bullish Wolf Wave:

Pakistan ki chat language mein, traders ko ye samajhna zaroori hai ke Bullish Wolf Wave unke trading decisions ko kaise improve kar sakta hai. Chat language ka istemal karke, traders apne tajaweezat aur tips ko aapas mein share kar sakte hain, jo ke naye traders ko bhi samajhne mein madad karte hain.

5. Muqabala Aur Faisla:

5.1 Bullish Wolf Wave Aur Forex Trading:- Bullish Wolf Wave ek powerful tool hai jo traders ko early reversal indications provide karta hai.

- Is pattern ko samajh kar, traders apne technical analysis ko enhance kar sakte hain aur market trends ko sahi taur par interpret karke apne trading strategies ko refine kar sakte hain.

5.2 Faisla:- Pakistan ki chat language mein, traders ko ye malumat hasil karna zaroori hai ke Bullish Wolf Wave ka sahi taur par istemal kaise karna hai.

- Is pattern ko samajhne ke liye traders ko constant learning aur apne experiences ko share karna chahiye, taki unki trading journey mein behtar taur par agay barha ja sake.

6. Conclusion:

Pakistan ki chat language mein, traders ko ye samajhna zaroori hai ke Bullish Wolf Wave unke trading decisions mein kaise madadgar ho sakta hai. Is pattern ko samajh kar, traders apne trading decisions ko improve kar sakte hain aur market mein hone wale reversals ko sahi taur par anticipate karke apne trading strategies ko optimize kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

What is the bullish wolf wave chart pattern?

Bullish Wolf Wave ek technical analysis chart pattern hai jo ke market mein aane wale taqatwar tezi ko darust karti hai. Is pattern ki pehchaan karnay ke liye traders ko market ke price charts par dhyan dena hota hai, aur isko samajhna unhein future price movements mein madad karti hai. Is pattern ka naam "Wolf Wave" is liye hai kyunki yeh ek wolf ki tarah hoti hai, jise dekh kar traders ko market ke behavior mein tabdili anay ka andesha hota hai.

Bullish Wolf Wave Kya Hai?

Bullish Wolf Wave ek chart pattern hai jo market mein tezi ke signals deta hai. Is pattern ko samajhne ke liye, traders ko price charts par dhyan dena hota hai, jismein kuch specific peaks aur troughs ko note karna zaroori hota hai. Bullish Wolf Wave mein, price chart par aik sequence hota hai jismein market ki tezi ko represent karnay wale peaks aur troughs hote hain. Jab ye sequence ban jata hai, to traders ko ye samajh aata hai ke market mein taqatwar tezi anay wali hai.

Bullish Wolf Wave Ki Pechaan Kaise Hoti Hai?

Bullish Wolf Wave ko pehchanne ke liye traders ko price charts par kuch specific features par dhyan dena hota hai. Ismein kuch peaks aur troughs aise hote hain jo ek particular angle par milte hain, jise traders "wolf teeth" kehte hain. Ye pattern ek aam wolf ke daant ki tarah hota hai, is liye iska naam Bullish Wolf Wave rakha gaya hai.

Bullish Wolf Wave Trading Strategy:

Bullish Wolf Wave ko samajh kar traders iska istemal apni trading strategy mein shamil kar sakte hain. Is pattern ki madad se wo market ke future movements ko predict kar sakte hain aur apne trades ko sahi samay par execute kar sakte hain. Lekin, har ek trading strategy ki tarah, Bullish Wolf Wave bhi risk ke saath aata hai, aur traders ko market conditions ka dhyan rakhna zaroori hai.

Conclusion:

Bullish Wolf Wave ek powerful chart pattern hai jo traders ko market ke future movements ka andesha dene mein madad karta hai. Is pattern ko samajh kar, traders apne tijarat mein behtareen faislay karne mein safalta pa sakte hain. Lekin, iski sahi pehchaan aur istemal ke liye, traders ko market ke dynamics ko samajhne aur constant learning par focus rakhne ki zaroorat hoti hai. -

#8 Collapse

**Bullish Wolf Wave Chart Pattern Kya Hai?**

Bullish Wolf Wave chart pattern ek technical analysis tool hai jo market ke price movements ko predict karne aur trading opportunities ko identify karne mein madad karta hai. Yeh pattern Bill Wolfe ke dwara develop kiya gaya tha aur isse traders ko bullish trends aur potential reversals ke signals milte hain. Is post mein, hum Bullish Wolf Wave pattern ke features, formation aur forex trading mein iski importance ko detail mein discuss karenge.

**Bullish Wolf Wave Pattern Ki Pehchaan:**

1. **Pattern Ka Formation:**

- **Description:** Bullish Wolf Wave pattern ek five-wave formation hota hai jo bearish trend ke baad bullish reversal ko signal karta hai. Is pattern mein paanch waves hoti hain: Wave 1 (initial decline), Wave 2 (retracement), Wave 3 (further decline), Wave 4 (minor recovery), aur Wave 5 (final decline before reversal). Yeh pattern market ke price swings ko represent karta hai aur potential bullish reversal points ko highlight karta hai.

- **Characteristics:** Bullish Wolf Wave pattern ko identify karne ke liye, waves ki sequence aur unki positioning ko dekha jata hai. Wave 1 aur Wave 3 market ke key declines ko represent karte hain, jabke Wave 2 aur Wave 4 price ke minor recoveries ko show karte hain. Wave 5 ke baad, pattern completion ke signals milte hain jo bullish reversal ko indicate karte hain.

2. **Pattern Ka Significance:**

- **Description:** Bullish Wolf Wave pattern ka main significance bearish trend ke baad bullish reversal ko signal karna hai. Jab yeh pattern complete hota hai aur Wave 5 ke baad bullish signal milta hai, to yeh traders ko market ke upward movement ke potential ke bare mein alert karta hai. Is pattern ka formation market ke buying pressure ke increase aur selling pressure ke decrease ko highlight karta hai.

**Bullish Wolf Wave Pattern Ka Forex Trading Main Use:**

1. **Entry Points:**

- **Description:** Bullish Wolf Wave pattern ko identify karne ke baad, traders entry points ke liye Wave 5 ke completion ke baad buy positions open kar sakte hain. Jab pattern complete hota hai aur Wave 5 ke baad bullish reversal signal milta hai, to yeh market ke upward momentum ko indicate karta hai. Entry points ko carefully evaluate karna zaroori hota hai taake profit opportunities ko maximize kiya ja sake.

2. **Stop-Loss Aur Take-Profit Levels:**

- **Description:** Bullish Wolf Wave pattern ke sath trading karte waqt stop-loss aur take-profit levels ko set karna zaroori hota hai. Stop-loss ko pattern ke Wave 1 ke low ke neeche set kiya jata hai, jisse market ke unexpected movement se protection milti hai. Take-profit levels ko pattern ke expected price targets ke around set kiya jata hai.

3. **Confirmation Signals:**

- **Description:** Bullish Wolf Wave pattern ke signals ko confirm karne ke liye, traders additional technical indicators ka use karte hain. Agar pattern ke formation ke baad volume increase hota hai aur momentum indicators bullish signals dete hain, to pattern ka signal zyada reliable hota hai. Confirmation signals pattern ki accuracy ko enhance karte hain aur trading decisions ko improve karte hain.

4. **Market Conditions Aur Sentiments:**

- **Description:** Bullish Wolf Wave pattern ko market conditions aur sentiments ke sath bhi analyze kiya jata hai. Agar yeh pattern ek strong bearish trend ke baad form hota hai aur market sentiment bullish hai, to pattern ka signal zyada strong hota hai. Traders market ke overall trend aur news events ko bhi consider karte hain.

**Conclusion:**

Bullish Wolf Wave pattern forex trading mein ek valuable tool hai jo bearish trend ke baad bullish reversal signals ko accurately identify karne mein madad karta hai. Is pattern ke waves aur formation ko samajhkar, traders effective entry aur exit points, stop-loss aur take-profit levels ko strategically plan kar sakte hain. Bullish Wolf Wave pattern ko other technical indicators aur market conditions ke sath combine karke use karna trading strategies ko enhance kar sakta hai aur traders ko informed trading decisions lene mein help karta hai. Yeh pattern market ke fluctuations ko track karne aur profitable trading opportunities identify karne mein key role play karta hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Bullish Wolf Wave Chart Pattern Kya Hai?

Bullish Wolf Wave ek technical analysis pattern hai jo price movements ko predict karne ke liye use hota hai. Ye pattern ek specific sequence of waves ko represent karta hai jo typically ek bullish (upar ki taraf) trend ke indicator ke tor par dekha jata hai. Is pattern ko samajhna aur identify karna traders ke liye kaafi helpful ho sakta hai, khaaskar jab wo market me entry aur exit points decide kar rahe hote hain.

#### Pattern Ki Structure

Bullish Wolf Wave pattern mein paanch distinct waves hoti hain:

1. **First Wave (W1)**: Ye wave pattern ka starting point hoti hai, jahan se market ek initial upward move dekhta hai. Ye move zyada strong nahi hota aur market ek choti si rally ke baad thoda sa consolidate kar sakta hai.

2. **Second Wave (W2)**: Is wave mein, market pehle wave ki upward move ke baad thodi si correction dekhti hai. Ye correction wave W1 ke low se zyada nahi girti, aur is wave ke end tak market phir se upar ki taraf move karti hai.

3. **Third Wave (W3)**: Ye wave pattern ki sabse important aur longest wave hoti hai. Is wave mein, market ek strong upward trend ko follow karti hai aur price ko significant levels tak push karti hai. Wave W3 ka end W1 ke high ke upar hota hai.

4. **Fourth Wave (W4)**: Is wave mein, market ek consolidation ya minor correction dekhti hai. Wave W4, W2 ki tarah hota hai, lekin ye wave W3 ke high se thoda niche hoti hai. Is wave ke dauran, market thoda sideway movement kar sakti hai.

5. **Fifth Wave (W5)**: Ye final wave hoti hai jo market ko ek final upward push provide karti hai. Wave W5 ka end W3 ke high se zyada hota hai, aur is wave ke end tak market ek strong bullish trend ko complete karti hai.

#### Pattern Ki Characteristics

Bullish Wolf Wave pattern ki kuch khas characteristics hoti hain:

- **Wave Proportions**: Waves ki proportions aur lengths market ki behavior ko predict karne mein madadgar hoti hain. Typicaly, Wave W3 longest aur Wave W4 shortest hoti hai.

- **Trend Confirmation**: Pattern tab confirm hota hai jab Wave W5 complete hoti hai aur price ne ek strong upward move dekha hota hai. Ye confirmation trend continuation ke liye signal hota hai.

- **Volume Analysis**: Volume analysis bhi is pattern ka ek important aspect hai. Volume ka increase Wave W3 aur W5 ke dauran bullish trend ko support karta hai.

#### Pattern Ki Usage

Traders is pattern ko identify karne ke liye charts pe attention dete hain aur price action ko closely observe karte hain. Pattern ke confirm hone par, traders entry points ko decide kar sakte hain aur risk management strategies apply kar sakte hain. Is pattern ka use karte waqt, stop-loss orders aur profit targets define karna zaroori hota hai taake unexpected market movements se bachaa ja sake.

#### Conclusion

Bullish Wolf Wave chart pattern ek effective tool hai jo market ke bullish trends ko predict karne mein madad karta hai. Ye pattern price action aur wave structure ko analyse karke future price movements ko anticipate karta hai. Traders is pattern ko apne trading strategy mein incorporate karke market trends ka faida utha sakte hain aur apne trading decisions ko enhance kar sakte hain.

-

#10 Collapse

**Bullish Wolf Wave Chart Pattern Kya Hai?**

Bullish Wolf Wave Chart Pattern ek technical analysis pattern hai jo forex aur stock markets mein price movements ko predict karne ke liye use hota hai. Ye pattern ek specific structure ko follow karta hai aur isse traders ko future price movements ka idea milta hai.

**Pattern Ki Pehchaan**

Bullish Wolf Wave Pattern ko pehchaan na thoda mushkil ho sakta hai kyunki ye ek complex pattern hota hai jo chaar major waves ko include karta hai: Wave 1, Wave 2, Wave 3, aur Wave 4. Pattern ka formation typically ek downward trend ke baad hota hai aur iski pehchaan se traders ko price reversal ka signal milta hai.

**Pattern Ka Formation**

1. **Wave 1**: Ye wave ek downward movement hoti hai jo price ko ek lower point tak le jaati hai. Is wave ke baad price thodi recovery dikhaati hai, lekin purani low se thodi upar hoti hai.

2. **Wave 2**: Is wave mein price phir se girti hai aur pehli wave ke low se neeche nahi girti. Yeh ek lower low banati hai aur market ko aur bhi bearish bana deti hai.

3. **Wave 3**: Wave 3 market mein ek strong upward movement dikhaati hai. Ye wave apne previous highs ko break karti hai aur price ko higher levels par le jaati hai. Yeh wave pattern ka sabse significant wave hoti hai.

4. **Wave 4**: Wave 4 ek correction phase hota hai jahan price thodi girti hai, lekin yeh wave apne previous high ko nahi todti. Is phase ke dauran market consolidation dikhaati hai.

**Pattern Ki Characteristics**

- **Support aur Resistance**: Bullish Wolf Wave Pattern mein support aur resistance levels ko identify karna zaroori hota hai. Wave 4 ke high ke upar price break karne se ek bullish signal milta hai, jo pattern ke successful completion ka indication hota hai.

- **Volume Analysis**: Pattern ke formation ke dauran volume ka analysis bhi important hai. Wave 3 ke dauran volume zyada hona chahiye, jo bullish momentum ko support karta hai.

- **Risk Management**: Pattern ko follow karte waqt risk management bhi zaroori hai. Traders ko stop-loss orders place karne chahiye takay unexpected market movements se bachaa ja sake.

**Trading Strategy**

Bullish Wolf Wave Pattern ke basis par trading strategy banate waqt, traders ko price action aur technical indicators ko combine karna chahiye. Jab pattern complete hota hai aur price Wave 4 ke high ko break karti hai, tab buy signal generate hota hai. Traders ko iske sath volume increase aur other technical indicators jaise Moving Averages, RSI, ya MACD ko bhi dekhna chahiye.

**Conclusion**

Bullish Wolf Wave Chart Pattern ek powerful tool hai jo market ke reversal points ko identify karne mein madad karta hai. Yeh pattern market ke momentum aur price action ko samajhne mein traders ki madad karta hai aur unhe profitable trading decisions lene mein assist karta hai. Lekin, is pattern ko use karte waqt proper risk management aur technical analysis ki practice zaroori hai, taake potential losses ko minimize kiya ja sake aur trading profits ko maximize kiya ja sake.

-

#11 Collapse

# Bullish Wolf Wave Chart Pattern Kya Hai?

Bullish Wolf Wave chart pattern ek technical analysis tool hai jo traders ko market ke reversal points aur price movements ko samajhne mein madad karta hai. Yeh pattern khas tor par bullish market trends mein dekha jata hai aur yeh traders ko potential buying opportunities identify karne mein madad karta hai. Is post mein, hum bullish Wolf Wave pattern ki pehchaan, formation, aur trading strategies par nazar dalenge.

### Formation

Bullish Wolf Wave pattern chaar main waves par mabni hota hai, jo aapas mein interconnected hote hain. Is pattern ki khasiyat yeh hai ke yeh market ki psychology aur price action ko darshata hai. Yeh pattern kuch is tarah se banta hai:

1. **Wave 1**: Yeh initial upward movement hoti hai, jo market ko bullish trend ki taraf le jaati hai.

2. **Wave 2**: Is wave ke doran price thodi girti hai, lekin yeh pehli wave ki low se upar hoti hai. Yeh wave market mein uncertainty ka signal hota hai.

3. **Wave 3**: Is wave mein price phir se barh kar previous high ko cross karti hai. Yeh wave bullish momentum ko darshati hai.

4. **Wave 4**: Yeh wave price ko phir se thoda ghatati hai, lekin yeh wave bhi pehli wave ki low se upar hoti hai.

Pattern ka completion tab hota hai jab price Wave 4 se upar nikal kar Wave 5 ki taraf jati hai, jo ke bullish breakout hota hai.

### Characteristics

Bullish Wolf Wave pattern ke kuch khas indicators hain:

- **Symmetry**: Is pattern ki waves ka symmetry hona zaroori hai. Wave 1 aur Wave 3 aksar ek dosre ke barabar hote hain.

- **Time Frames**: Yeh pattern har tarah ke time frames par banta hai, lekin daily ya weekly charts par zyada effective hota hai.

- **Volume**: Wave 3 ke doran volume ka increase hona bullish momentum ko darshata hai, jo pattern ke completion ko confirm karta hai.

### Trading Strategies

1. **Entry Points**: Traders is pattern ke completion ke baad entry points dhoondte hain. Jab price Wave 5 ke upar nikalti hai, toh yeh buying signal hota hai.

2. **Stop Loss**: Risk management ke liye stop loss ko Wave 4 ke low ke neeche rakhna behtar hota hai. Isse unexpected price movements se bachne mein madad milti hai.

3. **Profit Targets**: Profit targets set karte waqt previous resistance levels ya Fibonacci retracement levels ka khayal rakhna chahiye.

### Conclusion

Bullish Wolf Wave chart pattern ek powerful tool hai jo traders ko market ke reversal points aur bullish trends ko samajhne mein madad karta hai. Is pattern ki pehchaan aur iski trading strategies ko samajhkar, aap apne trading decisions ko behtar bana sakte hain. Lekin, kisi bhi trading strategy ko risk management ke sath istemal karna zaroori hai. Agar aap is pattern ko apne trading arsenal mein shamil karte hain, toh aapki trading performance mein sudhar aasani se dekhne ko mil sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Bullish Wolfe Wave Chart Pattern: Forex Trading Mein Ahmiyat**

- **Ta'aruf:**

- Bullish Wolfe Wave chart pattern ek technical analysis pattern hai jo market mein potential reversal ya trend change ka signal deta hai.

- Yeh pattern waves ki form mein banta hai aur market ke low points par is ka dekhna zyada common hai.

- Forex trading mein bullish Wolfe Wave ka use long positions ya buy opportunities identify karne ke liye hota hai.

- **Pattern Ki Structure:**

- **Wave 1 to 2:**

- Pehli wave mein price downtrend mein hota hai, aur ek low point banata hai.

- **Wave 2 to 3:**

- Price temporarily recover karta hai aur thoda upar jata hai, jo wave 2 se wave 3 tak ki movement hoti hai.

- **Wave 3 to 4:**

- Phir se price neeche aata hai, aur ek naya low banata hai, lekin yeh low pehle low (wave 1) se slightly neeche ya barabar hota hai.

- **Wave 4 to 5:**

- Wave 4 se 5 tak price thoda upar recover hoti hai, lekin phir final low banata hai jo reversal ka signal deta hai.

- **Breakout Line:**

- Wave 1 aur Wave 4 ke highs ko connect karne wali ek line hoti hai jise breakout line ya target line kehte hain. Jab price wave 5 ke baad is line ko cross karta hai, toh bullish trend shuru hota hai.

- **Identification Ka Tareeqa:**

- **5 Waves Ka Structure:**

- Bullish Wolfe Wave pattern ka ek khas tareeqa yeh hai ke isme 5 waves hoti hain, jisme price repeatedly neeche aur upar jata hai.

- **Wave 5 Reversal:**

- Jab price wave 5 par pohanchta hai, toh yeh pattern ka end hota hai aur yahan se bullish reversal ka signal milta hai.

- **Breakout Confirmation:**

- Jab price wave 5 ke baad breakout line ke upar jata hai, toh yeh confirmation hota hai ke bullish trend start ho chuka hai.

- **Bullish Wolfe Wave Ki Ahmiyat:**

- **Trend Reversal Indication:**

- Yeh pattern market ke downtrend ke khatam hone aur uptrend ke shuru hone ka signal deta hai.

- Forex trading mein is pattern ka dekhna traders ke liye ek important buy signal hota hai.

- **Accurate Entry Points:**

- Is pattern ka benefit yeh hai ke yeh clear aur well-defined entry points provide karta hai. Jab price wave 5 ke baad breakout karta hai, traders is point par long positions open karte hain.

- **Profit Targets:**

- Is pattern ke saath profit target ko accurately estimate kiya ja sakta hai, kyun ke breakout line (wave 1 se wave 4 ko connect karti hui) target level ka indication deti hai.

- **Forex Trading Mein Use:**

- **Buy Signal:**

- Jab price wave 5 ke baad breakout line ke upar jata hai, toh yeh strong buy signal hota hai. Is waqt forex traders apni long positions enter karte hain.

- **Stop-Loss Placement:**

- Stop-loss ko wave 5 ke lowest point ke neeche lagaya jata hai taake agar price unexpected direction mein jaye, toh loss control mein rahe.

- **Take-Profit Strategy:**

- Profit target breakout line ke qareeb set kiya jata hai. Jab price breakout ke baad apne target tak pohanchti hai, traders apni positions exit kar lete hain.

- **Confirmation Indicators:**

- **Volume Analysis:**

- Jab price wave 5 ke baad breakout karta hai, toh volume mein increase hona chahiye. Agar volume low ho, toh breakout weak ya short-lived ho sakta hai.

- **RSI (Relative Strength Index):**

- RSI indicator se overbought ya oversold conditions ka pata lagaya ja sakta hai, jo pattern ke confirmation mein madad karta hai.

- **Moving Averages:**

- Moving averages ka cross hona bhi ek additional confirmation hota hai ke bullish trend ka signal mil chuka hai.

- **Advantages of Bullish Wolfe Wave:**

- **Early Reversal Identification:**

- Yeh pattern early stage mein trend reversal ko identify karta hai, jo traders ko timely entry ka mauka deta hai.

- **High Accuracy:**

- Is pattern ka accuracy rate high hota hai agar proper analysis aur confirmation ke saath trade kiya jaye.

- **Risk Management:**

- Stop-loss aur breakout points clear hote hain, jisse risk ko effectively manage kiya ja sakta hai.

- **Disadvantages:**

- **Complex Identification:**

- Yeh pattern identify karna beginners ke liye thoda mushkil ho sakta hai, kyun ke iska wave structure accurately samajhna zaroori hai.

- **False Breakouts:**

- Kabhi kabhi market mein false breakouts bhi ho sakte hain, jisme price temporary upar jata hai lekin phir wapas neeche aa jata hai.

- **Final Tips:**

- Bullish Wolfe Wave pattern ko samajhne ke liye pehle market ke waves aur price action ko closely monitor karna hota hai.

- Hamesha pattern ko doosray technical indicators, jaise volume aur RSI, ke saath confirm karna chahiye taake false signals se bacha ja sake.

- Proper risk management aur stop-loss strategy ke saath trading karna zaroori hai taake unexpected price movements se loss ko control kiya ja sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:46 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим