Neckline pattern in trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

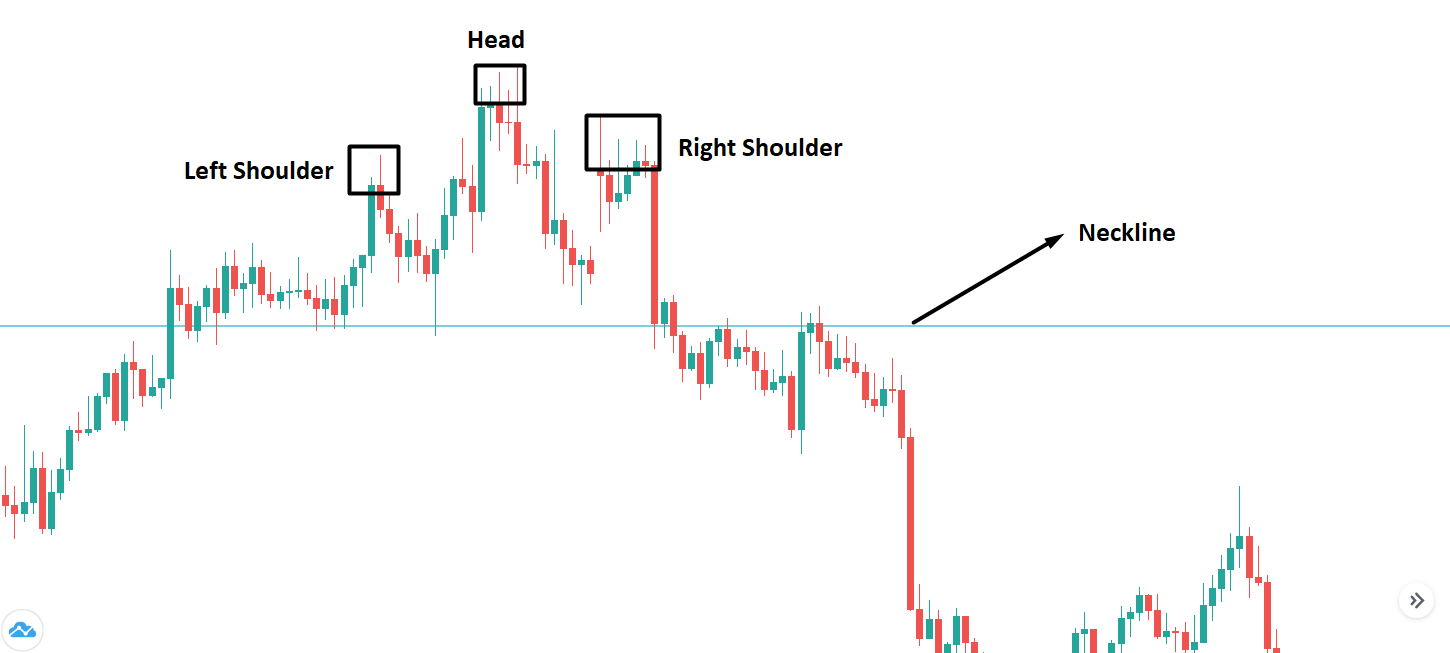

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam members khairiyat se honge aur mujhe ummid hai ki aap logon ki trade bhi bahut hi acchi ja rahi hogi bhai aur bahanon aap jitni jyada trade per focus karenge utani jyada aap profit Kama sakenge aur aap logon ko chahie ki jyada se jyada mehnat Karen aapki mehnati aapko unchai tak pahuncha sakti hai kyunki mehnat Karne wale Ki mehnat kabhi bhi Jaya Nahin jaati to main aapko Aaj jis topic ke bare mein bata rahi hai yah Pakistan per ek form ka ek important topic Hai is topic ko jitne jyada aap samjhenge isko follow karenge utna hi aapke liye fayda hoga to ham is topic per baat karte hain shukriya Neckline pattern neck line eik asi pattern hai jis me market ki movement ka pata chal sakta hai ye market ki movement ko show krny k liye graph p Ek point hota hai.Support aur resitk darmiyan ek pattern bantam hai jisy neck line kaha jata hai ye head and shoulder draw moles med bantam hwi jab market me trend neck line sy oper Chala jata hai to us me twist l sance no hoty ye continuously oper hi jata hai.neckline use Waqt Banti Hai Jab market double top ya fir double bottom create kar raha ho ya pher Head and shoulders pattern create kar raha ho is Surat ke andar neckline Ham draw kar k Ek bahut acche entry Lekar profit Hasil kar sakte hain.neck line trend line ke sath he hote hy.The neckline aik h level hota ha support or resistance ka jo ap head and shoulders pattern on dekh sakbty han jo traders use krty han to determine strategic areas for placing orders. Jab price rises above neckline ja rhi hoti han or usk bad us ma reversal trend ni hota us ma continues rehta ha usy neck line kaha jata ha.deckline pattern Ek bahut hi easy pattern hota hai jismein just aap ko do candlesticks ke bad pata chal jata hai ki yah neckline pattern banne ja raha hai.Agar market Upar ko movement kar rahi hai aur uske bad aap dekhte hain ki candles neckline banaa children Hain To iska matlab yah hota hai ki Iske bad market Apna trend continue Rakhe ki aur aur Majid Top hi move Karegi aur Agar market down move kar rahi hai aur Iske bad candles neckline patterns banaa children Hain To iska matlab yah hota hai ki market apni move ko continue Rakhegi aur Iske bad uski next move bhi down hi Hogi.market Mein jitni bhi candlestick hoti hai vah aapko bahut acche tarike se market ki next move ko show kar rahi hoti hai isliye aapko chahie ki aap in ko properly learn Karen Taki aap market ko aasani ke sath samajhne ki situation Mein a jaen jab tak aap ine ko acchi Tarah Nahin samajh lete aap kabhi bhi acchi trading nahin kar sakte isliye cleavage ki importance Se Koi Banda Inkar nahin kar sakta Work with a neckline neckline pattern ban jata hai to Uske bad market Ek Dafa Apna gap zarur pura karti hai aur ismein 80 percent chance Hote Hain Ki market Apna gap recovery karne ke bad apni movement ko continue rakhen Jaise ke aapko Maine bataya hai ki neckline Hamesha continue trend Mein banti hai aur just wo Apna gap recover karne ke liye Thodi Si reverse movement kar sakti hai to is situation Mein aapane Koi Bhi wrong decision Nahin lena. Support aur resitk darmiyan ek pattern bantam hai jisy neck line kaha jata hai ye head and shoulder draw moles med bantam hwi jab market me trend neck line sy oper Chala jata hai to us me reversal l sance no hoty ye continuously oper hi jata hai.Forex trading chart py jub bhi head and shoulders pattern bnta nazar ay aor usky head ky opposite side py lower side jo straight line bnti hai us ko on neck line kaha jata hai aor yeh zaroori nhi hai ky horizontal he ho wo thori teri bhi ho skti hai apko candlestick chart ko understand krna ana chye candlestick chart ma bajot sari information hoti hain aik one candle bhi market ma apko kafi sari information provide kr skti hai apko market ky bars ma hidden secrets ka ilm hina chye tb he ao achy professional trader bn skty hain. -

#3 Collapse

-

#4 Collapse

-

#5 Collapse

Neckline pattern" ek trading me istemal hone wala pattern hai, jo ki technical analysis ka hissa hota hai, aur yeh pattern trend reversal ya trend continuation ko darust karne me madad karta hai. Neckline pattern ke do pramukh prakar hote hain: Head and Shoulders Pattern (H&S) : Head and Shoulders pattern ek bearish trend reversal pattern hai, jo ki uptrend ke baad dikhta hai. Is pattern me, teen main components hote hain: Left Shoulder: Pehla peak hota hai, jo uptrend ke dauran aata hai.Head: Isme uptrend ke highest peak ko represent karta hai. Right Shoulder : Right shoulder, dobara se ek peak hota hai, lekin is peak ka height head ke peak se kam hota hai.In teen components ko ek neckline se jodte hain, jo ek horizontal line hoti hai aur left shoulder aur right shoulder ke lows ko connect karti hai. Agar price neckline ko break kar ke neeche girta hai, toh yeh ek bearish trend reversal signal hota hai aur traders sell positions le sakte hain. Inverse Head and Shoulders Pattern (Inverse H&S): Inverse Head and Shoulders pattern ek bullish trend reversal pattern hai, jo ki downtrend ke baad dikhta hai. Is pattern me bhi teen main components hote hain: Left Shoulder: Pehla dip hota hai, jo downtrend ke dauran aata hai.Head: Isme downtrend ke lowest dip ko represent karta hai. Right Shoulder: Right shoulder, dobara se ek dip hota hai, lekin is dip ka height head ke dip se kam hota hai.In teen components ko ek neckline se jodte hain, jo ek horizontal line hoti hai aur left shoulder aur right shoulder ke highs ko connect karti hai. Agar price neckline ko break kar ke upar chadhta hai, toh yeh ek bullish trend reversal signal hota hai aur traders buy positions le sakte hain.Neckline pattern ko samajhne ke liye, traders ko iske components aur price action ko dhyan se dekhna hota hai. Is pattern ko confirm karne ke liye, doosre technical indicators aur tools ka bhi istemal kiya jata hai. Is pattern ka istemal kisi bhi trading decision se pehle thorough analysis aur risk management ke saath karna chahiye, kyun ki market me kisi bhi samay par kathinayein ho sakti hain. -

#6 Collapse

NECKLINE CANDLESTICK PATTERN:-Neckline Candlestick pattern ya Bullish Engulfing pattern ka istemal trading mein trend reversals ki pehchan ke liye kiya jata hai. Agar aapko mazeed tafseelat chahiye to yeh cheezein yaad rakhna ahem hai: NECKLINE CANDLESTICK PATTERN KY FATORS:- Pehla Candlestick (Bearish Candle): Is candlestick mein asset ki price gir rahi hoti hai. Yani ke, opening price se closing price kam hoti hai. Yeh candle bearish sentiment ko darust karta hai, matlab ke sellers dominate kar rahay hain. Dusra Candlestick (Bullish Candle): Dusra candlestick pehle candlestick ko engulf kar leta hai, yani ke iski body pehli candlestick ki body ko puri tarah se cover karti hai. Ismein asset ki price upar jaati hai aur closing price opening price se zyada hoti hai. Yeh bullish sentiment ko indicate karta hai, matlab ke buyers ab dominate kar rahay hain aur price mein reversal hone ki sambhavna hai. NECKLINE CANDLESTICK PATTERN KY USES:-Neckline Candlestick pattern ya Bullish Engulfing pattern ka istemal trading mein trend reversals ki pehchan ke liye kiya jata hai. Agar aapko mazeed tafseelat chahiye to yeh cheezein yaad rakhna ahem hai: Confirmation: Neckline Candlestick pattern ko sirf ek candlestick formation ki bunyad par istemal mat karen. Hamesha market analysis aur dusri technical indicators ki madad se ise confirm karen. Dusri indicators jaise ke RSI, MACD, ya moving averages ko bhi istemal karen taake aapke decision ki tasdeeq ho. Stop Loss: Har trading decision ke sath ek stop loss order set karen. Stop loss aapko nuksan se bachata hai agar market aapke khilaf chala gaya. Yeh aapke risk ko manage karne mein madadgar hota hai. Risk Management: Apne trading positions ke liye ek risk management strategy banayen. Aapne kitna paisa har trade par lagaya hai aur kitna nuksan bardasht kar sakte hain, yeh samajhna ahem hai. Practice: Kabhi bhi naye trading patterns ka istemal karna sekhne mein waqt lag sakta hai. Demo trading account istemal kar ke ya paper trading se practice karen taake aap is pattern ko samajh sakein. Market Analysis: Market conditions ko samajhna bhi zaroori hai. News, economic events, aur overall market trend ko monitor karen. Market fundamentals aur sentiment bhi ahem hoti hain. Psychology: Khud ki trading psychology ko samjhen. Emotions ko control karna trading mein ahem hota hai. Gharoor se bachen aur hamesha disciplined rahein. Neckline Candlestick pattern ek powerful tool ho sakti hai agar sahi tarike se istemal ki jaye, lekin yeh kisi bhi trading decision ka hissa hoti hai. Isliye, sabr aur istemal sekhne mein waqt lagayen aur hamesha apne financial goals aur risk tolerance ke mutabik trading karen.

NECKLINE CANDLESTICK PATTERN KY USES:-Neckline Candlestick pattern ya Bullish Engulfing pattern ka istemal trading mein trend reversals ki pehchan ke liye kiya jata hai. Agar aapko mazeed tafseelat chahiye to yeh cheezein yaad rakhna ahem hai: Confirmation: Neckline Candlestick pattern ko sirf ek candlestick formation ki bunyad par istemal mat karen. Hamesha market analysis aur dusri technical indicators ki madad se ise confirm karen. Dusri indicators jaise ke RSI, MACD, ya moving averages ko bhi istemal karen taake aapke decision ki tasdeeq ho. Stop Loss: Har trading decision ke sath ek stop loss order set karen. Stop loss aapko nuksan se bachata hai agar market aapke khilaf chala gaya. Yeh aapke risk ko manage karne mein madadgar hota hai. Risk Management: Apne trading positions ke liye ek risk management strategy banayen. Aapne kitna paisa har trade par lagaya hai aur kitna nuksan bardasht kar sakte hain, yeh samajhna ahem hai. Practice: Kabhi bhi naye trading patterns ka istemal karna sekhne mein waqt lag sakta hai. Demo trading account istemal kar ke ya paper trading se practice karen taake aap is pattern ko samajh sakein. Market Analysis: Market conditions ko samajhna bhi zaroori hai. News, economic events, aur overall market trend ko monitor karen. Market fundamentals aur sentiment bhi ahem hoti hain. Psychology: Khud ki trading psychology ko samjhen. Emotions ko control karna trading mein ahem hota hai. Gharoor se bachen aur hamesha disciplined rahein. Neckline Candlestick pattern ek powerful tool ho sakti hai agar sahi tarike se istemal ki jaye, lekin yeh kisi bhi trading decision ka hissa hoti hai. Isliye, sabr aur istemal sekhne mein waqt lagayen aur hamesha apne financial goals aur risk tolerance ke mutabik trading karen. -

#7 Collapse

Nickline candlestick pattern Kya Hy market ki movement ka pata chal sakta hai ye market ki movement ko show krny k liye graph p Ek point hota hai.Support aur resitk darmiyan ek pattern bantam hai jisy neck line kaha jata hai ye head and shoulder draw moles med bantam hwi jab market me trend neck line sy oper Chala jata hai to us me twist l sance no hoty ye continuously oper hi jata hai.neckline use Waqt Banti Hai Jab market double top ya fir double bottom create kar raha ho ya pher Head and shoulders pattern create kar raha ho is Surat ke andar neckline Ham draw kar k Ek bahut acche entry Lekar profit Hasil kar sakte hain.neck line trend line ke sath he hote hy.The neckline aik h level hota ha support or resistance ka jo ap head and shoulders pattern on dekh sakbty han jo traders use krty han to determine strategic areas for placing orders. Jab price rises above neckline ja rhi hoti han or usk bad us ma reversal trend ni hota us ma continues rehta ha usy neck line kaha jata ha.deckline pattern Ek bahut hi easy pattern hota hai jismein just aap ko do candlesticks ke bad pata chal jata hai ki yah neckline pattern banne ja raha hai.Agar market Upar ko movement kar rahi hai aur uske bad aap dekhte hain ki candles neckline banaa children Hain To iska matlab yah hota hai ki Iske bad market Apna trend continue Rakhe ki aur aur Majid Top hi move Karegi aur Agar market down move kar rahi hai aur Iske bad candles neckline patterns banaa children Hain To iska matlab yah hota hai ki market apni move ko continue Rakhegi Formation aur Treading method market Ek Dafa Apna gap zarur pura karti hai aur ismein 80 percent chance Hote Hain Ki market Apna gap recovery karne ke bad apni movement ko continue rakhen Jaise ke aapko Maine bataya hai ki neckline Hamesha continue trend Mein banti hai aur just wo Apna gap recover karne ke liye Thodi Si reverse movement kar sakti hai to is situation Mein aapane Koi Bhi wrong decision Nahin lena. Support aur resitk darmiyan ek pattern bantam hai jisy neck line kaha jata hai ye head and shoulder draw moles med bantam hwi jab market me trend neck line sy oper Chala jata hai to us me reversal l sance no hoty ye continuously oper hi jata hai.Forex trading chart py jub bhi head and shoulders pattern bnta nazar ay aor usky head ky opposite side py lower side jo straight line bnti hai us ko on neck line kaha jata hai aor yeh zaroori nhi hai ky horizontal he ho wo thori teri bhi ho skti hai apko candlestick chart ko understand krna ana chye candlestick chart ma bajot sari information hoti ha -

#8 Collapse

Trading mein "Neckline Pattern" ek ahem technical analysis pattern hai jo market trend ko samajhne aur trading decisions banane mein madadgar hota hai. Ye pattern mainly price charts par dekha jata hai aur traders isay price reversals ke liye istemal karte hain. Neckline Pattern ka asal maqsad market ki direction ko samajhna hai. Ye pattern do main parts se milta hai: "Head and Shoulders" aur "Inverse Head and Shoulders." 1. Head and Shoulders Pattern : Head and Shoulders pattern usually market ki reversal ko represent karta hai. Ismein teen key parts hote hain: - Left Shoulder: Pehla part hota hai jab price ek uptrend ke baad slow down karta hai aur ek minor peak banata hai. Isko left shoulder kehte hain. - Head : Dusra part hota hai jab price ek neeche aata hai aur ek major low point create karta hai, jise head kehte hain. - Right Shoulder : Teesra part hota hai jab price phir se upar jaata hai lekin pehle left shoulder ki level tak nahi pohochta aur phir se neeche aata hai. Isko right shoulder kehte hain. Jab ye teen parts complete hote hain, ek neckline draw ki jati hai jo left shoulder aur right shoulder ke bottoms ko connect karti hai. Agar price neckline ko neeche se upar cross karta hai, to ye ek bearish signal hota hai aur traders sell positions lete hain. 2. Inverse Head and Shoulders Pattern: Inverse Head and Shoulders pattern market ki uptrend ko represent karta hai. Ismein bhi teen key parts hote hain, lekin ye bullish reversal pattern hai: - Left Shoulder: Pehla part hota hai jab price ek downtrend ke baad slow down karta hai aur ek minor low point create karta hai. - Head: Dusra part hota hai jab price ek upar jaata hai aur ek major high point create karta hai. - Right Shoulder: Teesra part hota hai jab price phir se neeche aata hai lekin pehle left shoulder ki level tak nahi pohochta aur phir se upar jaata hai. Jab ye teen parts complete hote hain, ek neckline draw ki jati hai jo left shoulder aur right shoulder ke tops ko connect karti hai. Agar price neckline ko upar se neeche cross karta hai, to ye ek bullish signal hota hai aur traders buy positions lete hain. Neckline Pattern ko samajh kar traders price reversals ko anticipate kar sakte hain. Iske sath hi, volume analysis bhi ahem hoti hai kyunki jab price neckline ko cross karta hai, to trading volume bhi zyada hota hai, jo ek confirmation signal deta hai. Yeh pattern trading mein successful hone ke liye ek acchi understanding aur risk management ki zarurat hoti hai. Traders ko chahiye ke stop-loss orders set karein taki agar trade against ja raha hai to nuksan kam ho sake. Isi tarah se, target levels bhi set kiye ja sakte hain taki traders apne profit ko maximize kar sakein. In conclusion, Neckline Pattern trading mein ek ahem technical analysis tool hai jo price reversals ko predict karne mein madadgar hota hai. Traders ko isko samajhna aur sahi tarah se istemal karna ahem hai, lekin yaad rahe ke koi bhi pattern 100% accurate nahi hota aur risk management bhi zaruri hai. -

#9 Collapse

The neckline pattern trading mein technical analysis mein ek ahem concept hai, khas tor par chart patterns aur potential price reversals ke hawale se. Ye pattern aksar head and shoulders pattern ke saath joda jata hai, jo market ke trend mein ek potential shift ko darust karne ki nishaani hai. Traders neckline pattern ko samajhne par tawajju dete hain kyun ke ye market sentiment mein insights provide karta hai aur unhe potential trading opportunities ka pata lagane mein madad karta hai.

Neckline pattern aam tor par head and shoulders pattern ka hissa hota hai, jo teen peaks se mil kar bana hota hai: a higher peak head aur do lower peaks shoulders. Neckline khud ek trendline hai jo do shoulders ki lows ko jodti hai, jisse price chart par ek horizontal ya thora sa sloping line ban jati hai. Inverted head and shoulders pattern mein, neckline ek support level ka kaam karta hai, jabke regular head and shoulders pattern mein, ye ek resistance level ka kaam karta hai.

Neckline pattern ka psychological significance uski role mein hai jo ek key support ya resistance level ke taur par hoti hai. Inverted head and shoulders pattern mein, neckline ke breakout ke upar se potential bullish reversal indicate karta hai, jo ke strengthening buying pressure ko darust karta hai. Mukhtalif strategies ka istemal hota hai neckline pattern ke sath deal karne mein. Ek common strategy breakout trading hai, jahan traders price ke breakout se pehle wait karte hain aur phir positions enter karte hain.

Kuch traders confirmation ka intezar karte hain trading se pehle, aur wo additional technical indicators ya chart patterns ka dekhte hain jo neckline pattern ke saath align hote hain. Ek aur approach ye hai ke neckline ke breakout ke baad ek pullback ka intezar karna. Ye strategy traders ko allow karta hai ke wo ek behtar price par enter karen agar price neckline-turned-support ya resistance level ko test karne ke liye retrace kare. Neckline pattern trading mein proper risk management ka essential hissa hai. Traders typically stop-loss orders neeche neckline ke long trade mein lagate hain inverted head and shoulders aur upar neckline ke short trade mein lagate hain head and shoulders takay potential losses ko limit kar sakein agar breakout fail ho.

Neckline patterns ke real-life examples trading mein kis tarah kaam karte hain, ye ek clearer understanding provide karte hain. For instance, ek inverted head and shoulders pattern jo bullish reversal ko signal karta hai, traders neckline ke upar long positions enter kar sakte hain ya phir neckline ke pullback par bhi. Conversely, ek head and shoulders pattern jo bearish reversal ko indicate karta hai, traders neckline ke neeche short positions enter kar sakte hain ya phir neckline ke pullback par bhi.

Neckline pattern technical analysis ka ek fundamental aspect hai, khas tor par head and shoulders patterns ke context mein. Traders jo neckline patterns ko kaise identify aur trade karte hain, unka potential opportunities ko spot karne mein aur risk ko manage karne mein improve ho jata hai. Neckline patterns ko aur technical analysis tools aur risk management strategies ke sath combine kar ke, traders various market conditions mein more informed trading decisions le sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#10 Collapse

Neckline pattern trading ki dunia mein ek ahem aur popular tareeqa hai. Ye pattern technical analysis mein istemal hota hai taake traders ko market trends aur price movements ka andaza lagaya ja sake. Neckline pattern, chart patterns mein ek tarah ka head and shoulders pattern hai. Isme, market ka trend pehle bullish hota hai phir ek bearish reversal hota hai, jise ek neckline se darust kiya jata hai.

Neckline pattern mein, pehle bullish trend ke baad ek price peak hota hai jo head kehlaya jata hai. Phir price girne lagti hai aur ek support level create karta hai, jise neckline kehte hain. Jab price neckline ko break karta hai aur niche girne lagta hai, ye ek bearish signal hota hai. Iske baad traders short positions le sakte hain ya existing positions ko close kar sakte hain.

Yeh pattern trading mein istemal karne ke liye zaroori hai ke traders market trends ko samajhne ke liye technical analysis ka sahara lein aur patterns ko sahi dhang se pehchan sakein. Iske alawa, stop-loss orders ka istemal karke risk ko manage karna bhi zaroori hai.

Neckline pattern trading mein ek mukhtasir aur effective tareeqa hai market movements ka analysis karne ka, lekin iske istemal se pehle, traders ko market ki mukhtalif factors ka bhi tafteesh karna chahiye aur apni strategy ko uske mutabiq adjust karna chahiye. -

#11 Collapse

### Neckline Pattern in Trading

**Neckline Pattern** trading mein ek important technical analysis pattern hai jo market trends aur potential reversals ko identify karne mein madad karta hai. Yeh pattern generally "Head and Shoulders" aur "Inverse Head and Shoulders" patterns se associated hota hai, jahan neckline ek critical support ya resistance level ko represent karta hai. Is post mein, hum neckline pattern ke specifications, identification, aur trading strategies ko detail se discuss karenge.

**Neckline Pattern Ki Specifications:**

1. **Definition:**

- **Neckline:** Neckline pattern ek horizontal ya sloping line hoti hai jo head and shoulders ya inverse head and shoulders pattern mein critical support ya resistance level ko define karti hai. Yeh line price action ke major turning points ko connect karti hai.

- **Head and Shoulders Pattern:** Yeh pattern ek bearish reversal pattern hai jahan price three peaks (shoulders aur head) banati hai. Neckline is pattern ka support level hota hai jo pattern ke complete hone par break hota hai.

- **Inverse Head and Shoulders Pattern:** Yeh pattern ek bullish reversal pattern hai jahan price three troughs (shoulders aur head) banati hai. Neckline is pattern ka resistance level hota hai jo pattern ke complete hone par break hota hai.

2. **Pattern Characteristics:**

- **Horizontal Neckline:** Jab neckline horizontal hoti hai, toh yeh ek clear support ya resistance level ko indicate karti hai. Yeh most common form hai jo market reversals ko identify karne mein help karti hai.

- **Sloping Neckline:** Jab neckline sloping hoti hai, toh yeh gradual trend changes aur trend continuation ko indicate karti hai. Yeh pattern ke direction aur strength ko analyze karne mein madad karti hai.

**Identification:**

1. **Head and Shoulders Pattern:**

- **Formation:** Head and Shoulders pattern mein ek left shoulder, ek head, aur ek right shoulder form hoti hai. Neckline is pattern ka support level hota hai jo head ke formation ke baad establish hota hai.

- **Breakout:** Pattern complete hone ke baad, jab price neckline ko break karti hai, tab bearish reversal signal generate hota hai.

2. **Inverse Head and Shoulders Pattern:**

- **Formation:** Inverse Head and Shoulders pattern mein ek left shoulder, ek head, aur ek right shoulder form hoti hai. Neckline is pattern ka resistance level hota hai jo head ke formation ke baad establish hota hai.

- **Breakout:** Pattern complete hone ke baad, jab price neckline ko break karti hai, tab bullish reversal signal generate hota hai.

**Trading Strategy:**

1. **Entry Points:**

- **Head and Shoulders:** Head and Shoulders pattern ke baad, neckline break hone par sell positions open ki jati hain. Entry point neckline ke break ke sath hota hai, aur confirmatory bearish candlestick patterns ke sath bhi consider kiya jata hai.

- **Inverse Head and Shoulders:** Inverse Head and Shoulders pattern ke baad, neckline break hone par buy positions open ki jati hain. Entry point neckline ke break ke sath hota hai, aur confirmatory bullish candlestick patterns ke sath bhi consider kiya jata hai.

2. **Stop-Loss Aur Take-Profit:**

- **Stop-Loss:** Stop-loss order ko neckline ke opposite side par set kiya jata hai. Head and Shoulders pattern ke liye, stop-loss ko neckline ke upar aur Inverse Head and Shoulders pattern ke liye neckline ke niche place kiya jata hai.

- **Take-Profit:** Take-profit targets ko pattern ke height ke basis par calculate kiya jata hai. Pattern ke formation ke height ko measure karke potential price move ko determine kiya jata hai.

3. **Risk Management:**

- **Position Sizing:** Position sizing aur risk management principles ko follow karke trades execute kiye jate hain. Risk-reward ratio ko evaluate karke trades ki profitability aur risk ko balance kiya jata hai.

- **Confirmation Signals:** Neckline pattern ke confirmation signals, jaise additional technical indicators aur market sentiment analysis, ko consider kiya jata hai.

**Practical Application:**

1. **Chart Analysis:**

- **Historical Data:** Historical price charts ko analyze karke neckline patterns ki occurrence aur effectiveness ko assess kiya jata hai. Previous patterns se pattern ki reliability aur accuracy ko evaluate kiya jata hai.

- **Combining Indicators:** Neckline patterns ko other technical indicators, jaise Moving Averages aur RSI, ke sath combine karke comprehensive trading strategies develop ki jati hain.

2. **Market Context:**

- **Economic News:** Market ke economic news aur events ko consider karna zaroori hai, jo price action aur pattern formation ko impact kar sakte hain. News ke impact ko samajh kar trading decisions ko adjust kiya jata hai.

**Conclusion:**

**Neckline Pattern** trading mein ek key technical analysis tool hai jo market trends aur reversals ko identify karne mein madad karta hai. Accurate identification aur pattern confirmation ke sath, traders effective trading decisions le sakte hain aur potential market reversals ko capitalize kar sakte hain. Proper risk management aur stop-loss placement ke sath, neckline patterns ko successful trading strategies mein integrate kiya ja sakta hai.

-

#12 Collapse

### Neckline Pattern in Trading: Ek Jaiza

Neckline pattern trading ki duniya mein ek important technical analysis tool hai. Ye pattern aksar reversal patterns ke saath jura hota hai, jaise double tops aur double bottoms. Is post mein hum neckline pattern ki definition, formation, aur trading strategies par tafseel se baat karenge.

**1. Neckline Kya Hai?**

Neckline wo horizontal line hai jo price chart par support ya resistance levels ko darshata hai. Is pattern ka istemal traders market ke potential reversals ko samajhne ke liye karte hain. Neckline ko samajhne se traders ko entry aur exit points tay karne mein madad milti hai.

**2. Formation Kaise Hoti Hai?**

Neckline pattern ki formation kuch specific scenarios par depend karti hai:

- **Double Top Pattern:**

Jab price chart par do peaks bante hain, to necklin banata hai jo do tops ke beech hota hai. Ye resistance level darshata hai. Jab price is neckline ko break karti hai, to ye bearish reversal signal hota hai.

- **Double Bottom Pattern:**

Is case mein do troughs ya lows bante hain, aur neckline unke beech hoti hai. Ye support level darshata hai. Jab price is neckline ko upar ki taraf break karti hai, to ye bullish reversal signal hota hai.

**3. Importance of Neckline Pattern:**

Neckline pattern ki importance iski ability mein hai market ke reversal signals ko samajhne mein. Jab price neckline ko break karti hai, to ye ek strong indication hota hai ke market trend change hone wala hai. Is pattern ka istemal kar ke traders apne trades ko sahi time par enter ya exit kar sakte hain.

**4. Trading Strategy:**

Neckline pattern ka istemal karte waqt kuch important strategies ko madde nazar rakhna chahiye:

- **Confirmation:**

Aapko neckline break hone ka intezar karna chahiye. Confirmation ke liye aapko next candle ka observation karna hoga. Agar candle neckline ko strongly break karti hai, to ye signal hota hai ke trend change hone wala hai.

- **Stop-Loss Orders:**

Risk management ke liye stop-loss orders lagana zaroori hai. Agar aap double top pattern ke case mein trade kar rahe hain, to stop-loss ko last peak ke upar set karein, taake market ke against movements se bachein.

- **Target Levels:**

Profit targets tay karte waqt previous support ya resistance levels ko dekhna na bhoolen. Ye aapko realistic profit targets achieve karne mein madad dega.

**5. Conclusion:**

Neckline pattern trading ke liye ek ahem tool hai jo market ke potential reversals ko samajhne mein madad karta hai. Is pattern ko sahi tarike se samajh kar aur confirmation signals ka intezar karke, aap effective trading decisions le sakte hain. Hamesha risk management aur emotional control ka khayal rakhein, taake aap apne trading outcomes ko behtar bana sakein. Agar aap neckline pattern ko apne trading strategies mein shamil karte hain, to ye aapki overall trading performance ko behtar bana sakta hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

NICKLINE PATTERN IN TRAINING

NICKLINE PATTERN IN TRAINING potential bullish reversal indicate karta hai, jo ke

strengthening buying pressure ko darust karta hai. Mukhtalif strategies ka istemal hota hai neckline pattern ke sath deal karne mein. Ek common strategy breakout trading hai, jahan traders price ke breakout se pehle wait karte hain aur phir positions enter karte hain.

Kuch traders confirmation ka intezar karte hain trading se pehle, aur wo additional technical indicators ya chart patterns ka dekhte hain jo neckline pattern ke saath align hote hain. Ek aur approach ye hai ke neckline ke breakout ke baad ek pullback ka intezar karna. Ye strategy traders ko allow karta hai ke wo ek behtar price par enter karen agar price neckline-turned-support ya resistance level ko test karne ke liye retrace kare. Neckline pattern trading mein proper risk management ka essential hissa hai. Traders typically stop-loss orders neeche neckline ke long trade mein lagate hain inverted head and shoulders aur upar neckline ke short trade mein lagate hain head and shoulders takay potential losses ko limit kar sakein agar breakout fail ho.

Neckline patterns ke real-life examples trading mein kis tarah kaam karte hain, ye ek clearer understanding provide karte hain. For instance, ek inverted head and shoulders pattern jo bullish reversal ko signal karta hai, traders neckline ke upar long positions enter kar sakte hain ya phir neckline ke pullback par bhi. Conversely, ek head and shoulders pattern jo bearish reversal ko indicate karta hai, traders neckline ke neeche short positions enter kar sakte hain ya phir neckline ke pullback par bhi.

Neckline pattern technical analysis ka ek fundamental aspect hai, khas tor par head and shoulders patterns ke context mein. Traders jo neckline patterns ko kaise identify aur trade karte hain, unka potential opportunities ko spot karne mein aur risk ko manage karne mein improve ho jata hai. Neckline patterns ko aur technical analysis tools aur risk management strategies ke sath combine kar ke, traders various market conditions mein more informed trading decisions le sakte hain. In tu tha very

no hoty ye continuously oper hi jata hai.neckline use Waqt Banti Hai Jab market double top ya fir double bottom create kar raha ho ya pher Head and shoulders pattern create kar raha ho is Surat ke andar neckline Ham draw kar k Ek bahut acche entry Lekar profit Hasil kar sakte hain.neck line trend line ke sath he hote hy.The neckline aik h level hota ha support or resistance ka jo ap head and shoulders pattern on dekh sakbty han jo traders use krty han to determine strategic areas for placing orders. Jab price rises above neckline ja rhi hoti han or usk bad us ma reversal trend ni hota us ma continues rehta ha usy neck line kaha jata ha.deckline pattern Ek bahut hi easy pattern hota hai jismein just aap ko do candlesticks ke bad pata chal jata hai ki yah neckline pattern banne ja raha hai.Agar market Upar ko movement kar rahi hai aur uske bad aap dekhte hain ki candles neckline banaa children Hain To iska matlab yah hota hai ki Iske bad market Apna trend continue Rakhe ki aur aur Majid Top hi move Karegi aur Agar market down move kar rahi hai aur Iske bad candles neckline patterns banaa children Hain To iska matlab yah hota hai ki market apni move ko continue Rakhegi Formation aur Treading method market Ek Dafa Apna gap zarur pura karti hai aur ismein 80 percent chance Hote Hain Ki market Apna gap recovery karne ke bad apni movement ko continue rakhen Jaise ke aapko Maine bataya hai ki neckline Hamesha continue trend Mein banti hai aur just wo Apna gap recover karne ke liye Thodi Si reverse movement kar sakti hai to is situation Mein aapane Koi Bhi wrong decision Nahin lena. Support aur resitk darmiyan ek pattern bantam hai jisy neck line kaha jata hai ye head and shoulder draw moles med bantam hwi jab market me trend neck line sy oper Chala jata hai to us me reversal l sance no hoty ye continuously oper hi jata hai.Forex trading chart py jub bhi head and shoulders pattern bnta nazar ay aor usky head ky opposite side py lower side jo straight line bnti hai us ko on neck line kaha jata hai aor yeh zaroori nhi hai ky horizontal he ho wo thori teri bhi ho skti hai apko candlestick chart ko understand krna ana chye candlestick chart ma bajot sari information hoti ha

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:07 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим