What is Black Hollow pattern in Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Asalam o alikum Dears What is Black Hollow pattern Definition chart par aik khokhli candle plot mojooda baar ke band honay aur mojooda baar ki khuli qeemat ke darmiyan farq aur taajiron ko batata hai ke is ke khilnay ke baad security barh gayi hai. khokhli body wali candle stick jahan qareebi qeemat khuli qeemat ki satah se oopar ho usay taizi candle stick kaha jata hai . Types of Black Hollow pattern khokhli candle stuck charts ki kayi kasmain hain, har aik ki apni munfarid khususiyaat aur khususiyaat hain. khokhli candle stuck charts ki sab se ziyada istemaal shuda aqsam mein shaamil hain : safaid mom batii : aik safaid mom batii aik qisam ki khokhli mom batii hai jo taizi se market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body safaid hai, jis se zahir hota hai ke ikhtitami qeemat iftitahi qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. black candle stuck : black candle stuck aik qisam ki hollow candle stuck hai jo bearish market ki numaindagi ke liye istemaal hoti hai. candle stick ka body kala hai, jis se zahir hota hai ke iftitahi qeemat band honay wali qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. long white candle stuck : aik lambi safaid mom batii aik qisam ki hollow candle stuck hai jo mazboot taizi ki market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par kam hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. lambi siyah mom batii : lambi siyah mom batii aik qisam ki khokhli candle stuck hai jo mazboot bearish market ki numaindagi karne ke liye istemaal hoti hai. Explanation candle stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain .Doji khokhli mom batii ki aik qisam hai jo market mein ghair faisla kin daur ki numaindagi karne ke liye istemaal hoti hai. iftitahi aur ikhtitami qeematein barabar hain, jis ke nateejay mein aik chhota ya ghair mojood jism hota hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. hathora : aik hathora khokhli mom batii ki aik qisam hai jo market mein mumkina taizi ke ulat jane ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur oopri batii jism se lambi hoti hai. nichli batii choti ya ghair mojood hai. yeh patteren batata hai ke bail market par control haasil karna shuru kar rahay hain. hanging mean : hanging mean aik qisam ki hollow candle stuck hai jo market mein mumkina bearish ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur neechay ki batii jism se lambi hoti hai. oopri batii choti ya ghair mojood hai. yeh namona batata hai ke reechh market par control haasil karna shuru kar rahay hain -

#3 Collapse

"Forex mein Black Hollow Pattern Kya Hai?Forex, ya foreign exchange, mein trading karne wale logon ke liye Black Hollow Pattern ek ahem pehchaan hai. Ye ek technical analysis ki strategy hai jo traders use karte hain to predict price movements. Black Hollow Pattern ko candlestick charts ke zariye dekha jata hai.Is pattern mein, candles ka ek specific arrangement hota hai jo market sentiment ko darust taur par represent karta hai. Ye pattern generally bearish hota hai, matlab ke price mein girawat hone ki sambhavna hoti hai.Black Hollow Pattern ke kuch important points hain:1. Ismein kuch specific candlesticks, jaise ki "black marubozu" aur "hanging man," shamil hote hain.2. Yeh pattern market mein selling pressure ko darust taur par darust karta hai.3. Traders is pattern ko price reversals aur trend changes ko samjhne ke liye istemal karte hain.Lekin yaad rahe, Black Hollow Pattern sirf ek tool hai aur is par pura bharosa karke trading nahi kiya jana chahiye. Market volatility aur dusre factors ko bhi madde nazar rakhte hue trading decisions liye jate hain. Isliye, traders ko market analysis aur risk management par bhi dhyan dena chahiye." -

#4 Collapse

INTRUDUCTION OF BLACK HOLLOW CANDLICTICK PATTREN: Dear members of the forex members omeed hy ap sab khariyat sy hoon gy Forex tradings Marketing main black hollow Candlictick Pattren ko kabel istemaal bnaty hei our ye candle stuck charts ki kayi kasmain hain, har aik ki apni munfarid khususiyaat aur khususiyaat hain. khokhli candle stuck charts ki sab se ziyada istemaal shuda aqsam mein shaamil aik safaid mom batii aik qisam ki khokhli mom batii hai jo taizi se market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body safaid hai, jis se zahir hota hai ke ikhtitami qeemat iftitahi qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. black candle stuck : black candle stuck aik qisam ki hollow candle stuck hai jo bearish market ki numaindagi ke liye istemaal hoti hai. candle stick ka body kala hai, jis se zahir hota hai ke iftitahi qeemat band honay wali qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. long white candle stuck : aik lambi safaid mom batii aik qisam ki hollow candle stuck hai jo mazboot taizi ki market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par kam hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. lambi siyah mom lambi siyah mom batii aik qisam ki khokhli candle stuck hai jo mazboot bearish market ki numaindagi karne ke liye istemaal hoti hai.Dear friends Forex trading Marketing Mei black hollow Candlictick Pattren aesa Pattren Hei jo tajir hazraat ko CANDLE ky sath trade kar sakty hen our black hollow Candlictick stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain .Doji khokhli mom batii ki aik qisam hai jo market mein ghair faisla kin daur ki numaindagi karne ke liye istemaal hoti hai. iftitahi aur ikhtitami qeematein barabar hain, jis ke nateejay mein aik chhota ya ghair mojood jism hota hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. hathora : aik hathora khokhli mom batii ki aik qisam hai jo market mein mumkina taizi ke ulat jane ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur oopri batii jism se lambi hoti hai. nichli batii choti ya ghair mojood hai. yeh patteren batata hai ke bail market par control haasil karna shuru kar rahay hain. hanging mean : hanging mean aik qisam ki hollow candle stuck hai jo market mein mumkina bearish ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur neechay ki batii jism se lambi hoti hai. oopri batii choti ya ghair mojood hai. yeh namona batata hai ke reechh market par control haasil karna zoriri hota Hai our yeh Pattren bhot sari kisme start karty wokt gold ko follow karty hen.

-

#5 Collapse

Black Hollow Chart Pattern: Black or Dark candle stuck aik qisam ki empty candle stuck hai jo negative market ki numaindagi ke liye istemaal hoti hai. candle ka body kala hai, jis se zahir hota hai ke iftitahi qeemat band honay wali qeemat se ziyada hai. flame stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. long white flame stuck aik lambi safaid mother batii aik qisam ki empty light stuck hai jo mazboot taizi ki market ki numaindagi karne ke liye istemaal hoti hai. candle ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya peak standard kam hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. lambi siyah mother lambi siyah mother batii aik qisam ki khokhli flame stuck hai jo mazboot negative market ki numaindagi karne ke liye istemaal hoti hai. Forex exchanging Advertising Mei dark empty Candlictick Pattren aesa Pattren Hei jo tajir hazraat ko Light ky sath exchange kar sakty hen our dark empty Candlictick stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya pinnacle standard ziyada hai. light stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hai. iftitahi aur ikhtitami qeematein barabar hain, jis ke nateejay mein aik chhota ya ghair mojood jism hota hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. hathora : aik hathora khokhli mother batii ki aik qisam hai jo market mein mumkina taizi ke ulat jane ki numaindagi karne ke liye istemaal hoti hai. mother batii ka jism chhota hota hai, aur oopri batii jism se lambi hoti hai. nichli batii choti ya ghair mojood hai. yeh patteren batata hai ke bail market standard control haasil karna shuru kar rahay hain. hanging mean : hanging mean aik qisam ki empty candle stuck hai jo market mein mumkina negative ki numaindagi karne ke liye istemaal hoti hai. mother batii ka jism chhota hota hai, Chart Pattern Formation: Trading karne wale logon ke liye Black Hollow Pattern ek ahem pehchaan hai. Ye ek technical analysis ki strategy hai jo traders use karte hain to predict price movements. Black Hollow Pattern ko candlestick charts ke zariye dekha jata hai.Is pattern mein, candles ka ek specific arrangement hota hai jo market sentiment ko darust taur par represent karta hai. Ye pattern generally bearish hota hai, matlab ke price mein girawat hone ki sambhavna hoti hai.Black Hollow Pattern ke kuch important points hain:1. Ismein kuch specific candlesticks, jaise ki "black marubozu" aur "hanging man," shamil hote hain.2. Yeh pattern market mein selling pressure ko darust taur par darust karta hai.3. Traders is pattern ko price reversals aur trend changes ko samjhne ke liye istemal karte hain.Lekin yaad rahe, Black Hollow Pattern sirf ek tool hai aur is par pura bharosa karke trading nahi kiya jana chahiye

Forex exchanging Advertising Mei dark empty Candlictick Pattren aesa Pattren Hei jo tajir hazraat ko Light ky sath exchange kar sakty hen our dark empty Candlictick stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya pinnacle standard ziyada hai. light stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hai. iftitahi aur ikhtitami qeematein barabar hain, jis ke nateejay mein aik chhota ya ghair mojood jism hota hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. hathora : aik hathora khokhli mother batii ki aik qisam hai jo market mein mumkina taizi ke ulat jane ki numaindagi karne ke liye istemaal hoti hai. mother batii ka jism chhota hota hai, aur oopri batii jism se lambi hoti hai. nichli batii choti ya ghair mojood hai. yeh patteren batata hai ke bail market standard control haasil karna shuru kar rahay hain. hanging mean : hanging mean aik qisam ki empty candle stuck hai jo market mein mumkina negative ki numaindagi karne ke liye istemaal hoti hai. mother batii ka jism chhota hota hai, Chart Pattern Formation: Trading karne wale logon ke liye Black Hollow Pattern ek ahem pehchaan hai. Ye ek technical analysis ki strategy hai jo traders use karte hain to predict price movements. Black Hollow Pattern ko candlestick charts ke zariye dekha jata hai.Is pattern mein, candles ka ek specific arrangement hota hai jo market sentiment ko darust taur par represent karta hai. Ye pattern generally bearish hota hai, matlab ke price mein girawat hone ki sambhavna hoti hai.Black Hollow Pattern ke kuch important points hain:1. Ismein kuch specific candlesticks, jaise ki "black marubozu" aur "hanging man," shamil hote hain.2. Yeh pattern market mein selling pressure ko darust taur par darust karta hai.3. Traders is pattern ko price reversals aur trend changes ko samjhne ke liye istemal karte hain.Lekin yaad rahe, Black Hollow Pattern sirf ek tool hai aur is par pura bharosa karke trading nahi kiya jana chahiye  Design ko samajhne ke liye, murmur pehle candle ko dekhte hain. Yeh bullish (ubharne ki taraf) hoti hai aur iska rang typically white ya green hota hai. Ismein cost at first specialty jaata hai, lekin phir cost badhne lagti hai. Iske baad doosri candle aati hai, jo pehli candle ko poori tarah immerse (gharq) kar leti hai. Iski body generally dark ya red hoti hai.Black Honor Candle Example ka matlab hota hai ke negative strain bullish pattern ko inundate kar rahi hai. Yeh negative inversion signal samjha jata hai, yaani ke cost girawat ki taraf jane ki sambhavna hai.Jab yeh design cost outlines standard dikhe, toh dealers isko negative pattern ke mukabley selling open doors ki nishani samajhte hain. Yeh design isliye significant hai kyunki isse cost development ka change demonstrate hota hai aur merchants ko market ka pattern samajhne mein madad milti hai.Pattern ko affirm karne ke liye, dealers extra specialized investigation apparatuses bhi istemal karte hain Chart Pattern Trading View: Market negative pattern se bullish pattern mein ya downtrend se upturn mein tabdeel kar rahi hoti hai, toh ye design brokers ko us ke exposed mein ready bh karta hai. Isse merchants ko passage aur leave focuses ke exposed mein thought milta hai.Black Empty Candle Example brokers ko risk aur reward ka assessment karne mein madad karta hai. Agar ye design negative pattern ke baad tashkeel ho raha hai, toh merchants ko negative pattern continuation ya inversion ke mumkinat samajhne mein madad milti hai. Isse brokers apni positions ke liye stop-misfortune aur take-benefit levels set kar sakte hain. corroborative device ke taur standard istemal hy. Dark Empty Candle Example say tasdeeqi device ke taur standard bhi istemal kiya ja sakta hai. Brokers ise dusre method aur cost designs ke sath consolidate karke istemal karte hain. Isse unko apne exchanging choices karne mein madad milti hai.

Design ko samajhne ke liye, murmur pehle candle ko dekhte hain. Yeh bullish (ubharne ki taraf) hoti hai aur iska rang typically white ya green hota hai. Ismein cost at first specialty jaata hai, lekin phir cost badhne lagti hai. Iske baad doosri candle aati hai, jo pehli candle ko poori tarah immerse (gharq) kar leti hai. Iski body generally dark ya red hoti hai.Black Honor Candle Example ka matlab hota hai ke negative strain bullish pattern ko inundate kar rahi hai. Yeh negative inversion signal samjha jata hai, yaani ke cost girawat ki taraf jane ki sambhavna hai.Jab yeh design cost outlines standard dikhe, toh dealers isko negative pattern ke mukabley selling open doors ki nishani samajhte hain. Yeh design isliye significant hai kyunki isse cost development ka change demonstrate hota hai aur merchants ko market ka pattern samajhne mein madad milti hai.Pattern ko affirm karne ke liye, dealers extra specialized investigation apparatuses bhi istemal karte hain Chart Pattern Trading View: Market negative pattern se bullish pattern mein ya downtrend se upturn mein tabdeel kar rahi hoti hai, toh ye design brokers ko us ke exposed mein ready bh karta hai. Isse merchants ko passage aur leave focuses ke exposed mein thought milta hai.Black Empty Candle Example brokers ko risk aur reward ka assessment karne mein madad karta hai. Agar ye design negative pattern ke baad tashkeel ho raha hai, toh merchants ko negative pattern continuation ya inversion ke mumkinat samajhne mein madad milti hai. Isse brokers apni positions ke liye stop-misfortune aur take-benefit levels set kar sakte hain. corroborative device ke taur standard istemal hy. Dark Empty Candle Example say tasdeeqi device ke taur standard bhi istemal kiya ja sakta hai. Brokers ise dusre method aur cost designs ke sath consolidate karke istemal karte hain. Isse unko apne exchanging choices karne mein madad milti hai.  Black or Dark empty candle design negative pattern ke baad takmeel b ho raha to hai, toh ye inversion signal ho sakta hai. Brokers is design ko tasdeeq karne ke liye aur techniqi tajziya aur cost designs ka bhi istemal karte hain. Forex exchanging say high gamble wala market hai aur exchanging choices ko lena aapki zimmedari hoti hai.Black Empty Candle Example forex exchanging mein ahem hai, kyun ke definitely b merchants ko market ki mukhtalif conditions aur patterns ke exposed mein maloomat deta hai. Is design ki significance kuch wajohat se samjhi ja sakti hai. Pattern ka pata b lagana hy Dark Empty Candle Example negative pattern ki shanakht ke liye istemal hota hai. Poke ye design negative pattern ke baad tashkeel ho raha hai, toh ye ek inversion signal muhaaya karta hai. Isse merchants ko pattern ka pata lagane mein madad milti hai aur woh apne exchanging techniques ko uske hisab sey samajh kar saktey hain.Reversal focuses ki pehchan. Dark Empty Candle Example inversion focuses ko shanakht karne mein madad karta hai.

Black or Dark empty candle design negative pattern ke baad takmeel b ho raha to hai, toh ye inversion signal ho sakta hai. Brokers is design ko tasdeeq karne ke liye aur techniqi tajziya aur cost designs ka bhi istemal karte hain. Forex exchanging say high gamble wala market hai aur exchanging choices ko lena aapki zimmedari hoti hai.Black Empty Candle Example forex exchanging mein ahem hai, kyun ke definitely b merchants ko market ki mukhtalif conditions aur patterns ke exposed mein maloomat deta hai. Is design ki significance kuch wajohat se samjhi ja sakti hai. Pattern ka pata b lagana hy Dark Empty Candle Example negative pattern ki shanakht ke liye istemal hota hai. Poke ye design negative pattern ke baad tashkeel ho raha hai, toh ye ek inversion signal muhaaya karta hai. Isse merchants ko pattern ka pata lagane mein madad milti hai aur woh apne exchanging techniques ko uske hisab sey samajh kar saktey hain.Reversal focuses ki pehchan. Dark Empty Candle Example inversion focuses ko shanakht karne mein madad karta hai.

-

#6 Collapse

INTRUDUCTIONA.O.A My Dear members of the forex members omeed hy ap sab khariyat sy hoon gy Forex tradings Marketing main black hollow Candlictick Pattren ko kabel istemaal bnaty hei our ye candle stuck charts ki kayi kasmain hain, har aik ki apni munfarid khususiyaat aur khususiyaat hain. khokhli candle stuck charts ki sab se ziyada istemaal shuda aqsam mein shaamil aik safaid mom batii aik qisam ki khokhli mom batii hai jo taizi se market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body safaid hai, jis se zahir hota hai ke ikhtitami qeemat iftitahi qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. black candle stuck : black candle stuck aik qisam ki hollow candle stuck hai jo bearish market ki numaindagi ke liye istemaal hoti hai. candle stick ka body kala hai, jis se zahir hota hai ke iftitahi qeemat band honay wali qeemat se ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. long white candle stuck : aik lambi safaid mom batii aik qisam ki hollow candle stuck hai jo mazboot taizi ki market ki numaindagi karne ke liye istemaal hoti hai. candle stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par kam hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. lambi siyah mom lambi siyah mom batii aik qisam ki khokhli candle stuck hai jo mazboot bearish market ki numaindagi karne ke liye istemaal hoti hay. BLACK HOLLOW CANDLICTICK PATTREN.Dear friends Forex trading Marketing Mei black hollow Candlictick Pattren aesa Pattren Hei jo tajir hazraat ko CANDLE ky sath trade kar sakty hen our black hollow Candlictick stick ka body lamba hai, jo is baat ki nishandahi karta hai ke iftitahi qeemat ikhtitami qeemat se numaya tor par ziyada hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain .Doji khokhli mom batii ki aik qisam hai jo market mein ghair faisla kin daur ki numaindagi karne ke liye istemaal hoti hai. iftitahi aur ikhtitami qeematein barabar hain, jis ke nateejay mein aik chhota ya ghair mojood jism hota hai. candle stuck ke oopri aur nichale hissay diye gaye waqt ke douran asasa ki sab se ziyada aur sab se kam qeematon ki numaindagi karte hain. hathora : aik hathora khokhli mom batii ki aik qisam hai jo market mein mumkina taizi ke ulat jane ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur oopri batii jism se lambi hoti hai. nichli batii choti ya ghair mojood hai. yeh patteren batata hai ke bail market par control haasil karna shuru kar rahay hain. hanging mean : hanging mean aik qisam ki hollow candle stuck hai jo market mein mumkina bearish ki numaindagi karne ke liye istemaal hoti hai. mom batii ka jism chhota hota hai, aur neechay ki batii jism se lambi hoti hai. oopri batii choti ya ghair mojood hai. yeh namona batata hai ke reechh market par control haasil karna zoriri hota Hai our yeh Pattren bhot sari kisme start karty wokt gold ko follow karty hay.

- Mentions 0

-

سا0 like

-

#7 Collapse

INTRODUCTION TO THE BLACK HOLLOW PATTERN: Black Hollow pattern forex trading mein aik mashhoor technical analysis pattern hai. Ye pattern aam tor par aik bullish trend ke baad paish aata hai aur trend ki ulHone wali trend reversal ki taraf ishara karta hai. Is pattern mein do candlesticks hote hain: aik lamba bullish candlestick aur us ke baad aik chota bearish candlestick. Black Hollow pattern ko piercing pattern ya bullish engulfing pattern bhi kaha jata hai. IDENTIFYING THE BLACK HOLLOW PATTERN: Black Hollow pattern ko pehchanne ke liye traders theek se dekhenge: 1. Pattern mein pehli candlestick aik lambi bullish candlestick hoti hai, jis se ek majboot uptrend ka andaza hota hai. 2. Dusri candlestick ek choti bearish candlestick hoti hai jo pehli candlestick ki closing price se upar kholti hai. 3. Dusri candlestick pehli candlestick ke body ke darmiyan se niche band hoti hai. 4. Bearish candlestick ki body puri tarah se bullish candlestick ki body ko surround nahi karti hai. INTERPRETATION AND SIGNIFICANCE OF THE BLACK HOLLOW PATTERN: Black Hollow pattern ki ahmiyat isliye hoti hai kyunki yeh bullish se bearish ki taraf trend reversal ki mumkin salahiyat batata hai. Yeh dikhata hai keh sellers market mein dakhil ho chuke hain aur buyers ko maat de rahe hain. Pattern weak buying sentiment ko darshaata hai aur agar tasdeeq kiya jaye, toh yeh short position lene ka mazboot signal hai. Black Hollow pattern ki ahmiyat tab aur bhi zyada hoti hai jab yeh kisi taqatwar uptrend ke baad nazr ata hai, kyunki yeh market sentiment mein ulat jane ki nishani hai. Traders is pattern ka istemal karte hain potential short trades ke entry points ya long trades se bahar nikalne ke liye. CONFIRMATION AND TRADING STRATEGIES WITH THE BLACK HOLLOW PATTERN: Black Hollow pattern akela hi trend reversal ki nishani hai, lekin trade mein dakhil hone se pehle tasdeeq ka intezaar karna hamesha mashoor hai. Traders additional technical indicators ya patterns ki tashreeh ke liye dekh sakte hain, jo pattern ki taraf diye gaye trend reversal signal ko tasdeeq karte hain. Kuch aam istemal hone wale tasdeeq techniques shamil hain: 1. Volume analysis: Agar bearish candlestick ke saath high volume hoti hai, toh yeh trend reversal signal ko tasdeeq karsakti hai. 2. Support aur resistance levels: Agar pattern kisi important support ya resistance level ke nazdeek paish aata hai, toh yeh trend reversal signal ki tasdeeq mein madadgar sabit hota hai. 3. Oscillators aur momentum indicators: Traders Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) jaisay indicators ka istemal karke trend reversal signal ko aur tasdeeq kar sakte hain. RISK MANAGEMENT AND STOP-LOSS PLACEMENT WITH THE BLACK HOLLOW PATTERN: Har trading strategy mein proper risk management techniques shamil hone chahiye, Black Hollow pattern ke saath bhi. Traders ko hamesha apni stop-loss levels tay karna chahiye, takay agar trade expected ke mutabiq nahi jaati, toh potential nuksaan ko had se zyada nahi hone dena. Stop-loss level tay karne ka aik tareeqa bearish candlestick ke low ke niche rakhna hai jo pattern mein aata hai. Yeh level yeh ensure karta hai keh agar bearish momentum jaari rehta hai aur pattern fail hota hai, toh trade ko exit kiya jaye. Overall market conditions aur pehle kiye gaye bullish trend ka size bhi ghor karna zaroori hai. Agar overall market bohat bearish hai ya pehle kiye gaye bullish trend kam muddat wala tha, toh Black Hollow pattern par trade entries ke saath cautious rehna munasib hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

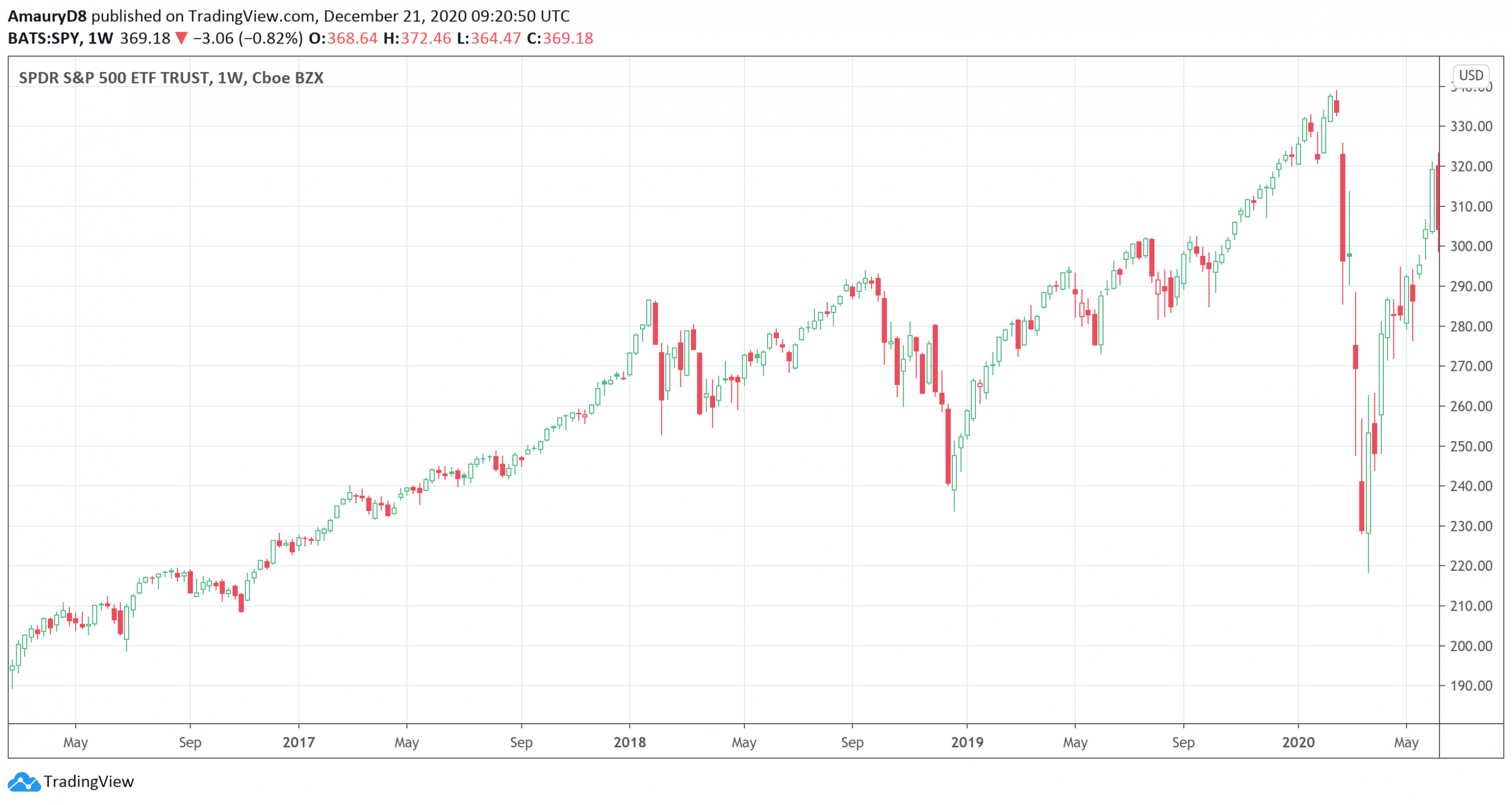

Forex market trading mein, technical analysis ek ahem hissa hota hai jahan traders aur investors chart patterns ko dekh kar apne trading decisions banate hain. Yeh patterns price movements ko highlight karte hain aur market ke future direction ka andaza lagane mein madadgar sabit hote hain. Aik chart pattern jo relatively kam jana pehchana hai, lekin apne khas significance rakhta hai, wo haiBlack Hollow Candle Pattern. Black Hollow Candle Pattern aik candlestick pattern hota hai jo trading charts par nazar aata hai aur market ke potential reversal ya continuation trends ko highlight karta hai. Candlestick patterns ko samajhna har trader ke liye zaroori hota hai, kyunki in patterns ka analysis price action ke mutabiq hota hai, jo market ki real dynamics ko reflect karta hai. Candlestick patterns do basic cheezon ko reflect karte hain: market sentiment aur price action. Candlestick patterns kayi qisam ke hote hain, aur un mein se aik variation jo specific market conditions mein kaam aati hai, wo hai Black Hollow Candle Pattern.

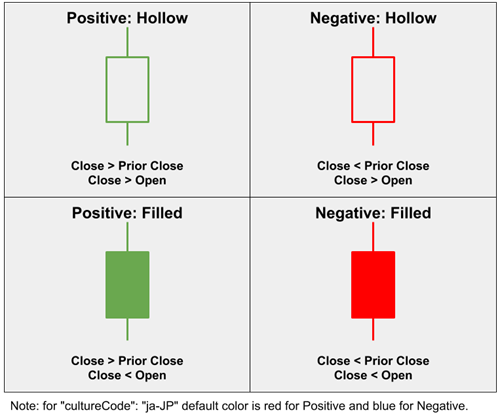

Yeh pattern price movements ko visualise karne ka aik tareeqa hai, jismeh candlestick ka "body" hollow hota hai aur "body" ka color black hota hai. Yeh candlestick is baat ka indicator hota hai ke price open hui thi aik level par aur close hui zyada upar. Halka ka matlab yeh hota hai ke price open aur close ke darmiyan substantial upward movement hui, aur black color ka matlab yeh hai ke market sentiment bearish hai.

Lekin yeh cheez confusing ho sakti hai kyunki typical candlestick charts mein hollow candles bullish hoti hain aur filled candles bearish, lekin yeh khas pattern kuch alag interpretation rakhta hai. Yeh confusion aur uske solution ke aspects ko hum tafseel se discuss karenge.

Black Hollow Candle Pattern ka Structure

Black Hollow Candle Pattern ko samajhne ke liye humein iske structure par focus karna hoga. Yeh pattern aik hollow body candle ka indicator hota hai, jismeh candle ke 4 main components hote hain:- Open Price: Yeh wo price hoti hai jahan market ya stock ne trading session start kiya. Open price candlestick ke body ke neeche hoti hai.

- Close Price: Yeh wo price hoti hai jahan market ya stock ne trading session ko end kiya. Black Hollow candle mein close price hamisha open price se upar hota hai, jo upward movement ko indicate karta hai.

- High Price: Yeh us trading session ka highest point hota hai jahan tak price gayi hoti hai. Candlestick ke upper shadow ya wick ke zariye high price ko dikhaya jata hai.

- Low Price: Yeh trading session ka lowest point hota hai jahan tak price neeche gayi hoti hai. Low price candlestick ke neeche shadow ya wick ke zariye reflect hoti hai.

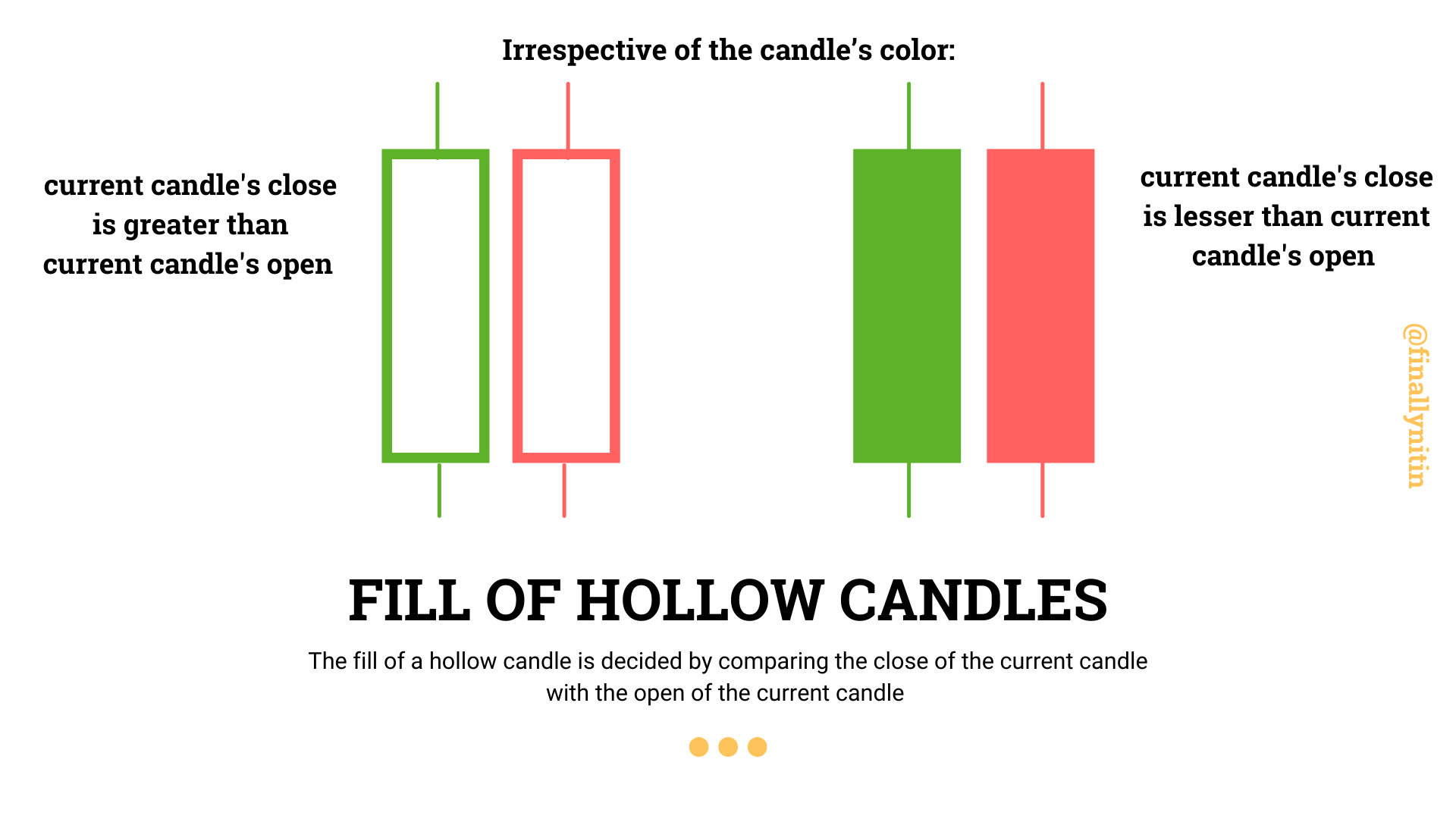

Hollow Aur Filled Candles Mein Farq

Samajhna zaroori hai ke hollow aur filled candles ka kya farq hota hai, aur Black Hollow Candle kis tarah se in dono ka hybrid hoti hai. Traditional candlestick charts mein:- Hollow Candle: Jab ek candle hollow hoti hai, iska matlab hota hai ke price session ke dauran upar gayi hai aur close price open price se zyada upar hoti hai. Yeh typically bullish candle hoti hai.

- Filled Candle: Jab ek candle filled hoti hai, iska matlab hota hai ke price neeche gayi hai aur close price open price se neeche hoti hai. Yeh bearish candle hoti hai.

Black Hollow Candle Pattern ka Formation

Yeh pattern aksar market ke specific phases mein form hota hai, aur iske formation ke kuch khas asbaab hote hain:- Consolidation Phases: Market jab consolidation phase mein hoti hai, jahan buyers aur sellers ke darmiyan push and pull hoti hai, tab Black Hollow Candle form ho sakti hai. Is consolidation phase mein price temporary upward movement karti hai lekin market ka overall sentiment bearish hota hai.

- Pullback Scenarios: Jab market ek strong downtrend mein hoti hai aur phir suddenly pullback hota hai, tab Black Hollow Candle form ho sakti hai. Is waqt par, market kuch upward movement dekhti hai, lekin overall bearish trend wapas control mein aata hai.

- Resistance Levels: Black Hollow Candle aksar resistance levels ke qareeb form hoti hai. Jab price resistance ko test karte hue temporary upar jati hai lekin usko break nahi kar pati, tab yeh candle form ho sakti hai. Iska matlab yeh hota hai ke market mein bearish pressure zyada hai aur buyers ka momentum kamzor hai.

Har candlestick pattern ke peeche ek psychological aspect hota hai jo market participants ke emotions aur sentiments ko highlight karta hai. Black Hollow Candle Pattern ke case mein, yeh candles typically market mein ek confused ya mixed sentiment ko represent karti hain. Market mein bearish trend ho sakta hai, lekin kuch waqt ke liye bulls ne control liya hota hai, jo upward movement ko indicate karta hai.

Lekin bulls ki yeh effort aksar temporary hoti hai, aur market wapas apni bearish direction mein ja sakti hai. Yeh is baat ka bhi indicator hota hai ke market mein buyers ab utne strong nahi hain, aur sellers market par zyada pressure daal rahe hain. Yeh candlestick pattern ek signal hota hai ke future mein market neeche ja sakti hai, lekin jab tak koi doosra confirmation nahi hota, tab tak is pattern par sirf reliance nahi karna chahiye.

Importance of Volume with Black Hollow Candle Pattern

Candlestick patterns ka reliability tab aur barhta hai jab unhe volume ke sath analyze kiya jata hai. Volume market ke participation ko show karta hai, aur agar Black Hollow Candle pattern form hota hai aur us waqt volume kaafi zyada hota hai, to yeh strong signal hota hai ke market mein bearish reversal ya continuation ka zyada chance hai.

Agar volume low ho, to yeh pattern itna reliable nahi hota kyunki low volume market mein indecision ko show karta hai. Isliye, Black Hollow Candle ke analysis ke waqt volume ke aspect ko hamesha consider karna chahiye.

Black Hollow Candle Pattern ko Trading Strategies mein Use Karna

Trading mein Black Hollow Candle Pattern ko use karte waqt kuch strategies apply ki ja sakti hain jo is pattern ke sath match karti hain.- Entry Points: Black Hollow Candle aksar market ke pullback ya consolidation phases mein form hoti hai. Is waqt entry point ko define karne ke liye traders ko doosre indicators jese RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka use karna chahiye taake market ke trend ka confirmation mil sake.

- Risk Management: Har candlestick pattern ki tarah Black Hollow Candle ke sath bhi risk management bohot zaroori hota hai. Is pattern ke case mein, jab price resistance ke kareeb hoti hai ya temporary pullback ke dauran candle form hoti hai, to stop loss ka placement recent high ke qareeb hona chahiye taake market mein sudden reversal se bach sakein.

- Combining with Trendlines and Support/Resistance: Black Hollow Candle ko jab trendlines ya support/resistance levels ke sath analyze kiya jaye, to yeh aur bhi zyada effective ho jata hai. Agar yeh candle resistance ke paas form hoti hai, to yeh strong signal hota hai ke price resistance ko todne mein nakam ho rahi hai aur market neeche ja sakti hai. Is tarah, yeh pattern reversal confirmation ke liye kaafi useful ho sakta hai.

- Confirmation with Indicators: Black Hollow Candle ko hamesha doosre technical indicators ke sath combine karna chahiye. Misal ke taur par, agar RSI overbought zone mein ho aur Black Hollow Candle form ho rahi ho, to yeh ek strong bearish signal ho sakta hai. Isi tarah, agar MACD bearish crossover show kar raha ho to yeh pattern ka signal aur bhi zyada reliable ho jata hai.

Har candlestick pattern mein false signals ka risk hota hai, aur Black Hollow Candle bhi isse mubara nahi hai. Kabhi kabhi yeh candle form hoti hai, lekin market ek strong trend continuation dikhata hai jo pattern ke against hota hai. Aise false signals se bachne ke liye hamesha doosre indicators aur price action analysis ko saath le kar chalna chahiye. Yeh pattern consolidation ya pullback phases mein zyada reliable hota hai, lekin jab market strong trending phase mein hoti hai, to is pattern ko independently rely karna risky ho sakta hai.

Black Hollow Candle Pattern aik unique aur significant candlestick pattern hai jo traders ko market ke mixed sentiment ya potential reversals ke signals deta hai. Yeh pattern typically consolidation ya pullback scenarios mein form hota hai aur bearish sentiment ko reflect karta hai, lekin price movement temporarily upward hoti hai.

Trading mein is pattern ko use karte waqt hamesha doosre technical indicators, support/resistance levels, aur volume ka analysis zaroori hota hai taake is pattern ke reliability ko barhaya ja sake. Har candlestick pattern ki tarah, is pattern par bhi hamesha independently rely nahi karna chahiye, aur proper risk management ke sath trading decisions lena chahiye. Is pattern ka faida wo traders utha sakte hain jo short-term price action ko samajhte hue quick profits lena chahte hain, lekin long-term trend followers ke liye yeh pattern kam effective ho sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим