Breakout and breakeven main farq?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introductions:Dear companions Umeed hai k ap sab discussion principal kafi sara information gain ker rhy hain.is liye aj primary tora ap ko forex fundamental bhot eham startegies k bary btata hon." Break out" aur" earn back the original investment" eslehaath hain jo makhsoos tijarti hikmat amlyon aur qeemat ki sthon ka hawala dete hain .Breakout:Forex exchanging mein break out is waqt hota hai poke money ke jore ki qeemat aik muqarara had ya had se bahar jati hai. is had ko aksar" support aur muzahmat" ki satah kaha jata hai. break out kisi bhi simt mein ho sakta hai : oopar ki taraf (bearish break out ) ya neechay ki taraf ( negative break out ) .• Tajir ahem qeematon ki naqal o harkat se faida uthany ke liye break out hikmat e amli istemaal karte hain. poke break out hota hai, to yeh aik naye rujhan ke aaghaz ka ishara day sakta hai, aur tajir aksar break out ki simt mein position mein daakhil hotay hain, aur tawaqqa karte hain ke qeemat is simt mein agay barhay gi .• Break out exchanging ki hikmat amlyon mein aksar khatray ka intizam karne aur munafe ko band karne ke liye Stoploss aur Take benefit request tarteeb dena shaamil hota hai .Breakeven:• Forex exchanging mein" make back the initial investment" se morad qeemat ki woh satah hai jis standard tridr ki position nah to munafe kamatee hai aur nah greetings nuqsaan uthaati hai, siwaye lain deen ke akhrajaat ( jaisay اSpread aur commission ). dosray lafzon mein, yeh woh maqam hai jis standard tajir ki ibtidayi sarmaya kaari ki vasuli hoti hai .• punch koi tajir - apne stop las request ko dakhlay ki qeemat ( woh qeemat jis standard woh tijarat mein daakhil sun-hwa ) standard muntaqil karta hai, kaha jata hai ke is ne tijarat ko make back the initial investment standard muntaqil kar diya hai. yeh aik rissk managment taknik hai jis ka maqsad mumkina nuqsanaat ko kam karna hai. stap las ko earn back the original investment mein muntaqil kar ke, aik tajir is baat ko yakeeni banata hai ke, terrible tareen pinnacle standard, agar kisi khaas nuqta ke baad market un ke khilaaf ho jati hai to woh baghair kisi nuqsaan ke tijarat se bahar nikal jayen ge .• breakeven taajiron ke liye aik nafsiati aur hikmat e amli ka sang e mil saabit ho sakta hai, kyunkay yeh tijarat mein sarmaye ke kho jane ke khauf ko daur karta hai, aur agar market un ke haq mein jari rehti hai to woh mumkina pinnacle standard izafi munafe ke liye tijarat standard sawaar ho satke hain .yeh note karna zaroori hai ke break out aur make back the initial investment dono hikmat amlyon ka istemaal market ke halaat, rissk managment, aur tajir ke majmoi tijarti plan standard ghhor karte tone kya jana chahiye. forex exchanging fitri peak standard khatarnaak hai, aur taajiron ko market mein hissa lainay se pehlay un aur deegar tasawurat ki thos samajh haasil karni chahiye. mazeed bar-aan, sarmaye ki hifazat aur mumkina nuqsanaat ko kam se kam karne ke liye munasib rissk managment instruments aur procedures ko istemaal karne ka mahswara diya jata hai . -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Breakout aur breakeven do ahem concepts hain trading mein, khas tor par stock, forex, aur commodities jese financial markets mein. Breakout tab hota hai jab kisi asset ka price kisi significant support ya resistance level ke upar ya neeche move karta hai. Support aur resistance levels price chart par aise areas hote hain jahan price rukti hai ya direction change hoti hai. Traders aksar in levels ka istemal trading decisions mein karte hain.Jab price kisi resistance level ke upar move karta hai, to ye bullish breakout hota hai, iska matlab hai ke buyers control mein hain aur price mazeed upar ja sakta hai. Umeed hoti hai ke price aur bhi upar jayegi. Aur agar price kisi support level ke neeche jaata hai, to ye bearish breakout hota hai, jo ke ye dikhata hai ke sellers control mein hain aur price mazeed neeche ja sakti hai.

Breakouts ka bohot ahem role hota hai kyun ke ye aksar strong price movements ke sath aate hain. Traders breakouts ko dekhte hain taake woh trades enter kar sakein breakout ke direction mein, aur ummid karte hain ke uss price movement se faida hoga. Breakout trading strategies alag alag hoti hain, lekin aam tor par ye involve karte hain buy ya sell orders ko place karna jab breakout confirm ho jaye, stop-loss orders ka istemal karke risk ko manage karna.

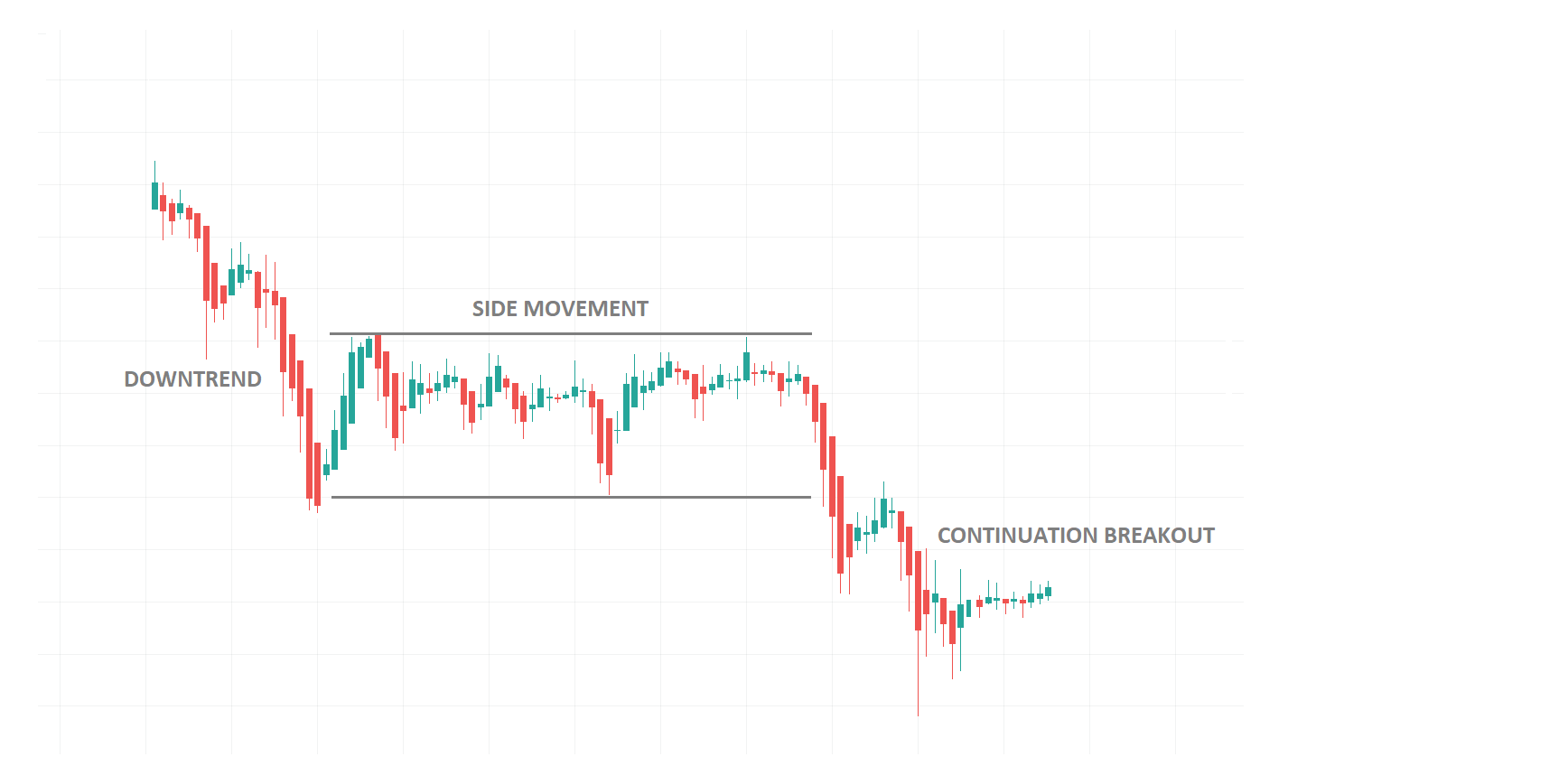

Kuch tarah ke breakouts hote hain jo traders dekhte hain:- Continuation Breakouts: Ye established trend ke andar hota hai. Agar koi stock uptrend mein hai, to ek continuation breakout hoga jab price short-term resistance level ke upar move kare, ye dikhate hue ke uptrend continue ho sakta hai.

- Reversal Breakouts: Ye hote hain jab price kisi key level ke upar ya neeche break kare, jo ke current trend ka reversal indicate karte hain. Masalan, agar koi stock downtrend mein hai aur phir major resistance level ke upar break hota hai, to ye uptrend ke liye reversal indicate kar sakta hai.

- False Breakouts: Kabhi kabhi breakout hota hai lekin sustain nahi hota. Isse false breakout ya fakeout kehte hain. False breakouts traders ko trap kar sakte hain jo initial breakout pe positions lete hain, aur nuqsan hota hai. Traders various techniques use karte hain, jese confirmation ka wait karna ya additional indicators ka istemal karna, false breakouts ke risk ko kam karne ke liye.

Successful breakout trading ke liye technical analysis, risk management, aur discipline ka combination zaroori hai. Traders aksar tools use karte hain jese trendlines, moving averages, aur chart patterns taake potential breakouts ko identify karein aur unki validity ko confirm karein trading se pehle. Ab, breakeven ke bare mein baat karte hain. Trading mein breakeven ka matlab hai jab koi trade na profit de aur na loss. Ye woh price level hai jahan trader ka initial investment recover hota hai. Breakeven risk management ka ek bohot ahem hissa hai kyun ke ye traders ko help karta hai stop-loss levels set karne mein takay losses ko minimize kiya ja sake. Stop-loss order ek instruction hoti hai kisi security ko sell karne ki jab wo kisi price tak pohanchti hai, traders ke losses ko limit karne mein madad karti hai.

Breakeven point calculate karne ke liye traders kuch factors consider karte hain, jese entry price, position size, trading fees, aur koi aur relevant costs. Breakeven price typically entry price ke thodi si upar hoti hai long position ke liye buying, transaction costs jese ke spreads ya commissions ko account karte hue. Short position ke liye selling, breakeven price entry price ke thodi si neeche hoti hai.

Transaction costs brokerage fees, spreads, commissions, aur slippage expected price aur actual execution price ke darmiyan ka farq shamil hote hain. Ye costs broker, market conditions, aur trading instrument ke upar depend karte hain. Breakeven analysis traders ko informed decisions lene mein help karta hai kahan pe stop-loss orders place karna hai. Stop-loss order breakeven point thodi si upar rakha jata hai taake profits ko protect kiya ja sake aur losses ko minimize kiya ja sake agar trade opposite direction mein jaati hai.

Traders breakeven analysis ko profit targets ke sath bhi use karte hain takay apne trades ko effectively manage kar sakein. Profit target ek price level hoti hai jahan trader profits lete hain aur trade close karte hain. Potential profit ko breakeven level aur risk stop-loss level ke base pe ke saath compare karke traders risk-reward ratio assess karte hain. A favorable risk-reward ratio bohot se trading strategies ke liye ek key criterion hai. Ye ek potential profit aur potential loss ke ratio ko refer karta hai trade pe. For example, agar trader ka profit target double hai unka stop-loss level ke muqablay, to unka risk-reward ratio 2:1 hoga. Traders aksar risk-reward ratios seek karte hain jo ek reasonable balance offer karte hain potential gains aur acceptable losses ke darmiyan.

Breakeven analysis portfolio management mein bhi role play karta hai. Traders aur investors apne portfolios ki overall performance ko assess karte hain individual trades ke breakeven levels ko portfolio ki total value aur performance ke sath compare karke. Ye analysis unko apne trading strategies ko adjust karne mein madad karta hai, capital effectively allocate karne mein help karta hai, aur risk ko portfolios ke darmiyan manage karne mein. Breakout aur breakeven trading mein bohot ahem concepts hain. Breakouts significant price movements represent karte hain jinpe traders profit karte hain, jabke breakeven analysis traders ko risk manage karte hain, stop-loss levels set karte hain, aur apne trades ke risk-reward ratio ko assess karte hain. In concepts ko master karna zaroori hai successful trading strategies develop karne aur financial markets mein long-term profitability achieve karne ke liye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

### Breakout aur Breakeven mein Farq: Ek Nazar

Aaj hum baat karte hain "Breakout aur Breakeven" ke farq ke baare mein. Yeh dono terms trading aur business mein bohot commonly use hoti hain. Magar, inka maqsad aur application mukhtalif hota hai. Chaliye, detail mein dekhte hain ke yeh dono terms kya hain aur inmein kya farq hai.

#### Breakout

Breakout wo moment hota hai jab price kisi specific level ko cross karti hai jo ke pehle resistance ya support ki tarah kaam kar rahi thi. Iska matlab yeh hota hai ke market mein ek nayi trend start hone wali hai. Breakout trading mein bohot important hota hai kyunki yeh humein ek nayi opportunity ki taraf ishara karta hai.

**Resistance Level**: Yeh wo price point hota hai jahan par stock price pehle ruk jaati thi. Jab price is level ko cross karti hai, to isay breakout kehte hain.

**Support Level**: Yeh wo price point hota hai jahan par stock price pehle bounce back karti thi. Jab price is level ke neeche chali jaati hai, to isay bhi breakout kehte hain.

**Trend Confirmation**: Breakout hamesha ek strong volume ke sath hona chahiye taake yeh confirm ho sake ke trend valid hai. Agar breakout ke baad volume low rahe to yeh ek false breakout bhi ho sakta hai.

#### Breakeven

Breakeven wo point hota hai jab aapki total revenues aapki total costs ke barabar ho jaati hain. Yani na profit na loss. Business terms mein breakeven point ko achieve karna bohot zaroori hota hai kyunki yeh indicate karta hai ke business atleast apne kharche poore kar raha hai.

**Fixed Costs**: Yeh wo costs hoti hain jo hamesha constant rehti hain chahe production ho ya na ho. Jaise ke rent, salaries, etc.

**Variable Costs**: Yeh wo costs hoti hain jo production ke sath vary karti hain. Jaise ke raw material, electricity, etc.

**Breakeven Formula**: Breakeven point nikalne ke liye hum fixed costs ko contribution margin per unit se divide karte hain. Contribution margin per unit ko nikalne ke liye hum selling price se variable cost per unit minus karte hain.

### Conclusion

Breakout aur breakeven dono hi apni jagah bohot important hain magar mukhtalif maqsad ke liye use hote hain. Breakout ek trading term hai jo market mein nayi trend ko indicate karta hai, jabke breakeven ek business term hai jo profit aur loss ke balance ko show karta hai. In dono concepts ko samajhna aur inka sahi tarah se analysis karna business aur trading decisions ko improve karne ke liye zaroori hai.

-

#5 Collapse

Breakout Aur Breakeven Main Farq

Forex trading mein "breakout" aur "breakeven" do mukhtalif concepts hain jo traders ko market ke trends aur risk management ko samajhne mein madad deti hain. Ye dono concepts trading strategies ke mukhtalif pehlu ko samajhne mein madadgar hain. Aaiye in dono ka tafseeli jaiza lete hain aur dekhte hain ke in dono mein kya farq hai.

Breakout Kya Hai?

Breakout trading terminology mein tab use hota hai jab price kisi key level ko cross karti hai. Yeh key level generally resistance (upar ki boundary) ya support (neeche ki boundary) hota hai. Breakout ka matlab hota hai ke price is level ko tod rahi hai aur naya trend develop ho sakta hai.

Breakout Ki Shanakht:- Resistance Breakout:

- Jab price ek resistance level ko break karti hai, toh yeh bullish signal hota hai. Traders is baat ko expect karte hain ke price upar ki taraf move karegi. Resistance level woh price point hai jahan se pehle ki prices ne decline kiya ho.

- Support Breakout:

- Jab price support level ko break karti hai, toh yeh bearish signal hota hai. Traders is baat ko expect karte hain ke price neeche ki taraf move karegi. Support level woh price point hai jahan se pehle ki prices ne rebound kiya ho.

Breakout Ki Strategies:- False Breakout:

- Kabhi kabhi price breakout ke baad phir se apne pehle ke level par wapas aa jati hai. Isse false breakout kehte hain aur is situation mein trading decision kaafi challenging hota hai.

- Volume Analysis:

- Effective breakout tab hota hai jab volume bhi increase ho raha ho. High volume breakout ki confirmation provide karta hai aur isse trade ki validity barh jaati hai.

- Pullback Entry:

- Breakout ke baad agar price thodi der ke liye pullback karti hai aur phir se breakout level ko retest karti hai, toh traders is pullback ke baad entry le sakte hain.

Breakeven trading mein ek aisa point hai jahan aapki total profits aur losses balance hoti hain, yani na aap profit mein hain aur na hi loss mein. Breakeven point wo hai jahan aapne apni trade par lagne wale costs ko cover kar liya hai aur koi net profit ya loss nahi ho raha.

Breakeven Ki Shanakht:- Entry Point:

- Breakeven point woh price hai jahan aapki entry aur exit ki price mein farq nahi hota. Aapne jo bhi initial investment ki thi, uska pura amount recover ho gaya hota hai.

- Risk Management:

- Breakeven strategy risk management ka ek hissa hota hai jahan aap trade ko risk free bana sakte hain. Yeh typically tab use hota hai jab trade profitable hone lagti hai aur aap apne stop loss ko breakeven level par shift kar dete hain.

Breakeven Ki Strategies:- Adjusting Stop Loss:

- Jab aapki trade profitable ho jati hai, aap apne stop loss ko breakeven level par shift kar dete hain. Isse aapka risk zero ho jata hai aur aap guaranteed hai ke aapko loss nahi hoga.

- Partial Profit Taking:

- Breakeven level ko achieve karne ke baad, traders kuch profits ko realize kar sakte hain aur baaki trade ko continue rakh sakte hain. Isse aap profit ke kuch portion ko secure kar sakte hain aur baaki trade ko future movements ke liye open chhod sakte hain.

- Breakeven Orders:

- Kuch traders breakeven orders place karte hain jahan ek baar trade profitable hoti hai, stop loss ko breakeven level par shift kar dete hain.

Conceptual Differences:- Purpose:

- Breakout ka purpose hai market trends aur price movements ko identify karna, jab price ek key level ko break karti hai. Isse traders ko market direction ke bare mein signals milte hain.

- Breakeven ka purpose hai apne risk ko manage karna aur trade ko risk-free banana. Yeh trading strategy ko protect karne ke liye use hoti hai jab trade profitable hoti hai.

- Application:

- Breakout trading strategy ka part hota hai jo new trends aur price action ko identify karne ke liye use hota hai.

- Breakeven risk management technique hai jo trading positions ko secure karne ke liye use hoti hai.

Implementation:- Breakout:

- Traders breakout points ko identify karne ke liye technical analysis aur chart patterns ka use karte hain. Yeh new trading opportunities ko define karta hai aur traders ko entry points provide karta hai.

- Breakeven:

- Traders apne stop loss ko breakeven level par adjust karte hain taake unka risk zero ho jaye. Yeh trade ke profitability ko secure karne ke liye use hota hai aur trade ko continue karne ka scope bhi provide karta hai.

Market Reaction:- Breakout:

- Breakout se market mein volatility aur price movements increase ho sakti hain. Yeh market ke direction aur trend ko define karta hai.

- Breakeven:

- Breakeven se market reaction ko manage karna aur trading risk ko minimize karna hota hai. Yeh trade ko ek secure position mein le aata hai.

Conclusion:

Breakout aur breakeven trading ke mukhtalif aspects ko cover karte hain. Breakout market trends aur price movements ko identify karne mein madad karta hai, jab ke breakeven risk management aur trade security ko ensure karta hai. Dono concepts trading strategies aur decision making mein important roles play karte hain aur traders ko market ke dynamics ko samajhne mein madad karte hain.

- Resistance Breakout:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Breakout Aur Breakeven Mein Farq: Roman Urdu Mein Tafseel**

Forex trading aur stock market trading mein, "breakout" aur "breakeven" dono terms ka apni importance hai. Yeh dono trading strategies aur risk management concepts ko define karte hain, lekin inke meanings aur implications alag hain. Aaiye, in dono terms ko detail mein samjhte hain aur inmein farq ko clear karte hain.

### 1. **Breakout Kya Hai?**

Breakout ek trading concept hai jo market ke price levels ke break hone ko describe karta hai. Jab price ek significant support ya resistance level ko break karti hai, to usay breakout kehte hain. Yeh trend ke potential change ka indication hota hai.

#### **Breakout Ki Characteristics**

- **Support/Resistance Levels:** Breakout tab hota hai jab price established support ya resistance levels ko break karti hai. Support level wo point hota hai jahan price niche nahi jati, aur resistance level wo point hota hai jahan price upar nahi jati.

- **Volume:** Effective breakout high volume ke sath hota hai. High volume indicate karta hai ke breakout strong hai aur trend ka continuation ho sakta hai.

- **Trend Direction:** Breakout upward ya downward direction mein ho sakta hai. Upward breakout ko bullish breakout kehte hain aur downward breakout ko bearish breakout kehte hain.

#### **Breakout Ki Trading Strategy**

- **Entry Point:** Jab price support ya resistance level ko break karti hai aur high volume confirm hota hai, to trade open karne ka signal milta hai.

- **Stop-Loss Placement:** Stop-loss ko breakout level ke thoda opposite side par place karein. Yeh ensure karega ke agar breakout false ho, to loss limit ho.

- **Profit Target:** Profit targets ko nearest support ya resistance levels par set karein. Trend ke strength aur market conditions ko dekhte hue profit targets adjust karein.

### 2. **Breakeven Kya Hai?**

Breakeven ek risk management concept hai jo trade par profit ya loss ka zero level ko indicate karta hai. Jab aap apne trade ko breakeven point par le aate hain, to aapke paas koi profit ya loss nahi hota.

#### **Breakeven Ki Characteristics**

- **Cost Recovery:** Breakeven point wo point hota hai jahan trade ke saare costs aur expenses recover ho jate hain. Yeh trade ke open aur exit points ke darmiyan ka difference hota hai.

- **Risk Management:** Breakeven strategy ka maqsad trade ko aise level par laana hota hai jahan aapka initial investment recover ho jaye aur future mein profit ke liye trade continue kar sakein.

#### **Breakeven Ki Trading Strategy**

- **Breakeven Point Setting:** Jab trade profitable ho aur market trend favorable ho, to stop-loss ko breakeven point par adjust karna chahiye. Yeh ensure karega ke agar market reverse ho jaye, to aapka loss nahi hoga.

- **Adjustments:** Breakeven point ko continuously monitor aur adjust karte rahna zaroori hai, especially jab market conditions change ho.

### 3. **Breakout Aur Breakeven Mein Farq**

#### **Conceptual Differences**

- **Breakout:** Breakout market ke price levels ke break hone ka concept hai jo trend changes aur potential trading opportunities ko indicate karta hai. Yeh ek action point hai jahan price ek significant level ko break karti hai.

- **Breakeven:** Breakeven ek risk management concept hai jo trade ke profitability ko zero level tak le aane ke process ko describe karta hai. Yeh ek risk control measure hai jahan aap apni losses ko protect karte hain aur profits ko secure karte hain.

#### **Trading Application**

- **Breakout:** Breakout trading mein aap market ke price movement ko analyze karte hain aur significant levels ko break hone par trade open karte hain. Yeh strategy market trends ke continuation aur reversal points ko identify karne mein madad karti hai.

- **Breakeven:** Breakeven trading mein aap trade ko manage karte hain aur risk ko minimize karte hain. Breakeven point ko set karna aur adjust karna trade ke initial investment ko secure karne aur future profits ko maximize karne mein madad karta hai.

#### **Risk Management**

- **Breakout:** Breakout trading mein risk management ka focus entry aur exit points ko identify karna hota hai. Aapko ensure karna hota hai ke breakout strong ho aur false signals se bachna chahiye.

- **Breakeven:** Breakeven trading mein risk management ka focus trade ke profitability ko zero level par lana hota hai. Yeh loss ko prevent karta hai aur trade ko safe rakhta hai.

### 4. **Practical Examples**

#### **Breakout Example**

1. **Market Observation:** Price ek significant resistance level ko test kar rahi hai aur high volume dekhne ko mil raha hai.

2. **Action:** Resistance level break hota hai aur high volume confirm hota hai. Aap buy order place karte hain.

3. **Stop-Loss Placement:** Stop-loss ko resistance level ke thoda niche place karte hain.

4. **Profit Target:** Profit targets ko nearest support levels ke mutabiq set karte hain.

#### **Breakeven Example**

1. **Trade Execution:** Aapne buy order place kiya aur trade profitable ho raha hai. Market trend aapke favor mein hai.

2. **Breakeven Adjustment:** Aap stop-loss ko breakeven point par adjust karte hain. Ab aapke trade ko close karne par aapko loss nahi hoga.

3. **Monitoring:** Market conditions ko monitor karte hain aur profit targets ko adjust karte hain.

### 5. **Limitations Aur Considerations**

#### **Breakout Limitations**

- **False Breakouts:** Kabhi kabhi breakouts false signals de sakte hain aur market trend ki continuation nahi hoti.

- **Volume Confirmation:** Breakout ke sath volume confirmation zaroori hai. Low volume ke sath breakout unreliable ho sakta hai.

#### **Breakeven Considerations**

- **Market Volatility:** Market volatility ke during breakeven point ko adjust karte waqt careful rahna zaroori hai.

- **Adjustment Frequency:** Breakeven point ko frequent adjustments ke sath monitor karna zaroori hai, especially jab market conditions change hoti hain.

### 6. **Conclusion**

Breakout aur breakeven dono trading aur risk management ke important concepts hain jo traders ko market trends aur risk control mein madad karte hain. Breakout market ke significant levels ke break hone ka concept hai jo potential trading opportunities ko indicate karta hai. Breakeven risk management ka concept hai jo trade ke profitability ko zero level tak le aata hai aur losses ko minimize karta hai. In dono concepts ko samajhna aur effectively use karna traders ko better trading decisions lene aur market opportunities ko maximize karne mein madad karta hai. Proper implementation aur risk management ke sath in strategies ko use karne se aap apne trading performance ko enhance kar sakte hain.

-

#7 Collapse

**Breakout Aur Breakeven Mein Main Difference**

Forex aur stock trading mein “breakout” aur “breakeven” do important terms hain jo traders ke decision-making aur strategy development mein crucial role play karte hain. Yeh terms often interchangeably use kiye jate hain, lekin inka specific meaning aur application alag hota hai. Is post mein, hum breakout aur breakeven ke concepts ko detail mein samjhenge aur inke beech ke key differences ko explore karenge.

**Breakout Kya Hai?**

Breakout trading strategy tab apply ki jati hai jab price ek key level, jese ke support ya resistance, ko break kar deti hai. Yeh ek significant price movement ko indicate karta hai jo market trend ko change kar sakta hai.

- **Formation:** Breakout tab hota hai jab price range-bound ya consolidation phase se nikal kar ek significant level ko break karti hai. Yeh level trend lines, horizontal support/resistance lines, ya other technical levels ho sakti hain.

- **Trading Strategy:** Traders breakout ke signals ko trading opportunities ke roop mein dekhtay hain. Breakout ke baad, traders typically buy positions open karte hain in an uptrend, aur sell positions in a downtrend. Confirmation ke liye additional indicators aur volume analysis ka use bhi kiya jata hai.

- **Risk Aur Reward:** Breakout trades mein risk hota hai ke price false breakout kar sakti hai aur wapas consolidate kar sakti hai. Isliye, proper risk management aur stop-loss orders ko set karna zaroori hota hai.

**Breakeven Kya Hai?**

Breakeven trading strategy tab apply hoti hai jab ek trade ke profitability point tak pahunchti hai, jahan par trader ne apni initial investment ko recover kar liya hai aur trade par profit ya loss zero hota hai.

- **Formation:** Breakeven tab hota hai jab price movement aise point tak pahunchti hai jahan trading position ka overall profit aur loss zero hota hai. Breakeven point par trader ne trade ke expenses aur transaction costs ko cover kar liya hota hai.

- **Trading Strategy:** Breakeven strategy ka goal trade ko profitable zone mein le jana aur initial risk ko eliminate karna hota hai. Traders often stop-loss ko breakeven point par shift karte hain taake trade profitable ho aur risk minimized rahe.

- **Risk Aur Reward:** Breakeven strategy ka primary goal loss ko avoid karna hai. Agar price breakeven point se move nahi karti, toh trader ko apni investment ko loss se protect karne ka benefit milta hai.

**Key Differences**

1. **Conceptual Difference:** Breakout ek price level ka significant breach hai jo market trend ke change ko indicate karta hai, jabke breakeven ek trading position ka point hai jahan profit aur loss equal hote hain.

2. **Application:** Breakout strategy market trends aur new price movements ko capitalize karne ke liye use hoti hai, jabke breakeven strategy trade ke risk ko manage karne aur loss ko prevent karne ke liye use hoti hai.

3. **Risk Management:** Breakout trading mein initial risk higher hota hai aur confirmation signals zaroori hote hain. Breakeven strategy risk ko minimize karti hai aur trade ke successful completion ke baad position ko protect karti hai.

**Conclusion**

Breakout aur breakeven trading strategies trading decisions mein key role play karti hain. Breakout strategy market trends aur price movements ko exploit karne ke liye hoti hai, jabke breakeven strategy trade ke risk ko manage karne aur loss ko avoid karne ke liye use hoti hai. In dono concepts ko samajhkar aur effectively apply karke, traders apni trading strategies ko optimize kar sakte hain aur overall trading performance ko improve kar sakte hain.

-

#8 Collapse

Breakout aur Breakeven Main Farq: Ek Mukhtasir Jaiza

Muqaddama

Trading ke dunia mein, kai technical terms aur concepts hain jo traders ko market movements aur strategies samajhne mein madad dete hain. In terms mein se do ahm concepts "Breakout" aur "Breakeven" hain. Ye dono terms bilkul mukhtalif hain aur inka use bhi alag-alag scenarios mein hota hai. Is article mein hum Breakout aur Breakeven ka farq detail mein samjhenge.

Breakout Kya Hai?

Breakout ek technical analysis term hai jo tab use hoti hai jab price ek specific level ko breach karta hai, jo aam tor par support ya resistance level hota hai. Jab price is level ko break karta hai, toh ye indicate karta hai ke price movement ek nayi direction mein shuru ho rahi hai. Breakouts ko do qisam mein categorize kiya ja sakta hai:- Bullish Breakout: Ye tab hota hai jab price resistance level ko cross karke upar ki taraf move karta hai. Bullish breakout indicate karta hai ke buyers control mein hain aur price aur bhi upar ja sakti hai.

- Bearish Breakout: Ye tab hota hai jab price support level ko cross karke neeche ki taraf move karta hai. Bearish breakout indicate karta hai ke sellers control mein hain aur price aur bhi neeche ja sakti hai.

Breakeven Kya Hai?

Breakeven ek financial term hai jo tab use hoti hai jab aapki investment ya trade ka profit aur loss equal ho jaye, matlab na profit ho aur na loss. Breakeven point wo level hota hai jahan aapki trade ke total costs (including commissions, fees, etc.) cover ho jati hain.

Breakout aur Breakeven Ka Farq- Definition:

- Breakout: Price movement ka wo point jab price ek significant level (support ya resistance) ko breach karta hai aur nayi direction mein move karta hai.

- Breakeven: Wo point jab aapki trade ka profit aur loss equal ho jaye, aur aap na profit mein ho aur na loss mein.

- Application:

- Breakout: Breakout ko identify karna important hota hai taake aap potential trading opportunities ko capture kar sakein. Ye levels trading strategies ko formulate karne mein madadgar hote hain.

- Breakeven: Breakeven point ko achieve karna traders ke liye important hota hai taake wo apni investment ya trade ko loss se bacha sakein. Ye risk management ka ek hissa hota hai.

- Impact on Trading:

- Breakout: Jab breakout hota hai, toh price ka significant move expected hota hai jo traders ko profitable trading opportunities de sakta hai.

- Breakeven: Breakeven point achieve karna risk management ke liye zaroori hota hai, taake traders apni capital ko protect kar sakein aur unnecessary losses se bach sakein.

Conclusion

Breakout aur Breakeven trading ke do mukhtalif concepts hain jo different scenarios mein use hote hain. Breakout price movement aur potential trading opportunities ko indicate karta hai, jabke Breakeven wo point hai jahan aapka trade na profit mein hota hai aur na loss mein. Dono concepts ko sahi tarah se samajhna aur apply karna successful trading ke liye zaroori hai. Har trader ko in terms ka farq samajhna chahiye aur inko apni trading strategy mein effectively use karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Breakout aur Breakeven Mein Farq: Ek Nazar Forex Trading Mein Iski Importance

Forex trading ek aisa maidan hai jahan traders bhot se concepts aur techniques ka istemal karte hain apni trading strategies ko behtar banane ke liye. Aaj hum "breakout" aur "breakeven" ki concepts ke darmiyan farq aur inki Forex trading mein importance ko samjhenge. Ye do concepts zyada tar novice traders ke liye confusion ka sabab bante hain, lekin inhe samajhna koi mushkil kaam nahi hai.

1. Breakout Kya Hai?

Definition:

Breakout ka matlab hai kisi bhi price level ya technical pattern ko todna. Jab currency pair ki price kisi resistance ya support level ko cross karti hai, toh usse breakout kaha jata hai.

1.1 Breakout Ki Types- Bullish Breakout: Jab price upper resistance level ko todti hai, toh ise bullish breakout kaha jata hai. Yeh bullish trend ka aik nishan ho sakta hai.

- Bearish Breakout: Jab price lower support level ko niche girti hai, toh ise bearish breakout kaha jata hai. Yeh bearish trend ka nishan hota hai.

Breakout trading strategy ko samajhna isliye zaroori hai kyunki isse traders ko entry aur exit points ka pata chal sakta hai. Jab price breakout hoti hai, toh market yeh indicate karti hai ke trend mein koi badlav aa raha hai. Iska fayda uthane ke liye traders kai techniques istemal karte hain:- Volume Analysis: Trend ke saath volume ko bhi dekhna chahiye. Agar volume zyada ho toh yeh confirm karta hai ke breakout asli hai.

- Stop Loss Placement: Aksar traders stop loss ko support ya resistance level ke thoda upar ya niche rakhte hain takay risk management behtar ho.

Definition: Breakeven ka matlab hai wo point jahan aapki total earnings aapke total costs ke barabar hoti hain. Forex trading mein, iska matlab yeh hai ke aapki position par na to koi profit hai aur na hi koi nuksan.

2.1 Breakeven Point Ki Importance

Breakeven point aapko yeh samajhne mein madad karta hai ke kab aapko apni trade se exit lena hai. Yeh khas tor par risk management ke liye behtar hai. Is term ka istamal jyada tar tab hota hai jab traders apne profits ko secure karna chahte hain.

2.2 Breakeven Kaise Set Karein?- Cost Addition: Aapko aditional trade costs jese ke spreads aur commissions ko bhi madde nazar rakhna hoga jab aap breakeven level set karein.

- Locking in Profits: Jab aapki trade thode profit mein ho, toh aap breakeven ko set karke risk ko reduce kar sakte hain.

Breakout aur breakeven ke concepts mein kaafi badi similarity hai, lekin inke maqsad aur istemal mein farq hai.

3.1 Trading Strategy- Breakout: Yeh strategy khud ko market ke naye trends se jodne ka kaam karti hai. Aksar traders breakout ke baad trend ki taqat ko samajhne ki koshish karte hain.

- Breakeven: Yeh strategy profit sealing aur risk management mein zyada madadgar hoti hai. Breakeven ko istemal kar ke traders apne emotions ko control karne ki try karte hain.

- Breakout: Risk yahan high hota hai kyunki traders naye trend ki taraf chal rahe hote hain.

- Breakeven: Yahan risk ko minimize kiya jata hai kyunki yeh profit ko secure karne ka ek tool hai.

Forex trading mein breakout aur breakeven ka istemal karne se aap apni trading strategies ko behtar bana sakte hain. In concepts ko sahi tarah samajhna aur istemal karna aapki financial success ke liye zaroori hai.

4.1 Technical Analysis

Forex traders aksar technical indicators jaise ke moving averages, RSI, aur MACD ka istemal karte hain breakout aur breakeven points ko identify karne ke liye. Is analysis se traders yeh jaan sakte hain ke kab market mein momentum aa raha hai ya kab unhe profit secure karna chahiye.

4.2 Fundamental Analysis

Fundamental factors jaise economic indicators, news events, aur geopolitical situations bhi breakout aur breakeven mein ahmiyat rakhte hain. Agar ek important news release hota hai, toh yeh breakout trigger kar sakta hai. Yahan, risk management ke liye breakeven point ka sahi estamal zaroori hai.

4.3 Real Life Example

Misaal ke tor par, agar kisi ek currency pair ka resistance level 1.2000 hai aur price is level ko cross karti hai, toh aapko bullish breakout milta hai. Ab aap is point ke aas paas apni trade ko setup kar sakte hain. Agar market move ho ke aap 1.2050 par pahuchti hai, toh aap breakeven set kar ke risk ko minimize kar sakte hain.

5. Fayday aur Nuksan

5.1 Breakout Ke Fayday- Quick Profit Generation: Agar aap breakout ka sahi istemal karte hain, toh aap nayi opportunities mein tezi se profit kama sakte hain.

- Trend Direction Understand Karna: Breakout se aapko market trend samajhne mein madad milti hai, jisse aap better decisions le sakte hain.

- False Breakouts: Aksar market false breakouts provide karta hai, jo traders ko nuksan de sakta hai.

- Volatility Risks: Breakouts ke waqt market mein volatility zyada hoti hai, jo loss ka sabab ban sakta hai.

- Risk Management: Breakeven point se traders ko apne losses ko minimize karne ka mauqa milta hai.

- Emotional Control: Jab aap profit ko secure karte hain, toh yeh aapko trading ke emotional stress se door rakh sakta hai.

- Missed Profit Opportunities: Kabhi-kabhi, breakeven set karne se aap amount profit miss karne ka risk lete hain.

- Commissions/Spreads: Breakeven set karne ki wajah se jab aap commission ya spreads consider karte hain, toh akshar profit margin kam ho jata hai.

Breakout aur breakeven ke concepts Forex trading mein critical importance rakhte hain. Inhe samajhna aur sahi tarike se istemal karna trade quality ko behtar kar sakta hai. Aakhir mein, effective strategy aur risk management ki wajah se aap apni earnings ko behtar banane ki koshish kar sakte hain.

Is article mein humne breakout aur breakeven ke concepts, unki importance, and trading strategies ko cover kiya. Ukhaaf se aap forex ko profitable trading avenue ke tor par istemal kar sakte hain. Sabse zaroori baat hai ke aap apne trading plan ko consistently follow karein aur emotional trading se bachne ki koshish karein. Happy Trading!

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:16 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим