Kicker candlestick pattern !!

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Kicker candlestick pattern !! Introduction Salaam alaikum ummid Karti hun ke Forex ke tamam khairiyat se honge bhai aur bahanon aaj ka hamara topic bahut hi khas topic Hai is topic ko samajhne ki bahut jyada jarurat hai is topic ko jitna jyada aap samjhenge utna jyada aapke liye fayda hoga yah Jo topic mein aap logon ke liye Lai hun is topic ka naam hai kikar candlestick pattern hai iske kya fayde Hain Aaj main ine sab ke bare mein detail se aapko bataungi to Yahan main is topic per baat karte hain shukriya What is a candlestick?? A strong white candle pattern reverses the hai jo pattern along the hai card. A candle from a candle, jinmein doosriShamdan pehle wali Shamdan ki bedeni ko puri tarah "digging" kar deti hai. Jab kicker galat tarah se samjha jaye mun ise keliye ek strong field signal Jab kicker shampattern pehchana jaye trader apne liye ek if against, kar sakte hain, aur isliye yeh jata hai strong technical indicator. raha hai aur aaj bhi is a widely accepted form of technical analysis keliye maana jata hai.Description!! Candlestick pattern, mana jata hai combination, jinmein doosri sham pehli wali ki bed ko ko puri tarah se "kick" card. Yes nagish tab banta hai jab doosra lamp ka open dono pehle wali lamp ka range ka bahar hote hain. Close Candle The candle price is the opening and closing price. Kicker candlestick pattern is a strong trend that may reverse in zaria hai. Signal signal deta ka market ka trend mein moment kam kam hone ka andar ho raha hai aur koi new trend ho sakta hai. Understand bazaar long pattern kicker baad nikale uska matlab yeh hota hai i feel i have a strong position ho rahi hai. Key Isko yad rakhna bhi zaruri hai the longer the trend the stronger the signal balance.

-

#3 Collapse

kicker candlestick pattern introduction Kicker candlestick pattern ek technical analysis tool hai jo stock market ya financial markets mein istemal hota hai. Yeh pattern do candlesticks (mumkin hai, kisi aur timeframe pe bhi) ke beech hone wala hota hai, aur ye market sentiment ko darust karne mein madadgar hota hai. Kicker candlestick pattern mein do main components hote hain: Pehli Candlestick: Pehli candlestick ek trend mein hoti hai, jaise uptrend ya downtrend. Is candlestick ka rang zyada hota hai aur uski closing price dusri candlestick ke opening price ke nazdeek hoti hai. Dusri Candlestick: Dusri candlestick opposite direction mein hoti hai, yaani agar pehli candlestick uptrend mein thi, to dusri candlestick downtrend mein hoti hai aur vice versa. Iski opening price pehli candlestick ki closing price ke nazdeek hoti hai. Kicker candlestick pattern formation Kicker candlestick pattern ek technical analysis ka part hai jo stock market ya forex trading me istemal hota hai. Kicker pattern do opposite candles se banta hai, aur yeh bullish ya bearish market reversals ko darust karne me madadgar hota hai. Bullish Kicker Pattern: Pehla candle bearish hota hai aur ek downtrend ko darust karta hai. Dusra candle opposite direction me (bullish) open hota hai aur pehle candle ke close price se above hota hai. Yeh pattern bullish reversal ko darust karta hai, iska matlab ki market me uptrend shuru hone ke chances hote hain. Bearish Kicker Pattern: Pehla candle bullish hota hai aur ek uptrend ko darust karta hai. Dusra candle opposite direction me (bearish) open hota hai aur pehle candle ke close price se below hota hai. How to trade kicker candlestick pattern Kicker candlestick pattern forex trading mein ek powerful reversal pattern hai. Is pattern ko trade karne ke liye niche diye gaye steps follow kar sakte hain: Identify the Kicker Pattern: Sabse pehle, aapko market charts par kicker candlestick pattern ko identify karna hoga. Ye pattern do candles se mil kar banta hai: ek bullish (green) candle followed by ek bearish (red) candle jiska size pehle candle se bada hota hai. Confirmation: Kicker pattern ko trade karne se pehle, aapko iske confirmation ke liye aur factors ka bhi dhyan dena hoga. Jaise ki trend, support aur resistance levels, aur technical indicators ka use. Entry Point: Agar aapne kicker pattern ko identify kiya aur confirm kiya, toh entry point par dhyan dena hoga. Aap entry point ke liye stop-loss aur target levels bhi set kar sakte hain. Risk Management: Hamesha risk management ka dhyan rakhein. Apne trading capital ka ek chhota hissa hi har trade par lagayein. Stop-loss orders ka use karein taaki loss control mein rahe. Practice and Analysis: Kicker pattern ko trade karne se pehle demo account par practice karein aur historical data ko analyze karein. Isse aapko is pattern ko samajhne aur improve karne mein madad milegi. Market Conditions: Market conditions ka bhi dhyan rakhein. Kicker pattern acchi tarah se work karta hai jab market mein strong reversal hote hain. Range-bound markets mein iska use kam effective ho sakta hai. Stay Informed: Forex market ki latest news aur events ko follow karein kyunki ye market sentiment par bhi asar daalte hain.

- Mentions 0

-

سا0 like

-

#4 Collapse

Kicker Candlestick Pattern ka Introduction Kicker Candlestick Pattern eik technical indicator hai jo traders ko market trends ko samajhne mein madadgar hota hai. Is pattern ki samajh se traders behtar trading decisions le sakte hain aur apne investments ko surakshit rakh sakte hain. Lekin, hamesha yaad rahe ke kisi bhi trading pattern ki tafseelat ko samajhne aur istemal karne se pehle, aapko apni research aur risk management par bhi tawajjo deni chahiye. Trading mein safalta hasil karne ke liye, ilm aur sahi samajh bohot zaroori hain.Kicker Candlestick Pattern, in the world of technical analysis, is a fascinating and powerful indicator used by traders to identify potential trend reversals in the financial markets. This pattern, with its distinct characteristics, can provide valuable insights into market sentiment and help traders make informed decisions. In this article, we will delve into the intricacies of the Kicker Candlestick Pattern in Roman Urdu, shedding light on its significance and how traders can effectively utilize it. **Kicker Candlestick Pattern Ki Tareef Kicker Candlestick Pattern ek aisi trading pattern hai jo price charts par paya jata hai aur ye aksar trend reversal ko darust karti hai. Iska naam "Kicker" is wajah se hai kyunki ye ek tezi se changing market trend ko signal karta hai, jaise kisi kicker ki kick hoti hai jo game mein palat jati hai. **Kicker Candlestick Pattern Ke Khasosiyat Kicker Candlestick Pattern ki pehchan karne ke liye, aap ko iske kuch mukhtalif pehluon par tawajjo deni hoti hai: Do Candlesticks Hote Hain:** Kicker Candlestick Pattern hamesha do candlesticks se banta hai. Pehla candlestick ek trend mein hota hai aur doosra candlestick opposite trend mein hota hai. Dono Candlesticks Ka Size Barabar Hota Hai:** Kicker Pattern ke dono candlesticks ka size barabar hota hai ya phir bohot kareeb barabar hota hai. Pehla Candlestick Large or Solid Hota Hai:** Pehla candlestick usually large aur solid hota hai, jo trend ko confirm karta hai. Dusra Candlestick Pehle Candlestick Ko Cover Karta Hai:** Dusra candlestick pehle candlestick ko poori tarah se cover karta hai, iska matlab hai ke ye naye trend ki shuruat ko darust karta hai. Kicker Candlestick Pattern ky sath Trading Strategies Kicker Candlestick Pattern ka istemal trading strategies banane mein kiya jata hai. Is pattern ko samajh kar traders market mein behtar faislay kar sakte hain. Yahan kuch am taur par istemal hone wali strategies hain:1. Kicker Bullish Pattern2. Kicker Bearish Pattern1. **Kicker Bullish Pattern:** Agar pehla candlestick downtrend mein hai aur doosra candlestick strong uptrend mein hai, to ye Kicker Bullish Pattern hai. Isko dekhte hue traders long positions le sakte hain.2. **Kicker Bearish Pattern:** Agar pehla candlestick uptrend mein hai aur doosra candlestick strong downtrend mein hai, to ye Kicker Bearish Pattern hai. Isko dekhte hue traders short positions le sakte hain.3. **Stop Loss Aur Target Levels:** Kicker Candlestick Pattern ke istemal mein, stop loss aur target levels ko tay karna bhi zaroori hai. Isse risk management behtar hoti hai. **Kicker Candlestick Pattern Ke Fayde Kicker Candlestick Pattern ke istemal se traders ko kuch faide milte hain, Trend Reversal Ko Pehchan:** Ye pattern trend reversal ko jaldi pehchanne mein madadgar hota hai. Entry Aur Exit Points:** Iske istemal se traders behtar entry aur exit points tay kar sakte hain.Risk Management:** Stop loss aur target levels tay karke risk management ko behtar banaya ja sakta hai. -

#5 Collapse

Kicker candlestick pattern ek reversal pattern hota hai, jo market direction mein ek sudden change ko represent karta hai. Ye pattern typically do consecutive candlesticks ke sath hota hai, ek bullish (upward) aur ek bearish (downward). Kicker pattern traders ke liye important hota hai, kyunki isse market direction ke unexpected changes ko indicate kiya jata hai.

Kicker pattern ki key characteristics:

1. Pehli Candlestick (First Candle):- Pehli candlestick ek established trend ko represent karti hai, jo typically long and strong hoti hai.

- Yeh candlestick bullish ya bearish ho sakti hai, depending on the existing trend.

2. Dusri Candlestick (Second Candle):- Dusri candlestick, pehli candlestick ke opposite direction mein hoti hai.

- Yeh candlestick bhi strong hoti hai, typically opening price pe gap open hoti hai (yani pehli candlestick ke closing price se dusri candlestick ki opening price mein substantial gap hota hai).

- Dusri candlestick opposite direction mein hone ke sath sath, substantially long hoti hai, jisse ye indicate hota hai ke market direction mein strong reversal hone ke chances hain.

Kicker pattern ek clear reversal signal deta hai, jahan traders ko market direction ke change ke bare mein peshewar hota hai. Agar pehli candlestick bullish hai aur dusri candlestick bearish hai, to ye bearish reversal signal deta hai. Aur agar pehli candlestick bearish hai aur dusri candlestick bullish hai, to ye bullish reversal signal deta hai.

Trading Strategy using Kicker Candlestick Pattern:

Bullish Kicker Pattern:- Agar pehli candlestick bearish hai aur dusri candlestick bullish hai, to ye bullish kicker pattern hota hai.

- Traders is pattern ke baad long position le sakte hain, with a stop-loss order to manage risk.

- Target levels tay kiya jate hain jahan tak price ke bullish move ka expectation hota hai.

Bearish Kicker Pattern:- Agar pehli candlestick bullish hai aur dusri candlestick bearish hai, to ye bearish kicker pattern hota hai.

- Traders is pattern ke baad short position le sakte hain, with a stop-loss order to manage risk.

- Target levels tay kiya jate hain jahan tak price ke bearish move ka expectation hota hai.

Kicker pattern trading strategy risky ho sakti hai, isliye risk management aur stop-loss orders ka istemal zaroori hai. Is pattern ko dusre technical indicators aur analysis ke saath istemal karne se behtar results mil sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

Kicker candlesticks Pattern Kia Ha?

Kicker pattern ek aisa two bar candlestick pattern hai jo kisi asset ke price trend ki direction mein ek badlaav ka prediction karta hai. Is pattern ki pehchaan hoti hai two candlesticks ke span mein price mein tezi se reversal hone ki. Traders iska istemaal karte hain direction mein kaunsa market participants ka group control mein hai yeh determine karne ke liye.

Kicker Candlesticks Direction:

Yeh pattern ek strong change ko point karta hai investors ke attitudes mein ek security ke prati. Direction ka change usually tab hota hai jab kisi company industry ya economy ke valuable information ka release hota hai.

Kicker Candlesticks Bulls or Bears:

Kicker patterns ya to bullish hote hain ya bearish. Bullish kickers bearish candle se shuru hote hain aur phir bullish gap up dikhaate hain. Bearish kickers bullish candle se shuru hote hain aur phir bearish gap down dikhaate hain. Kicker pattern ko observe karne wale traders ko lag sakta hai ki price bahut jaldi move ho gayi hai aur woh pullback ka wait kar sakte hain. Lekin, woh traders khud ko pareshan mehsus kar sakte hain ki woh kabhi position enter kar lete jab unhone pehle hi kicker pattern ko identify kiya tha.

Kicker Candlesticks Pattern Strong Sentiment Indicator:

Kicker pattern ek strong bull ya bear sentiment indicator hai lekin yeh pattern rare hota hai. Zyaadatar professional traders ek direction mein jaldi se overreact nahi karte hain. Lekin, jab kicker pattern present hota hai, money managers turant notice lete hain. Candles ke bodies kai trading platforms par mukhtalif rangon mein dikhai deti hain, jis se investor sentiment mein hone wali tabdeeli ko rangin tareeqe se dikhaya jata hai. Kicker pattern sirf tab hota hai jab investor attitude mein significant tabdeeli hojati hai, isliye isko aksar market psychology ya behavioral finance ke dusre measures ke saath study kiya jata hai.

Kicker Bearish Candlesticks Pattern:

Pehle din Day 1 ek candlestick uptrend mein jaari rehti hai aur isliye bullish nature ki hoti hai. Jab ye uptrend mein banti hai, toh iska apne aap mein koi khaas maayne nahi hota. Dusre din Day 2 ek bearish candlestick nikalti hai. Ye candlestick pehle din ki candle ki price par open hoti hai ya gap down hoti hai aur phir Day 1 ki candle ke opposite direction mein move karti hai. Is pattern ko sahi hone ke liye, dusre din ki candle pehle din ki candle ke price par ya usse niche open honi chahiye. Traders aam taur par ye ummeed karte hain ki dusre din ki candle se pehle ki gap down hone se prices dusre din ke baad bhi girti rahengi.

Kicker Candlesticks Example:

Kicker pattern samajhne ke liye humein pehle financial market ki duniya ko samajhna zaruri hai. financial market mein buyers (bulls) aur sellers (bears) mein competition hoti hai. In players ke beech constant tug of war hoti hai jisse candlestick patterns ban jate hain. Candlestick charting technique 1700s mein Japan mein develop hui thi jahan pe rice ke price ko track kiya jata tha. Candlesticks kisi bhi liquid financial asset jaise stocks, futures, aur foreign exchange ke trading ke liye suitable technique hai. Kicker pattern ek reliable reversal pattern mana jata hai aur generally ek company ke fundamentals mein dramatic change ko indicate karta hai. Kicker pattern ek reversal pattern hai, aur yeh gap pattern se alag hota hai, jismein gap up ya down dikhta hai aur us trend mein rehta hai. Patterns similar lagte hain, lekin har ek apne tareeke se kuch alag imply karte hain. -

#7 Collapse

Kicker candlestick pattern

Title: "Kicker Candlestick Pattern:

Introduction: Candlestick patterns are essential tools in technical analysis, providing traders with valuable insights into market sentiment and potential price movements. One such powerful pattern is the "Kicker" candlestick pattern. In this detailed guide, we will explore the characteristics of the Kicker pattern, its significance, and how traders can leverage this information for effective decision-making.

Section 1: Candlestick Basics Candlestick charts originated in Japan and have become widely popular in financial markets. These charts visually represent price movements, with each candlestick providing information about the opening, closing, high, and low prices for a specific time period. Understanding the basics of candlestick analysis is crucial for interpreting complex patterns like the Kicker.

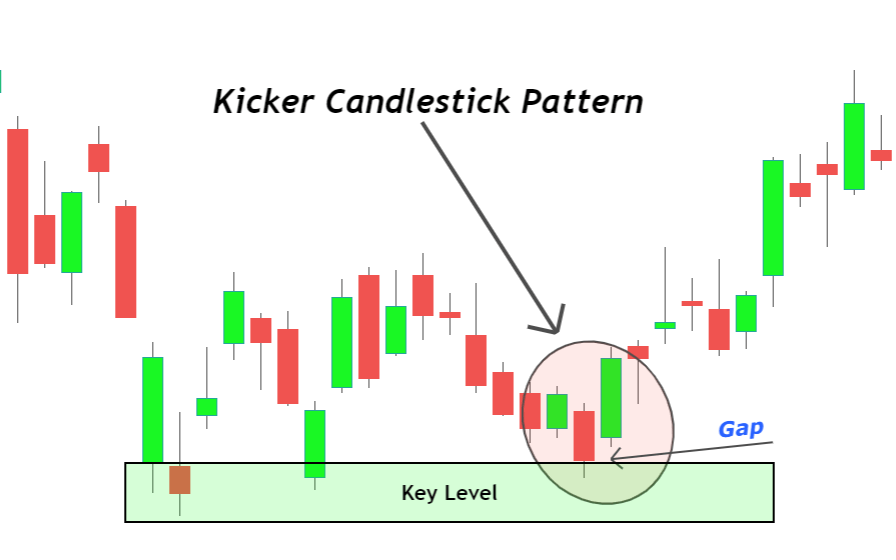

Section 2: Anatomy of a Kicker Candlestick The Kicker pattern consists of two candles: the first candlestick reflects the prevailing trend, while the second candlestick opens with a gap in the opposite direction. This sudden shift signifies a change in market sentiment and often leads to significant price reversals.

Section 3: Identifying the Kicker Pattern Traders should be vigilant in identifying Kicker patterns on their charts. Look for a strong, decisive candle in one direction, followed by a gap in the opposite direction in the next candle. The gap represents a sudden change in market sentiment, and the larger the gap, the more significant the potential reversal.

Section 4: Types of Kicker Patterns There are two main types of Kicker patterns: Bullish Kicker and Bearish Kicker. The Bullish Kicker occurs after a downtrend, signaling a potential reversal to the upside. Conversely, the Bearish Kicker appears after an uptrend, indicating a possible shift to the downside. Traders need to recognize these variations to make informed trading decisions.

Section 5: Significance of the Kicker Pattern The Kicker pattern is considered a robust and reliable reversal signal. Its formation suggests a sudden and forceful change in market sentiment, catching many traders off guard. This unexpected shift often leads to substantial price movements, providing lucrative opportunities for those who can correctly identify and act upon the pattern.

Section 6: Trading Strategies with the Kicker Pattern Successful trading requires more than just recognizing patterns; it involves developing effective strategies. Traders can incorporate the Kicker pattern into their trading plans by using it as a confirmation signal for other technical indicators. Additionally, combining the Kicker with risk management strategies enhances the likelihood of profitable trades.

Section 7: Real-Life Examples To better grasp the application of the Kicker pattern, examining real-life examples is invaluable. Through historical charts and case studies, traders can witness how the Kicker pattern played out in different market conditions, reinforcing their understanding and confidence in utilizing this powerful tool.

Section 8: Common Pitfalls and Challenges While the Kicker pattern is a robust signal, traders must be aware of potential pitfalls and challenges. False signals, market noise, and incomplete gaps can mislead traders. Therefore, it is essential to combine the Kicker pattern with other technical analysis tools for a comprehensive assessment.

Section 9: Conclusion In conclusion, the Kicker candlestick pattern is a dynamic and potent tool in a trader's arsenal. Its ability to signal abrupt shifts in market sentiment makes it valuable for identifying potential trend reversals. However, traders should exercise caution, employ risk management strategies, and complement the Kicker pattern with other indicators for a well-rounded approach to trading.

By understanding the intricacies of the Kicker pattern, traders can enhance their technical analysis skills and make more informed decisions in the dynamic world of financial markets. -

#8 Collapse

Title: "Kicker Candlestick Pattern:

Introduction: Candlestick patterns are essential tools in technical analysis, providing traders with valuable insights into market sentiment and potential price movements. One such powerful pattern is the "Kicker" candlestick pattern. In this detailed guide, we will explore the characteristics of the Kicker pattern, its significance, and how traders can leverage this information for effective decision-making.

Section 1: Candlestick Basics Candlestick charts originated in Japan and have become widely popular in financial markets. These charts visually represent price movements, with each candlestick providing information about the opening, closing, high, and low prices for a specific time period. Understanding the basics of candlestick analysis is crucial for interpreting complex patterns like the Kicker.

Section 2: Anatomy of a Kicker Candlestick The Kicker pattern consists of two candles: the first candlestick reflects the prevailing trend, while the second candlestick opens with a gap in the opposite direction. This sudden shift signifies a change in market sentiment and often leads to significant price reversals.

Section 3: Identifying the Kicker Pattern Traders should be vigilant in identifying Kicker patterns on their charts. Look for a strong, decisive candle in one direction, followed by a gap in the opposite direction in the next candle. The gap represents a sudden change in market sentiment, and the larger the gap, the more significant the potential reversal.

Section 4: Types of Kicker Patterns There are two main types of Kicker patterns: Bullish Kicker and Bearish Kicker. The Bullish Kicker occurs after a downtrend, signaling a potential reversal to the upside. Conversely, the Bearish Kicker appears after an uptrend, indicating a possible shift to the downside. Traders need to recognize these variations to make informed trading decisions.

Section 5: Significance of the Kicker Pattern The Kicker pattern is considered a robust and reliable reversal signal. Its formation suggests a sudden and forceful change in market sentiment, catching many traders off guard. This unexpected shift often leads to substantial price movements, providing lucrative opportunities for those who can correctly identify and act upon the pattern.

Section 6: Trading Strategies with the Kicker Pattern Successful trading requires more than just recognizing patterns; it involves developing effective strategies. Traders can incorporate the Kicker pattern into their trading plans by using it as a confirmation signal for other technical indicators. Additionally, combining the Kicker with risk management strategies enhances the likelihood of profitable trades.

Section 7: Real-Life Examples To better grasp the application of the Kicker pattern, examining real-life examples is invaluable. Through historical charts and case studies, traders can witness how the Kicker pattern played out in different market conditions, reinforcing their understanding and confidence in utilizing this powerful tool.

Section 8: Common Pitfalls and Challenges While the Kicker pattern is a robust signal, traders must be aware of potential pitfalls and challenges. False signals, market noise, and incomplete gaps can mislead traders. Therefore, it is essential to combine the Kicker pattern with other technical analysis tools for a comprehensive assessment.

Section 9: Conclusion In conclusion, the Kicker candlestick pattern is a dynamic and potent tool in a trader's arsenal. Its ability to signal abrupt shifts in market sentiment makes it valuable for identifying potential trend reversals. However, traders should exercise caution, employ risk management strategies, and complement the Kicker pattern with other indicators for a well-rounded approach to trading.

By understanding the intricacies of the Kicker pattern, traders can enhance their technical analysis skills and make more informed decisions in the dynamic world of financial markets.

-

#9 Collapse

Kicker candlestick pattern

Dear forex members Kicker candlestick pattern ek technical analysis tool hai jo stock market ya financial markets me istemal hota hai. Yeh pattern 2 candlesticks ke beech hony wala hota hai, aur ye market sentiment ko darust karny me helpful hota hai. Kicker candlestick pattern me 2 main components hoty hain

Bearish Kicker Candlestick Pattern

Dear my friends Bearish Kicker candlestick pattern ek powerful bearish reversal pattern hai jo stock market ya financial market me traders aur investors ke liye bhot mufeed hota hai. Yeh pattern normally bullish trend ke bad dekha jata hai, aur bearish trend shuruwat ko signify karta hai.Bearish Kicker pattern 2 candlesticks se banta hai. Pehla candlestick ek bullish (upward) trend me hota hai aur dusra candlestick iske bilkul neeche (downward) open hota hai. Dono candlesticks ke body, range aur closing prices me significant gap hota hai, jo indicate karta hai ki market sentiment suddenly change ho gya hai.

Bullish Kicker Candlestick Pattern

Dear members Bullish kicker candlestick pattern ko Stock Trading Me Samajhna"Bullish Kicker Candlestick Pattern ek powerful bullish reversal pattern hai jo stock trading me istemal hota hai. Yeh pattern price trend ke reversal ya change ko indicate karta hai. Bullish Kicker pattern uptrend ya sideway market ke baad dikhai deta hai aur ek strong bullish signal provide karta hai. Bullish Kicker Pattern ka Formation mein Pehla candlestick bearish red ya black hota hai jo price ka downward movement dikhata hai.Doosra Candlestick: Doosra candlestick bullish green ya white hota hai aur pehle wale bearish candlestick ke neeche open hota hai. Yani ke doosra candle pehle wale candle ke range ke andar start hota hai.

-

#10 Collapse

-:Kicker candlesticks Pattern:-

"Kicker" ek term hai jo technical analysis ke candlestick chart patterns mein istemal hota hai. Kicker candlestick pattern do candle bars se mil kar banta hai aur isse market ki sentiment mein tezi se palat aane ka signal milta hai. Ye pattern strong aur reliable reversal pattern mana jata hai. Iske do types hote hain: Bullish Kicker aur Bearish Kicker.

- Bullish Kicker:

- Pehla candlestick lamba bearish (down) candle hota hai jo current downtrend ko darust karti hai.

- Dusra candlestick lamba bullish (up) candle hota hai jo pehle din ke close se kafi nicha khulta hai.

- Bullish Kicker ka appearance ek strong buying interest ko darust karta hai, jisse downtrend mein achanak se trend reversal hota hai.

- Is pattern mein traders ko attention dene ki zarurat hoti hai, kyun ki yeh ek powerful reversal signal ho sakta hai.

- Bullish Kicker ke baad, uptrend shuru ho sakta hai, aur traders is signal ko confirmation ke liye doosre technical indicators ke saath combine karte hain.

2. Bearish Kicker:- Pehla candlestick lamba bullish (up) candle hota hai jo current uptrend ko darust karta hai.

- Dusra candlestick lamba bearish (down) candle hota hai jo pehle din ke close se kafi oopar khulta hai.

- Dusra candle jaldi se market ki sentiment ko palat deta hai, oopar khulta hai lekin tezi se neeche jaakar band hota hai.

- Bearish Kicker ka appearance ek strong selling pressure ko darust karta hai, jisse uptrend mein achanak se trend reversal hota hai.

- Is pattern ko dekhte hue traders cautious hote hain aur existing long positions ko protect karne ke liye measures le sakte hain.

- Bearish Kicker ke baad, downtrend shuru ho sakta hai, aur traders is signal ko confirmation ke liye doosre technical indicators ke saath combine karte hain.

- Bullish Kicker aur Bearish Kicker dono hi market mein sudden reversal ko darust karne ka signal dete hain aur traders in patterns ko dekh kar future price movements ka anuman lagane ka pryas karte hain. Yeh patterns market psychology ko reflect karte hain, jisme buyers aur sellers ke beech mein tewar badalne ki suchna hoti hai.

- Bullish Kicker:

-

#11 Collapse

Kicker candlestick pattern

1. Ta'aruf (Introduction):

Kicker candlestick pattern ek technical analysis ka hissa hai jo ke financial markets mein istemal hota hai. Ye pattern market ke trend aur reversal ko samajhne mein madad karta hai. Kicker candlestick pattern mein do mukhtalif candles shamil hote hain.

2. Kicker Candlestick Pattern Ki Pechan (Identification of Kicker Candlestick Pattern):

Kicker candlestick pattern ko pehchan'ne ke liye aapko do consecutive (aapas mein musallas) candles ki zarurat hoti hai. Pehli candle downtrend ya uptrend mein hoti hai, jabke dusri candle opposite direction mein hoti hai.

3. Uptrend Mein Kicker Candlestick Pattern:

Agar pehli candle uptrend mein hai, aur dusri candle downtrend mein hai to ye ek bullish kicker hai. Iska matlub hai ke market ka trend badal sakta hai aur buyers control mein aa sakte hain.

4. Downtrend Mein Kicker Candlestick Pattern:

Agar pehli candle downtrend mein hai, aur dusri candle uptrend mein hai to ye ek bearish kicker hai. Iska matlub hai ke market ka trend badal sakta hai aur sellers control mein aa sakte hain.

5. Trading Signals (Trading Signals):

Kicker candlestick pattern traders ko ye indication deta hai ke market mein sudden reversal hone ke chances hain. Agar aapko ye pattern milta hai to aapko trend reversal ka samay aaya ho sakta hai.

6. Hifazati Tadabeer (Precautionary Measures):

Har technical analysis pattern ki tarah, kicker candlestick pattern bhi 100% sahi nahi hota. Traders ko hamesha market ke aur factors ko madde nazar rakhte hue apne decisions leni chahiye.

7. Khatima (Conclusion):

Kicker candlestick pattern ek powerful tool hai jo market trends ko samajhne mein madad karta hai. Is pattern ki sahi samajh aur istemal se traders apne trading strategies ko behtar bana sakte hain.

-

#12 Collapse

Kicker Pattern

blush kukkar ki misaal aik mazboot aur wazeh mom batii design hai jo mumkina ulat ya utney ke tasalsul ko jhanda deta hai. is misaal ko aik ghair mutawaqqa aur barray amoodi laagat ke sorakh se bayan kya gaya hai, jo market mein manfi se taizi ki raye ke liye mazbooti ke shobo ka muzahira karta hai. bullish kicker misaal ki mukammal barikyan yeh hain :

Pattern Formation:

blush kukkar design do mom btyon par mushtamil hai : aik manfi ( neechay ) candle ke baad blush ( oopar ) candle .

principal candle aik motadil lambi aur manfi mom batii hai jo neechay ke rujhan ke douran hoti hai. yeh roshni farokht ke dabao aur aik ahem manfi ehsas ko daur karti hai .

Interpretation:

manfi se taizi ki taraf market ke ehsas mein fori aur taaqatwar tabdeeli ki sifarish karta hai .

do mom btyon ke darmiyan laagat ka sorakh kharidari ki dilchaspi aur mumkina kharidari ke dabao ke liye taaqat ke shobo ko zahir karta hai .

dealers is misaal ko is alamat ke tor par samajte hain ke kharidaron ne kamaan sambhaal li hai aur yeh ke koi ulta ho sakta hai ya mojooda izafay ka tasalsul ho sakta hai .

sorakh jitna ziyada ground hoga aur blush light ka is ki oonchai se barah e raast talluq hai, blush kukkar design ke baray mein socha jata hai .

Trading Strategies:

blush kukkar design ki roshni mein tabadlay mein daakhil honay se pehlay toseeq ke liye tajir kasrat se lataktay rehtay hain. is mein is baat par bharosa karna shaamil ho sakta hai ke darj zail candle onche band ho jaye gi ya taizi ke ulat jane mein madad ke liye izafi khusoosi markroon ke liye .

indraaj : chand tajir teesri mom batii ke khilnay par fori tor par aik lambi ( kharidari ) position mein daakhil ho jatay hain, jo taizi ke sath jari rehne ki tawaqqa rakhtay hain .

stop misfortune : khatray ki nigrani ke liye doosri ( taizi ) candle ke nichale hissay ke neechay aik stap bad qismati ki darkhwast dalain .

faida uthayen : khusoosi imthehaan ke paish e nazar faida uthany ke liye marozi satah ka faisla karen, misaal ke tor par, mandarja zail rukawat ki satah ya misaal se jaan boojh kar iqdaam .

Caution:

agarchay blush kukkar nishani ke liye taaqat ke barray shobay hain, lekin tabadlay ke ikhtiyarat par tay karne se pehlay deegar khusoosi awamil aur muashi halaat par ghhor karna bunyadi hai .

run davn mein, blush kukkar ki misaal aik do mom batii wala design hai jo taizi se neechay ke rujhan se mumkina izafay ki taraf jhandi dekhata hai. dealers is misaal ko khulay darwazay ki kharidari mein farq karne ke liye istemaal karte hain aur market mein taizi ke ulat ya tasalsul ki tawaqqa karte hain. asbat aur munasib juaa board blush kukkar design ke paish e nazar tabadlay ke ahem hissay hain . -

#13 Collapse

Kicker Pattern

kicker pattern aik two-bar candlestick pattern hai jo kisi asasay ki qeemat ke rujhan ki simt mein tabdeeli ki paish goi karta hai. yeh namona do mom btyon ke doraniye mein qeemat mein taizi se ulat phair ki khasusiyat rakhta hai. tajir is ka istemaal is baat ka taayun karne ke liye karte hain ke market ke shurka ka kon sa group simt ke control mein hai .

pattern security ke hawalay se sarmaya karon ke rawaiyon mein mazboot tabdeeli ki taraf ishara karta hai. simt mein tabdeeli aam tor par company, sanat, ya maeeshat ke baray mein qeemti maloomat ke ajra ke baad hoti hai.

kicker-candle-trading-1.webp

Understanding the Kicker Pattern

kicker pattern ko sab se ziyada qabil reliable reversal pattern mein se aik samjha jata hai aur aam tor par company ke bunyadi usoolon mein dramayi tabdeeli ki nishandahi karta hai. kicker pattern aik ulat palat patteren hai, aur yeh aik gape pattern se mukhtalif hai, jo oopar ya neechay ke farq ko zahir karta hai aur is rujhan mein rehta hai. pattern aik jaisay nazar atay hain, lekin har aik ka matlab kuch mukhtalif hota hai.

Bull Market vs. Bear Market

takneeki tajzia mein do sab se ahemtwo most important kicker patterns in technical analysis ke liye, sab se pehlay bull market aur bear market ke darmiyan farq ko samjhna zaroori hai.

animal reference ke zareya liya gaya inancial terms directly relates se maliyati manndi mein muqaabla karne walay competing buyers ( bulls) aur sellers walon ( bears) ki financial market se mutaliq hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Kicker Candlestick Pattern:

Kicker candlestick pattern, ya toh bullish ya bearish hota hai, aur ye ek powerful reversal signal provide karta hai. Is pattern ka tajurbah aapke candlestick analysis ko improve kar sakta hai.

Kicker pattern, do opposite colored candles se milta hai jo ek dusre ke opposite directions mein close hote hain. Ye ek strong market reversal signal deta hai, indicating a sudden shift in market sentiment.

Bullish Kicker:

Bullish kicker pattern mein pehle candle bearish hota hai, jo ki ek downtrend ko represent karta hai. Dusre candle ka open pehle candle ke close se higher hota hai, aur ye green/bullish candle hota hai. Yeh sudden change bullish momentum ko darust karta hai.

Bearish Kicker:

Bearish kicker pattern mein pehla candle bullish hota hai, jo ki ek uptrend ko darust karta hai. Dusre candle ka open pehle candle ke close se lower hota hai, aur ye red/bearish candle hota hai. Yeh sudden change bearish momentum ko darust karta hai.

Kicker Pattern ki Tafseelat:

Pehla Candle (Initiating Candle):

Ye candle existing trend ko reflect karta hai.

Dusra Candle (Kicking Candle):

Iski opening value pehle candle ki closing value se opposite direction mein hoti hai, indicating a sudden and strong shift in market sentiment.

Bullish Kicker ka Tafseelaat:

Pehle candle bearish hota hai, indicating downtrend.

Dusra candle bullish hota hai, indicating a sudden shift to uptrend.

Ye bullish reversal ko confirm karta hai.

Bearish Kicker ka Tafseelaat:

Pehla candle bullish hota hai, indicating uptrend.

Dusra candle bearish hota hai, indicating a sudden shift to downtrend.

Ye bearish reversal ko confirm karta hai.

Kyun Kicker Pattern Kaam Karta Hai:

Strong Reversal Signal:

Kicker pattern ek strong reversal signal hai, kyunki dusre candle ki opening value pehle candle ki closing value se opposite hoti hai.

Market Sentiment Change:

Kicker pattern indicate karta hai ke market sentiment mein sudden aur drastic change hua hai.

Volume Confirmation:

Is pattern ke sath high trading volume ka hona bhi important hai, jo ki reversal ko confirm karta hai.

Trading Strategies:

Confirmation Ke Liye Wait Karein:

Kicker pattern ko confirm karne ke liye, traders ko dusre technical indicators aur volume analysis ka istemal karna chahiye.

Stop-Loss aur Target Levels Set Karein:

Risk management ke liye, stop-loss aur target levels set karna important hai.

Dusre Confirmatory Signals Dhundein:

Kicker pattern ke sath dusre confirmatory signals, jaise ki RSI, MACD, aur trend lines ka istemal karein.

Khatraat aur Hifazati Tadabeer:

False Signals:

Kicker pattern bhi false signals generate kar sakta hai, is liye confirmation ke liye aur indicators ka istemal karein.

News Aur Events Ka Dhyan Rakhein:

Market mein sudden changes aane par, news aur events ka bhi dhyan rakhein, kyunki ye pattern unke influence mein ho sakta hai.

Conclusion:

Kicker pattern powerful hai, lekin har ek trading decision ko carefully analyze karna zaroori hai. Technical analysis ke sath fundamental analysis aur risk management ko combine karke hi trading karein.

Is pattern ko samajhne ke liye practice aur experience ki zarurat hai. Trading mein successful hone ke liye, consistent learning aur improvement ka tajurbah bhi hona chahiye.

Thanks for your guys

- CL

- Mentions 0

-

سا1 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:54 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим