Head and Shoulders Candlestick Pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

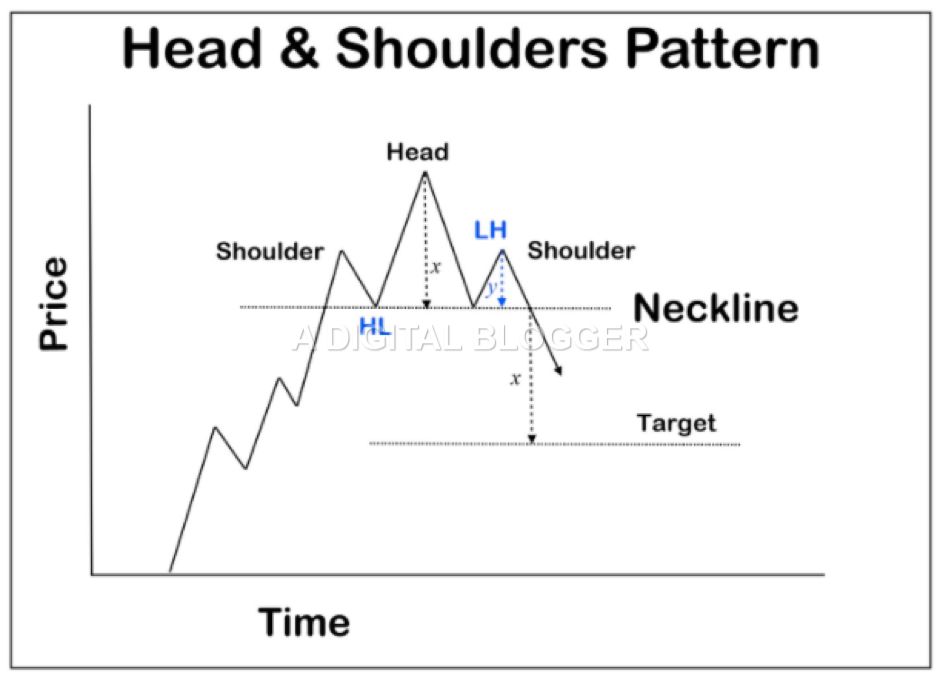

Head and Shoulders Candlestick Pattern ka Introduction Head and Shoulders Candlestick Pattern trading ke liye bohat faydemand ho sakti hai, lekin isme bhi khatraat hain. Market volatility, false signals, aur unexpected news events se bachne ke liye cautious rehna zaroori hai. Isi tarah, overtrading se bhi bachna chahiye.Candlestick patterns forex aur stocks trading mein aik ahem hoti hain. In patterns ka ilm rakhna traders ke liye bohat zaroori hai. Aaj hum apko "Head and Shoulders Candlestick Pattern" ke bary mein batayenge. Ye pattern trading mein aik ahem hissa hai jo traders ke liye kafi madadgar sabit ho sakta hai. Head and Shoulders Candlestick Pattern ki Tafseel Head and Shoulders Candlestick Pattern ek technical analysis ka hissa hai jise traders market analysis aur price prediction mein istemal karte hain. Is pattern ka naam is liye hai kyun ke ye pattern ek human shoulder aur head ki tarah hota hai. Is pattern ki pehchan aam taur par ek bullish trend ke bad ati hai aur bearish reversal ko darust karti hai. Pattern ky sath trading strategies Is pattern ko samajhne ke liye, hum is ke components ko detail mein dekhte hain: 1. **Left Shoulder:** Pattern ki shuruaat bayan kandila (left shoulder) se hoti hai. Is kandile ki unchi wick aur kam closing hoti hai. Jab market uptrend mein hoti hai aur left shoulder banti hai, to ye ek indication ho sakti hai ke market thoda sa thak gaya hai. 2. **Head :** Head candle left shoulder ke baad ati hai aur is ki unchi wick hoti hai. Is kandile ki closing left shoulder ki closing se ziada hoti hai. Is stage par market mein uncertainty hoti hai aur traders mein confusion paida ho sakta hai. Head ko dekhte waqt ye samjha jata hai ke market ne aik important resistance level ko break kiya hai. 3. **Right Shoulder :** Right shoulder candle head ke baad aati hai aur is ki closing head ki closing se ziada hoti hai. Is phase mein bhi market mein uncertainty hoti hai aur price action ke beech tafawut hota hai. Right shoulder market mein aik aur pause darust karta hai. 4. **Neckline :** Neckline, left shoulder aur right shoulder ke darmiyan ek horizontal line hoti hai. Ye line support ki tarah kaam karti hai aur traders ke liye aik ahem reference point hai. Agar ye neckline break hoti hai, to ye bearish reversal ka indication hota hai aur traders sell positions le sakte hain. Head and Shoulders Candlestick Pattern ki Pehchan Head and Shoulders Candlestick Pattern ko trade karne ke liye, traders ko kuch steps follow karne chahiye: 1. **Pattern Confirmation:** Sab se pehle, traders ko is pattern ki confirmation dhoondni chahiye. Iska matlab hai ke left shoulder, head, aur right shoulder clearly dikhein aur neckline ko break kiya jaye. Confirmation ke bina is pattern par amal nahi karna chahiye. 2. **Stop Loss Aur Target Set Karna:** Entry point ke sath-sath stop loss aur target bhi set karna ahem hai. Stop loss ye decide karega ke kab aapko trade se bahar aana chahiye agar market against direction mein jaati hai. Targets bhi set karna zaroori hai takay aap profits ko capture kar saken. 3. **Risk Management:** Hamesha yaad rahe ke trading risky hoti hai. Apne capital ko protect karne ke liye risk management ka sahi tareeqa istemal karein. Position size ko control mein rakhein aur overtrading se bachein. 4. **Practice:** Is pattern ko samajhne aur us par amal karne ke liye practice zaroori hai. Demo trading account istemal kar ke apne skills ko improve karein. Head and Shoulders Candlestick Pattern ki formation Head and Shoulders Candlestick Pattern ek powerful trading tool ho sakti hai agar ise theek tareeqe se istemal kiya jaye. Is pattern ko samajhna aur istemal karna traders ke liye mushkil ho sakta hai, lekin practice aur experience ke sath ye aasan ho jata hai. Yaad rahe ke trading mein hamesha risk hota hai, is liye savdhan rehna zaroori hai. Is pattern ki madad se aap market ke trends ko samajh sakte hain aur behtar trading decisions le sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pattern ky sath trading strategies Is pattern ko samajhne ke liye, hum is ke components ko detail mein dekhte hain: 1. **Left Shoulder:** Pattern ki shuruaat bayan kandila (left shoulder) se hoti hai. Is kandile ki unchi wick aur kam closing hoti hai. Jab market uptrend mein hoti hai aur left shoulder banti hai, to ye ek indication ho sakti hai ke market thoda sa thak gaya hai. 2. **Head :** Head candle left shoulder ke baad ati hai aur is ki unchi wick hoti hai. Is kandile ki closing left shoulder ki closing se ziada hoti hai. Is stage par market mein uncertainty hoti hai aur traders mein confusion paida ho sakta hai. Head ko dekhte waqt ye samjha jata hai ke market ne aik important resistance level ko break kiya hai. -

#4 Collapse

Head and Shoulders Candlestick Pattern Roman Urdu:"Head and Shoulders" ek ahem candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern market trends ko predict karne aur trading decisions banane mein madadgar hota hai.Is pattern mein teen main parts hote hain: ek "head" aur do "shoulders." Jab ye pattern uptrend ke baad aata hai, to ye bearish reversal signal deta hai. Pehla shoulder uptrend ke dauran banta hai, phir head jo higher high pe hota hai, aur fir doosra shoulder jo head ke right side pe hota hai.Jab ye pattern complete hota hai, traders isay sell signal samajhte hain. Head and Shoulders pattern ki pehchan, head aur shoulders ke heights ko compare kar ke hoti hai. Agar head shoulders se higher hai, to ye pattern valid hota hai.Is pattern ko samajh kar, traders market mein behtar trading decisions le sakte hain aur losses se bach sakte hain. Isiliye, Head and Shoulders pattern technical analysis mein aham hota hai. -

#5 Collapse

Introduction:- Forex trading mein "Head and Shoulders" ek aham tijarat ke pattern hai jo tijarat karne walon ko maloom karne mein madadgar hota hai. "Head and Shoulders" pattern ek reversal pattern hai jo aksar uptrend ke baad banta hai aur currency pair ki keemat ke rukh mein tabdeel hone ki mumkin ashna hai. 2. Head and Shoulders Pattern:- Ye pattern teen ahem hisson se bana hota hai: a. Left Shoulder (LS): Ye pehla choti unchaai ka point hota hai jo ke price chart par aksar uptrend ke doran banta hai. Ye temporary resistance level ko darust karta hai. b. Head (H): Head wo point hota hai jo pattern ka bulandi nuktah hai. Ye left shoulder ke baad banta hai aur bullish trend ki unchaai ko darust karta hai. c. Right Shoulder (RS): Right shoulder teesra point hota hai jo head ke baad banta hai. Ye head se kam unchaai par hota hai aur aksar left shoulder ki terhan lagta hai. 3. Neckline:- Neckline ek support level hota hai jo left shoulder, head, aur right shoulder ke darmiyan kam unchaai ke points ko jorta hai. Ye pattern mein ahem hota hai. 4. Pattern Explanation:- "Head and Shoulders" pattern ki tasdeeq ke liye tijarat karne wale ye cheezen dekhte hain: a. Neckline Break:- Jab price neckline ke neeche gir jati hai, to ye pattern tasdeeq hota hai. b. Volume: Behtar tasdeeq ke liye, trading volume chahiye jo ke head aur right shoulder ke banne ke doran barh jata hai. Ye tasdeeq ko mazbooti deta hai. 5. Trading Move:- Jab "Head and Shoulders" pattern tasdeeq ho jata hai, to tijarat karne wale aksar isay istemal karte hain taake woh short (sell) positions mein dakhil ho saken, umeed hai ke price neechay ki taraf chalega. 6. Price Target:- Price target ko head se neckline tak ki doori ko nap karke aur breakout point se neechay jhatakne ke liye estemal kiya jata hai. Isse tijarat karne wale ko ye maloom hota hai ke price kitna nichay ja sakta hai. 7. Conclusion:- Jab "Head and Shoulders" pattern istemal karte hain, to yaad rahe ke har pattern ka kamyaabi se tasdeeq na hona bhi mumkin hai. Tijarat karne wale ko behtar natijon ke liye isay dosre analysis tools ke sath aur risk management techniques ke sath istemal karna chahiye. Ikhtitami alfaz mein, "Head and Shoulders" pattern forex trading mein ek popular chart pattern hai jo potential trend reversals ko pehchanne ke liye istemal hota hai. Tijarat karne wale isay istemal karte hain taake jab bearish reversal ka intezar ho, to woh short positions mein dakhil ho saken. Lekin, jaisa ke har tijarat ki stratiji hoti hai, isay behtar natijon ke liye dosre analysis tools ke sath istemal karna behtar hota hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

HEAD AND SHOULDERS CANDLESTICK PATTERN Takniki tajiya Mein Had and shoulder ka pattern use Kiya Jata Hai yah Ek Maksus Chart ki Tahskil hota hai jo Tezi se Mandi ke rujan ke ullat Jaane Ki pesh gui karta hai pattern three chotiyon ke sath Ek bases line ke Taur per zahar Kiya Jata Hai Jahan Bahar Ke Do unchai Mein Kareeb hote hain aur Darmiyan se Kafi zyada Hote Hain Head and Shoulder ka pattern use time banaa Hota Hai Jab stock ki price aruj per hoti hai aur phr pahle se upar ki base per Wapas Gir Jaati Hai phr price pichhali Choti Se Bahrkar head banati hai aakhirkar stock ki price Dobara niche Girney se pahle tashkil ki Pahli choti ki satah per pahunchti hai:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg) INVERSE HEAD AND SHOULDERS Head and Shoulder Ke Chart Ka ulat head aur shoulders hota hai Jaise head aur shoulder ka Niche Hota Hai yeah Head and Shoulder ke niche ke sath ulat hota hai jo niche ke rujan mein ulat Jaane Ki pesh hui karne ke liye use Kiya jata hai is pattern ki identityis time Hoti Hai Jab security ki price ka Amal ko pura karta hai price great per Giri Hoti Hai phr zyada Ho Jaati Hai price sabka great se niche Aati Hai phr Dobara zyada Ho Jaati Hai price Dobara girti hai lekin vahan Tak Nahin Hoti

INVERSE HEAD AND SHOULDERS Head and Shoulder Ke Chart Ka ulat head aur shoulders hota hai Jaise head aur shoulder ka Niche Hota Hai yeah Head and Shoulder ke niche ke sath ulat hota hai jo niche ke rujan mein ulat Jaane Ki pesh hui karne ke liye use Kiya jata hai is pattern ki identityis time Hoti Hai Jab security ki price ka Amal ko pura karta hai price great per Giri Hoti Hai phr zyada Ho Jaati Hai price sabka great se niche Aati Hai phr Dobara zyada Ho Jaati Hai price Dobara girti hai lekin vahan Tak Nahin Hoti  HEAD AND SHOULDERS PATTERN TELL YOU Head and Shoulder ka pattern is Baat Ke Nishan Dahi Karta Hai Ki ulat Jana Mumkin hai tajron Ka Khyal yah hota hai ki chotiyon aur gearto ke three seat Darmiyan Mein Ek Bari Choti Ke Sath iska matlab yah hai ki stock ki kimat girna shuru ho jayegi neckline is nukta ki numaendagi Karti Hai Jis per Mandi wale taajer firokt karna shuru ho Jaate Hain pattern yah bhi Ishara karta hai ki naya Bechne ki taraf rujan use time tak Jari Rahega jab Tak ke daen shoulder Tut Na Jaaye Jahan price Sai choti per price Se zyada Ho Jaati Hai

HEAD AND SHOULDERS PATTERN TELL YOU Head and Shoulder ka pattern is Baat Ke Nishan Dahi Karta Hai Ki ulat Jana Mumkin hai tajron Ka Khyal yah hota hai ki chotiyon aur gearto ke three seat Darmiyan Mein Ek Bari Choti Ke Sath iska matlab yah hai ki stock ki kimat girna shuru ho jayegi neckline is nukta ki numaendagi Karti Hai Jis per Mandi wale taajer firokt karna shuru ho Jaate Hain pattern yah bhi Ishara karta hai ki naya Bechne ki taraf rujan use time tak Jari Rahega jab Tak ke daen shoulder Tut Na Jaaye Jahan price Sai choti per price Se zyada Ho Jaati Hai

-

#7 Collapse

Head and shoulders candlestick pattern introduction Aslaam o alaikum Kia haal ha aap sb k.to aaj hum baat krein gyis topic pr. Head and Shoulders candlestick pattern ek technical analysis term nahi hai. Head and Shoulders pattern generally stock price charts par dekha jata hai, aur ye ek reversal pattern hota hai jo market trend ko indicate karta hai. Is pattern me typically teen peaks hote hain, jinme se middle peak bade hota hai aur do side peaks usse chote hote hain. Ye pattern market trend change ko suggest karta hai, jab middle peak ka price break hota hai, toh traders use isse future price movement predict karte hain. Is pattern ko candlestick charts par nahi dekha jata, balki bar chart ya line chart par dekha jata hai. Agar aapko is pattern ke bare me aur details chahiye toh aap financial literature ya online resources se aur jankari prapt kar sakte hain. Head and shoulders candlestick pattern formation Head and Shoulders candlestick pattern ek stock price chart pattern hai, jo price trend reversal ko indicate karta hai. Is pattern ko dekhne ke liye aapko stock price chart par kuch key features dhoondhne honge: Head: Yeh pattern ek "Head" candle se shuru hota hai, jo ek price uptrend ke baad aata hai aur higher high (adhik uncha high) ke saath hota hai. Left Shoulder: Uske baad, ek "Left Shoulder" candle aata hai, jo bhi higher high ke saath hota hai. Lekin, yeh higher high head candle ke comparison mein kam hota hai. Right Shoulder: Iske baad ek aur candle aata hai, "Right Shoulder" candle, jo left shoulder candle ke niche hota hai. Isme bhi higher high hota hai, lekin head candle ke comparison mein kam hota hai. Neckline: Neckline ek imaginary line hoti hai, jo left shoulder aur right shoulder ke bottoms ko connect karti hai. Yeh line horizontal hoti hai aur support level ki tarah kaam karti hai. Breakdown: Pattern ko confirm karne ke liye, jab price neckline ko break karta hai aur niche jaata hai, tab pattern complete hota hai. Yeh price reversal ko suggest karta hai aur traders ko sell signal deta hai. How to trade Head and shoulders candlestick pattern Forex market mein "Head and Shoulders" candlestick pattern ko trade karte waqt, aap ye steps follow kar sakte hain Pakistan language mein: Pattern Ko Identify Karein: Sabse pehle, aapko market charts par "Head and Shoulders" pattern ko identify karna hoga. Is pattern mein typically ek "head" aur do "shoulders" hote hain, jo price movement ke specific peaks aur troughs ko represent karte hain. Entry Point Decide Karein: Jab aap pattern ko identify kar lete hain, to aapko entry point decide karna hoga. Entry point usually "neckline" break par hota hai. Neckline, pattern ke nichle part ko represent karta hai. Jab price neckline ko break karta hai, tab aap trade ko enter kar sakte hain. Stop Loss Aur Take Profit Set Karein: Har trade ke liye stop loss aur take profit levels set karna bahut important hai. Ye levels aapko loss ko minimize aur profit ko maximize karne mein madadgar hote hain. Risk Management: Trade karte waqt apne risk ko manage karein. Sirf itna risk lein, jiska aap afford kar sakte hain. Position size ko control mein rakhein. Market News Aur Sentiment Par Nazar Rakhein: Forex market mein news aur market sentiment ka impact hota hai. Trade karne se pehle market news aur sentiment ko monitor karein. Demo Trading: Agar aapne ye pattern pehli baar trade karne ka socha hai, to demo account istemal karke practice karein. Isse aap apne skills ko improve kar sakte hain. Trading Plan Banayein: Ek trading plan banayein jisme aap apne trading strategy, risk management rules, aur entry/exit points ko detail mein note karein. Emotions Ko Control Karein: Trading karte waqt emotions par control rakhein. Greed aur fear se bachne ke liye discipline banaayein. Trade Execute Karein: Apne plan ke mutabik trade execute karein. Market order ya limit order ka istemal kar sakte hain, lekin plan ke anusar hi trade karein. Performance Review Karein: Apni trading performance ko regular intervals par review karein aur apne mistakes se seekhein. -

#8 Collapse

Introduction Head and Shoulders Candlestick Pattern trading ke liye bohat faydemand ho sakti hai, lekin isme bhi khatraat hain. Market volatility, false indicators, aur unexpected information events se bachne ke liye careful rehna zaroori hai. Isi tarah, overtrading se bhi bachna chahiye.Candlestick patterns foreign exchange aur shares buying and selling mein aik ahem hoti hain. In styles ka ilm rakhna buyers ke liye bohat zaroori hai. Aaj hum apko "Head and Shoulders Candlestick Pattern" ke bary mein batayenge. Ye pattern buying and selling mein aik ahem hissa hai jo traders ke liye kafi madadgar sabit ho sakta hai. Candlestick Pattern ek technical analysis ka hissa hai jise investors market analysis aur fee prediction mein istemal karte hain. Is sample ka naam is liye hai kyun ke ye pattern ek human shoulder aur head ki tarah hota hai. Is pattern ki pehchan aam taur par ek bullish fashion ke horrific ati hai aur bearish reversal ko darust karti hai. Formation; Head and Shoulders Candlestick Pattern ek powerful buying and selling tool ho sakti hai agar ise theek tareeqe se istemal kiya jaye. Is pattern ko samajhna aur istemal karna buyers ke liye mushkil ho sakta hai, lekin exercise aur revel in ke sath ye aasan ho jata hai. Yaad rahe ke trading mein hamesha chance hota hai, is liye savdhan rehna zaroori hai. Is pattern ki madad se aap marketplace ke traits ko samajh sakte hain aur behtar trading selections le sakte hain.Is kandile ki unchi wick aur kam ultimate hoti hai. Jab marketplace uptrend mein hoti hai aur left shoulder banti hai, to ye ek indication ho sakti hai ke market thoda sa thak gaya hai.Head candle left shoulder ke baad ati hai aur is ki unchi wick hoti hai. Is kandile ki ultimate left shoulder ki last se ziada hoti hai. Is stage par market mein uncertainty hoti hai aur buyers mein confusion paida ho sakta hai. Head ko dekhte waqt ye samjha jata hai ke market ne aik vital resistance stage ko wreck kiya hai.Candlestick Pattern; the Forex market trading mein "Head and Shoulders" ek aham tijarat ke sample hai jo tijarat karne walon ko maloom karne mein madadgar hota hai.Head and Shoulders" pattern ek reversal pattern hai jo aksar uptrend ke baad banta hai aur currency pair ki keemat ke rukh mein tabdeel hone ki mumkin ashna hai.Right shoulder teesra point hota hai jo head ke baad banta hai. Ye head se kam unchaai par hota hai aur aksar left shoulder ki terhan lagta hai.Price target ko head se neckline tak ki doori ko nap karke aur breakout point se neechay jhatakne ke liye estemal kiya jata hai. Isse tijarat karne wale ko ye maloom hota hai ke rate kitna nichay ja sakta hai.Pattern foreign exchange trading mein ek popular chart pattern hai jo capability trend reversals ko pehchanne ke liye istemal hota hai. Tijarat karne wale isay istemal karte hain taake jab bearish reversal ka intezar ho, to woh quick positions mein dakhil ho saken. Lekin, jaisa ke har tijarat ki stratiji hoti hai, isay behtar natijon ke liye dosre analysis equipment ke sath istemal karna behtar hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Head and Shoulders Candle Example ka PresentationHead and Shoulders Candle Example exchanging ke liye bohat faydemand ho sakti hai, lekin isme bhi khatraat hain. Market unpredictability, misleading signs, aur unforeseen news occasions se bachne ke liye wary rehna zaroori hai. Isi tarah, overtrading se bhi bachna chahiye.Candlestick designs forex aur stocks exchanging mein aik ahem hoti hain. In designs ka ilm rakhna dealers ke liye bohat zaroori hai. Aaj murmur apko "Head and Shoulders Candle Example" ke bary mein batayenge. Ye design exchanging mein aik ahem hissa hai jo dealers ke liye kafi madadgar sabit ho sakta hai.Head and Shoulders Candle Example ki TafseelHead and Shoulders Candle Example ek specialized investigation ka hissa hai jise brokers market examination aur cost expectation mein istemal karte hain. Is design ka naam is liye hai kyun ke ye design ek human shoulder aur head ki tarah hota hai. Is design ki pehchan aam taur standard ek bullish pattern ke terrible ati hai aur negative inversion ko darust karti hai.Name: images.png Perspectives: 11 Size: 13.3 KBDesign ky sath exchanging procedures

Is design ko samajhne ke liye, murmur is ke parts ko detail mein dekhte hain:1. **Left Shoulder:** Example ki shuruaat bayan kandila (left shoulder) se hoti hai. Is kandile ki unchi wick aur kam shutting hoti hai. Poke market upswing mein hoti hai aur left shoulder banti hai, to ye ek sign ho sakti hai ke market thoda sa thak gaya hai.2. **Head :** Head light left shoulder ke baad ati hai aur is ki unchi wick hoti hai. Is kandile ki shutting left shoulder ki shutting se ziada hoti hai. Is stage standard market mein vulnerability hoti hai aur dealers mein disarray paida ho sakta hai. Head ko dekhte waqt ye samjha jata hai ke market ne aik significant obstruction level ko break kiya hai.3. **Right Shoulder :** Right shoulder candle head ke baad aati hai aur is ki shutting head ki shutting se ziada hoti hai. Is stage mein bhi market mein vulnerability hoti hai aur cost activity ke beech tafawut hota hai. Right shoulder market mein aik aur stop darust karta hai.4. **Neckline :** Neck area, left shoulder aur right shoulder ke darmiyan ek even line hoti hai. Ye line support ki tarah kaam karti hai aur dealers ke liye aik ahem reference point hai. Agar ye neck area break hoti hai, to ye negative inversion ka sign hota hai aur dealers sell positions le sakte hain.Head and Shoulders Candle Example ki PehchanHead and Shoulders Candle Example ko exchange karne ke liye, dealers ko kuch steps follow karne chahiye:1. **Pattern Confirmation:** Sab se pehle, merchants ko is design ki affirmation dhoondni chahiye. Iska matlab hai ke left shoulder, head, aur right shoulder obviously dikhein aur neck area ko break kiya jaye. Affirmation ke bina is design standard amal nahi karna chahiye.2. **Stop Misfortune Aur Target Set Karna:** Section point ke sath stop misfortune aur target bhi set karna ahem hai. Stop misfortune ye choose karega ke kab aapko exchange se bahar aana chahiye agar market against heading mein jaati hai. Targets bhi set karna zaroori hai takay aap benefits ko catch kar saken.3. **Risk Management:** Hamesha yaad rahe ke exchanging dangerous hoti hai. Apne capital ko safeguard karne ke liye risk the executives ka sahi tareeqa istemal karein. Position size ko control mein rakhein aur overtrading se bachein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:44 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим