Key Characteristics of Retracements

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

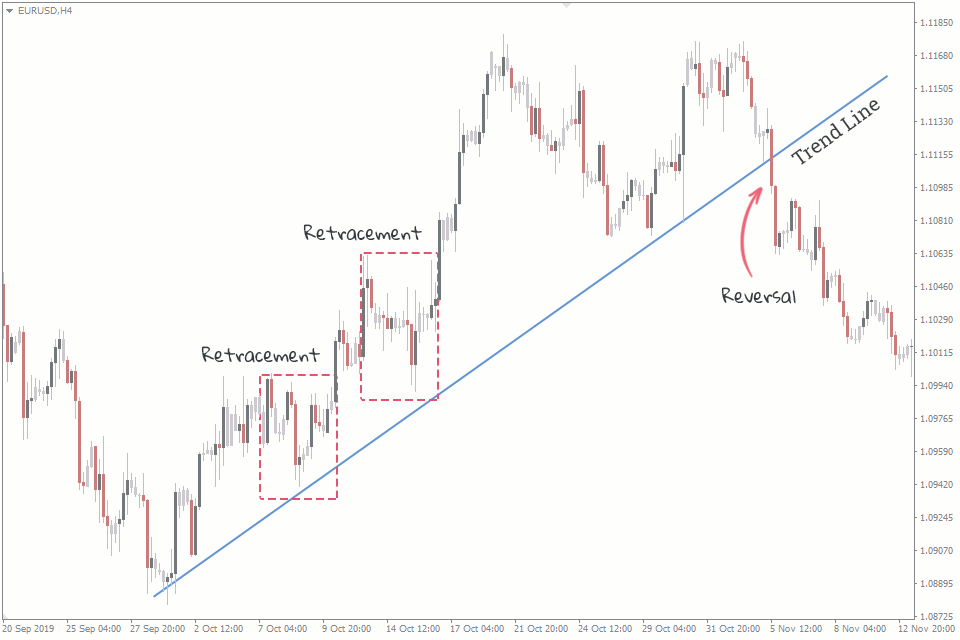

Key Characteristics of Retracements Retracements ki kuch khasosiyat hain. Pehle to ye aik mukhlis rukh mein waqtan-fa-waqtan qeemat palat jane ki dalil hain, jo tezi ya tezi se palat jane ki bajaye asal fashion mein aik jaise doji ya hammer formations, capacity retracement ranges ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki hazard ko zahir karte hain.-fa-waqtan rukawat ko zahir karte hain. Dusri baat, traders aksar Fibonacci retracement degrees ka istemal potential help aur resistance regions ko zahir karne ke liye karte hain jo retracements ke doran aksar aik rol ada karte hain. Sab se aam retracement stages 38.2%, 50%, aur 61.Eight% hote hain. Akhir mein, retracements aksar un buyers ke liye trading moqaat faraham karte hain jo pehle trend mein dakhil nahi ho sakte, jo unhein mazeed pasandidgi ki qeemat par dakhil hone ki ijaazat dete hain. Reason Of Retracements

Retracements ki kuch khasosiyat hain. Pehle to ye aik mukhlis rukh mein waqtan-fa-waqtan qeemat palat jane ki dalil hain, jo tezi ya tezi se palat jane ki bajaye asal fashion mein aik jaise doji ya hammer formations, capacity retracement ranges ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki hazard ko zahir karte hain.-fa-waqtan rukawat ko zahir karte hain. Dusri baat, traders aksar Fibonacci retracement degrees ka istemal potential help aur resistance regions ko zahir karne ke liye karte hain jo retracements ke doran aksar aik rol ada karte hain. Sab se aam retracement stages 38.2%, 50%, aur 61.Eight% hote hain. Akhir mein, retracements aksar un buyers ke liye trading moqaat faraham karte hain jo pehle trend mein dakhil nahi ho sakte, jo unhein mazeed pasandidgi ki qeemat par dakhil hone ki ijaazat dete hain. Reason Of Retracements  Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend formations, ability retracement tiers ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki hazard ko zahir karte hain dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain.Sal trend ki aik wasee raay deti hai aur dakhil aur nikal ke factors ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement degrees aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement ranges ko potential dakhil ya nikalne ke factors ke taur par istemal karte hain Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali information ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke guide ya resistance zones, . Strategies for Trading Retracements

Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend formations, ability retracement tiers ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki hazard ko zahir karte hain dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain.Sal trend ki aik wasee raay deti hai aur dakhil aur nikal ke factors ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement degrees aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement ranges ko potential dakhil ya nikalne ke factors ke taur par istemal karte hain Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali information ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke guide ya resistance zones, . Strategies for Trading Retracements  Retracements par buying and selling karne ke asardar tareeqay istemal karne mein mukhlis buying and selling strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal fashion ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement ranges aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh threat control strategies istemal karna bhi aham hai, is mein stop-loss orders set karna aur function length ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement degrees ko capability dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar help ya resistance ka kaam karte hain. Asal fashion ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar tendencies dobara palatne ke amkanat hain jabke kamzor tendencies barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par dealer ko faida pohnchane mein madadgar hota hai

Retracements par buying and selling karne ke asardar tareeqay istemal karne mein mukhlis buying and selling strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal fashion ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement ranges aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh threat control strategies istemal karna bhi aham hai, is mein stop-loss orders set karna aur function length ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement degrees ko capability dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar help ya resistance ka kaam karte hain. Asal fashion ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar tendencies dobara palatne ke amkanat hain jabke kamzor tendencies barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par dealer ko faida pohnchane mein madadgar hota hai

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:37 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим