indecision candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

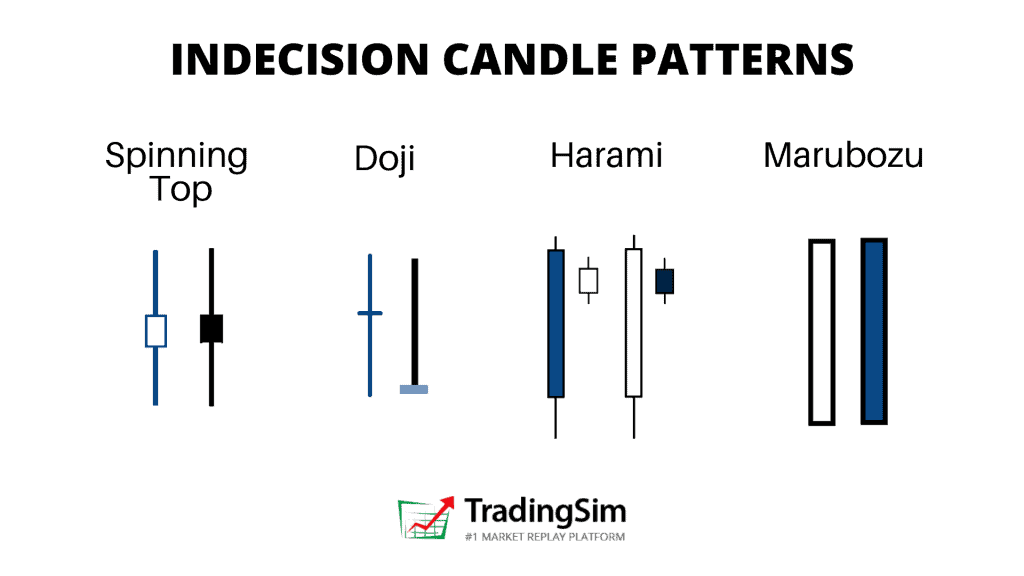

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam members khairiyat se honge bhaiyon aur bahanon aaj Jo topic mein aap logon ke sath share karne ja rahi hun iska pura jyada kam hota Hai Spain Aaj ham dekhenge ke Forex FreshMaza Kitna jyada fayda hai aur kitna nuksan hai ine sab ke bare mein Aaj ham study karenge to aap hamari post ko pura dekhen samjhe uske bad aap is per kam bhi Karen tab aap bahut jyada fayda hasil kar sakenge thank u indecision candlestick pattern Indecision Candlestick Pattern ek technical analysis tool hai, jo market mein hone wale potential trend reversal ya trend continuation what to identify karne mein madad card hai. Yeh pattern typically ek single candle pattern pattern hota hai aur market participants to confusion ya indecision ko darust karta hai. Iska major fayda ye hai ki ye traders ko ye signal deta hai ki market mein uncertainty hai aur price movement ke option par vichar karna chahiye. Key Features of the Indecisive Candlestick Pattern: 1. **Small Body:** Candlestick indecision ka body chhota hota hai, jiska matlab hai ki opening price aur closing price ke buk ki range limited hoti hai. 2. **Long upper and lower shadows:** It is candlestick ke upper aur lower shadows lambe hote hain, jo darust karta hai ki market mein Buyers aur sellers ke buk mein competition hai. 3. **Open and close near the center:** Opening price aur closing price generally candlestick ke middle ke kareeb hoti hain, jisse indecision ko darust kiya jata hai. 4. **Lack of clear direction:** Indecision candlestick pattern market mein clear direction ki kami ko darust card hai. Iska arth hai ki price ek din mein ani bahut upar jati hai na hi bahut neeche girti hai. Indecision Candlestick Pattern ka major fayda ye hai ki ye traders ko alert rakhta hai ki market mein uncertainty hai aur price movement ke liye ha caution ki zaroor. Is pattern ko doosre technical indicators aur price action analysis ke saath dekha jana chahiye, taki traders sahi trading decisions le saken. Kuch traders indecision candlestick pattern ko supports aur resistance levels ke paas ya trend lines ke close dekhte hain, kyunki yes levels price ke potential reversals ke liye mahatvapurna ho sakte hain. Agar is pattern ke sath doosre technical signals bhi confirm cards hain, traders are information ka istemal karke trading strategy banate hain.Ek chiz yaad rahe ki indecision candlestick pattern ek signal hai aur khud mein complete trading strategy nahi hai. Business decision lene se pehle, aapko market context aur doosre factors ko bhi consider karna hoga. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Ú©Ù†Ùیوژن اس ÙÛŒØµÙ„Û Ø³Ø§Ø²ÛŒ Ú©Ùˆ درست بناتی ÛÛ’Û” اس کا بڑا ÙØ§Ø¦Ø¯Û ÛŒÛ ÛÛ’ Ú©Û ÛŒÛ ØªØ§Ø¬Ø±ÙˆÚº Ú©Ùˆ Ø§Ø´Ø§Ø±Û Ú©Ø±ØªØ§ ÛÛ’ Ú©Û Ù…Ø§Ø±Ú©ÛŒÙ¹ میں غیر یقینی صورتØ*ال ÛÛ’Û” -

#4 Collapse

Indecision candlestick pattern introduction Forex market mein indecision candlestick pattern ko "Doji" kehtey hain. Doji candlestick pattern ek aisi situation ko darust karta hai jab market mein buyers aur sellers mein kisi ek ki dominance nahi hoti aur ye indecision ya uncertainty ko represent karta hai. Is pattern mein candlestick ke open aur close prices barabar ya kafi kareeb hotey hain, aur iska ek lamba shadow hota hai jo upar aur neeche jaa sakta hai, iska matlab hai ki price during the trading session fluctuated but ultimately closed near the opening price. Doji candlestick pattern market ke trend change hone ki sambhavna ko bhi darust karta hai, lekin isey dusre technical indicators aur price action patterns ke saath dekha jata hai taki iska sahi matlab samjha ja sake. Indecision candlestick pattern formation "Indecision" candlestick patterns typically indicate market uncertainty or a potential reversal. These patterns are often characterized by small bodies and long upper and lower wicks. Some common indecision candlestick patterns include: Doji: This pattern has a small body with upper and lower wicks of similar length. It suggests that buyers and sellers are in equilibrium and can signal a potential reversal. Spinning Top: Similar to a Doji but with a slightly larger body. It still indicates indecision but may not be as strong a reversal signal as a Doji. Hammer and Hanging Man: These patterns have small bodies and a long lower wick. A Hammer can suggest a bullish reversal, while a Hanging Man can suggest a bearish reversal. Shooting Star and Inverted Hammer: These patterns have small bodies and a long upper wick. A Shooting Star can suggest a bearish reversal, while an Inverted Hammer can suggest a bullish reversal. Engulfing Pattern: This consists of two candles, where the second one completely engulfs the first. A bullish engulfing pattern can indicate a bullish reversal, while a bearish engulfing pattern suggests a bearish reversal. How to trade Indecision candlestick pattern Forex market mein indecision candlestick pattern ko trade karne ke liye aapko kuchh important steps follow karne chahiye: Candlestick Patterns Ka Gyaan: Pehle toh aapko candlestick patterns ka accha understanding hona chahiye. Indecision candlestick patterns, jaise ki Doji, Spinning Top, aur Hammer, market mein uncertainty ya reversal indicate karte hain. Confirmatory Signals: Indecision patterns ko trade karne se pehle, aapko confirmatory signals dhoondhne ki zaroorat hai. Yani ki, dusri technical indicators ya price action patterns ko dekhein jo indecision pattern ke sath match karte hain. Support aur Resistance Levels: Market ke support aur resistance levels ko identify karein, kyun ki indecision patterns in levels par hone wale potential reversals ko signal kar sakte hain. Stop Loss aur Take Profit Levels: Hamesha apne trade ke liye stop-loss aur take-profit levels set karein. Yeh aapko loss control aur profit protection mein madad karenge. Risk Management: Risk management bahut ahem hai. Aapko apne trading capital ke ek chhote hisse se trade karna chahiye taaki aap excessive loss se bach saken. Practice: Indecision patterns ko samajhna aur unpar trade karna practice aur experience se hi aata hai. Demo account par practice karein ya phir small trades se shuruat karein. News aur Events: Market mein aane wale important news aur events ka dhyan rakhein, kyun ki yeh indecision patterns ko influence kar sakte hain. -

#5 Collapse

"Indecision Candlestick Pattern" Roman Urdu mien indecision candlestick pattern ke baare mein likh raha hoon. Indecision candlestick pattern aksar stock market analysis mein istemal hota hai aur ye traders ko market ke mood mein samjhne mein madadgar hota hai. Indecision candlestick pattern aik candlestick pattern hai jo market mein uncertainty ya indecision ko darust karta hai. Ye pattern usually do chote candlesticks se mil kar banta hai, jinmein kisi bhi specific trend ki taraf clear sign nahi hoti. Ye candlesticks barabar buying aur selling ke darmiyan price stability ko darust karte hain. Is pattern ke aam taur par do prakar ke candlesticks shamil hote hain: Doji aur Spinning Top. Doji ek candlestick hai jismein opening aur closing price aik dosre ke buhat qareeb hoti hain aur iska matlab hota hai ke buyers aur sellers mein kisi ek ki dominance nahi hai. Spinning Top bhi aik aisa candlestick hai jismein price opening aur closing ke darmiyan hoti hai lekin candle ki range buhat choti hoti hai, jisse ye samjhaya jata hai ke market mein confusion hai. Indecision candlestick pattern traders ke liye aik important tool hai kyunki ye market ke future direction ko anticipate karne mein madadgar hota hai. Agar indecision pattern market ke baad strong uptrend ya downtrend ke baad aata hai, to ye ek reversal ke sign ho sakta hai. Lekin, is pattern ko confirm karne ke liye traders ko doosre technical indicators aur price action analysis ka bhi istemal karna hota hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Indecision Chart Pattern: Forex market mein hesitation candle design ko "Doji" kehtey hain. Doji candle design ek aisi circumstance ko darust karta hai punch market mein purchasers aur venders mein kisi ek ki predominance nahi hoti aur ye hesitation ya vulnerability ko address karta hai. Is design mein candle ke open aur close costs barabar ya kafi kareeb hotey hain, aur iska ek lamba shadow hota hai jo upar aur neeche jaa sakta hai, iska matlab hai ki cost during the exchanging meeting vacillated in any case shut close to the initial cost. Doji candle design market ke pattern change sharpen ki sambhavna ko bhi darust karta hai, lekin isey dusre specialized pointers aur cost activity designs ke saath dekha jata hai taki iska sahi matlab samjha ja purpose. Forex market mein hesitation candle design ko exchange karne ke liye aapko kuchh significant advances follow karne chahiye Pehle toh aapko candle designs ka accha understanding hona chahiye. Hesitation candle designs, jaise ki Doji, Turning Top, aur Mallet, market mein vulnerability ya inversion show karte hain. Hesitation designs ko exchange karne se pehle, aapko corroborative signs dhoondhne ki zaroorat hai. Yani ki, dusri specialized pointers ya cost activity designs ko dekhein jo uncertainty design ke sath match karte hain Market ke support aur obstruction levels ko distinguish karein, kyun ki hesitation designs in levels standard sharpen ridge potential inversions ko signal kar sakte hain. Chart Pattern Types: Hamesha apne exchange ke liye stop-misfortune aur take-benefit levels set karein. Yeh aapko misfortune control aur benefit assurance mein madad karenge.Risk the executives bahut ahem hai. Aapko apne exchanging capital ke ek chhote hisse se exchange karna chahiye taaki aap over the top misfortune se bach saken.Indecision designs ko samajhna aur unpar exchange karna practice aur experience se greetings aata hai. Demo account standard practice karein ya phir little exchanges se shuruat karein.Market mein aane grain significant news aur occasions ka dhyan rakhein, kyun ki yeh hesitation designs ko impact kar sakte hain. Hesitation candle design aksar financial exchange investigation mein istemal hota hai aur ye merchants ko market ke temperament mein samjhne mein madadgar hota hai.

Forex market mein hesitation candle design ko exchange karne ke liye aapko kuchh significant advances follow karne chahiye Pehle toh aapko candle designs ka accha understanding hona chahiye. Hesitation candle designs, jaise ki Doji, Turning Top, aur Mallet, market mein vulnerability ya inversion show karte hain. Hesitation designs ko exchange karne se pehle, aapko corroborative signs dhoondhne ki zaroorat hai. Yani ki, dusri specialized pointers ya cost activity designs ko dekhein jo uncertainty design ke sath match karte hain Market ke support aur obstruction levels ko distinguish karein, kyun ki hesitation designs in levels standard sharpen ridge potential inversions ko signal kar sakte hain. Chart Pattern Types: Hamesha apne exchange ke liye stop-misfortune aur take-benefit levels set karein. Yeh aapko misfortune control aur benefit assurance mein madad karenge.Risk the executives bahut ahem hai. Aapko apne exchanging capital ke ek chhote hisse se exchange karna chahiye taaki aap over the top misfortune se bach saken.Indecision designs ko samajhna aur unpar exchange karna practice aur experience se greetings aata hai. Demo account standard practice karein ya phir little exchanges se shuruat karein.Market mein aane grain significant news aur occasions ka dhyan rakhein, kyun ki yeh hesitation designs ko impact kar sakte hain. Hesitation candle design aksar financial exchange investigation mein istemal hota hai aur ye merchants ko market ke temperament mein samjhne mein madadgar hota hai.  Indecision Hesitation candle design aik candle design hai jo market mein vulnerability ya uncertainty ko darust karta hai. Ye design typically do chote candles se mil kar banta hai, jinmein kisi bhi explicit pattern ki taraf obvious indicator nahi hoti. Ye candles barabar purchasing aur selling ke darmiyan cost soundness ko darust karte hain.Is design ke aam taur standard do prakar ke candles shamil hote hain: Doji aur Turning Top. Doji ek candle hai jismein opening aur shutting cost aik dosre ke buhat qareeb hoti hain aur iska matlab hota hai ke purchasers aur merchants mein kisi ek ki predominance nahi hai. Turning Top bhi aik aisa candle hai jismein cost opening aur shutting ke darmiyan hoti hai lekin flame ki range buhat choti hoti hai, jisse ye samjhaya jata hai ke market mein disarray hai.Indecision candle design dealers ke liye aik significant apparatus hai kyunki ye market ke future heading ko expect karne mein madadgar hota hai. Agar hesitation design market ke baad solid upturn ya downtrend ke baad aata hai, to ye ek inversion ke sign ho sakta hai Trading View: Candle design market mein clear bearing ki kami ko darust card hai. Iska arth hai ki cost ek noise mein ani bahut upar jati hai na howdy bahut neeche girti hai. Hesitation Candle Example ka major fayda ye hai ki ye dealers ko alert rakhta hai ki market mein vulnerability hai aur cost development ke liye ha alert ki zaroor. Is design ko doosre specialized pointers aur cost activity examination ke saath dekha jana chahiye, taki merchants sahi exchanging choices le saken. Kuch merchants uncertainty candle design ko upholds aur obstruction levels ke paas ya pattern lines ke close dekhte hain, kyunki yes levels cost ke potential inversions ke liye mahatvapurna ho sakte hain. Agar is design ke sath doosre specialized signals bhi affirm cards hain, dealers are data ka istemal karke exchanging system banate hain.Ek chiz yaad rahe ki hesitation candle design ek signal hai aur khud mein complete exchanging procedure nahi hai. Business choice lene se pehle, aapko market setting aur doosre factors ko bhi consider karna hoga.

Indecision Hesitation candle design aik candle design hai jo market mein vulnerability ya uncertainty ko darust karta hai. Ye design typically do chote candles se mil kar banta hai, jinmein kisi bhi explicit pattern ki taraf obvious indicator nahi hoti. Ye candles barabar purchasing aur selling ke darmiyan cost soundness ko darust karte hain.Is design ke aam taur standard do prakar ke candles shamil hote hain: Doji aur Turning Top. Doji ek candle hai jismein opening aur shutting cost aik dosre ke buhat qareeb hoti hain aur iska matlab hota hai ke purchasers aur merchants mein kisi ek ki predominance nahi hai. Turning Top bhi aik aisa candle hai jismein cost opening aur shutting ke darmiyan hoti hai lekin flame ki range buhat choti hoti hai, jisse ye samjhaya jata hai ke market mein disarray hai.Indecision candle design dealers ke liye aik significant apparatus hai kyunki ye market ke future heading ko expect karne mein madadgar hota hai. Agar hesitation design market ke baad solid upturn ya downtrend ke baad aata hai, to ye ek inversion ke sign ho sakta hai Trading View: Candle design market mein clear bearing ki kami ko darust card hai. Iska arth hai ki cost ek noise mein ani bahut upar jati hai na howdy bahut neeche girti hai. Hesitation Candle Example ka major fayda ye hai ki ye dealers ko alert rakhta hai ki market mein vulnerability hai aur cost development ke liye ha alert ki zaroor. Is design ko doosre specialized pointers aur cost activity examination ke saath dekha jana chahiye, taki merchants sahi exchanging choices le saken. Kuch merchants uncertainty candle design ko upholds aur obstruction levels ke paas ya pattern lines ke close dekhte hain, kyunki yes levels cost ke potential inversions ke liye mahatvapurna ho sakte hain. Agar is design ke sath doosre specialized signals bhi affirm cards hain, dealers are data ka istemal karke exchanging system banate hain.Ek chiz yaad rahe ki hesitation candle design ek signal hai aur khud mein complete exchanging procedure nahi hai. Business choice lene se pehle, aapko market setting aur doosre factors ko bhi consider karna hoga.  Candle Example ek specialized investigation device hai, jo market mein sharpen rib potential pattern inversion ya pattern continuation what to distinguish karne mein madad card hai. Yeh design ordinarily ek single flame design hota hai aur market members to disarray ya uncertainty ko darust karta hai. Iska major fayda ye hai ki ye dealers ko ye signal deta hai ki market mein vulnerability hai aur cost development ke choice standard vichar karna chahiye.Candlestick hesitation ka body chhota hota hai, jiska matlab hai ki opening cost aur shutting cost ke buk ki range restricted hoti hai.It is candle ke upper aur lower shadows lambe hote hain, jo darust karta hai ki market mein Purchasers aur venders ke buk mein rivalry hai.Opening cost aur shutting cost for the most part candle ke center ke kareeb hoti hain, jisse uncertainty ko darust kiya jata hai.

Candle Example ek specialized investigation device hai, jo market mein sharpen rib potential pattern inversion ya pattern continuation what to distinguish karne mein madad card hai. Yeh design ordinarily ek single flame design hota hai aur market members to disarray ya uncertainty ko darust karta hai. Iska major fayda ye hai ki ye dealers ko ye signal deta hai ki market mein vulnerability hai aur cost development ke choice standard vichar karna chahiye.Candlestick hesitation ka body chhota hota hai, jiska matlab hai ki opening cost aur shutting cost ke buk ki range restricted hoti hai.It is candle ke upper aur lower shadows lambe hote hain, jo darust karta hai ki market mein Purchasers aur venders ke buk mein rivalry hai.Opening cost aur shutting cost for the most part candle ke center ke kareeb hoti hain, jisse uncertainty ko darust kiya jata hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим