Peak and Trough In Forex Trading

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Peak and Trough In Forex Trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

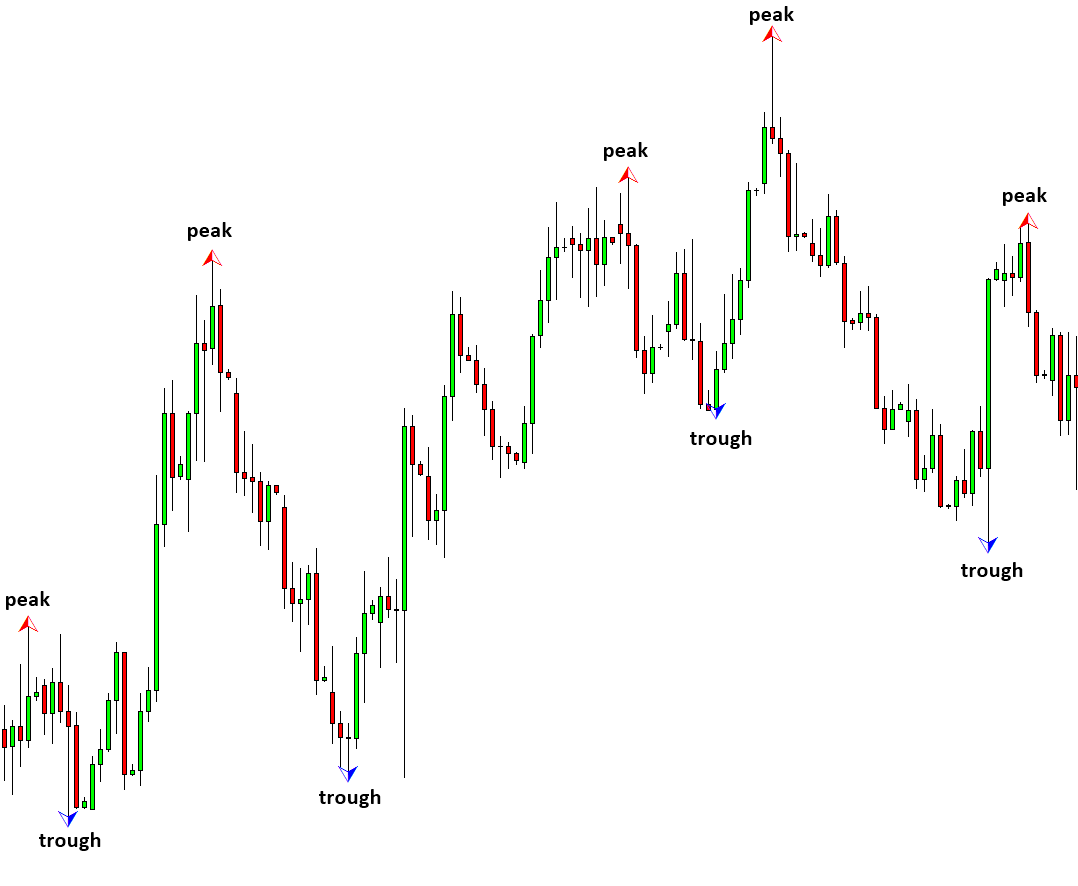

Understanding Peaks and Troughs in Forex TradingForex trading mein peak and trough ko samajhna zaroori hai. Ye shabd, jo ke highs aur lows ke taur par bhi jante hain, ek currency pair ki keemat jo kisi mukarar waqt mein pohanchti hai ke unchaai aur neechai darj karte hain. In points ko pehchaanne ka ahem hai kyun ke yeh market trends, mumkin reversals aur support aur resistance ke areas ke liye ahem wafirat pesh karte hain. Identifying Peaks and Troughs Peak and trough ko price chart par pehchaanne ke liye traders un points ki taraf raastein dhoondhte hain jahan kisi currency pair ki keemat kisi mukarar waqt mein apne sab se unchi level tak pohanchti hai. Peak aam taur par uss waqt kee keemat ke level ke hain jo aas paas ke bars ya candlesticks ke levelon se zyada hoti hain, jisse ke market ki quwat ya bullish sentiment ka ishara hota hai. Dusri taraf, lambi, ya neechai, ek currency pair ki keemat ko dikhate hain jo kisi mukarar waqt mein sab se kam level par pohanchti hai. Ye lambiyan price levels ko dikhate hain jo padosi bars ya candlesticks ke levelon se kam hain, jisse ke market ki kamzori ya bearish sentiment ka ishara hota hai. Significance of Peaks and Troughs Low aur high forex trading mein ahemiyat rakhti hain. Ye traders ko trend pehchaanne mein madad karti hain, kyun ke ek uptrend peak and trough ko ishara karti hain, jo bullish momentum ki taraf ishara karti hai. Ulti situation mein, aur lambiyan kam keemat aur kam levelon ko dikhate hain, jo bearish sentiment ko ishara karte hain. Iske alawa peaks aksar resistance levels ban jaati hain, jabke lambi support levels ke taur par kaam karti hain. Traders in levels par bharosa karte hain taake unhain informed trading decisions banane mein madad milti hai, jaise ke entry aur exit points set karna ya stop-loss orders lagana.

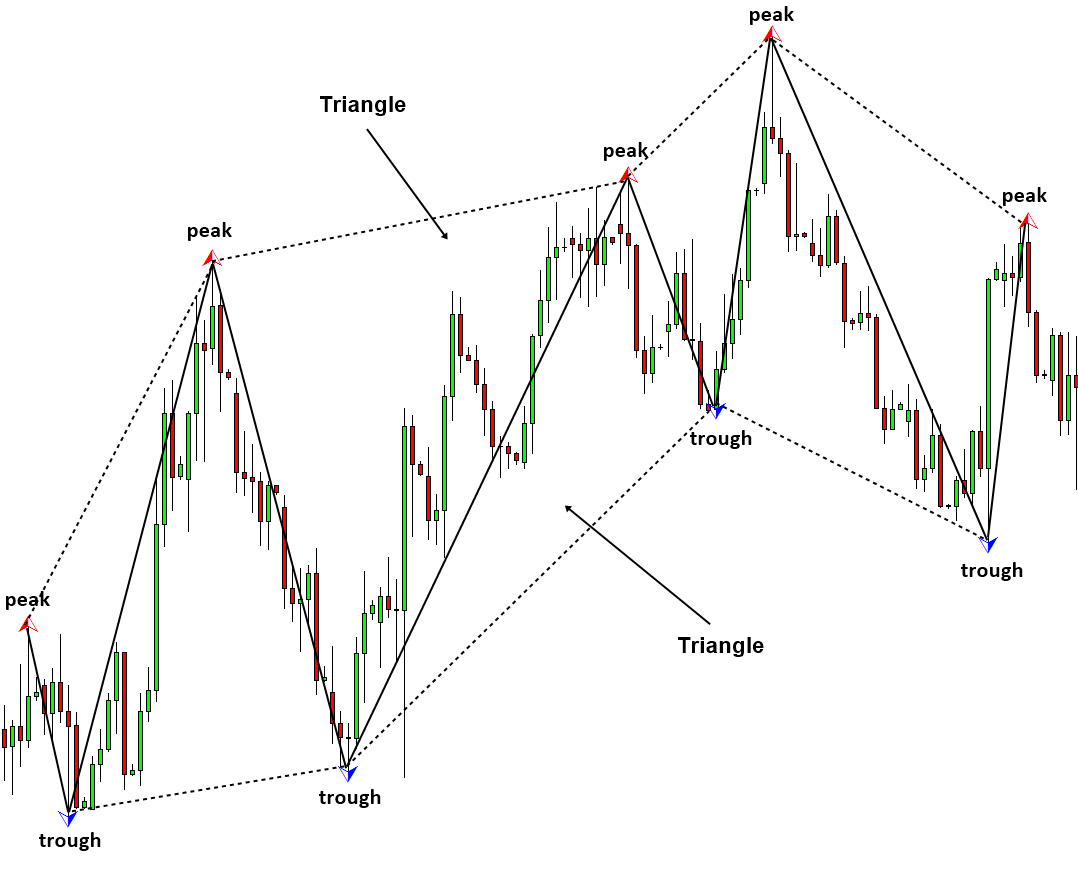

Identifying Peaks and Troughs Peak and trough ko price chart par pehchaanne ke liye traders un points ki taraf raastein dhoondhte hain jahan kisi currency pair ki keemat kisi mukarar waqt mein apne sab se unchi level tak pohanchti hai. Peak aam taur par uss waqt kee keemat ke level ke hain jo aas paas ke bars ya candlesticks ke levelon se zyada hoti hain, jisse ke market ki quwat ya bullish sentiment ka ishara hota hai. Dusri taraf, lambi, ya neechai, ek currency pair ki keemat ko dikhate hain jo kisi mukarar waqt mein sab se kam level par pohanchti hai. Ye lambiyan price levels ko dikhate hain jo padosi bars ya candlesticks ke levelon se kam hain, jisse ke market ki kamzori ya bearish sentiment ka ishara hota hai. Significance of Peaks and Troughs Low aur high forex trading mein ahemiyat rakhti hain. Ye traders ko trend pehchaanne mein madad karti hain, kyun ke ek uptrend peak and trough ko ishara karti hain, jo bullish momentum ki taraf ishara karti hai. Ulti situation mein, aur lambiyan kam keemat aur kam levelon ko dikhate hain, jo bearish sentiment ko ishara karte hain. Iske alawa peaks aksar resistance levels ban jaati hain, jabke lambi support levels ke taur par kaam karti hain. Traders in levels par bharosa karte hain taake unhain informed trading decisions banane mein madad milti hai, jaise ke entry aur exit points set karna ya stop-loss orders lagana.  Using Peaks and Troughs for Technical Analysis Technical analysts peak and trough ko alag alag tareekon se istemal karte hain taki woh informed trading decisions bana saken. Traders peak and trough ke sequence ko analyse karte hain taake woh prevailing trend ko pehchaan saken. Higher peak and trough ka ek asar uptrend ko dikhate hain, jabke lower peak and trough ek downtrend ko ishara karte hain. Low aur high support aur resistance levels ko pehchaanne mein madad karti hain. Ye levels stop-loss orders set karne, entry aur exit points determine karne, aur risk-reward ratios ko assess karne ke liye ahem hain. Divergence, Chart Patterns, aur Trading Strategies Divergence ek phenomenon hai jahan price movements aur technical indicators conflicting signals provide karte hain. For example, jab Relative Strength Index (RSI) mein higher price peaks ke sath lower RSI peak hoti hain, to yeh bullish momentum kam hone ka ishara ho sakta hai. Iske ilawa peak and trough se bani chart patterns, jaise ke double tops ya head and shoulders patterns, traders ko specific entry aur exit signals offer karte hain jo pattern-based strategies follow karne wale traders ke liye ahem hote hain. Traders peak and trough ko istemal karke mukhtalif strategies ka istemal karte hain. Ek well-established trend mein, woh trend ki taraf positions enter karte hain jab currency pair naye higher peaks (uptrend) ya lower troughs (downtrend) banata hai. Ulti sthiti mein, extreme peaks and troughs potential trend reversals ko ishara kar sakti hain, jo traders ko counter-trend positions enter karne ke liye majboor kar sakti hain. Breakout trading mein traders peaks (resistance) ke upar ya troughs (support) ke neeche ke breakouts ko monitor karte hain taake trend continuation signals ko pehchaan saken.

Using Peaks and Troughs for Technical Analysis Technical analysts peak and trough ko alag alag tareekon se istemal karte hain taki woh informed trading decisions bana saken. Traders peak and trough ke sequence ko analyse karte hain taake woh prevailing trend ko pehchaan saken. Higher peak and trough ka ek asar uptrend ko dikhate hain, jabke lower peak and trough ek downtrend ko ishara karte hain. Low aur high support aur resistance levels ko pehchaanne mein madad karti hain. Ye levels stop-loss orders set karne, entry aur exit points determine karne, aur risk-reward ratios ko assess karne ke liye ahem hain. Divergence, Chart Patterns, aur Trading Strategies Divergence ek phenomenon hai jahan price movements aur technical indicators conflicting signals provide karte hain. For example, jab Relative Strength Index (RSI) mein higher price peaks ke sath lower RSI peak hoti hain, to yeh bullish momentum kam hone ka ishara ho sakta hai. Iske ilawa peak and trough se bani chart patterns, jaise ke double tops ya head and shoulders patterns, traders ko specific entry aur exit signals offer karte hain jo pattern-based strategies follow karne wale traders ke liye ahem hote hain. Traders peak and trough ko istemal karke mukhtalif strategies ka istemal karte hain. Ek well-established trend mein, woh trend ki taraf positions enter karte hain jab currency pair naye higher peaks (uptrend) ya lower troughs (downtrend) banata hai. Ulti sthiti mein, extreme peaks and troughs potential trend reversals ko ishara kar sakti hain, jo traders ko counter-trend positions enter karne ke liye majboor kar sakti hain. Breakout trading mein traders peaks (resistance) ke upar ya troughs (support) ke neeche ke breakouts ko monitor karte hain taake trend continuation signals ko pehchaan saken. Peaks and Troughs in Different Timeframes Peak aur trough ko alag alag timeframes par dekha ja sakta hai, chhoti term ke intraday charts se lekar lambi term ke weekly ya monthly charts tak. Traders multiple timeframes ka analysis karte hain taki woh comprehensive market view hasil kar saken, jahan chhoti term ke timeframes intraday trends ko pehchaanne mein madadgar hoti hain aur lambi term wale timeframes bade market trends ko reveal karte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:46 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим