Explanation Of Retracement in Forex Trading

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

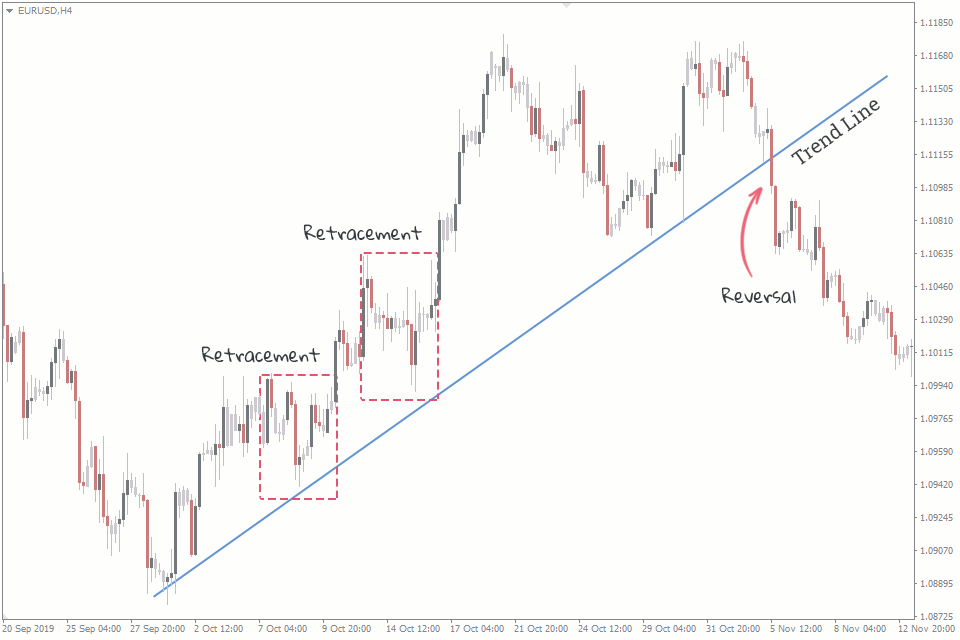

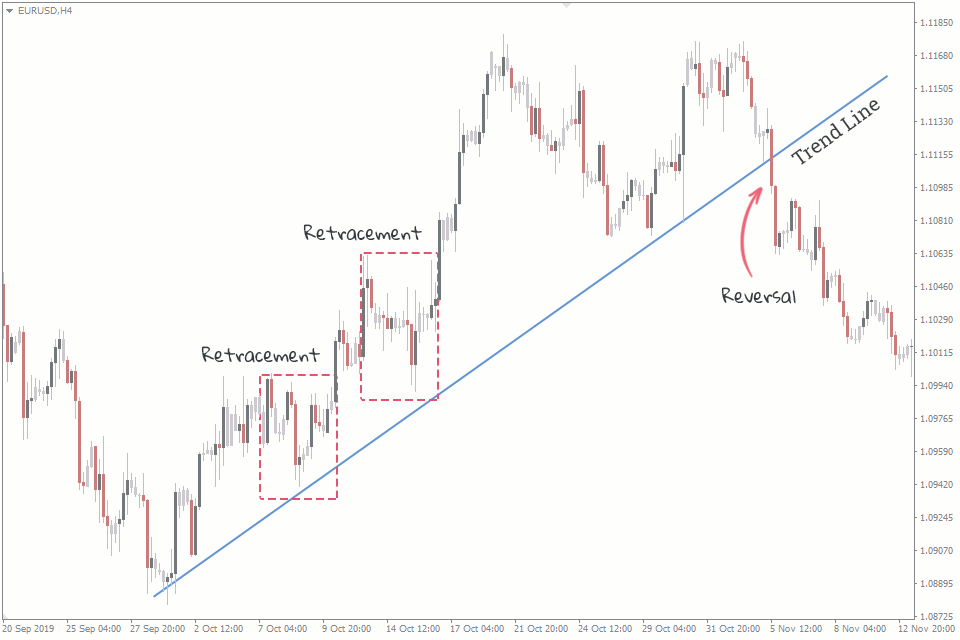

Understanding Retracement in Forex TradingRetracement, jo ke pullback ya correction ke naam se bhi jana jata hai, forex market mein aik aam hadsa hai. Is se muraad aik currency pair ke qeemat ke hawale se mawjud trend ke rukh mein aik waqtan-fa-waqtan ulat pher hai. Retracements bazar ke chalne aur ubharte-dhuarte hisson ka natural hissa hain, aur ye traders ko asle level par trading karne ke moqaat faraham karte hain. Aam taur par retracements tab hoti hain jab currency pair aik mukhlis rukh mein kuch waqt ke liye rawana hota hai aur ye tezi se qeemat mein palat jati hai. Ye yaad rakhna zaroori hai ke retracements trend ke mukhlis palat jane ki dalil nahi hain, balke moqay ko rokne wala ya asal trend mein rukawat dalne wala aik waqtan-fa-waqtan rookna hai. Key Characteristics of Retracements Retracements ki kuch khasosiyat hain. Pehle to ye aik mukhlis rukh mein waqtan-fa-waqtan qeemat palat jane ki dalil hain, jo tezi ya tezi se palat jane ki bajaye asal trend mein aik waqtan-fa-waqtan rukawat ko zahir karte hain. Dusri baat, traders aksar Fibonacci retracement levels ka istemal potential support aur resistance areas ko zahir karne ke liye karte hain jo retracements ke doran aksar aik rol ada karte hain. Sab se aam retracement levels 38.2%, 50%, aur 61.8% hote hain. Akhir mein, retracements aksar un traders ke liye trading moqaat faraham karte hain jo pehle trend mein dakhil nahi ho sakte, jo unhein mazeed pasandidgi ki qeemat par dakhil hone ki ijaazat dete hain. Reason Of Retracements Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend mein dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain. Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali data ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke support ya resistance zones, jo retracements ka asar dalte hain. Taqatwar ya kamzor trends ke doran qeemat aksar in ahem points par milti hai. Qeemat ke mukhlis palatne ke doran, tawanai kay sath qeemat ka pesh-kadmi dekhne se bhi faida hota hai, is tarah ke aur price ke barhav ko khatima dene wale asoolon ka mutalia bhi madadgar ho sakta hai.

Reason Of Retracements Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend mein dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain. Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali data ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke support ya resistance zones, jo retracements ka asar dalte hain. Taqatwar ya kamzor trends ke doran qeemat aksar in ahem points par milti hai. Qeemat ke mukhlis palatne ke doran, tawanai kay sath qeemat ka pesh-kadmi dekhne se bhi faida hota hai, is tarah ke aur price ke barhav ko khatima dene wale asoolon ka mutalia bhi madadgar ho sakta hai.  Identifying Retracements Traders retracements ko pesh-kadmi karne ke liye mukhtalif tools aur tajaweez istemal karte hain. Aik aam tareeqa trendlines ko high aur low par banane ka hai. Jab qeemat trendline ko choo leti hai ya uske qareeb pohnchti hai, to is se retracement ka ishara ho sakta hai. Dusre tareeqay me se aik Fibonacci retracement levels istemal karne wale traders, potential retracement areas ko zahir karne mein madadgar hoti hain. Aam taur par istemal hone wale Fibonacci levels 38.2%, 50%, aur 61.8% hote hain. Moving averages, jaise ke 50-period aur 200-period moving averages, retracement levels ko zahir karne mein madadgar hoti hain. Candlestick patterns, jaise doji ya hammer formations, potential retracement levels ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki chance ko zahir karte hain.

Identifying Retracements Traders retracements ko pesh-kadmi karne ke liye mukhtalif tools aur tajaweez istemal karte hain. Aik aam tareeqa trendlines ko high aur low par banane ka hai. Jab qeemat trendline ko choo leti hai ya uske qareeb pohnchti hai, to is se retracement ka ishara ho sakta hai. Dusre tareeqay me se aik Fibonacci retracement levels istemal karne wale traders, potential retracement areas ko zahir karne mein madadgar hoti hain. Aam taur par istemal hone wale Fibonacci levels 38.2%, 50%, aur 61.8% hote hain. Moving averages, jaise ke 50-period aur 200-period moving averages, retracement levels ko zahir karne mein madadgar hoti hain. Candlestick patterns, jaise doji ya hammer formations, potential retracement levels ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki chance ko zahir karte hain.  Strategies for Trading Retracements Retracements par trading karne ke asardar tareeqay istemal karne mein mukhlis trading strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal trend ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement levels aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement levels ko potential dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar support ya resistance ka kaam karte hain. Asal trend ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar trends dobara palatne ke amkanat hain jabke kamzor trends barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par trader ko faida pohnchane mein madadgar hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Strategies for Trading Retracements Retracements par trading karne ke asardar tareeqay istemal karne mein mukhlis trading strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal trend ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement levels aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement levels ko potential dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar support ya resistance ka kaam karte hain. Asal trend ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar trends dobara palatne ke amkanat hain jabke kamzor trends barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par trader ko faida pohnchane mein madadgar hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Understanding Retracement in Forex TradingRetracement, jo ke pullback ya correction ke naam se bhi jana jata hai, forex market mein aik aam hadsa hai. Is se muraad aik currency pair ke qeemat ke hawale se mawjud trend ke rukh mein aik waqtan-fa-waqtan ulat pher hai. Retracements bazar ke chalne aur ubharte-dhuarte hisson ka natural hissa hain, aur ye traders ko asle level par trading karne ke moqaat faraham karte hain. Aam taur par retracements tab hoti hain jab currency pair aik mukhlis rukh mein kuch waqt ke liye rawana hota hai aur ye tezi se qeemat mein palat jati hai. Ye yaad rakhna zaroori hai ke retracements trend ke mukhlis palat jane ki dalil nahi hain, balke moqay ko rokne wala ya asal trend mein rukawat dalne wala aik waqtan-fa-waqtan rookna hai. Key Characteristics of Retracements Retracements ki kuch khasosiyat hain. Pehle to ye aik mukhlis rukh mein waqtan-fa-waqtan qeemat palat jane ki dalil hain, jo tezi ya tezi se palat jane ki bajaye asal trend mein aik waqtan-fa-waqtan rukawat ko zahir karte hain. Dusri baat, traders aksar Fibonacci retracement levels ka istemal potential support aur resistance areas ko zahir karne ke liye karte hain jo retracements ke doran aksar aik rol ada karte hain. Sab se aam retracement levels 38.2%, 50%, aur 61.8% hote hain. Akhir mein, retracements aksar un traders ke liye trading moqaat faraham karte hain jo pehle trend mein dakhil nahi ho sakte, jo unhein mazeed pasandidgi ki qeemat par dakhil hone ki ijaazat dete hain. Reason Of Retracements Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend mein dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain. Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali data ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke support ya resistance zones, jo retracements ka asar dalte hain. Taqatwar ya kamzor trends ke doran qeemat aksar in ahem points par milti hai. Qeemat ke mukhlis palatne ke doran, tawanai kay sath qeemat ka pesh-kadmi dekhne se bhi faida hota hai, is tarah ke aur price ke barhav ko khatima dene wale asoolon ka mutalia bhi madadgar ho sakta hai.

Reason Of Retracements Forex market mein retracements hone ki wajahen kai hain. Aik aam wajah profit kamana hoti hai jab traders jo pehle trend mein dakhil hote hain, ab apne munafe ko mehfooz karne ki koshish karte hain. Is bechnayi ke dabao se aik waqtan-fa-waqtan qeemat palat jane ka silsila shuru ho sakta hai. Is ke ilawa, bazar ki jazbat mein tabdeeli, aksar maali data ke jariye ya geopolitical waqiat ki wajah se mutasir hoti hai, jo traders ko apni positions dobara dekhnay par majboor karti hai, aur is se retracements paida ho sakti hain. Technical levels bhi qeemat par asar andaz hoti hain, jaise ke support ya resistance zones, jo retracements ka asar dalte hain. Taqatwar ya kamzor trends ke doran qeemat aksar in ahem points par milti hai. Qeemat ke mukhlis palatne ke doran, tawanai kay sath qeemat ka pesh-kadmi dekhne se bhi faida hota hai, is tarah ke aur price ke barhav ko khatima dene wale asoolon ka mutalia bhi madadgar ho sakta hai.  Identifying Retracements Traders retracements ko pesh-kadmi karne ke liye mukhtalif tools aur tajaweez istemal karte hain. Aik aam tareeqa trendlines ko high aur low par banane ka hai. Jab qeemat trendline ko choo leti hai ya uske qareeb pohnchti hai, to is se retracement ka ishara ho sakta hai. Dusre tareeqay me se aik Fibonacci retracement levels istemal karne wale traders, potential retracement areas ko zahir karne mein madadgar hoti hain. Aam taur par istemal hone wale Fibonacci levels 38.2%, 50%, aur 61.8% hote hain. Moving averages, jaise ke 50-period aur 200-period moving averages, retracement levels ko zahir karne mein madadgar hoti hain. Candlestick patterns, jaise doji ya hammer formations, potential retracement levels ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki chance ko zahir karte hain.

Identifying Retracements Traders retracements ko pesh-kadmi karne ke liye mukhtalif tools aur tajaweez istemal karte hain. Aik aam tareeqa trendlines ko high aur low par banane ka hai. Jab qeemat trendline ko choo leti hai ya uske qareeb pohnchti hai, to is se retracement ka ishara ho sakta hai. Dusre tareeqay me se aik Fibonacci retracement levels istemal karne wale traders, potential retracement areas ko zahir karne mein madadgar hoti hain. Aam taur par istemal hone wale Fibonacci levels 38.2%, 50%, aur 61.8% hote hain. Moving averages, jaise ke 50-period aur 200-period moving averages, retracement levels ko zahir karne mein madadgar hoti hain. Candlestick patterns, jaise doji ya hammer formations, potential retracement levels ke qareeb aik waqtan-fa-waqtan palat jane ka ishara kar sakte hain. Akhir mein, oscillators jaise ke Relative Strength Index (RSI) overbought ya oversold shiraa'it ko zahir karne mein madadgar ho sakte hain, jo ke retracement ki chance ko zahir karte hain.  Strategies for Trading Retracements Retracements par trading karne ke asardar tareeqay istemal karne mein mukhlis trading strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal trend ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement levels aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement levels ko potential dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar support ya resistance ka kaam karte hain. Asal trend ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar trends dobara palatne ke amkanat hain jabke kamzor trends barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par trader ko faida pohnchane mein madadgar hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Strategies for Trading Retracements Retracements par trading karne ke asardar tareeqay istemal karne mein mukhlis trading strategies ko lekar aata hai. Traders ko dastaar se yaqeeni ho ke retracement khatam ho raha hai aur trend dobara jaari ho raha hai ke ibtida mein dakhil ho jane ke bajaye retracement ke pehle is ke liye tasdeeq talash karni chahiye. Mukhtalif timeframes ki analysis asal trend ki aik wasee raay deti hai aur dakhil aur nikal ke points ko saaf karne mein madadgar ho sakti hai. Mukhtalif technical indicators ko jaise ke Fibonacci retracement levels aur oscillators jaise ke Relative Strength Index (RSI) istemal kar ke retracement trades mein yaqeen barhaya ja sakta hai. Saheeh risk management techniques istemal karna bhi aham hai, is mein stop-loss orders set karna aur position size ke ahem qawaneen ko ada karna shamil hai. Traders aksar Fibonacci retracement levels ko potential dakhil ya nikalne ke points ke taur par istemal karte hain, kyun ke ye levels aksar support ya resistance ka kaam karte hain. Asal trend ki taqat ka jayeza lena bhi ahem hai, kyun ke taqatwar trends dobara palatne ke amkanat hain jabke kamzor trends barhne ke amkanat hain. Trailing stops ko istemal kar ke retracement ke doran munafe ko mehfooz karna bhi ahem hai, jo retracement jaari rahne par trader ko faida pohnchane mein madadgar hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

Forex trading, ek volatile financial market hai, jahan traders currencies ko exchange karte hain. Retracement ek important concept hai, jo traders ke liye crucial hota hai. Retracement ka matlab hota hai ki market price ek specific trend ya direction mein move karte waqt temporarily reverse hoti hai, lekin phir wapas trend ke according move karti hai.Retracement ko samajhna traders ke liye vital hai, kyunki isse entry aur exit points decide kiye ja sakte hain. Retracement usually Fibonacci retracement levels ke sath analyze ki jati hai, jisse ki traders price movement ko predict kar sakte hain. Yeh levels commonly 38.2%, 50%, aur 61.8% hote hain.Retracement ka sahi taur par istemal karke traders apni positions ko manage kar sakte hain. Yadi aapko trend ke contrary price movement mein trading karne ki strategy aati hai, to retracement analysis aapko market ko samajhne mein madadgar sabit ho sakta hai. Lekin yaad rahe, market mein risk hota hai, aur retracement analysis bhi kabhi-kabhi galat ho sakti hai. Isliye, risk management ka bhi dhyan rakhna zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Forex trading, ek volatile financial market hai, jahan traders currencies ko exchange karte hain. Retracement ek important concept hai, jo traders ke liye crucial hota hai. Retracement ka matlab hota hai ki market price ek specific trend ya direction mein move karte waqt temporarily reverse hoti hai, lekin phir wapas trend ke according move karti hai.Retracement ko samajhna traders ke liye vital hai, kyunki isse entry aur exit points decide kiye ja sakte hain. Retracement usually Fibonacci retracement levels ke sath analyze ki jati hai, jisse ki traders price movement ko predict kar sakte hain. Yeh levels commonly 38.2%, 50%, aur 61.8% hote hain.Retracement ka sahi taur par istemal karke traders apni positions ko manage kar sakte hain. Yadi aapko trend ke contrary price movement mein trading karne ki strategy aati hai, to retracement analysis aapko market ko samajhne mein madadgar sabit ho sakta hai. Lekin yaad rahe, market mein risk hota hai, aur retracement analysis bhi kabhi-kabhi galat ho sakti hai. Isliye, risk management ka bhi dhyan rakhna zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим