Swing Trading in Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Swing Trading in Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Swing Trading in ForexForex trading mein swing trading aik maqbool trading tareeqa hai. Ye day trading aur long-term investing ke darmiyan aik markaz mein hoti hai aur traders ko currency markets mein mukhtalif muddat ke qeemat ki choti ya darmiyani mudat mein taqatwar hoti hai. Swing trading aik trading style hai jo forex (foreign exchange) trading ke duniya mein maqbool hai. Ye day trading aur long-term investing ke darmiyan mein hoti hai aur traders ko currency markets mein qismon mein muddat ke liye positions pakarne ka mauqa deti hai. Is zyada muddat wali holding period ki waja se traders mukhtalif trends mein currency ki qeemat ke liye safar karte hain, currency ko ooncha ya neecha jate dekhte hain. Swing traders asal mein technical analysis par bharosa karte hain, patterns, trends, aur ahem support aur resistance levels ko pehchanne ke liye. Lekin woh bhi fundamental factors ko madde nazar rakhte hain jo currency ki qeemat par asar dal sakte hain, jaise ke maali data release, central bank policies, geo-political events, aur ziyada. Key Characteristics of Swing Trading in Forex Medium-Term Timeframes: Swing traders aam taur par daily, 4-hour, ya 1-hour charts ka istemal trading opportunities pehchanne ke liye karte hain. Ye timeframes day trading ke mukabley market ko ziada waqt tak dekhte hain lekin long-term investors ke timeframes se chote hote hain.

Swing traders asal mein technical analysis par bharosa karte hain, patterns, trends, aur ahem support aur resistance levels ko pehchanne ke liye. Lekin woh bhi fundamental factors ko madde nazar rakhte hain jo currency ki qeemat par asar dal sakte hain, jaise ke maali data release, central bank policies, geo-political events, aur ziyada. Key Characteristics of Swing Trading in Forex Medium-Term Timeframes: Swing traders aam taur par daily, 4-hour, ya 1-hour charts ka istemal trading opportunities pehchanne ke liye karte hain. Ye timeframes day trading ke mukabley market ko ziada waqt tak dekhte hain lekin long-term investors ke timeframes se chote hote hain.- Position Holding: Swing traders qeemat ki movement ko pakarne ke liye kuch dinon se lekar kuch hafton ya mahinon tak positions hold karte hain. Unhein din mein kayi bar trading karne ki zarurat nahi hoti aur woh positions ko raat ko ya hafta bhar tak hold kar sakte hain.

- Technical Analysis: Technical analysis swing trading mein ahem kirdar ada karta hai. Traders entry aur exit points pehchanne ke liye mukhtalif technical indicators, chart patterns, aur trend analysis tools ka istemal karte hain.

- Risk Management: Saf aur mutaliq risk management swing traders ke liye lazmi hai. Aksar traders potential nuksan ko mehdood karne ke liye stop-loss orders ka istemal karte hain aur apne maali asal ko mehfooz rakhne ke liye munasib position sizing ka istemal karte hain.

- Flexibility: Swing trading mukhtalif market shiraiton ke mutabiq adapt ki ja sakti hai. Traders bullish markets mein long (kharidna) kar sakte hain aur bearish markets mein short (bechna) kar sakte hain, is tarah ye aik versatile strategy hai.

Swing Trading Strategies Forex market mein traders mukhtalif swing trading strategies ka istemal kar sakte hain. Ye strategies technical analysis par mabni hoti hain aur potential entry aur exit points ko pehchanne mein madadgar hoti hain. Yahan kuch aam swing trading strategies hain:

Swing Trading Strategies Forex market mein traders mukhtalif swing trading strategies ka istemal kar sakte hain. Ye strategies technical analysis par mabni hoti hain aur potential entry aur exit points ko pehchanne mein madadgar hoti hain. Yahan kuch aam swing trading strategies hain:- Trend Following: Ye strategy taqatwar trend ki taraf aane wale signals ko pehchanne aur trade karne ke liye istemal hoti hai. Traders moving averages ya trendlines jaise technical indicators ka istemal trend ki taraf jari rahegi ya rukne ka andaza lagane ke liye karte hain.

- Breakout Trading: Breakout traders un waqiyat ko dhoondhte hain jab kisi currency pair ki qeemat aik ahem resistance level se oonchi ya aik ahem support level se nichli hoti hai. Woh breakout ke rukh mein positions lete hain, taake woh taqatwar raftar ko follow kar saken.

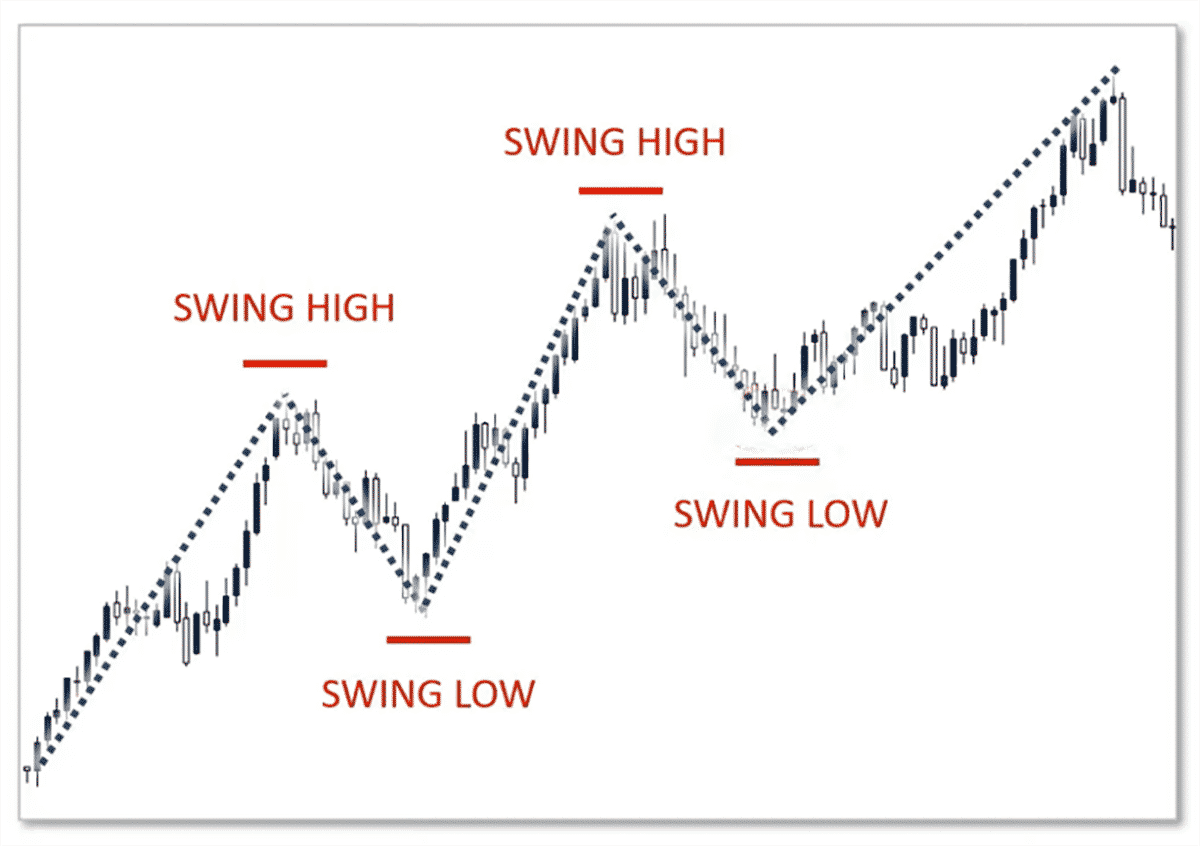

- Swing Highs aur Lows: Traders price chart pe swing highs (peaks) aur swing lows (troughs) ko pehchan sakte hain. Woh swing lows ke qareeb long positions aur swing highs ke qareeb short positions lete hain, tawaqo karte hain ke qeemat ka rukh palat jaye ga.

- Fibonacci Retracement: Fibonacci retracement levels ko potential support aur resistance levels pehchanne ke liye istemal kiya jata hai. Swing traders aksar in levels pe positions lete hain, umeed karte hain ke qeemat mein palat aaye gi.

- Moving Average Crossovers: Ye strategy do moving averages ke sath istemal karne ka shamil hai jin ke mukhtalif time periods hotey hain. Jab chhota time period wala moving average bara time period wale moving average ke ooper se guzar jata hai, to yeh aik buy signal generate karta hai, aur jab woh neechay se guzar jata hai, to yeh aik sell signal generate karta hai.

- Bollinger Bands: Bollinger Bands aik middle band (a moving average) aur do outer bands se banti hain jo average se standard deviations ko darust karti hain. Swing traders Bollinger Bands ko overbought aur oversold conditions pehchanne aur trading decisions banane ke liye istemal karte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:49 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим