What is pips forex ??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

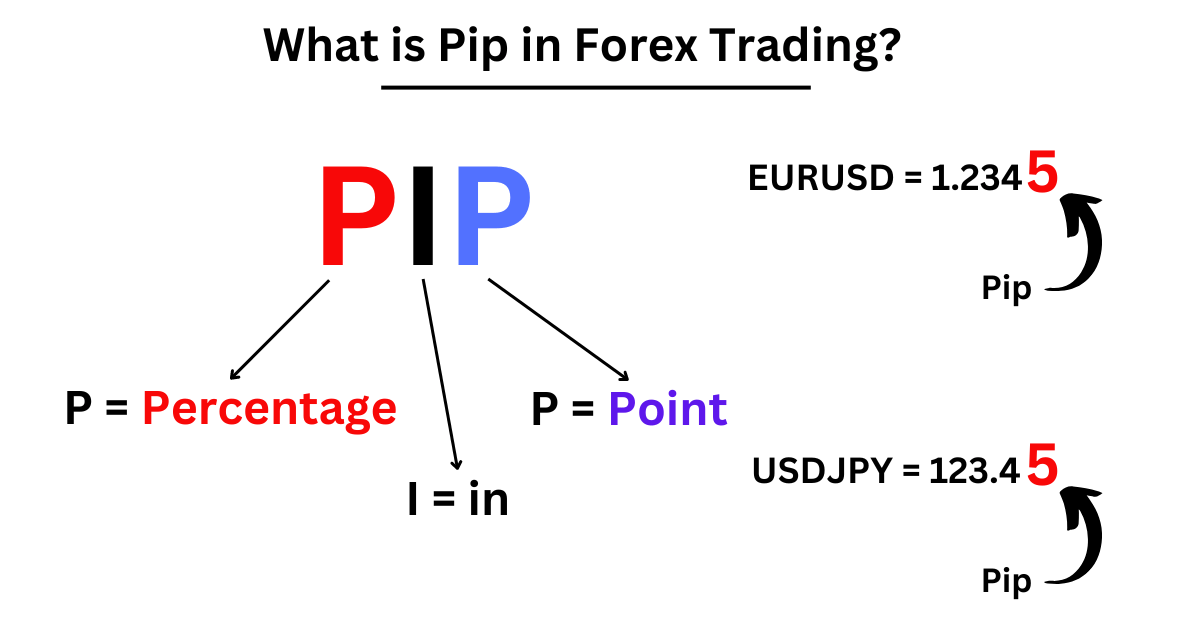

Assalamualaikum dear frnds ... Forex trading, jo k aik international market hai jahan currencies ko khareed-o-farokht ki jati hai, mein traders forex pips k concept se waqif hote hain. Forex pips ka matlab hota hai "Percentage in Points" ya "Price Interest Point" jo k forex market mein exchange rates ki smallest unit hai. Forex pips ki ahamiyat yeh hai k yeh traders ko apni trades ki performance ki monitoring mein madad deta hai. Forex pips ka concept har forex trader k liye kafi important hai. Pip value ko maloom karna traders ko apni trades ki performance ko measure karne mein madad deta hai. Forex traders ko pip value ki knowledge apni trading strategy ko improve karne mein bhi madad deti hai. Forex market mein currencies ki value ka measurement pips mein kiya jata hai. Jab koi currency pair ki value mein ek pip ki change hoti hai to iska matlab hota hai k us currency pair ki value mein 0.0001 ya 0.01% ka change aya hai. Forex market mein sab se common currency pairs EUR/USD, GBP/USD, USD/JPY or USD/CHF mein 1 pip ki value 0.0001 hoti hai, jab k NZD/USD or USD/CAD mein 1 pip ki value 0.0001 se zyada hoti hai. Pips calculation !!! Forex pips ki value ko calculate karna kafi asan hai. Iske liye sab se pehle traders ko currency pair ki exchange rate ki value ko note karna hota hai. Phir traders ko us currency pair ki pip value maloom karna hoti hai. Pip value ko calculate karne k liye traders ko apni account ki currency or trade size ka pata hona zaroori hota hai. Iske baad traders aik simple formula se pip value ko calculate kar sakte hain. Jaisa k traders jantay hain k forex trading mein profit or loss ki measurement pips mein hoti hai. Is liye, pip value ko janna forex traders k liye kafi important hai kyun k isse wo apni trades ki performance measure kar sakte hain. For example, agar kisi trader ne 1 lot ki trade ki hai to uski pip value 10 USD ho sakti hai. Agar uski trade 100 pips profit pe close hoti hai to uski total profit 100 x 10 = 1000 USD ho sakti hai. Forex pips ko samajhna aur calculate karna har forex trader k liye zaroori hota hai. Forex traders ko pip value ko maloom karna chahiye takay wo apni trades ki performance ko measure kar sakein. Iske alawa, pip value ki knowledge forex traders ko risk management mein bhi madad deti hai. Jab kisi trader ko apni trade ki entry or exit points ko decide karna hota hai to pip value ki knowledge usko correct decisions lene mein madad deta hai. Forex traders ko apni trades k liye pip value ko calculate karna zaroori hota hai. Jab traders kisi trade ko open karte hain to wo uski trade size or currency pair ki exchange rate ki value ko note kar sakte hain. Iske baad traders ko pip value ko calculate karna hota hai. Pip value ko calculate karne k liye, traders ko aik simple formula use karna hota hai. Formula ki terms ki value traders k account ki currency or trade size pe depend karti hai. Pipette concept !! Forex trading mein traders ko forex pips k sath sath pipettes ka concept bhi samajhna zaroori hota hai. Pipette, forex market mein currencies ki value ki measurement ka aik aur smallest unit hota hai. Pipette, forex pips ki ek fraction hoti hai jo k 1/10th of a pip hoti hai. Pipette traders ko currencies ki precise value ki measurement karna allow karta hai. Forex market mein pipette ki value, different currency pairs k liye vary karti hai. Jaisa k traders jantay hain k forex market mein sab se common currency pairs EUR/USD, GBP/USD, USD/JPY or USD/CHF mein 1 pip ki value 0.0001 hoti hai. Jab k NZD/USD or USD/CAD mein 1 pip ki value 0.0001 se zyada hoti hai. Pipette ki value different currency pairs k hisaab se change hoti hai. Jis se traders ko pipettes ki value ko maloom karna zaroori hota hai. Pipettes ko calculate karna kafi asan hai. Iske liye traders ko sab se pehle currency pair ki exchange rate ki value ko note karna hota hai. Phir traders ko pipette ki value maloom karni hoti hai. Pipette ki value ko maloom karny k liye traders ko sab se pehle pip ki value ko maloom karna hota hai. Jab traders pip ki value maloom kar lety hain to wo is formula k zariye pipette ki value ko calculate kar sakte hain: 1 pip ki value / 10 = Pipette ki value Pipette ki value ko calculate karne k baad traders apni trades ko open or close karny k liye pipettes ka use kar sakte hain. For example, agar kisi trader ko 1 lot ki trade open karni hai to usko pipettes ko consider karna hoga. Agar uski currency pair ki exchange rate 1.12345 hai to uski pip ki value 0.0001 ho sakti hai aur pipette ki value 0.00001 ho sakti hai. Forex market mein pipettes ka use karny se traders ko currencies ki value ki measurement mein zyada accuracy milti hai. Iski wajah yeh hai k pipettes 1/10th of a pip ki value rakhty hain jis se traders currencies ki value ko boht precise tareeqy se measure kar sakte hain. Pipettes ka use karny se traders ko apni trades ko manage karna asan hota hai aur unko zyada flexibility milti hai. Forex market mein pipettes ka concept forex traders k liye boht important hai. Pipettes ka use karny se traders ko apni trades ki performance ki monitoring mein madad milti hai. Pipettes ki knowledge traders ko currencies ki value ko zyada precise tareeqy se calculate karne mein madad deta hai. Iske alawa, pipettes ka use karny se traders ko apni trades ko manage karny mein bhi asani milti hai. Pips lot size !! Forex pips aur lot size dono foreign exchange trading mein bahut ahem hai. Dono ka relationship traders ke liye ek important aspect hai, jo inki trading strategy, risk management aur profit earning potential ko impact karta hai. Sabse pehle, hum pips ki definition ko samajhte hain. Pips, foreign exchange market mein price movement ka unit of measurement hai. Yeh price ke change ko denote karta hai. For example, agar EUR/USD pair ka current rate 1.2000 hai aur agle din 1.2050 ho jata hai, to iska pips difference 50 pips hoga. Forex traders usually use pips to calculate their profit and loss. Lot size, forex trading mein ek unit hai, jiske through traders currency pairs ko buy aur sell karte hain. Lot size ka use, trade ke size ko decide karne ke liye kiya jata hai. Lot size, forex trading mein bahut ahem hai, kyun ki isse trader ka risk aur profit ka level decide hota hai. Ab hum forex pips aur lot size ke relationship ko samajhte hain. Forex pips aur lot size ke beech mein relationship bahut simple hai. Jab bhi traders kisi currency pair ko trade karte hain, to wo lot size decide karte hain, jiske through wo trade karenge. Lot size decide karne ke liye, traders apni risk management aur trading strategy ko consider karte hain. Jaise ki hum jante hain, ki lot size ke through trade size decide kiya jata hai. Agar koi trader, apni trading strategy ke according, 1 lot size ka use karta hai, to uska trade size bahut bada hoga. Agar wo 1 pip move par $1 ka profit earn karta hai, to 100 pips move par uska profit $100 hoga. Lekin, agar wo 1 lot size ke sath trading karta hai, to uska risk bhi bahut bada hoga. Agar wo 100 pips move par $100 ka profit earn karta hai, to 100 pips move par uska loss bhi $100 hoga. Is tarah, forex pips aur lot size ke beech mein relationship bahut ahem hai, kyun ki ye trader ke risk aur profit level ko impact karta hai. Agar trader, apne risk level ko kam rakhna chahta hai, to wo kam lot size ka use karega. Lekin agar wo apne profit level ko increase karna chahta hai, to wo bada lot size ka use karega. Lot size ko decide karne se pehle, trader ko apni trading strategy, risk management aur profit earning potential ko consider karna chahiye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

PIPs

PIP or “Percentage in Point” do currencies k darmeyan sharah e tabadela main qeemat ki sab se choti tabdeeli ki numayendaggi karti hai. "Bank of International Settlement" k mutabiq forex trading market main sab se ziadda trading hone wali currencies main American Dollar (USD), Euro (EUR), Japanese Yen (JPY) aur aik khas had tak British Pound (GBP) shamil hen.

In currencies ka hawala (quoted) ishareya k baad fourth fourth decimal point par hai, jiss kamatlab hai k tabdeeli ki sab se choti ikaye ishareya k baad fourth number hai. Sirf Japanese Yen (JPY) ko chor kar baqqi sab par ye rule apply hotta hai. Japanese Yen (JPY) wali currencies pairs main ishareya k baad dosre number pips ki ikaye hotti hai.

Forex trading market main currencies pairs ki up down harkat pios main hotti hai, iss waja se market main honne wale nafa aur nuqsan (profit and loss) ka hisab bhi pips main hi count kia jatta hai. Pips k mutaleq knowledge rakhna aur iss ki calculation bohut zarorri hai. Pips ko samajhne k leye darjazzel example par gjawar karen, k ye kese kaam kartta hai, ya bantta hai?

Example:

Forex trading main currencies chonkeh pairs ki sorat main hotti hai, iss waja se jab bhi hum aik currency ko buy kartte hen, to automatically dosre currency ko sath main sell kar rahe hotte hen. Currency pairs main 1st currency ko Base Currency jab 2nd currency ko Quote Currency kaha jatta hai. Base currency k buy karnne se quote currency sell hotti hai, aur sell karnne par buy hotti hai. Ab atte hen apnni example ki tarraf;

Aggar aik currency jore jaisa k EURUSD ki maojooda qeemat 1.1350 ho to iss ka matlab hai k one (1) EUR 1.1350 USD k barabar hai. Currency pair main base currency ki value hamesha 1 k barabar hoggi aur quote currency ki value maukhtalif hoggi, ye ziadda ya kam ho saktti hai.

Jab aap EURUSD ko maojooda qeemat yanni 1.1350 par buy kartte ho, currency pair bullish harkat karta howa 1.1352 tak jatta hai, aur aap iss point par currency jore k trade ko close kartte ho to iss ka matlab hai k aapko 2 pips hasil howe, baqqi pios k mutabiq munafay ka inhisar lot size par munhasir hotta hai, bare lot size se nafa aur nuqsan ziadda hotta hai, jab k small lot size ye kam hotta hai.

Explaination

Forex trading me pips bohut aham point hai. Forex trading me pips se murad wo value hai jo kisi pair ki movement k dowran changes ko zahir karti hai. Jab bhi market me kisi pair ki movement hoti hai to is se murad pips ki changing hoti hai. Agar market ki aik pair ki pips ki movement positive hoti hai to us se murad hota hai k ye pair ki uptrend hai aur market ki movement downward hoti hai to pips pair ki kam hoti hai. Jitni ziada pips ki movement hoti hai utni hi ziada market ki up down movement ki teezi show karti hai. Forex trading market me buy aur sell k darmeyan jo difference hota hai jis ko spreads kaha jata hai wo pips ki sorat me hi hota hai.

Forex trading market me lot size se pips ka bara taluq hota hai, jitna hum lot size ko increase karte hen to is se pips ki value increase hoti hai jis se murad hai k aik bare lot size se pips strong hota hai aur jab k small lot size pips ki weak hota hai. Agar incase hamara lot size 1 ho to aik pip ki movement se 10$ ki difference ata hai lekin agar market me lot size hum 0.001 (jo sab se small lot size hai) ka istemal karte hen to aik pip ki movement se account me 0.01$ ki faraq ata hai.

Forex trading market pips ka har aik pair me mukhtalif movement hoti hai, kisi pair me ye movement 3 digits pe hota hai aur kisis me ye pair 6 digits pe bhi hota hai. Forex trading me pair ki movement se lot size ki movement se hota hai. Spreads ziada hone se pips ki ziada faraq hota hai jo k hamare leye nuqsan deh hai. Pips ko sahi andaza hona chaheye, ta keh hamare pair jis pe trade karte hen us se hamen faida mel jaye.

Forex trading me pips ki movement hi ki waja se hum forex trading me benifits hasil karte hen. Agar forex trading market me pips ki movement fast hoti hai to ye market ki fast volition kehlati hai. Jab k agar market ki movement me pips ziada move ho rahi ho to ye forex trading market ki fast move nahi hoti hai bulke ye kisi pair ki zyada trading kehlati hai. Q k EURUSD me sab se ziada trading hoti hai aur is k pips daily base pe 100 se bhi ziada pips ki movement hoti hai, to is ka ye matlab nahi hai k ye ziada volitile hai. Bulke ye ziada istemal hone wala pair hai.

Pipette

Pipette "Pips" ki mazzeed chotti ikaye hotti hai, ya aik pip ka daswan (10th) hisa hotta hai. Wese trading plateforme main ye nazzar to atta hai, lekin iss ki normal trading main koi khas value nahi hotti hai, pips ki asal value 4rth digit tak hi hotti hai. Q k asal pip uss se hi shoro hotta hai. Pipette ka istemal sirf aik hi jaggah hotta hai aur wo hai "Nano accounts" ya "cent account" amin. Cent account main broker apne clients ko cent main trading karnne ki sahulat dette hen, aur ye account ziadda tar new traders ya kam experience wale trader market se waqefeyat hasil karnne k leye istemal kartte hen. 1Pipeete = 0.1 Pip or 0.00001

Pips Counting

1.1352 par trading karnne wala EURUSD currency jore main 1 EUR 1.13852 k value k barabar hotta hai. Ab ye 1.1352 value 11,352 pips k barbar hai. Pips kisi jore ki vlaue ko right side se left side ki taraf count kartta hai. Jesa k, 1.1352 main last 2 digit pehla pip hogga, jo k 2 pips k barabar hogga, isi tarah 5 digit 50 pips ka, 3 digit 300 pips, 1 digit 1000 pips aur last ya left side se pehla digit 10000 pips k barabar hai.

How to Calculate Pips?

Faraz karen k aap ne EURUSD ki maojooda price 1.1350 par aik lot ki position open ki hai, yanni iss currency jore ko yahan par buy kia hai, to iss ka matlab hai k 10000 EUR ko buy karne k leye aap ko 1,1350 USD ki zarrorat hoggi.

Ab aggar ye price 1.1352 par chali jatti haiaur app ko 2 pips hasil hotte hen, to aap ko iss ko peso main tabdeel karnna zarrori hai.

Pehle hum pips ko exchange karengay, q k humen 2 pips ka munaffa howa tha. Chonkeh 1pip = 0.0001 hai.

((0.0001/1.1350) x 100,000) = 8.8 EUR aik pip ki value hai. Aapko trading main 2 pips ka munafa howa tha aur 1 pip ka munafa 8.8 hai to 2 pips ka munaffa hogga,

2pips × 8.8 = $17.6 . Big lot size se pips ki vlaue main faraq ayega jo k ziadda munafa ya loss hoga aur small lot size se bhi pips ki value up ya down hogi, jo k kam naffa ya nuqsan ka bahis banega.

-

#4 Collapse

WHAT IS PIPS FOREX DEFINITION

Sirf ek whole unit price ka sabse smallest move Hai Jise forex market convention ki based per exchange rate banaa sakta hai price interest Ke point mein percentage ka acronym hai pipe Jo forex trading Mein istemal Hote Hain unko interest rate market Mein used hone wale bps best points ke sath confused Main Nahi dalna chahie Jo one percentage Jaani zero ke one/hundred hisse i,e one percentage ki represent Karte Hain zyadatar currency pair ki price four decimal place per hoti hai and Ek pip 4th decimal place per Hota Hai Jenny one / ten ,zero zero zero for example USD / CAD currency Pair ke zarie sab se smallest whole unit ki move zero .zero zero zero one $ ya Ek pipe hai

UNDERSTANDING PIPS

Infrared pair ke qoutes bid and ask wale sprea ke Taur per appear Hote Hain Jo 4 decimal ke places per accurate Hote Hain Kyunki most currency pair ko maximum four decimal places per quotes Diya jata hai isliye UN Pair Ke Liye sabse smallest whole unit ki changa Ek pipes hai Ek pipe foreign exchange ka Basic concept hai forex trader Aisi currency sell and buy hain Jiski price Kisi dusri currency ke quotes appear Ki Jaati Hai exchange ki rate mein movement pipes ke zariye measured ho jata hai

REAL WORLD EXAMPLE OF PIPS

REAL WORLD EXAMPLE OF PIP

Government Ne exchange rate se six zero ko khatm karke is ka name new Turkish Lira Rakh Diya bahut se trading system adjust nahin kar sakte hain hyperinflation and devaluation main Kami ka combination exchange rate ko is point tak le ja sakta hai Jahan voh unmanageable Ho Jaate Hain in consumer ko impacting karne ke alava Jo large amount Mein cash Le Jaane per forced Hai yah trading ko unmanageable banaa sakta hai and pipe ka concept meaning loses sakta hai Ek Aur case Turkish ka lira hai

-

#5 Collapse

What is pips forex ??

"Pips" (Percentage in Point) forex trading mein istemal hone wala aik unit hai jo currency pairs ke price movements ko represent karta hai. Ye trading market mein chhoti si tabdiliyon ko measure karne ke liye istemal hota hai. Pips ka concept traders ko bataata hai ke currency pair ki price mein kitni chhoti tabdiliyan hui hain.

Forex market mein, currency pairs ka rate aksar decimal places mein diya jata hai. Aik pip ka matlab hota hai ke currency pair ki price mein aik unit ki chhoti si tabdili hui hai, jo aksar decimal ke teesre ya chouthay digit mein hoti hai. Yeh tabdiliyan currency pair ke exchange rate mein hoti hain.

For example:- Agar EUR/USD ka rate 1.1250 hai aur phir yeh badal kar 1.1251 ho jata hai, to is tabdili ko aik pip kaha jayega.

- Agar USD/JPY ka rate 109.75 hai aur phir yeh badal kar 109.76 ho jata hai, to is tabdili ko aik pip kaha jayega.

Forex traders pips ka istemal karte hain taake woh price movements ko quantify kar sakein. Iske zariye, woh apne trades ka risk aur reward tay karte hain. Pips ki counting ke zariye, traders apne trading strategies ko optimize karte hain aur market ke movements ko samajhte hain.

Iske alawa, leverage ka concept bhi forex trading mein ahem hai. Small price movements bhi high leverage ki wajah se achi returns ya nuksanat paida kar sakti hain. Pips is tarah ke price changes ko measure karne mein madad karte hain, lekin yaad rahe ke high leverage ke sath trading mein risk bhi barh jata hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is pips forex ??

Forex (foreign exchange) market mein, "pip" ek common unit of measurement hai, jise price movements ka quantify karne ke liye istemal kiya jata hai. Pip ka matlab hota hai "percentage in point" ya "price interest point." Pip, currency pairs ki price movements ka smallest possible change ko represent karta hai.

Har currency pair ke liye pip ka value alag hota hai, lekin aam taur par, pip ka value 4 decimal places tak hota hai. Jaise ke agar aap USD/EUR currency pair ki baat karte hain aur price 1.1234 se 1.1235 tak badalti hai, to is change ko ek pip maana jayega.

Example ke taur par, agar aap ek currency pair mein trade kar rahe hain aur uski price 1.3000 se 1.3005 tak badalti hai, to is movement ko 5 pips kaha jayega.

Yeh important hai kyunki traders apne positions ke size aur profit/loss calculations ke liye pip values ka istemal karte hain. Market mein hone wale small price changes ko pips mein measure karke traders apne strategies ko plan karte hain.

Iske alawa, kuch currency pairs mein pip ka value 2 decimal places tak hota hai. Jaise ke Japanese Yen (JPY) pairs mein pip value 2 decimal places mein hoti hai. Agar USD/JPY pair ki price 110.50 se 110.51 tak badalti hai, to is movement ko 1 pip maana jayega.

To summarize, pip forex market mein price movements ko quantify karne ka standard unit hai, jiska value currency pair ke specific characteristics par depend karta hai.

- 145.1400 USDJPY

- Mentions 0

-

سا1 like

-

#7 Collapse

What is pips forex ??

"Pips" (Percentage in Point) forex trading mein istemal hone wala aik unit of measurement hai jo currency pairs ke price movements ko quantify karta hai. Pips ka concept traders ko market ki movement ko asaan taur par samajhne aur quantify karne mein madad karta hai.

Ek pip, aksar ke currency pairs mein, ka matlab hota hai price ka chhota sa change jo fourth decimal place tak hota hai. Lekin, kuch currency pairs mein, jaise ke yen-based pairs, pip ka ek unit third decimal place tak hota hai.

Yeh samajhne mein madadgar hai jab traders price movements ko dekhte hain aur unki trading decisions lene mein istemal karte hain. Jab market mein price ek pip badalta hai, toh iska mtlb hai ke currency pair ki value mein chhota sa change hua hai.

For example:- Agar EUR/USD ki price 1.1200 se 1.1201 badalti hai, toh iska matlab hai ke market mein ek pip ka movement hua hai.

- Agar USD/JPY ki price 110.50 se 110.51 badalti hai, toh yeh bhi ek pip ka movement darust karegi.

Pips ka istemal profit aur loss ko bhi quantify karne mein hota hai. Jab aap trading karte hain, toh aap apne entry aur exit points mein pip values ka difference dekhte hain. Is tareeqe se, aap apne trades ka risk aur reward asaan taur par calculate kar sakte hain.

Pips ke sath trading karne mein, traders ko market movements ko precision ke saath quantify karne mein madad milti hai, aur isse trading strategies ko design aur implement karne mein bhi asaan hota hai.

-

#8 Collapse

Forex trading, jo ke foreign exchange trading ka short term hai, mein "pip" ek ahem mudda hai.

Pip ka matn hota hai "percentage in point," jo trading market mein asalat ke aik chhote hisse ko darust karta hai.

Ek pip, aksar trading rates mein chhote tabdeelion ka hamil hai aur trading mein ahem hota hai.

Forex traders ke liye, pip unki kamaai ya nuksan ko darust karne mein madad karta hai.

Har currency pair mein, pip ka qeemat alag hoti hai, jise traders ko samajhna zaroori hai.

Forex market mein, pip se related movement ka zikar hota hai, jo ke currency pair ki keemat mein hoti hai.

Pip ka faida yeh hai ke chhote tabdeelion ko asan taur par samajha ja sakta hai.

Agar aapka currency pair ek pip se zyada tabdeel hota hai, toh yeh ek significant movement hai.

Pip ka concept traders ko market ki volatility ko samajhne mein madad karta hai.

Forex trading mein, pip trading ke size aur profit ya loss ko measure karne ka tareeqa hai.

Traders ko apne trades ke size ko pip mein measure karke risk aur reward ko control karne mein asani hoti hai.

Pip values currency pair par mabni hoti hain, aur har currency pair ka apna ek pip value hota hai.

Yeh pip value traders ko pata lagane mein madad karta hai ke har pip kitni keemat ka hota hai.

Pip values ko samajh kar, traders apni trading strategies ko behtar taur par design kar sakte hain.

Forex trading mein pip ke hawale se basic understanding hona zaroori hai, taki traders sahi decisions le saken.

Pip movement traders ko market trends ko samajhne mein madad deta hai.

Forex trading mein, pip ke fluctuations ka asar trading positions par hota hai.

Pip ki movement traders ko market mein hone wale tabdeelion ko predict karne mein asani hoti hai.

Pip values ke changes par tawajju dene se traders apni trading strategies ko adapt kar sakte hain.

Har trader ko zaroori hai ke woh apne trades ko pip movement ke hawale se monitor kare.

Pip fluctuations ke zariye traders apne risk management ko behtar taur par handle kar sakte hain.

Forex trading mein, pip ke concept se judi learning continuous hoti hai aur traders ko hamesha update rehna chahiye.

Har pip ka asalat ke value se taluq hota hai, is liye market trends ko closely observe karna zaroori hai.

Pip movement ko samajhne ke liye traders ko technical analysis aur market indicators ka istemal karna chahiye.

Pip values se judi sahi information ke liye reliable sources ka istemal zaroori hai.

Forex market mein pip ke importance ko samajhne ke liye traders ko educational resources ka istemal karna chahiye.

Trading strategies ko design karte waqt, pip values aur movements ko shamil karna zaroori hai.

Pip fluctuations se judi technical knowledge hone se traders apne decisions ko aur behtar bana sakte hain.

Har pip ka impact traders ke trades par alag hota hai, is liye har movement ko carefully analyze karna zaroori hai.

Pip values ke samajhne se traders apne trades ke liye sahi risk-reward ratio set kar sakte hain.

Forex market mein pip values ke changes ko track karna har trader ke liye essential hai.

Har currency pair ke liye pip ka value alag hota hai, is liye traders ko market ke variations ko samajhna zaroori hai.

Pip values aur movement ka analysis karke traders apne trading decisions ko refine kar sakte hain.

Forex market mein, pip ke concept ko ignore karna risky ho sakta hai, is liye ise samajhna zaroori hai.

Har pip movement ka impact trading positions par hota hai, is liye traders ko market ke har asool ko samajhna zaroori hai.

Pip values ko predict karne ke liye technical and fundamental analysis ka istemal karna zaroori hai.

Forex market mein pip values ke fluctuations ko samajh kar, traders apne trades ko optimize kar sakte hain.

Har pip ka importance har trader ke liye alag hota hai, is liye market conditions ko samajhna zaroori hai.

Pip values ko analyze karke traders apne risk tolerance ko improve kar sakte hain.

Forex trading mein pip values ka tafsili ilm hone se traders market volatility ko navigate kar sakte hain.

Har currency pair mein pip values ka study karna, traders ko market ke nuances ko samajhne mein madad karta hai.

Pip fluctuations ke impact ko samajh kar, traders apne trading strategies ko optimize kar sakte hain.

Forex market mein pip values par research karna traders ko market trends ko anticipate karne mein madad karta hai.

Har pip movement se judi information traders ko market sentiment ko better understand karne mein madad karta hai.

Pip values ke fluctuations ko analyze karke traders apne risk management ko enhance kar sakte hain.

Forex market mein, pip ka concept traders ko market dynamics ko comprehend karne mein madad karta hai.

Har pip ka value trading positions par direct asar daalta hai, is liye traders ko market ke har aspect ko study karna zaroori hai.

Pip values se judi research aur analysis traders ko market ki uncertainties ko address karne mein madad karta hai.

Har pip movement se judi information, traders ko market trends ko forecast karne mein asani deta hai.

Forex trading mein, pip ka concept hona traders ke liye zaroori hai, taki woh market ke challenges ko effectively face kar sake

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pips in Forex Trading: Currency Market Mein Measurement Unit

Forex trading, ya foreign exchange trading, ek global marketplace hai jahan currencies buy aur sell hoti hain. Yahan, trading mein ek common term jo aapko baar-baar sunne ko milta hai, woh hai "pips." Pips ek measurement unit hain jo currency pairs ki price movement ko quantify karte hain aur traders ko market ki volatility ka andaza dete hain.

"Pip" ka matlab hota hai "percentage in point" ya "price interest point." Har currency pair mein pip ka value alag hota hai, lekin iska basic concept ye hai ke yeh smallest possible price change ko represent karta hai. Isse trading mein precision bani rahti hai aur traders ko chhote se chhote price movements ka bhi andaza hota hai.

Pips Ki Calculation

Pips ka calculation har currency pair ke liye alag hota hai. Aam taur par, most currency pairs ke liye pip ka value ek decimal place ke baad hota hai. For example, agar aap EUR/USD pair trade kar rahe hain aur price 1.1234 se badal kar 1.1235 ho jata hai, toh isme ek pip ka movement hua.

Lekin, kuch currency pairs mein pip ka value do decimal places ke baad hota hai. Jaise ke USD/JPY, agar price 109.50 se 109.51 ho jata hai, toh isme ek pip ka movement hua. Ismein pip ka value 0.01 hota hai.

Pips Aur Profit/Loss

Pips ka importance tab samajh aata hai jab aap apne trades ki profit ya loss calculate karte hain. Har trade mein, aapne ek entry point aur ek exit point decide kiya hota hai. Is movement ko pips mein measure karke, aap apne trade ki performance ka analysis kar sakte hain.

Agar aap long position le rahe hain (yani aapko lagta hai ke currency pair ki price badhegi), toh aap profit tab kamaenge jab market mein price badhega. Is situation mein, aap apne exit point ko apne entry point se zyada rakhege, aur yeh difference pips mein measure hota hai.

Wahi opposite scenario hota hai jab aap short position lete hain (yani aapko lagta hai ke currency pair ki price giregi). Aap tab profit kamayenge jab market mein price girega, aur is difference ko bhi pips mein measure karenge.

Pips Aur Risk Management

Pips ka concept risk management mein bhi bahut important role play karta hai. Har trader apne trades mein ek certain amount of risk lena chahta hai, aur iske liye stop-loss orders ka use hota hai. Stop-loss order, ek predetermined level par apne trade ko automatically close kar dene ka kaam karta hai.

Traders stop-loss level ko pips mein define karte hain. Yeh unka maximum allowable loss hota hai. Agar market is level tak jaata hai, toh trade automatically close ho jati hai, aur trader apni loss ko control mein rakhta hai.

Conclusion

Pips forex trading mein ek essential concept hai jo traders ko market movement ko samajhne mein madad karta hai. Iska sahi se istemal karke, traders apne trades ko analyze karte hain, profit aur loss ko quantify karte hain, aur overall apne trading strategy ko improve karte hain. Pips ka concept samajhna, forex trading ke liye ek crucial step hai jise har trader ko seekhna chahiye.

-

#10 Collapse

FOREX DEFINITION;

the Forex market buying and selling me pips ki movement hello ki waja se hum forex trading me benifits hasil karte fowl. Agar forex trading marketplace me pips ki movement speedy hoti hai to ye market ki speedy volition kehlati hai. Jab k agar market ki movement me pips ziada flow ho rahi ho to ye foreign exchange buying and selling market ki rapid flow nahi hoti hai bulke ye kisi pair ki zyada buying and selling kehlati hai. Q okay EURUSD me sab se ziada trading hoti hai aur is okay pips each day base pe 100 se bhi ziada pips ki motion hoti hai, to is ka ye matlab nahi hai okay ye ziada volitile hai. Bulke ye ziada istemal hone wala pair hai.Jab aap EURUSD ko maojooda qeemat yanni 1.1350 par buy kartte ho, foreign money pair bullish harkat karta howa 1.1352 tak jatta hai, aur aap iss factor par currency jore k alternate ko close kartte ho to iss ka matlab hai k aapko 2 pips hasil howe, baqqi pios ok mutabiq munafay ka inhisar lot length par munhasir hotta hai, naked lot length se nafa aur nuqsan ziadda hotta hai, jab ok small lot length ye kam hotta hai.

Explaination

the Forex market buying and selling foremost currencies chonkeh pairs ki sorat fundamental hotti hai, iss waja se jab bhi hum aik forex ko buy kartte chicken, to automatically dosre forex ko sath foremost promote kar rahe hotte bird. Currency pairs important 1st forex ko Base Currency jab 2d forex ko Quote Currency kaha jatta hai. Base currency k buy karnne se quote forex promote hotti hai, aur promote karnne par purchase hotti hai. Ab atte chook apnni example ki tarraf;Forex trading me pips bohut aham factor hai. Forex buying and selling me pips se murad wo cost hai jo kisi pair ki movement okay dowran modifications ko zahir karti hai. Jab bhi market me kisi pair ki motion hoti hai to is se murad pips ki changing hoti hai. Agar market ki aik pair ki pips ki movement positive hoti hai to us se murad hota hai ok ye pair ki uptrend hai aur marketplace ki movement downward hoti hai to pips pair ki kam hoti hai. Jitni ziada pips ki motion hoti hai utni hi ziada marketplace ki up down movement ki teezi show karti hai. Forex trading market me purchase aur promote okay darmeyan jo distinction hota hai jis ko spreads kaha jata hai wo pips ki sorat me hello hota hai.

UNDERSTANDING Trading;

Infrared pair ke qoutes bid and ask wale sprea ke Taur according to seem Hote Hain Jo four decimal ke places in step with accurate Hote Hain Kyunki most currency pair ko most 4 decimal places in keeping with prices Diya jata hai isliye UN Pair Ke Liye sabse smallest complete unit ki changa Ek pipes hai Ek pipe foreign exchange ka Basic idea hai forex trader Aisi currency promote and buy hain Jiski charge Kisi dusri currency ke quotes appear Ki Jaati Hai exchange ki fee mein motion pipes ke zariye measured ho jata hai.Exchange rate se six 0 ko khatm karke is ka name new Turkish Lira Rakh Diya bahut se buying and selling device modify nahin kar sakte hain hyperinflation and devaluation predominant Kami ka mixture trade price ko is point tak le ja sakta hai Jahan voh unmanageable Ho Jaate Hain in purchaser ko impacting karne ke alava Jo massive quantity Mein cash Le Jaane according to forced Hai yah trading ko unmanageable banaa sakta hai and pipe ka idea that means loses sakta hai Ek Aur case Turkish ka lira hai. -

#11 Collapse

Pips ForexForex pip ki tadad mein ek shirayana taur par sahar ka sab se chhota hissa hai. Pip forex mein currency pairs ki keemat ka aik fraction hota hai. Yeh fraction usually ek percent ya ek so percent ke barabar hota hai. Pip forex mein currency trading ke liye ek ahem aur basic concept hai, jo ke traders ke liye zaroori hai samajhna.

Pip Ka Matlab

"Pip" ka lafzi ma'na hota hai "percentage in point." Pip forex market mein currency pairs ki keemat ka sab se chhota hissa hota hai jo ke price mein hota hai. Pip ke changes traders ke liye ahem hote hain, kyun ke small changes mein bhi significant profits ya losses ho sakte hain.

Ahmiyat

Pip forex market mein currency pairs ki keemat ko measure karne ka tareeqa hai. Har ek currency pair ka pip value mukhtalif hota hai, jis se trading karne wale ko har pair ki specifics ka ilm hona zaroori hai. Pip forex trading mein har waqt istemal hota hai, chahe trading small scale ya large scale ho.

Pip Ki Calculation

Pip ki calculation har currency pair ke liye mukhtalif hoti hai. Yeh usually ke decimal point ke digits ke roop mein express kiya jata hai. Jaise ke EUR/USD mein, agar 1.1045 se 1.1046 tak price move hoti hai, toh iska matlab hai ke yeh ek pip move hai.

Values

Har currency pair ka pip value mukhtalif hota hai, aur isko calculate karne ke liye kuchh formulas istemal kiye jate hain. Pip value ko calculate karne ke liye, traders ko currency pair, trading volume aur current market rate ka pata hona zaroori hai.

Pip Forex Trading Strategies

Pip forex trading mein kai strategies istemal hoti hain. Kuchh traders short-term gains ke liye scalping technique ka istemal karte hain, jisme wo chhote chhote price movements ka faida uthate hain. Doosri strategies mein long-term investments pe focus hota hai, jisme traders bade price movements ka intezaar karte hain.

Pip Aur Spread

Pip aur spread dono forex trading mein important concepts hain. Spread ek broker ke dwara currency pairs ke bechne aur khareedne ke liye charge kiya jata hai. Spread ek factor hai jo pip value ko effect karta hai, kyun ke traders ko spread ko bhi account mein lena hota hai jab wo trade karte hain.

Forex Trading Mein Risks

Pip forex trading mein kai tarah ke risks hote hain. Price fluctuations, market volatility, geopolitical events, aur economic indicators ki changes pip forex trading ke liye challenges create kar sakte hain. Isliye, traders ko market conditions ko samajhne aur risks ko manage karne ke liye proper strategies ka istemal karna zaroori hai.

Forex Trading Ka Muaamla

Pip forex trading ka muaamla complex ho sakta hai, lekin agar traders isay samajh lein aur usay sahi tarah se istemal karein toh iska faida uthaya ja sakta hai. Iske liye traders ko market trends, economic indicators, aur currency pairs ki movements ka tajziya karna hota hai.

- 1.0804 EURUSD

- Mentions 0

-

سا1 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is pips forex ??

1. Pips Forex: Ta'aruf

Pips, "Percentage in Point" ka short form hai, jo foreign exchange market ya forex market mein price movement ko measure karne ka ek standard unit hai. Pips ek ahem concept hai jo traders ke liye currency pairs ki price changes ko quantify karne mein madad karta hai.

2. Pips Ka Istemal: Price Changes Ko Measure Karna

Pips, forex market mein price changes ko measure karne ka tareeqa hai. Har currency pair ka ek specific pip value hota hai, jo ke market conditions aur currency pair ke nature par mabni hota hai.

3. Pips Ki Calculation: Hisaab Kitab

Pips ka calculation aam taur par last decimal place ke badle kiya jata hai. Jaise ke EUR/USD mein agar price 1.1250 se 1.1251 par badle, toh iska matlab hai ke price mein ek pip ka izafah hua hai.

4. Pip Value: Ek Ahem Concept

Pip value, traders ke liye ek ahem concept hai, kyun ke iske zariye woh calculate kar sakte hain ke unki trading positions kitna profit ya loss generate kar rahi hai. Har currency pair ke liye pip value alag hota hai, aur isse trader ye maloom karta hai ke har pip ki kitni value hai uski base currency mein.

5. Pip Movement Aur Trend Analysis: Trends Ko Samajhna

Pips ka istemal market trends ko samajhne mein bhi hota hai. Agar currency pair mein price mein zyada pips ka izafah hota hai, toh yeh indicate karta hai ke market mein strong trend ho sakta hai. Pip movement ko dekhte hue traders trend analysis karte hain.

6. Pip Spread: Bid aur Ask Price Ke Darmiyan Farq

Pip spread, bid (khareedne ki qeemat) aur ask (bechne ki qeemat) price ke darmiyan ka farq hota hai. Spread ko pips mein measure kiya jata hai aur yeh traders ke liye transaction costs ka ek hissa hota hai.

7. Pips Ka Istemal Trading Strategies Mein: Trading Mein Pips Ka Role

Pips ka istemal traders apni trading strategies ko plan karte waqt karte hain. Target levels aur stop-loss levels ko pip terms mein define karna traders ko ye maloom karta hai ke unki trading positions ke liye kitna risk aur reward hai.

Pips forex market mein ek common aur essential concept hai jo traders ke liye price movements ko quantify karne mein madad karta hai. Iske istemal se traders apne trading decisions ko precise aur informed taur par le sakte hain

-

#13 Collapse

What's pips

Forex trading mein, pips ek notation hai jo currency pair ki rate mein ek unit ki badlav ko represent karta hai. Pips ka full form hai "percentage in point".

Forex market mein, currency pair ki rate ko 4 decimal places tak upyog kiya jata hai. Isliye, ek pip ka matlab hai currency pair ki rate mein ek decimal place ki badlav.

Yahan ek example hai:

Agar EUR/USD ki rate 1.12345 se badhkar 1.12355 ho jaati hai, to ismein 1 pip ki badlav hui hai.

Pips ko calculate karne ke liye, aapko currency pair ki rate mein ek decimal place ki badlav ko dekhna hoga.

Pips calculate formula

Pip Value = (Base Currency Value / 100)

Yahan,- Pip Value = Pip ki value

- Base Currency Value = Currency pair mein base currency ki value

Yahan ek example hai:

Agar EUR/USD ki rate 1.12345 hai, aur base currency EUR hai, to pip ki value kya hogi?

Pip Value = (1 / 100)

Pip Value = 0.01

Isliye, EUR/USD ki rate mein ek pip ki badlav 0.01 EUR ki badlav hai.

Pips forex trading mein bahut important hain. Traders apne profit aur loss ko pips mein measure karte hain.

Yahan pips ka use karne ke kuchh examples hain:- Ek trader 100 pips ka target set kar sakta hai. Agar uska trade 100 pips badh jata hai, to wo profit mein hoga.

- Ek trader 50 pips ka stop loss set kar sakta hai. Agar uska trade 50 pips gir jata hai, to wo trade ko close kar dega.

Pips ko samajhna forex trading mein bahut important hai. Agar aap pips ko samajhte hain, to aap apne trade ko aur behtar tarike se manage kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

foreign exchange ( fx ) marketon mein, pip currency ki qeemat ki naqal o harkat ki pemaiesh ki ikai hai." Persantage un point" ya" price interest point" wohi hai jis ka matlab pip hai. mayaari fx market practice ke mutabiq, yeh qeemat ki sab se choti tabdeeli ki numaindagi karta hai jis ka aik makhsoos sharah mubadla ka saamna hota hai .

pipe bilkul aakhri hindsay ko zahir karta hai, aur currency ke joron ko aam tor par qeematon ke convention ka istemaal karte hue tijarat kya jata hai jis mein chaar aashariya jaghen shaamil hoti hain, jinhein" barray adaad o shumaar" ya" barray injeer" bhi kaha jata hai. nateejay ke tor par, yeh wazeh hai ke aik pipe 0. 0001 ke barabar hai. yeh aik bees point ( bps ) ke barabar bhi hai, jo aik feesad ya aik feesad ke feesad ke liye wasee pemanay par istemaal honay wali pemaiesh ki ikai hai .

misaal ke tor par, kya cad / usd ki sharah tabadlah 1. 2014 se 1. 2015 tak muntaqil ho jaye, is mein farq

Why Use Pips

lain deen ke liye pemaiesh ki akayyan ahem hain kyunkay fx marketon mein lain deen ka aik bara hajam hai aur woh bohat maya hain. mazeed bar-aan, sharah mubadla mein utaar charhao ko durust tareeqay se zahir karne ke liye aashariya ki ziyada tadaad ki zaroorat hoti hai kyunkay akayyan aam tor par kaafi choti hoti hain .

taham, aisay halaat hotay hain jab pipe ka istemaal na munasib hota hai, jaisay ke jab krnsyon mein ziyada afraat zar hota hai, jis se pipe values ka istemaal karte hue sharah mubadla ka hisaab lagana mushkil ho jata hai. ashya aur khidmaat ki qeematon mein had se ziyada aur be qaboo izafah ke daur ko hyper infletion kaha jata hai. intehai aala fx harkat ke sath pipe value kam ho jati hai .

aik qabil zikar misaal Zimbabwe mein 2008 mein paish aayi, jahan mahana afraat zar ki sharah November mein 79 billion feesad tak pahonch gayi. jab hyper infletion qaim ho jati hai, to pipe ki choti pemaiesh be maienay ho jati hai kyunkay currency ki akayyon mein ghair mamooli sharah se izafah hota hai .

How are Pips Used in FX Markets?

aik zaroori tijarti metric boli poochnay ka phelao hai. is ka matlab hai baichnay walay ko milnay wali qeemat aur khredar ki ada kardah qeemat ke darmiyan farq .

ghair mulki zar e mubadla ki mandiyon mein, phelao ko pipe ki eslehaath mein zahir kya jata hai aur usay un adaad o shumaar ke darmiyan farq ke tor par zahir kya jata hai. fx brokr lain deen se jo munafe kamaye ga is ki numaindagi bhi boli poochnay ke spread se hoti hai, bashart e kay woh doosri taraf se mumasil lain deen talaash karne mein bhi kamyaab hon .

fx qeemat ke taayun mein barray adad o shumaar ko aam tor par taizi se chalne wali marketon se bahar rakha jata hai kyunkay market bananay walon ka khayaal hai ke qeemat achi terhan se maloom hai. market ke electronic trading ki taraf muntaqil honay ki wajah se, sooti tijarat kam masail ka shikaar hoti hai — hta ke utaar charhao walay baazaaron mein bhe_lekin is par amal daraamad ki ghalti ka ziyada imkaan hota hai, is liye tajurbah car tajir hamesha barray adaad o shumaar ki do baar jaanch karen ge taakay yeh yakeeni banaya ja sakay ke har koi mutfiq hai .

misaal ke tor par, boli / peshkash 1. 1009 / 14 ke eur / usd iqtabas par phaily hui hai 5 pips, ya 5 bunyadi points .

sooti tijarat ka istemaal karne wala sapat fx tajir pips ko" 09-14" ke tor par hawala day sakta hai, jis ke sath counter party ko baqi jan-nay ki tawaqqa hai, halaank boli / peshkash mukammal tor par 1. 1009 / 14 hai .

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is pips forex ??

Forex Mein Pips Kya Hote Hain?

Forex (Foreign Exchange) mein "pips" ek aham muddat hai jo trading aur exchange rates mein istemal hoti hai. Yeh term traders ke liye zaroori hai takay woh market ki movement ko samajh sake aur apne trades ko monitor kar sake.

1. Pips Ka Matlab (Definition):

"Pips" ka matlab hota hai "Percentage in Point" ya "Price Interest Point". Yeh ek chhota unit hai jo exchange rates mein tabdeeli ko darust karnay mein madadgar hota hai.

2. Pips Ki Qeemat (Value of Pips):

Har currency pair ke liye pips ki qeemat alag hoti hai. Aam taur par, ek pips ka maan ek dollar hota hai, lekin yeh qeemat market conditions par mabni hoti hai.

3. Pips Ka Istemal (Use of Pips):

Traders pips ka istemal karke apne trades ki performance ko evaluate karte hain. Yeh bataata hai ke kitna faida ya nuksan hua hai. Agar kisi currency pair ka price 1.3000 se 1.3020 tak badla hai, toh is movement ko 20 pips kehenge.

4. Pips Aur Leverage (Pips and Leverage):

Leverage ka istemal karke traders chhote movements mein bhi bade faide hasil kar sakte hain, lekin yeh sath hi sath nuksan bhi la sakti hai. Pips ko leverage ke sath mila kar dekha jaata hai takay trading ke results ko sahi taur par samjha ja sake.

5. Pips Aur Risk Management (Pips and Risk Management):

Pips ko samajh kar traders apne risk management strategies ko improve kar sakte hain. Stop loss aur take profit orders ko pips mein set karke, woh apne trades ko control mein rakh sakte hain.

6. Pips Aur Trading Strategies (Pips and Trading Strategies):

Traders apni trading strategies ko banate waqt pips ko mad e nazar rakhte hain. Price movements ko pips mein analyze karke, woh apne trading decisions ko aur bhi mazboot bana sakte hain.

Ikhtitami Guftagu (Conclusion):

Pips forex trading mein ek ahem concept hai jo market ki movement ko quantify karne mein madad deta hai. Traders ko apne trades ko monitor karne aur evaluate karne mein asani hoti hai, aur isse unka risk management bhi behtar hota hai.

- CL

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:14 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим