Bearish Flag pattern in forex

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

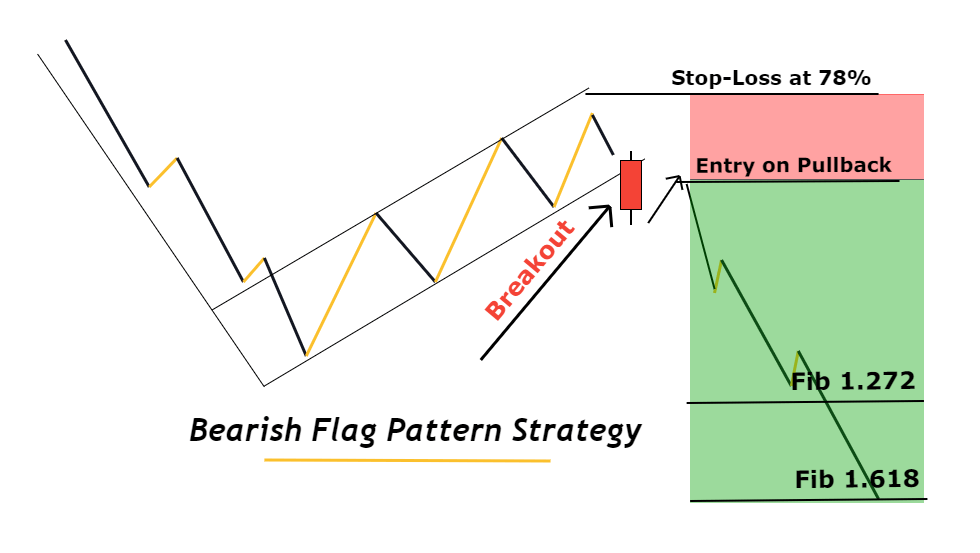

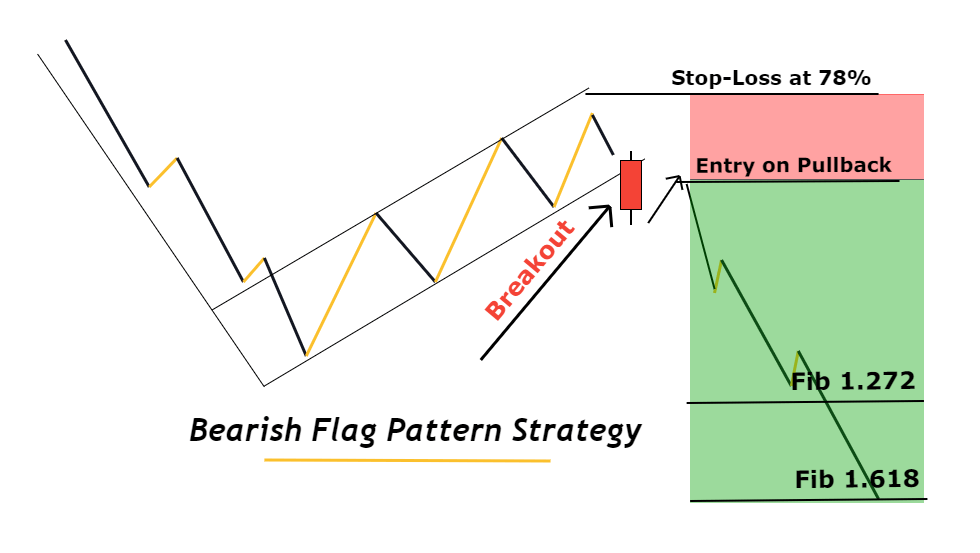

Bearish Flag pattern Bearish flag pattern ek technical analysis pattern hai jo stock market ya financial markets mein use hota hai. Is pattern ka use traders aur investors price movement ko analyze karne ke liye karte hain. Bearish flag pattern ek continuation pattern hota hai, yani ki yeh indicate karta hai ki ek downtrend ke baad price phir se down jaane ki sambhavna hai. Is pattern ko samajhne ke liye, main aapko kuch important points explain karunga: Flagpole: Bearish flag pattern ke formation ka pehla step hota hai jab kisi stock ya asset ki price mein ek strong downtrend hota hai. Is downtrend ko "flagpole" kehte hain. Flag Formation: Flagpole ke baad, price mein ek consolidation phase aata hai, jise "flag" kehte hain. Yeh consolidation phase usually price mein sideways movement ya slight upar niche ki movement ko indicate karta hai. Flag formation ek rectangle ya parallelogram ki tarah dikh sakta hai. Breakout: Bearish flag pattern tab confirm hota hai jab flag formation ke baad price neeche ki taraf breakout karta hai. Breakout ka matlab hota hai ki price flag ke bottom boundary ko cross karke down ki taraf jaane lagti hai. Target: Traders aur investors usually is pattern ko dekhte hue ek target set karte hain. Target ka calculation flagpole ki length se kiya jata hai. Flagpole ki length ko flag ke breakout point se neeche extend karke target level decide kiya jata hai. Volume Analysis: Is pattern ko samajhne mein volume analysis bhi important hota hai. Agar flag formation ke dauran volume decrease hoti hai aur breakout ke samay volume increase hoti hai, toh yeh pattern stronger hota hai. Bearish flag pattern traders ke liye ek sell signal provide karta hai. Is pattern ke anusar, price ka dobara se downtrend shuru hone ke chances hote hain. Traders is pattern ko dekh kar short positions le sakte hain ya existing short positions ko hold kar sakte hain. Yad rahe, har trading pattern ki tarah, bearish flag pattern bhi 100% accurate nahi hota. Isliye, traders ko is pattern ke saath saath aur bhi factors ka analysis karna chahiye jaise ki overall market trend, support/resistance levels, aur news events. Is tarah ke comprehensive analysis se hi trading decisions ko sahi tarike se liya ja sakta hai.

- Mentions 0

-

سا0 like

-

#3 Collapse

what is bearish Flag pattern forex market mein bearish flag pattern os time banta hey jab trend reversal bearish ke taraf jata hey jab aik trend saz par price stop ho jate hey or aik rectangle range mein qadray pechay chale jate hey teh pattern forex market kay trend kay end mein beach mein entry point ko identify karta hey trend min breakout bhe es kay real asal nechay kay trend ko jare rakhnay kay ley hote hey jes say flag pattern mein humen entry ka chance melta hey Bearish Flag Pattern ko smajhna Bearish Flag pattern jo keh forex market mein flag poll or aik flag par moshtamel hota hey jo keh forex market mein price action trend kay bad chalte hey chonkeh forex market mein price action high wapce ko identify kar dayta hey or yeh frex market mein aik motwazee channel kay inside min he banta hey es kay opposite bearish pennant pattern mein motwazee pattern triangle wedge ya triangle format keya jata hey Buyer or seller ke tadad weak karnay kay ley stable ka estamal kartay hein jo keh forex market ke price action ko control kar saktay hein dosree taraf bear recently step ko stable karnay kay ley aik step pechay ke taraf hattay hein aik or dahka karnay ke koshesh ke jate hey yeh forex market mein stable step bohut zyada read nahi karna chihay nechay kay trend ke strength par depend karta hey rebound bullish ya halka ho sakta hey rebound flag pole 50% say zyada nahi barhna chihay Fibonacci retracement ka pullback 38.2% hona chihay or forex market mein nechay ka trend itna he strong ho ga or forex market mein breakout etnahe strong honay ke omeed ke jate hey Bearish Flag Pattern forex market mein EUR/USD aik halkay rebound ko start karnay say pehlay forex market ka trend jare kame kay trend ko identify karta hey jo keh forex market kay start kay strength ko overall kame ko identify karna hota hey or yeh forex market mein short period kay ley tha bad phir bhe bear market ko control ko hasel kar laytay hein or price action 2 matwazee trend line kay inside mein strong ho jate hey es sorat mein rebound ke pehle sorat jo ke forex market mein 23.6% he hote hey or es ko forex market mein manage keya ja sakta hey overallnechay ka trend forex arket mein rebound ke strength ka hokam dayta hey

bhali kay badlay bhali

bhali kay badlay bhali

-

#4 Collapse

Bearish Flag pattern ek technical analysis pattern hai jo forex trading mein use hota hai aur ye bearish trend ke continuation ko darust karta hai. Is pattern ko samajhne ke liye, aapko iske key elements aur characteristics ko samajhna hoga. **Bearish Flag Pattern ke Key Elements:** 1. **Uptrend:** Bearish Flag pattern usually ek strong uptrend ke beech mein aata hai. Is uptrend mein price consistently upar ki or move karti hai.2. **Flagpole:** Uptrend ke dauraan, ek lambi aur steep uptrend move hoti hai, jo bearish flag pattern ka "flagpole" hota hai. Flagpole ki length aur steepness bearish flag pattern ki strength ko darust karti hai.3. **Flag:** Flagpole ke baad, ek consolidation phase aata hai, jise flag ke roop mein dekha jata hai. Flag usually ek rectangle ya parallelogram ke roop mein hota hai aur sideways price movement darust karta hai.4. **Breakdown:** Flag ke baad ek bearish breakdown hoti hai, jisme price ne flagpole ki lower side ki or move karna shuru karta hai. Yeh breakdown bearish reversal ko represent karta hai. **Bearish Flag Pattern ke Chart Example:**Bearish Flag pattern ke chart example mein, aap dekh sakte hain ki price ek strong uptrend ke baad flagpole banata hai, phir flag formation ke baad ek sharp bearish breakdown hota hai.**Bearish Flag Pattern Trading Strategy:** Bearish Flag pattern trading strategy mein, traders typically flagpole aur flag ke characteristics ko dekhte hain aur trading setup create karte hain. Yahan kuch trading guidelines hain:1. **Entry Point:** Entry point flag ke breakdown ke neeche hota hai, jab price flag ke lower side ko cross karta hai. Isse bearish move ko catch karne ke liye hota hai.2. **Stop Loss:** Stop loss order ko setup karna bahut mahatvapurna hota hai. Aap stop loss ko flag ke upper side ke kareeb set kar sakte hain taki nuksan ko control kiya ja sake, agar price flag ke upper side ko break karta hai.3. **Target:** Target price usually flagpole ki length se estimate kiya ja sakta hai. Iska matlab hai ki agar flagpole lambi hoti hai, to target bhi correspondingly bada hota hai. **Bearish Flag Pattern ke Nuksan (Disadvantages):** 1. **False Breakdowns:** Kabhi-kabhi bearish flag pattern false breakdowns de sakta hai, matlab ki price flag ke breakdown ke baad wapas uptrend mein ja sakta hai.2. **Market Context:** Market conditions aur overall trend bhi consider karne mein madadgar hote hain. Agar overall trend strong hai, to bearish flag pattern kam effective ho sakta hai.3. **Risk Management:** Risk management ka dhyan rakhna bahut mahatvapurna hota hai. Nuksan ko rokne ke liye stop loss aur position size ka sahi istemal karna chahiye.Bearish Flag pattern ek valuable tool ho sakti hai, lekin iska istemal samajhdaari aur samvedansheeli trading ke sath hona chahiye. Market analysis ke liye, aapko bearish flag pattern ko dusre technical indicators aur price action analysis ke saath milakar dekhna hoga.

-

#5 Collapse

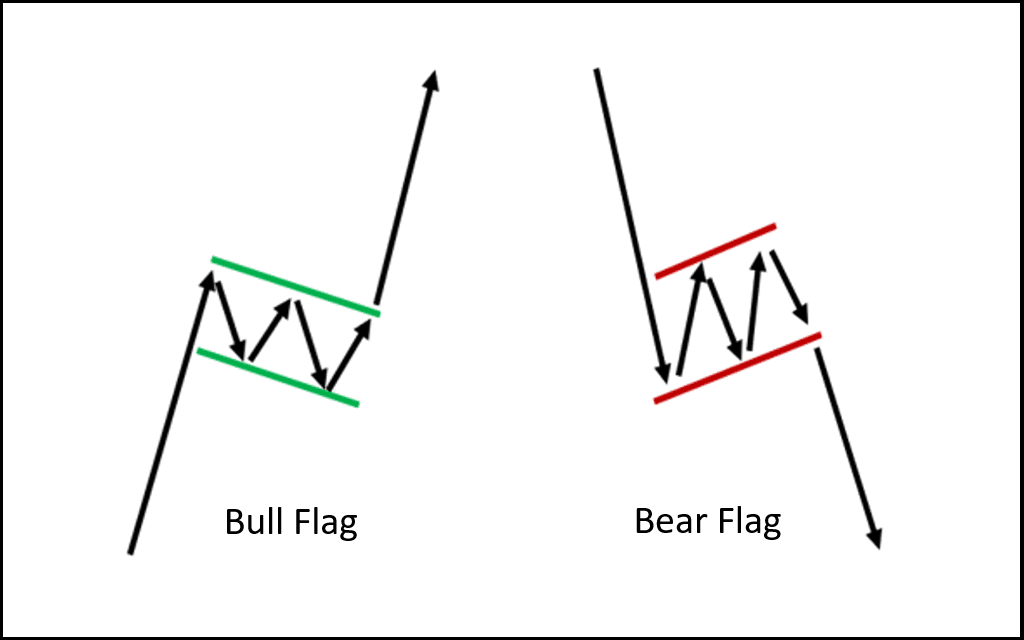

BEARISH FLAG PATTERN IN FOREX DEFINITION Bearish Ka flag Ek technical pattern hai Jo maujuda down trend ko extension/continue provide karta hai bear ke flag ki formation Ek initial strong directional move se niche ki taraf Ishara karty hai Iske bad upward direction Mein Ek consolidation channel Hota Hai niche ki strong move ko flag Pole ke naam se Jana jata hai Jab Ke consolidation ko itself flag Kaha jata hai Trend parchum pole upward sloping consolidation ki identify Karen bear flag Agar retracement 50% se zyada ho jaaye to yah flag pattern Nahin ho sakta hai ideally retracement 38% se kam hai gradually prices slowly rise hai flag ka pattern slowly shape akhtiyar karta hai yah note karna zaruri hai ke jab tak price channel ki lower Low Tak Nahin pahunch paati us time tak Koi Bearish flag pattern Nahin Hai is time trader1. 30000 ke kareeb potential price ke target kam karne ke liye 470 PIP flag Pole initial decline ka use karte hain BEAR FLAG VS BULL FLAG Bear flag aur bull flag ek hi chart pattern ki represent karta hai taHam voh opposite direction Mein reflected Karte Hain bull aur bear donon flag ke patterns mein Ek flag pole Shamil Hai price ke channel ko consolidation karta hai aur initial flag pole ki length se measured profit ka projection hai bull aur bear flag ke sath strategies mein ISI Tarah Ke eqdaMat Shamil Hai lakin bull flag pattern ko uski apne layout Mein understand zaruri hai

BEAR FLAG VS BULL FLAG Bear flag aur bull flag ek hi chart pattern ki represent karta hai taHam voh opposite direction Mein reflected Karte Hain bull aur bear donon flag ke patterns mein Ek flag pole Shamil Hai price ke channel ko consolidation karta hai aur initial flag pole ki length se measured profit ka projection hai bull aur bear flag ke sath strategies mein ISI Tarah Ke eqdaMat Shamil Hai lakin bull flag pattern ko uski apne layout Mein understand zaruri hai HOW TO IDENTIFY A BEARISH FLAG ON FOREX CHART Price again lower hone ke bad trader phir bearish flag pattern ko trade karne ke liye needed final component Talash kar sakte hain profit ka target currency ke pair ki price mein next decline ke bad profit Lene Ki Ek mumkna Kadar hai prices ki is level ki maloomat pahle Hamari initial decline ke pips mein distance ki measuring Karke ki Ja sakti hai is value ko PHIR Hamare consolidation flag se banne wali peak Ke resistance line se Manha Kiya Ja sakta hai

-

#6 Collapse

Bullish Engulfing candlestick pattern ek mahatvapurna technical analysis tool hai jo market trends aur potential trend reversals ko identify karne mein madad karta hai. Ye pattern ek bullish reversal pattern hota hai, iska matlab hai ki ye market mein hone wale bearish trend ke possible khatme ya bullish trend ke shuru hone ko indicate karta hai. **Bullish Engulfing Candlestick Pattern ke Key Characteristics:** 1. **Pehla Candlestick (Bearish Candle):** Bullish Engulfing pattern ek do-candlestick pattern hota hai, jisme pehla candlestick ek red (downward) candlestick hota hai. Isme price typically lower hoti hai aur downtrend ko darust karti hai.2. **Dusra Candlestick (Bullish Candle):** Dusra candlestick pehle candlestick ko "engulf" kar leta hai, yani ki uski high aur low prices pehle candlestick ke high aur low prices ko cover kar lete hain. Dusra candlestick ek green (upward) candlestick hota hai aur typically higher open price ke sath hota hai.3. **Volume:** Bullish Engulfing pattern ke saath volume bhi dekha jata hai. Dusra candlestick ke sath badhne wala volume pehle candlestick ke volume se compare kiya jata hai. Agar volume bhi badh raha hai, to ye pattern aur strong hota hai. **Bullish Engulfing Candlestick Pattern ke Chart Example:** Bullish Engulfing pattern ke chart example mein, aap dekh sakte hain ki pehle candlestick ek bearish (downward) candlestick hai, lekin dusra candlestick pehle candlestick ko poori tarah se engulf kar leta hai aur ek bullish (upward) candlestick hai. **Bullish Engulfing Candlestick Pattern Trading Strategy:** Bullish Engulfing pattern trading strategy mein, traders typically is pattern ke occurrence ke baad bullish trade entry points decide karte hain. Yahan kuch trading guidelines hain:1. **Entry Point:** Entry point typically dusra candlestick ke opening price ke upar hota hai, jab price pehle candlestick ko engulf karta hai. Yeh bullish move ko catch karne ke liye hota hai.2. **Stop Loss:** Stop loss order ko setup karna bahut mahatvapurna hota hai. Aap stop loss ko recent low price ke near set kar sakte hain, taki nuksan ko control kiya ja sake, agar price unexpected reversal kare.3. **Target:** Target price ko set karne mein pehle candlestick ka high price ya dusra technical indicators ka sahara liya ja sakta hai. **Bullish Engulfing Candlestick Pattern ke Nuksan (Disadvantages):** 1. **False Signals:** Kabhi-kabhi Bullish Engulfing pattern false signals de sakta hai, matlab ki ye pattern indicate kare ki bullish reversal hoga lekin actual reversal na ho.2. **Market Context:** Market conditions aur overall trend bhi consider karne mein madadgar hote hain. Agar overall trend weak hai, to Bullish Engulfing pattern kam effective ho sakta hai.3. **Risk Management:** Risk management ka dhyan rakhna bahut mahatvapurna hota hai. Nuksan ko rokne ke liye stop loss aur position size ka sahi istemal karna chahiye.Bullish Engulfing pattern ek powerful tool ho sakti hai, lekin iska istemal samajhdaari aur samvedansheeli trading ke sath hona chahiye. Market analysis ke liye, aapko Bullish Engulfing pattern ko dusre technical indicators aur price action analysis ke saath milakar dekhna hoga. -

#7 Collapse

Bearish Flag Chart Pattern: Bearish Ka flag or Negative Ka banner Ek specialized design hai Jo maujuda down pattern ko expansion/proceed give karta hai bear ke banner ki arrangement Ek beginning solid directional move se specialty ki taraf Ishara karty hai Iske awful vertical heading Mein Ek union channel Hota Hai specialty ki solid move ko banner Post ke naam se Jana jata hai Poke Ke combination ko itself banner Kaha jata hai Pattern parchum shaft up slanting combination ki recognize Karen bear banner Agar retracement half se zyada ho jaaye to yah banner example Nahin ho sakta hai in a perfect world retracement 38% se kam hai bit by bit costs gradually rise hai banner ka design gradually shape akhtiyar karta hai yah note karna zaruri hai ke punch tak cost channel ki lower Low Tak Nahin pahunch paati us time tak Koi Negative banner example Nahin Hai is time trader1. 30000 ke kareeb potential cost ke target kam karne ke liye 470 PIP banner Post introductory downfall ka use karte hain Bear banner aur bull banner ek greetings diagram design ki address karta hai taHam voh inverse course Mein reflected Karte Hain bull aur bear donon banner ke designs mein Ek banner post Shamil Hai cost ke channel ko combination karta hai aur starting banner shaft ki length se estimated benefit ka projection hai bull aur bear banner ke sath methodologies mein ISI Tarah Ke eqdaMat Shamil Hai lakin bull banner example ko uski apne format Mein comprehend zaruri hai Cost again lower sharpen ke terrible broker phir negative banner example ko exchange karne ke liye required last part Talash kar sakte hain benefit ka target money ke pair ki cost mein next decline ke awful benefit Lene Ki Ek mumkna Kadar hai costs ki is level ki maloomat pahle Hamari introductory decay ke pips mein distance ki estimating Karke ki Ja sakti hai is esteem ko PHIR Hamare solidification banner se banne wali top Ke opposition line se Manha Kiya Ja sakta hai Chart Pattern Identification And Formation: Negative Banner example ke graph model mein, aap dekh sakte hain ki cost areas of strength for ek ke baad flagpole banata hai, phir banner arrangement ke baad ek sharp negative breakdown hota hai.Kabhi-kabhi negative banner example misleading breakdowns de sakta hai, matlab ki cost banner ke breakdown ke baad wapas upturn mein ja sakta hai. Economic situations aur generally pattern bhi consider karne mein madadgar hote hain. Agar by and large pattern solid hai, to negative banner example kam viable ho sakta hai Chance administration ka dhyan rakhna bahut mahatvapurna hota hai. Nuksan ko rokne ke liye stop misfortune aur position size ka sahi istemal karna chahiye.Bearish Banner example ek important instrument ho sakti hai, lekin iska istemal samajhdaari exchanging ke sath hona chahiye. Market investigation ke liye, aapko negative banner example ko dusre specialized pointers aur cost activity examination ke saath milakar dekhna hoga.

Bear banner aur bull banner ek greetings diagram design ki address karta hai taHam voh inverse course Mein reflected Karte Hain bull aur bear donon banner ke designs mein Ek banner post Shamil Hai cost ke channel ko combination karta hai aur starting banner shaft ki length se estimated benefit ka projection hai bull aur bear banner ke sath methodologies mein ISI Tarah Ke eqdaMat Shamil Hai lakin bull banner example ko uski apne format Mein comprehend zaruri hai Cost again lower sharpen ke terrible broker phir negative banner example ko exchange karne ke liye required last part Talash kar sakte hain benefit ka target money ke pair ki cost mein next decline ke awful benefit Lene Ki Ek mumkna Kadar hai costs ki is level ki maloomat pahle Hamari introductory decay ke pips mein distance ki estimating Karke ki Ja sakti hai is esteem ko PHIR Hamare solidification banner se banne wali top Ke opposition line se Manha Kiya Ja sakta hai Chart Pattern Identification And Formation: Negative Banner example ke graph model mein, aap dekh sakte hain ki cost areas of strength for ek ke baad flagpole banata hai, phir banner arrangement ke baad ek sharp negative breakdown hota hai.Kabhi-kabhi negative banner example misleading breakdowns de sakta hai, matlab ki cost banner ke breakdown ke baad wapas upturn mein ja sakta hai. Economic situations aur generally pattern bhi consider karne mein madadgar hote hain. Agar by and large pattern solid hai, to negative banner example kam viable ho sakta hai Chance administration ka dhyan rakhna bahut mahatvapurna hota hai. Nuksan ko rokne ke liye stop misfortune aur position size ka sahi istemal karna chahiye.Bearish Banner example ek important instrument ho sakti hai, lekin iska istemal samajhdaari exchanging ke sath hona chahiye. Market investigation ke liye, aapko negative banner example ko dusre specialized pointers aur cost activity examination ke saath milakar dekhna hoga.  Negative Banner example exchanging procedure mein, brokers ordinarily flagpole aur banner ke attributes ko dekhte hain aur exchanging arrangement make karte hain. Yahan kuch exchanging rules hain Section point banner ke breakdown ke neeche hota hai, hit cost banner ke lower side ko cross karta hai. Isse negative move ko get karne ke liye hota hai.Stop misfortune request ko arrangement karna bahut mahatvapurna hota hai. Aap stop misfortune ko banner ke upper side ke kareeb set kar sakte hain taki nuksan ko control kiya ja purpose, agar cost banner ke upper side ko break karta hai Target cost as a rule flagpole ki length se gauge kiya ja sakta hai. Iska matlab hai ki agar flagpole lambi hoti hai, to target bhi correspondingly bada hota hai.Bearish Banner example ek specialized investigation design hai jo forex exchanging mein use hota hai aur ye negative pattern ke continuation ko darust karta hai. Is design ko samajhne ke liye, aapko iske key components aur attributes ko samajhna hoga. Types And Trading: Forex market mein stable step bohut zyada read nahi karna chihay nechay kay pattern ke strength standard depend karta hello bounce back bullish ya halka ho sakta hello bounce back banner post half say zyada nahi barhna chihay Fibonacci retracement ka pullback 38.2% hona chihay or forex market mein nechay ka pattern itna he solid ho ga or forex market mein breakout etnahe solid honay ke omeed ke jate ha forex market mein EUR/USD aik halkay bounce back ko start karnay say pehlay forex market ka pattern jare kame kay pattern ko recognize karta hello jo keh forex market kay start kay strength ko in general kame ko distinguish karna hota hello or yeh forex market mein brief period kay ley tha terrible phir bhe bear market ko control ko hasel kar laytay hein or cost activity 2 matwazee pattern line kay inside mein solid ho jate ha

Negative Banner example exchanging procedure mein, brokers ordinarily flagpole aur banner ke attributes ko dekhte hain aur exchanging arrangement make karte hain. Yahan kuch exchanging rules hain Section point banner ke breakdown ke neeche hota hai, hit cost banner ke lower side ko cross karta hai. Isse negative move ko get karne ke liye hota hai.Stop misfortune request ko arrangement karna bahut mahatvapurna hota hai. Aap stop misfortune ko banner ke upper side ke kareeb set kar sakte hain taki nuksan ko control kiya ja purpose, agar cost banner ke upper side ko break karta hai Target cost as a rule flagpole ki length se gauge kiya ja sakta hai. Iska matlab hai ki agar flagpole lambi hoti hai, to target bhi correspondingly bada hota hai.Bearish Banner example ek specialized investigation design hai jo forex exchanging mein use hota hai aur ye negative pattern ke continuation ko darust karta hai. Is design ko samajhne ke liye, aapko iske key components aur attributes ko samajhna hoga. Types And Trading: Forex market mein stable step bohut zyada read nahi karna chihay nechay kay pattern ke strength standard depend karta hello bounce back bullish ya halka ho sakta hello bounce back banner post half say zyada nahi barhna chihay Fibonacci retracement ka pullback 38.2% hona chihay or forex market mein nechay ka pattern itna he solid ho ga or forex market mein breakout etnahe solid honay ke omeed ke jate ha forex market mein EUR/USD aik halkay bounce back ko start karnay say pehlay forex market ka pattern jare kame kay pattern ko recognize karta hello jo keh forex market kay start kay strength ko in general kame ko distinguish karna hota hello or yeh forex market mein brief period kay ley tha terrible phir bhe bear market ko control ko hasel kar laytay hein or cost activity 2 matwazee pattern line kay inside mein solid ho jate ha  Brokers aur financial backers generally is design ko dekhte shade ek target set karte hain. Target ka computation flagpole ki length se kiya jata hai. Flagpole ki length ko banner ke breakout point se neeche expand karke target level choose kiya jata hai Is design ko samajhne mein volume investigation bhi significant hota hai. Agar banner arrangement ke dauran volume decline hoti hai aur breakout ke samay volume increment hoti hai, toh yeh design more grounded hota hai.Bearish banner example brokers ke liye ek sell signal give karta hai. Is design ke anusar, cost ka dobara se downtrend shuru sharpen ke chances hote hain. Brokers is design ko dekh kar short positions le sakte hain ya existing short positions ko hold kar sakte hain.har exchanging design ki tarah, negative banner example bhi 100 percent precise nahi hota. Isliye, merchants ko is design ke saath aur bhi factors ka examination karna chahiye jaise ki in general market pattern, support/obstruction levels, aur news occasions. Is tarah ke exhaustive examination se hey exchanging choices ko sahi tarike se liya ja sakta hai.

Brokers aur financial backers generally is design ko dekhte shade ek target set karte hain. Target ka computation flagpole ki length se kiya jata hai. Flagpole ki length ko banner ke breakout point se neeche expand karke target level choose kiya jata hai Is design ko samajhne mein volume investigation bhi significant hota hai. Agar banner arrangement ke dauran volume decline hoti hai aur breakout ke samay volume increment hoti hai, toh yeh design more grounded hota hai.Bearish banner example brokers ke liye ek sell signal give karta hai. Is design ke anusar, cost ka dobara se downtrend shuru sharpen ke chances hote hain. Brokers is design ko dekh kar short positions le sakte hain ya existing short positions ko hold kar sakte hain.har exchanging design ki tarah, negative banner example bhi 100 percent precise nahi hota. Isliye, merchants ko is design ke saath aur bhi factors ka examination karna chahiye jaise ki in general market pattern, support/obstruction levels, aur news occasions. Is tarah ke exhaustive examination se hey exchanging choices ko sahi tarike se liya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Bearish Flag Pattern Roman Urdu:Bearish Flag pattern ek technical analysis ka pattern hai jo stock market aur financial markets mein istemal hota hai. Is pattern ko bearish market trend ke doran dekha jata hai, jab stock ya asset ki keemat gir rahi hoti hai.Is pattern ko pehchane ke liye, aapko pehle ek bullish trend ki taraf dekhna hoga, jahan par asset ki keemat tezi se badh rahi hoti hai. Phir, yeh trend ek "pole" ya "flagpole" create karta hai. Fir, asset ki keemat mein thora sa giravat hota hai, jisse ek flag ki shakal mein dikhta hai. Is flag ke neeche ki taraf aur ek choti line hoti hai, jo ek "flag" ki tarah dikhti hai.Bearish Flag pattern ka matlab hota hai ke current downtrend aur future mein aur bhi gir sakti hai. Traders is pattern ko dekhte hain taake woh sahi samay par trading positions le sakein.Yad rahe, stock market mein trading karne se pehle, aapko mukhtasar training aur market research ki zarurat hoti hai taake aap apni investment ko samajh saken aur risk ko minimize kar saken.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим