Reversal Patterns in Forex Trading

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Reversal Patterns in Forex Trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

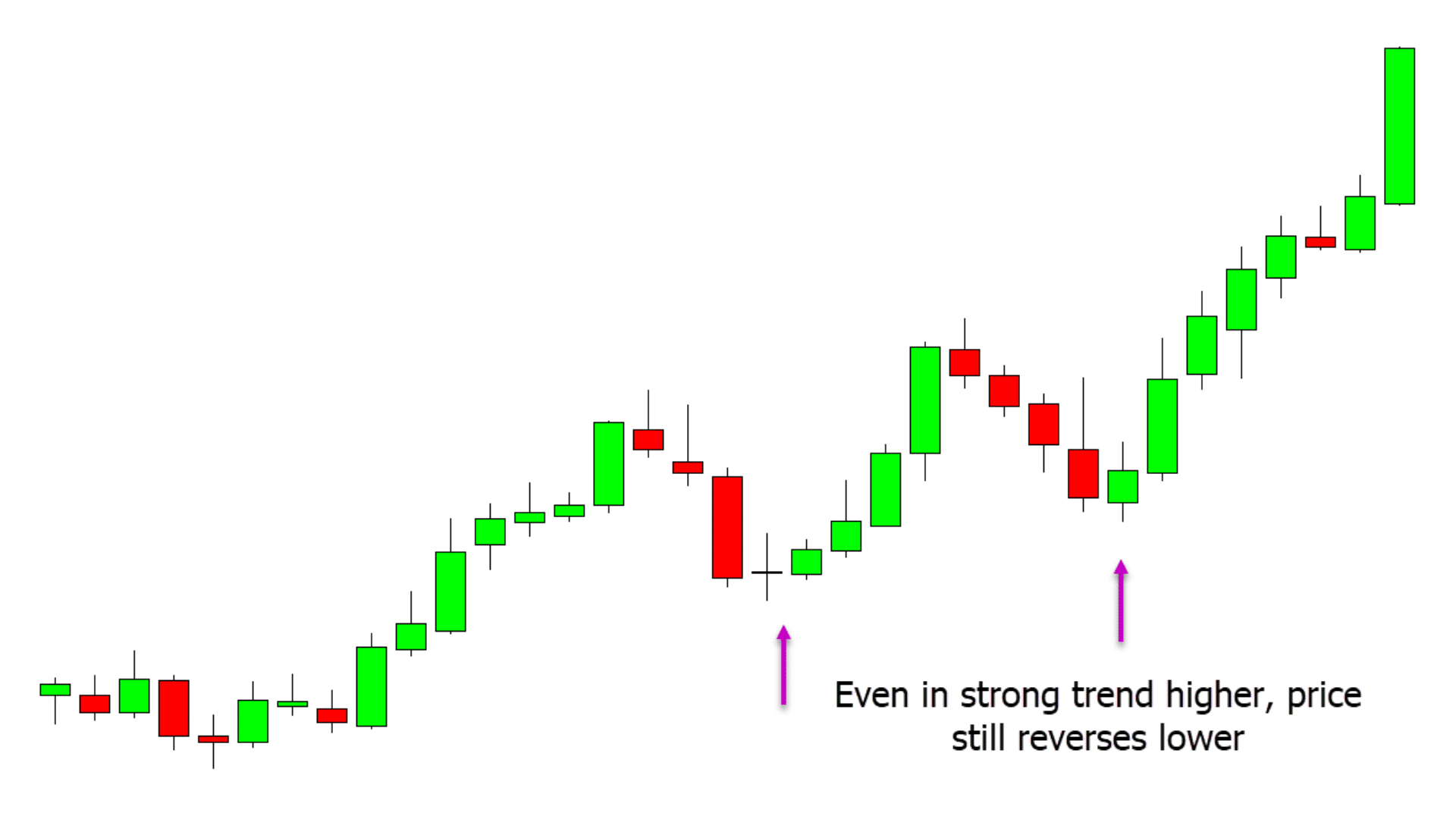

Reversal Patterns in Forex TradingForex trading ke duniya mein, traders ek mukhtasir qisam ki price trends ki taraf tawajjo dete hain. Price ki harkaton ko pehchanna aur is par amal karne ki salahiyat munafa bakhsh trading mauqe par le kar aati hai. In harkaton mein se aik hissa price trends ki taraf mukhtalif harkaton ka waqia hota hai, jise reversal patterns kehte hain. Reversal patterns mukhtalif technical signals hote hain jo keemat trend ki taraf naye rukh ki taraf tawajjo dilate hain. Traders in patterns ko istemal karte hain takay wo mukhtalif trends ko pehle se pehle pehchan sakein aur is par amal kar ke behtareen trading faislay le sakein. Understanding Price Trends and Reversals Reversal patterns ki taraf guzarish karne se pehle, price trends ki tawajjo mein lena zaroori hai. Forex mein price trends us muddat mein ek currency pair ki keemat ka amomi rukh hota hai. In trends ko teen mukhya qisam mein taqseem kiya ja sakta hai: uptrend, downtrend, aur sideways (jo ke range-bound kehte hain). Uptrend mein keemat ki baar baar unchaiyan buland hoti hain aur neechaiyan bhi buland hoti hain, jabke downtrend mein baar baar unchaiyan kam hoti hain aur neechaiyan bhi kam hoti hain. Sideways trend ek mukarrar hadood mein keemat ki hilne ki soorat hai, jahan keemat mukarrar hadood mein ghoomti rehti hai. Reversal patterns tab aate hain jab kisi trend ki taqat khatam ho rahi hoti hai ya wo mukammal hone par hai. Ye patterns asal mein keemat ki harkaton ke tasveeri tajawuzat hote hain jo keemat trend se naye rukh ki taraf tawajjo dilate hain. Inka kirdar isliye ahmiyat rakhta hai kyunki ye traders ko mukhtalif trend reversals ki pehchan karne mein madadgar sabit ho sakte hain, jisse unko waqt se pehle market ki harkaton ka andaza ho sake.

Understanding Price Trends and Reversals Reversal patterns ki taraf guzarish karne se pehle, price trends ki tawajjo mein lena zaroori hai. Forex mein price trends us muddat mein ek currency pair ki keemat ka amomi rukh hota hai. In trends ko teen mukhya qisam mein taqseem kiya ja sakta hai: uptrend, downtrend, aur sideways (jo ke range-bound kehte hain). Uptrend mein keemat ki baar baar unchaiyan buland hoti hain aur neechaiyan bhi buland hoti hain, jabke downtrend mein baar baar unchaiyan kam hoti hain aur neechaiyan bhi kam hoti hain. Sideways trend ek mukarrar hadood mein keemat ki hilne ki soorat hai, jahan keemat mukarrar hadood mein ghoomti rehti hai. Reversal patterns tab aate hain jab kisi trend ki taqat khatam ho rahi hoti hai ya wo mukammal hone par hai. Ye patterns asal mein keemat ki harkaton ke tasveeri tajawuzat hote hain jo keemat trend se naye rukh ki taraf tawajjo dilate hain. Inka kirdar isliye ahmiyat rakhta hai kyunki ye traders ko mukhtalif trend reversals ki pehchan karne mein madadgar sabit ho sakte hain, jisse unko waqt se pehle market ki harkaton ka andaza ho sake.  Common Reversal Patterns Forex traders mukhtalif aham reversal patterns ko mukhtalif tawajjo se dekhte hain. Har pattern apni khaas khasosiyaton aur tabdeeliyon ke zahir karne mein mukhtalif hota hai. Chaliye kuch aise patterns ke bare mein jaan lein jo aam taur par istemal hote hain: 1. Head and Shoulders Pattern Head and Shoulders pattern aik aam taur par pehchaana janay wala reversal pattern hai jo teen choton se mil kar bana hota hai. Markazi choti ko head kehte hain, jabke dono taraf ke zara kam unchaiyon ko shoulders kehte hain. Is pattern ki taraf tabdeeli ki nishani hoti hai jab keemat uptrend se potential downtrend ki taraf shift hone lagti hai. Traders is pattern ko tamam hone par consider karte hain jab keemat neckline ko break karti hai, jo shoulders ki zara kam unchaiyon ke darmiyan ki gayi trendline hoti hai. 2. Double Top and Double Bottom Double top aur double bottom patterns do mukhtalif oonchaiyon ya neechaiyon ke baad ki gayi ek zawiye wali rukhbat harkat ko zahir karte hain. Aik double top uptrend se potential downtrend ki taraf shift hone ki nishani hai, jabke double bottom is ka ulta hai, potential downtrend se uptrend ki taraf rukhbat hone ki taraf ishara karta hai. 3. Triple Top and Triple Bottom Triple top aur triple bottom patterns bhi do mukhtalif oonchaiyon ya neechaiyon ke baad ki gayi teen zawiye wali rukhbat harkat ko zahir karte hain. Ye patterns potential trend reversals ki mazeed mazboot nishani hoti hain.

Common Reversal Patterns Forex traders mukhtalif aham reversal patterns ko mukhtalif tawajjo se dekhte hain. Har pattern apni khaas khasosiyaton aur tabdeeliyon ke zahir karne mein mukhtalif hota hai. Chaliye kuch aise patterns ke bare mein jaan lein jo aam taur par istemal hote hain: 1. Head and Shoulders Pattern Head and Shoulders pattern aik aam taur par pehchaana janay wala reversal pattern hai jo teen choton se mil kar bana hota hai. Markazi choti ko head kehte hain, jabke dono taraf ke zara kam unchaiyon ko shoulders kehte hain. Is pattern ki taraf tabdeeli ki nishani hoti hai jab keemat uptrend se potential downtrend ki taraf shift hone lagti hai. Traders is pattern ko tamam hone par consider karte hain jab keemat neckline ko break karti hai, jo shoulders ki zara kam unchaiyon ke darmiyan ki gayi trendline hoti hai. 2. Double Top and Double Bottom Double top aur double bottom patterns do mukhtalif oonchaiyon ya neechaiyon ke baad ki gayi ek zawiye wali rukhbat harkat ko zahir karte hain. Aik double top uptrend se potential downtrend ki taraf shift hone ki nishani hai, jabke double bottom is ka ulta hai, potential downtrend se uptrend ki taraf rukhbat hone ki taraf ishara karta hai. 3. Triple Top and Triple Bottom Triple top aur triple bottom patterns bhi do mukhtalif oonchaiyon ya neechaiyon ke baad ki gayi teen zawiye wali rukhbat harkat ko zahir karte hain. Ye patterns potential trend reversals ki mazeed mazboot nishani hoti hain.  4. Rounding Top and Rounding Bottom Rounding top pattern ulta U ki shakl mein hota hai, jo potential uptrend se downtrend ki taraf rukhbat hone ki taraf ishara karta hai. Isi tarah, rounding bottom pattern aam U ki shakl mein hota hai aur potential downtrend se uptrend ki taraf rukhbat hone ki taraf ishara karta hai. 5. Reversal Candlestick Patterns Candlestick patterns forex trading ki technical analysis ka integral hissa hain. Kuch candlestick patterns jaise ke Hammer, Shooting Star,Engulfing, aur Doji bhi reversal signals ke taur par kaam karte hain. Misal ke tor par, ek Hammer candlestick downtrend ke baad ek potential uptrend ki taraf ishara ho sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

4. Rounding Top and Rounding Bottom Rounding top pattern ulta U ki shakl mein hota hai, jo potential uptrend se downtrend ki taraf rukhbat hone ki taraf ishara karta hai. Isi tarah, rounding bottom pattern aam U ki shakl mein hota hai aur potential downtrend se uptrend ki taraf rukhbat hone ki taraf ishara karta hai. 5. Reversal Candlestick Patterns Candlestick patterns forex trading ki technical analysis ka integral hissa hain. Kuch candlestick patterns jaise ke Hammer, Shooting Star,Engulfing, aur Doji bhi reversal signals ke taur par kaam karte hain. Misal ke tor par, ek Hammer candlestick downtrend ke baad ek potential uptrend ki taraf ishara ho sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!

Reversal Candlestick Pattern

Candlestick patterns mein se ek group aisa hai jo sirf aik candle se bana hota hai aur is trading technique ko asal mein stock market ke liye banaya gaya tha, lekin jald hi ye currency trading mein bhi kamyabi hasil kar gaya.

Trading mein mukhtalif anokhe naam dekhe ja sakte hain, jaise ke Shooting Star, Hanging Star, Hammer, aur Inverted Hammer. Ye lafz single candlestick patterns ko kehte hain, jo ke market ki tasweer ko badalne mein qabil hain. Ye aapas mein bohat milte julte hain, is liye kuch traders ne inhe chameleons ka majaz naam diya hai.

Major Forex Trend Reversal Candlestick Patterns

Major forex patterns akele Japanese candle se bane hue reversal patterns hain. Inhe aapas mein farq karne ki salahiyat hona zaroori hai kyun ke trading tactics pattern ke qisam par mabni hogi. In patterns ki kuch aam khasoosiyaton ko paish kiya ja sakta hai:- Major patterns trend mein tabdil hone ka ishara karte hain, yaani ke ye typical reversal patterns hain, pin bars aur Harami ke saath;

- Inhe sirf aik candle se bana hai;

- Candle ki body chhoti hoti hai. Ye is wajah se hota hai ke opening aur closing prices mein zyada farq nahi hota;

- In patterns mein rang ahem nahi hai, lekin ye signal ki taqat mein kuch hissa ada karte hain.

Inmein farq ye hai:- Pattern ki pehchan mein iske tails ka kirdar ahem hai;

- Ye patterns alag alag trends ko zahir karte hain: kuch ascending hote hain aur kuch descending.

In patterns ko pehchan kar in par trade karna bohat zaroori hai, is liye har aik ki tafseelat ko ek nazar mein samajhna lazim hai.

Hammer Candlestick

Hammer aik bullish candle hai, jo ke aik downtrend mein banta hai, yaani ke ye mojooda minimum price level ka ishara hai.

Is tarah, hammer ke banne ki logic Shooting Star ke ulte hoti hai, is liye in dono ko ghalti se milana mushkil hai.

Ideal Hammer ki parameters ye hain:- Behtareen body ke proportion square hain;

- Aik lambi lower shadow hoti hai, lekin zyada tar lambi upper tail nahi hoti - ye bulls ki taraf se trend ko apni taraf dhakelne ki koshish ko point karta hai. Ye downtrend se uptrend ki taraf tabdil ka ishara hai;

- Ye zaroori hai ke wo candle jo hammer se pehle band hua ho, uski range chhoti ho. Is tarah, chart par opening aur closing prices mein thora sa farq fix hota hai;

- White (green) hammer sab se kamyaab hota hai.

Hammer ke banne ke doran, quotes ki be-takallufi harkat mehsoos hoti hai, jo ke pattern size ko doosre candles ke mutabiq zyada kar deti hai. Is ne buyers aur sellers ke darmiyan jang ko bhi ishara karta hai.

Inverted Hammer Vs Shooting Star

Inverted hammer hammer pattern ke ulte model ko darust karta hai. Aam taur par aik stable downtrend mein usual hammer ke mutabiq, bulls ki shamil hone se ek upper shadow paida hoti hai, lekin closing ke waqt bears apni haari hui positions par wapas aa jaate hain. Agay ke harkat agle trading day tak maaloom nahi hoti.

Is pattern par low price increasing ki taraf badalta hai. Ye sellers ke price kam hone ke doraan banta hai. Is tarah, inverted hammer aur usual hammer ke darmiyan asal farq ye hai ke price jump jo tail ki lambai mein zahir hota hai, wo candle band hone par foran fix nahi hota. Inverted hammer ki kuch khasoosiyaten hain:- Isme aik lambi upper tail hoti hai, warna ye hammer ke mutabiq nahi lagta, is liye isey ulta hammer kaha jata hai. Is tarah, farq sab se zyada tail mein hai, bears ke positions ki taraf ishara karte hue;

- Inverted hammer shooting star ke mutabiq hai, farq sirf price trend ke badalne ki nature mein hai;

- Shooting star aik bearish pattern hai, jo ke rising trend se falling trend ki taraf tabdil ko darust karta hai - iska matlab hai ke price peak par thi lekin phir achanak 'girne' lagi;

- Is doran market mein significant changes hoti hain. Bulls mutaddid activity ki wajah se, jo ke unki buland khareedari ki wajah se initial uptrend mein price ko minimum par le jaate. Bulls ki taqat kamzor hoti hai aur trend palat jata hai.

Shooting star ki key graphical khasoosiyaten hain:- Lower shadow ki na hona aur aik lambi upper end ki mojoodgi bearish activity ka wazeh ishara hai;

- Rang koi bhi ho sakta hai, lekin black sab se mazboot pattern mana jata hai.

Hanging Man Candlestick

Hanging man ek uptrend ke end par aata hai jab buyers apni positions tezi se band kar rahe hote hain. Hanging man ke aane ka wajood mantarz hai ke jab uptrend ka pahaar ho jaata hai, to bears price ko win karne ki koshish karte hain, lekin phir leading positions ko bulls ko wapas mil jaati hain. Is tarah, chart par aik lambi bottom shadow aur chhoti body banti hai. Hanging man ke formation ki description se aap ye samajh sakte hain ke ye inverted hammer ke ulte hota hai.

Hanging man ka jometry kaafi asaan hai:- Pattern ne ek price ki barhne ki end point par banaya gaya tha;

- Pattern ke saath ek lower long tail hai jo figure ke ideal parameters ke mutabiq hai (tail body ke 2-3 guna bara hota hai). Ye uptrend se downtrend ki taraf tawajjuh badalne ka ishara karta hai;

- Hammer ke mutabiq hai lekin fark ye hai ke market reversal direction mein hota hai.

Patterns Ki Graphical Characteristics

Aap in tasweerati khasoosiyaton ko paayeinge jo perfect shooting star, hammer, hanging, aur inverted hammer patterns ko darust batati hain:

Chhota candle body. Ye dikhata hai ke bulls aur bears ke darmiyan jang ka ikhtitam kaisa hota hai. Body aur long shadow ki behtareen milawat taqreeban 2-3 units hai. Dusre parameters ek bilkul mukhtalif market situation ko refect karte hain, is liye figure ke jhootay signs par tawajjuh dena nuksan ka sabab ho sakta hai.

Candlestick ek hi hoti hai, Rail, Engulfing, aur dosre patterns ke khilaaf.

Aik shadow lambi hoti hai (body size ke 300% kareeb), aur doosri chhoti hoti hai (size ke 10%). Ye tajaweezat ideal figure ki isharaat hain.

Ye signs chaar patterns ke liye mukhtalif hote hain.

Ye patterns, jaise ke baqi patterns, aksar doosri figures se ghalti se mil sakti hain. Ek trader ke liye mufeed hai ke wo in patterns ke jhootay signs ke bare mein seekhein takay ghalatfehmiyon ke bajaye nuksan se bacha ja sake. Shooting star ke saath ye patterns bohot milti hain:

Gravestone Doji - Inka ittefaq ye hai ke candle chhota hota hai, lekin gravestone mein body bilkul nahi hoti, jabke shooting star mein chhoti body hoti hai. Amoman maana jata hai ke gravestone shooting star pattern ka ek qisam hai.

Morning/Evening Star - Inke naam mein to ittefaq hai, lekin inki market mein kirdar aur jometry alag hoti hai. Shooting star aik candle se banta hai (kuch traders isay do candles se banta kehte hain kyun ke dosri candle trend mein tabdil hone ko tasdeeq karti hai), jabke morning aur evening stars teen candles se banti hain.

Aik chhoti tail ke saath oonchi candle hanging man ke pehle dikhaye ga to iska matlub hai ke trend upar jaye ga, aur trader ke hisaab se price ki tabdili galat hogi.

Shooting star resistance boundary ko cross karna trader ke liye bura sign hai, aapko is pattern ko asli shooting star na samajhna chahiye, jiska movement kuch khaas qawaidon ke mutabiq hota hai.

Head and shoulders doosra pattern hai jo star se visually milta hai. Fark ye hai ke head and shoulders aik mukhtalif trend ki nishani hai jabke shooting star aik star pattern hai. Isi tarah, head and shoulders mein price upar jaati hai, lekin phir thoda sa neeche jaati hai, center mein ek bulandai banate hue, aur sides par almost barabar tail levels hoti hain. Agar trader ko 'starfall' ka samna karna padta hai, to tasweer thodi si mukhtalif hoti hai: barabar extrema hamesha nahi banti kyun ke shooting star ki asli jometry mein trend reversal ke baad kisi bhi qisam ki strict price movement nahi hoti, trend ka rukh badal jaata hai lekin kisi bhi chote se peaks tak pohanchne ki zarurat nahi hoti.

Hammer ke mutabiq, aapko ye tips mil sakti hain:- Ye pattern kabhi kabhi pin bar se ghalti se mil sakta hai. Similarities long shadow size mein milti hai, lekin fark ye hai ke hammer ek downward price line par hota hai jabke pin bar kisi bhi trend par hosakta hai.

- Aik chhota tail wale hammer ko aik strong signal na samjha jaye. Ye sirf short-term tabdili ko darust karta hai.

- Bohat chhoti body aur bohat lambi tail aik impulse price spike ka ishara hai, jo ke trading ke liye kamzor hota hai.

Inverted hammer ke mutabiq, aap notice kar sakte hain ke standard hammer ke ulte hone ki wajah se false signs milte hain:- Ek chhota tail minor tabdili ka ishara hai;

- Ek kamzor saath mein upar jaane wali lambi tail aik tezi se jump ka signal hai, jo trend ko nahi badalta.

False hanging man ke baare mein, ye note karna behtar hai:- Ye candle Dragonfly Doji pattern ke saath milta hai, jo hanging man ka aik qisam hota hai, lekin isme koi body nahi hoti;

- Aisi situation jisme lambi tail 3 guna zyada hoti hai, ek naqabil-e-itminan trend ki wazahat hai aur ye short-term hone ke imkanat hai;

- Trader ke liye khatra hai agar hanging man ke paas ek Marubozu bhi ho. Aisi chandani figure jo lambi body aur bina tail ke hoti hai, achhi nahi hoti, yaani ke yeh darust hai ke market ke ek malik - ya to bulls ya bears - ka dabdaba bohat zyada hai. Is halat mein trading tactics hanging man ke kehne se kaafi mukhtalif hoti hai;

- Agar body resistance line par hai, to behtar hai ke trading na karein.

Reversal Candlestick Patterns Ko Kaise Trade Karein

In figures ke saath kaam karne ke liye asal amal ka silsila taqreeban tamam patterns ke liye amuman mukhtalif nahi hota:- Technical analysis, jise candles ke location aur pattern ke banne ke daur mein shamil kiya jata hai, sath hi pattern ke proportions aur mukhtalif levels ke sath rishton ki tajziyaat ka mutalia;

- Trading ko asaan banane ke liye mukhtalif indicators ka istemal karna: Fibonacci retracement, Color MACD, Stochastic, Shooting indicator, Ozymandias.

- Market ka intikhab karna aur in patterns ke saath iske khasusiyat ko madde nazar rakhna neeche bayan kiya gaya hai.

- Munasib time frame par tawajjuh dena, jo munafa hasil karne ki mumkinat ko barhane mein madadgar hota hai.

- Patterns ke khasusiyat ko madde nazar rakh kar trade karna - patterns ke anatomi ke bare mein malumat ka istemal karna.

- Risks ko kam karne ke liye Stop Loss aur Take Profit set karna.

Markets

In patterns ka istemal karte waqt foreign exchange aur stock markets dono par trade kiya ja sakta hai. Lekin trading type ke mutabiq farq hoga:

Candles ke darmiyan gaps stock market mein aam hote hain. Aise gaps banne ka amal kisi khabar ke bais hota hai. Stock markets ke liye ye gap trend ke end par hota hai, yaani ke trend ke end par.

Currency market mein ye situation kam hoti hai aur amuman trading week (Friday-Sunday) ke end par hoti hai.

Time Frames

Naye logon ko kam time frames par trade karne se sakht mana kiya jata hai, kyunke faida hone ke bajaye bohat zyada nuksan ho sakta hai. Aam taur par high time frame ko sab se safe mana jata hai. Relatively high time frame ke andar false fluctuations aur market noise kam honge.

Ek faida karne wala tafseel hai jo munafa barhane mein madad karegi. Yeh mumkin hai (aur zaroori bhi hai) ke market ko alag alag time frames par ek saath tajziya kiya jaaye - baray aur chhotay. Is tarah higher time frame se aap general trend tay kar sakte hain, aur lower trading period ko dekhte hue market mein dakhil hone ka behtareen waqt talaash sakte hain. Aap standard aur non-standard time frames dono ko trading ke liye set kar sakte hain.

Trading k Main Rules

Shooting star candlestick ko trade karte waqt, aapko in asaan qawaidon par amal karna chahiye:- Agar market mein shooting star hai, to samajh lijiye ke ab short karna behtar hai;

- Pattern ko perfect shape mein hona chahiye, jo ke pehle batai gayi hai. Taayeen hone wala sign - pattern ke baad aane wala ek bearish candle;

- Yeh samajhna zaroori hai ke hamesha perfect shape trader ke paas nahi aata aur aksar trend kuch waqt ke liye nahi badalta, is liye Stop Losses par jaldi na jaiye;

- Mazbooti ke levels aur resistance ka istemal karna;

- Closed candlestick, Sell Stop order (candlestick ke Low se thoda ooncha set karein), ya Sell Limit order (star ke 38.2-50% par) ke zariye dakhil ho sakti hai;

- Stop Loss ko hilaf hilaf ki kamai mein set karna chahiye.

Hammer candle ke mutabiq, ye tips zaroori hain:- Jaise ke baqi patterns mein, trader ko pattern ke false aur perfect signs par tawajjuh deni chahiye.

- Jab hammer aata hai, to aap ek trade khol sakte hain (isay buy signal kehte hain).

- Market mein dakhil hone ke liye closing price, Buy Stop (highest point se 4-5 points ki ijazat ke sath), ya limit order (hammer ke level ke 50% tak) ka istemal karna chahiye.

Aapko sirf wo hammer ko madde nazar rakhna chahiye jo trend ke end par banta hai, warna ye market ke rukh mein koi tabdili nahi la sakta, balke sirf guzishta impulses ko darust karega.

Bearish patterns ke saamne trading na karein to behtar hai.

Stop Loss ko price ki kamai ke liye low par rakhna chahiye.

Hanging man ke mutabiq, rules hammer ke trading ke liye milte julte hain, is ke saath saath ye bhi madde nazar rakha jaaye ke bullish strategy bearish strategy mein tabdeel ho jaati hai. Lekin risks hammer ke mukable zyada hote hain is ki signals ki kamzori ki wajah se. Is ke ilawa, perfect patterns ko dhoondhna aur bullish candlestick patterns se bachna behtar hai.

In figures ki khasusiyaton ko madde nazar rakhte hue in tools se maharat haasil karnay se aap asaan taur par munafa haasil kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:17 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим