What is the broadening pattern?

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is the broadening pattern? -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

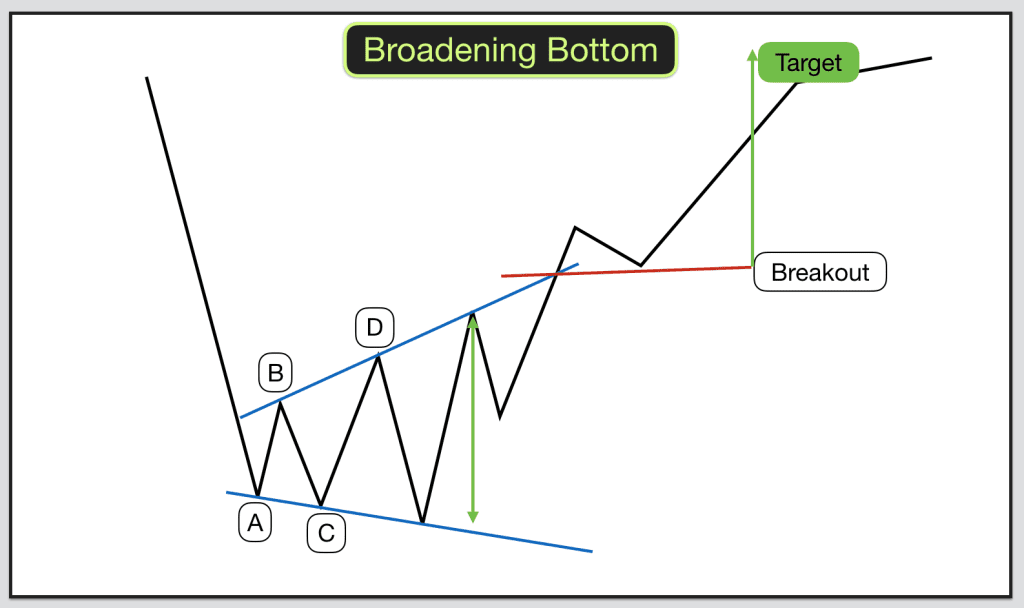

INTRODUCTION TO BROADENING PATTERN : Broadening patterns stock prices mein dekhe jane wale technical chart patterns hain. Ye patterns dusre chart patterns ke opposite hote hain, jinmein price range yaAssistant. FORMATION AND STRUCTURE OF BROADENING PATTERNS : Broadening patterns tab bante hain jab market participants ke darmiyan kisi asset ki qeemat ke baray mein mukhtalif raye hoti hai. Is tafreeq ke natijay mein higher highs aur lower lows ki series banti hai, jis se qeemat ka range phail jata hai. Broadening pattern ka tashkeel aam taur par do trendlines se banta hai. Uper wali trendline higher highs ko jorta hai, jab ke lower wali trendline lower lows se jorti hai. In dono trendlines ke darmiyan fasla aur bhi ziyada hota hai, jab tak pattern ki tashkeel banti hai. Yaad rakhein ke trendlines barabar nahi honi chahiye; balkeh dono trendlines opposite directions mein harkat karni chahiye, ta ke asal broadening pattern ban sake. TYPES OF BROADENING PATTERNS : Broadening patterns ke do main aqsaam hotay hain: broadening top aur broadening bottom. Broadening top tab banta hai jab qeemat uptrend mein ho aur higher highs aur lower lows paida ho. Doosri taraf, broadening bottom tab hota hai jab qeemat downtrend mein ho aur lower lows aur higher highs ban jayein. Dono patterns ki tashkeel mein kuch milta julta hota hai, lekin unke taabeer aur asar alag hote hain. Broadening top aam taur par bearish reversal pattern ke tor par tasawwur kiya jata hai, jis se uptrend se downtrend mein trend reversal ka ehtemam hota hai. Muqabil mein, broadening bottom bullish reversal pattern ke tor par samjha jata hai, jis se downtrend se uptrend mein price ka tahleel mumkin hojati hai. TRADING SIGNALS AND STRATEGIES USING BROADENING PATTERNS : Broadening patterns se hasil hone wale trading signals trendlines ke breakout par mabni hote hain. Broadening top pattern mein bearish signal is waqt paida hota hai jab price lower trendline ko tor kar neeche jaye, jis se potential trend reversal confirm hota hai. Traders is par short position le sakte hain ya apni mojooda holdings ko bech sakte hain, ta ke mutawaqif downward move se faida utha sakein. Baraye meharbani, broadening bottom pattern mein bullish signal is waqt trigger hota hai jab price upper trendline ko tor kar upar jaye, jis se possible upward reversal ka andesha hota hai. Traders yahan par long positions le sakte hain ya asset ko khareed sakte hain, ta ke mutawaqif price ki izafayi se faida utha sakein. Trading strategies ko mazeed behtar banane ke liye, aur indicators aur confirmations ko bhi shamil karna ahem hai. Maslan, traders volume ka jaanch kar sakte hain signals ki taqat ko samajhne ke liye. Breakout ke samay ziyada volume broadening pattern ki sahiyat ko tasleem karta hai aur mehsool hone wale trade ke chances ko barha deta hai. Is ke ilawa, traders oscillators jaise Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD) ka istemal kar sakte hain, overbought ya oversold halaat ko pehchanne ke liye, trading decision ko mazeed support karte hue. LIMITATIONS AND RISKS OF BROADENING PATTERNS : Jaise ki koi bhi technical analysis tool, broadening patterns bhi puri tarah se reliable nahi hote aur unke interpretation se judi kuch limitations aur risks hote hain. Sab se pehle, ye pattern subjective hota hai, aur alag-alag traders alag tareeqo se structure ko samajh sakte hain, jis se conflicting trading decisions paida ho sakte hain. Dusra, false breakouts bhi ho sakte hain, jahan price trendline ko briefly break karta hai lekin woh move ko sustain nahi kar pata, jis se traders ko nuqsaan ka samna karna pad sakta hai. Teesra, broadening patterns banane mein zyada waqt lag sakta hai, is liye traders ko sabar aur discipline rakhni zaroorat hoti hai. Akhir mein, overall market conditions aur dusre fundamental factors ko bhi mad-e-nazar rakhna zaroori hai, kyunki broadening patterns akele mein puri tarah se analysis nahi provide kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

The term "broadening pattern" is often used in technical analysis to describe a price chart pattern that resembles a widening or broadening formation of price movements. This pattern is characterized by higher highs and lower lows over a period of time, creating a visual pattern that looks like a megaphone or an expanding triangle. There are two main types of broadening patterns: Broadening Top Pattern: This pattern occurs when the price of an asset exhibits higher highs and lower lows over time. It typically signals increased volatility and uncertainty in the market. Traders and analysts often interpret a broadening top pattern as a potential reversal pattern, suggesting that a bullish trend might be losing momentum and a bearish trend could be developing. Broadening Bottom Pattern: This pattern is the opposite of the broadening top. It forms when an asset's price shows lower lows and higher highs over time. It can indicate increased volatility and indecision among market participants. Traders may view a broadening bottom pattern as a potential reversal pattern, suggesting that a bearish trend might be weakening and a bullish trend could be emerging. Both types of broadening patterns are relatively rare and can be challenging to interpret accurately. They are considered more complex than some other chart patterns like triangles, flags, and head and shoulders patterns. Traders often use additional technical indicators and tools to confirm the signals provided by broadening patterns before making trading decisions. It's important to note that while technical analysis can provide insights into potential price movements, it's not foolproof, and market behavior can be influenced by a wide range of factors, including fundamental news, economic indicators, and geopolitical events. As such, traders and investors should use a combination of tools and approaches to make informed decisions.

Broadening Top Pattern: This pattern occurs when the price of an asset exhibits higher highs and lower lows over time. It typically signals increased volatility and uncertainty in the market. Traders and analysts often interpret a broadening top pattern as a potential reversal pattern, suggesting that a bullish trend might be losing momentum and a bearish trend could be developing. Broadening Bottom Pattern: This pattern is the opposite of the broadening top. It forms when an asset's price shows lower lows and higher highs over time. It can indicate increased volatility and indecision among market participants. Traders may view a broadening bottom pattern as a potential reversal pattern, suggesting that a bearish trend might be weakening and a bullish trend could be emerging. Both types of broadening patterns are relatively rare and can be challenging to interpret accurately. They are considered more complex than some other chart patterns like triangles, flags, and head and shoulders patterns. Traders often use additional technical indicators and tools to confirm the signals provided by broadening patterns before making trading decisions. It's important to note that while technical analysis can provide insights into potential price movements, it's not foolproof, and market behavior can be influenced by a wide range of factors, including fundamental news, economic indicators, and geopolitical events. As such, traders and investors should use a combination of tools and approaches to make informed decisions.

-

#4 Collapse

**Forex Trading Mein Broadening Pattern:** Broadening Pattern forex trading mein ek ahem chart pattern hai jo traders ki taraf se daryaft kiya jata hai. Is pattern mein price ek aise range mein spread hoti hai jis mein high aur low points barhte jaate hain. Yeh pattern trading charts par dekhe jane wale 'megaphone' ya 'dari' ke roop mein bhi jana jata hai. Is pattern ki pehchan karne se traders ko market ke future price movements ke baray mein behtar samjhne mein madad milti hai. **Formation:** Broadening pattern ka formation jab hota hai jab price ek zigzag pattern mein badhti aur ghataati hai. Is pattern mein price ke peaks (highs) aur troughs (lows) ek expansion ke saath badhte hain. Aksar yeh pattern volatile market conditions mein paya jata hai jab uncertainty zyada hoti hai. Is pattern ka dhyaan rakhna mahatvapurn hai kyun ke yeh ek price reversal ya trend change ka sign ho sakta hai. **Tashkhees aur Istemal:** Broadening pattern ko tashkhees karne ke liye, traders ko price ke highs aur lows ko observe karna hota hai aur unhe connect karna hota hai taki ek broadening range ban sake. Jab price ki range widen hoti hai aur higher highs aur lower lows ban rahe hote hain, tab yeh pattern ban raha hota hai. Is pattern ka istemal kai maqasid ke liye hota hai. Yeh traders ko price volatility aur market uncertainty ki jankari dene mein madad karta hai. Iske alawa, yeh pattern ek potential trend reversal ya breakout ka indication bhi ho sakta hai. Agar price pattern ke range ke bahar nikalta hai, toh yeh ek possible trend change ya new trend ka signal ho sakta hai. **Faiday:** 1. **Price Predictions:** Broadening pattern ki madad se traders ko price movements ke bare mein sahi tashkhees karne mein madad milti hai. Is pattern se price ka potential future direction aur volatility ka andaza lagaya ja sakta hai. 2. **Trend Reversal Indicator:** Agar price pattern range se bahar nikalta hai, toh yeh ek trend reversal ka sign ho sakta hai. Traders is signal ko istemal karke apne trades ko manage kar sakte hain. 3. **Risk Management:** Broadening pattern se traders apni trades ko better risk management ke saath execute kar sakte hain. Pattern ke breakout se pehle aur baad mein stop-loss aur take-profit levels set karke risk ko control kiya ja sakta hai. 4. **Trading Strategies:** Is pattern ko samajh kar traders alag-alag trading strategies tayyar kar sakte hain, jaise breakout trading ya trend following strategies. **Ikhtitam:** Forex trading mein broadening pattern ek ahem tool hai jo traders ko market ke price movements aur trends ke baray mein maloomat faraham karta hai. Is pattern ki samajh se traders apne trading decisions ko improve kar sakte hain aur market volatility aur uncertainty ke sath behtar tarike se deal kar sakte hain. -

#5 Collapse

BROADENING CANDLESTICK PATTERN:-Broadening Candlestick Pattern ka maqsad hota hai traders ko market mein hone wale uncertainty ya volatility ko darust tarah se samajhnay mein madadgar hona. Ye pattern typically market mein hone wale indecision aur volatality ko represent karta hai. Broadening Candlestick Pattern ki wazahat karnay ke liye, aapko candlesticks ki movement aur unke shapes par nazar rakhni hoti hai. Broadening Candlestick Pattern do tarah ke hote hain:Broadening Top Pattern: Ye pattern typically ek uptrend ke doran aata hai aur ismein price range kafi wide ho jata hai. Ismein do ya do se zyada candlesticks hoti hain jo ki upper highs aur lower lows par jati hain. Ye indecision aur volatality ko dikhata hai aur traders ko alert karta hai ke market mein uncertainty badh gaya hai. Broadening Bottom Pattern: Ye pattern typically ek downtrend ke doran aata hai aur ismein price range wide hota hai. Ismein do ya do se zyada candlesticks hoti hain jo ki lower lows aur higher highs par jati hain. Is pattern se traders ko ye signal milta hai ke market mein volatility aur uncertainty badh gayi hai aur price mein reversal hone ke chances ho sakte hain. Broadening Candlestick Patterns ke saath-saath, aapko dusre technical indicators aur market analysis tools ka bhi istemal karna chahiye taake aap sahi trading decisions le saken. Lekin yaad rahe ke candlestick patterns sirf ek hissa hote hain market analysis ka aur khud mein complete picture nahi dete, isliye prudent trading ke liye additional research aur risk management bhi zaroori hai.

Broadening Candlestick Pattern do tarah ke hote hain:Broadening Top Pattern: Ye pattern typically ek uptrend ke doran aata hai aur ismein price range kafi wide ho jata hai. Ismein do ya do se zyada candlesticks hoti hain jo ki upper highs aur lower lows par jati hain. Ye indecision aur volatality ko dikhata hai aur traders ko alert karta hai ke market mein uncertainty badh gaya hai. Broadening Bottom Pattern: Ye pattern typically ek downtrend ke doran aata hai aur ismein price range wide hota hai. Ismein do ya do se zyada candlesticks hoti hain jo ki lower lows aur higher highs par jati hain. Is pattern se traders ko ye signal milta hai ke market mein volatility aur uncertainty badh gayi hai aur price mein reversal hone ke chances ho sakte hain. Broadening Candlestick Patterns ke saath-saath, aapko dusre technical indicators aur market analysis tools ka bhi istemal karna chahiye taake aap sahi trading decisions le saken. Lekin yaad rahe ke candlestick patterns sirf ek hissa hote hain market analysis ka aur khud mein complete picture nahi dete, isliye prudent trading ke liye additional research aur risk management bhi zaroori hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Broadening Pattern Kya Hai?"Broadening pattern ek technical analysis term hai jo stock market mein use hoti hai. Is pattern mein stock ki trading range overtime broad hoti hai, matlab ki highs aur lows ke beech ka difference badh jata hai. Is pattern ko samajhne ke liye yeh dekha jata hai ki stock ke highs aur lows kaise expand ho rahe hain, aur kya yeh ek possible trend reversal indicator ho sakta hai. -

#7 Collapse

What is the broadening pattern? "Broadening pattern" ek term hai jo kuch financial markets mein istemal hota hai, khaas karke technical analysis (kisi bhi financial asset ki price movement ko study karne ka ek method) mein. Yeh pattern market mein price movement ke specific tariko ko darust karne ke liye istemal hota hai. Broadening pattern ka matlab hota hai ki ek financial asset ki price movement mein increasing volatility aur uncertainty hai. Is pattern ko samjhne ke liye, aapko yeh dekhna hota hai ki asset ki price mein higher highs (jab price ek certain level se upar jaati hai) aur lower lows (jab price ek certain level se niche jaati hai) ek sequence mein occur ho rahi hai. Yeh pattern traders aur analysts ke liye ek signal provide karta hai ki market participants (jaise ki buyers aur sellers) confuse ya indecisive hai aur asset ki future direction ke baare mein uncertainty hai. Iska matlab hai ki market mein volatility ya price ke fluctuations kaafi jyada ho sakta hai. Broadening pattern ek potential reversal (price direction ka badalna) ya ek period of high volatility ko suggest kar sakta hai. Is pattern ko samjhne ke liye, aapko technical analysis ke tools aur price charts ka istemal karna hota hai. Broadening pattern ka example aapko price chart par dekha ja sakta hai, jahan par higher highs aur lower lows ek zigzag pattern create karte hain. Yad rahe ki market patterns aur signals hamesha accurate nahi hote, aur traders ko risk management aur aur doosre factors ka bhi dhyan rakhna chahiye jab woh trading karte hain. -

#8 Collapse

Introduction to Broadening Pattern

Broadening pattern, jo kay broadening top ya broadening formation kay naam se bhi jaani jati hai, ye aik technical analysis pattern hai jo kay aam tor par financial markets mein dekha jata hai. Isay barhne wali price volatility aur wide trading range ki nishaniyan hain, jo aksar uncertainty aur market trend mein potential reversals ko darust karne ki taraf ishara deti hain. Traders aur analysts is pattern ko future price movements ko pehchanne aur mutmaeen trading decisions lene ke liye istemal karte hain.

Structure of the Broadening Pattern

Broadening pattern ki structure uski barhte hue range ke liye mashhoor hai. Ye sab se zyada wazeh khasiyat hai, jahan price movements ki highs aur lows waqt ke sath wide hoti hain. Ye expansion growing volatility aur market participants mein indecision ko zahir karta hai. Is ke ilawa, pattern higher highs aur lower lows ko banata hai jab range expand hoti hai, jo ke market mein bullish aur bearish sentiment ke conflicting forces ko reflect karta hai. Volume analysis bhi broadening pattern ko confirm karne mein ahem hai, kyun ke ideal taur par, volume ko barhna chahiye jab pattern develop hota hai, jo ke zyada trading activity aur potential market shifts ka ishara hai.

Interpretation of the Broadening Pattern

Broadening pattern ko interpret karna bari market trends aur key support/resistance levels ke andar uski context ko samajhna shamil hai. Aik aam interpretation ye hai ke ye aik reversal signal hai. Jab broadening pattern ek extended uptrend ya downtrend ke baad aata hai, to ye market sentiment ka uncertainty barh raha hai. Ye widening range yehi darust karti hai ke buyers aur sellers active tor par participate kar rahe hain, lekin na to kisi taraf ka clear advantage hai, jo potential trend reversals ki taraf le jata hai.

Reversal Signal Interpretation

Ek aur interpretation ye hai ke ye aik continuation pattern hai. Is surat mein, broadening pattern ek bade trend ke andar hota hai, aur ye temporary pause ya consolidation ko zahir karta hai pehle se chal rahe trend mein. Traders confirmation signals ko dhoondte hain, jaise ke breakout pattern ke boundaries ke upar ya niche, taake wo next major price movement ka direction maloom kar sakein.

Breakout Confirmation Strategy

Broadening pattern ke saath judi trading strategies trader ki risk tolerance, timeframe, aur market conditions par depend karti hain. Aik approach ye hai ke breakout confirmation ka wait karna, jahan price decisively pattern ke boundaries ke upar ya niche move karta hai increased volume ke saath. Ye breakout ek potential trading opportunity ko signal karta hai breakout ki taraf, jahan stop-loss orders ko risk ko manage karne ke liye place kiya jata hai. Dusri taraf, kuch traders broadening pattern ko contrarian signal ke tor par istemal karte hain, reversal ka anticipation karte hue jab pattern apne widest point tak pohanchta hai. Wo divergence indicators ko dhoondte hain, jaise ke bearish ya bullish divergences oscillators mein jaise ke Relative Strength Index (RSI) ya Moving Average Convergence Divergence (MACD), apne trading decisions ko validate karne ke liye.

Examples of Broadening Patterns in Financial Markets

Broadening patterns ke examples ko alag alag financial markets mein dekha ja sakta hai, jaise ke stocks, forex, aur commodities. Maslan, stock trading mein, aik broadening pattern aik company ke shares ki price chart par uncertainty ko indicate kar sakta hai investors ke darmiyan uske future prospects ke regarding. Traders phir fundamental aur technical factors ko analyze karte hain takay informed trading decisions broadening pattern ke signals par base ban sakein. Broadening pattern aik versatile technical analysis tool hai jo market volatility, sentiment shifts, aur potential trend reversals ya continuations mein valuable insights provide karta hai. Traders is pattern ko apni analysis mein shamil kar sakte hain dusre indicators aur strategies ke saath takay unki trading decisions ko enhance kiya ja sake aur risk ko effectively manage kiya ja sake.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is the broadening pattern?

Broadening Pattern, jo ke Broadening Top ya Megaphone Pattern ke naam se bhi jaani jati hai, ek technical chart pattern hai jo financial markets mein dekha jata hai. Ye pattern aksar barhti hui volatility aur uncertainty ke doran hota hai aur iski pehchan wafir price swings aur mukhtalif tarah ke high aur low points se hoti hai.

Broadening Pattern ki kuch ahem pehchanen:- Barhate Hue Range: Ye pattern aam tor par barhti hui price swings ko dikhata hai jo waqt ke sath taqreeban barhta jata hai, jisse ek megaphone ya wide cone ki shakal ban jati hai.

- Mukhtalif Highs aur Lows: Broadening Pattern ke andar, price mukhtalif high aur low points banata hai, jo ek doosre se door hotay jate hain aur ek series ki peaks aur valleys ko paida karte hain.

- Barhti Hui Volatility: Jab price swings widen hote hain, to volatility aam tor par barhti hai, jo market ke participants ke darmiyan uncertainty aur be-yaqeeni ko darust karta hai.

- Trend Ka Raqba Na Hona: Kuch doosre chart patterns ki mukhtalif tareeqo ki nisbat, broadening pattern market mein koi mukhtalif raqba dikhata hai, jahan bullish aur bearish forces dono ka kirdar hota hai.

- Breakout Ka Potensial: Broadening pattern aksar ek reversal pattern ke tor par liya jata hai, jo mojooda trend mein tabdeeli ka ishara karta hai. Traders aam tor par pattern ke upper boundary (bullish breakout) ya lower boundary (bearish breakout) ke breakout ko tasdiq karte hain.

- Volume Ki Tasdiq: Pattern ki maanayat ko aksar breakout ke sath barhne wala trading volume tasdiq karta hai.

Broadening pattern ki tabeer overall market trend ke context mein mukhtalif ho sakti hai. Agar uptrend mein hai, to ye ek downtrend ki taraf tabdeeli ka ishara kar sakta hai, jabke downtrend mein, ye uptrend ki taraf tabdeeli ka ishara kar sakta hai. Magar, traders ko ehtiyaat baratni chahiye aur additional technical analysis tools aur tasdiqati signals ka istemal karke broadening pattern par base trading faislay ko darust karne chahiye.

-

#10 Collapse

Broadening Pattern Kya Hai?

Broadening pattern ek technical analysis concept hai jo ke chart patterns mein istemal hota hai. Ye pattern typically price volatility aur uncertainty ko darust karta hai. Is pattern mein price chart mein ek series of higher highs aur lower lows hoti hai, jo ke ek expanding range mein hoti hai.

Broadening pattern ko identify karne ke liye, traders ko price chart par expanding range ya phela hua pattern dekhna hota hai, jahan price highs aur lows continuously expand ho rahe hote hain. Ye pattern typically sideways markets mein dekha jata hai, jab market mein confusion aur volatility hoti hai.

Is pattern mein price ka movement typically zigzag hota hai, jahan highs aur lows ke darmiyan expanding range hoti hai. Ye pattern bullish ya bearish market mein bhi dekha ja sakta hai, lekin iska interpretation market context aur surrounding indicators ke saath kiya jata hai.

Broadening pattern ka interpretation kafi subjective hota hai aur iske signals ka confirmation dusre technical indicators aur price action analysis ke zariye kiya jata hai. Lekin, kuch common guidelines hote hain jinse traders is pattern ko samajh sakte hain:- Higher Highs aur Lower Lows: Broadening pattern mein price chart par higher highs aur lower lows dekhe jate hain jo ke expanding range mein hote hain.

- Increasing Volatility: Is pattern ke sath typically volatility increase hoti hai, jisse price movements unpredictable ho jate hain.

- Lack of Trend: Broadening pattern ka ek characteristic yeh hai ke ismein koi clear trend nahi hota hai. Price range continuously expand hoti hai, indicating market confusion aur indecision.

Broadening pattern ko identify karne ke baad, traders ko apne trading strategies ko adjust karna hota hai. Agar is pattern ko properly analyze kiya jata hai, toh traders potential trading opportunities ko identify kar sakte hain. Lekin, is pattern ka istemal karne se pehle thorough analysis aur risk management ki zarurat hoti hai.

Toh, broadening pattern ek important technical analysis concept hai jo ke traders ko market volatility aur uncertainty ke bare mein inform karta hai. Is pattern ko samajhne aur sahi tarah se interpret karne ke liye practice aur experience ki zarurat hoti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Broadening pattern forex market mein ek price action pattern hai jo market volatility aur uncertainty ko darust karta hai. Is pattern mein price range din ba din barh rahi hoti hai aur trading range chaaron taraf se barhti hai. Neeche broadening pattern ke kuch mukhya points hain:

Pehele Candle (First Candle):

Broadening pattern ka pehla candle ek direction mein move karta hai, jaise uptrend mein bullish candle ya downtrend mein bearish candle.

Dusra Candle (Second Candle):

Dusra candle opposite direction mein move karta hai pehle candle ke. Agar pehla candle bullish tha, to doosra candle bearish hoga aur agar pehla candle bearish tha, to doosra candle bullish hoga.

Price Range:

Broadening pattern mein price range barhti rehti hai. Har new candle pehle candle ke high ya low se bahar move karta hai, jisse range broad hoti hai.

Volume:

Volume ki bhi importance hoti hai broadening pattern mein. Agar price range barhti hai aur volume bhi barhta hai, toh yeh indication hai ke market mein strong volatility hai.

Confirmation:

Broadening pattern ko confirm karne ke liye traders doosre candle ke close ke baad entry lete hain, jab trend direction confirm ho jaaye.

Stop Loss aur Target:

Broadening pattern ki trade mein stop loss aur target levels set kiye jaate hain. Stop loss usual pehle candle ke opposite side ke breakout ke thik bahar rakha jaata hai, aur target usually pehle candle ke opposite direction ke move ka size hota hai. Broadening pattern ek volatile market mein trend reversal ka indication deta hai. Is pattern ko samajhne ke liye traders ko price action aur market psychology ko dhyaan mein rakhna hota hai.

Top of Form

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим