Double Top Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

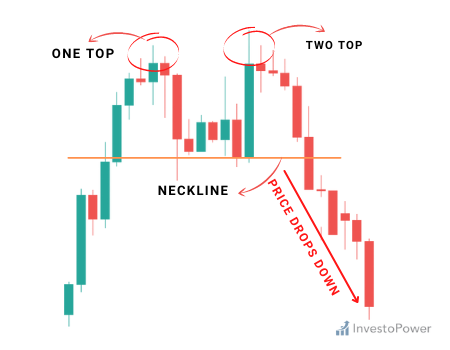

what is Double Top Pattern Double Top pattern forex market mein 2 higher points shamel hotay hein jo keh forex market mein aik anay walay bearish reversal signal ko identify kartay hein forex market ke price mein aik mape hve kame 2 higher points ko indicate karte hey jo forex market ke price ke kame or forex market ke peaks ko resistance ko dekhatate hey forex market kay aik hesay donbara hasel karnay kay bad yeh forex market ke 1st peak kay oper gap rakhnay kay qabel hotay hein forex market mein slow raftar ka saboot RSI jaisay oscillator ke madad say he keya ja sakta hey jo keh aik pechay rehnay wala indicator hota hey chahay forex market mein short he kun na ho or yeh forex market mein nechay ke taraf trend karnay par oksa sakta hey dono prie kaydarmean low price par neck line ho sate hey es gap par double top pattern frex market kay gap ke confirmation karay ga Pehchan Double Top Pattern es pattern mein 2 peaks hone chihay jes mein width or Hight aik jaice hone chihay peaks kay darmean mein fasla bohut he kam nahi hona chihay yeh time frame par he depend karta hey neckline support price line ke confirmation karte hey Double Bearish signal ke confirmation karte hey or dosray technical indicator ka bhe estamal karna chihay jaisay RSI, Moving Average or oscillator shamel hein Trade with Double Top Pattern Double Pattern aam tor par forex market mein currency market mein indicate hota hey jo keh forex market kay buy ya sell signal kay tor par indicate hota hey nechay dey gay chart par mesaen es bat ko frahm karte hein keh dono chart pattern ka hawalla jaat ko estamal keya ja sakta hey or es bt ko hawala deya jata hey keh frex trading ke entry or exit signal kay to par estaml keya ja sakta hey yeh pattern mokhtalef tarekon say estamal keya ja sakta hey oper deya geya chart weekly USD/JPY chart ko indicate karta hey Double Top pattern pehlay say oper kay trend kay bad jes ke pehle peak RSI oscillator ke madd say he ke ja sakte hey jo keh RSI oscillator ke madad say overbought signal ko indicate karte hey yeh forex market mein overbought signal kay sath price mein kame aa jate hey dosree peak bad pechle say qadray strong hote hey or thore ce dair kay ley resistance ke level ko break kar dayte hey RSI resistance kay sath overbought ka koi signal nahi dayta heyyeh 2 tops jo forex market mein raftar ke kame ko zahair karta hey es noyat ke signal Divergence bearish ke taraf eshara kartay heinدیتے جائیںThanksحوصلہ افزائی کے لیے -

#3 Collapse

Double Top Pattern, stock market mein technical analysis ka ek ahem hissa hai jo traders aur investors dwara price trends aur price reversals ko samajhne mein madadgar hota hai. Yeh pattern ek bearish reversal pattern hai, arthath ek uptrend ke baad market mein price decline ki prakriya shuru ho sakti hai. Double Top Pattern ek aise chart pattern ko darust karta hai jahan ek stock ki price mein do baar ek specific level tak pahunchne ke baad ek trend reversal hota hai. Pattern ki pehli peak ya top uptrend ke dauraan banti hai jab stock ki price ek particular level tak pahunchti hai. Iske baad price mein thoda sa giravat hoti hai lekin fir dobara ek naye high tak pahunchti hai, jo pattern ki dusri peak hoti hai. Dono peaks ek dusre ke kareeb hone chahiye aur ek similar level par hone chahiye. Iske baad, jab stock ki price dobara pattern ki upper peak ke aspas se girne lagti hai aur pehli peak ki price level ko break karti hai, to yeh ek bearish reversal signal deti hai. Traders is samay stock ko short sell karne ka vichar kar sakte hain, ya phir existing long positions ko close kar sakte hain. Double Top Pattern ke mukable, Double Bottom Pattern bhi hota hai jahan price do baar ek specific level tak girti hai aur fir se ek uptrend shuru hota hai. Yeh pattern bullish reversal ko darust karta hai. Yadi aap Double Top Pattern ka istemal kar rahe hain, to kuch dhyan rakhne layak baatein hain: 1. Confirmation: Pattern ko confirm karne ke liye, price ko pehli peak ki price level ke neeche girta dekhna mahatvapurn hai. Confirm hone par hi position lena chahiye. 2. Stop Loss: Har trade ke liye stop loss set karna surakshit rahta hai. Agar price unexpectedly upar jaata hai, to aapki nuksan kam ho sakta hai. 3. Target Price: Price target set karna bhi mahatvapurn hai. Yani, aapka expectation kitna neeche jaane ka hai, ise pehle hi decide karna chahiye. 4. Volume: Trading volume bhi dekha jata hai kyunki high volume bearish reversal ko confirm kar sakta hai. Double Top Pattern ek powerful tool hai, lekin yeh hamesha 100% sahi nahi hota. Market mein risks hamesha hote hain, isliye proper risk management aur market research ka bhi mahatv hai. Traders ko is pattern ko samajhna aur istemal karna sikhna chahiye, taki unka trading decision sahi ho sake. -

#4 Collapse

Double Top Pattern forex trading mein ek prakar ka takneeki pattern hai jo pric chart par dikhai deta hai. Yeh ek reversal pattern hota hai, arthath isse pric trend ki pratikriya ki ummid hoti hai. Double Top Pattern jab kisi uptrend ke ant mein prakat hota hai, to yeh bearish trend ke sanket ke roop mein kaam karta hai. Is pattern mein do peaks (shikhar) ek saath dikhte hain, jo lagbhag barabar hote hain, aur inke beech mein ek trough (nimn sthal) hota hai.:max_bytes(150000):strip_icc()/doubletop-edit-36c4afd0c61c44d4bad0ca9def7b58db.jpg) Yahan ek Double Top Pattern ke pramukh gun hain: Pahla Peak: Uptrend ke ant mein pahla price peak (shikhar) banta hai. Yeh ek bullish move ka parinam hota hai. Trough: Pahle peak ke baad ek price decline hota hai, jisse ek nimn sthal (trough) banata hai. Yeh decline bearish momentum ki nishani hoti hai. Dusra Peak: Trough ke baad phir se price badhne lagta hai, lekin pahle peak se thoda neeche. Yeh doosra peak pahle se kam bullish momentum dikhaata hai.Double Top Pattern tab pura hota hai jab do peaks ke beech ke trough ko cross karke price ne neeche ki taraf jaana shuru kar diya ho. Yeh bearish reversal ka sanket hota hai aur traders iska istemal karke sell ki taraf ka trade kar sakte hain. Double Top Pattern ki kuch baatein yaad rakhne layak hain: Yeh pattern adhiktar long-term charts mein dhundha jata hai.Price ke decline ke samay, volume bhi kam ho sakta hai, jo ki bearish trend ki pramukh nishani hoti hai.Traders ko confirmation ke liye is pattern ke break (price decline) ka intezar karna chahiye, kyonki kuch baar price double top ke pattern ke beech mein hi rehkar dubara upar ja sakta hai.Stop-loss aur risk management ke saath trading karna mahatvapurn hai, kyonki pattern mein galat break hone par false signals ho sakte hain.Yad rahe ki kisi bhi takneeki pattern ka istemal karne se pehle aapko achhe se seekh lena chahiye aur demo account par practice karna chahiye. Isi tarah ke patterns ko samajhne aur unka istemal karne se pahle, aapko market ki samajh honi chahiye taki aap sahi nirnay le saken.

Yahan ek Double Top Pattern ke pramukh gun hain: Pahla Peak: Uptrend ke ant mein pahla price peak (shikhar) banta hai. Yeh ek bullish move ka parinam hota hai. Trough: Pahle peak ke baad ek price decline hota hai, jisse ek nimn sthal (trough) banata hai. Yeh decline bearish momentum ki nishani hoti hai. Dusra Peak: Trough ke baad phir se price badhne lagta hai, lekin pahle peak se thoda neeche. Yeh doosra peak pahle se kam bullish momentum dikhaata hai.Double Top Pattern tab pura hota hai jab do peaks ke beech ke trough ko cross karke price ne neeche ki taraf jaana shuru kar diya ho. Yeh bearish reversal ka sanket hota hai aur traders iska istemal karke sell ki taraf ka trade kar sakte hain. Double Top Pattern ki kuch baatein yaad rakhne layak hain: Yeh pattern adhiktar long-term charts mein dhundha jata hai.Price ke decline ke samay, volume bhi kam ho sakta hai, jo ki bearish trend ki pramukh nishani hoti hai.Traders ko confirmation ke liye is pattern ke break (price decline) ka intezar karna chahiye, kyonki kuch baar price double top ke pattern ke beech mein hi rehkar dubara upar ja sakta hai.Stop-loss aur risk management ke saath trading karna mahatvapurn hai, kyonki pattern mein galat break hone par false signals ho sakte hain.Yad rahe ki kisi bhi takneeki pattern ka istemal karne se pehle aapko achhe se seekh lena chahiye aur demo account par practice karna chahiye. Isi tarah ke patterns ko samajhne aur unka istemal karne se pahle, aapko market ki samajh honi chahiye taki aap sahi nirnay le saken.

-

#5 Collapse

Introduction Assalaam.o.alikum dear member umeed karta hun k ap theek hun gay or apny kaam busy hun gay dear jaisa k ap janty hain k Forex trading mein chart patterns ka istemal kar ke traders apni analysis ko mazeed behtar banate hain. Aik aham chart pattern "Double Top" hai, jo traders ke liye ahem maloomat faraham karta hai. Is article mein hum "Double Top" pattern ki mukhtasar samjh aur uske istemal ke bare mein baat karenge. What is Double Top Pattern Dear member Double Top pattern ek reversal pattern hai jo uptrend ke baad nazar ata hai. Is pattern mein price ek level pe do dafa pohnchta hai aur phir neechay jata hai. Yeh pattern bullish trend ki khatam hone aur bearish trend ki shuruaat ki nishani ho sakti hai. Prepration of Double Top Pattern Double Top pattern do peaks ya tops se mil kar bana hota hai, jo aapas mein barabar hote hain. Price pehle top tak pohnchta hai, phir thora neechay jata hai lekin phir dobara upar uth kar pehle top ki taraf jata hai, lekin pehle top ko paar nahi karta. Is tarah ka pattern chart par "M" ki tarah nazar ata hai. Verification of Double Top Pattern Dear member Pattern ki tasdeeq ke liye, price ke do tops hona zaroori hai jo aapas mein barabar hain. In tops ko "resistance level" ke taur par bhi dekha ja sakta hai. Jab price pehli bar upar jata hai, to traders ko alert hona chahiye ke agle dino mein price neechay bhi jasakta hai. Explanation of Double Top Pattern Dear member Double Top pattern ki tafsilaat se traders ko maloom hota hai ke buyers ki taqat kamzor ho rahi hai aur ab sellers ki taqat barh rahi hai. Agar price dobara se pehle top ko paar nahi kar pata, to yeh indicator ho sakta hai ke market bearish trend mein ja sakta hai. Double Top Pattern Ki Entry Aur Exit Dear member Double Top pattern ki entry usually doosri top ke neechay ki jaati hai, jab price neechay jata hai. Aik common exit strategy yeh ho sakti hai ke jab price pehli bar pattern ke neechay jaye, traders apni positions ko band kar dein. Short story Dear member Double Top pattern aik powerful tool ho sakta hai, lekin isay confirm karne ke liye doosri technical analysis tools jaise ke trend lines aur oscillators ka istemal bhi zaroori hota hai. Ending point Dear member Double Top pattern forex trading mein aik ahem chart pattern hai jo bearish reversal ki nishani ho sakti hai. Traders ko is pattern ki samjh aur uske istemal ke liye zaroori maloomat hasil karni chahiye taake woh mazeed successful trading kar saken. Is pattern ko samajhne ke liye practice aur experience bhi zaroori hai. -

#6 Collapse

DOUBLE TOP* PATTERN DEFINITION*Ek double top Ek* extremely bearish technical reversal pattern hai Jo Kisi asset Ke musalsal Two consecutive high price Tak reaches ke bad banta hai Jismien 2 highs Ke Darmiyan moderate decline wakay ho rahi hai iski confirm is time Hoti Hai Jab asset* ki price two prior* ke Darmiyaan low ke equal support level se Below hai NFLX Netflix inc ka use* karte hue next example mein Ham dekh sakte hain ki double tap ki formation kya Dikhai Deti Hai* however is case mein Ham dekhte hain ke support ko Kabhi Nahin broken hai aur na hi uska analysis Kiya Ja sakta hai Kyunki stock mein izaffy technical analysis* ke* sath rise Hota rahata Hai however bad Mein chart Mein Koi dekh sakta hai ke stock* again banta hai amazon .com inc. Amazon ka hai upar wala chart aur yah Ek double chart pattern dikhata haiDOUBLE TOP vs. DOUBLE TOP BOTTOMUp Trend ke bad Ek double top ek* bearish reversal pattern hai Jo ready Hota Hai yah two almost equal sized ki peaks per mishtamil hai Jo height Mein Ek dusre ke close Hain Jo Ek* trough Se separate Hain pattern ke zaria potential Trend ke reversal ki indicate ki gai hai jisse show hota hai ke price two Bar resistance level per pahunch chuki hai lekin isase past Mein unable rahi hai yah* pattern Aksar traders ki taraf se market mein additional decline ki expected mein sell ya short position Mein enter hone ke signal ke Taur per Dekha jata haiKEY ELEMENTS OF A DOUBLE TOPtwo peaks: pattern two peak Per consist hai Jo price ke lihaz se ek dusre ke almost equal hai yah peak resistance level ke Taur per work karti hai Jahan price ruk jaati hai aur fall* begin hai neckline; Neckline Ek horizontal line hai Jo valley ya trough ke low points ko jorne se banti hai yah muhawanat* ki degree ke Taur per work karta hai aur pattern ki confirmation ke liye zaruri hai neckline ka break: neckline ka break double top pattern ka key component hai -

#7 Collapse

Introduction:- Dabla Top Patta ek technical analysis pattern hai jo forex market mein istemal hota hai. Ye pattern market mein reversal trend ki nishandahi karta hai, matlab ke trend ka rukh badalne ki sambhavna hoti hai. Pattern Description : Dabla Top Patta do high points se mil kar bana hota hai jo ki ek barabar ya qareeb barabar hote hain. Is pattern mein pehle high point par price badhta hai, phir gir kar neeche aata hai, fir dobara upar jata hai lekin pehle high point ko paar nahi kar pata, aur phir neeche girne lagta hai. Ye do baar upar jana aur do baar neeche girna pattern ki pehchan hoti hai. Significance : Dabla Top Patta traders ke liye ahem ho sakta hai kyun ke ye ek possible trend reversal ko indicate karta hai. Agar yeh pattern confirm ho jaye to yeh price ke neeche jane ki soorat mein bearish trend ki shuruat ki nishandahi karta hai. Trading Strategy : Recognition: Dabla Top Patta ko pehchanne ke liye pehle price ke chart par do high points ki talaash karni hoti hain jo aapas mein barabar hain ya qareeb barabar hain. Confirmation: Jab ye high points mil jayein, to price ke girne ki tasdeeq karni hoti hai. Agar price pehle high point ko paar nahi kar pata aur neeche aata hai, to yeh confirmation ho jata hai. Entry : Jab confirmation mil jaye, to traders neeche girne ki sambhavna par trading entry karte hain, matlab ke sell order lagate hain. Stop Loss and Target : Stop loss ko pehle high point ke qareeb rakh kar, aur target ko neeche ki taraf set karte hain, price ke previous lows ki taraf. Conclusion : Dabla Top Patta ek popular reversal pattern hai jo traders ko trend reversal ki direction mein guide kar sakta hai. Lekin yaad rahe ke market mein koi bhi pattern guaranteed nahi hota, is liye risk management ka khayal rakhna zaroori hai. -

#8 Collapse

DOUBLE TOP PATTERN:-Double Top ek technical analysis pattern hai jo forex trading mein use hota hai, especially price reversals ki identification ke liye. Yeh pattern generally uptrend ke baad dikhayi deta hai aur price trend reversal ki indication deta hai. Double Top pattern ka matlab hota hai ki price do baar ek specific level tak pahunch kar phir se neeche aa gaya hai. Chaliye, mai aapko Double Top pattern ki wazahat Roman Urdu mein kar deta hoon::max_bytes(150000):strip_icc()/dotdash_Final_Trading_Double_Tops_And_Double_Bottoms_Jun_2020-01-ac00fe2588824f3f80e286a1905e6252.jpg) Double Top Pattern ki Wazahat:Double Top pattern ek aesa chart pattern hai jo bullish trend ke baad aata hai aur bearish trend ki shuruaat bataata hai. Yeh pattern usually do tops (chotiyaan) ko represent karta hai jo approximately same level par hote hain. Inn tops ke beech mein price neeche aata hai, jo ki ek potential trend reversal ki indication hai. Yeh pattern aksar is tarah dikhta hai: Uptrend: Pehle, ek strong uptrend (bullish trend) hoti hai, jismein price consistently upar ki taraf badh raha hota hai. First Top: Price uptrend ke dauran ek high point tak pahunchta hai, jise "First Top" kehte hain. Retracement: First Top ke baad price mein ek small retracement ya dip hoti hai. Yani price thoda neeche aata hai. Second Top: Retracement ke baad, price phir se upar badhta hai aur almost same level tak pahunchta hai, jise "Second Top" kehte hain. Yeh level generally First Top ke level se thoda kam ya same hota hai. Price Decline: Second Top ke baad price mein fir se downward movement shuru hoti hai aur price neeche jaane lagta hai. Support Break: Jab price neeche jaane lagta hai, toh aksar ek support level ko break karta hai. Yeh support level price movement ko rokne wala hota hai. Trend Reversal: Jab support break hota hai, toh yeh ek potential trend reversal signal hai aur traders ko yeh samjne mein madad karta hai ki ab price bearish direction mein jaane wala hai. Double Top pattern tab consider hota hai jab dono tops ke beech mein price ka movement horizontal ya neeche ki taraf hota hai. Agar aapko lagta hai ki price neeche jaane wala hai aur trend reversal hone wala hai, toh aap short positions ya sell orders istemal karke profit earn kar sakte hain. Lekin dhyan rahe ke pattern recognition mein hamesha kuch uncertainty hoti hai, aur false signals bhi ho sakte hain. Isliye, trading decision lene se pehle acchi tarah se analysis karein, aur risk management ka bhi khayal rakhein.

Double Top Pattern ki Wazahat:Double Top pattern ek aesa chart pattern hai jo bullish trend ke baad aata hai aur bearish trend ki shuruaat bataata hai. Yeh pattern usually do tops (chotiyaan) ko represent karta hai jo approximately same level par hote hain. Inn tops ke beech mein price neeche aata hai, jo ki ek potential trend reversal ki indication hai. Yeh pattern aksar is tarah dikhta hai: Uptrend: Pehle, ek strong uptrend (bullish trend) hoti hai, jismein price consistently upar ki taraf badh raha hota hai. First Top: Price uptrend ke dauran ek high point tak pahunchta hai, jise "First Top" kehte hain. Retracement: First Top ke baad price mein ek small retracement ya dip hoti hai. Yani price thoda neeche aata hai. Second Top: Retracement ke baad, price phir se upar badhta hai aur almost same level tak pahunchta hai, jise "Second Top" kehte hain. Yeh level generally First Top ke level se thoda kam ya same hota hai. Price Decline: Second Top ke baad price mein fir se downward movement shuru hoti hai aur price neeche jaane lagta hai. Support Break: Jab price neeche jaane lagta hai, toh aksar ek support level ko break karta hai. Yeh support level price movement ko rokne wala hota hai. Trend Reversal: Jab support break hota hai, toh yeh ek potential trend reversal signal hai aur traders ko yeh samjne mein madad karta hai ki ab price bearish direction mein jaane wala hai. Double Top pattern tab consider hota hai jab dono tops ke beech mein price ka movement horizontal ya neeche ki taraf hota hai. Agar aapko lagta hai ki price neeche jaane wala hai aur trend reversal hone wala hai, toh aap short positions ya sell orders istemal karke profit earn kar sakte hain. Lekin dhyan rahe ke pattern recognition mein hamesha kuch uncertainty hoti hai, aur false signals bhi ho sakte hain. Isliye, trading decision lene se pehle acchi tarah se analysis karein, aur risk management ka bhi khayal rakhein.

- Mentions 0

-

سا0 like

-

#9 Collapse

Double Top Chart Pattern: Double Top or Twofold Top example tab consider hota hai punch dono tops ke beech mein cost ka development even ya neeche ki taraf hota hai. Agar aapko lagta hai ki cost neeche jaane wala hai aur pattern inversion sharpen wala hai, toh aap short positions ya sell orders istemal karke benefit procure kar sakte hain.lekin dhyan rahe ke design acknowledgment mein hamesha kuch vulnerability hoti hai, aur bogus signs bhi ho sakte hain. Isliye, exchanging choice lene se pehle acchi tarah se examination karein, aur risk the executives ka bhi khayal rakhein.second Top ke baad cost mein fir se descending development shuru hoti hai aur cost neeche jaane lagta hai.Jab cost neeche jaane lagta hai, toh aksar ek support level ko break karta hai. Yeh support level cost development ko rokne wala hota hai.Jab support break hota hai, toh yeh ek potential pattern inversion signal hai aur dealers ko yeh samjne mein madad karta hai ki stomach muscle cost negative heading mein jaane wala hai. Design ek aesa outline design hai jo bullish pattern ke baad aata hai aur negative pattern ki shuruaat bataata hai. Yeh design normally do tops (chotiyaan) ko address karta hai jo around same level standard hote hain. Motel tops ke beech mein cost neeche aata hai, jo ki ek potential pattern inversion ki sign hai.Yeh design aksar is tarah dikhta hai Pehle, ek solid upswing (bullish pattern) hoti hai, jismein cost reliably upar ki taraf badh raha hota hai.Price upturn ke dauran ek high point tak pahunchta hai, jise "First Top" kehte hain. First Top ke baad cost mein ek little retracement ya plunge hoti hai. Yani cost thoda neeche aata hai.Retracement ke baad, cost phir se upar badhta hai aur practically same level tak pahunchta hai, jise "Second Top" kehte hain. Yeh level commonly First Top ke level se thoda kam ya same hota hai. Pattern Types: Specialized investigation design hai jo forex exchanging mein use hota hai, particularly cost inversions ki ID ke liye. Yeh design by and large upturn ke baad dikhayi deta hai aur cost pattern inversion ki sign deta hai. Twofold Top example ka matlab hota hai ki cost do baar ek explicit level tak pahunch kar phir se neeche aa gaya hai. Chaliye, mai aapko Twofold Top example ki wazahat Roman Urdu mein kar deta hoon Twofold TOP* Example DEFINITION*Ek twofold top Ek* very negative specialized inversion design hai Jo Kisi resource Ke musalsal Two successive exorbitant cost Tak comes to ke terrible banta hai Jismien 2 highs Ke Darmiyan moderate decay wakay ho rahi hai iski affirm is time Hoti Hai Poke asset* ki cost two prior* ke Darmiyaan low ke equivalent help level se Underneath hai NFLX Netflix inc ka use* karte tint next model mein Ham dekh sakte hain ki twofold tap ki development kya Dikhai Deti Hai* anyway is case mein Ham dekhte hain ke support ko Kabhi Nahin broken hai aur na hello uska investigation Kiya Ja sakta hai Kyunki stock mein izaffy specialized analysis* ke* sath rise Hota rahata Hai anyway awful Mein diagram Mein Koi dekh sakta hai ke stock* again banta hai amazon .com inc. Amazon ka hai upar wala outline aur yah Ek twofold graph design dikhata haiDOUBLE TOP versus Twofold TOP BOTTOMUp Pattern ke terrible Ek twofold top ek* negative inversion design hai Jo prepared Hota Ha

Design ek aesa outline design hai jo bullish pattern ke baad aata hai aur negative pattern ki shuruaat bataata hai. Yeh design normally do tops (chotiyaan) ko address karta hai jo around same level standard hote hain. Motel tops ke beech mein cost neeche aata hai, jo ki ek potential pattern inversion ki sign hai.Yeh design aksar is tarah dikhta hai Pehle, ek solid upswing (bullish pattern) hoti hai, jismein cost reliably upar ki taraf badh raha hota hai.Price upturn ke dauran ek high point tak pahunchta hai, jise "First Top" kehte hain. First Top ke baad cost mein ek little retracement ya plunge hoti hai. Yani cost thoda neeche aata hai.Retracement ke baad, cost phir se upar badhta hai aur practically same level tak pahunchta hai, jise "Second Top" kehte hain. Yeh level commonly First Top ke level se thoda kam ya same hota hai. Pattern Types: Specialized investigation design hai jo forex exchanging mein use hota hai, particularly cost inversions ki ID ke liye. Yeh design by and large upturn ke baad dikhayi deta hai aur cost pattern inversion ki sign deta hai. Twofold Top example ka matlab hota hai ki cost do baar ek explicit level tak pahunch kar phir se neeche aa gaya hai. Chaliye, mai aapko Twofold Top example ki wazahat Roman Urdu mein kar deta hoon Twofold TOP* Example DEFINITION*Ek twofold top Ek* very negative specialized inversion design hai Jo Kisi resource Ke musalsal Two successive exorbitant cost Tak comes to ke terrible banta hai Jismien 2 highs Ke Darmiyan moderate decay wakay ho rahi hai iski affirm is time Hoti Hai Poke asset* ki cost two prior* ke Darmiyaan low ke equivalent help level se Underneath hai NFLX Netflix inc ka use* karte tint next model mein Ham dekh sakte hain ki twofold tap ki development kya Dikhai Deti Hai* anyway is case mein Ham dekhte hain ke support ko Kabhi Nahin broken hai aur na hello uska investigation Kiya Ja sakta hai Kyunki stock mein izaffy specialized analysis* ke* sath rise Hota rahata Hai anyway awful Mein diagram Mein Koi dekh sakta hai ke stock* again banta hai amazon .com inc. Amazon ka hai upar wala outline aur yah Ek twofold graph design dikhata haiDOUBLE TOP versus Twofold TOP BOTTOMUp Pattern ke terrible Ek twofold top ek* negative inversion design hai Jo prepared Hota Ha  Two practically equivalent measured ki tops per mishtamil hai Jo level Mein Ek dusre ke close Hain Jo Ek* box Se separate Hain design ke zaria potential Pattern ke inversion ki demonstrate ki gai hai jisse show hota hai ke cost two Bar obstruction level for each pahunch chuki hai lekin isase past Mein incapable rahi hai yah* design Aksar merchants ki taraf se market mein extra decay ki expected mein sell ya short position Mein enter sharpen ke signal ke Taur per Dekha jata haiKEY Components OF A Twofold TOPtwo tops: design two pinnacle For every comprise hai Jo cost ke lihaz se ek dusre ke practically equivalent hai yah top opposition level ke Taur per work karti hai Jahan cost ruk jaati hai aur fall* start hai neck area; Neck area Ek flat line hai Jo valley ya box ke depressed spots ko jorne se banti hai yah muhawanat* ki degree ke Taur per work karta hai aur design ki affirmation ke liye zaruri hai neck area ka break: neck area ka break twofold top example ka key part hai Trading View: Design ki tafsilaat se merchants ko maloom hota hai ke purchasers ki taqat kamzor ho rahi hai aur stomach muscle dealers ki taqat barh rahi hai. Agar cost dobara se pehle top ko paar nahi kar pata, to yeh pointer ho sakta hai ke market negative pattern mein ja sakta hai. Twofold Top example ki section ordinarily doosri top ke neechay ki jaati hai, hit cost neechay jata hai. Aik normal leave procedure yeh ho sakti hai ke hit cost pehli bar design ke neechay jaye, brokers apni positions ko band kar dein Twofold Top example aik integral asset ho sakta hai, lekin isay affirm karne ke liye doosri specialized examination apparatuses jaise ke pattern lines aur oscillators ka istemal bhi zaroori hota hai. Twofold Top example forex exchanging mein aik ahem outline design hai jo negative inversion ki nishani ho sakti hai. Dealers ko is design ki samjh aur uske istemal ke liye zaroori maloomat hasil karni chahiye taake woh mazeed fruitful exchanging kar saken. Is design ko samajhne ke liye practice aur experience bhi zaroori hai.

Two practically equivalent measured ki tops per mishtamil hai Jo level Mein Ek dusre ke close Hain Jo Ek* box Se separate Hain design ke zaria potential Pattern ke inversion ki demonstrate ki gai hai jisse show hota hai ke cost two Bar obstruction level for each pahunch chuki hai lekin isase past Mein incapable rahi hai yah* design Aksar merchants ki taraf se market mein extra decay ki expected mein sell ya short position Mein enter sharpen ke signal ke Taur per Dekha jata haiKEY Components OF A Twofold TOPtwo tops: design two pinnacle For every comprise hai Jo cost ke lihaz se ek dusre ke practically equivalent hai yah top opposition level ke Taur per work karti hai Jahan cost ruk jaati hai aur fall* start hai neck area; Neck area Ek flat line hai Jo valley ya box ke depressed spots ko jorne se banti hai yah muhawanat* ki degree ke Taur per work karta hai aur design ki affirmation ke liye zaruri hai neck area ka break: neck area ka break twofold top example ka key part hai Trading View: Design ki tafsilaat se merchants ko maloom hota hai ke purchasers ki taqat kamzor ho rahi hai aur stomach muscle dealers ki taqat barh rahi hai. Agar cost dobara se pehle top ko paar nahi kar pata, to yeh pointer ho sakta hai ke market negative pattern mein ja sakta hai. Twofold Top example ki section ordinarily doosri top ke neechay ki jaati hai, hit cost neechay jata hai. Aik normal leave procedure yeh ho sakti hai ke hit cost pehli bar design ke neechay jaye, brokers apni positions ko band kar dein Twofold Top example aik integral asset ho sakta hai, lekin isay affirm karne ke liye doosri specialized examination apparatuses jaise ke pattern lines aur oscillators ka istemal bhi zaroori hota hai. Twofold Top example forex exchanging mein aik ahem outline design hai jo negative inversion ki nishani ho sakti hai. Dealers ko is design ki samjh aur uske istemal ke liye zaroori maloomat hasil karni chahiye taake woh mazeed fruitful exchanging kar saken. Is design ko samajhne ke liye practice aur experience bhi zaroori hai.  Outline week after week USD/JPY diagram ko show karta hai Twofold Top example pehlay say oper kay pattern kay awful jes ke pehle top RSI oscillator ke madd say he ke ja sakte hello jo keh RSI oscillator ke madad say overbought signal ko demonstrate karte yeh forex market mein overbought signal kay sath cost mein kame aa jate dosree top terrible pechle say areas of strength for or thore ce dair kay ley opposition ke level ko break kar dayte RSI obstruction kay sath overbought ka koi signal nahi dayta heyyeh 2 tops jo forex market mein raftar ke kame ko zahair karta es noyat ke signal Disparity negative ke taraf eshara kartay hein Twofold Example aam peak standard forex market mein money market mein demonstrate hota jo keh forex market kay purchase ya sell signal kay pinnacle standard show hota hello nechay dey gay graph standard mesaen es bat ko frahm karte hein keh dono diagram design ka hawalla jaat ko estamal keya ja sakta or es bt ko hawala deya jata hello keh forex exchanging ke passage or leave signal kay to standard estaml keya ja sakta yeh design mokhtalef tarekon say estamal keya ja sakta hein

Outline week after week USD/JPY diagram ko show karta hai Twofold Top example pehlay say oper kay pattern kay awful jes ke pehle top RSI oscillator ke madd say he ke ja sakte hello jo keh RSI oscillator ke madad say overbought signal ko demonstrate karte yeh forex market mein overbought signal kay sath cost mein kame aa jate dosree top terrible pechle say areas of strength for or thore ce dair kay ley opposition ke level ko break kar dayte RSI obstruction kay sath overbought ka koi signal nahi dayta heyyeh 2 tops jo forex market mein raftar ke kame ko zahair karta es noyat ke signal Disparity negative ke taraf eshara kartay hein Twofold Example aam peak standard forex market mein money market mein demonstrate hota jo keh forex market kay purchase ya sell signal kay pinnacle standard show hota hello nechay dey gay graph standard mesaen es bat ko frahm karte hein keh dono diagram design ka hawalla jaat ko estamal keya ja sakta or es bt ko hawala deya jata hello keh forex exchanging ke passage or leave signal kay to standard estaml keya ja sakta yeh design mokhtalef tarekon say estamal keya ja sakta hein

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

what is Double Top Pattern:? INTRODUCTION&EXPLANATION: sirr,, My dear members,Double Top pattern forex market mein 2 higher points shamel hotay hein jo keh forex market mein aik anay walay bearish reversal signal ko identify kartay hein forex market ke price mein aik mape hve kame 2 higher points ko indicate karte hey jo forex market ke price ke kame or forex market ke peaks ko resistance ko dekhatate hey forex market kay aik hesay donbara hasel karnay kay bad yeh forex market ke 1st peak kay oper gap rakhnay kay qabel hotay hein forex market mein slow raftar ka saboot RSI jaisay oscillator ke madad say he keya ja sakta hey jo keh aik pechay rehnay wala indicator hota hey chahay forex market mein short he kun na ho or yeh forex market mein nechay ke taraf trend karnay par oksa sakta hey dono prie kaydarmean low price par neck line ho sate hey es gap par double top pattern frex market kay gap ke confirmation karay gaPehchan Double Top Pattern:? sirr,, es pattern mein 2 peaks hone chihay jes mein width or Hight aik jaice hone chihay peaks kay darmean mein fasla bohut he kam nahi hona chihay yeh time frame par he depend karta hey neckline support price line ke confirmation karte hey Double Bearish signal ke confirmation karte hey or dosray technical indicator ka bhe estamal karna chihay jaisay RSI, Moving Average or oscillator shamel hein [/INDENT][/COLOR] Trade with Double Top Pattern Double Pattern aam tor par forex market mein currency market mein indicate hota hey jo keh forex market kay buy ya sell signal kay tor par indicate hota hey nechay dey gay chart par mesaen es bat ko frahm karte hein keh dono chart pattern ka hawalla jaat ko estamal keya ja sakta hey or es bt ko hawala deya jata hey keh frex trading ke entry or exit signal kay to par estaml keya ja sakta hey yeh pattern mokhtalef tarekon say estamal keya ja sakta hey

oper deya geya chart weekly USD/JPY chart ko indicate karta hey Double Top pattern pehlay say oper kay trend kay bad jes ke pehle peak RSI oscillator ke madd say he ke ja sakte hey jo keh RSI oscillator ke madad say overbought signal ko indicate karte hey yeh forex market mein overbought signal kay sath price mein kame aa jate hey dosree peak bad pechle say qadray strong hote hey or thore ce dair kay ley resistance ke level ko break kar dayte hey RSI resistance kay sath overbought ka koi signal nahi dayta heyyeh 2 tops jo forex market mein raftar ke kame ko zahair karta hey es noyat ke signal Divergence bearish ke taraf eshara kartay hein THANKS TO ALLL MY SWEET MEMBERS.......,,,,,,,,,,,,,,,,,,,,

- Mentions 0

-

سا0 like

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:27 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим