What is cup and handle chart pattern:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

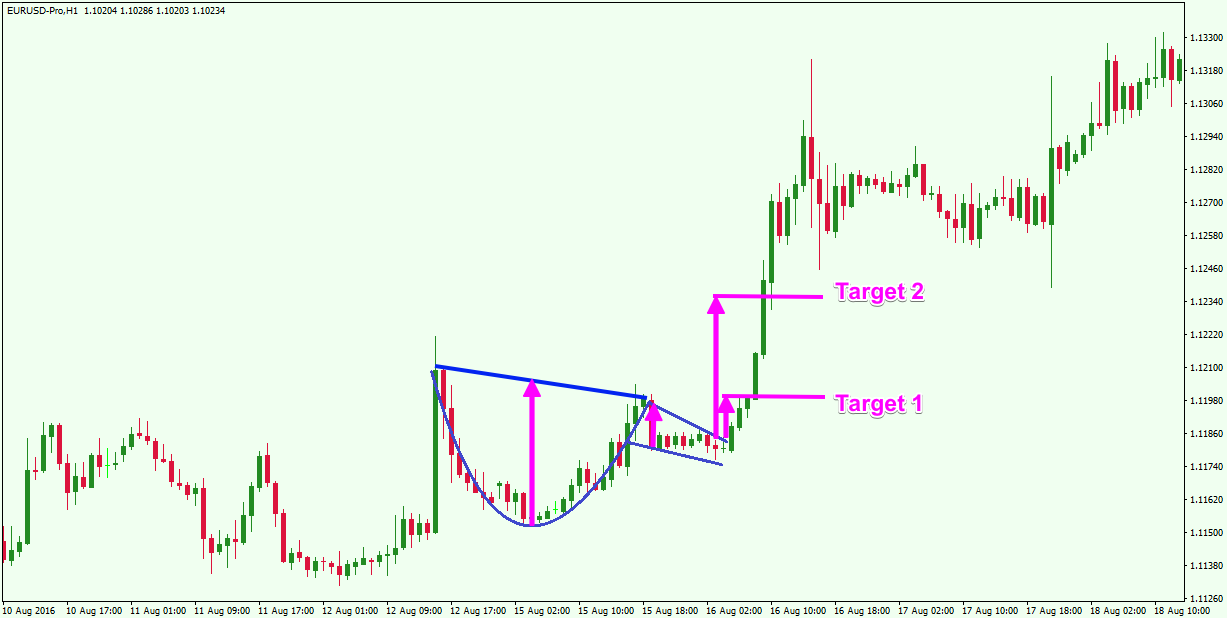

WHAT IS CUP AND HANDLE CHART PATTERN:Cup and Handle sample Pattern tab complete hota hai jab qeemat cope with ki consolidation variety se bahar nikalti hai, aam taur par oopar ki taraf. Breakout ek ahem sign hota hai attern ka pehla marhala cup ki shakal ki hota hai, jisme qeemat ki harqat ek tea cup ki tarah gol hoti hai. Isse pata chalta hai ke maal ki qeemat ne neeche aana band kar diya hai aur ek mogheeri taraf ki taraf jane lagegi. Cup ki shakal ko easy aur rounded curve ke saath banana zaroori hai, bina qeemati teziyon ke. Traders talaash karte hain, kyunke yeh ek mumkin bullish move ki taraf ishara karta hai. Lekin, tasdeeq ke liye zyada trading volume ka intezar zaroori hai, kyunke agar breakout mein wusat na ho to yeh itna qabil-e-aitbaar nahi hota.Ek aisa technical analysis pattern hai jo maaliyat mein mumkin trend reversals ki pehchaan karne ke liye traders aur buyers dwara istemal hota hai. Is pattern ki pehchaan uske mukhtalif aur chai ke kulhad ki shakal se hoti hai, jiska baad mein ek chota consolidation hota hai jo "take care of" kehlata hai. Traders aksar is pattern ka istemal ek utarte hue fashion ke baad hone wale bullish moves ki tashkhees ke liye karte hain. HANDLE KI CONSOLIDATION :

Cup formation ke baad, qeemat ek consolidation marhale mein aati hai jo manage kehlata hai. Handle kiup aur handle pattern traders ke liye aik pasandida technical analysis device hai jo mumkin fashion reversals aur bullish mauqay ki tashkhees ke liye istemal hota hai. Cup ki khaas uper niche hota rehta ha iske bd fee aik chute se consolidation period chala jta ha consolidation duration mtlb k aik smmit variety is consolidation period ka jhokao uper ki jnb hota ha is consolidation period ko is term ka take care of khte ha iske bd jb term me breakout hota ha tb market ko samjhne aur breakout ke saath tasdeeq ko pehchankar, traders maqool trading faislay lene mein madad hasil kar sakte hain. Lekin, jaise har technical analysis tool, iski mehdoodiyat ko bhi ghor se ghor karke aur isse aik mukamm consolidation mein qeemat mein thoda neeche aana hota hai, jisse aksar ek flag ya pennant sample banta hai. Handle, chote cup formation ke bade cup ke andar ek temporary rukawat hai aur yeh ek thora sa waqt guzarne se pehle hone wale trend ko sign karta hai.

-

#3 Collapse

Cup and Handle Chart Pattern (Ú©Ù¾ اور Ûینڈل چارٹ پیٹرن) ek ahem technical analysis pattern hai jo financial markets mein istemal hota hai, khaaskar stocks aur commodities ke price charts ko analyze karne mein. Is pattern ka main maqsad trend continuation ya trend reversal points ko pehchanna hota hai. **Cup and Handle Pattern Ka Banawat:** Cup and handle pattern ek specific price pattern ko darust karta hai, jo aam taur par do hisson se mil kar banta hai: 1. **Cup (Ú©Ù¾):** Pehla hissa "Cup" ke tor par hota hai. Is mein price chart par ek rounding bottom ya U-shape banti hai, jise "Ú©Ù¾" kehte hain. Is "Cup" ke neechay price pehle gir kar upar aata hai aur phir dubara upar jata hai, lekin ye upper movement slow hoti hai. 2. **Handle (Ûینڈل):** Dusra hissa "Handle" ke tor par hota hai. Ye pattern mein cup ke baad ek small price consolidation ya pullback hoti hai jo "Ûینڈل" ki shakal bana leti hai. Handle typically downward-sloping hota hai aur price tham jati hai. **Cup and Handle Pattern Ki Ahmiyat:** Cup and handle pattern bullish continuation ya reversal signal ke tor par istemal hota hai: - Agar ye pattern uptrend ke baad aata hai, to ye bullish continuation ki taraf ishara karta hai, yaani trend ko jari rakhne ki sambhavna hoti hai. - Agar ye pattern downtrend ke baad aata hai, to ye bullish reversal ki taraf ishara karta hai, yaani bearish trend ko khatma karne aur naye bullish trend ki shuruaat hone ki sambhavna hoti hai. - Is pattern ko tasdeek karne ke liye traders typically handle ke upper breakout ka intezar karte hain. Jab price handle ke upper se bahar nikal jata hai, to ye pattern complete hota hai. **Cup and Handle Pattern Ke Fayde:** - Ye pattern traders ko potential entry aur exit points faraham karta hai. - Is pattern ki wajah se traders trend ke continuity ya reversal ko samajh sakte hain. - Cup and handle pattern aik visual pattern hai jo traders ko price action ko samajhne mein madadgar hota hai. **Akhir Mein:** Cup and Handle Chart Pattern ek ahem technical tool hai jo traders aur investors ke liye market analysis mein madadgar hota hai. Lekin, yaad rahe ke kisi bhi pattern ki tarah, ye bhi 100% pur-asar nahi hota aur false signals bhi aa sakte hain. Isliye, is pattern ko dusre technical indicators aur risk management strategies ke sath istemal karna zaroori hai trading ke faislay lene se pehle. -

#4 Collapse

Cup and Handle chart pattern ek popular bullish continuation pattern hai jo trading mein technical analysis ke zariye identify kiya jata hai. Yeh pattern ek lambe duration ke consolidation period ke baad market ke bullish trend ke continuation ko indicate karta hai. Cup and Handle pattern aksar stocks, commodities, aur forex markets mein paya jata hai.

Cup and Handle Pattern ka Structure

Yeh pattern do main parts se milkar banta hai: cup aur handle.- Cup:

- Shape: Cup ka shape rounded hota hai aur yeh deep U-shape banata hai. Yeh rounded bottom bullish signal deta hai ke market gradual tareeke se apni niche se upar ki taraf move kar raha hai.

- Duration: Cup portion aksar 1 se 6 months tak ka time period cover karta hai, lekin kabhi kabhi yeh period is se zyada bhi ho sakta hai.

- Depth: Cup ki depth vary karti hai, lekin generally yeh depth 15% se 30% tak hoti hai.

- Handle:

- Shape: Handle cup ke baad banta hai aur yeh ek small consolidation phase hota hai. Handle aksar flag ya pennant shape mein banta hai.

- Duration: Handle ka duration cup se kam hota hai, aksar yeh 1 se 4 weeks tak ka hota hai.

- Depth: Handle ki depth bhi kam hoti hai, yeh aksar cup ki depth ka 10% se 15% hota hai.

- Uptrend:

- Cup and Handle pattern ka formation aksar ek strong uptrend ke baad hota hai. Yeh pattern ek bullish continuation signal hota hai, iska matlab hai ke yeh pehle se chal rahi bullish trend ko continue karne ka indication deta hai.

- Cup Phase:

- Market gradually niche girta hai aur rounded bottom form karta hai. Yeh bottom ek U-shape banata hai jahan buyers slowly phir se market mein interest lena shuru karte hain aur prices ko upar push karte hain.

- Handle Phase:

- Jab price cup ke resistance level ke qareeb pahunchti hai, to market mein thodi profit-taking hoti hai aur prices slightly niche girti hain, is phase ko handle kehte hain. Yeh handle ek small consolidation phase hota hai jahan market thodi der ke liye sideways move karta hai.

- Breakout:

- Handle ke formation ke baad, jab price handle ke resistance level ko break karti hai, to yeh signal hota hai ke bullish trend ab phir se continue hoga. Breakout ke baad prices aksar significant upar jati hain.

Cup and Handle Pattern ki Identification ke Steps- Identify Uptrend:

- Sabse pehle uptrend ko identify karein jo cup and handle pattern ke formation se pehle chal rahi hoti hai. Yeh zaroori hai ke pattern ek bullish market mein form ho raha ho.

- Identify Cup Shape:

- Ek rounded U-shape cup ko identify karein jo gradual bottom banata hai. Is cup ka duration aur depth note karein.

- Identify Handle Shape:

- Cup ke formation ke baad ek small consolidation phase ya handle ko identify karein. Handle ki shape ko dekhein ke woh flag ya pennant pattern mein hai.

- Volume Analysis:

- Cup and handle pattern mein volume ka analysis bohot aham hai. Cup ke formation ke dauran volume gradually decrease hota hai aur jab handle form hota hai to volume phir se slightly increase hota hai. Jab breakout hota hai, to volume significant increase hona chahiye.

- Breakout Confirmation:

- Jab handle ka resistance level break hota hai, to yeh confirmation hoti hai ke pattern complete ho gaya hai aur bullish trend continue hoga. Breakout ke waqt volume ka increase hona zaroori hai taake breakout ko confirm kiya ja sake.

- Entry Point:

- Entry point handle ke breakout point par hota hai. Jab price handle ke resistance level ko break karti hai aur volume significant increase hota hai, to yeh ek buy signal hota hai.

- Stop-Loss:

- Stop-loss ka placement bohot zaroori hai taake potential losses ko minimize kiya ja sake. Stop-loss aksar handle ke lowest point ke neeche lagaya jata hai.

- Profit Target:

- Profit target calculate karne ke liye cup ki depth ko measure karein. Cup ki depth ko breakout point se add karein taake expected profit target mil sake. Yeh ek conservative tareeqa hai profit target set karne ka.

Pros:- Bullish Continuation: Yeh pattern ek strong bullish continuation signal deta hai jo ke traders ko long positions lene mein madadgar hota hai.

- Reliable Pattern: Yeh pattern aksar reliable hota hai aur accurate predictions deta hai agar sahi tareeke se identify aur confirm kiya jaye.

- Volume Confirmation: Volume analysis ke zariye breakout ko confirm karne ka moka milta hai jo ke signals ko aur zyada reliable banata hai.

Cons:- Time-Consuming: Yeh pattern form hone mein kaafi time leta hai, jo ke impatient traders ke liye mushkil ho sakta hai.

- False Breakouts: Kabhi kabhi false breakouts bhi ho sakte hain jo ke misleading signals de sakte hain aur losses ka sabab ban sakte hain.

- Identification Issues: Is pattern ko accurately identify karna har trader ke liye asaan nahi hota, isliye experience aur practice zaroori hai.

Ek stock uptrend mein hai aur phir gradually niche gir kar ek rounded bottom banata hai, jo ke cup ka formation hota hai. Yeh cup 3 months ka period cover karta hai aur iska depth 20% hota hai. Phir stock thodi der ke liye sideways move karta hai aur ek flag shape ka handle banata hai jo ke 3 weeks ka period cover karta hai. Handle ka depth 10% hota hai. Jab stock handle ke resistance level ko break karta hai aur volume significant increase hota hai, to yeh ek buy signal hota hai.

Trader apni entry handle ke breakout point par karta hai aur stop-loss handle ke lowest point ke neeche lagata hai. Cup ki depth ko breakout point se add karke profit target set karta hai. Agar cup ki depth 20% hai, to trader breakout point se 20% upar apna profit target set karta hai.

Cup and Handle pattern ek strong bullish continuation pattern hai jo traders ko market ke bullish trend ko identify aur capitalize karne mein madadgar hota hai. Is pattern ko accurately identify karna aur confirm karna zaroori hai taake trading decisions reliable aur profitable hon. Volume analysis aur breakout confirmation ke zariye traders apne signals ko aur zyada reliable bana sakte hain. Trading mein in patterns ka sahi istemaal experience aur practice ke zariye hi aata hai, isliye regular analysis aur learning ka process zaroori hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Cup:

-

#5 Collapse

The cup and handle chart pattern is a technical analysis pattern used in trading. It consists of a cup-shaped price pattern followed by a smaller, sideways consolidation or retracement (the "handle"). This pattern often signals a continuation of an uptrend, with the handle serving as a brief pause before further upward movement. Traders often look for a breakout above the handle's resistance level as a signal to enter a long position. The "cup and handle" chart pattern ek technical analysis pattern hai jo trading mein istemal hota hai. Ye ek cup-shaped price pattern ko follow karta hai jo baad mein ek chhota, sideways consolidation ya retracement (handle) hota hai. Ye pattern aksar uptrend ka continuation signal deta hai, jahan handle ko ek chhoti si rukawat ke roop mein dekha jata hai, phir mazeed upward movement ke liye. Traders aksar handle ke resistance level ke upar breakout ka intezar karte hain, jaise hi long position mein dakhil hone ka signal milta hai.

Cup and handle chart pattern ek technical

analysis pattern hai jisme ek cup-shaped price pattern hota hai, uske baad ek chhota sideways consolidation ya retracement aata hai, jise handle kehte hain. Ye pattern aksar uptrend ka continuation signal deta hai, handle ko ek brief pause ke roop mein dekha jata hai, phir further upward movement ke liye. Traders handle ke resistance level ke breakout ka intezar karte hain, jo ek long position ke liye entry ka signal hota hai.

Cup and handle chart pattern ek technical analysis pattern hai. Isme ek "cup" shaped price pattern hota hai, fir ek chhota sideways consolidation ya retracement aata hai jo "handle" kehlata hai. Ye pattern aksar uptrend ka continuation signal deta hai. Traders handle ke resistance level ke breakout ka wait karte hain, jo ek long position ke liye signal hota hai.

Cup and handle chart pattern ek technical analysis pattern hai jo trading mein istemal hota hai. Isme ek cup-shaped price pattern hota hai, uske baad ek chhota consolidation phase aata hai jo handle kehlata hai. Ye pattern aksar uptrend ka continuation signal deta hai. Traders handle ke breakout ka wait karte hain, jo ek long position ke liye entry point hota hai.

Cup and handle chart pattern ek technical analysis pattern hai jo trading mein istemal hota hai. Isme ek cup-shaped price pattern hota hai, uske baad ek chhota consolidation phase aata hai jo handle kehlata hai. Ye pattern aksar uptrend ka continuation signal deta hai. Traders handle ke breakout ka wait karte hain, jo ek long position ke liye entry point hota hai.

Cup and handle chart pattern ek technical analysis pattern hai jo trading mein istemal hota hai. Isme ek cup-shaped price pattern hota hai, uske baad ek chhota consolidation phase aata hai jo handle kehlata hai. Ye pattern aksar uptrend ka continuation signal deta hai. Traders handle ke breakout ka wait karte hain, jo ek long position ke liye entry point hota ha

-

#6 Collapse

**Cup and Handle Chart Pattern Kya Hai?**

Cup and Handle chart pattern stock market mein bohat mashhoor hai, aur isko technical analysis mein istimaal kiya jata hai taake price movement ko samjha ja sake. Ye pattern aksar bullish signal deti hai, yani ke price upar jane ke chances zyada hote hain.

Cup and Handle Pattern Ka Structure

Cup and Handle pattern do hisson par mushtamil hoti hai:

1. **Cup**:

- Ye part round ya "U" shape ka hota hai.

- Is mein pehle price girta hai, phir low banata hai, aur phir wapas upar chala jata hai.

- Cup ka shape smooth aur symmetrically curved hota hai, jaise ek cup ka bottom hota hai.

2. **Handle**:

- Cup ke baad ek chhoti consolidation ya correction hoti hai, jo handle kehlati hai.

- Ye handle aksar sideways ya thoda downward move karta hai.

- Handle ka shape aksar flag ya pennant pattern se milta julta hota hai.

Cup and Handle Pattern Ko Pehchan'ne Ka Tariqa

1. **Trend**:

- Pattern se pehle ek upward trend hona chahiye, yani ke price already upar ja rahi ho.

2. **Cup**:

- Cup ka bottom rounded hona chahiye, na ke sharp.

- Cup ka depth (gehraai) kam az kam 1/3 ya 1/2 of the previous upward move ka hona chahiye.

3. **Handle**:

- Handle ko cup ke upper half mein form hona chahiye.

- Handle ka duration cup ke duration se chhota hota hai.

4. **Breakout**:

- Jab handle ke baad price handle ke resistance level ko break karti hai, to ye confirmation hota hai ke pattern complete ho gaya hai aur bullish trend shuru hone wala hai.

Cup and Handle Pattern Ka Matlaab

Ye pattern bullish continuation signal hoti hai. Iska matlab hai ke agar market mein pehle se hi upward trend hai aur ye pattern form hota hai, to uske baad bhi price aur upar ja sakti hai.

Trading Strategy

1. **Entry Point**:

- Jab price handle ke resistance level ko break kare, tab entry karni chahiye.

2. **Stop Loss**:

- Handle ke lowest point par stop loss set karna chahiye, taake risk ko control kiya ja sake.

3. **Target**:

- Price target ko measure karne ke liye, cup ke depth ko handle ke breakout point par add kar sakte hain.

Conclusion

Cup and Handle chart pattern ek reliable aur effective tool hai technical analysis mein. Isko sahi tareeke se identify karke aur iski strategy ko follow karke traders market mein acha munafa kama sakte hain. Yad rahe, technical analysis ke sath sath risk management bhi zaroori hai, taake potential losses se bacha ja sake. -

#7 Collapse

### Cup and Handle Chart Pattern Kya Hai?

**Cup and Handle chart pattern** ek popular technical analysis pattern hai jo market mein bullish reversal aur continuation signals ko identify karne mein madad karta hai. Yeh pattern ek cup aur handle ki shape ki tarah dikhai deta hai aur trading charts par ek distinctive formation create karta hai. Aaiye, is pattern ko detail mein samjhte hain aur dekhtay hain ke yeh forex trading aur stock markets mein kaise use kiya ja sakta hai.

**1. Cup and Handle Pattern Ka Basic Concept**

Cup and Handle pattern ek bullish pattern hai jo typically ek long-term uptrend ke continuation ya ek downtrend ke reversal ko indicate karta hai. Is pattern ka structure ek cup aur uske saath handle ki tarah hota hai, jo ek rounded shape banata hai.

**2. Pattern Ki Formation**

- **Cup Formation:** Cup formation ek rounded shape mein hoti hai jo market ke gradual decline aur uske baad recovery ko show karti hai. Is phase ke dauran, price pehle decline karti hai aur phir gradual recovery dikhati hai, jo ek cup ki shape banata hai. Cup ka bottom usually shallow hota hai aur smooth round shape ko reflect karta hai.

- **Handle Formation:** Cup ke baad, ek consolidation phase aati hai jahan price sideways movement dikhati hai, jo handle ki shape banata hai. Handle typically cup ke right side mein hota hai aur iske formation ke dauran, price thoda decline karti hai ya consolidation phase mein hoti hai. Handle ki formation cup ke high level ke below hoti hai aur yeh pattern ke consolidation phase ko indicate karta hai.

- **Breakout:** Handle ke complete hone ke baad, price ek breakout dikhati hai jo handle ke high level ko break karta hai. Yeh breakout bullish trend ke continuation ya reversal ka signal hota hai, jo traders ko buying opportunities provide karta hai.

**3. Key Characteristics**

- **Shape:** Cup and Handle pattern ki shape ek cup aur uske saath handle ki tarah hoti hai. Cup rounded shape mein hota hai aur handle consolidation ya sideways movement ko reflect karta hai.

- **Volume Analysis:** Volume pattern ke formation ke dauran bhi important hota hai. Cup formation ke dauran volume decrease hoti hai, aur handle formation ke dauran bhi volume low hoti hai. Breakout ke dauran volume increase hota hai, jo bullish signal ko confirm karta hai.

- **Time Frame:** Cup and Handle pattern typically long-term trend changes ko indicate karta hai aur yeh pattern develop hone mein time lag sakta hai. Traders ko patience aur careful analysis ki zaroorat hoti hai is pattern ko accurately identify karne ke liye.

**4. Trading Strategy**

- **Entry Point:** Traders usually handle ke completion aur breakout ke baad entry point consider karte hain. Jab price handle ke high level ko break karti hai, toh buying signal generate hota hai.

- **Stop-Loss Aur Take-Profit Levels:** Risk management ke liye stop-loss orders ko handle ke low level ke nazdeek set kiya jata hai. Take-profit levels ko recent price movements aur target levels ke basis par set kiya jata hai.

- **Confirmation Tools:** Pattern ke signals ko confirm karne ke liye, traders technical indicators jaise Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ka use kar sakte hain.

**5. Conclusion**

Cup and Handle chart pattern forex trading aur stock markets mein ek effective tool hai jo bullish reversal aur continuation signals ko identify karne mein madad karta hai. Is pattern ki distinct cup aur handle shape traders ko potential buying opportunities aur trend changes ko detect karne mein help karti hai. Accurate pattern recognition aur effective trading strategies ke zariye, traders successful trades execute kar sakte hain aur market ke potential opportunities ka faida utha sakte hain.

-

#8 Collapse

### Cup and Handle Chart Pattern: Kya Hai Aur Kaise Kaam Karta Hai?

Cup and Handle chart pattern ek popular technical analysis tool hai jo bullish reversal aur continuation signals ko darshata hai. Yeh pattern aksar long-term price movements mein dekha jata hai aur traders ko entry aur exit points identify karne mein madad karta hai. Is post mein, hum cup and handle pattern ki definition, iski khasiyat, aur iska trading mein istemal kaise kiya ja sakta hai, par baat karenge.

#### Cup and Handle Pattern Kya Hai?

Cup and Handle pattern ka naam iski shape se hai, jo ek cup ke form mein banta hai aur phir uske upar ek handle banta hai. Is pattern ko do main phases mein divide kiya ja sakta hai:

1. **Cup Formation**: Yeh phase price ki downward movement se shuru hota hai, jahan price pehle girti hai aur phir dheere dheere recover karti hai, jo cup ki shape banata hai. Cup ki depth ideally chhoti honi chahiye, taake yeh strong reversal signal provide kare.

2. **Handle Formation**: Cup ke baad, price thodi der ke liye consolidation mein chali jaati hai, jo handle ki tarah hota hai. Is phase mein price thoda girega, lekin yeh cup ke higher levels se zyada nahi girna chahiye. Handle ka formation typically short-term traders ke liye hota hai.

#### Khasiyat

1. **Bullish Indicator**: Cup and Handle pattern aksar bullish sentiment ko darshata hai. Is pattern ke complete hone par, traders ko price ke barhne ki umeed hoti hai.

2. **Volume Analysis**: Is pattern ke saath volume bhi ek important factor hai. Jab price handle formation ki taraf ja rahi hoti hai, to volume mein decrease hona chahiye, lekin jab price breakout hoti hai, to volume ka increase hona zaroori hai.

3. **Time Frame**: Cup and Handle pattern ko kisi bhi time frame par dekha ja sakta hai, lekin yeh daily aur weekly charts par zyada reliable hota hai.

#### Trading Strategy

1. **Entry Point**: Traders ko handle ke upper resistance level ke break hone par entry lene ka sochna chahiye. Jab price cup ke high ko todti hai, to yeh bullish breakout ka signal hota hai.

2. **Stop Loss**: Risk management ke liye, stop loss ko handle ke low ke neeche set karna chahiye. Yeh unexpected price movements se protection provide karta hai.

3. **Target Setting**: Target price ko previous resistance levels ya cup ki depth ke mutabiq set karna chahiye. Yeh aapko potential profit taking points dikhata hai.

### Conclusion

Cup and Handle chart pattern ek powerful tool hai jo bullish reversals aur continuations ko darshata hai. Is pattern ko sahi tarike se identify karne aur trade karne ke liye volume analysis, price action, aur proper risk management ka istemal zaroori hai. Jab aap is pattern ka istemal karte hain, to aapko market ke potential movements ka andaza lagane ka mauqa milta hai, jo aapki trading strategy ko behtar banata hai.

-

#9 Collapse

Cup and Handle Chart Pattern

Cup and Handle Pattern kya hai?

Cup and handle chart pattern ek technical analysis tool hai jo aam tor par stock market aur Forex trading mein istemal hota hai. Yeh pattern bullish (upward) trend ka izhar karta hai aur isay long-term price movement ke liye ek indicator ke tor par dekha jata hai. Is pattern ka naam iski shakal ki wajah se rakha gaya hai, jo ek pyale (cup) aur ek handle ki tarah nazar aata hai.

Cup ka Hisso

Cup ka hissa ek 'U' shakal mein hota hai, jahan pehle stock ki price ek point par girti hai, phir dhire dhire upar ki taraf aati hai takay yeh apne pehle ke high point tak pahunche. Iska matlab yeh hai ke market mein selling pressure kam hota hai aur buyers ki demand barhti hai. Jab price is 'U' shape mein hoti hai, to yeh indicate karta hai ke market apne aap ko recover kar raha hai. Yeh hissa aam tor par 1 se 6 mahine tak chal sakta hai.

Handle ka Hisso

Cup ke baad, handle ka hissa aata hai. Handle ka hissa kuch kya dafa hota hai jab price thodi si aur girti hai, phir phir se upar aati hai. Yeh phase kuch dino se le kar ek maheen tak chal sakta hai. Handle ka purpose yeh hai ke yeh ek minor consolidation period show karta hai jahan traders apne positions ka intezar karte hain. Agar handle ke doraan price thoda gira jata hai, to yeh is baat ka izhar hota hai ke yeh pattern ek strong bullish trend ki taraf badhne ke liye tayyar hai.

Cup and Handle Pattern ka Pehchan

Cup and handle pattern ko pehchanne ke liye kuch cheezon par ghor karna zaroori hai:- U Shape: Cup ka hissa achi tarah se 'U' shakal mein hona chahiye, aur yeh aaraam se dikhayi dena chahiye.

- Volume: Cup ke doraan trading volume badhni chahiye jab price recover hoti hai, lekin handle ke doraan volume kam hona chahiye.

- Breakout Point: Jab price handle ke upper boundary ko todti hai, to yeh bullish breakout ka signal hota hai.

Conclusion

Cup and handle pattern traders ko long-term bullish trades ka mauqa deta hai. Is pattern ko samajhna aur istemal karna sikhna ek acha trading strategy hai, lekin hamesha risk management ke strategies ko mad-e-nazar rakhna bhi zaroori hai. Trading mein kisi bhi pattern ka istemal karte waqt, market ki overall condition aur fundamentals ko bhi dekhna chahiye. Is tarah, cup and handle pattern ko istemal karke aap apne trading decisions ko behtar bana sakte hain.

⚡ "Profit is the reward for patience, loss is the fee for learning." 💡 -

#10 Collapse

Cup and Handle Chart Pattern Kya Hai?

Cup and Handle chart pattern ek mashhoor trading pattern hai jo aksar stock market aur financial markets mein dekha jata hai. Ye pattern khas tor par bullish reversal ki taraf ishara karta hai, jahan ek downward trend ke baad price ek certain range mein consolidate hoti hai, phir upar ki taraf break karti hai. Is maqale mein, hum cup and handle pattern ke mukhtalif pehluon par roshni dalenge.

1. Cup and Handle Pattern Ka Structure

Cup and handle pattern do hissoon par mushtamil hota hai: "Cup" aur "Handle". Cup aksar ek U-shape ya circular shape mein hota hai, jabke handle thoda sa downward sloping hota hai. Cup ka formation tab hota hai jab price pehle girti hai, phir dhire dhire upar aati hai aur apni previous high ki taraf wapas jati hai. Iske baad, handle ka formation hota hai, jahan price kuch waqt tak consolidate hoti hai ya choti si girawat karti hai. Is consolidation ke baad agar price upar ki taraf break kare, to ye bullish signal hota hai.

2. Cup Aur Handle Ki Pehchan

Cup aur handle pattern ki pehchan karne ke liye kuch khaas baaton ka khayal rakhna chahiye. Pehle, cup ka depth zyada nahi hona chahiye; ye 10% se 30% tak girawat mein ho sakta hai. Cup ka duration aam tor par 1 se 6 mahinon tak hota hai. Handle ka duration 1 se 4 weeks ke beech hota hai. Is pattern ka sab se ahem pehlu ye hai ke handle ke baad price ki upward movement honi chahiye, jo trader ke liye entry point tay karega.

3. Cup and Handle Pattern Ki Importance

Cup and handle pattern ki importance un traders ke liye bohat zyada hai jo bullish trends ko dhoondte hain. Ye pattern na sirf price movements ko samajhne mein madad karta hai, balki ye traders ko entry aur exit points tay karne mein bhi help karta hai. Jab ek trader is pattern ko pehchanta hai aur price handle se break karti hai, to ye ek clear signal hota hai ke price mein bullish momentum aa raha hai. Is pattern ki madad se trader risk ko manage kar sakta hai aur profit potential ko maximize kar sakta hai.

4. Cup and Handle Pattern Ka Trading Strategy

Is pattern ko trading mein istemal karne ke liye kuch strategies hain jo traders follow karte hain. Pehle, trader ko cup aur handle ka formation dekhna chahiye. Jab handle complete hota hai aur price upper resistance line ko break karti hai, to ye entry point hota hai. Is waqt, stop-loss order ko handle ke neeche rakha jata hai taake risk ko minimize kiya ja sake. Trader ko apne target price ko bhi tay karna chahiye, jo aksar cup ke highest point se nikaala jata hai.

5. Cup and Handle Pattern Ke Limitations

Jab ke cup and handle pattern ek reliable bullish signal hai, lekin iske kuch limitations bhi hain. Ye pattern hamesha successful nahi hota aur kabhi kabhi price expected direction mein nahi jaati. Isliye, traders ko is pattern par akeli hi rely nahi karna chahiye. Market ke baaqi indicators, jese ke volume, RSI (Relative Strength Index), aur support and resistance levels ko bhi madde nazar rakhna chahiye. Yeh saare elements milkar trading decision ko behtar bana sakte hain.

6. Cup and Handle Pattern Ki Analysis

Cup and handle pattern ki analysis karne ke liye traders ko kuch khaas tools aur techniques istemal karne chahiye. Volume analysis bahut ahem hota hai; jab price handle se break karti hai, to volume mein izafa hona chahiye. Ye bullish confirmation deta hai ke market mein genuine buying interest hai. Iske ilawa, traders ko price action ko bhi monitor karna chahiye. Agar price handle ke doran support level par rukti hai aur phir upar ki taraf break hoti hai, to ye ek strong bullish signal hota hai.

Conclusion

Cup and handle chart pattern ek powerful trading tool hai jo traders ko market ki bullish momentum ko samajhne mein madad karta hai. Is pattern ki pehchan karna, sahi entry aur exit points tay karna, aur market ki analysis karna traders ke liye bohat zaroori hai. Lekin, ye yaad rakhna chahiye ke koi bhi trading pattern 100% reliable nahi hota, isliye risk management aur baaqi indicators ka istemal zaroori hai. Traders ko is pattern ke saath sath market ke overall conditions ka bhi khayal rakhna chahiye taake woh informed trading decisions le sakein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Cup and Handle Chart Pattern Kya Hai?

Cup and handle chart pattern trading ki duniya mein ek bohot mashhoor aur effective technique hai. Yeh pattern aksar stock market aur financial instruments mein dekha jata hai, jahan traders isay price movements ko samajhne ke liye istemal karte hain. Is article mein, hum cup and handle pattern ke bare mein tafsili jaankari dene ki koshish karenge, iski khususiyaat, istemal ka tareeqa, aur kaise yeh pattern aapki trading strategies ko behtar bana sakta hai.

1. Cup and Handle Pattern Ki Pehchan

Cup and handle pattern ka asal naam iski shakal se hai. Is pattern ki pehli khushbu ek "cup" ki tarah hoti hai, jo do hilltop (high points) ke darmiyan ek curve ya dip banaata hai. Is curve ke baad ek "handle" hota hai, jo ek chhoti si consolidation ya pullback hoti hai. Yeh pattern aksar bullish trend ki nishani hota hai, yani jab market mein price upar ki taraf ja rahi hoti hai. Cup aur handle ka ye pattern typically daily ya weekly charts par dekha jata hai.

2. Cup Aur Handle Ka Banawati Tareeqa

Cup and handle ka pattern banne ke liye kuch khas stages hoti hain. Pehle, price ka uptrend hona zaroori hai, jahan price kisi point par peak tak pahunchti hai, jo cup ki pehli taraf hai. Phir yeh price girti hai, aur ek nadar ya low point par rukti hai, jo cup ka neeche ka hissa banata hai. Iske baad price phir se upar ki taraf badhti hai aur ek aur peak banati hai, jo cup ka doosra hissa hota hai.

Iske baad, price thodi der ke liye consolidate hoti hai, jo handle ke form mein aata hai. Handle mein price thodi si ghatne lagti hai, lekin is ghatav ko zyada lamba nahi hona chahiye, warna pattern ki validity khatam ho sakti hai. Aakhir mein, agar price handle ke ooper breakout karti hai, to yeh bullish signal hota hai, jahan traders entry le sakte hain.

3. Cup and Handle Pattern Ki Khususiyaat

Cup and handle pattern ki kuch khaasiyat hain jo isay trading mein kaafi valuable banati hain:- Clear Entry Aur Exit Points: Is pattern ki wajah se traders ko entry aur exit points ka pata chal jata hai. Handle ke breakout par entry lena aur cup ke nadar point par stop-loss lagana.

- Bullish Sentiment: Yeh pattern aksar bullish sentiment ki nishani hota hai, yani jab traders ka expectation hai ke price agle kuch waqt mein badhegi.

- High Probability Trade: Cup and handle pattern ko generally high probability trade mana jata hai. Jab yeh pattern sahi tarah se banta hai, to is par trading karne se achhe returns milne ke chances hote hain.

- Versatile Use: Yeh pattern sirf stocks tak mehdood nahi hai, balki forex aur commodities jese aur markets mein bhi istemal hota hai.

Cup and handle pattern ka istemal karne ke liye kuch steps follow karna chahiye:- Chart ko Monitor Karna: Sabse pehle, aapko apne preferred charts ko dekhna hoga. Daily aur weekly charts mein cup and handle pattern ki talash karein.

- Cup Aur Handle ki Shakal Ki Pahchan: Jab aapko cup aur handle ki shakal nazar aaye, to uski pehchan karein. Cup ka deep hona chahiye, lekin itna bhi nahi ke yeh bearish market ko darshaye.

- Breakout Point Identify Karein: Jab price handle se breakout kare, to yeh aapka entry point hoga. Is point par buy order lagayein.

- Stop-Loss Lagana: Risk management ka khaayal rakhein. Entry point ke neeche stop-loss lagana zaroori hai taake agar price aapki soch ke khilaf chale, to nuksan kam ho.

- Target Set Karein: Aapko price ke target set karne chahiye, jo ke aapke entry point se cup ki depth ke barabar hota hai. Yeh aapki potential profit ko define karega.

Jabke cup and handle pattern kaafi faida mand ho sakta hai, lekin iski kuch limitations bhi hain:- False Breakouts: Kabhi-kabhi price handle se breakout nahi karti aur niche gir jaati hai, jo ek false breakout hota hai. Is wajah se traders ko cautious rehna chahiye.

- Market Conditions: Cup and handle pattern ka effective hona bhi market ki overall condition par depend karta hai. Agar market bearish hai, to yeh pattern kaam nahi kar sakta.

- Time Lag: Yeh pattern banne mein waqt lag sakta hai, jise traders ko samajhna padega. Kabhi-kabhi pattern banne mein weeks ya months lag sakte hain.

Cup and handle pattern se profit kamaane ke liye, traders ko chaaron taraf se strategies banani hongi. Pehle, aapko patience rakni hogi jab tak pattern achi tarah se ban nahi jata.

Doosra, aapko breakout point par trade karna hoga, lekin saath hi risk management ka khayal rakhna bhi zaroori hai. Aapko market ki halat ka bhi khayal rakhna hoga, kyunki agar overall market bearish hai, to cup and handle pattern ke chances kam ho sakte hain.

Aakhir mein, consistent review aur practice se aap cup and handle pattern mein mahir ho sakte hain. Market trends ko samajhkar aur is pattern ko apne trading plan mein shamil karke, aap apne trading mein behtari la sakte hain.

Nihayat

Cup and handle chart pattern trading ke liye ek powerful tool hai. Yeh pattern traders ko price movements ka achha idea deta hai, jisse wo informed decisions le sakte hain. Is pattern ka sahi istemal karne se aap apne trading returns ko behtar bana sakte hain. Isliye, trading ki duniya mein cup and handle pattern ki jaankari rakhna aap ke liye faida mand sabit ho sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:04 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим