Bullish doji star !!

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

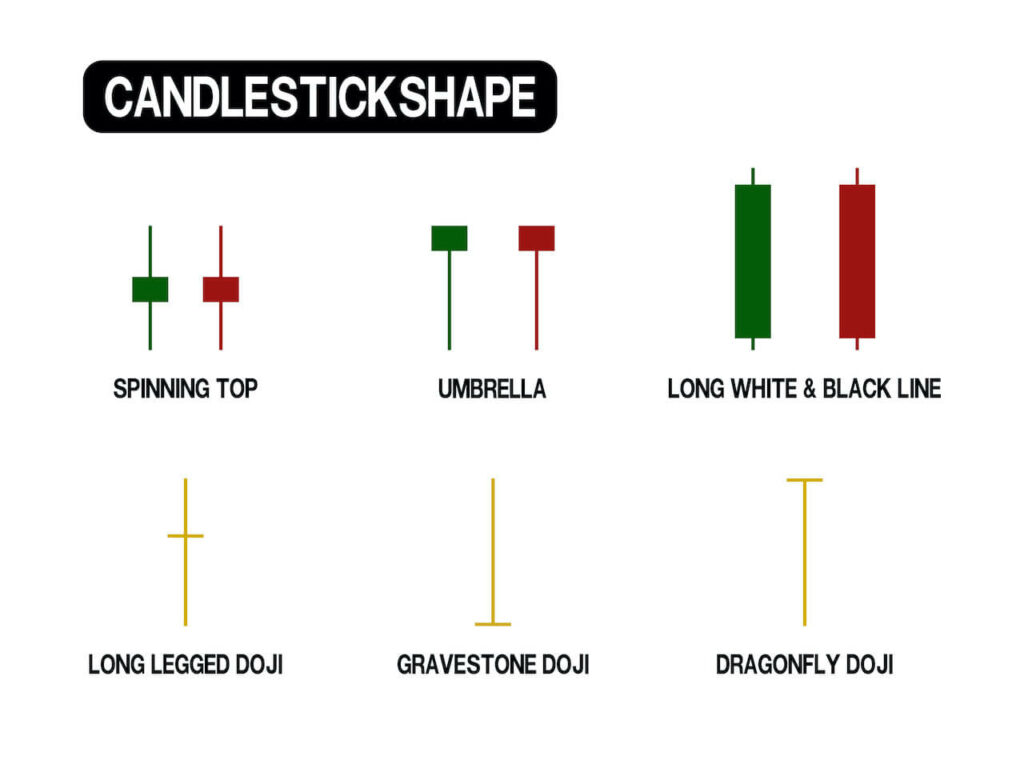

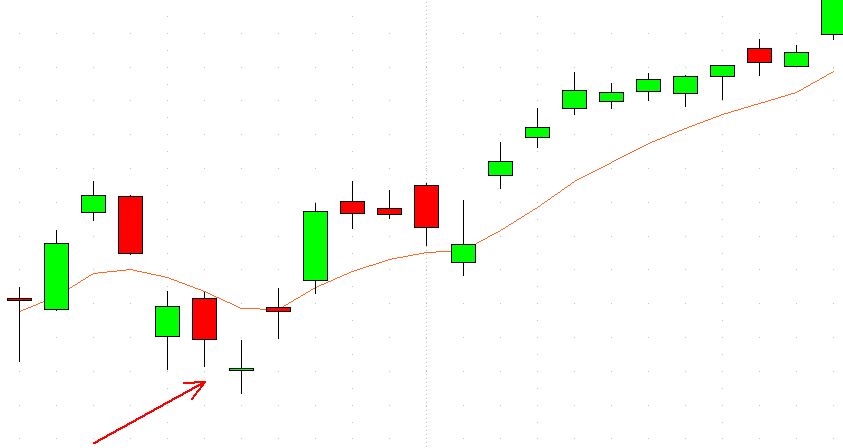

Assalamualaikum !!! Bullish doji star !! Bullish Doji Star" aik notable candle test hai jo kee diagram examination mein istemal hota hai. Is design ko samajhne se pahle, humein candle diagrams aur uske mukhtalif added substances ke exposed mein samajhna hoga. Candle diagrams, cost moves ko graphical taur standard dikhane ridge ek prakar ke outline hote hain. Har ek candle ek term (maslan ek clamor) ki exchanging leisure activity ko darshata hai. Doji ek explicit sort ka candle hota hai jismein open aur close to rate barabar ya qareeb barabar hote hain. Iska matlab hai ke purchasers aur sellers ke darmiyan koi faasla nahin hua hai. Agar ek Doji light ke baad ek strong bullish candle aaye, to yeh "Bullish Doji Star" test kehte hain.Har candle ke adolescent significant parts hote hain: open cost, close rate, high expense aur low rate. Bullish doji star design !! Bullish Doji Star" test, market ke pattern ka palatne ka sign deta hai lekin iska a triumph istemal karne ke liye practice aur experience ki zaroorat hoti hai. Is design ko samajhne mein waqt slack sakta hai lekin punch aap isko samajh jaate hain, to aap exchanging decisions ko upgrade kar sakte hain.Yaad rahe ke market Target cost level woh stage hota hai jahan standard aapko income digital book karna hai. Aap isko going before highs ya obstruction stages standard set kar sakte hain.Har trade mein danger aur reward ka balance rakhna zaroori hai. Aapko zyada se zyada do guna danger lekar kam se kam do guna acclaim hasil karna chahiye.Mein kuch bhi check nahin hota, is liye hamesha chance control ka khayal rakhein. Candle designs ke sath dusre specialized pointers aur diagram styles ka bhi istemal karke apne exchange ko check karna zaroori hai. Market ke design ka palatne ka signal deta hai lekinhain, to aap exchanging decisions ko upgrade kar sakte hain. ​Target value doji star !! Cost target tay karne ke liye, aap doji ki exorbitant cost se ooncha point dekh saktay hain, ya phir specialized investigation ke devices jaise ke Fibonacci retracements aur opposition levels ka istemal kar ke apna cost target tay kar saktay hain. Bullish Doji Star design ki tafseel aur mukhtalif market circumstances mein iska istemal aur tashkhees karne ke liye, aapko specialized investigation ki mukhtalif kitaabon aur online assets ki taraf mukhatib hona chahiye. Bullish Doji Star design ek ahem specialized investigation instrument hai jo tijarti mumlikat mein urooj ki tashkeel ki alamat deta hai. Is design ki samajh aur istemal se aap apni exchanging methodology ko behtar bana saktay hain. Iske ilawa, hamesha maharat hasil karne ke liye amomi market investigation aur risk the executives ka bhi khayal rakhein.

Bullish Doji Star design ki tafseel aur mukhtalif market circumstances mein iska istemal aur tashkhees karne ke liye, aapko specialized investigation ki mukhtalif kitaabon aur online assets ki taraf mukhatib hona chahiye. Bullish Doji Star design ek ahem specialized investigation instrument hai jo tijarti mumlikat mein urooj ki tashkeel ki alamat deta hai. Is design ki samajh aur istemal se aap apni exchanging methodology ko behtar bana saktay hain. Iske ilawa, hamesha maharat hasil karne ke liye amomi market investigation aur risk the executives ka bhi khayal rakhein.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Doji Star" ek prakar ka candlestick pattern hai jo technical analysis mein istemal hota hai taki market ke trend mein mukhalif parivartan ki sambhavna ko darshane mein madad karta hai. Yeh pattern do candlesticks se banta hai, jisme pehla candlestick ek bearish (neeche ki taraf) movement ko darshata hai aur doosra candlestick ek "doji" ko darshata hai, jo ek aisa candlestick hota hai jismein real body bahut chhoti hoti hai jahan par khulta aur band hota hai, aur dono keemat lagbhag ek si hoti hai.Yahan hai Bullish Doji Star pattern ko pehchaanne ke tarike: Pehla Candlestick: Pehla candlestick ek lamba bearish (neechi ki taraf) candle hota hai, jo darshata hai ki bazar ek downtrend mein hai. Dusra Candlestick (Doji): Dusra candlestick ek doji hota hai, jismein khulta aur band hota hain wo bahut paas ya lagbhag ek jaise hote hain. Yeh darshata hai ki bazar mein anishchitata hai. Samanvay Candle: Teesra candlestick ek bullish (upward) candle hota hai jo pehle din ke doji candle ke band hone se upar khulta hai aur ideally pehle bearish candle ki madhya rekha se upar band hota hai.Bullish Doji Star pattern yeh suggest karta hai ki ek downtrend ke baad, bikri karne wale momentum ko khota ja rahe hain aur bazar anishchit ho raha hai. Doji star ka dikhna bazar mein anishchitata ya sambhav parivartan ki sanket hai. Agla din ke confirmation candle dikhata hai ki kharidne walon ko niyantrit hone mein safalta milti hai, jo ki ek uptrend ki or le ja sakta hai.Kisi bhi candlestick pattern ki tarah, vyaparik nirnay lene se pehle sambhav parivartan ko satyapit karne ke liye dusre factors aur sanket ka vichar karna mahatvapurn hai.

Samanvay Candle: Teesra candlestick ek bullish (upward) candle hota hai jo pehle din ke doji candle ke band hone se upar khulta hai aur ideally pehle bearish candle ki madhya rekha se upar band hota hai.Bullish Doji Star pattern yeh suggest karta hai ki ek downtrend ke baad, bikri karne wale momentum ko khota ja rahe hain aur bazar anishchit ho raha hai. Doji star ka dikhna bazar mein anishchitata ya sambhav parivartan ki sanket hai. Agla din ke confirmation candle dikhata hai ki kharidne walon ko niyantrit hone mein safalta milti hai, jo ki ek uptrend ki or le ja sakta hai.Kisi bhi candlestick pattern ki tarah, vyaparik nirnay lene se pehle sambhav parivartan ko satyapit karne ke liye dusre factors aur sanket ka vichar karna mahatvapurn hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

BULLISH DOJI STAR:-"Bullish Doji Star" ek candlestick chart pattern hai jo technical analysis mein istemal hota hai. Ye pattern market ke trend ke reversal ya change ko indicate karta hai. "Bullish" islia hai kyunki ye pattern ek potential uptrend ya bullish movement ka sanket deta hai. "Doji" ek candlestick hai jismein opening price aur closing price ek doosre ke kareeb hote hain, jisse uska body bahut chhota hota hai.

"Bullish Doji Star" pattern do candles se mil kar banta hai:

BULLISH DOJI STAR MURAKKAB HA:-Pehla Candle: Pehle candle mein, market downtrend mein hota hai aur bearish movement hota hai. Is candle ki body lambi hoti hai. Doosra Candle (Doji): Doosre candle mein, market ki movement choppy hoti hai aur opening price aur closing price ek doosre ke kareeb hote hain, jisse doji pattern banta hai. Is candle ki body chhoti hoti hai, ya phir bilkul hi nazar nahi aati. Teesra Candle: Teesre candle mein, market ki movement fir se uptrend ki taraf shift hoti hai. Is candle ki body pehle candle se lambi hoti hai aur ideally pehle candle ki upper side me ghuste hue close hoti hai. Is pattern ki wajah se, traders ko lagta hai ke market ke downtrend ke baad ab uptrend shuru ho sakta hai. Lekin yaad rahe ke candlestick patterns ko confirm karne ke liye dusri technical indicators aur price patterns ka bhi istemal hota hai, kyunke kabhi-kabhi false signals bhi ho sakte hain. Ye pattern tab zyada effective hota hai jab isko dusri technical analysis tools ke saath istemal kiya jata hai, jaise ke moving averages, support aur resistance levels, aur trend lines.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:01 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим