**Bump and Run Trading Strategy Forex Trading Mein**

Forex trading mein “Bump and Run” ek aise trading strategy hai jo market ke price movements ko predict karne aur trading opportunities ko identify karne mein madad deti hai. Yeh strategy mainly trend reversal patterns ko target karti hai aur trading signals ko generate karne ke liye price action aur technical analysis ko use karti hai.

**Bump and Run Strategy Kya Hai?**

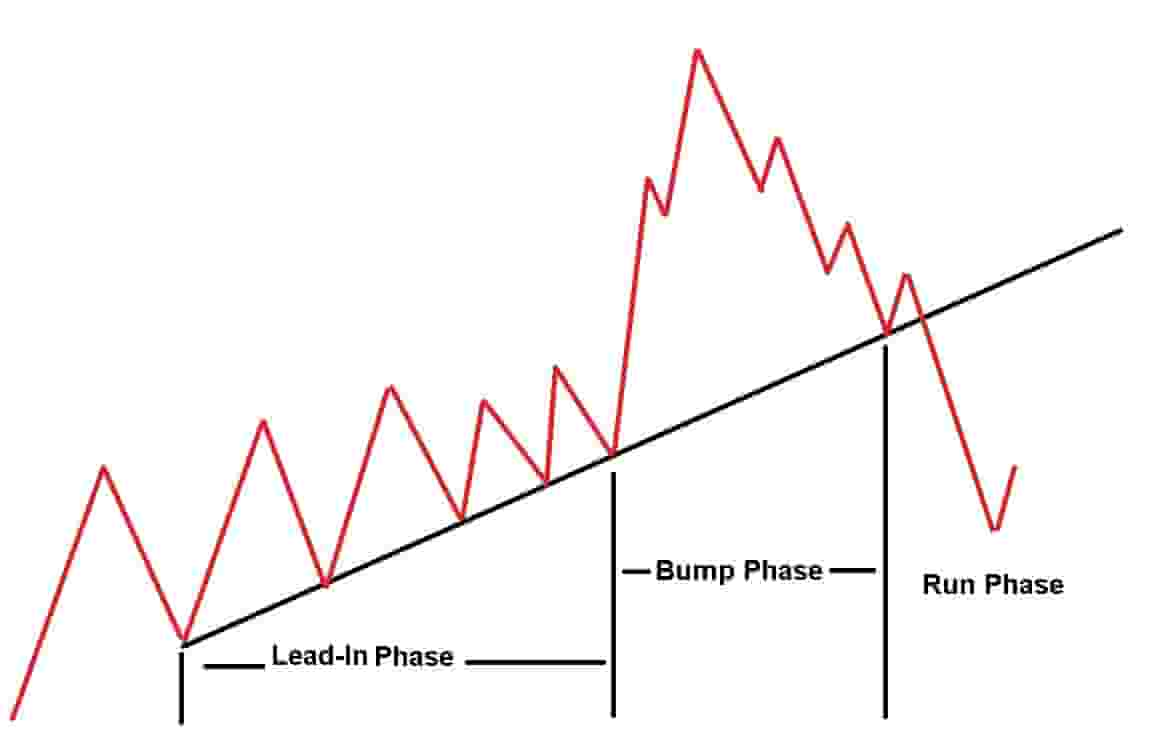

Bump and Run trading strategy ek technical pattern hai jo market ke short-term trends ko identify karne aur profit maximize karne ke liye use ki jati hai. Is strategy ka naam pattern ke unique structure ke naam par rakha gaya hai, jismein “bump” aur “run” key components hote hain.

**Pattern Ke Components**

1. **Bump Phase**: Bump and Run pattern ki shuruat ek strong price movement se hoti hai, jo ke “bump” kehlata hai. Yeh phase market ke price ko ek direction mein push karta hai aur trend ko accelerate karta hai. Bump phase ke dauran price high level tak reach karti hai aur momentum build hota hai.

2. **Run Phase**: Bump ke baad market consolidation ya retracement phase mein chala jata hai, jo “run” kehlata hai. Is phase mein price ek chhoti consolidation range mein move karti hai, jo ke previous trend ke against hoti hai. Run phase ke dauran price usually ek narrow channel ke andar fluctuation karti hai.

**Trading Signals**

1. **Breakout Signal**: Bump and Run strategy mein, key trading signal tab milta hai jab price consolidation phase ke boundary ko break karti hai. Agar price consolidation range ke upper boundary ko break karti hai, toh yeh bullish trend continuation ka signal hota hai. Conversely, agar price lower boundary ko break karti hai, toh yeh bearish trend continuation ka signal hota hai.

2. **Volume Analysis**: Volume bhi is pattern ke analysis mein important role play karta hai. Higher trading volume breakout ke confirmation ko strengthen karta hai. Traders ko volume increase ko dekhna chahiye jab pattern ka breakout hota hai.

**Strategy Ka Use**

- **Entry Points**: Traders Bump and Run strategy ka use karte hue breakout points ko entry points ke roop mein use karte hain. Iske liye price action aur volume ko closely monitor kiya jata hai.

- **Stop-Loss Aur Target Levels**: Traders stop-loss orders ko previous consolidation range ke outside set karte hain taake potential losses ko limit kiya ja sake. Target levels ko bhi pattern ke range aur price movements ke basis par set kiya jata hai.

Bump and Run trading strategy forex trading mein trend reversals aur breakout opportunities ko effectively capture karne mein madad karti hai. Is strategy ko sahi tarah se samajhkar aur use karke, traders apne trading decisions ko enhance kar sakte hain aur market movements se faida utha sakte hain.

Forex trading mein “Bump and Run” ek aise trading strategy hai jo market ke price movements ko predict karne aur trading opportunities ko identify karne mein madad deti hai. Yeh strategy mainly trend reversal patterns ko target karti hai aur trading signals ko generate karne ke liye price action aur technical analysis ko use karti hai.

**Bump and Run Strategy Kya Hai?**

Bump and Run trading strategy ek technical pattern hai jo market ke short-term trends ko identify karne aur profit maximize karne ke liye use ki jati hai. Is strategy ka naam pattern ke unique structure ke naam par rakha gaya hai, jismein “bump” aur “run” key components hote hain.

**Pattern Ke Components**

1. **Bump Phase**: Bump and Run pattern ki shuruat ek strong price movement se hoti hai, jo ke “bump” kehlata hai. Yeh phase market ke price ko ek direction mein push karta hai aur trend ko accelerate karta hai. Bump phase ke dauran price high level tak reach karti hai aur momentum build hota hai.

2. **Run Phase**: Bump ke baad market consolidation ya retracement phase mein chala jata hai, jo “run” kehlata hai. Is phase mein price ek chhoti consolidation range mein move karti hai, jo ke previous trend ke against hoti hai. Run phase ke dauran price usually ek narrow channel ke andar fluctuation karti hai.

**Trading Signals**

1. **Breakout Signal**: Bump and Run strategy mein, key trading signal tab milta hai jab price consolidation phase ke boundary ko break karti hai. Agar price consolidation range ke upper boundary ko break karti hai, toh yeh bullish trend continuation ka signal hota hai. Conversely, agar price lower boundary ko break karti hai, toh yeh bearish trend continuation ka signal hota hai.

2. **Volume Analysis**: Volume bhi is pattern ke analysis mein important role play karta hai. Higher trading volume breakout ke confirmation ko strengthen karta hai. Traders ko volume increase ko dekhna chahiye jab pattern ka breakout hota hai.

**Strategy Ka Use**

- **Entry Points**: Traders Bump and Run strategy ka use karte hue breakout points ko entry points ke roop mein use karte hain. Iske liye price action aur volume ko closely monitor kiya jata hai.

- **Stop-Loss Aur Target Levels**: Traders stop-loss orders ko previous consolidation range ke outside set karte hain taake potential losses ko limit kiya ja sake. Target levels ko bhi pattern ke range aur price movements ke basis par set kiya jata hai.

Bump and Run trading strategy forex trading mein trend reversals aur breakout opportunities ko effectively capture karne mein madad karti hai. Is strategy ko sahi tarah se samajhkar aur use karke, traders apne trading decisions ko enhance kar sakte hain aur market movements se faida utha sakte hain.

تبصرہ

Расширенный режим Обычный режим