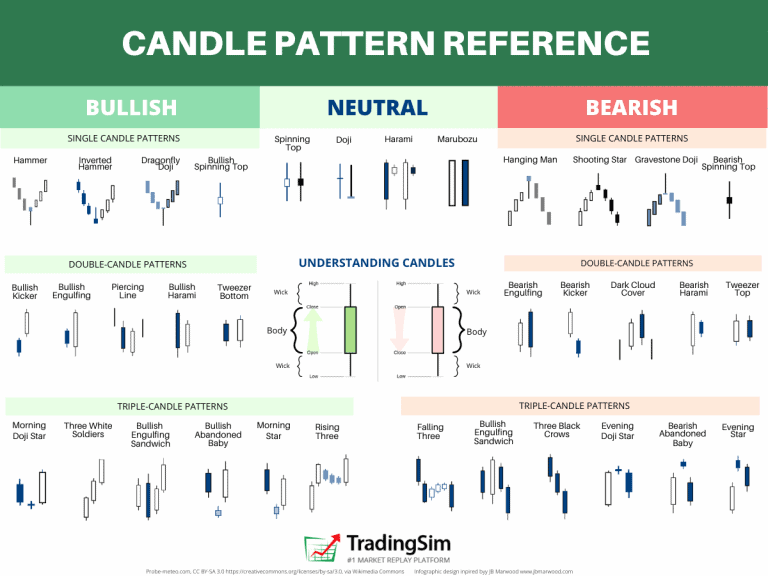

What is candle stick pattern and their forms.

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

**Candlestick Pattern (Kyandi Stik Pattern) aur Unki Shaklain:**Candlestick patterns forex trading mein price action analysis ka aik important hissa hain. In patterns ki madad se traders price movements ko samajhte hain aur trend directions aur reversals ki pehchan karte hain. Yeh patterns candlesticks ki shapes aur unke combinations par mabni hotay hain. Yahan kuch commonly used candlestick patterns aur unki shaklain hain:1. **Doji (ڈوجی):** Doji pattern mein open aur close price barabar hoti hain, jis se candlestick ki body na koi upar ki shadow (wick) na neechay ki shadow ho. Yeh indecision ya trend change ki indication deta hai.2. **Hammer (Ûیمر):** Hammer pattern bullish reversal ki indication deta hai. Ismein lambi lower shadow hoti hai jo body se zyada extend hoti hai, aur upper shadow choti hoti hai.3. **Shooting Star (شوٹنگ اسٹار):** Shooting Star pattern bullish trend ke akhri phase mein price reversal ki early indication deta hai. Ismein body choti hoti hai aur lambi upper shadow hoti hai.4. **Bullish Engulfing (بلش اینگلÙÙ†Ú¯):** Bullish Engulfing pattern bearish trend ke baad potential bullish reversal ki indication deta hai. Pehli candlestick bearish hoti hai aur dusri candlestick bullish hoti hai, aur dusri ki body pehli ki body ko engulf karti hai.5. **Bearish Engulfing (بیرش اینگلÙÙ†Ú¯):** Bearish Engulfing pattern bullish trend ke baad potential bearish reversal ki indication deta hai. Pehli candlestick bullish hoti hai aur dusri candlestick bearish hoti hai, aur dusri ki body pehli ki body ko engulf karti hai.6. **Doji Star (ڈوجی اسٹار):** Doji Star pattern trend ke reversal ki possibility ko suggest karta hai. Ismein pehli aur dusri candlesticks bearish hain, aur tisri candlestick doji hoti hai.7. **Three Inside Up (تھری انسائیڈ اپ):** Three Inside Up pattern bearish trend ke baad bullish reversal ki indication deta hai. Teesri candlestick pehli ki body ke andar hoti hai aur pehli ki high ko cross karti hai.8. **Three Inside Down (تھری انسائیڈ ڈاؤن):** Three Inside Down pattern bullish trend ke baad bearish reversal ki indication deta hai. Teesri candlestick pehli ki body ke andar hoti hai aur pehli ki low ko cross karti hai.Yeh kuch common candlestick patterns hain, lekin mazeed patterns bhi hain jo traders istemal karte hain. In patterns ko samajhna aur recognize karna traders ke liye zaroori hai taake woh trading decisions ko improve kar sakein.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

CANDLESTICK PATTERN:-Forex (foreign exchange) me candlestick patterns ka istemal price charts par trading decisions banane ke liye hota hai. Candlestick patterns charts par price movement ko visualize karne me madadgar hote hain, aur traders ko price ke future direction ka idea dete hain. Yahan kuch pramukh candlestick patterns aur unki forms ke baare mein jankari di gayi hai: CANDLESTICK PATTERN KI FORMS:-Doji Pattern: Doji ek candlestick pattern hai jisme opening price aur closing price barabar hoti hain. Ye market mein indecision ya reversal ko darust karti hai. Kuch pramukh Doji patterns hain: Neutral Doji: Open aur close price barabar hote hain. Long-legged Doji: High aur low price barabar hote hain. Gravestone Doji: High, open, aur close price ek dusre ke qareeb hote hain. Bullish Candlestick Patterns: Ye patterns uptrend ya bullish reversal ko indicate karte hain. Kuch pramukh Bullish patterns hain: Hammer: Ek lambi lower shadow ke saath choti body hoti hai, jo downward trend ko indicate karti hai. Bullish Engulfing: Ek small bearish candle ke baad ek larger bullish candle aata hai jo use engulf karta hai. Piercing Line: Ek bearish candle ke baad ek bullish candle aati hai, jo pehli candle ki opening price se upar open hoti hai. Bearish Candlestick Patterns: Ye patterns downtrend ya bearish reversal ko show karte hain. Kuch pramukh Bearish patterns hain: Shooting Star: Ek small body ke saath lambi upper shadow hoti hai, jo upward trend ko indicate karti hai. Bearish Engulfing: Ek small bullish candle ke baad ek larger bearish candle aata hai jo use engulf karta hai. Dark Cloud Cover: Ek bullish candle ke baad ek bearish candle aati hai, jo pehli candle ki opening price se neeche open hoti hai. Continuation Patterns: Ye patterns current trend ko jari rakhte hain. Kuch pramukh continuation patterns hain: Bullish Flag: Ek flagpole ke baad ek small sideways range hoti hai, phir trend ke saath upar move hoti hai. Bearish Pennant: Ek flagpole ke baad ek small sideways range hoti hai, phir trend ke saath neeche move hoti hai. Reversal Patterns: Ye patterns current trend ko change karne ka sanket dete hain. Kuch pramukh reversal patterns hain: Head and Shoulders: Ek trend ke baad ek inverted head and shoulders pattern aata hai, jo trend reversal ko indicate karta hai. Double Top and Double Bottom: Ye patterns price ke do bar resistance ya support level ko test karne ke baad trend reversal ko darust karti hain. Yeh kuch pramukh candlestick patterns aur unke forms the, lekin trading decisions banate samay, trader ko market context aur confirmation ke liye dusre technical indicators ka bhi istemal karna chahiye. Candlestick patterns ke istemal se judi surakshit trading aur risk management par dhyan dena bhi mahatvapurn hota hai.

CANDLESTICK PATTERN KI FORMS:-Doji Pattern: Doji ek candlestick pattern hai jisme opening price aur closing price barabar hoti hain. Ye market mein indecision ya reversal ko darust karti hai. Kuch pramukh Doji patterns hain: Neutral Doji: Open aur close price barabar hote hain. Long-legged Doji: High aur low price barabar hote hain. Gravestone Doji: High, open, aur close price ek dusre ke qareeb hote hain. Bullish Candlestick Patterns: Ye patterns uptrend ya bullish reversal ko indicate karte hain. Kuch pramukh Bullish patterns hain: Hammer: Ek lambi lower shadow ke saath choti body hoti hai, jo downward trend ko indicate karti hai. Bullish Engulfing: Ek small bearish candle ke baad ek larger bullish candle aata hai jo use engulf karta hai. Piercing Line: Ek bearish candle ke baad ek bullish candle aati hai, jo pehli candle ki opening price se upar open hoti hai. Bearish Candlestick Patterns: Ye patterns downtrend ya bearish reversal ko show karte hain. Kuch pramukh Bearish patterns hain: Shooting Star: Ek small body ke saath lambi upper shadow hoti hai, jo upward trend ko indicate karti hai. Bearish Engulfing: Ek small bullish candle ke baad ek larger bearish candle aata hai jo use engulf karta hai. Dark Cloud Cover: Ek bullish candle ke baad ek bearish candle aati hai, jo pehli candle ki opening price se neeche open hoti hai. Continuation Patterns: Ye patterns current trend ko jari rakhte hain. Kuch pramukh continuation patterns hain: Bullish Flag: Ek flagpole ke baad ek small sideways range hoti hai, phir trend ke saath upar move hoti hai. Bearish Pennant: Ek flagpole ke baad ek small sideways range hoti hai, phir trend ke saath neeche move hoti hai. Reversal Patterns: Ye patterns current trend ko change karne ka sanket dete hain. Kuch pramukh reversal patterns hain: Head and Shoulders: Ek trend ke baad ek inverted head and shoulders pattern aata hai, jo trend reversal ko indicate karta hai. Double Top and Double Bottom: Ye patterns price ke do bar resistance ya support level ko test karne ke baad trend reversal ko darust karti hain. Yeh kuch pramukh candlestick patterns aur unke forms the, lekin trading decisions banate samay, trader ko market context aur confirmation ke liye dusre technical indicators ka bhi istemal karna chahiye. Candlestick patterns ke istemal se judi surakshit trading aur risk management par dhyan dena bhi mahatvapurn hota hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:51 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим