Counter Trend Trading kiya hai detauls k sath samjhain

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

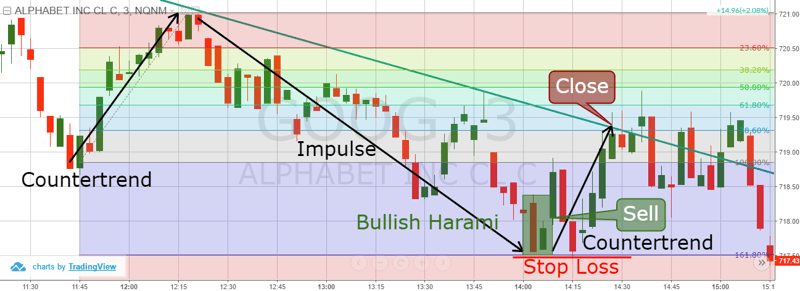

**Counter Trend Trading (کاؤنٹر ٹرینڈ ٹریڈنگ):** "Counter Trend Trading" ek trading approach hai jahan traders trend ke against trades lete hain. Yani, jab market ek specific direction mein move kar raha ho, to counter trend traders us direction ke against trades lene ki koshish karte hain. Yeh approach risky ho sakti hai kyun ke trend ke against trades lene se loss ka risk zyada hota hai. Lekin, is approach ka istemal carefully aur strategy ke sath kiya ja sakta hai.**Counter Trend Trading ka Maqsad:** Counter Trend Trading ka maqsad hota hai ke traders trend reversals ya temporary retracements ka advantage utha sakein. Jab market ek taraf move kar raha ho aur traders expect karte hain ke trend reverse hoga, to woh counter trend trades lete hain taki woh trend change ke early stage mein profit hasil kar saken. **Counter Trend Trading ke Fayde:* 1. **Early Entry Points:** Counter trend trading se traders trend change ke early stage mein entry points pakad sakte hain.2. **Potential High Profits:** Agar trend reverse hota hai to counter trend traders high profits hasil kar sakte hain.3. **Diverse Strategies:** Counter trend trading ke liye different strategies istemal ki ja sakti hain, including candlestick patterns, technical indicators, aur price action. **Counter Trend Trading ke Nuksan:** 1. **High Risk:** Counter trend trading high risk wala approach hai kyun ke trend ke against trades lene se loss ka risk zyada hota hai.2. **False Reversals:** Market mein false trend reversals bhi ho sakte hain, jisse counter trend traders loss mein phans sakte hain.3. **Trend Continuation Risk:** Agar trend continue hota hai to counter trend traders ko loss ho sakta hai. **Counter Trend Trading ki Strategies (طریقے):** 1. **Candlestick Patterns:** Aap candlestick patterns ka istemal karke trend reversals ko identify kar sakte hain. Agar aapko reversal pattern milta hai, to aap counter trend trade le sakte hain.2. **Divergence Indicators:** Divergence indicators jaise RSI aur MACD ka istemal karke traders trend ki weakness ya reversal ka pata lagate hain.3. **Support aur Resistance:** Agar price support ya resistance level se bounce back karta hai, to aap counter trend trade le sakte hain.4. **Fibonacci Retracements:** Fibonacci retracement levels ki madad se traders temporary retracements ko identify kar sakte hain.**Yad rahe ke counter trend trading ko istemal karne se pehle aapko market ki analysis karke apne decisions ko support karna chahiye.** Is approach ko istemal karne se pehle aapko practice aur experience hasil karna zaroori hai. Forex trading mein involved risks ko samajhne ke baad hi decisions leni chahiye aur ideal scenario mein kisi financial advisor ki madad bhi li jaani chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Counter trend trading ek stock market ya financial markets trading strategy hai jahan par traders price trends ke viruddh trade karte hain. Yani agar ek uptrend (price badhne wala trend) ho raha hai, toh counter trend traders down moves par trade karna pasand karenge aur agar ek downtrend (price ghatne wala trend) ho raha hai, toh woh up moves par trade karenge. Is strategy ke peeche kuch main ideas hote hain: Market Reversals: Counter trend traders market ke reversals ko pakadne ki koshish karte hain. Jab ek trend kisi specific point par reverse hota hai, jaise ki uptrend se downtrend ya downtrend se uptrend me, tab counter trend traders us reversal point par entry aur exit points find karne ki koshish karte hain. Overextended Moves: Jab price ek trend mein bahut zyada move karta hai, toh woh overextended ho jata hai. Counter trend traders is situation ka fayda uthakar expect karte hain ki price thoda reverse ho aur unka trade profitable ho. Support aur Resistance Levels: Counter trend traders often support aur resistance levels ka istemal karte hain. Jab price kisi specific level tak pahunchta hai jo pehle se hi significant hai, woh traders us level par trade karte hain with the expectation ki price wapas reverse hoga. Profit Booking: Jab price ek trend mein zyada move kar leta hai, toh traders profit booking ke liye counter trend trades karte hain. Yani agar price zyada up move karta hai toh woh traders short positions le sakte hain. Lekin counter trend trading kaafi risky ho sakta hai, kyun ki agar market trend mein hai toh woh usually strong hota hai aur trend ke viruddh trade karke loss ho sakta hai. Ismein market timing ka bhi mahatvapurna role hota hai. Agar market trend mein hai, toh counter trend traders ko market reversals ya overextended moves ke indications ka dhyan rakhna chahiye. Ek successful counter trend trading ke liye traders ko market ke movement ke sahi samay ko samajhna, technical analysis aur price patterns ko acchi tarah se interpret karna, aur risk management ka sahi istemal karna zaroori hota hai. Ismein experience aur market understanding ka bhi mahatvapurna yogdan hota hai. Dhyan rahe ki trading mein koi bhi strategy 100% foolproof nahi hoti aur market risks hamesha hote hain. Kabhi bhi trading start karne se pehle acchi tarah se research kare aur preferabl

Is strategy ke peeche kuch main ideas hote hain: Market Reversals: Counter trend traders market ke reversals ko pakadne ki koshish karte hain. Jab ek trend kisi specific point par reverse hota hai, jaise ki uptrend se downtrend ya downtrend se uptrend me, tab counter trend traders us reversal point par entry aur exit points find karne ki koshish karte hain. Overextended Moves: Jab price ek trend mein bahut zyada move karta hai, toh woh overextended ho jata hai. Counter trend traders is situation ka fayda uthakar expect karte hain ki price thoda reverse ho aur unka trade profitable ho. Support aur Resistance Levels: Counter trend traders often support aur resistance levels ka istemal karte hain. Jab price kisi specific level tak pahunchta hai jo pehle se hi significant hai, woh traders us level par trade karte hain with the expectation ki price wapas reverse hoga. Profit Booking: Jab price ek trend mein zyada move kar leta hai, toh traders profit booking ke liye counter trend trades karte hain. Yani agar price zyada up move karta hai toh woh traders short positions le sakte hain. Lekin counter trend trading kaafi risky ho sakta hai, kyun ki agar market trend mein hai toh woh usually strong hota hai aur trend ke viruddh trade karke loss ho sakta hai. Ismein market timing ka bhi mahatvapurna role hota hai. Agar market trend mein hai, toh counter trend traders ko market reversals ya overextended moves ke indications ka dhyan rakhna chahiye. Ek successful counter trend trading ke liye traders ko market ke movement ke sahi samay ko samajhna, technical analysis aur price patterns ko acchi tarah se interpret karna, aur risk management ka sahi istemal karna zaroori hota hai. Ismein experience aur market understanding ka bhi mahatvapurna yogdan hota hai. Dhyan rahe ki trading mein koi bhi strategy 100% foolproof nahi hoti aur market risks hamesha hote hain. Kabhi bhi trading start karne se pehle acchi tarah se research kare aur preferabl

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:20 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим