What is money & Risk management in forex

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Asalamu alaikum dear forex trading members!! I hope you all well good umeeed krti hon APNA Kam mehnat sy kr rahy hon gy guyz apka yh week kesa h araha h aur agr ap ky pass koi information h to plz hum sy share kryn aj hum apko money risk and management ko jany gy aye ap ky sath discussion krty Hain What is money management? Honorary Member, Money Management and Capital Management. Capital account management is an easy way to calculate the number of months or months of losses, depending on the size of the account. What is the main balance of the main account? because the loss of the main trade jati hain un k loss account brdsht ni kar pati or blov jati hain. And yes, because yes. What is risk management? Honor member forex trading card main reward pool hota ha or wahi retail trader hotha ha apny car risk k risk management trading card. Risk management or money management is the main income. Aik ka phly apko karna ha k ap ni kitna use multi-dimension karna ha or we bad apko karna ha k apny account ka kitny interest karna chahty hain. Many traders use 5% high risk cards. ho taa k taa ap​​​​cover len ko len ko loss ko cover kr ly tbhi ap kamam ho skty hain. -

#3 Collapse

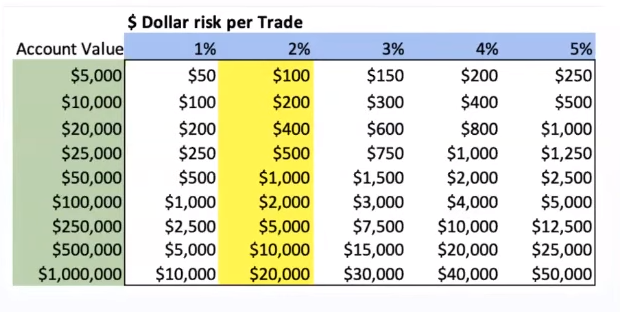

Money Management in Forex::max_bytes(150000):strip_icc()/dotdash_INV_final_Forex_Money_Management_Matters_Jan_2021-01-4c8b546882594377abf72a64e7e90f6e.jpg) Money management in forex refers to the strategies and techniques traders use to effectively manage their trading capital. It's a critical aspect of trading, as improper money management can lead to significant losses even if a trader has a winning trading strategy. The goal of money management is to protect your capital, minimize losses, and optimize profits. Here are some key principles of money management in forex: Risk Per Trade: Determine how much of your trading capital you're willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your capital on a single trade. Position Sizing: Based on the risk per trade and the distance to your stop loss, calculate the appropriate position size. Position sizing helps control the potential loss on a trade while maintaining consistency in risk management. Stop Loss Orders: Always use stop loss orders to limit potential losses on a trade. A stop loss is an order to close a position when the market moves against you by a certain amount. Diversification: Avoid putting all your capital into a single trade. Diversifying your trades can help spread risk across different currency pairs and trading strategies. Pyramiding: This technique involves adding to a winning position as the trade moves in your favor. However, it's important to do this cautiously and only when the trade's momentum is strong. Risk-Reward Ratio: Before entering a trade, determine the potential reward relative to the risk. A common rule is to aim for a risk-reward ratio of at least 1:2, meaning the potential profit should be at least twice the potential loss. Risk Management in Forex:

Money management in forex refers to the strategies and techniques traders use to effectively manage their trading capital. It's a critical aspect of trading, as improper money management can lead to significant losses even if a trader has a winning trading strategy. The goal of money management is to protect your capital, minimize losses, and optimize profits. Here are some key principles of money management in forex: Risk Per Trade: Determine how much of your trading capital you're willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your capital on a single trade. Position Sizing: Based on the risk per trade and the distance to your stop loss, calculate the appropriate position size. Position sizing helps control the potential loss on a trade while maintaining consistency in risk management. Stop Loss Orders: Always use stop loss orders to limit potential losses on a trade. A stop loss is an order to close a position when the market moves against you by a certain amount. Diversification: Avoid putting all your capital into a single trade. Diversifying your trades can help spread risk across different currency pairs and trading strategies. Pyramiding: This technique involves adding to a winning position as the trade moves in your favor. However, it's important to do this cautiously and only when the trade's momentum is strong. Risk-Reward Ratio: Before entering a trade, determine the potential reward relative to the risk. A common rule is to aim for a risk-reward ratio of at least 1:2, meaning the potential profit should be at least twice the potential loss. Risk Management in Forex: :max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg) Risk management in forex involves identifying, assessing, and mitigating the various risks associated with currency trading. These risks can arise from market volatility, economic events, geopolitical factors, and even the trader's own decisions. Effective risk management aims to preserve capital and ensure long-term success. Here are some key aspects of risk management in forex: Risk Identification: Recognize the potential risks involved in trading, such as market risk (volatility and price movements), interest rate risk, credit risk, and geopolitical risk. Market Analysis: Conduct thorough market analysis before entering a trade. Understand the fundamental and technical factors influencing the currency pair you're trading. Economic Calendar: Keep track of economic events and data releases that can impact the forex market. These events can lead to sudden price movements and increased volatility. Hedging: Hedging involves opening a position to offset potential losses in another position. While this can be complex, it can help mitigate risk in certain situations. Emotional Control: Emotional decisions often lead to poor risk management. Maintain discipline and stick to your trading plan even during periods of high market volatility. Stay Informed: Continuously educate yourself about the forex market, trading strategies, and risk management techniques. Being well-informed can help you make more informed decisions. Remember that forex trading involves inherent risks, and there's no guaranteed way to eliminate all risks. However, with proper money and risk management techniques, traders can increase their chances of success and minimize the impact of potential losses.

Risk management in forex involves identifying, assessing, and mitigating the various risks associated with currency trading. These risks can arise from market volatility, economic events, geopolitical factors, and even the trader's own decisions. Effective risk management aims to preserve capital and ensure long-term success. Here are some key aspects of risk management in forex: Risk Identification: Recognize the potential risks involved in trading, such as market risk (volatility and price movements), interest rate risk, credit risk, and geopolitical risk. Market Analysis: Conduct thorough market analysis before entering a trade. Understand the fundamental and technical factors influencing the currency pair you're trading. Economic Calendar: Keep track of economic events and data releases that can impact the forex market. These events can lead to sudden price movements and increased volatility. Hedging: Hedging involves opening a position to offset potential losses in another position. While this can be complex, it can help mitigate risk in certain situations. Emotional Control: Emotional decisions often lead to poor risk management. Maintain discipline and stick to your trading plan even during periods of high market volatility. Stay Informed: Continuously educate yourself about the forex market, trading strategies, and risk management techniques. Being well-informed can help you make more informed decisions. Remember that forex trading involves inherent risks, and there's no guaranteed way to eliminate all risks. However, with proper money and risk management techniques, traders can increase their chances of success and minimize the impact of potential losses.

-

#4 Collapse

Forex Mein Paisa (Money) Aur Risk Ka Intizam:Paisa (Money) Aur Forex: Forex, yaani Foreign Exchange, mein currencies ka exchange hota hai. Yahan traders currencies ko ek dusre se khareedte hain ya bechte hain, taa ke unka maqsad munafa kamana ho. Yeh market 24/5 khuli hoti hai aur dunya bhar ke currencies mein tabdeeli ka mauqa deti hai. Money Management (Paisa Ka Intizam): Money management, forex trading mein safalta haasil karne ka ek ahem hissa hai. Iska maqsad trader ko apne khata mein mojud paisay ko thek tareeqay se istemaal karne mein madad karna hota hai. Kuch ahem money management principles yeh hain: Capital Ka Taksim: Apne total trading capital ko chota hisson mein taksim karna acha hota hai. Ek hi trade mein pura paisa laga kar risk lena behter nahi hota. Risk Per Trade Ka Intizam: Har trade mein kitna paisa khona tay karne se pehle tay karna zaroori hai. Aam taur par, har trade mein 1% se 3% tak ka risk lena sahi samjha jata hai. Stop Loss Aur Take Profit Ka Istemal: Har trade mein Stop Loss aur Take Profit levels tay karna zaroori hai. Stop Loss, tabdeeli ki taraf jane wale rates se bachata hai aur Take Profit munafa hasil karne mein madad deta hai. Trading Plan Ka Banana: Trading plan banane se pehle, apne maqsad aur strategy ko saaf tareeqay se samajhna zaroori hai. Is plan mein trade karne se pehle kiya karna hai, kis tarah se karna hai, aur kab karna hai waghera tay kiya jata hai.Risk Management (Risk Ka Intizam):Forex trading mein risk ko samajhna aur kam karna bhi zaroori hai. Risk management, trading ke zariye paisa khona se bachne ke liye ki jati hai. Kuch tips risk management ke hain: Risk-Reward Ratio Ka Istemal: Har trade mein kitna paisa khonay ka risk hai aur kitna munafa hasil karne ka maqsad hai, yeh tay karna zaroori hai. Acha risk-reward ratio istemal karke trades karna zaroori hai. Diversification (Mukhtalif Maqasid Mein Invest Karna): Apne paisay ko mukhtalif currencies mein invest karke risk ko taqseem karna acha hota hai. Ek hi currency pair mein zyada paisa lagane se hone wale nuksan ka khatra hota hai. Emotional Control (Jazbaati Qabu): Trading ke doran jazbaat se parhez karna zaroori hai. Loss mein jazbaat mein aakar ghalat faislay liye ja sakte hain. Demo Trading Ka Istemal: Naye traders ke liye demo trading ka istemal karke pehle practice karna zaroori hai. Is se real market mein trading karne ki practice hojati hai bina actual paisay khaye.Ikhtitam (Conclusion):Forex trading mein paisa (money) aur risk ka sahi tareeqay se intizam karna ahem hai. Money management aur risk management principles ko samajh kar istemal karna, traders ko zyada mutasir hone se bachata hai aur unko trading mein acha nataij hasil karne mein madad deta hai. Is liye, trading shuru karne se pehle in masail ko samajhna zaroori hai. -

#5 Collapse

Money Management:

Forex mein paisa aur risk management ka maqsad hai ke apne trading capital ko mehfooz rakha jaye, jabke potential profit ko ziada se ziada banaya jaye. Forex mein apne capital ko bachana aur trading performance ko optimize karne ke liye aik soch samajh kar market mein ana zaroori hai. Is mein apne trading positions ka size tay karna, stop-loss orders set karna aur capital allocation ke liye guidelines banane shamil hai. Yeh ye hai ke koi aik trade aapke account ki bara ek hissa mita de, taake aap market ke tabdeel hone wale halat mein bhi qaim reh sako.- Position Sizing: Risk aur Reward ka Balance

- Ek individual trader ke taur par, zaroori hai ke har trade ke liye apne risk tolerance aur overall account size ke mutabiq munasib size tay kiya jaye.

- Aam tor par istemal hone wala ek qaidah ye hai ke har trade par 1-2% tak ka risk lekar trading karna, jo ke aapke account ko bari nuksan se bachane mein madad karta hai.

- Diversification: Risk ko Alag-Alag Assets Mein Taqseem Karna

- Apne trades ko alag-alag currency pairs par taqseem karna risk management ka faida ho sakta hai. Is se aapke ek behtar trade ki kamzori aapke overall portfolio par kam asar dalta hai.

- Stop-Loss Orders Set Karna: Risk Limits Ko Define Karna

- Stop-loss orders set karna money management ka aik ahem hissa hai, jo aapko aik trade par hone wale nuksan ka maximum had saaf taur par batata hai.

- Market ki conditions, technical indicators aur apne risk-reward ratio ko tajaweez ke mutabiq stop-loss levels tay karnay mein istemal karein.

- Risk-Reward Ratio: Balance Qaim Karna

- Trade mein dakhil hone se pehle uski potential reward ko uski risk ke mutabiq tay karna zaroori hai. Ek faida mand risk-reward ratio ye ensure karta hai ke mogheema faida mogheema nuksan se ziada hota hai.

- Misal ke tor par, aam risk-reward ratio 2:1 ho sakta hai, jisme aapko ye maqsad hai ke aap jo bhi risk le rahe hain, uska dugna profit hasil karein.

Risk Management:

Jabke money management aik mazeed tawel concept hai, risk management market ke tabdeel hone wale halat aur anjaane hone wale waqiat ke mutabiq adapt hone par zor deta hai.- Malumat Hasil Karna: Musalsal Taur Par Seekhna aur Tafseelati Tahlil

- Ek hissa waqt mein trading karne wale ke taur par, maamoolan taur par economic indicators, geopolitical events aur market news ke baray mein malumat hasil karna zaroori hai. Ye aapko mukammal faislay karne aur tabdeel hone wale market conditions ke mutabiq adapt hone mein madad karta hai.

- Jazbati Hushiyari: Zehni Masail Se Nipatna

- Jazbati hushiyari, effective risk management ka aham hissa hai. Khauf ya lalach se mohr laganay wale impulsive decisions se bachain.

- Apne trading plan par amal karna, aur zarurat paray toh breaks le kar ek saaf dimaag banaye rakhne mein madad karein.

- Regular Tahlil: Trades Se Seekhna

- Apni trades ko baar-baar tahlil karna, chahe woh munafa de rahe hon ya nuksan, ye zaroori hai. Dekhein ke kya behtar kaam kia gaya aur kya sudharat ho sakti hai.

- Apne evaluations ke mutabiq apne strategies ko adjust karein, dhyan mein rakhte hue ke forex market dynamc hai aur is mein mukammal adaptability ki zarurat hai.

- Risk Mitigation Tools Ka Istemal Karna: Hedging aur Options

- Hedging aur options jese advanced strategies ka istemal kuch market conditions mein risk kam karne ke liye kiya ja sakta hai.

- In tools ko apne trading plan mein shamil karne se pehle inka theek tarah se istemal samajh lein.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- Position Sizing: Risk aur Reward ka Balance

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

### Forex Trading Mein Money Aur Risk Management Kya Hai?

Forex trading mein success ke liye, sirf market trends aur technical analysis hi nahi, balki effective money aur risk management bhi zaroori hai. Yeh strategies aapko losses ko control karne aur profits ko maximize karne mein madad karti hain. Aaj hum discuss karenge ke money aur risk management kya hota hai aur forex trading mein iska importance kya hai.

### Money Management

**Money management** forex trading mein aapke trading capital ko effectively manage karne ki strategy hai. Iska main goal yeh hota hai ke aap apni trading capital ko protect karte hue consistent profits achieve kar sakein. Money management ke key elements hain:

1. **Position Sizing**: Yeh determine karta hai ke aap har trade mein kitna capital risk par laga rahe hain. General rule yeh hai ke ek trade mein apni total capital ka 1-2% se zyada risk na lein. Yeh aapke capital ko large losses se protect karta hai.

2. **Risk-Reward Ratio**: Yeh ratio aapko batata hai ke aap har trade mein potential reward ko risk ke comparison mein kaise evaluate karte hain. Achi trading strategies mein risk-reward ratio 1:2 ya usse zyada hona chahiye, jiska matlab hai ke aap har trade mein apne risk se do guna ya usse zyada profit expect karte hain.

3. **Trading Plan**: Money management ke ek part ke roop mein ek clear trading plan banana zaroori hai. Isme aapke trading goals, strategies, aur risk management rules define honi chahiye. Yeh plan aapko disciplined trading aur consistent results achieve karne mein madad karta hai.

### Risk Management

**Risk management** trading risks ko minimize karne aur trading losses ko control karne ki strategy hai. Iska main goal yeh hota hai ke aap apni capital ko large losses se bachayein aur trading risks ko effectively manage karein. Risk management ke key elements hain:

1. **Stop-Loss Orders**: Yeh orders aapko ek predefined price level par apni position automatically close karne mein madad karte hain, jab market aapke against move karti hai. Stop-loss orders aapko losses ko limit karne aur capital ko protect karne mein help karte hain.

2. **Take-Profit Orders**: Yeh orders aapki position ko ek predetermined profit level par close karte hain. Take-profit orders aapke profits ko lock karte hain aur market ki reversal se aapke gains ko protect karte hain.

3. **Diversification**: Trading capital ko diversify karna bhi ek effective risk management strategy hai. Different currency pairs aur trading strategies mein capital invest karne se aap apne overall risk ko spread kar sakte hain aur specific trades ke risk ko reduce kar sakte hain.

### Conclusion

Forex trading mein money aur risk management ka role bohot crucial hai. Effective money management strategies aapke capital ko protect karne aur consistent profits achieve karne mein madad karti hain, jabke risk management strategies aapko trading risks ko minimize karne aur large losses se bachane mein help karti hain. In strategies ko apni trading plan mein include karke, aap apne trading performance ko improve kar sakte hain aur long-term trading success achieve kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:15 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим