Harmonic chart patterns;

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

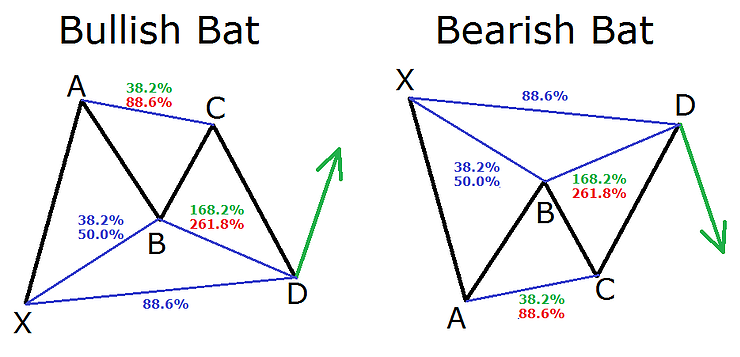

Assalam alaikum traders! Aj huk chart patterns main agy barhty hovy naya topic start karty hain HARMONIC Patterns. harmonic patterbd drasal geomatic shapes hoti hain jo k market main fibonacci levels ko use kr k bnti hain or phr ye hamen market ki next movement k bary main information deti hain. Top 7 Harmonic chart patterns THE ABCD pattern The BAT pattern The GARTLEY patterb The BUTTERFLY pattern The CRAB pattern The SHARK pattern The DEEP CRAB pattern aj in main se hum 2 patterns ko discuss karen or baki series ki form main posts main discuss kia krn gy 2,2 kr k. THE ABCD PATTERN; Ye harmonic patterns main se sb se easy pattern ha ye pattern 3 movements or 4 points py mushtamil hota ha. 2 impulsive moves hoti hain or 1 corrective move hoti ha. 1st impulsive move AB hoti ha or phr corrective move hoti ha BC and then impulsive move hoti ha CD estra 4 points ko mila k 1 pattern bn jata ha. Traders es pattern main C point se entry ke skty hain D tk ya phr patterb complete hony ka wait krna chahye koe bhi entry leny k lye.THE BAT PATTERN: Es pattern ko BAT pattern es lye kaha jata ha k pattern complete hony py 1 BAT jaosi shape dekhny ko milti ha. Es main ABCD pattern se 1 extra ray hoti ha jisko leg b kaha jata or 1 extra point ha X k nam se. 1st leg XA hoti ha or us k bad AB retracement hoti ha agr AB retracement XA ki move k 50% ho to ap BAT pattern ka wait kar skty hain. or es k bad BC move hoti ha jo k 2.18% ho skti ha or us k nad final CD move hoti ha jo k XA k equal ya us se zada ho skti ha. In sb moves k conplete hony py BAT shape banti ha. -

#3 Collapse

HARMONIC CHART PATTERN IN FOREX EXPLANATION INTRODUCTION Harmonic chart patterns are a set of trading formations that use specific price ratios to identify potential trend reversals or continuation points in the forex market. These patterns are based on Fibonacci ratios and help traders make more informed decisions. TYPES OF HARMONIC CHART PATTERNS There are eight important and famous Harmonic chart patterns are as under. ABCD Pattern BAT Pattern BUTTERFLY Pattern CRAB Pattern DEEP CRAB Pattern SHARK Pattern GARTLEY Pattern GARTLEY PATTERN Gartley pattern is a four-point formation that signals potential reversals. It consists of specific Fibonacci ratios that help traders predict where price might change direction. BUTTERFLY PATTERN Butterfly pattern is a variation of the Gartley pattern. It also involves four points and Fibonacci ratios, but the structure differs slightly. It indicates potential trend reversals as well. BAT PATTERN The Bat pattern is another harmonic pattern that focuses on potential reversals. It uses five points and specific Fibonacci levels to identify possible turning points in the market. CYPHER PATTERN Cypher pattern is a four-point formation that aims to identify potential trend continuation points. Traders use Fibonacci ratios to spot where price might continue its current trajectory. ABCD CHART PATTERN Ye harmonic patterns main se sb se easy pattern ha ye pattern 3 movements or 4 points py mushtamil hota ha.2 impulsive moves hoti hain or 1 corrective move hoti ha.1st impulsive move AB hoti ha or phr corrective move hoti ha BC and then impulsive move hoti ha CD estra 4 points ko mila k 1 pattern bn jata ha.Traders es pattern main C point se entry ke skty hain D tk ya phr patterb complete hony ka wait krna chahye koe bhi entry leny k lye. SHARK PATTERN Shark pattern is a five-point structure that can signal both reversals and continuations. It helps traders anticipate potential price movements based on Fibonacci levels. CRAB PATTERN The Crab pattern is a relatively rare harmonic pattern. It involves five points and specific Fibonacci ratios to predict potential turning points in the market. HARMONIC CHART PATTERNS STRATEGY Traders identify harmonic patterns by plotting price points and connecting them with trendlines. Once a pattern is recognized, traders can anticipate potential entry and exit points for their trades. However, it's important to note that harmonic patterns are just one tool among many in a trader's toolkit and should be used in conjunction with other analysis techniques for better accuracy.In summary, harmonic chart patterns provide forex traders with a systematic way to identify potential trend reversals and continuation points in the market using Fibonacci ratios and specific price formations. -

#4 Collapse

Harmonic chart patterns ek prakar ke technical analysis tools hote hain jo price charts mein specific geometric structures aur price ratios ko identify karne mein madad karte hain. In patterns ka istemal traders aur investors market trends aur potential price reversals ko samajhne mein karte hain. Ye patterns historical price data par adharit hote hain aur market psychology aur supply-demand dynamics ko reflect karte hain.Yahan kuch pramukh harmonic chart patterns diye gaye hain: Gartley Pattern: Ye pattern 4 price swings (legs) par based hota hai aur Fibonacci ratios ka istemal karta hai. Gartley pattern potential trend reversal ko indicate karta hai. Butterfly Pattern: Butterfly pattern bhi 4 price swings par based hota hai, lekin isme different Fibonacci ratios aur structure hota hai. Ye pattern price trend mein potential reversal ko dikhata hai. Bat Pattern: Bat pattern bhi 4 legs par based hai aur specific Fibonacci ratios ka istemal hota hai. Iska goal price trend mein reversal ka indication dena hota hai. Cypher Pattern: Cypher pattern bhi 4 legs par based hota hai aur Fibonacci ratios ka istemal karta hai. Ye pattern market trend mein change ko signal karta hai.Shark Pattern: Shark pattern bhi 4 price swings par focused hota hai aur Fibonacci ratios ka istemal hota hai. Ye pattern trend reversal ke liye use hota hai. ABCD Pattern: ABCD pattern price swings ko specific ratios se connect karta hai aur price trend ke potential reversal ko dikhata hai. Three-Drive Pattern: Is pattern mein 3 price drives ya moves hote hain jo Fibonacci ratios ke saath correlate karte hain. Crab Pattern: Crab pattern bhi Fibonacci ratios aur 4 price legs par based hota hai, aur ye potential reversal points ko highlight karta hai.Ye sirf kuch harmonic chart patterns hain, aur har pattern apni unique geometry, Fibonacci ratios, aur trading rules ke saath aata hai. Lekin yaad rakhein ki harmonic patterns ka istemal karna complex ho sakta hai aur unko samajhne aur trade karne ke liye thorough knowledge aur practice ki zaroorat hoti hai. -

#5 Collapse

"Harmonic Chart Patterns" forex market mein dekhe jane wale specific price patterns hote hain jo price action analysis mein istemal hote hain. Yeh patterns Fibonacci retracement aur extension levels par based hote hain aur trend continuation ya reversal ki possibility ko indicate karte hain. Chaliye, iske bare mein aur jankari hasil karte hain: **Harmonic Chart Patterns:** Harmonic chart patterns specific geometrical shapes hote hain jo Fibonacci levels ko follow karte hain. In patterns mein price movement ko geometric ratios se compare kiya jata hai, jaise ki 0.618 (Golden Ratio) aur 0.382. Kuch pramukh Harmonic Patterns hote hain:- 1. **Gartley Pattern:** Yeh pattern price movement mein AB=CD aur BC=0.618AB ratios ko follow karta hai.

- 2. **Butterfly Pattern:** Is pattern mein AB=CD aur BC=0.786AB ratios dekhe jate hain.

- 3. **Bat Pattern:** Bat pattern AB=CD aur BC=0.886AB ratios par based hota hai.

- 1. **Price Reversal Prediction:** Harmonic patterns trend reversal ki possibility ko point karte hain, jisse traders trend change ke liye taiyar ho sakte hain.

- 2. **Entry and Exit Points:** Pattern ki madad se traders entry aur exit points decide kar sakte hain.

- 3. **Clear Risk-Reward Ratio:** Fibonacci levels ki madad se traders stop-loss aur target points set karke risk-reward ratio improve kar sakte hain.

- 1. **Complexity:** Patterns ko identify karna complex ho sakta hai, khaaskar beginners ke liye.

- 2. **False Signals:** Kabhi-kabhi pattern false signals generate kar sakta hai, jahan price movement expected direction mein nahi hota.

- 3. **Subjective Interpretation:** Traders ke different interpretations ki wajah se pattern ko sahi tareekay se recognize karna mushkil ho sakta hai.

-

#6 Collapse

Harmonic chart patterns are a set of trading formations that use specific price ratios to identify potential trend reversals or continuation points in the forex market. These patterns are based on Fibonacci ratios and help traders make more informed decisions. TYPES OF HARMONIC CHART PATTERNS There are eight important and famous Harmonic chart patterns are as under. ABCD Pattern BAT Pattern BUTTERFLY Pattern CRAB Pattern DEEP CRAB Pattern SHARK Pattern GARTLEY PatternGARTLEY PATTERN Gartley pattern is a four-point formation that signals potential reversals. It consists of specific Fibonacci ratios that help traders predict where price might change direction. BUTTERFLY PATTERN Butterfly pattern is a variation of the Gartley pattern. It also involves four points and Fibonacci ratios, but the structure differs slightly. It indicates potential trend reversals as well. BAT PATTERN The Bat pattern is another harmonic pattern that focuses on potential reversals. It uses five points and specific Fibonacci levels to identify possible turning points in the market. CYPHER PATTERN Cypher pattern is a four-point formation that aims to identify potential trend continuation points. Traders use Fibonacci ratios to spot where price might continue its current trajectory.ABCD CHART PATTERN Ye harmonic patterns main se sb se easy pattern ha ye pattern 3 movements or 4 points py mushtamil hota ha.2 impulsive moves hoti hain or 1 corrective move hoti ha.1st impulsive move AB hoti ha or phr corrective move hoti ha BC and then impulsive move hoti ha CD estra 4 points ko mila k 1 pattern bn jata ha.Traders es pattern main C point se entry ke skty hain D tk ya phr patterb complete hony ka wait krna chahye koe bhi entry leny k lye.

SHARK PATTERN Shark pattern is a five-point structure that can signal both reversals and continuations. It helps traders anticipate potential price movements based on Fibonacci levels. CRAB PATTERN The Crab pattern is a relatively rare harmonic pattern. It involves five points and specific Fibonacci ratios to predict potential turning points in the market. HARMONIC CHART PATTERNS STRATEGY

-

#7 Collapse

Harmonic Chart Pattern: Harmonic or Consonant examples ki recognizable proof aur understanding mein intricacy hoti hai. In designs ko sahi tareekay se samajhna aur apply karna merchants ke liye testing ho sakta hai.2. **False Signals:** kabhi market commotion ya unforeseen cost developments ki wajah se symphonious examples misleading signs create kar sakte hain.3. **Subjectivity:** Consonant examples ko decipher karte waqt dealers ke choices mein subjectivity ka factor hota hai. Various merchants various translations kar sakte hain.4. **Time-Consuming:** Examples ki exact ID aur affirmation tedious ho sakti hai, particularly unpracticed brokers ke liye.**Yad rahe ke symphonious examples bhi ek progressed idea hain aur inko sahi tareekay se samajhne aur apply karne ke liye practice aur experience ki zaroorat hoti hai.** Forex exchanging mein implied gambles with ko samajhne ke baad hey choices leni chahiye aur ideal situation mein kisi monetary consultant ki madad bhi li jaani chahiye. Designs market ke pattern change sharpen ke early signs give karte hain.2. **Entry and Exit Points:** In designs ko dekhte tint brokers ko potential passage aur leave focuses ka thought mil jata hai. Yani, punch ek consonant example affirm ho jata hai, to brokers us point standard positions le sakte hain.3. **High Likelihood Setups:** Agar symphonious examples sahi tareekay se recognize aur affirm kiye jayein, to yeh high likelihood exchanging arrangements give karte hain. Isse brokers areas of strength for ko inversions mein fayda hota hai.4. **Target Levels:** Har ek symphonious example ke saath target levels bhi related hote hain, jahan cost ka development jana expected hai. Yeh levels design ke extents aur proportions ke based standard compute kiye jate hain.5. **Combination with Other Indicators:** Symphonious examples ko other specialized pointers aur cost designs ke saath consolidate karke brokers apni investigation ko further approve kar sakte hain.6. **Different Time Frames:** Symphonious examples ko dealers different time periods standard bhi use kar sakte hain Pattern Formation: Harmonic pattern examples fundamental se sb se simple example ha ye design 3 developments or 4 focuses py mushtamil hota ha.2 incautious moves hoti hain or 1 remedial action hoti ha.1st indiscreet move Stomach muscle hoti ha or phr restorative move hoti ha BC and afterward rash move hoti ha Album estra 4 focuses ko mila k 1 example bn jata ha.Traders es design primary C point se passage ke skty hain D tk ya phr patterb complete hony ka stand by krna chahye koe bhi passage leny k lye.Harmonic graph designs progressed merchants ke liye amazing assets ho sakte hain, lekin unka sahi se istemal karne ke liye exhaustive comprehension aur experience zaroori hota hai. Designs ko samjhne ke liye authentic cost information dissect karna zaroori hai. Hamesha economic situations aur risk factors ko samjh kar exchanging choices lena zaroori hai. Designs ki affirmation ke liye cost development ko intently screen karna zaroori hai, taki bogus signs se bacha ja purpose. Iske saath hello there, risk the board ko bhi need dena zaroori hai.

Designs market ke pattern change sharpen ke early signs give karte hain.2. **Entry and Exit Points:** In designs ko dekhte tint brokers ko potential passage aur leave focuses ka thought mil jata hai. Yani, punch ek consonant example affirm ho jata hai, to brokers us point standard positions le sakte hain.3. **High Likelihood Setups:** Agar symphonious examples sahi tareekay se recognize aur affirm kiye jayein, to yeh high likelihood exchanging arrangements give karte hain. Isse brokers areas of strength for ko inversions mein fayda hota hai.4. **Target Levels:** Har ek symphonious example ke saath target levels bhi related hote hain, jahan cost ka development jana expected hai. Yeh levels design ke extents aur proportions ke based standard compute kiye jate hain.5. **Combination with Other Indicators:** Symphonious examples ko other specialized pointers aur cost designs ke saath consolidate karke brokers apni investigation ko further approve kar sakte hain.6. **Different Time Frames:** Symphonious examples ko dealers different time periods standard bhi use kar sakte hain Pattern Formation: Harmonic pattern examples fundamental se sb se simple example ha ye design 3 developments or 4 focuses py mushtamil hota ha.2 incautious moves hoti hain or 1 remedial action hoti ha.1st indiscreet move Stomach muscle hoti ha or phr restorative move hoti ha BC and afterward rash move hoti ha Album estra 4 focuses ko mila k 1 example bn jata ha.Traders es design primary C point se passage ke skty hain D tk ya phr patterb complete hony ka stand by krna chahye koe bhi passage leny k lye.Harmonic graph designs progressed merchants ke liye amazing assets ho sakte hain, lekin unka sahi se istemal karne ke liye exhaustive comprehension aur experience zaroori hota hai. Designs ko samjhne ke liye authentic cost information dissect karna zaroori hai. Hamesha economic situations aur risk factors ko samjh kar exchanging choices lena zaroori hai. Designs ki affirmation ke liye cost development ko intently screen karna zaroori hai, taki bogus signs se bacha ja purpose. Iske saath hello there, risk the board ko bhi need dena zaroori hai.  Diagram designs ek prakar ke specialized examination devices hote hain jo cost outlines mein explicit mathematical designs aur cost proportions ko recognize karne mein madad karte hain. In designs ka istemal brokers aur financial backers market patterns aur potential cost inversions ko samajhne mein karte hain. Ye designs authentic cost information standard adharit hote hain aur market brain research aur supply-request elements ko reflect karte hain.Yahan kuch pramukh symphonious diagram designs diye gaye ha Es design ko BAT design es lye kaha jata ha k example complete hony py 1 BAT jaosi shape dekhny ko milti ha. Es principal ABCD design se an additional 1 beam hoti ha jisko leg b kaha jata or additional point ha X k nam se.1st leg XA hoti ha or us k awful Stomach muscle retracement hoti ha agr Abdominal muscle retracement XA ki move k half ho to ap BAT design ka stand by kar skty hain.or es k terrible BC move hoti ha jo k 2.18% ho skti ha or us k nad last Compact disc move hoti ha jo k XA k equivalent ya us se zada ho skti ha.in sb moves k conplete hony py BAT shape banti ha. Pattern Trading View: Design 4 cost swings (legs) standard based hota hai aur Fibonacci proportions ka istemal karta hai. Gartley design potential pattern inversion ko show karta hai.Butterfly design bhi 4 cost swings standard based hota hai, lekin isme different Fibonacci proportions aur structure hota hai. Ye design cost pattern mein potential inversion ko dikhata hai.Bat design bhi 4 legs standard based hai aur explicit Fibonacci proportions ka istemal hota hai. Iska objective cost pattern mein inversion ka sign dena hota hai Code design bhi 4 legs standard based hota hai aur Fibonacci proportions ka istemal karta hai. Ye design market pattern mein change ko signal karta hai.Shark Example: Shark design bhi 4 cost swings standard centered hota hai aur Fibonacci proportions ka istemal hota hai. Ye design pattern inversion ke liye use hota hai.ABCD design cost swings ko explicit proportions se associate karta hai aur cost pattern ke potential inversion ko dikhata hai.Is design mein 3 cost drives ya moves hote hain jo Fibonacci proportions ke saath associate karte hain.

Diagram designs ek prakar ke specialized examination devices hote hain jo cost outlines mein explicit mathematical designs aur cost proportions ko recognize karne mein madad karte hain. In designs ka istemal brokers aur financial backers market patterns aur potential cost inversions ko samajhne mein karte hain. Ye designs authentic cost information standard adharit hote hain aur market brain research aur supply-request elements ko reflect karte hain.Yahan kuch pramukh symphonious diagram designs diye gaye ha Es design ko BAT design es lye kaha jata ha k example complete hony py 1 BAT jaosi shape dekhny ko milti ha. Es principal ABCD design se an additional 1 beam hoti ha jisko leg b kaha jata or additional point ha X k nam se.1st leg XA hoti ha or us k awful Stomach muscle retracement hoti ha agr Abdominal muscle retracement XA ki move k half ho to ap BAT design ka stand by kar skty hain.or es k terrible BC move hoti ha jo k 2.18% ho skti ha or us k nad last Compact disc move hoti ha jo k XA k equivalent ya us se zada ho skti ha.in sb moves k conplete hony py BAT shape banti ha. Pattern Trading View: Design 4 cost swings (legs) standard based hota hai aur Fibonacci proportions ka istemal karta hai. Gartley design potential pattern inversion ko show karta hai.Butterfly design bhi 4 cost swings standard based hota hai, lekin isme different Fibonacci proportions aur structure hota hai. Ye design cost pattern mein potential inversion ko dikhata hai.Bat design bhi 4 legs standard based hai aur explicit Fibonacci proportions ka istemal hota hai. Iska objective cost pattern mein inversion ka sign dena hota hai Code design bhi 4 legs standard based hota hai aur Fibonacci proportions ka istemal karta hai. Ye design market pattern mein change ko signal karta hai.Shark Example: Shark design bhi 4 cost swings standard centered hota hai aur Fibonacci proportions ka istemal hota hai. Ye design pattern inversion ke liye use hota hai.ABCD design cost swings ko explicit proportions se associate karta hai aur cost pattern ke potential inversion ko dikhata hai.Is design mein 3 cost drives ya moves hote hain jo Fibonacci proportions ke saath associate karte hain.  Design cost development mein AB=CD aur BC=0.618AB proportions ko follow karta hai. design mein AB=CD aur BC=0.786AB proportions dekhe jate hain. design AB=CD aur BC=0.886AB proportions standard based hota hai.Harmonic designs pattern inversion ki probability ko point karte hain, jisse brokers pattern change ke liye taiyar ho sakte hain. Design ki madad se merchants passage aur leave focuses choose kar sakte hain.Fibonacci levels ki madad se dealers stop-misfortune aur target focuses set karke risk-reward proportion improve kar sakte hain.Patterns ko recognize karna complex ho sakta hai, khaaskar amateurs ke liye.Kabhi-kabhi design misleading signs create kar sakta hai, jahan cost development expected heading mein nahi hota. Brokers ke various translations ki wajah se design ko sahi tareekay se perceive karna mushkil ho sakta hai

Design cost development mein AB=CD aur BC=0.618AB proportions ko follow karta hai. design mein AB=CD aur BC=0.786AB proportions dekhe jate hain. design AB=CD aur BC=0.886AB proportions standard based hota hai.Harmonic designs pattern inversion ki probability ko point karte hain, jisse brokers pattern change ke liye taiyar ho sakte hain. Design ki madad se merchants passage aur leave focuses choose kar sakte hain.Fibonacci levels ki madad se dealers stop-misfortune aur target focuses set karke risk-reward proportion improve kar sakte hain.Patterns ko recognize karna complex ho sakta hai, khaaskar amateurs ke liye.Kabhi-kabhi design misleading signs create kar sakta hai, jahan cost development expected heading mein nahi hota. Brokers ke various translations ki wajah se design ko sahi tareekay se perceive karna mushkil ho sakta hai

-

#8 Collapse

Harmonic Chart Patterns:- Harmonic Chart Patterns forex trading mein aik qisam ki technical analysis hai jahan price charts par mawazna karke future price movements ko predict karna maqsood hota hai. Ye patterns price chart par geometric shapes banate hain jo previous price movements ki tashkeel mein hote hain. Different Harmonic Chart Patterns: Bat Pattern: Ye pattern five key points par mabni hota hai. Ye price movement ka tafsili analysis karke trend ki tashkeel mein madad deti hai. Gartley Pattern: Gartley pattern bhi bat pattern ki tarah hota hai, lekin ismein ratios mukhtalif hotay hain. Ye trend reversal ko show karta hai. Butterfly Pattern: Butterfly pattern strong trend reversal indicate karta hai aur Gartley pattern se mukhtalif hota hai. Is mein price movement ke ratios unique hote hain. Cypher Pattern: Cypher pattern bhi trend reversal ko show karta hai. Ismein price movement ratios important hote hain jo market ki tashkeel par asar andaz hote hain. Shark Pattern: Ye pattern bhi trend reversal ko darshata hai. Shark pattern mein price movement ratios Gartley pattern se mukhtalif hote hain. Harmonic Pattern Identification: Harmonic patterns ko pehchan'ne ke liye traders Fibonacci ratios aur price points ka istemal karte hain. Ye patterns price chart par shapes banate hain jo previous price movements ke sath milti-julti hoti hain. Harmonic Pattern Importance: Harmonic patterns forex traders ke liye ahem hote hain kyun ke inka istemal price predictions mein madad deta hai. Agar pattern sahi tashkeel mein ban raha ho to traders is se future price movements ka andaza lagate hain. Key Point: Harmonic patterns ka istemal karne se pehle mukammal research aur practice zarur karni chahiye. Ye patterns kabhi-kabhi misleading bhi ho sakte hain, is liye in par poori tarah se bharosa karne se pehle mazeed analysis ki zarurat hoti hai. -

#9 Collapse

Harmonic chart patterns, technical analysis ka ek hissa hain jo ke financial markets, jaise ke stocks, currencies, commodities, aur cryptocurrencies, mein istemal hota hai. Ye patterns price charts par nazar aane wale specific geometric shapes hote hain jo market movements mein repetition aur symmetry dikhate hain. Harmonic chart patterns traders aur investors ke liye ek tarah ki roadmap ki tarah kaam karte hain, jo unhe market ke future price movements ka idea dene mein madad karte hain. Ye patterns Fibonacci retracement aur extension levels ke sath judte hain, jinse market trends aur reversals ko predict kiya ja sakta hai.HARMONIC CHART PATTERN:-:max_bytes(150000):strip_icc()/HarmonicPatterns1_2-c9baaf6883714ab2b14f844adb27e175.png) COMMON HARMONIC CHART PATTERN:-Gartley Pattern: Ye pattern price mein ek specific sequence of retracements aur extensions par based hota hai. Gartley pattern bullish aur bearish dono directions mein paya jata hai. Butterfly Pattern: Butterfly pattern bhi retracement aur extension levels par depend karta hai. Isme price mein ek specific symmetrical shape banta hai, jisse traders future price movements ka estimate lagate hain. Bat Pattern: Bat pattern bhi Gartley aur Butterfly patterns ki tarah price movements ko analyze karta hai. Ye bhi ek specific shape create karta hai jo traders ko market ke potential reversals ke bare mein information deta hai. Cypher Pattern: Cypher pattern bhi Fibonacci levels aur price symmetry par based hota hai. Isme price mein ek distinct pattern banta hai jo future price trends ko anticipate karne mein madad karta hai. Shark Pattern: Shark pattern bhi retracement aur extension levels par focus karta hai. Isme price mein ek sharp reversal ki possibility hoti hai. Ye patterns price charts par drawing aur Fibonacci levels ke use se identify kiye ja sakte hain. Traders in patterns ko analyze karke, potential entry aur exit points ka faisla lete hain. Importantly, harmonic chart patterns ek tool hote hain – unka use karne se pehle aapko aur bhi technical aur fundamental analysis ki zarurat hoti hai taake aap sahi trading decisions le saken.

COMMON HARMONIC CHART PATTERN:-Gartley Pattern: Ye pattern price mein ek specific sequence of retracements aur extensions par based hota hai. Gartley pattern bullish aur bearish dono directions mein paya jata hai. Butterfly Pattern: Butterfly pattern bhi retracement aur extension levels par depend karta hai. Isme price mein ek specific symmetrical shape banta hai, jisse traders future price movements ka estimate lagate hain. Bat Pattern: Bat pattern bhi Gartley aur Butterfly patterns ki tarah price movements ko analyze karta hai. Ye bhi ek specific shape create karta hai jo traders ko market ke potential reversals ke bare mein information deta hai. Cypher Pattern: Cypher pattern bhi Fibonacci levels aur price symmetry par based hota hai. Isme price mein ek distinct pattern banta hai jo future price trends ko anticipate karne mein madad karta hai. Shark Pattern: Shark pattern bhi retracement aur extension levels par focus karta hai. Isme price mein ek sharp reversal ki possibility hoti hai. Ye patterns price charts par drawing aur Fibonacci levels ke use se identify kiye ja sakte hain. Traders in patterns ko analyze karke, potential entry aur exit points ka faisla lete hain. Importantly, harmonic chart patterns ek tool hote hain – unka use karne se pehle aapko aur bhi technical aur fundamental analysis ki zarurat hoti hai taake aap sahi trading decisions le saken. -

#10 Collapse

HARMONIC CHART PATTERN:-Harmonic chart patterns financial markets mein potential price reversals aur trend continuation points ko pehchanne ke liye traders aur investors dwara istemal kiye jane wale technical analysis tools hain. Ye patterns Fibonacci ratios aur mukhtalif price aur time relationships par mabni hote hain. Harmonic chart patterns mein ye kuch ahem patterns shamil hain:Butterfly Pattern: Butterfly pattern ko iski mukhtalif M-shape structure se pehchana jata hai. Iska istemal mojud trend mein hone wale potential reversal points ko pehchanne ke liye hota hai. Gartley Pattern: Gartley pattern chart par "W" ya "M" ki shakal mein hota hai aur iska istemal market mein hone wale potential reversal points ko pehchanne ke liye hota hai. Bat Pattern: Bat pattern ek chamgadar ki pankhon ki shakal ko yaad dila dene wala hota hai aur iska istemal market mein hone wale potential reversal points ko pehchanne ke liye hota hai. Crab Pattern (Keera Pattern): Crab pattern market mein hone wale potential reversal points ko pehchane ke liye istemal hota hai. Iska pattern Z-shape ka hota hai aur Fibonacci ratios par mabni hota hai. Shark Pattern (Siyapa Pattern): Shark pattern market mein hone wale potential reversal points ko pehchane ke liye istemal hota hai. Iska pattern bhi Fibonacci ratios par mabni hota hai aur ek V-shape ya inverted V-shape ka hota hai. Ye harmonic patterns traders aur investors ke liye ahem hote hain kyunki inka istemal price movements ke potential changes ko samjhne aur trading decisions banane mein kiya jata hai. In patterns ko chart par dhundh kar samajhna aur unka istemal karna market analysis ka ek hissa hota hai.

Harmonic chart patterns mein ye kuch ahem patterns shamil hain:Butterfly Pattern: Butterfly pattern ko iski mukhtalif M-shape structure se pehchana jata hai. Iska istemal mojud trend mein hone wale potential reversal points ko pehchanne ke liye hota hai. Gartley Pattern: Gartley pattern chart par "W" ya "M" ki shakal mein hota hai aur iska istemal market mein hone wale potential reversal points ko pehchanne ke liye hota hai. Bat Pattern: Bat pattern ek chamgadar ki pankhon ki shakal ko yaad dila dene wala hota hai aur iska istemal market mein hone wale potential reversal points ko pehchanne ke liye hota hai. Crab Pattern (Keera Pattern): Crab pattern market mein hone wale potential reversal points ko pehchane ke liye istemal hota hai. Iska pattern Z-shape ka hota hai aur Fibonacci ratios par mabni hota hai. Shark Pattern (Siyapa Pattern): Shark pattern market mein hone wale potential reversal points ko pehchane ke liye istemal hota hai. Iska pattern bhi Fibonacci ratios par mabni hota hai aur ek V-shape ya inverted V-shape ka hota hai. Ye harmonic patterns traders aur investors ke liye ahem hote hain kyunki inka istemal price movements ke potential changes ko samjhne aur trading decisions banane mein kiya jata hai. In patterns ko chart par dhundh kar samajhna aur unka istemal karna market analysis ka ek hissa hota hai. -

#11 Collapse

### Harmonic Chart Patterns: Ek Wazahat

Harmonic chart patterns ek advanced technical analysis technique hai jo price movements ko predict karne mein madad karti hai. Yeh patterns mathematical ratios aur Fibonacci levels par mabni hote hain, aur inhe traders market ke reversals aur continuations ko samajhne ke liye istemal karte hain. Aayiye, harmonic patterns ki buniyadi asal, types aur trading strategies par nazar daalte hain.

**Harmonic Patterns Ki Pehchaan**

Harmonic patterns chaar ya zyada price swings par mabni hote hain, jinke darmiyan defined relationships aur ratios hote hain. Yeh patterns aksar complex hote hain, lekin inki pehchaan se traders ko precise entry aur exit points milte hain. Kuch mashhoor harmonic patterns hain:

1. **Gartley Pattern**: Yeh pattern bullish ya bearish reversal ko darust karta hai aur 61.8% Fibonacci retracement level par banta hai.

2. **Bat Pattern**: Yeh bhi bullish ya bearish reversal ko darust karta hai, lekin iski key level 88.6% Fibonacci retracement hoti hai.

3. **Butterfly Pattern**: Yeh pattern market ki volatility ko darust karta hai aur iski key level 78.6% Fibonacci retracement par hoti hai.

4. **Crab Pattern**: Yeh pattern zyada volatile hota hai aur 161.8% Fibonacci extension level par banta hai.

**Market Sentiment**

Harmonic patterns market ki psychological behavior aur price movements ko samajhne mein madadgar hote hain. Jab yeh patterns form hote hain, to yeh indicate karte hain ke market mein reversal ya continuation ki potential hoti hai. Traders ko in patterns ki confirmation ka intezar karna chahiye, jaise candlestick patterns ya volume analysis.

**Trading Signals**

1. **Entry Points**: Jab harmonic pattern complete hota hai aur price reversal ya continuation ki taraf jati hai, to traders yahan entry le sakte hain. Entry Fibonacci levels par hoti hai.

2. **Exit Points**: Take profit levels ko previous highs/lows ya Fibonacci extensions par set kiya jata hai.

**Risk Management**

Harmonic patterns mein risk management bohot zaroori hai. Traders ko stop-loss orders ko recent swing high (bullish trades) ya swing low (bearish trades) ke neeche ya upar rakhna chahiye. Yeh unexpected market movements se bachne mein madadgar hota hai.

**Conclusion**

Harmonic chart patterns ek sophisticated approach hai jo forex trading mein use hoti hai. In patterns ka sahi istemal traders ko market ki dynamics ko samajhne aur profitable trades lene mein madad karta hai. Hamesha risk management ka khayal rakhein aur comprehensive analysis karna na bhoolen taake behtar results hasil kar saken.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

### Harmonic Chart Patterns: Ek Overview

1. **Ta'aruf**:

- Harmonic chart patterns technical analysis ke ek advanced tool hain jo price movements ki prediction ke liye istemal hote hain.

- Yeh patterns Fibonacci numbers aur ratios par mabni hote hain, jo price retracement aur extension ko samajhne mein madadgar hote hain.

2. **Basic Concept**:

- Harmonic patterns kisi bhi financial market, jaise forex, stocks, aur commodities mein bante hain.

- Yeh patterns ek definite geometric shape mein form hote hain, jo bullish ya bearish trends ko indicate karte hain.

3. **Common Harmonic Patterns**:

- **Gartley Pattern**:

- Is pattern mein ek bullish reversal hota hai.

- Iski structure AB=CD pattern par mabni hoti hai, jahan retracement 61.8% tak hoti hai.

- **Bat Pattern**:

- Yeh bullish ya bearish reversal ko indicate karta hai.

- Iska retracement 38.2% se 88.6% tak hota hai, jo market ki momentum ko darshata hai.

- **Butterfly Pattern**:

- Is pattern mein price ek extreme reversal point par hota hai.

- Retracement 78.6% tak hota hai, jo bearish ya bullish trend ke liye signals deta hai.

- **Crab Pattern**:

- Yeh bearish ya bullish trend reversal ka indication deta hai.

- Retracement 61.8% se 88.6% tak hota hai, aur ismein price movement sudden hota hai.

4. **Pattern Formation**:

- Har harmonic pattern ke liye specific points hain jo Fibonacci ratios ke mutabiq hoti hain.

- Patterns ki identification ke liye price movements ko carefully analyze karna padta hai.

5. **Trading Strategy**:

- Harmonic patterns ko identify karne ke liye chart patterns aur Fibonacci retracement levels ka istemal hota hai.

- Entry point tab hota hai jab pattern complete hota hai aur confirmation signal milta hai.

- Stop loss ko pattern ke outer edge ya last swing point ke neeche rakhna chahiye.

6. **Psychology**:

- Harmonic patterns market participants ki psychology ko darshate hain, jo trading decisions aur market movements ko affect karte hain.

- Traders in patterns ko use kar ke sentiment aur market ke potential reversals ko samajhte hain.

7. **Limitations**:

- Harmonic patterns ka identification mushkil ho sakta hai, kyunki market conditions aur volatility in patterns ko affect kar sakti hain.

- In patterns ko sirf ek analysis tool ke taur par istemal karna chahiye, dusre indicators ke sath milakar.

8. **Conclusion**:

- Harmonic chart patterns traders ko market ke potential reversals aur trends ko samajhne mein madad karte hain.

- Yeh patterns advanced analysis ka hissa hain, aur inhe sahi tarike se istemal karke traders apne trading decisions ko behtar bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:56 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим