what is wolfe wave pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

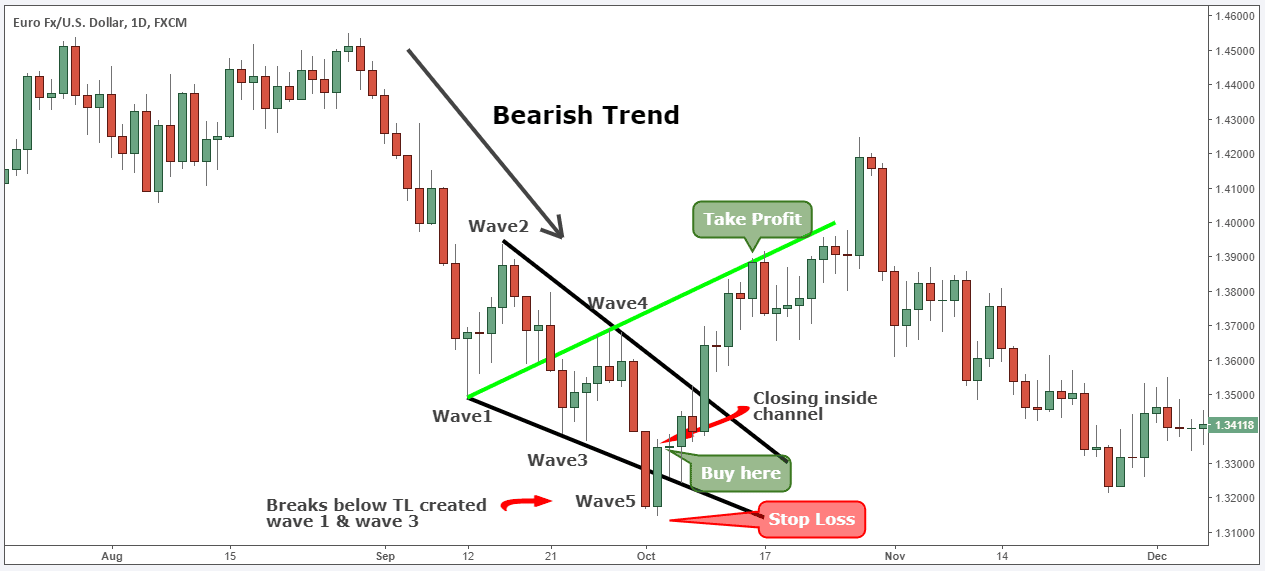

Introductions Dear members mery dost behn bhai Azizo umeed h ky ap sb khairiyat se honge bhaiyo aj mn apko wolf wave pattern ke bare mein bataungi ke wolf wave pattern kya hai iska Forex ke platform Mein Kya Kam Hai to main Aaj aapko ine sab ke bare mein bataungi detail Mein jisko janne ke bad aap bahut jyada fayda utha sakenge to aaye ham is topic per batchit karte hain shukriya Wolfe Wave Pattern" forex trading mein aik chart pattern hai jo trend reversal aur trend continuation co identify card hai. Is pattern ki shakal thodi si wazeh nahi hoti lekin isme price ke specific movements hot hain.Wolfe Wave pattern mein pehle ek wave hota hai jo bear movement card hai Uske baad make small waves hotay hain jinmein price thoda move up card hai Phir aata hai aik big bull wave yes pehle bear wave ke starting point tak pohunchta hai Iske baad phir aik small bear wave ata hai yes previous bull wave wave mein retrace hota hai. Yani, yeh pattern "abcdabcd" ki shakal mein hota hai.Is pattern ki pehchaan thodi mushkil ho sakti hai Wolfe Wave pattern ko confirm karne ke liye specific Fibonacci retracement levels aur price movements a ko detekh trading kar traders Agar pattern theek se identify ho, toh yeh price ka reversal ya continuation ka strong signal ho sakta hai.Je pattern ka istemal trend reversals aur entry points tayyar karne mein hota hai. Lekin, Wolfe Wave pattern complex hai aur isko sahi tashkhees karne ke liye practice aur research zaroori hai. Is pattern ko sirf confirmation aur doosre indicators ke saath istemal karna chahiye, kyun ke kabhi kabhi false signals bhi ho sakte hain.Toh yaar, Wolfe Wave pattern ek powerful tool ho sakta hai agar sahi tareeqay se istemal kiya jaye. Lekin samajhne aur istemal karne se pehle, iska samajhne study aur practice zaroori hai. what is wolfe wave pattern Bilkul, tafseel maze with samjhaata hoon. Wolfe Wave pattern forex trading mein ek advanced chart pattern hai jo traders ko price trends aur reversals ko pehchaanne mein madad deta hai.Pattern ka shape "abcdabcd" ki tarah hota hai. Yani, pehle aik bear move hota hai (A), phi do chote bull moves (B aur C) aate hain, aur akhir mein aik lamba bull move hota hai jo pehle bear move (A) to starting point tak pohunchta hai (D) . Iske baad phir aik chota bearish retracement hota hai jo us lambay bullish movement (D) mein hota hai.Wolfe Wave pattern ko identify karna mushkil ho sakta hai, lekin isme Fibonacci retracement levels aur specific price points ki madad se pehchan ki ja sakti hai . Agar yeh pattern sahi dhang se tashkhees ho, toh iska matlab ho sakta hai ke price trend ka reversal honay wala hai ya phir trend continuation ho raha hai. Pattern ka faida yeh hai ke yeh traders ko entry aurne de exit points haydayar . Lekin, iska nuksan yeh bhi hai ke kabhi kabar yeh false signals de sakta hai. Isliye Wolfe Wave pattern ko confirmation aur doosre technical tools ke saath istemal karna zaroori hota hai.Bhai, Wolfe Wave pattern trading my ek powerful tool ho sakta hai, lekin iska istemal sahi tareeqay se karna zaroori hai. He is a role model ko samajhne aur istemal karne ke liye praxi aur research ki zaroorat hoti hai. -

#3 Collapse

-

#4 Collapse

-

#5 Collapse

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

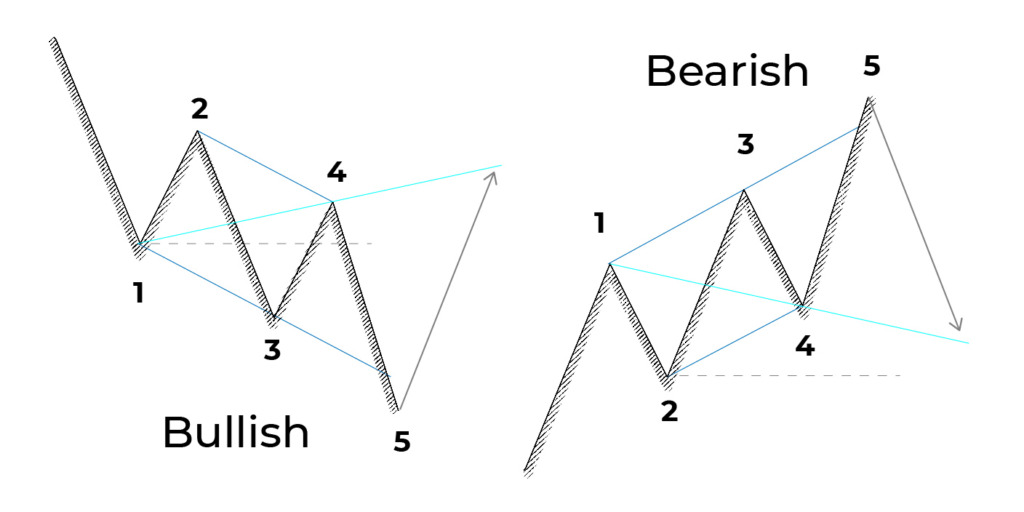

"Wolfe Wave" ek technical analysis pattern hai jo financial markets mein istemal hota hai. Ye pattern price chart par dikhne wale highs aur lows ko identify karta hai, jisse ek particular price movement ka pattern ban jata hai. Is pattern mein typically 5 waves hote hain, jinmein 3 bullish (upward) aur 2 bearish (downward) moves shamil hote hain. Ye pattern traders ko future price movement predict karne mein madad dene ke liye istemal hota hai. -

#7 Collapse

WHAT IS WOLFE WAVE PATTERN DEFINITION wolfe wave Ek candlestick chart pattern Hota Hai is system ko istemal Karne Wale invester pattern ki taraf se indicated resistance and support lines ki buniyad per apni trade ka time Karte Hain Jo price Mein 5 Wave pattern per moshtamil Hota Hai wolfe ke mutabik naturally taur per Tamam market Mein Paye Jaate Hain in ko pahchanne ke liye traders ko price ke Ek series ki maloomat Karni chahie Teesri aur Chauthi wave ko Pahli and dusri waves ke zariye banae Gaye channel ke andar Rahana chahie target ke price Wave ke end ki predict Karti Hain aur uski vajah se vah Mukam Jis per traders ka maksad position se fayda uthana hai agar koi traders walfe wave ki tashkel ke sath hi uski right identify karta hai IDENTIFYING WOLFE WAVE PATTERN USING TECHNICAL ANALYSIS wolfe wave Mein technical analysis chart pattern ka istemal Karte Hain jismein wolfe wave zyada Se zyada profit ke liye market ki movement Ko chart pattern Mein dekhte hain Jo Ek. Ke dauran security ke liye price ki movement ko zahar Karte Hain Jab technical analysis wolfe wave Jaise patterns ko Talash karte hain to vah break out Se fayda uthane Ki Koshish Karte Hain Jahan shares ki prices support and resistance level ke zarie banne wale channel se Bahar Chali Jaati Hai aur supply and demand Vahi Laws support and resistance ki level Paida Karte Hain Agar traders pattern ya trend ki mis identify Karte Hain to vah Ek Aham risk se dochar Hote Hain zyada Se zyada profit kamane Wale traders ko real time mein kharidne ya Bechne ke liye right points ki maloomat Karni chahie

IDENTIFYING WOLFE WAVE PATTERN USING TECHNICAL ANALYSIS wolfe wave Mein technical analysis chart pattern ka istemal Karte Hain jismein wolfe wave zyada Se zyada profit ke liye market ki movement Ko chart pattern Mein dekhte hain Jo Ek. Ke dauran security ke liye price ki movement ko zahar Karte Hain Jab technical analysis wolfe wave Jaise patterns ko Talash karte hain to vah break out Se fayda uthane Ki Koshish Karte Hain Jahan shares ki prices support and resistance level ke zarie banne wale channel se Bahar Chali Jaati Hai aur supply and demand Vahi Laws support and resistance ki level Paida Karte Hain Agar traders pattern ya trend ki mis identify Karte Hain to vah Ek Aham risk se dochar Hote Hain zyada Se zyada profit kamane Wale traders ko real time mein kharidne ya Bechne ke liye right points ki maloomat Karni chahie  UNDERSTANDING WOLFE WAVE wolfe wave ki two types hoti hain Jo falling channels aur rising channels Hain Jab position niche ki taraf Hoti Hai To price down trend Mein Pai jaati hai aur Agar price Upar ki taraf jaati hai to aap trend Mein Jaati Hai forex market Mein bulls and bears Ek dusre se opposite Hote Hain aur iska determine rising window Se Ki Jaati Hai is pattern ke upri Shadow Hote Hain

UNDERSTANDING WOLFE WAVE wolfe wave ki two types hoti hain Jo falling channels aur rising channels Hain Jab position niche ki taraf Hoti Hai To price down trend Mein Pai jaati hai aur Agar price Upar ki taraf jaati hai to aap trend Mein Jaati Hai forex market Mein bulls and bears Ek dusre se opposite Hote Hain aur iska determine rising window Se Ki Jaati Hai is pattern ke upri Shadow Hote Hain

-

#8 Collapse

Wolfe Wave pattern ek technical analysis pattern hai jo trading mein istemal hota hai taakay potenital price reversals ko pehchaan sakay. Is pattern ka tashkeel ek trader Bill Wolfe ne banaya tha, aur is ka asal maqsad yeh hai ke bazar mein qeemat (price) aksar ek serye mein taqseem hoti hai. Is pattern ka maqsad amooman yeh hota hai ke jahan price ek hali trend ko reverse karke opposite direction mein jana hai, uss point ko pehchaanna hai. Aam taur par ek Wolfe Wave pattern mein paanch waves shamil hotay hain. Yeh waves ya to bullish (umeed se ziada qeemat) hote hain ya phir bearish (umeed se kam qeemat) hote hain. Is pattern ko mukhtalif points aur lines se define kiya jata hai:- Point 1: Yeh pattern ka shuruaati point hota hai aur amooman ek bullish pattern mein pehli wave ki kam qeemat ya bearish pattern mein pehli wave ki ziada qeemat hoti hai.

- Point 2: Yeh point ek temporary high hota hai bullish pattern mein ya phir temporary low bearish pattern mein.

- Point 3: Yeh bullish move ka ziada point hota hai ya phir bearish move ka kam point hota hai. Yeh amooman point 1 se ziada qeemat par hota hai bullish pattern mein aur point 1 se kam qeemat par hota hai bearish pattern mein.

- Point 4: Yeh point ek temporary low hota hai bullish pattern mein ya temporary high bearish pattern mein. Yeh amooman point 1 aur point 3 ke darmiyan hota hai.

- Point 5: Yeh point woh point hota hai jahan price ko reverse honay ki tawaqo ki jati hai aur woh opposite direction mein jana shuru karta hai. Yeh amooman ek line ko shamil karta hai jo point 1 se point 3 tak jati hai aur dosri line ko shamil karta hai jo point 2 se point 4 tak jati hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Wolfe Wave pattern ek technical analysis tool hai jo financial markets, jaise ki stocks, forex, commodities, aur cryptocurrencies mein price movements ko analyze karne ke liye istemal hota hai. Wolfe Wave pattern price chart par specific geometric shapes aur price patterns ko identify karne mein madad karta hai, jisse traders aur investors future price movements predict kar sakte hain. Wolfe Wave pattern ek trend-reversal pattern hai, yaani ki yeh price trend ke palatne ka sanket deta hai. Is pattern mein typically ek sequence of rising aur falling price waves hoti hai, jinmein kuch specific rules follow hote hain. Wolfe Wave pattern ek bullish (uptrend) ya bearish (downtrend) reversal pattern ho sakta hai. Wolfe Wave pattern ka formation kuch basic steps par rely karta hai:Initial Impulse (Leg 1-2): Pehla step mein, ek strong price movement hota hai, either up ya down. Isse "Leg 1" aur "Leg 2" kaha jata hai. Wave 1-2 Retracement: Leg 1 ke baad, price mein ek retracement hota hai, jise "Wave 1-2 Retracement" kehte hain. Is retracement mein price thoda reverse hota hai. Wave 2-3 Trend: Retracement ke baad, price phir se direction change karta hai aur ek naya trend shuru hota hai, jise "Wave 2-3 Trend" kehte hain. Wave 3-4 Retracement: Leg 2 tak ka trend ke baad, phir se ek retracement hota hai, jise "Wave 3-4 Retracement" kehte hain. Wave 4-5 Trend: Retracement ke baad, price phir se direction change karta hai aur pattern ka completion hota hai, jise "Wave 4-5 Trend" kehte hain. Wolfe Wave pattern ko identify karne ke liye specific rules aur guidelines hote hain, jaise ki wave lengths, slope directions, aur price levels. Traders is pattern ko dekh kar future price movement ka anuman lagane ki koshish karte hain, lekin yeh reliable nahi hamesha hota hai, kyunki markets unpredictable hote hain aur patterns ka asar market conditions par depend karta hai. Pattern ko correctly identify karna aur us par trade karna complex ho sakta hai, isliye traders ko isko achhe se samajhne aur test karne ki practice karni chahiye, ideally demo accounts par, before using it for real trading decisions.

-

#10 Collapse

-

#11 Collapse

Wolfe Wave pattern aik technical analysis ka method hai jo traders ke liye financial markets mein price movements ka predict karne mein madadgar hota hai. Yeh pattern ek khas formation banata hai charts par, jo price ke reversal ya continuation ke baare mein signal deta hai. Is pattern ko sabse pehle Bill Wolfe ne identify kiya tha, aur is wajah se isko Wolfe Wave kaha jaata hai. Aam taur par, yeh pattern natural law of physics par mabni hota hai, aur yeh waves ke 5 points par mabni hota hai jo kisi bhi market mein paaye ja sakte hain, chaahe woh stocks hoon, commodities hoon, ya forex pairs hoon. Wolfe Wave aik reversal pattern hai jo price ke extreme levels ko dhoondhne ke liye use hota hai. Is pattern mein paanch points (waves) shamil hoti hain jo aik khas tariqe se form hoti hain. Yeh waves bullish ya bearish dono situations mein banti hain. Is pattern ka maksad yeh hai ke market mein support aur resistance levels ko identify karna aur phir unko trade karna.

Wolfe Wave pattern ko samajhne ke liye, sabse pehle yeh samajhna zaroori hai ke yeh kis tarah se form hoti hai:- Wave 1 aur Wave 2: Yeh waves initial movement hoti hain. Wave 1 se start hoti hai aur wave 2 tak jaati hai. Yeh do points (top ya bottom) banate hain.

- Wave 3: Yeh wave 2 ke baad hoti hai aur yeh trend ke against movement ko represent karti hai.

- Wave 4: Yeh wave phir se trend ke saath hoti hai, aur yeh wave 1 ke level par ya us se qareeb hoti hai.

- Wave 5: Yeh final wave hoti hai aur yeh wave 3 ke level tak ya us se thodi upar jaati hai. Yeh wave usually market mein reversal ka indication deti hai.

Wolfe Wave Pattern ke Asal Elements

Wolfe Wave pattern ke kuch basic elements hain jo traders ko identify karne hote hain:- Elliott Waves: Wolfe Waves ka concept kuch hade tak Elliott Waves se milta julta hai, lekin yeh dono alag methodologies hain. Wolfe Waves mein 5 waves hoti hain, jahan Wave 1 aur Wave 2 initial point banate hain, aur Wave 3 aur Wave 4 correction points hain. Yeh waves naturally market ke demand aur supply ke hawalay se banti hain.

- Symmetry: Wolfe Waves ka aik ahem feature symmetry hai. Yeh pattern naturally market mein paaya jaata hai jab market overbought ya oversold condition mein hoti hai. Is pattern ko identify karne ka ek tareeqa yeh hai ke price action ka symmetric behavior dekha jaaye.

- Time Frame: Wolfe Wave pattern kisi bhi time frame par ban sakta hai, chaahe woh minute chart ho ya monthly chart. Yeh trader par depend karta hai ke woh kis time frame par trade karna chahta hai.

- Entry aur Exit Points: Wolfe Wave pattern ko samajhne ka sabse important pehlu entry aur exit points ka hai. Jab wave 5 form hoti hai, toh yeh entry ka signal hota hai. Target point usually line drawn from wave 1 se wave 4 tak hota hai, jise "EPA" (Estimated Price at Arrival) kehte hain.

Wolfe Wave pattern i do main types hoti hain:- Bullish Wolfe Wave Pattern: Yeh pattern us waqt banta hai jab market ke lower level par price ko support milta hai aur phir reversal hota hai. Is pattern mein wave 5 niche hoti hai, lekin EPA ki line ke upar move karti hai, jo yeh indicate karti hai ke market bullish ho rahi hai.

- Bearish Wolfe Wave Pattern: Yeh pattern market ke upper level par banta hai jab price resistance level se takrati hai aur phir reversal hota hai. Is case mein wave 5 upar hoti hai, lekin EPA ki line ke niche move karti hai, jo yeh signal deti hai ke market bearish ho sakti hai.

Wolfe Wave pattern ko identify karna thoda mushkil ho sakta hai agar aap beginner hain, lekin kuch practices aur guidelines follow karne se isko identify karna asaan ho jaata hai.- Chart Analysis: Sabse pehle, aapko price chart par highs aur lows identify karne hain. Wolfe Wave ke liye 5 points (waves) dhoondhne hote hain. Yeh points naturally ban rahe hote hain, bas aapko unko identify karna hota hai.

- Trend Lines Draw Karna: Jab aap waves identify kar lete hain, toh aapko trend lines draw karni hoti hain. Aap wave 1 se wave 3 tak ek line draw karte hain, aur phir wave 2 se wave 4 tak doosri line draw karte hain. Yeh lines aapko EPA ka estimation denge.

- Symmetry Check Karna: Symmetry check karna zaroori hai. Yeh dekhna hota hai ke wave 3 aur wave 4 ki length aur time duration same hain ya nahi, kyun ke Wolfe Wave pattern ke liye symmetry ka hona zaroori hai.

- Volume Analysis: Volume ka analysis bhi zaroori hai, kyun ke jab wave 5 complete hoti hai, toh volume mein increment hona chahiye jo reversal ka indication ho.

- Confirmation: Aakhir mein, confirmation ke liye aapko price ka EPA line par aana dekhna hota hai. Agar price EPA par ya us ke qareeb aa rahi hai, toh yeh signal hai ke Wolfe Wave pattern kaam kar raha hai.

Wolfe Wave pattern ko use karne ke liye aik khas trading strategy ka hona zaroori hai. Yahan kuch ahem points hain jo aapko trading ke dauran madadgar sabit ho sakte hain:- Entry Point: Aapko entry tab leni hoti hai jab wave 5 complete ho rahi ho aur EPA line ke saath touch ho rahi ho. Yeh best entry point hota hai kyun ke is time market mein reversal ka chance hota hai.

- Stop Loss: Stop loss ko wave 5 ke niche ya upar set karna chahiye (depending on bullish or bearish pattern). Yeh aapko unexpected price movements se protect karega.

- Take Profit: Take profit EPA line tak rakhna chahiye. Is line ko usually wave 1 aur wave 4 ki line se draw kiya jaata hai. Yeh profit taking ka safest point hota hai.

- Risk Management: Wolfe Wave pattern mein risk management bohat zaroori hai. Aapko apni risk appetite ke mutabiq trade ka size decide karna chahiye. High leverage use karne se guraiz karna chahiye, kyun ke yeh trading ko zyada risky bana sakta hai.

- Multiple Time Frame Analysis: Wolfe Wave pattern ko identify karne ke liye multiple time frames ka use karna chahiye. Yeh aapko better perspective dega aur trade ke direction ke baare mein zyada confident banayega.

- Wait for Confirmation: Wolfe Wave pattern mein jaldbazi se guraiz karna chahiye. Hamesha confirmation ka wait karna chahiye, specially jab aap large position size ke saath trade kar rahe ho.

Wolfe Wave pattern ke bhi kuch faide aur nuqsanat hain jo har trader ke liye jaana zaroori hain.

Faide- Price Reversal Prediction: Wolfe Wave pattern aapko price ke reversal ke baare mein accurate prediction dene mein madad karta hai, jo kisi bhi trader ke liye profitable ho sakta hai.

- Clear Entry aur Exit Points: Is pattern ke through aapko clear entry aur exit points milte hain, jo aapki trading ko disciplined aur systematic banate hain.

- Universal Application: Yeh pattern kisi bhi financial market mein use ho sakta hai, chaahe woh forex, stocks, ya commodities hoon.

- Natural Market Movements: Wolfe Wave pattern market ke natural movements par mabni hota hai, jo isko zyada reliable banata hai.

- Complexity: Yeh pattern beginners ke liye thoda mushkil ho sakta hai, specially agar aap chart patterns ke analysis mein naye hain.

- False Signals: Agar aap correct symmetry ya confirmation ko identify nahi kar pate, toh yeh pattern false signals bhi de sakta hai.

- Patience ki Zaroorat: Wolfe Wave pattern ko trade karne ke liye bohot patience ki zaroorat hoti hai. Aapko right opportunity ka wait karna hota hai, warna aap galat trade mein fas sakte hain.

- Advanced Charting Skills: Is pattern ko effectively use karne ke liye advanced charting skills ka hona zaroori hai. Aapko trend lines aur price movements ko acche se samajhna hota hai.

Wolfe Wave pattern ko real-world trading mein use karna thoda challenging ho sakta hai, lekin agar aap isko sahih tareeke se apply karein, toh yeh bohot profitable ho sakta hai. Bohot se professional traders is pattern ko use karte hain complex market situations ko simplify karne ke liye.

Example

Suppose karein ke aap forex market mein EUR/USD pair trade kar rahe hain. Aapko daily chart par Wolfe Wave pattern ka formation nazar aata hai. Aap waves ko identify karte hain aur dekhtay hain ke wave 5 EPA line ke qareeb aa rahi hai. Is point par aap entry lete hain aur stop loss wave 5 ke niche rakhte hain. Aapka take profit EPA line par set hota hai. Agar market aapke analysis ke mutabiq move karta hai, toh aapko significant profit ho sakta hai.

Is example se yeh samajh aata hai ke Wolfe Wave pattern ko real-world market mein kaise use kiya ja sakta hai. Yeh pattern aapko market ke unpredictable movements ko predict karne mein madad deta hai, lekin iske liye aapko proper knowledge aur skills ki zaroorat hoti hai.

Wolfe Wave pattern aik powerful tool hai jo aapko market ke reversal points ko identify karne mein madad deta hai. Yeh pattern thoda complex zaroor hai, lekin agar aap isko sahih tareeke se samajh lein, toh yeh aapki trading ke liye bohot faidemand sabit ho sakta hai. Wolfe Wave pattern ka istimaal aapko disciplined aur systematic trading ke liye encourage karta hai, aur iske through aap better risk management aur profit-taking strategies develop kar sakte hain.

Trading mein successful hone ke liye Wolfe Wave pattern ko seekhna aur practice karna bohot zaroori hai. Aapko yeh samajhna hota hai ke market kis tarah se move kar rahi hai aur Wolfe Waves kis tarah us movement ko represent kar rahi hain. Is knowledge ke saath, aap financial markets mein behtareen trading decisions le sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Wolfe Wave pattern aik technical analysis tool hai jo financial markets mein price movements ko samajhne ke liye istemal hota hai. Yeh pattern 5 points ko involve karta hai aur iska naam Bill Wolfe ke naam par rakha gaya hai, jo is theory ke developer hain. Wolfe Waves ka maqsad future price movements ko predict karna aur trading opportunities identify karna hota hai.

Wolfe Wave pattern ko samajhne ke liye, sabse pehle yeh zaroori hai ke iske 5 key points ko identify kiya jaye. Yeh points hain: Point 1, Point 2, Point 3, Point 4, aur Point 5. Point 1 aur Point 2 market ke high aur low ko indicate karte hain, jabke Point 3 market ke reversal point ko dikhata hai. Point 4 aur Point 5 pattern ke final stages hain jo market ke movement ka final trend determine karte hain.

Pattern ki pehchaan karte waqt, Point 1 se lekar Point 2 tak price ka trend usually ek strong move hota hai. Point 2 ke baad, Point 3 aata hai jo ek corrective phase ko show karta hai. Yeh phase, Point 3 ke baad, market ki stability aur next trend ka indication hota hai. Point 4 aur Point 5 pattern ki completion ko dikhate hain, jahan se market ek clear trend ko follow karta hai.

Wolfe Wave pattern ka use karte waqt, traders ko kuch important cheezon ka khayal rakhna padta hai. Sabse pehle, pattern ki identification ka process precise hona chahiye, aur 5 points ki placement accurate honi chahiye. Agar points ko sahi se place na kiya jaye, to pattern ki effectiveness kam ho sakti hai. Iske ilawa, Wolfe Waves ko combine karke dusre technical analysis tools ke sath use kiya jata hai jese ke Fibonacci retracements, trend lines aur moving averages, taake market movements ka zyada accurate analysis kiya ja sake.

Aksar, Wolfe Wave patterns ko bullish aur bearish trends dono ko identify karne ke liye use kiya jata hai. Bullish Wolfe Wave pattern market ke upward trend ka indication hota hai, jabke bearish Wolfe Wave pattern downward trend ko indicate karta hai. Yeh patterns traders ko market ke entry aur exit points determine karne mein madad dete hain.

Wolfe Wave pattern ka analysis market ke behavioral aspects ko samajhne ke liye bhi useful hota hai. Market ke participants ka behavior, jese ke buying aur selling pressure, is pattern ke through analyze kiya ja sakta hai. Yeh pattern ek market cycle ko represent karta hai jahan traders price movement ke different stages ko dekh kar apni trading strategies ko optimize kar sakte hain.

Wolfe Wave pattern ko effectively use karne ke liye practice aur experience zaroori hai. Market conditions ko analyze karte waqt, traders ko yeh ensure karna hota hai ke woh pattern ki key points ko accurately identify kar sakein aur apni strategies ko accordingly adjust kar sakein. Yeh technique traders ko market ke fluctuations ko predict karne aur better trading decisions lene mein madad deti hai, lekin har tool ki tarah, Wolfe Wave pattern bhi market risks ko completely eliminate nahi kar sakta.

Isliye, Wolfe Wave pattern ka istemal karte waqt, risk management aur proper analysis zaroori hai taake successful trading strategies develop ki ja sakein.

-

#13 Collapse

**Wolfe Wave Pattern: Ek Jaiza**

**Wolfe Wave Pattern** ek technical analysis tool hai jo market price movements aur trend reversals ko identify karne ke liye use hota hai. Yeh pattern market ke cyclic nature aur price action ke basis par develop kiya gaya hai. Yahan Wolfe Wave Pattern aur iska Forex trading mein role detail mein explain kiya gaya hai:

1. **Definition**:

- Wolfe Wave Pattern ek five-wave formation hai jo market trends aur reversals ko predict karta hai.

- Yeh pattern market ke natural price cycles aur fluctuations ko reflect karta hai aur trend reversal points ko identify karne mein madad karta hai.

2. **Formation**:

- **Wave 1**: Pehli wave ek initial move ko represent karti hai jo trend ke start ko indicate karti hai. Yeh wave typically short aur sharp hoti hai.

- **Wave 2**: Dusri wave pehli wave ke retracement hoti hai aur trend ko reverse karne se pehle market ko consolidate karti hai.

- **Wave 3**: Teesri wave market ke main trend ko continue karti hai aur strong move ko represent karti hai. Yeh wave sabse lengthy aur significant hoti hai.

- **Wave 4**: Chhathi wave ek corrective phase hoti hai jo Wave 3 ke partial retracement ke form mein hoti hai.

- **Wave 5**: Paachvi wave final move ko represent karti hai jo trend ko complete karti hai aur market ke reversal point ko signal karti hai.

3. **Significance**:

- **Trend Reversal**: Wolfe Wave Pattern trend reversals ko identify karta hai aur market ke potential reversal points ko highlight karta hai.

- **Market Cycles**: Yeh pattern market ke natural cycles aur fluctuations ko reflect karta hai, jisse traders ko market behavior ko samajhne mein madad milti hai.

4. **Trading Strategy**:

- **Entry Signal**: Wolfe Wave Pattern ke fifth wave (Wave 5) ke complete hone ke baad, traders entry signals ko consider karte hain. Yeh entry point trend reversal ke potential signal ko represent karta hai.

- **Stop-Loss**: Risk management ke liye stop-loss orders ko Wolfe Wave Pattern ke recent lows (bullish patterns) ya highs (bearish patterns) ke aas-paas set kiya jata hai.

- **Take-Profit**: Profit targets ko pattern ke initial wave points aur trend line projections ke basis par set kiya jata hai.

5. **Pattern Validation**:

- **Volume Analysis**: Wolfe Wave Pattern ke signals ko volume analysis ke saath validate kiya jata hai. High volume ke saath pattern ke signals strong aur reliable hote hain.

- **Additional Indicators**: Moving Averages, RSI, aur MACD jaise indicators bhi pattern ke effectiveness ko confirm karne ke liye use kiye jate hain.

6. **Limitations**:

- **Complexity**: Wolfe Wave Pattern ko accurately identify karna complex hota hai aur precise wave counts aur patterns required hote hain.

- **False Signals**: Yeh pattern false signals bhi generate kar sakta hai agar market conditions aur additional indicators se confirm na ho.

Wolfe Wave Pattern Forex trading mein market trends aur reversals ko accurately predict karne ke liye ek valuable tool hai. Is pattern ko sahi tarah se samajhkar aur additional confirmation tools ke sath use karke trading decisions ko optimize kiya ja sakta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Wolfe Wave Pattern aik natural trading pattern hai jo market ke price movements ko predict karne mein madad karta hai. Yeh pattern usually reversal points ko pehchanne ke liye use hota hai aur yeh buyer aur seller ke equilibrium (balance) ko represent karta hai. Wolfe Wave Pattern ka structure kuch is tarah ka hota hai:

1. **Waves Structure:**

- Wolfe Wave Pattern mein total 5 waves hoti hain. In waves ka structure typical price movement ko represent karta hai jisme support aur resistance levels involve hotay hain.

2. **Identification of Waves:**

- Wave 1 se Wave 2 tak price upar ya neeche move karti hai.

- Wave 2 se Wave 3 tak price opposite direction mein move karti hai.

- Wave 3 se Wave 4 tak price phir se original direction mein move karti hai.

- Wave 4 se Wave 5 tak price phir se opposite direction mein move hoti hai. Wave 5 usually ek significant reversal point hota hai.

3. **Line of Balance (LOB):**

- Wolfe Wave mein, ek important line draw ki jati hai jo Wave 1 aur Wave 4 ko connect karti hai. Is line ko "Line of Balance" kehte hain. Jab Wave 5 is line ko cross karti hai, to yeh ek strong reversal signal hota hai.

4. **Target Line:**

- Target Line ko Wave 1 aur Wave 4 ko connect kar ke extend kiya jata hai. Yeh line future price movement ka target predict karti hai. Jab Wave 5 complete hoti hai aur reversal hota hai, price usually Target Line tak move karti hai.

5. **Symmetry:**

- Wolfe Wave Pattern mein symmetry ka hona bhi important hota hai. Waves ke duration aur length mein harmony hone chahiye, taake pattern accurate ho aur reliable trading signals de.

6. **Volume Confirmation:**

- Volume ka analysis Wolfe Wave ke dauran helpful hota hai. Wave 5 ke complete hote waqt agar volume increase hota hai, to yeh pattern ki strength ko confirm karta hai.

7. **Bullish Wolfe Wave:**

- Yeh pattern tab bullish hota hai jab Wave 5 neeche se upar ki taraf reversal indicate karti hai. Is case mein, traders usually buy position enter karte hain jab price Line of Balance se cross karti hai.

8. **Bearish Wolfe Wave:**

- Yeh pattern tab bearish hota hai jab Wave 5 upar se neeche ki taraf reversal indicate karti hai. Is case mein, traders usually sell position enter karte hain jab price Line of Balance se cross karti hai.

9. **Trading Strategy:**

- Wolfe Wave Pattern ko pehchanne ke baad, traders apni entry, stop loss, aur target positions ko accurately define kar sakte hain. Entry usually Wave 5 ke reversal point pe hoti hai aur Target Line tak exit kiya jata hai.

Wolfe Wave Pattern ek advanced trading tool hai jo experienced traders ke liye kaafi effective ho sakta hai agar sahi tareeke se use kiya jaye. Is pattern se aap market ke potential reversal points ko pehchan kar profitable trades execute kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:19 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим