What Is Pips In Forex Trading .

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

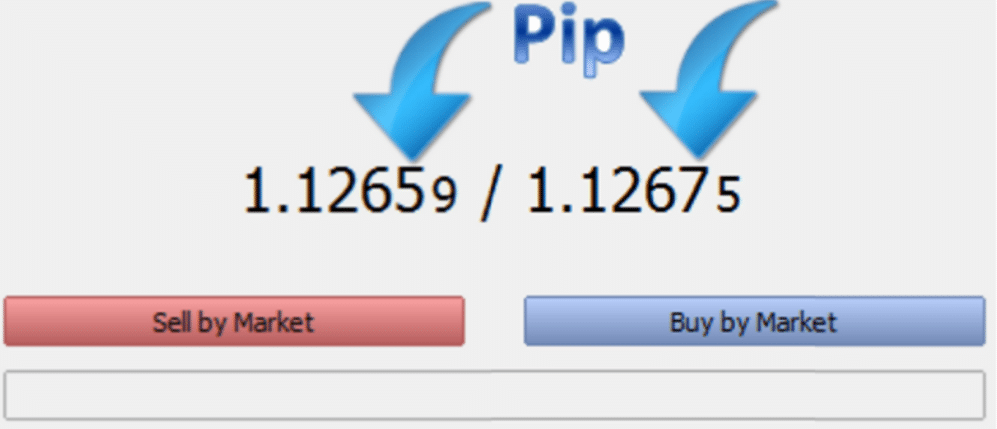

What is Pips: Forex (Foreign Exchange) trading mein, "pip" ek ahem aur mukhtalif concept hai jo currency pairs ki price movement ka measure karta hai. Pip, "Percentage in Point" ka abbreviation hai aur yeh smallest price movement ko represent karta hai jo currency pair ki exchange rate mein hota hai. Iska maqsad currency pairs ki price changes ko quantify karna hota hai, taake traders ko market movement ka andaza ho. How To Calculate Pips: Pip ka matlab hai ke currency pair ki price mein hone wale minor change ko measure kiya ja sakta hai. Forex market mein, prices ka bohat chota fraction pip ke zariye represent hota hai. Aam tor par, 1 pip ka matlab hota hai 0.0001 ya 0.01% ka change. Yeh fraction alag-alag currency pairs ke liye different hota hai kyun ke unki exchange rate alag hoti hai. Example ke tor par, agar EUR/USD currency pair ki price 1.1200 se 1.1201 hojaye, to iska matlab hai ke price ne 1 pip ka movement kiya hai. Agar aap long (buy) position mein hain aur price 1 pip up hoti hai, to aapka trade profitable ho sakta hai. Isi tarah, agar aap short (sell) position mein hain aur price 1 pip down hoti hai, to bhi aapka trade profitable ho sakta hai. Count Pips Before Open A Trade: Pips trading mein bohat ahem hote hain kyun ke traders apne trades ki profitability ko measure karte waqt inko consider karte hain. Forex mein, price ki movement volatile hoti hai aur chhoti si price changes bhi significant impact daal sakti hain. Traders apne risk aur reward ko calculate karte waqt pips ka istemal karte hain, taake woh sahi trading decisions le sakein. In summary, pips forex trading mein price movement ko measure karne ka ek crucial concept hain. Yeh traders ko market ki movement samajhne aur apne trades ki profitability ko evaluate karne mein madad deta hai. Isi liye, pip ka concept har forex trader ke liye zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu Alaikum Dosto!Forex Pips

Forex market mein trade karte waqat, aapko do currencies par aik sath qareebi nazar rakhni parti hai. PIPs forex mein ahem hote hain kyun ke ye traders ko batate hain ke kisi khaas currency pair se kitna munafa ya nuksan mil sakta hai.

Sare forex currencies PIPs ke taur par qeemat diye jate hain, aur har currency exchange rate ki har harkat ye batati hai ke traders ko kitna dena parega aur kitna munafa hasil ho sakta hai.

Percentage in Point, jise PIP bhi kehte hain, ek currency pair ke exchange rate ki tabdili ka aik unit hai forex market mein. Digar alfaz mein, yeh woh sab se chhota price move hai jo ek currency exchange rate kar sakta hai.

PIP ki qeemat exchange rate ko 0.0001 se taqseem karke maloom hoti hai. PIP aam tor par sabhi US dollar ke sath judi currency pairs ke liye $0.0001 hota hai. Isay 1/100th of 1% ke tor par calculate kiya jata hai.

For example, agar USD/EUR currency pair 100 ke tor par quote hota hai aur ek PIP ke liye, to PIP ki qeemat hogi 1/100 ÷ 100 = $0.0001. Isi tarah, 15 basis points ke sath, aik PIP ki tabdili aik basis point ke sath muqabla mein currency values mein ziada volatility paida karegi.

Jitni kam PIP, currency trading utna kam risk hoti hai.

PIP Kaise Kaam Karta Hai

Kyunki sari exchange rate movements PIPs ke zariye napa jati hain, to zyadatar currency pairs ke liye sab se chhota tabdili hamesha 1 PIP hota hai. Ek PIP ki qeemat ko US Dollars ya kisi doosri currency mein tabdeel karne ke liye, PIP ki qeemat ko exchange rate se zarb lagana hota hai takay munafa ya nuksan ka pata lag sake.

For example, chaliye maan lete hain ke aap CAD/USD pair ko exchange rate 1 par kharidna chahte hain, iska matlab hai ke aap Canadian Dollars kharid rahe hain aur saath hi saath US Dollars bech rahe hain. Ab, agar aap trade ko 0.7 par band karte hain, to aapko 3 PIPs ke nuksan ka samna karna parega, aur agar aap trade ko 1.05 par band karte hain, to aapko 5 PIPs ka munafa hoga.

Mini lot trading ko lekar chaliye, for example, 0.1 lot par trading. Agar aap EURUSD ko 1.1215 par 0.1 lots ke sath bechte hain, to iska matlab hai ke aapne notional value mein 10,000 EUR ki qeemat kharidi hai. Aapka P&L 1 USD per pip movement hoga (kyunki USD is example mein TERM currency hai). To agar EURUSD 1.1210 tak gir jaye, to aapko 5 USD ka munafa hoga.

Factors jo PIP ko Effect Karte Hain- Leverage

Leverage tab hoti hai jab aap apne broker se funds udhaar lete hain takay aap apne available cash balance se ziada trading exposure aur position hasil kar sakein. Jitni zyada leverage aapki position ho gi, utni hi zyada risky hogi.

Highly leveraged position ko PIPs ke sath jodna aapke invested value ko barah-e-karam kam kar sakta hai, hatta ke agar PIP kuch point hi gir jaye. Isliye ke jo zyada aapki transaction value ho gi, woh PIPs ki qeemat utni hi zyada hogi jo ke aapki investment ko jald az jald khatam kar sakti hai. - Volume

Trade ka volume, forex market mein aik muqarar arsay mein kitni currency pairs hoti hain, PIP forex values ko seedha mutasir karta hai, yani ke jitni bari trade volume ho gi, utna hi PIPs ke zariye hasil hone wala munafa bhi ziada hoga.

Agar market 50 PIPs aapki taraf move hoti hai aur aapke paas 100,000 units ki lot hoti hai, to PIP forex value per unit 100,000*0.0001 = $10 hogi. 50 PIPs dollar mein traders ko $500 ka munafa dilwaye gi. Lekin agar trade ki qeemat kam hai, maan lijiye 10,000 units sirf, to PIP per unit ki qeemat bhi kam hogi = 10,000*0.0001 = $1. - Currency Pairs K Types

Kyunki sari currency pair harkaten PIPs ke zariye napayi jati hain, to aik PIP ki qeemat har alag currency pair ke liye hamesha mukhtalif hogi. Iska ye matlab hai ke har currency pair ki exchange rates bhi mukhtalif hoti hain.

PIP ko Forex Mein Kaise Calculate Karen

Har PIP ki price currency pair par depend karti hai jo trade ki ja rahi hai, trade ki qeemat aur mojooda exchange rate par. Yahan PIP ko calculate karne ka tareeqa diya gaya hai:-- Apni PIP size maloom karen. Kyunki zyadatar currencies ko 4 decimal places tak quote kiya jata hai, to iski qeemat 0.0001 hoti hai zyadatar currencies ke liye, siwaye un currencies ke jo Japanese Yen mein shamil hain. Kyunki Japanese Yen ki qeemat kam hoti hai, iske liye mostly 0.01 hoti hai.

- Currency pair ka exchange rate maloom karen.

- PIP value calculate karne ke liye forex PIPs value ka formula istemal karen –

Currency PIP value = (PIP size/exchange rate) * position size - Jo PIP value aapko milti hai, use apne mulk ki currency mein mojooda exchange rate ka istemal karke tabdeel karen.

Misal k tawar par humare paas CAD/USD currency pair hai, jiska direct quote 0.7747 hai. Iska matlab hai ke 1 Canadian dollar se trader ko kuchh around 0.7747 US dollars mil sakte hain. Ab maan lijiye ke 1-PIP ki tabdili ho gayi aur quote 0.7748 ho gaya hai. Canadian dollar ki qeemat relative tor par barh jayegi, kyunki ab 1 CAD trader ko pehle se zyada dollars (0.7748) kharidne ki ijaazat dega.

Price Move Calculation with Pips

Trades ke size ka seedha asar hota hai ke aap PIPs ke zariye kitna munafa ya nuksan hasil kar sakte hain. Bade positions ko mali faiday aur nuksan ka ziada samna karna parta hai.

Aap forex price moves ko is formula se calculate kar sakte hain =

Position size * 0.0001 = PIP ka maaliati value

To agar aapne 100,000 PIPs ke sath aik position kholi hai, to har PIP ki qeemat hogi 100,000*0.0001 = $10 per PIP. Har buy position jab market aapki taraf move karega, to har unit par aapko $10 kamai hogi, aur yehi hoga jab aap aik sell position kholenge jab exchange rate wo hoga jo aapne isay kharida tha se zyada hoga.

Lekin agar market aapke khilaf ja rahi hai aur aap aik buy ya sell position kholte hain, to har unit par aapko $10 ka nuksan hoga har PIP ke movement par.

Isi tarah, agar trade size 5,000 units tak gir jaye, to har PIP ki qeemat $0.5 hogi; agar trade size 50,000 tak barh jaye, to har PIP ki qeemat $5 hogi, aur agar trade size 1,000,000 jitni bari ho, to har PIP ki qeemat hogi 1,000,000*0.0001 = $100.

Profit aur Losses Ko PIP Ke Sath Calculate Karna

Dono profit aur loss ko PIP value ko total trading lot ke saath multiply karke calculate kiya ja sakta hai. Jitna ziada lot hoga, utna hi ziada investment aur utna hi ziada risk ya munafa hoga. Chaliye isko ek example ke sath samajhte hain.- PIP K Zarye Profit Calculation

For example, aapne 500,000 units ke sath USD/EUR ka aik position khola hai. Position 1.5 par band hoti hai aur is trade mein 50 PIPs (dollars mein) ka munafa hota hai. Position ka total munafa calculate karne ke liye pehle har PIP ki qeemat ko upar samjhi gayi tarah calculate karna hoga –

PIP ki qeemat = (0.0001/1.5)*500,000 = 33.34 USD

Total munafa = 50 PIPs * 33.34 USD = $1666.67 - PIP K Zarye Loss Calculation

For example, aapne 500,000 units ke sath USD/EUR ka aik position khola hai. Position ab 1 par band hoti hai aur is trade mein kul milake 70 PIPs ka nuksan hota hai.

PIP ki qeemat = (0.0001/1)*500,000 = 50 USD

Total nuksan = 70 PIPs * 50 = $3500

Currencies Ke Baesd Par PIP Value Ko Convert Karna

PIP value ko aapki trading currency ke mutabiq convert kiya ja sakta hai. Alag alag currencies ke liye alag rules lagte hain. Agar aap UK mein trade kar rahe hain aur aapka account GBP mein hai, to aapko PIP ki value ko GBP mein convert karna hoga. Is kaam ko aap current PIP value ko GBP/USD exchange rate ke mutabiq calculate karke kar sakte hain.

USD/JPY Currency Pair Mustisna Hai

USD/JPY currency pair, forex mein PIPs ko calculate karne mein aik isthisna hai. Jab bhi koi major currency Japanese currency ke khilaf trade hoti hai, to PIPs ki calculation mein chouthay decimal ki bajaye doosray decimal ka istemal hota hai. Iska ye sabab hai ke Yen ki qeemat dosray major currencies ke mukable mein bohat kam hoti hai.

For example, agar aap USD/JPY mein 10,000 units ki lot par trade kar rahe hain, to aik PIP ki movement ya value 0.01 Yen hogi har unit ke liye, ya total lot ke liye 100 Yen.

Top Forex PIP Trading Strategies- 50 PIPs a Day

50 PIPs a day forex trading strategy mein, traders ek din mein kai positions kholte hain aur band karte hain, instead of long term ke liye paise invest karne ke bajaye. Ye day traders ke liye munafa kamane ka maqsad rakhte hain. Ye strategy helps hai ke ek trading day mein forex currency pairs ki price range mein kam se kam 50 percent ko capture kiya ja sake.

Aapko chart par gehri nazar rakhni hogi jaise hi koi candlestick aik din ke doraan band hoti hai. Jab ye band hoti hai, to aap ek buy pending order aur ek sell pending order place kar sakte hain, jisme buy stop order wo hoga jo high price point se 2 PIPs upar hoga aur sell stop order wo hoga jo low price point se 2 PIPs neeche hoga, taake aap profit hasil kar sakein chahe market gir raha ho ya chadh raha ho.

Ya to dono pending orders mein se ek execute ho ga jab currency pair ka price fluctuate karega, aur yahan aap opposing order ko cancel karke fluctuating price range se faida utha sakte hain.- Take profit order ko 50 PIPs ke target par place kiya ja sakta hai

- Risk managing stop-loss order ko high price se 10 PIPs upar ya low price se 10 PIPs neeche place kiya ja sakta hai

Agar aapka profit target hit hota hai, to aapki deal puri hogai hai. Lekin agar currency pair price aapke profit target ko nahi chhuti, to aapko trading day khatam hone se pehle trade se bahar nikal dena chahiye by moving to your stop loss or break-even point. Is strategy mein har successful trade aapko kam se kam 50 PIPs ka profit dilwaye gi jo ke $0.005 ke barabar hai, jo ke 100,000 ki trading lot size ke liye $500 ka izafah karta hai. - 30 PIPs a Day

30 PIPs a day forex trading strategy mein, aap market ke volatile currency pairs se munafa hasil kar sakte hain jaise ke GBP/JPY, AUD/JPY, GBP/AUD, GBP/NZD aur aur bhi. Is strategy mein 5-minute time frame sab se behtar hai kyun ke ye market mein zaroorat parne par wazeh reversal points provide karta hai.

30 PIPs a day strategy 10-period Exponential Moving Average (EMA) aur 26-period EMA par mabni hai.

Jab 10-period EMA 26-period EMA ko cross karta hai, to ye aapko market ki trading direction dene ke liye entry signal deta hai. Currency pair price dheere dheere direction follow karna shuru karta hai jo EMAs indicate karte hain taake market sentiment confirm ho sake.

Aik position high price point ya low price point par open ki ja sakti hai jaise hi market retraces hoti hai, jiska ye matlab hai ke short-term correction ke doran market direction ko pakadna chaha jata hai jo post-correction mein munafa hasil kar sakta hai.

Ye strategy sirf retracement levels par trade ki jati hai kyun ke market direction khud ko confirm karne ke liye khud ko theek karta hai jo trades mein ziada kamyabi deta hai.- Aik sell position downtrend ke doran open ki ja sakti hai jab 10-period EMA 26-period EMA ko upar se cross karta hai aur continue kam hota hai

- Aik buy position uptrend ke doran open ki ja sakti hai jab 10-period EMA 26-period EMA se neeche se cross karta hai aur continue barhta hai

- Stop-loss ko sell level se 20 PIPs upar place kiya ja sakta hai

- Take profit ko sell level se 40 PIPs upar place kiya ja sakta hai.

- Leverage

-

#4 Collapse

Forex Trading Mein Pips Kya Hai?

Forex trading, ya Foreign Exchange Trading, aik global marketplace hai jahan currencies ko buy aur sell kiya jata hai. Ye market 24 ghanton ke daire mein chalti hai aur duniya bhar ke banks, financial institutions, corporations, aur individual traders ismein shamil hote hain. Forex market ka size bohot bada hai aur rozana trillions dollars ki transactions hoti hain. Is market mein trading karne wale traders ko pips ka concept samajhna zaroori hai, kyun ke ye unki trading decisions par asar daal sakta hai.

1. Pips Ki Tareef

Pips, ya Price Interest Point, ek chota unit hai jo currency pairs ke price mein tabdili ko measure karta hai. Ye tabdili usually last decimal point par hoti hai. Jaise ke agar EUR/USD ki price 1.1200 se 1.1201 ho jaye, to is mein 1 pip ki tabdili hui hai. Pips ki value har currency pair ke mutabiq mukhtalif hoti hai. Jaise ke agar currency pair ki qeemat 1.0000 se 1.0001 ho jaye, to is mein 1 pip ki value alag hogi jabke agar qeemat 1.5000 se 1.5001 ho jaye, to is mein bhi 1 pip ki value mukhtalif hogi.

2. Pips Ka Matlab

Pips ka matlab hota hai "percentage in point" ya phir "price interest point". Ye market mein choti si tabdiliyon ko darust karta hai. Is tarah se traders ke liye easy ho jata hai ke wo price movements ko track kar sakein. Pips ka concept ek universal language ki tarah hai jo traders ke liye asani se samajhne aur use karne mein madad deta hai.

3. Pips Ka Istemal

Pips ka istemal kar ke traders currency pairs ki qeemat mein tabdili ko dekhte hain. Ye unhein batata hai ke kis direction mein market move ho raha hai aur unhein apni trading strategy ko adjust karne mein madad deta hai. Jab traders pips ko samajhte hain, to wo apne trades ko monitor karne mein behtar ho jate hain aur profit ya loss ko accurately estimate kar sakte hain.

4. Pips Ki Ahmiyat

Pips ki sahi samajh trading decisions mein ahem hai. Jab traders pips ko samajhte hain, to wo apni trades ko monitor karne mein behtar ho jate hain aur profit ya loss ko accurately estimate kar sakte hain. Pips ka concept traders ko ye bhi samajhne mein madad deta hai ke kitna risk wo ek trade mein lena chahte hain aur kitna reward unhein chahiye.

5. Pips Ki Calculation

Pips ko calculate karne ke liye traders nechay di gayi formula istemal karte hain:

Pips = (Change in Quote Currency) / (Exchange Rate) * (Lot Size)

Jahan "Change in Quote Currency" wo tabdili hai jo currency pair ki qeemat mein hoti hai, "Exchange Rate" wo rate hai jis par currency pair trade hota hai, aur "Lot Size" wo size hai jo trading position ka hai. Is formula ke istemal se traders asani se pips ki value calculate kar sakte hain aur apne trades ko analyze kar sakte hain.

6. Pips Aur Lot Size

Pips ke value lot size par depend karti hai, jo ke trading position ka size hota hai. Jitna bada lot size hoga, utne zyada pips ka value hoga, aur utni zyada tabdiliyon ka asar hoga. Agar kisi trader ka lot size bara hai, to uski har pip ki value bhi zyada hogi aur agar lot size chhota hai, to pip ki value bhi kam hogi.

7. Pips Aur Spread

Spread, yaani bid aur ask ke darmiyan ka farq, bhi pips mein shumar hota hai. Jab traders currency pair buy karte hain, to unko spread ke form mein ek chhota sa fee deni hoti hai. Spread ko calculate karne ke liye, traders bid aur ask price mein farq ko dekhte hain aur is farq ko pips mein measure karte hain. Spread ke zyada hona traders ke liye nuksan deh ho sakta hai, is liye wo spread ko bhi apni trading strategy mein consider karte hain.

8. Pips Aur Pipette

Pipette ek fraction hoti hai jis mein pips ka aik hissa hota hai, zyada precise calculations ke liye istemal hoti hai. Pipette ka concept traders ko zyada accurate results dene mein madad karta hai. Normal pips ek decimal place tak hoti hain, lekin pipette ki value 1/10th ya 1/100th pip ki hoti hai. Is tarah se pipette traders ko zyada precise measurements provide karta hai aur wo apne trades ko aur behtar tareeqe se analyze kar sakte hain.

9. Pips Aur Stop Loss

Stop loss orders ko set karte waqt traders pips ka istemal karte hain taake risk ko control kar sakein. Stop loss order ek tarah ka safety net hota hai jo traders ko excessive loss se bachata hai. Is order ke zariye, traders apne trades ko limit set kar sakte hain ke jab market unke favor mein nahi ja raha hai, to wo apni position close kar sakein aur zyada nuksan se bach sakein.

10. Pips Aur Take Profit

Take profit orders bhi pips mein set ki jati hain, taake traders apne profits ko maximize kar sakein. Ye orders traders ke liye ahem hote hain kyun ke wo predefined level tak profit book kar sakte hain. Take profit orders traders ko ye flexibility dete hain ke wo apni trades ko monitor karne ke bajaye automatically profit book kar sakein jab market unke favor mein ja raha hota hai.

11. Pips Aur Scalping

Scalping strategy mein traders choti pips ki tabdiliyon par focus karte hain. Ye strategy short-term trading ke liye kaafi popular hai aur traders ko choti profits earn karne mein madad deta hai. Scalping mein traders usually kuch seconds ya minutes ke liye trades karte hain aur choti tabdiliyon se profit earn karne ki koshish karte hain. Is strategy mein pips ka value bohot ahem hota hai kyun ke har pip ki value kaafi zyada hoti hai aur choti tabdiliyon se bhi profits generate ki ja sakti hai.

12. Pips Aur Long Term Trading

Long term trading mein pips ki value bhi ahem hoti hai, lekin focus zyada bade tabdiliyon par hota hai. Long term traders ko currency pairs ke long-term trends par focus karna hota hai, jo ke pips ki value par bhi asar dalta hai. Is tarah se long term traders ko pips ki value ko samajhna aur analyze karna bohot zaroori hai taake wo sahi waqt par apni positions ko enter aur exit kar sakein.

13. Pips Ki Variability

Market conditions ke tabdeel hone se pips ki variability bhi hoti hai. Jab market volatile hoti hai, to pips ki value bhi zyada ho sakti hai, jabke stable market mein pips ki value kam hoti hai. Market ke volatility ka pata lagane ke liye traders economic indicators, news, aur technical analysis ka istemal karte hain. Is tarah se wo market conditions ko analyze karke pips ki value ko samajhte hain aur apne trades ke liye sahi decisions lete hain.

14. Pips Aur Risk Management

Pips ko samajh kar traders apni risk management strategy ko behtar bana sakte hain. Wo apne trades ko analyze kar ke samajh sakte hain ke kitna risk wo lena chahte hain aur stop loss orders ke through apna risk control kar sakte hain. Risk management ek ahem hissa hai har trading strategy ka aur traders ko apne trades ko manage karte waqt pips ka istemal karke apna risk control karna chahiye.

15. Pips Ki Conclusion

Pips forex trading mein ek ahem concept hai jo traders ke liye zaroori hai samajhna. Is ke istemal se trading decisions ko behtar banaya ja sakta hai. Pips ki value ko samajh kar traders apne trades ko monitor kar sakte hain aur sahi waqt par entries aur exits kar sakte hain. Overall, pips ka concept ek essential hai har forex trader ke liye jo market mein successful hona chahta hai. Pips ko samajhne ke liye traders ko market ki conditions ko analyze karna aur economic indicators aur technical analysis ka istemal karna chahiye. Is tarah se wo market ke movements ko samajh sakte hain aur apne trades ke liye sahi decisions le sakte hain. -

#5 Collapse

What Is Pips In Forex Trading :

Forex trading mein "pips" ka matlab hota hai "Percentage in Point". Ye ek unit hoti hai jisse traders use karte hain currency pairs ki price movements ko measure karne ke liye. Har currency pair ke price mein ek pips ka difference hota hai, jise traders use karte hain profit ya loss calculate karne ke liye.

Sare forex currencies PIPs ke taur par qeemat diye jate hain, aur har currency exchange rate ki har harkat ye batati hai ke traders ko kitna dena parega aur kitna munafa hasil ho sakta hai.

Percentage in Point, jise PIP bhi kehte hain, ek currency pair ke exchange rate ki tabdili ka aik unit hai forex market mein. Digar alfaz mein, yeh woh sab se chhota price move hai jo ek currency exchange rate kar sakta hai.

PIP ki qeemat exchange rate ko 0.0001 se taqseem karke maloom hoti hai. PIP aam tor par sabhi US dollar ke sath judi currency pairs ke liye $0.0001 hota hai. Isay 1/100th of 1% ke tor par calculate kiya jata hai.

Pips ko use krny ka faida:

Forex trading mein pips ki importance bohot zyada hoti hai aur iska traders ko kayi benefits milte hain:- Profit Calculation: Pips ki help se traders apne trades ka profit ya loss calculate kar sakte hain. Har currency pair ke liye ek pips ka value hota hai, jise traders use karte hain apne trades ke performance ko measure karne ke liye.

- Risk Management: Pips traders ko risk management mein help karte hain. Stop loss aur take profit levels set karne ke liye pips ka use hota hai. Traders apne trades mein kitna risk lena chahte hain, ye pips ki help se decide karte hain.

- Trading Strategies: Pips ki understanding traders ko trading strategies banane mein help karte hain. Price movements ko pips mein measure karke traders apne entry aur exit points decide karte hain.

- Performance Measurement: Pips traders ko apni trading performance measure karne mein help karte hain. Pips ke through traders apne trades ka success rate aur overall performance track kar sakte hain.

- Flexibility: Pips ki value har currency pair ke liye alag hoti hai, lekin iska concept universal hai. Isliye traders easily different currency pairs par trading kar sakte hain aur pips ka use karke unki performance ko compare kar sakte hain.

Overall, pips forex trading mein ek important concept hai jo traders ko trading decisions lene mein help karta hai aur unhe trading performance ko improve karne mein madad karta hai

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is pips in forex trading .

Pips Kya Hain?

"Pips" (Percentage in Point) forex trading mein price movement ka standard measure hai. Ye ek small unit hai jo currency pairs ke price changes ko measure karne ke liye istemal hoti hai. Pips ka concept forex market mein bahut important hai aur ye traders ko price movements ko quantify karne mein madad deta hai.

Pips Ka Matlab

Pips ka matlab hota hai currency pairs ke price ka minimum price change jo ke last decimal point par hota hai. Forex market mein zyada tar currency pairs 5 decimal places tak hoti hain, jahan pe sabse chhota price change ek pip ke form mein hota hai. Agar kisi currency pair ka price 1.12345 se 1.12346 tak move hota hai, toh iska matlab hai ke price ek pip increase hua hai.

Pips Ki Value

Pips ki value depend karti hai currency pair par aur lot size par. Har currency pair ka pip value alag hota hai. Sabse common currency pair EUR/USD ka ek pip ka value generally $10 per standard lot (100,000 units) hota hai. Agar aap mini lot (10,000 units) trade kar rahe hain to pip value $1 hoga.

Pips Ka Istemal

Pips ka istemal forex trading mein price movements ko measure karne aur quantify karne ke liye hota hai:- Price Movement Measurement: Pips ka istemal price movements ko measure karne ke liye hota hai. Jab currency pair ka price move hota hai, toh traders pip ke form mein us movement ko quantify karte hain.

- Profit/Loss Calculation: Pips ka use profit aur loss calculate karne ke liye hota hai. Agar aap long position hold kar rahe hain aur price aapke favor mein move karta hai, toh aapki profit pip movement ke according calculate hoti hai.

- Stop Loss/Take Profit Levels: Traders stop loss aur take profit levels ko pip distances ke basis par set karte hain. Ye unki risk management ko define karta hai.

Pips Aur Points

Pips ko kuch markets mein "points" ke naam se bhi jaana jata hai. Jaise ki Japanese Yen (JPY) based currency pairs mein, pip ko points ke roop mein refer kiya jata hai. Ek pip generally 0.01 point hota hai.

Conclusion

Pips forex trading mein price movements ko measure karne ka ek standardized method hai jo ke traders ko market analysis aur risk management mein madad deta hai. Iska concept important hai har forex trader ke liye aur pip values ko samajhna zaruri hota hai trading decisions lene ke liye.

Is tareeqe se, pips forex market mein price changes ko quantify karne ka ek important tool hai jo ke traders ko price movements ko samajhne aur analyze karne mein madad deta hai.

-

#7 Collapse

What is pips in forex trading .

Pips Kya Hain Forex Trading Mein?

Forex trading ka aik important concept hai "pips." Yeh term traders ke liye bohot ahem hai, kyunke iske zariye woh apne trades ki performance ko measure karte hain. Iss blog mein, hum pips ke bare mein gehri understanding hasil karne ki koshish karenge.

1. Pips Ka Matlab- Pips ka matlab hai "Percentage in Point."

- Yeh ek unit hoti hai jo currency pair ki price mein choti si change ko darust karti hai.

- Forex market mein pips ka ek ahem role hota hai, kyunke iske zariye traders currency pair ki movement ko quantify karte hain.

2. Pips Ki Calculation- Pips ki calculation currency pair ke base currency aur quote currency ke beech ke price ke mutabiq hoti hai.

- Agar currency pair ki price 1.2000 se 1.2010 tak badhti hai, toh iska matlab hai ke isne 10 pips ki movement ki hai.

- Pips ki value depend karti hai currency pair par. Jaise ke EUR/USD mein ek pip ki value 0.0001 hoti hai.

3. Pips Aur Profits- Traders pips ke zariye apne profits ko measure karte hain.

- Agar ek trader ne long position li hai aur currency pair ki price 50 pips upar chali jati hai, toh uska profit 50 pips hoga.

- Pips ki value ke mutabiq, trader apne profits aur losses ko calculate karta hai.

4. Pips Aur Risk Management- Pips risk management ke liye bhi ahem hai.

- Har trader ko apne trades ko manage karne ke liye ek risk management strategy honi chahiye.

- Pips ke zariye, trader apne har trade ke liye stop loss aur take profit levels set karke apne risk ko control kar sakta hai.

5. Pips Aur Spread- Spread bhi ek important concept hai jo pips ke saath juda hua hai.

- Spread ka matlab hai currency pair ki bid aur ask price ke darmiyan ka difference.

- Spread ki value bhi pips mein measure hoti hai.

6. Pips Aur Forex Trading Strategies- Forex trading strategies mein pips ka istemal bohot ahem hai.

- Scalping strategies mein traders choti choti price movements ko target karte hain, jiski wajah se unhe pips ka ahem role samajhna zaroori hai.

- Long-term trading strategies mein bhi pips ki value ka khayal rakhna zaroori hai, kyunke iske zariye trader apne targets aur stops ko define karte hain.

7. Pips Aur Trading Platforms- Trading platforms mein pips ka display hota hai jo traders ko market ki movement ko samajhne mein madad karta hai.

- Platforms par pips ki value ka display alag-alag tarah se hota hai, kuch mein 4 decimal places tak aur kuch mein 5 decimal places tak.

- Traders ko apne trading platform ke hisab se pips ka istemal karna aur samajhna zaroori hai.

8. Pips Aur Forex Education- Forex trading mein successful hone ke liye pips ka concept samajhna zaroori hai.

- Traders ko pips ke importance ko samajhne ke liye forex education courses aur resources ka istemal karna chahiye.

- Pips ke understanding se hi traders apne trading decisions ko better bana sakte hain.

Ikhtitami Guftagu

Pips forex trading mein ek crucial concept hai jo traders ke liye bohot ahem hai. Iske zariye traders currency pair ki movement ko measure karte hain aur apne profits aur losses ko quantify karte hain. Pips ki understanding ke bina, forex trading mein successful hona mushkil ho sakta hai. Isliye, har trader ko pips ke concept ko gehri understanding hasil karke apni trading strategy ko improve karna chahiye.

- 1.0693 EURUSD

- Mentions 0

-

سا4 likes

-

#8 Collapse

Forex trading mein "pips" ek important concept hai jo price movements ko measure karne ke liye istemal hota hai. Pips ka matlab hota hai "Percentage in Point" ya "Price Interest Point". Yeh ek chhota unit hota hai jo currency pairs ke price changes ko represent karta hai. Yahan, pips ke baare mein mukammal points hain:

Pips Ka Hissa:

Forex market mein har currency pair ki price ek particular decimal point tak hoti hai. Ek pip usually sabse chhote decimal point ka ek unit hota hai. Jaise ki EUR/USD ki price 1.12345 se 1.12346 par badalne par, yeh ek pip ka difference hota hai.

Price Movements Ko Measure Karne Ke Liye Istemal:

Pips ko price movements ko measure karne ke liye istemal kiya jata hai. Price agar ek pip badalti hai, toh yeh ek chhota price movement hota hai.

Profit Aur Loss Ko Calculate Karne Ke Liye:

Pips ko trading mein profit aur loss ko calculate karne ke liye istemal kiya jata hai. Jab aap trade karte hain, aapki position ke price movements ko pips mein measure kiya jata hai.

Spread Mein Istemal:

Spread bhi pips mein measure kiya jata hai. Spread ka matlab hota hai bid price aur ask price ke beech ka difference. Jaise agar EUR/USD ki current price 1.12345/1.12346 hai, toh spread 1 pip hai.

Pips Aur Lot Size:

Pips ka value lot size par depend karta hai. Ek standard lot mein 100,000 units hoti hain aur har pip ka value $10 hota hai. Mini lot mein 10,000 units hoti hain aur har pip ka value $1 hota hai. Micro lot mein 1,000 units hoti hain aur har pip ka value $0.10 hota hai.

Volatility Ka Measure:

Pips volatility ko bhi measure karne mein madadgar hota hai. Jyada pips ka movement high volatility ko darshata hai aur kam pips ka movement low volatility ko darshata hai.

Pips Aur Trading Strategy:

Trading strategy banate waqt, traders pips ko bhi consider karte hain. Stop loss aur target levels ko set karte waqt, traders pips ka istemal karte hain takay risk aur reward properly manage kiya ja sake. Pips ka concept samajhna forex trading mein bahut zaroori hai kyun ki iske bina price movements aur trading ka performance measure karna mushkil ho jata hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Mein Pips Kya Hota Hai

Forex trading mein "pips" ek common term hai jo price movements ko measure karne ke liye istemal hota hai. Yeh article mein hum pips ke baare mein detail mein baat karenge aur iska forex trading mein istemal samjhayenge.

Pips Ka Matlab

"Pips" ka matlab hai "percentage in point" ya "price interest point". Yeh ek unit of measurement hai jo currency pairs ke price movements ko quantify karta hai. Har currency pair ke price ka ek smallest possible movement hota hai jo pips mein express kiya jaata hai.

Pips Ka Calculation

Pips ka calculation depend karta hai currency pair ke quote ke tarike par. Majority cases mein, forex quotes do tarah ke hote hain: direct quotes aur indirect quotes.

1. Direct Quotes

Direct quotes mein, pips ka calculation price ke decimal points ke taur par hota hai. Jaise ki agar EUR/USD ki price 1.1234 se 1.1235 ho jaaye, toh iska difference ek pip hoga.

2. Indirect Quotes

Indirect quotes mein, pips ka calculation opposite hota hai. Agar quote ke decimal point ka position badal jaata hai, toh pips ka value change hota hai. Jaise ki agar USD/JPY ki price 110.50 se 110.51 ho jaaye, toh iska difference ek pip hoga.

Pips Aur Profit/Loss

Forex trading mein pips ka importance hota hai profit aur loss ko calculate karne mein. Agar aap long position par hain aur currency pair ki price aapke favor mein move karti hai, toh aap pips ke hisab se profit earn karte hain. Lekin agar price against aapki position move karti hai, toh aap pips ke hisab se loss suffer karte hain.

Pips Aur Lot Size

Pips ka value lot size ke saath directly related hota hai. Ek standard lot size mein, ek pip ka value $10 hota hai. Lekin agar aap mini lot ya micro lot trade kar rahe hain, toh pip ka value correspondingly kam hota hai.

Conclusion

Pips ek important concept hai forex trading mein jo price movements ko measure karne ke liye istemal hota hai. Iska understanding traders ke liye zaroori hai takay wo apne trades ka profit aur loss accurately calculate kar sakein. Har currency pair ka pip value alag hota hai, isliye traders ko apne trades ko plan karte waqt is factor ka dhyan rakhna chahiye.

-

#10 Collapse

What Is Pips In Forex Trading .

Pips ka Forex Trading men Introduction:

Pips Forex trading ka ek mukhya hissa hai jo currency pairs ki price movement ko measure karta hai. Pips ka matlab "Percentage in Point" hota hai aur ye ek small unit of change hai jo currency pairs ki price me hota hai. Yeh measurement decimal point ke fourth digit tak hoti hai.

Har currency pair ka ek specific pip value hota hai, jo trading platform par display hota hai. For example, agar EUR/USD ka pip value 0.0001 hai aur aapki trade me price 1.3000 se 1.3001 ho jati hai, to iska matlab hai ki aapne ek pip ki movement dekhi hai.

Pips ka use trading me profit aur loss ko measure karne ke liye hota hai. Jab aap trade karte hain, aap target price aur stop loss set karte hain jo pips me measure kiye jate hain. Is tarah se, aap apne risk aur reward ko manage kar sakte hain.

Pips ka concept samajhna Forex trading ke liye bahut zaroori hai, kyun ki isse aap trade ki performance ko evaluate kar sakte hain aur apne trading strategies ko improve kar sakte hain.

How Many Pips In Forex Trading required:

Forex trading mein pips ka istemal price movement ko measure karne ke liye hota hai. Har currency pair ka ek specific pip value hota hai, jise trading platform par display kiya jata hai. Iske alawa, traders apni trading strategies aur risk management ke hisab se pips ka use karte hain.

For example, agar aap EUR/USD mein trade kar rahe hain aur uska pip value 0.0001 hai, to agar price 1.3000 se 1.3001 ho jati hai, to iska matlab hai ki aapne ek pip ki movement dekhi hai.

Forex trading mein pips ki zarurat tab hoti hai jab aap profit aur loss ko measure karte hain. Aap apne trades ko pips mein analyze kar sakte hain aur apne risk aur reward ko manage kar sakte hain.

Agar aapko pips aur unka istemal samajhna hai, to aap trading education resources se help le sakte hain ya kisi experienced trader se guidance le sakte hain.

Pips ko Count krnay ka Tarika?

Pips ko count karne ka tarika simple hai, lekin isme thora calculation ka kaam hota hai. Yahan main aapko ek basic example ke through pips count karne ka tarika samjhaunga:- Currency Pair Ka Pip Value Pata Karein: Sabse pehle aapko apne trade ke liye currency pair ka pip value pata karna hoga. Har currency pair ka pip value alag hota hai, jise trading platform par usually display kiya jata hai. For example, agar EUR/USD ka pip value 0.0001 hai.

- Price Movement Ko Calculate Karein: Ab aapko price movement ko calculate karna hai. Maan lijiye aapne EUR/USD mein trade kiya hai aur price 1.3000 se 1.3020 ho gayi hai.

- Price Movement Ko Pips Mein Convert Karein: Price movement ko pips mein convert karne ke liye aapko decimal points ko count karna hoga. Jaise ki 1.3000 se 1.3020 ka difference 20 pips hoga, kyunki 1 pip ka value 0.0001 hai.

-

#11 Collapse

Forex Trading Mein Pips Kya Hota Hai?

**Forex Trading Mein Pips Kya Hota Hai**

Forex trading mein "pips" ek ahem mudda hai jo traders ke liye mahatvapurna hai. Pips (Percentage in Points) trading market mein currency pairs ki keemat ke chote badlav ko darshata hai. Yeh market mein aam istilah hai aur traders ke liye trading performance ko quantify karne ka ek tareeka hai.

Pips ki kimat currency pair aur trading platform par depend karti hai. Ek pips ke kimat currency pair ke tareeqe se mukhtalif hoti hai. Masalan, agar EUR/USD pair 1.2500 se 1.2501 tak badle, to iska matlab hai ke yeh ek pip ka farq hai.

Forex trading mein pips ki ahmiyat is baat mein hai ke is se traders ke liye trading performance ka andaza lagaya ja sakta hai. Pips ko use karke traders apne positions ko monitor karte hain aur unki performance ka anuman lagate hain.

Pips ke saath trading karne ka faida yeh hai ke isse traders ko asani se profit aur loss ko quantify karne mein madad milti hai. Yeh ek standardised unit hai jo traders ko trading performance ko samajhne mein madad karta hai.

Ek important point yeh hai ke pips ka mahatva har currency pair ke liye alag hota hai. Kuch pairs mein ek pip ka farq ek dhai sauveen hisse ya usse bhi kam hota hai, jabki doosri pairs mein yeh farq zyada hota hai. Isliye, har ek trader ko apne trading strategy ke hisaab se pips ka mahatva samajhna zaroori hai.

Pips ke zariye traders apni trades ki performance ko monitor karte hain aur apne trading strategy ko improve karne ke liye feedback lete hain. Isliye, yeh ek zaroori concept hai har ek forex trader ke liye.

Is tarah, forex trading mein pips ka ahem maqam hai aur traders ko apne performance ko quantify karne aur improve karne mein madad karta hai. Pips ke concept ko samajhna har ek trader ke liye zaroori hai taake woh apni trading ko behtar bana sakein.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Mein Pips Kya Hain?

Forex trading mein "pips" ek ahem concept hai jo ke traders ke liye zaroori hai unki positions ki value aur price movements ko samajhne ke liye. Pips, ya "Percentage in Points", currency pairs ke price movements ka standard unit hai.

Pips ka ek aam definition hai ke ye currency pair ke price ka sab se chhota possible change hai jo typically last decimal place mein reflect hota hai. Har currency pair ka ek fixed pip value hota hai, jise traders ke liye important hai calculate karne ke liye.

Jaise ke EUR/USD currency pair ke liye, agar price 1.2500 se 1.2501 par move hota hai, toh iska matlab hai ke price mein ek pip ka change hua hai. Agar price 1.2500 se 1.2600 par move hota hai, toh iska matlab hai ke price mein 100 pips ka change hua hai.

Pips ka importance tab hota hai jab traders apni positions ko analyze karte hain aur stop loss aur target levels set karte hain. Stop loss aur target levels typically pips mein measure kiye jate hain, jisse traders apne risk aur reward ko quantify kar sakein.

Pips ke saath saath, traders ko bhi pip value ka concept samajhna zaroori hai. Har currency pair ka ek specific pip value hota hai jo ke traders ke liye important hai unki positions ki value ko calculate karne ke liye. Pip value calculate karne ke liye, traders typically apne trade size aur currency pair ka pip value ka use karte hain.

Forex trading mein pips ka istemal karke, traders market movements ko quantify karte hain aur apne trading decisions ko inform karte hain. Pips ke through, traders apne profit aur loss ko measure kar sakte hain aur apne trading strategies ko refine kar sakte hain.

Toh, pips forex trading mein ek essential concept hai jo ke traders ke liye zaroori hai market movements ko samajhne aur positions ki value ko calculate karne ke liye. Pips ka istemal karke, traders apne trading decisions ko better inform kar sakte hain aur apne trading performance ko improve kar sakte hain.

-

#13 Collapse

What is pips in forex trading .

Pips Kya Hain Forex Trading Mein?

Forex trading ka aik important concept hai "pips." Yeh term traders ke liye bohot ahem hai, kyunke iske zariye woh apne trades ki performance ko measure karte hain. Iss blog mein, hum pips ke bare mein gehri understanding hasil karne ki koshish karenge.

1. Pips Ka Matlab- Pips ka matlab hai "Percentage in Point."

- Yeh ek unit hoti hai jo currency pair ki price mein choti si change ko darust karti hai.

- Forex market mein pips ka ek ahem role hota hai, kyunke iske zariye traders currency pair ki movement ko quantify karte hain.

2. Pips Ki Calculation- Pips ki calculation currency pair ke base currency aur quote currency ke beech ke price ke mutabiq hoti hai.

- Agar currency pair ki price 1.2000 se 1.2010 tak badhti hai, toh iska matlab hai ke isne 10 pips ki movement ki hai.

- Pips ki value depend karti hai currency pair par. Jaise ke EUR/USD mein ek pip ki value 0.0001 hoti hai.

3. Pips Aur Profits- Traders pips ke zariye apne profits ko measure karte hain.

- Agar ek trader ne long position li hai aur currency pair ki price 50 pips upar chali jati hai, toh uska profit 50 pips hoga.

- Pips ki value ke mutabiq, trader apne profits aur losses ko calculate karta hai.

4. Pips Aur Risk Management- Pips risk management ke liye bhi ahem hai.

- Har trader ko apne trades ko manage karne ke liye ek risk management strategy honi chahiye.

- Pips ke zariye, trader apne har trade ke liye stop loss aur take profit levels set karke apne risk ko control kar sakta hai.

5. Pips Aur Spread- Spread bhi ek important concept hai jo pips ke saath juda hua hai.

- Spread ka matlab hai currency pair ki bid aur ask price ke darmiyan ka difference.

- Spread ki value bhi pips mein measure hoti hai.

6. Pips Aur Forex Trading Strategies- Forex trading strategies mein pips ka istemal bohot ahem hai.

- Scalping strategies mein traders choti choti price movements ko target karte hain, jiski wajah se unhe pips ka ahem role samajhna zaroori hai.

- Long-term trading strategies mein bhi pips ki value ka khayal rakhna zaroori hai, kyunke iske zariye trader apne targets aur stops ko define karte hain.

7. Pips Aur Trading Platforms- Trading platforms mein pips ka display hota hai jo traders ko market ki movement ko samajhne mein madad karta hai.

- Platforms par pips ki value ka display alag-alag tarah se hota hai, kuch mein 4 decimal places tak aur kuch mein 5 decimal places tak.

- Traders ko apne trading platform ke hisab se pips ka istemal karna aur samajhna zaroori hai.

8. Pips Aur Forex Education- Forex trading mein successful hone ke liye pips ka concept samajhna zaroori hai.

- Traders ko pips ke importance ko samajhne ke liye forex education courses aur resources ka istemal karna chahiye.

- Pips ke understanding se hi traders apne trading decisions ko better bana sakte hain.

Ikhtitami Guftagu

Pips forex trading mein ek crucial concept hai jo traders ke liye bohot ahem hai. Iske zariye traders currency pair ki movement ko measure karte hain aur apne profits aur losses ko quantify karte hain. Pips ki understanding ke bina, forex trading mein successful hona mushkil ho sakta hai. Isliye, har trader ko pips ke concept ko gehri understanding hasil karke apni trading strategy ko improve karna chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

### Forex Trading Mein Pips Kya Hote Hain?

Forex trading mein "pip" ek fundamental concept hai jo trading calculations aur profit-loss analysis mein use hota hai. Pip ka full form "Percentage in Point" hai, aur yeh trading aur market analysis mein ek standard unit of measurement hai. Is post mein, hum pip ki definition, significance aur calculation ko detail mein discuss karenge.

**1. Pip Ki Definition:**

- **Basic Concept:** Pip ek smallest price move hai jo ek currency pair ki exchange rate ko represent karta hai. Generally, pip ek point ki ek specific digit ke movement ko refer karta hai. Most currency pairs mein, pip ek 0.0001 (fourth decimal place) ki movement ko represent karta hai.

- **Currency Pair:** Currency pairs ke case mein, jahan ek currency ko doosri currency ke against trade kiya jata hai, pip ki measurement exchange rate ki decimal places ke basis par hoti hai. For example, EUR/USD pair mein 1 pip ka movement 0.0001 hota hai.

**2. Pip Ki Importance:**

- **Profit Loss Calculation:** Pips ka istemal traders ke profit aur loss ko calculate karne ke liye hota hai. Jab traders ek currency pair ko buy ya sell karte hain, toh pip ki movement unki trade ke outcome ko affect karti hai.

- **Risk Management:** Pip ka measurement risk management strategies mein bhi important role play karta hai. Traders apne stop-loss aur take-profit levels ko pips ke terms mein set karte hain, jisse risk ko manage karna aur profit targets ko achieve karna asaan hota hai.

- **Trade Size Calculation:** Pip ke movement se trade size aur position sizing bhi calculate kiya jata hai. Yeh calculation trading account balance aur risk tolerance ke basis par ki jati hai.

**3. Pip Calculation:**

- **Standard Calculation:** Most currency pairs ke liye, 1 pip ki value 0.0001 hoti hai. For example, agar EUR/USD ka exchange rate 1.1000 se 1.1001 ho jata hai, toh yeh ek pip ki movement hoti hai.

- **Currency Pair Value:** Currency pairs jahan currency ka quote second decimal place par hota hai, wahan pip ki value slightly different hoti hai. Jaise, JPY based pairs mein, 1 pip ki value 0.01 hoti hai. For instance, agar USD/JPY ka rate 110.00 se 110.01 ho jata hai, toh yeh 1 pip ka movement hota hai.

**4. Pip Value Calculation Example:**

- **Example for Standard Account:** Agar aap EUR/USD currency pair mein 1 standard lot (100,000 units) trade kar rahe hain aur EUR/USD rate 1.1000 se 1.1001 ho jata hai, toh 1 pip ki value 10 USD hoti hai. Yeh calculation formula: Pip Value = (1 Pip / Exchange Rate) x Lot Size.

- **Example for Mini and Micro Lots:** Mini lot (10,000 units) aur micro lot (1,000 units) ke liye, pip value proportionally decrease hoti hai. Mini lot mein, 1 pip ki value 1 USD hoti hai aur micro lot mein, 1 pip ki value 0.10 USD hoti hai.

**5. Additional Considerations:**

- **Account Currency:** Pip ki value trading account ke base currency par bhi depend karti hai. Agar aapka trading account base currency USD hai, toh pip ki value directly calculate ki ja sakti hai. Lekin agar base currency different hai, toh pip ki value ko convert kiya jana padta hai.

- **Volatility Impact:** Market volatility pip movements ko affect kar sakti hai. High volatility periods mein, pips ke movements zyada noticeable aur significant ho sakte hain.

**Conclusion:** Forex trading mein pip ek essential unit hai jo currency pairs ke price movements ko measure karne aur profit-loss calculations karne mein madad karta hai. Accurate pip calculation, risk management, aur trading strategies ko understand karna trading success ke liye crucial hai. Pips ko effectively utilize karke traders apni trading decisions ko enhance kar sakte hain aur market ke fluctuations ko better manage kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:05 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим