Average true range indicator;

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

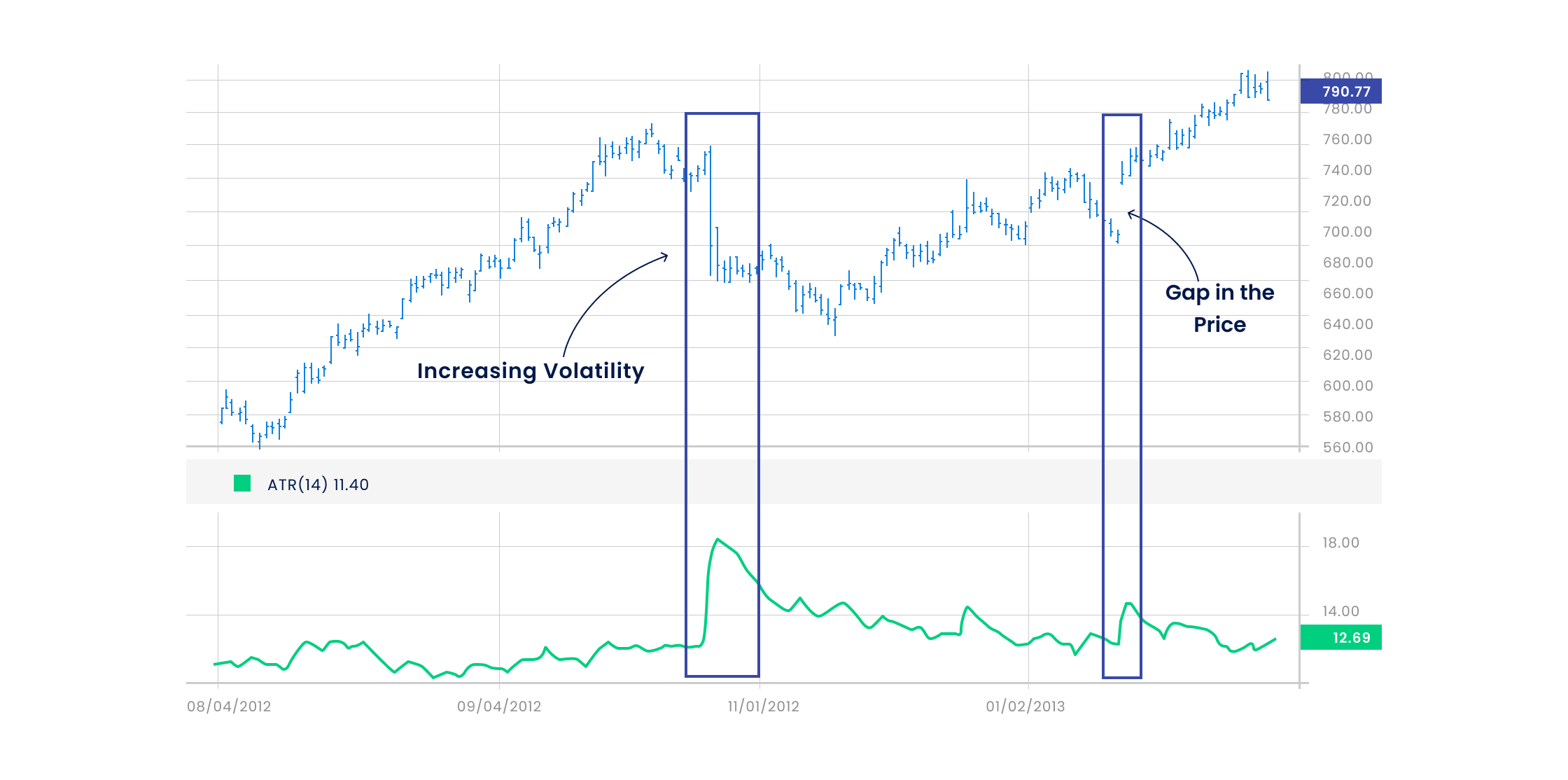

Assalam alaikum! dear members umeed ha ap sb khairiat se hn gy ir apka trading week acha ja raha ho ga. aj ki es post main hum Average True range indicator ko study karen gy k eska working mechanism kia ha or es se hamen trading main kesy help mil skti ha. WHAT IS AVERAGE TRUE RANGE? Dear members average true range ATR aik technical indicator ha jo oscillator family se ha or market main volatility ko measure krta ha by decomposing the prices for that period. True range infact 1 moving average hoti ha jo k 14 days ki hoti ha ap esy apni marzi se change bhi kar skty hain. Volatility es situation ko khty hain jb matket main kafi zada trading volume ho or prices teezi se tabdeel ho rhi hn.Yhi time trading k lye best b hota ha risky bhi agr ap achi entry lety hain to volatile market main apko acha profit mil skta ha or Average True range indicator esi chz main apki help karta ha ye apko btata ha k kis time market main volatility ha taa k ap achi entry le skn. Zada tr traders es indicators ko trade exit karny k lye use karty hain q k jb low volatility ho market main to price bht ahsta se move karti hain tb traders exit ho jaty hain. Ye indicator position sizing main bhi help karta k kitny size ki position se kb entry li jy. HOW TO USE AVERAGE TRUE RANGE INDICATOR? Dear members ATR closing prices py apply hota ha or ye hamen exact signal ni deta sell ya buy ka laikin ye ohr bhi hamen trading main help karta ha. Agr price ATR ki closing se opr trade karti ha to hum yahan se buy position le skty hain jb aisa hota ha ti eska mtlb hota ha k volatility change ho chuki ha or ah prices opr ki trf move karen ge es lye hum long position lety hain. Limitation of ATR: the first and main limitation of ATR, wo ye ha k ye indicator hamen sirf or sirf volatility k bary main btata ha ye market k trend or direction k bary main ni btata. es lye es k sth sth hamen koe trend indicator b use karna chahye taa k hm esko sth main use kr k confirmation k bad trade len or hmari trades profitable hn. 2ndly ye hamen es bary main bhi ni btata k kb trend reverse hona ha or kb tk koe trend continue rhna ha. -

#3 Collapse

Average True Range (ATR) ek aisa technical analysis indicator hai jo market ki volatility yaani price ki flactuations ko measure karta hai. Iska istemal traders aur investors karte hain taake wo market ki price movements ko behtar samajh sakein aur apne trading decisions ko mazid achha bana sakein. ATR ko J. Welles Wilder Jr. ne 1978 mein apni kitab New Concepts in Technical Trading Systems mein introduce kiya tha. Tab se yeh indicator trading community mein kaafi mashhoor ho gaya hai.

ATR ko kisi bhi asset ke liye istemal kiya ja sakta hai, jaise ke stocks, commodities, forex, ya cryptocurrencies. Yeh indicator price ke movements ki range ko measure karta hai, jo traders ko yeh samajhne mein madad karta hai ke market mein kitni volatility hai.

ATR Indicator Ki Pehchaan

ATR ko samajhne ke liye sab se pehle humein volatility ke concept ko samajhna hoga. Volatility se murad hai ke price kis had tak fluctuate karti hai. Agar price ki fluctuations zyada hain, to market volatile hai, aur agar fluctuations kam hain, to market stable hai. ATR, in fluctuations ko measure karta hai aur ek average value provide karta hai.

ATR ka calculation kuch steps mein hota hai:- True Range (TR) Ki Pehchaan: True range ko calculate karne ke liye humein current high aur low ke darmiyan ka farq, previous close aur current high ke darmiyan ka farq, aur previous close aur current low ke darmiyan ka farq nikaalna hota hai. In teen values mein se jo sabse zyada value hoti hai, wahi true range hoti hai.

- Average True Range (ATR) Ka Calculation: ATR ko calculate karne ke liye true range values ka average liya jata hai. Yeh average aksar 14 days ke liye calculate kiya jata hai.

ATR ka istemal trading mein bohat se purposes ke liye kiya jata hai:- Volatility Measurement: ATR market ki volatility ko measure karne mein madad karta hai. Jab ATR ki value zyada hoti hai, iska matlab hai ke market volatile hai. Is waqt price ki movements bhi zyada hoti hain, jo traders ke liye opportunities create karti hain. Jab ATR ki value kam hoti hai, to market stable hota hai, aur price ki movements bhi choti hoti hain.

- Position Sizing: ATR ka istemal position sizing ke liye bhi hota hai. Agar aapko market ki volatility ke baare mein pata hai, to aap apne trades ki size ko accordingly adjust kar sakte hain. Zyada volatility hone par aap choti position size le sakte hain taake aapka risk kam ho jaye, jab ke kam volatility hone par aap badi position size le sakte hain.

- Setting Stop Loss: ATR ka istemal stop loss levels set karne ke liye bhi hota hai. Jab aap ATR ki madad se stop loss set karte hain, to aap price ki fluctuations ko madde nazar rakhte hain. Is tarah aap apne stop loss ko aise set karte hain ke wo normal price movements se trigger na ho.

- Trend Confirmation: ATR trend confirmation ke liye bhi use kiya jata hai. Agar market mein zyada volatility hai, to iska matlab hai ke trend strong hai. Jab ATR increase hota hai, to aap samajh sakte hain ke trend strong hai aur aap trade karne ka soch sakte hain.

- Breakout Confirmation: Jab price kisi important level ko break karte hain, to ATR ko use karna helpful hota hai. Agar ATR value breakout ke dauran badhti hai, to yeh confirm karta hai ke price movement genuine hai. Iska matlab hai ke market mein asli interest hai, aur aap breakout trade karne ka soch sakte hain.

ATR ki value ko interpret karte waqt kuch important points hain jo hamesha yaad rakhne chahiye:- High ATR Value: Jab ATR ki value high hoti hai, to iska matlab hai ke market mein zyada volatility hai. Is waqt traders ko short-term trades par focus karna chahiye, kyunki price movements zyada ho sakti hain.

- Low ATR Value: Jab ATR ki value low hoti hai, to market mein stability hoti hai. Is waqt long-term trades par focus karna behtar hota hai, kyunki price ki movements kam hoti hain.

- Trends Aur ATR: Jab market ek strong trend mein hota hai, to ATR value badh sakti hai. Agar price upar ki taraf ja rahi hai aur ATR bhi increase ho raha hai, to yeh bullish trend ka confirmation hota hai. Agar price niche ja rahi hai aur ATR bhi badh raha hai, to yeh bearish trend ka confirmation hota hai.

- Divergence: Kabhi kabhi ATR aur price action ke beech divergence bhi dekha jata hai. Agar price higher high bana rahi hai lekin ATR lower high bana raha hai, to yeh potential reversal ka signal hota hai. Iska matlab hai ke price momentum khatam ho raha hai aur market mein bearish reversal ho sakta hai.

Jab ke ATR kaafi useful hai, lekin iski kuch limitations bhi hain:- False Signals: ATR kabhi kabhi false signals de sakta hai. Agar market zyada volatile hai lekin trend weak hai, to ATR ki high value misleading ho sakti hai.

- Lagging Indicator: ATR ek lagging indicator hai, iska matlab hai ke yeh price movements ke baad signal provide karta hai. Isliye traders ko ATR ko dusre indicators ke sath use karna chahiye taake unka analysis aur accurate ho sake.

- Market Conditions: ATR market conditions ke mutabiq bhi change hota hai. Jab market trends change hota hai, to ATR ki value bhi adjust hoti hai.

ATR ko dusre indicators ke sath combine karne se aap apni trading strategy ko mazid behtar bana sakte hain. Yeh kuch popular combinations hain:- Moving Averages: Moving averages ko ATR ke sath combine karke aap trend ki strength aur volatility dono ko samajh sakte hain. Jab moving average ka crossover hota hai aur ATR ki value bhi high hoti hai, to yeh strong trend ka confirmation hota hai.

- Relative Strength Index (RSI): ATR aur RSI ka combination traders ko market ki momentum aur volatility dono ko samajhne mein madad karta hai. Jab RSI overbought ya oversold condition show karta hai, aur ATR bhi high hai, to yeh potential reversal ka signal hota hai.

- Bollinger Bands: ATR ko Bollinger Bands ke sath use karke aap price ki volatility aur trends ko visualize kar sakte hain. Jab price Bollinger Bands ke outside move karti hai aur ATR ki value bhi high hoti hai, to yeh breakout ya reversal ka signal hota hai.

ATR Indicator Ka Use Case Study

Case Study: Aapne ek stock ka analysis kiya aur dekha ke ATR ki value pichle 14 dinon mein zyada hai, jo ke market ki volatility darshata hai.- Analysis: Aapne dekha ke stock ne kuch important levels ko breakout kiya hai aur ATR ki value bhi increase ho rahi hai. Iska matlab hai ke market mein genuine interest hai.

- Trading Decision: Aapne decide kiya ke aap breakout ke time entry karenge. Aapne apne stop loss ko ATR ki madad se set kiya taake wo price fluctuations se bache.

ATR kaafi useful hai, lekin iski limitations ko bhi samajhna zaroori hai. Isliye, ATR ko dusre technical indicators ke sath combine karna chahiye taake aap apne trading results ko behtar bana sakein. ATR ka istemal karke aap market ke fluctuations ko behtar tarike se manage kar sakte hain, aur aapki trading strategy ko mazid strong kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

### Average True Range (ATR) Indicator

**Definition:**

- ATR ek technical analysis indicator hai.

- Iska istemal market volatility measure karne ke liye kiya jata hai.

**History:**

- ATR ko J. Welles Wilder Jr. ne develop kiya.

- Pehli dafa ye "New Concepts in Technical Trading Systems" kitab mein introduce hua tha.

**Calculation:**

1. **True Range (TR) calculate karna:**

- TR ka formula hai:

- TR = Max[(Current High - Current Low), abs(Current High - Previous Close), abs(Current Low - Previous Close)]

2. **Average True Range (ATR) calculate karna:**

- ATR ko TR ke average se nikaala jata hai.

- Ye simple moving average (SMA) ya exponential moving average (EMA) ka istemal kar sakta hai.

- ATR ki common period length 14 days hoti hai.

**Uses:**

- **Volatility Measure:**

- ATR se market ki volatility ko measure kiya jata hai.

- Agar ATR high hai, to market zyada volatile hai; agar low hai, to market stable hai.

- **Risk Management:**

- Traders ATR ko stop-loss levels set karne ke liye istemal karte hain.

- Ye unko help karta hai position size ko manage karne mein.

- **Trade Entry/Exit Signals:**

- ATR ka istemal trade entry aur exit points define karne ke liye bhi kiya jata hai.

- High ATR ke saath breakouts zyada significant maane jate hain.

**Limitations:**

- ATR sirf volatility ko measure karta hai, price direction ko nahi.

- Iska analysis short-term movements par focus karta hai, jo long-term trends ko overlook kar sakta hai.

**Conclusion:**

- ATR ek useful tool hai jo traders ko market volatility ko samajhne aur manage karne mein madad karta hai.

- Iska istemal trading strategies ko refine karne aur risk ko manage karne ke liye hota hai.

- ATR ke sath dusre indicators ko combine karna zaroori hai taake comprehensive analysis ho sake.

**Recommendations:**

- ATR ka istemal karte waqt market ke context ko samajhna important hai.

- Backtesting ki madad se ATR ki effectiveness ko jaanchna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим