What is pennant chart pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam members khairiyat se honge bhaiyon aur bahanon aaj Jo topic mein aap logon ke sath share karne ja rahi hun yah bahut hi khas topic hai aur bahut hi aasan topic hai ismein aisi koi bhi mushkil wali baat nahin hai jo ky ap logo ko samajh m na ay many boht hi asan lafzon Mein aap logon ke sath share kia h taky ap aik hi nazar m samajh jayn ye topic boht hi intursting topic h ap jb is topic ko parhyn gy to to apka dil is topic mein lga rhy ga or ap is topic sy boht ziyada faida dy ga to ayn hm is topic py bt chet krty hai shukriya importance Takneeki tajziye mein, flag aik kisam ka tasalsul ka namena hai jab security mein aik barri harkat hoti hai, jisay flag pol pol na na se jana jata hai, training linon ka sath aik mazbooti ka dorania hota hai. First all actions are ke par par, jo parcham ka dosray nisf hissay ki numindagi karti hai. Basic method pera tasalsul kana patteren hain jahan takneeki tajzia mein istemaal honai no break kana baad istehkaam ka aik waqfa hota hai. kalam mein hajam ko dekhna zaroori hai - consolidation ki duration ka hajam kam hona chahiye aur bulkier par hona chahiye. a card dealer instead of a merchant. takneeki tajzia ki doosri shaklon ka sath mil kar qlimin jo tasdeeq ka tor par kaam karti hain. Understanding Pennant, jo saakht ka lehaaz se jhndon se mlitay jaltay hain, un ke istehkaam ki muddat kana douran rujhan ki lakerain tabdeel hoti hain aur se muraja se hafton tak rehti hain. Flag ke har daur mein hajam bhi ahem hai. Ibtidayi harkat ko barray hajam ka sath poora kya jana chahiye jabkay flag ka hajam kamzor hona chahiye, ke douad hajam mein bara izafah hona chahiye. -

#3 Collapse

-

#4 Collapse

-

#5 Collapse

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

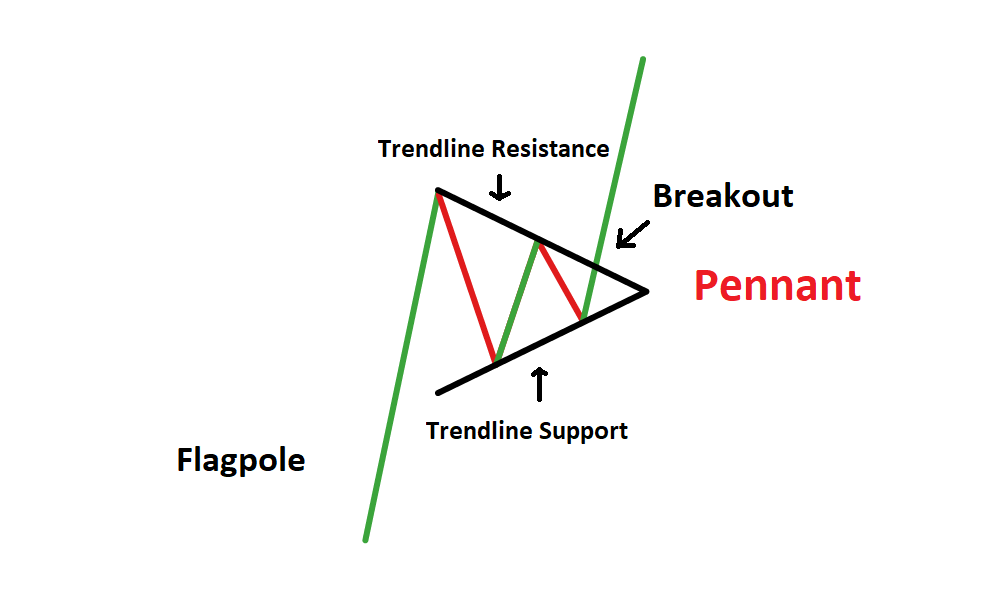

A pennant chart pattern is a technical analysis pattern that typically forms after a strong price movement in a financial market. It is considered a continuation pattern, meaning that it suggests that the prevailing trend is likely to continue after a period of consolidation. The pennant pattern resembles a small symmetrical triangle, where the price movements converge into a narrower and narrower range, forming the shape of a pennant. Key features of a pennant chart pattern include::max_bytes(150000):strip_icc()/IO-Chart-02152019-5c66c9584cedfd00014aa38e.png) Flagpole: Before the pennant forms, there is a sharp and strong price movement, either upward (bullish) or downward (bearish). This initial move is referred to as the flagpole. Consolidation Phase : After the flagpole, there is a period of consolidation where the price movements become narrower. This consolidation often takes the form of converging trendlines, resembling a symmetrical triangle or a small pennant. Volume: During the consolidation phase, trading volume tends to decrease. This reduction in volume indicates a temporary pause in market activity. Breakout: The pennant pattern is considered complete when the price breaks out of the consolidation phase. This breakout can occur in either direction, depending on the direction of the preceding trend. Price Target: The price target after the breakout can be estimated by measuring the length of the flagpole and projecting it in the direction of the breakout. It's important to note that while pennant patterns can provide insights into potential future price movements, they are not always accurate predictors. Traders and analysts often use them in combination with other technical indicators and analysis methods to make more informed decisions. Pennant patterns are commonly found in various financial markets, including stocks, forex, commodities, and cryptocurrencies. Traders use these patterns to identify potential trading opportunities and to manage risk by placing stop-loss orders near the breakout points.

Flagpole: Before the pennant forms, there is a sharp and strong price movement, either upward (bullish) or downward (bearish). This initial move is referred to as the flagpole. Consolidation Phase : After the flagpole, there is a period of consolidation where the price movements become narrower. This consolidation often takes the form of converging trendlines, resembling a symmetrical triangle or a small pennant. Volume: During the consolidation phase, trading volume tends to decrease. This reduction in volume indicates a temporary pause in market activity. Breakout: The pennant pattern is considered complete when the price breaks out of the consolidation phase. This breakout can occur in either direction, depending on the direction of the preceding trend. Price Target: The price target after the breakout can be estimated by measuring the length of the flagpole and projecting it in the direction of the breakout. It's important to note that while pennant patterns can provide insights into potential future price movements, they are not always accurate predictors. Traders and analysts often use them in combination with other technical indicators and analysis methods to make more informed decisions. Pennant patterns are commonly found in various financial markets, including stocks, forex, commodities, and cryptocurrencies. Traders use these patterns to identify potential trading opportunities and to manage risk by placing stop-loss orders near the breakout points.

-

#7 Collapse

-

#8 Collapse

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

The "pennant" chart pattern is a technical analysis pattern frequently observed in financial markets like stocks, forex, and commodities. It is considered a continuation pattern, which means that it suggests that the prevailing trend will likely continue after a brief consolidation period. The pennant pattern is formed when there is a strong price movement (either up or down), followed by a consolidation phase where the price moves within converging trendlines. The pattern resembles a small symmetrical triangle that looks like a pennant on a flagpole, hence the name. Key characteristics of a pennant chart pattern:Flagpole: The flagpole is the initial strong price movement that precedes the consolidation phase. It can be a sharp upward or downward movement. Consolidation Phase: After the flagpole, the price enters a consolidation phase where it moves within converging trendlines. This creates the triangular shape of the pattern. Volume: During the consolidation phase, there is usually a decrease in trading volume, reflecting a temporary equilibrium between buyers and sellers. Breakout: The pennant pattern is typically followed by a breakout in the direction of the initial trend. For example, if the flagpole was an upward movement, the breakout would likely be upward as well. Traders and analysts look for pennant patterns as potential trading opportunities. When the price breaks out from the pattern, it's often accompanied by a surge in trading volume, confirming the breakout direction. This can signal a continuation of the previous trend, and traders might consider entering trades in that direction. It's important to note that while chart patterns like the pennant can provide insights into potential price movements, they are not always 100% accurate. Market conditions can change rapidly, and false breakouts do occur. Therefore, it's recommended to use pennant patterns in conjunction with other technical analysis tools and indicators to make more informed trading decisions.

-

#10 Collapse

Janab ap ka chart simple hota hai Us chart main ap kay pas candlestick, line or bar wala just chart hota hai or baqi sub cheezain like patterns mai head and shoulder, wave lines, double top and bottom etc kafi patterns jo ap kay pairs kay leye suitable hai woh ap chose kar kay sakty hain or time frame kay mutabiq un ko set kar use kar kay ap sahi sy pattern ka use kar kay earning kar skaty hain.اصل پيغام ارسال کردہ از: Jamshaid99 پيغام ديکھيےWhat is pennant chart pattern? -

#11 Collapse

FOREX ME PENNET CHART PATTERN:-

Forex me Pennant chart pattern ek technical analysis tool hai jo traders ko market trends aur price movements ke bare me samajhne me madad karta hai. Pennant chart pattern ek continuation pattern hota hai, yaani ki yeh ek existing trend ke continuation ko darust karta hai.

Pennant pattern ek chhota flag jaisa dikhta hai, jisme price ke ek tight range ke andar move hota hai. Yeh pattern generally ek trend ke beech me paya jata hai aur ek samay par trading range me hota hai. Pennant pattern me do important components hote hain:

PENNET CHART PATTERN K COMPONENTS:-

1. **Pole (Lamba Dhari)**:

Yeh woh portion hota hai jahan pe price ek clear trend me move kar raha hota hai. Is trend ke upar ya neeche pennant pattern ban raha hota hai.

2. **Pennant (Jhanda)**:

Pennant ek small, triangular pattern hota hai jo pole ke baad create hota hai. Yeh pattern normally price ke contraction ko darust karta hai, jaise ki ek pennant flag. Is pattern ke andar price kisi particular direction me move karne ke liye consolidate hota hai.

Pennant pattern ko samajhne aur trading decisions lene ke liye, aapko kuch important points par dhyan dena chahiye:

PENNET CHART PATTERN K KEY POINTS:-

- **Entry Point**:

Entry point ko determine karne ke liye aapko pennant pattern ke breakout ke wait karna hoga. Breakout ek direction me hota hai, yaani ki price ek specific level ko cross karta hai. Agar price upper side breakout karta hai, to yeh bullish (khareedne ke liye) signal hai, aur agar price lower side breakout karta hai, to yeh bearish (bechne ke liye) signal hai.

- **Stop Loss and Take Profit Levels**:

Trading me risk management bahut important hota hai. Isliye aapko stop loss aur take profit levels ko set karna hoga taki aap apne trading positions ko protect kar sake.

- **Volume**:

Volume bhi ek important factor hota hai. Agar breakout ke samay volume bada hota hai, to yeh breakout strong hota hai, aur agar volume kam hota hai, to breakout weak hota hai.

- **Timeframe**:

Aap pennant pattern ko kisi bhi timeframe par dekh sakte hain, lekin jyadatar traders daily chart ya hourly chart par iska istemal karte hain.

Dhyan rahe ki chart patterns ke istemal me hamesha risk hota hai aur kisi bhi pattern ke adhar par trading decisions lene se pahle, aapko market analysis, risk management, aur trading strategy ko madhya me rakhna chahiye. Iske alawa, ek acchi trading education aur experience bhi bahut mahatvapurn hai.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Pennat Chart Pattern kia hy.....

Assalam o Alium Dear ! Technical analysis ma , pennant continuation pattern ki aik type hy ,jub a secutity ma bari harkat hoti hy ,tooo usa flag pole ka name dya jata hy ,jo converging period line ka sath follow kia hota hy ,jo harkat ko break karta hy aik kasi direction ma ,jo second half of flage pole ko zahir karta hy .- Pennants cotinuarion pattern hy jaha technical analysis istamal kar ka usa follow kia jata hy .

- Yada tar trader pennant ka istamal karta hy kis sa una techinical analysis ki confirmation hoti hy .

Let 's take a look at a real life example of a pennant :

Stock pinnant ko create karta hy jab ya break out hota hy ,tajarbat per ghour phikar ,iss ka yada break out hota hy .Upper trend line high reaction ka barkhas bhi pennant line ka trend ko risist karti hy .Is sa trader un level ka break out kalaya dakhna ja chuka hy aur is breakout sa profit hasil kaya jata hy.

Key Characteristics of a Pennant pattern ....- A flagpole : Pennant pattern hamasha flagpole sa shru hota hy ,jo dosra pattern sa agal karta hy .Flag pole amuam stong hota hy jo symmetical triangle per move karta hy .

- Beakout Levels : Is ma doo kisam ka breakout hota hy ,aik flagpole ka end pa hota hy ,aur aik ghoarfikar per hota hy ,jaha upward aur downward trend jari rata hy .

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

What is pennant chart pattern?

Pennant Chart Pattern:

Pennant Chart Pattern, ya technical analysis mein istemal hone wala ek chart pattern hai jis se financial assets, jaise ke stocks, currency pairs, ya commodities ke future price movements ka andaza lagaya jata hai. Isay ek "continuation pattern" ke tor par consider kia jata hai, jiska matlab hai ke ye aksar existing price trend ke doran ban jata hai aur is pattern ke mutabiq price ke future direction ka andaza lagaya jata hai.

Pennant Chart Pattern Ki Pechan:

Jhand Flagpole:

Pattern ek taqatwar aur tez price movement se shuru hota hai, jise "jhand flagpole" kehte hain. Ye ek ahem price change ko darust karta hai, chahe wo upar ki taraf (bullish) ho ya neeche ki taraf (bearish).

Mawadat (Consolidation):

Jhand flagpole ke bad, price ek mawadat ke doran enter karta hai. Is doran price movement ek tijaratun numa shakal banata hai, jo ke aik chota symmetrical triangle ya symmetrical wedge ki tarah hota hai. Is mawadat ko "pennant" ya "pennant formation" kehte hain.

Volume:

Mawadat (consolidation) ke doran aksar volume kam ho jata hai, jo ke temporary equilibrium ko darust karta hai buyers aur sellers ke darmiyan.

Breakout:

Pennant pattern aksar choti muddat ka hota hai, aur traders next price direction ko confirm karne ke liye breakout ke liye dekhte hain. Agar price pennant se bahar nikal kar jhand flagpole ke pehle direction mein (bullish pennant ke liye upar ya bearish pennant ke liye neeche) nikalta hai, to ye signal hai ke trend jis taraf ja raha hai, wohi jari rahega.

Traders aksar technical analysis ke tools aur indicators ka istemal karke breakout ko confirm karne mein madad lete hain, jaise ke moving averages, relative strength indicators (RSI), aur doosre. Jhand flagpole ki size ko bhi use kiya ja sakta hai taake aa jane wale trend ke liye potential price target ka andaza lagaya ja sake.

Yaad rahe ke har pennant pattern ke peeche significant price movement nahi hoti, aur galat breakouts bhi ho sakte hain. Traders ko ihtiyat ke sath kaam karna chahiye aur pennant pattern ke di gayi signals ko confirm karne ke liye doosre analysis techniques ka istemal karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:14 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим