What is Tweezer candlestick pattern?

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

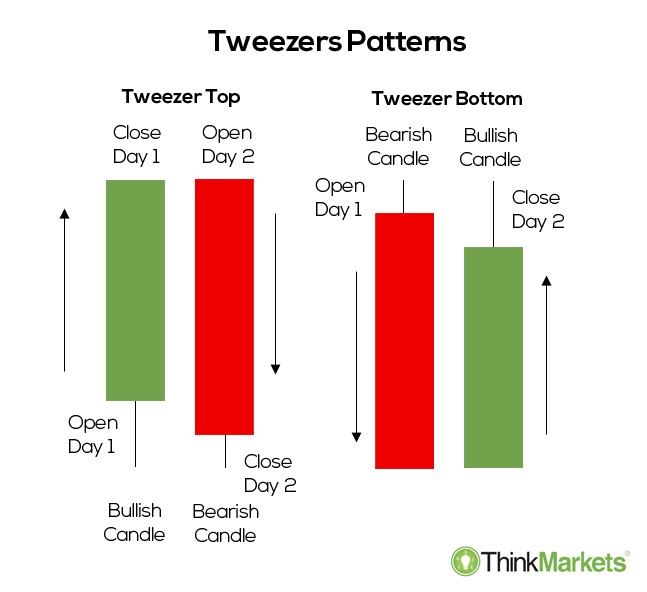

Aj is thread me apko me Pakistan forex trading ke ak bhot he important topic Tweezer candlestick pattern keep bare me btao ga or me umeed karta ho ke jo Information me apse share Karo ga wo apke knowledge or experience me zaror izafa Kare ge. Definition Bullish trend mein consistent bearish candles tweezer shape mein ban ti hain to trend reversal predicted hota hai trading market mein bahut sari different forecast dete hain aise hi tweezer top and bottom candlestick chart pattern ko use kar ke decision liya ja sakta hai market to reverse the trend and continue trend ka,market apni top position behind jati hai or us k bad aik aisi candle banti hai jahan behind last candlestick band hui thi same usi jaga say next candle bear trend ki banti hai tu us bod ko ap tweezer up khety hain. Last bullish closing candlestick or next bearish candlestick ka point or shadows same point same hona cheye,Jab market apni low positions behind ati hai or us k bad aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candlestick bullish trend ki banti hai tu us bod ko ap tweezer Lower khety hain. Explanation SO, Forex trading main hamaein achi trading karney K liye market ki movement ko monitor karna hota hay aur jab ham market may tweezers Bottom hotay dekhtay hain to hamein us time market ki movement ko daikhtay hoye apni trade open karni hoti hay aur hamein information honi chahiye kay tweezer lower keasy identify kia jata hay , market may tweezer lower banta hay to market may upward trend chal raha hota hay market ki move opper ko move karti hay aur tweezer lower ko oper ki taraf ko banti hay iss candal koada identify karna bohaut zay easy method hota hay traders iss ko jaldi say monitor kar saktay hain aur phir uss K by trading kartay hay, market ki movement ko analyze karna bohaut zayada important hota hay ta k ham uss Kay by trading Kar sakay, forex trading may Jab candal sticks pattern pay tweezer stab top ka trends hota hay tou iss situation can market can bullish trend chal raha hota hay uss time market mein opper k trends hota hay traders ko trading karney Kay liye market ki movement key by trade open karni hoti ha. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Tweezer Candlestick Pattern" forex trading mein aik pattern hai jahan pe do candlesticks ek hi price level par close karte hain. Agar upper wala "tweezer top" hota hai toh yeh downtrend ki possibility dikhata hai, jabke lower wala "tweezer bottom" uptrend ki possibility dikhata hai. Ye pattern price reversal ya continuation ka ishara ho sakta hai, lekin confirmations ki zaroorat hoti hai. -

#4 Collapse

"Tweezer" ek technical analysis mein istemal hone wala candlestick pattern hai, jisme do candlesticks hote hain jinke highs ya lows match karte hain. Ye patterns aksar vyaparik bazar mein, vishesh roop se share bazar ya forex trading mein, reversal indicators ke roop mein dekhe jate hain. Tweezer pattern upar ki taraf ek uptrend (bearish reversal) ya niche ki taraf ek downtrend (bullish reversal) mein dikhai de sakta hai. Chaliye dono prakar ke patterns ko explore karte hain: Bearish Tweezer: Ek bearish tweezer pattern mein, pehla candlestick bullish hota hai (hara ya safed), aur uske baad dusra candlestick bearish hota hai (laal ya kaala). Dono candlesticks ke opening aur closing prices lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candlesticks ke highs lagbhag ek hi star par hote hain, jo ek "tweezer top" banate hain. Ye pattern yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candlestick mein bears ne niyantran mein liya. Bullish Tweezer: Ek bullish tweezer pattern mein, pehla candlestick bearish hota hai (laal ya kaala), aur uske baad dusra candlestick bullish hota hai (hara ya safed). Fir se, dono candlesticks ke opening aur closing prices lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain, aur unke lows lagbhag ek hi star par hote hain, jo ek "tweezer bottom" banate hain. Ye pattern yeh dikhaata hai ki bears ne kimat ko neeche dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candlestick mein bulls ne niyantran mein liya.Tweezer patterns tab adhik vishwasniye hote hain jab ye kisi pehle wale trend ke baad dikhai dein, kyun ki ye us trend ka reversal sujhate hain. Halaanki, jaise ki sabhi technical analysis patterns, ye guarantee nahi dete aur inhe dusre prakar ke analysis aur risk management strategies ke saath istemal karna chahiye. Vyapari aksar candlestick patterns ko doosre technical indicators aur chart patterns ke saath milakar adhik soojh-bhoojh se vyaparik nirnay lene ke liye istemal karte hain.

-

#5 Collapse

Tweezer candlestick pattern k releted apne kadi best learning share ki hain umeeed karti hain kaap thek hongy forex trading main best learning karne kliye hard work karna must hota forex main best learning nhe hain tu loss hota hain forex main best learning ki jati hain tu forex main hard work k sath best learning krna must hota hain Tweezer candlestick pattern main market buy and sell hoti rehti hain jisne learning k sath kaaam kia wahi Tweezer candlestick pattern main benefit mil jata hain Tweezer candlestick pattern main rules and trend ko follow b krna parta hain Tweezer candlestick pattern main market k trend main agar buy ka setp banta hain tu ek traders ko buy lagana parta hain forex trading main learning kare regular pratice kare Tweezer candlestick pattern main kafi benefit mil jata hain Tweezer candlestick pattern in forex market: Tweezer candlestick pattern main market ki move ko b dekha jata hain qk jaaab tak merket main Tweezer candlestick pattern nhe banta hain vo traders benefit hasil nhe kar skte hain Tweezer candlestick pattern main rules and forex trading main pratice karna must hain Tweezer candlestick pattern main market main analysis karna must hota hain Tweezer candlestick pattern ek acha benefit de skta hain jaaab tak learning strong nhe hain vo traders big loss kar skte hain loss and profit forex trading ka hissa hain and Tweezer candlestick pattern main learning ko strong krna must hain hard work karna must hain Tweezer candlestick pattern main kafi benefit mil jata hain -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Tweezer Chart Pattern: Tweezer candle design primary market ki move ko b dekha jata hain qk jaaab tak merket fundamental Tweezer candle design nhe banta hain vo merchants benefit hasil nhe kar skte hain Tweezer candle design principal rules and forex exchanging principal pratice karna must hain Tweezer candle design principal market primary examination karna must hota hain Tweezer candle design ek acha benefit de skta hain jaaab tak learning solid nhe hain vo dealers huge misfortune kar skte hain misfortune and benefit forex exchanging ka hissa hain and Tweezer candle design principal learning major areas of strength for ko must hain difficult work karna must hain Tweezer candle design principal kafi benefit mil jata hain Candle design k releted apne kadi best learning share ki hain umeeed karti hain kaap thek hongy forex exchanging principal best learning karne kliye difficult work karna must hota forex fundamental best learning nhe hain tu misfortune hota hain forex primary best learning ki jati hain tu forex fundamental difficult work k sath best learning krna must hota hain Tweezer candle design fundamental market trade hoti rehti hain jisne learning k sath kaaam kia wahi Tweezer candle design principal benefit mil jata hain Tweezer candle design primary guidelines and pattern ko observe b krna parta hain Tweezer candle design principal market k pattern primary agar purchase ka setp banta hain tu ek merchants ko purchase lagana parta hain forex exchanging principal learning kare standard pratice kare Tweezer candle design fundamental kafi benefit mil jata hain Chart Pattern Formation: Ek bullish tweezer design mein, pehla candle negative hota hai (laal ya kaala), aur uske baad dusra candle bullish hota hai (hara ya safed). Fir se, dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain, aur unke lows lagbhag ek hello there star standard hote hain, jo ek "tweezer base" banate hain. Ye design yeh dikhaata hai ki bears ne kimat ko neeche dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bulls ne niyantran mein liya.Tweezer designs tab adhik vishwasniye hote hain poke ye kisi pehle ridge pattern ke baad dikhai dein, kyun ki ye us pattern ka inversion sujhate hain. Halaanki, jaise ki sabhi specialized investigation designs, ye ensure nahi dete aur inhe dusre prakar ke examination aur risk the executives systems ke saath istemal karna chahiye. Vyapari aksar candle designs ko doosre specialized pointers aur diagram designs ke saath milakar adhik soojh-bhoojh se vyaparik nirnay lene ke liye istemal karte hain.

Candle design k releted apne kadi best learning share ki hain umeeed karti hain kaap thek hongy forex exchanging principal best learning karne kliye difficult work karna must hota forex fundamental best learning nhe hain tu misfortune hota hain forex primary best learning ki jati hain tu forex fundamental difficult work k sath best learning krna must hota hain Tweezer candle design fundamental market trade hoti rehti hain jisne learning k sath kaaam kia wahi Tweezer candle design principal benefit mil jata hain Tweezer candle design primary guidelines and pattern ko observe b krna parta hain Tweezer candle design principal market k pattern primary agar purchase ka setp banta hain tu ek merchants ko purchase lagana parta hain forex exchanging principal learning kare standard pratice kare Tweezer candle design fundamental kafi benefit mil jata hain Chart Pattern Formation: Ek bullish tweezer design mein, pehla candle negative hota hai (laal ya kaala), aur uske baad dusra candle bullish hota hai (hara ya safed). Fir se, dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain, aur unke lows lagbhag ek hello there star standard hote hain, jo ek "tweezer base" banate hain. Ye design yeh dikhaata hai ki bears ne kimat ko neeche dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bulls ne niyantran mein liya.Tweezer designs tab adhik vishwasniye hote hain poke ye kisi pehle ridge pattern ke baad dikhai dein, kyun ki ye us pattern ka inversion sujhate hain. Halaanki, jaise ki sabhi specialized investigation designs, ye ensure nahi dete aur inhe dusre prakar ke examination aur risk the executives systems ke saath istemal karna chahiye. Vyapari aksar candle designs ko doosre specialized pointers aur diagram designs ke saath milakar adhik soojh-bhoojh se vyaparik nirnay lene ke liye istemal karte hain.  Tweezer" ek specialized mein istemal sharpen wala candle design hai, jisme do candles hote hain jinke highs ya lows match karte hain. Ye designs aksar vyaparik bazar mein, vishesh roop se share bazar ya forex exchanging mein, inversion markers ke roop mein dekhe jate hain. Tweezer design upar ki taraf ek upturn (negative inversion) ya specialty ki taraf ek downtrend (bullish inversion) mein dikhai de sakta hai. Chaliye dono prakar ke designs ko investigate karte hain Ek negative tweezer design mein, pehla candle bullish hota hai (hara ya safed), aur uske baad dusra candle negative hota hai (laal ya kaala). Dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candles ke highs lagbhag ek hey star standard hote hain, jo ek "tweezer top" banate hain. Ye design yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya Chart Pattern Trading View: Bullish pattern mein steady negative candles tweezer shape mein boycott hain to drift inversion anticipated hota hai exchanging market mein bahut sari different conjecture dete hain aise hello tweezer top and base candle diagram design ko use kar ke choice liya ja sakta hai market to alter the course and proceed with pattern ka,market apni top situation behind jati hai or us k awful aik aisi flame banti hai jahan behind last candle band hui thi same usi jaga say next candle pattern ki banti hai tu us body ko ap tweezer up khety hain. Last bullish shutting candle or next negative candle ka point or shadows same point same hona cheye,Jab market apni low situations behind ati hai or us k awful aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candle bullish pattern ki banti hai tu us body ko ap tweezer Lower khety hain.

Tweezer" ek specialized mein istemal sharpen wala candle design hai, jisme do candles hote hain jinke highs ya lows match karte hain. Ye designs aksar vyaparik bazar mein, vishesh roop se share bazar ya forex exchanging mein, inversion markers ke roop mein dekhe jate hain. Tweezer design upar ki taraf ek upturn (negative inversion) ya specialty ki taraf ek downtrend (bullish inversion) mein dikhai de sakta hai. Chaliye dono prakar ke designs ko investigate karte hain Ek negative tweezer design mein, pehla candle bullish hota hai (hara ya safed), aur uske baad dusra candle negative hota hai (laal ya kaala). Dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candles ke highs lagbhag ek hey star standard hote hain, jo ek "tweezer top" banate hain. Ye design yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya Chart Pattern Trading View: Bullish pattern mein steady negative candles tweezer shape mein boycott hain to drift inversion anticipated hota hai exchanging market mein bahut sari different conjecture dete hain aise hello tweezer top and base candle diagram design ko use kar ke choice liya ja sakta hai market to alter the course and proceed with pattern ka,market apni top situation behind jati hai or us k awful aik aisi flame banti hai jahan behind last candle band hui thi same usi jaga say next candle pattern ki banti hai tu us body ko ap tweezer up khety hain. Last bullish shutting candle or next negative candle ka point or shadows same point same hona cheye,Jab market apni low situations behind ati hai or us k awful aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candle bullish pattern ki banti hai tu us body ko ap tweezer Lower khety hain. Forex exchanging primary hamaein achi exchanging karney K liye market ki development ko screen karna hota roughage aur poke ham market may tweezers Base hotay dekhtay hain to hamein us time market ki development ko daikhtay hoye apni exchange open karni hoti feed aur hamein data honi chahiye kay tweezer lower keasy recognize kia jata roughage , market may tweezer lower banta roughage to market may up drift chal raha hota roughage market ki move opper ko move karti roughage aur tweezer lower ko oper ki taraf ko banti roughage iss candal koada distinguish karna bohaut zay simple strategy hota feed dealers iss ko jaldi say screen kar saktay hain aur phir uss K by exchanging kartay roughage, market ki development ko examine karna bohaut zayada significant hota feed ta k ham uss Kay by exchanging Kar sakay, forex exchanging may Hit candal sticks design pay tweezer wound top ka patterns hota roughage tou iss circumstance can market can bullish pattern chal raha hota roughage uss timemarket mein opper k patterns hota roughage merchants ko exchanging karney Kay liye market ki development key by profession open karni hoti ha.

-

#7 Collapse

Aj is thread me apko me tweezer candlestick pattern ke bare me btao ga.Bullish trend mein consistent bearish candles tweezers shape mein ban ti hain to reverse the trend predicted hota hai trading market mein bahut sari different forecast dete hain aise hi tweezers top and bottom candlestick chart pattern ko use kar to decide liya ja sakta hai market reverse the trend and continue the trend ka,market apni top position behind jati hai or us k bad aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candle bear trend ki banti hai tu us point ko ap tweezer up khety hain. Last bullish closing candlestick or next bearish candlestick ka point or shadows same point same hona cheye,Jab market apni low positions behind ati hai or us k bad aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candlestick bullish trend ki banti hai tu us bod ko ap tweezer Lower khety hain. -

#8 Collapse

What is tweezer candlestick pattern. umeeed karti hain kaap thek hongy forex trading main best learning karne kliye hard work karna must hota forex main best learning nhe hain tu loss hota hain forex main best learning ki jati hain tu forex main hard work k sath best learning krna must hota hain Tweezer candlestick pattern main market buy and sell hoti rehti hain jisne learning k sath kaaam kia wahi Tweezer candlestick pattern main benefit mil jata hain Tweezer candlestick pattern main rules and trend ko follow b krna parta hain Tweezer candlestick pattern main market k trend main agar buy ka setp banta hain.qk jaaab tak merket fundamental Tweezer candle design nhe banta hain vo merchants benefit hasil nhe kar skte hain Tweezer candle design principal rules and forex exchanging principal pratice karna must hain Tweezer candle design principal market primary examination karna must hota hain Tweezer candle design ek acha benefit de skta hain jaaab tak learning solid nhe hain vo dealers huge misfortune kar skte hain misfortune and benefit forex exchanging ka hissa hain and Tweezer candle design principal learning major areas of strength for ko must hain difficult work karna must hain. Explanation. Ye designs aksar vyaparik bazar mein, vishesh roop se share bazar ya forex exchanging mein, inversion markers ke roop mein dekhe jate hain. Tweezer design upar ki taraf ek upturn (negative inversion) ya specialty ki taraf ek downtrend (bullish inversion) mein dikhai de sakta hai. Chaliye dono prakar ke designs ko investigate karte hain Ek negative tweezer design mein, pehla candle bullish hota hai (hara ya safed), aur uske baad dusra candle negative hota hai (laal ya kaala). Dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candles ke highs lagbhag ek hey star standard hote hain, jo ek "tweezer top" banate hain. Ye design yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya Forex exchanging primary hamaein achi exchanging karney K liye market ki development ko screen karna hota roughage aur poke ham market may tweezers Base hotay dekhtay hain to hamein us time market ki development ko daikhtay hoye apni exchange open karni hoti feed aur hamein data honi chahiye kay tweezer lower keasy recognize kia jata roughage , market may tweezer lower banta roughage to market may up drift chal raha hota roughage market ki move opper ko move karti roughage aur tweezer lower ko oper ki taraf ko banti roughage iss candal koada distinguish karna bohaut zay simple strategy hota feed dealers iss ko jaldi say screen kar saktay hain aur phir uss K by exchanging kartay roughage, market ki development ko examine karna bohaut zayada significant hota feed ta k ham uss Kay by exchanging Kar sakay, forex exchanging may Hit candal sticks design pay tweezer wound top ka patterns hota roughage tou iss circumstance can market can bullish pattern chal raha hota roughage uss timemarket mein opper k patterns hota roughage merchants ko exchanging karney Kay liye market ki development key by profession open karni hoti ha. Forex trading ma importance. Tweezer candlestick pattern main market ki move ko b dekha jata hain qk jaaab tak merket main Tweezer candlestick pattern nhe banta hain vo traders benefit hasil nhe kar skte hain Tweezer candlestick pattern main rules and forex trading main pratice karna must hain Tweezer candlestick pattern main market main analysis karna must hota hain Tweezer candlestick pattern ek acha benefit de skta hain jaaab tak learning strong nhe hain vo traders big loss kar skte hain loss and profit forex trading ka hissa hain and Tweezer candlestick pattern main learning ko strong krna must hain hard work karna must hain Tweezer candlestick pattern main kafi benefit mil jata hain.exchanging market mein bahut sari different conjecture dete hain aise hello tweezer top and base candle diagram design ko use kar ke choice liya ja sakta hai market to alter the course and proceed with pattern ka,market apni top situation behind jati hai or us k awful aik aisi flame banti hai jahan behind last candle band hui thi same usi jaga say next candle pattern ki banti hai tu us body ko ap tweezer up khety hain. Last bullish shutting candle or next negative candle ka point or shadows same point same hona cheye,Jab market apni low situations behind ati hai or us k awful aik aisi candle banti hai jahan behind last candle band hui thi same usi jaga say next candle bullish pattern ki banti hai tu us body ko ap tweezer Lower khety hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Tweezer" ek specialized examination mein istemal sharpen wala candle design hai, jisme do candles hote hain jinke highs ya lows match karte hain. Ye designs aksar vyaparik bazar mein, vishesh roop se share bazar ya forex exchanging mein, inversion markers ke roop mein dekhe jate hain. Tweezer design upar ki taraf ek upturn (negative inversion) ya specialty ki taraf ek downtrend (bullish inversion) mein dikhai de sakta hai. Chaliye dono prakar ke designs ko investigate karte hain: Negative Tweezer//// Ek negative tweezer design mein, pehla candle bullish hota hai (hara ya safed), aur uske baad dusra candle negative hota hai (laal ya kaala). Dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candles ke highs lagbhag ek hey star standard hote hain, jo ek "tweezer top" banate hain. Ye design yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bears ne niyantran mein liya. Bullish Tweezer//// Ek bullish tweezer design mein, pehla candle negative hota hai (laal ya kaala), aur uske baad dusra candle bullish hota hai (hara ya safed). Fir se, dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain, aur unke lows lagbhag ek hey star standard hote hain, jo ek "tweezer base" banate hain. Ye design yeh dikhaata hai ki bears ne kimat ko neeche dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bulls ne niyantran mein liya.Tweezer designs tab adhik vishwasniye hote hain hit ye kisi pehle ridge pattern ke baad dikhai dein, kyun ki ye us pattern ka inversion sujhate hain. Halaanki, jaise ki sabhi specialized examination designs, ye ensure nahi dete aur inhe dusre prakar ke investigation aur risk the executives systems ke saath istemal karna chahiye. Vyapari aksar candle designs ko doosre specialized markers aur diagram designs ke saath milakar adhik soojh-bhoojh se vyaparik nirnay lene ke liye istemal karte hain

Negative Tweezer//// Ek negative tweezer design mein, pehla candle bullish hota hai (hara ya safed), aur uske baad dusra candle negative hota hai (laal ya kaala). Dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain. Dono candles ke highs lagbhag ek hey star standard hote hain, jo ek "tweezer top" banate hain. Ye design yeh sujhata hai ki bulls ne kimat ko upar dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bears ne niyantran mein liya. Bullish Tweezer//// Ek bullish tweezer design mein, pehla candle negative hota hai (laal ya kaala), aur uske baad dusra candle bullish hota hai (hara ya safed). Fir se, dono candles ke opening aur shutting costs lagbhag ek doosre ke saman hote hain ya bahut kareeb hote hain, aur unke lows lagbhag ek hey star standard hote hain, jo ek "tweezer base" banate hain. Ye design yeh dikhaata hai ki bears ne kimat ko neeche dhakelne ki koshish ki, lekin unka safal nahi ho paya, aur dusre candle mein bulls ne niyantran mein liya.Tweezer designs tab adhik vishwasniye hote hain hit ye kisi pehle ridge pattern ke baad dikhai dein, kyun ki ye us pattern ka inversion sujhate hain. Halaanki, jaise ki sabhi specialized examination designs, ye ensure nahi dete aur inhe dusre prakar ke investigation aur risk the executives systems ke saath istemal karna chahiye. Vyapari aksar candle designs ko doosre specialized markers aur diagram designs ke saath milakar adhik soojh-bhoojh se vyaparik nirnay lene ke liye istemal karte hain

-

#10 Collapse

### Tweezer Candlestick Pattern: Kya Hai Aur Iski Pehchaan

Tweezer candlestick pattern ek ahem technical analysis tool hai jo market ke potential reversals ko darshata hai. Yeh pattern aksar short-term trading mein istemal hota hai aur traders ko entry aur exit points identify karne mein madad karta hai. Is post mein, hum tweezer candlestick pattern ki pehchan, types, aur iska istemal kaise kiya jata hai, par tafseel se baat karenge.

### Tweezer Pattern Ki Pehchan

Tweezer pattern do candlesticks par mabni hota hai jo ek doosre ke samne hoti hain. Is pattern ki khasiyat yeh hai ke dono candlesticks ke highs ya lows milte hain, jo market ke potential reversal ko indicate karte hain. Tweezer pattern aksar bullish ya bearish reversal ke signals ke liye dekha jata hai.

### Tweezer Pattern Ke Types

1. **Tweezer Tops**: Yeh bearish reversal pattern hota hai jo do candlesticks se milkar banta hai. Pehli candlestick ek bullish (upward) candlestick hoti hai, jabke doosri candlestick ek bearish (downward) candlestick hoti hai. Dono candlesticks ke highs milte hain, jo signal dete hain ke market mein buying pressure kam ho raha hai.

2. **Tweezer Bottoms**: Yeh bullish reversal pattern hota hai. Pehli candlestick ek bearish candlestick hoti hai, jabke doosri candlestick ek bullish candlestick hoti hai. Dono candlesticks ke lows milte hain, jo yeh indicate karte hain ke market mein selling pressure kam ho raha hai.

### Tweezer Pattern Ka Istemal Kaise Karein?

1. **Pattern Identification**: Tweezer pattern ko identify karne ke liye traders ko pehle candlestick chart dekhna hoga. Jab do consecutive candlesticks ka high ya low milta hai, to yeh tweezer pattern ka signal hota hai.

2. **Confirmation**: Is pattern ki reliability ko confirm karne ke liye traders ko volume ka analysis bhi karna chahiye. Agar volume do candlesticks ke saath zyada hai, to pattern ki validity badh jaati hai.

3. **Entry Points**: Jab tweezer tops ka formation hota hai, to traders sell position lene ka sochte hain. Iske baraks, tweezer bottoms par buy position lena chahiye. Entry point tab hota hai jab doosri candlestick close hoti hai.

4. **Stop-Loss Setting**: Risk management ke liye, stop-loss ko tweezer pattern ke opposite side par set karna chahiye. Yeh potential losses ko limit karne mein madad karega.

5. **Profit Targets**: Profit targets ko determine karne ke liye, traders previous support aur resistance levels ka istemal karte hain. Isse unhe clear exit points milte hain.

### Advantages

- **Clear Reversal Signals**: Tweezer pattern traders ko clear reversal signals provide karta hai, jo timely decisions lene mein madadgar hota hai.

- **Easy to Identify**: Is pattern ko identify karna relatively asan hota hai, jo naye traders ke liye beneficial hai.

- **Versatility**: Yeh pattern kisi bhi time frame par kaam kar sakta hai, jo traders ko flexibility deta hai.

### Disadvantages

- **False Signals**: Kabhi kabhi tweezer pattern false signals generate kar sakta hai, jo traders ko confuse kar sakta hai.

- **Volume Dependence**: Agar volume confirmatory nahi hai, to pattern ki reliability kam ho sakti hai.

### Aakhir Mein

Tweezer candlestick pattern Forex trading mein ek valuable tool hai jo market ke potential reversals ko darshata hai. Iska sahi istemal karne se traders apne trading strategies ko behtar bana sakte hain aur profitable decisions le sakte hain. Hamesha yaad rakhein ke kisi bhi technical analysis tool ke saath risk management aur volume analysis zaroori hai. Agar aap tweezer pattern ko samajhte hain aur iski signals ko analyze karte hain, to aap successful trading kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Tweezer Candlestick Pattern: Kya Hai Aur Iski Pehchaan

Tweezer candlestick pattern ek ahem technical analysis tool hai jo traders ko market ke reversal points identify karne mein madad karta hai. Is pattern ki do khas candlesticks hoti hain jo aksar ek doosre ke sath match karti hain. Yeh pattern bullish ya bearish dono ho sakta hai, aur iski pehchaan karna aasan hai agar aap candlestick charts ka ghor se mutala karein.

Tweezer Bottom: Bullish Reversal

Tweezer bottom pattern tab banta hai jab do consecutive candlesticks hote hain jinki lows same ya mushabih hote hain. Pehli candlestick bearish hoti hai, jabke doosri bullish hoti hai. Yeh bullish reversal signal hai, jo yeh darust karta hai ke market ne apni downward movement khatam kar di hai. Agar aap is pattern ko dekhte hain, toh yeh aapko market ke upar jane ki taraf ishara kar sakta hai. Yeh pattern aksar support level ke aas paas banta hai.

Tweezer Top: Bearish Reversal

Iske mukabil, tweezer top pattern bearish reversal ke liye hota hai. Yeh pattern tab hota hai jab do consecutive candlesticks hote hain jinke highs same ya mushabih hote hain. Pehli candlestick bullish hoti hai, jabke doosri bearish hoti hai. Yeh bearish reversal signal hai, jo dikhata hai ke market apni upward movement khatam kar raha hai. Agar aap is pattern ko dekhte hain, toh yeh aapko market ke neeche jane ki taraf ishara kar sakta hai. Yeh pattern aksar resistance level ke paas banta hai.

Trading Strategy: Is Pattern Ka Istemaal

Tweezer candlestick pattern ko trade karte waqt, yeh zaroori hai ke aap dusre technical indicators ke sath is pattern ko confirm karein. Aksar traders is pattern ko volume analysis, moving averages, ya RSI ke sath mila kar istemal karte hain. Agar aapko tweezer bottom pattern milta hai aur saath mein volume increase hota hai, toh yeh bullish momentum ka strong signal ho sakta hai. Is tarah, aap apne entry aur exit points ko behtar tarike se tay kar sakte hain.

Conclusion: Tweezer Pattern Ki Ahmiyat

Tweezer candlestick pattern trading ki duniya mein ek valuable tool hai. Yeh aapko market ke reversal points samajhne mein madad karta hai aur aapki trading decisions ko behtar bana sakta hai. Is pattern ki pehchaan aur samajh aapko trading mein faida de sakti hai. Hamesha yaad rakhein ke kisi bhi trading strategy ko implement karte waqt risk management zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:11 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим