Meeting line candlestick pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam member se khairiyat se honge bhaiyon aur bahanon aaj ham ek aisa topic share karne ja rahe Hain jiska platform mein bahut jyada kam chalta hai is topic ka naam hai meeting line candlestick pattern Aaj ham meeting line candlestick pattern ke bare mein aapko bahut jyada jankari Denge jisko janne ke bad aap bahut jyada fayda utha sakte hain to aap hamari is post ko pura dekhen samjhe jitna jyada aap is post ko samjhenge utna jyada aapko profit hoga to aaye ham is topic ke bare mein discuss karte hain aapse shukriya Matches the bulb pattern How to trade candles "White magic candidate yes or female card 10 percent yes. Compare the line with the white candle pattern and yes or candle or white long distance black black yes market ko sharp reverse mate. with a medium range, but this last one, trend yes candle now to low card yes. Energy and assembly line business Dear forex members, patterns are always patterns and movement patterns, ker rehi hoti hai agar ok ko achi terha samajh lain You are the main forex market hamari liay trade kerna asan ho jata hai ki pattern ki patterns of the main market ker rehi hoti hai tou trading patterns and time Sun City This is a connecting line pattern, trader, strong market, signal, signal, trader, pattern, waiting for a full line, waiting for a full point, Explanation: Whether it is a trader, market trading or traders, or long term. trade. Stopping Growth: Traders sell isolated line segments -

#3 Collapse

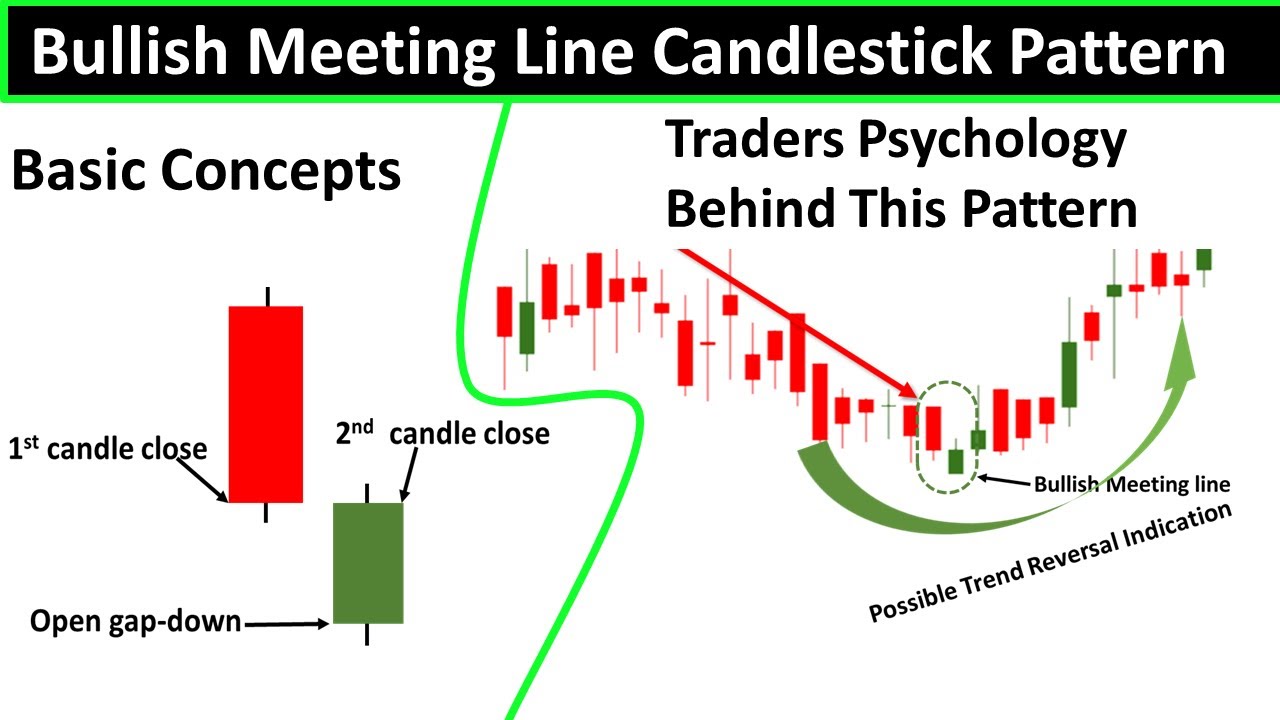

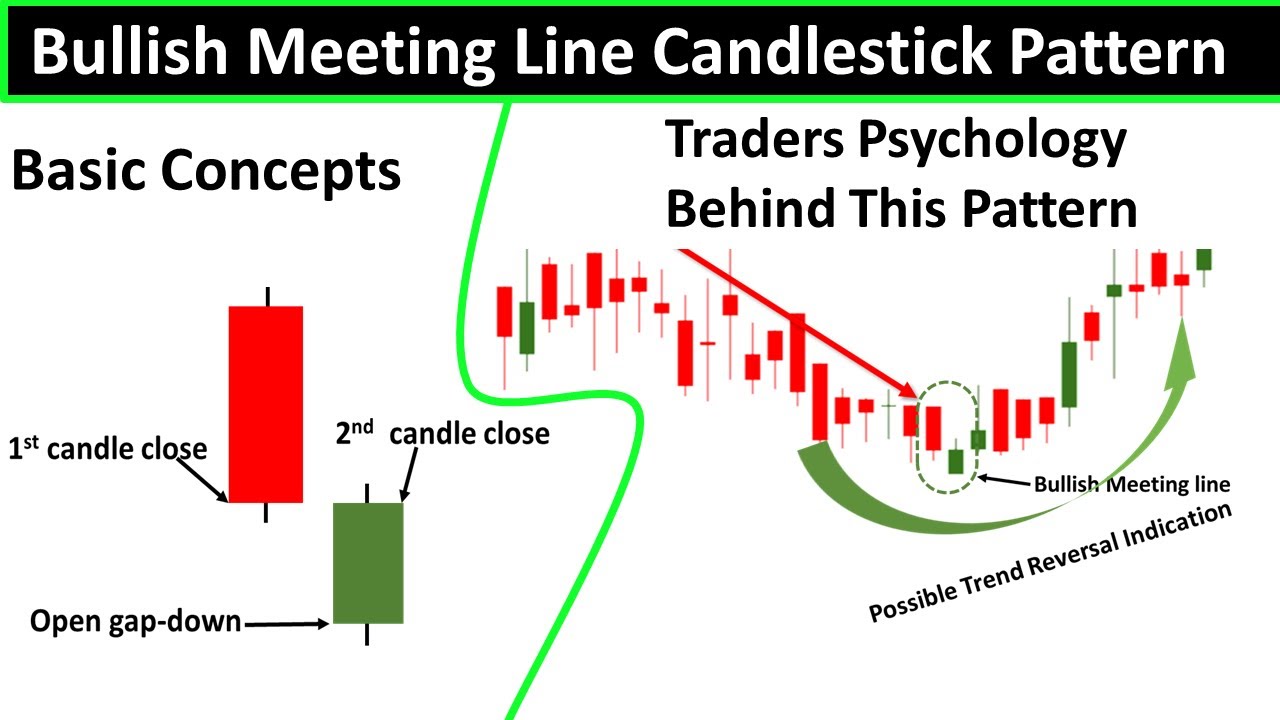

Meeting Line Candlestick Pattern ek technical analysis tool hai jo stock market ya financial markets mein istemal hota hai. Yeh pattern do candlesticks se mil kar banta hai, aur market direction ko samjhne mein madadgar ho sakta hai. Is pattern mein: 1. **Pehla Candlestick:** Pehla candlestick normally uptrend ya bullish trend ke dauran aata hai aur lambi bullish (buyers dominate) candle hoti hai. 2. **Dusra Candlestick:** Dusra candlestick pehle candlestick ke ulte trend mein hoti hai, yaani downtrend ya bearish trend mein aati hai. Lekin yeh candle pehle candle ki range ke andar rehti hai aur iski closing price pehle candle ki opening price ke kareeb hoti hai. **Conclusions (Nateeje):** 1. **Indecision:** Meeting Line Candlestick Pattern market mein uncertainty ya indecision ko darust kar sakta hai. Yeh dikhata hai ke buyers aur sellers mein balance hai. 2. **Trend Reversal:** Agar yeh pattern strong trend ke baad aata hai, toh yeh ek reversal signal ho sakta hai, matlab ke trend badalne ki sambhavna hai. Lekin, aapko is signal ko aur dusre confirmation indicators ko bhi dekh kar istemal karna chahiye. 3. **Continuation:** Kabhi-kabhi yeh pattern trend ke beech mein bhi aata hai aur trend continue hone ka sign ho sakta hai. Yeh important hai ki aap Meeting Line Candlestick Pattern ko dusre technical indicators ke saath istemal karein, aur market ki overall situation ko samjhkar trading decisions lein. Is pattern ko ek signal ke roop mein dekha ja sakta hai, lekin uski confirmation aur risks ko samjhna bhi mahatvapurna hai. -

#4 Collapse

"Meeting Line Candlestick Pattern" ek technical analysis tool hai jo share market ya maali bazaaron mein istemal hota hai. Is pattern mein do mukhya kyandle shaamil hote hain aur isse bazaar ki disha ko samajhne mein madad milti hai. Is pattern mein: 1. **Pehla Kyandle:** Pehla kyandle aam taur par uptrend ya bullish trend ke dauran aata hai aur yeh kyandle lambi hoti hai, iska matlab hai ke kharidar (buyers) adhik hote hain aur bechne wale (sellers) kam hote hain. 2. **Dusra Kyandle:** Dusra kyandle pehle kyandle ke ulte trend mein hoti hai, yaani downtrend ya bearish trend ke dauran aati hai. Lekin yeh kyandle pehle kyandle ki range ke andar rehti hai aur iski band hone wali keemat pehle kyandle ki shuruaati keemat ke kareeb hoti hai. **Nateeje (Conclusions):** 1. **Indecision:** Meeting Line Candlestick Pattern market mein uncertainty ya indecision ko darust kar sakta hai. Yeh dikhata hai ke kharidar aur bechne wale mein samanata hai. 2. **Trend Reversal:** Agar yeh pattern majboot trend ke baad aata hai, toh yeh trend ke ulatne ka sanket ho sakta hai, matlab trend badalne ki sambhavna hai. Lekin, is signal ko aur dusre confirmation indicators ko bhi dekh kar istemal karna chahiye. 3. **Continuation:** Kabhi-kabhi yeh pattern trend ke beech mein aata hai aur trend jaari rehne ki sambhavna hoti hai. Yad rahe ke Meeting Line Candlestick Pattern ko dusre technical indicators ke saath istemal karna zaroori hai, aur market ki overall sthiti ko samajh kar vyapaarik nirnay lene chahiye. Yeh ek signal ke roop mein dekha ja sakta hai, lekin uski pushti aur riskon ko samajhna bhi mahatvapurna hai. -

#5 Collapse

-

#6 Collapse

"Meeting Line Candlestick Pattern" forex trading mein aik pattern hai jahan pe do consecutive candlesticks, yaani aik ke baad aik, ek hi price level par close karte hain. Agar pehli candlestick bullish hai aur doosri candlestick usi range mein open hoti hai, toh yeh uptrend ko confirm karta hai. Is pattern ka istemal trend direction aur entry points pehchane mein madad deta hai, lekin confirmations ke saath trading faislon ko lena zaroori hota hai. -

#7 Collapse

"Meeting Lines" ek candlestick pattern hai jo technical analysis mein istemal hota hai. Ye pattern do alag-alag candlesticks se bana hota hai jo aam taur par uptrend ya downtrend ke beech mein dikhta hai. Ye pattern trend reversal ko indicate kar sakta hai. Meeting Lines pattern mein, do consecutive candlesticks hote hain jinmein pehli candlestick trend mein hai (uptrend ya downtrend), aur doosri candlestick us trend ke opposite direction mein hoti hai. In dono candlesticks ki body lengths kuch had tak similar hoti hain. Pattern ko samajhne ke liye, aapko in candlesticks ki opening price, closing price, high price, aur low price ko dhyan se dekhna hota hai. Bullish Meeting Lines (Uptrend me): Isme pehli candlestick downtrend mein hoti hai jiska closing price neeche hota hai. Doosri candlestick bhi downtrend mein hoti hai, lekin iska opening price pehli candlestick ki opening price ke paas hota hai aur closing price uske closing price ke paas hota hai. Is pattern ko ek possible trend reversal signal samjha jata hai. Bearish Meeting Lines (Downtrend me): Isme pehli candlestick uptrend mein hoti hai jiska closing price upar hota hai. Doosri candlestick bhi uptrend mein hoti hai, lekin iska opening price pehli candlestick ki opening price ke paas hota hai aur closing price uske closing price ke paas hota hai. Ye pattern bhi trend reversal ke possibility ko dikhata hai. Meeting Lines pattern ka istemal akele nahi kiya jata, balki isey dusre technical indicators aur price patterns ke saath combine kiya jata hai trend reversal ki confirmation ke liye. Is tarah ke patterns ki samajh aur unka istemal karne ke liye aapko candlestick chart analysis ka acchi tarah se gyaan hona chahiye. -

#8 Collapse

**Meeting Line Candlestick Pattern:** **Meeting Line** ek candlestick pattern hai jo traders ko trend continuation aur trend reversals ki signals provide karta hai. Yeh pattern do consecutive candlesticks se bana hota hai, jahan ek bearish candlestick ek bullish candlestick ke saath mil jati hai. Meeting line pattern bullish ya bearish trend mein appear ho sakta hai aur traders ko price movements aur trend changes ko samajhne mein madad deta hai. **Tafseel:** **Bullish Meeting Line:** Agar pehli candlestick bearish hai aur dusri candlestick bullish hai, aur dusri candlestick pehli candlestick ki body mein fit hoti hai aur uski closing price pe close hoti hai, to yeh bullish meeting line pattern hai. Yeh bullish reversal ki signal hoti hai, indicating ke bearish trend khatam ho raha hai aur bullish trend start ho sakta hai. **Bearish Meeting Line:** Agar pehli candlestick bullish hai aur dusri candlestick bearish hai, aur dusri candlestick pehli candlestick ki body mein fit hoti hai aur uski closing price pe close hoti hai, to yeh bearish meeting line pattern hai. Yeh bearish reversal ki signal hoti hai, indicating ke bullish trend khatam ho raha hai aur bearish trend start ho sakta hai. **Meeting Line Pattern Ke Fawaid:**- 1. **Trend Reversal aur Continuation Signals:** Meeting line pattern trend reversals aur trend continuation ki signals provide karta hai, jin se traders ko price movements ka direction aur trend changes ke baray mein maloomat milti hai.

- 2. **Confirmation:** Is pattern ko confirm karne ke liye traders doosre technical indicators aur analysis tools ka istemal kar sakte hain.

- 3. **Entry aur Exit Points:** Traders is pattern ki madad se entry aur exit points confirm kar sakte hain, jisse unka potential for profit increase hota hai.

- 1. **False Signals:** Kabhi-kabhi meeting line pattern false signals bhi de sakta hai, jahan actual trend reversal nahi hota.

- 2. **Market Volatility:** Market volatility ke dauran pattern ka interpretation mushkil ho sakta hai.

- 3. **Limited Accuracy:** Yeh pattern ki accuracy depend karti hai market conditions aur other factors par.

-

#9 Collapse

Meeting Line Candles Pattern: "Meeting Line Candle Example" forex exchanging mein aik design hai jahan pe do continuous candles, yaani aik ke baad aik, ek greetings cost level standard close karte hain. Agar pehli candle bullish hai aur doosri candle usi range mein open hoti hai, toh yeh upturn ko affirm karta hai. Is design ka istemal pattern course aur passage focuses pehchane mein madad deta hai, lekin affirmations ke saath exchanging faislon ko lena zaroori hota hai.Meeting Line design ka istemal karte waqt, brokers ko aur bhi specialized markers aur cost activity ke saath mila kar samjhna chahiye. Yeh design akela hello there solid nahi hota aur bogus signs bhi dene ka imkan hota hai. Isliye is design ko affirm karne ke liye dusre pointers ka bhi istemal karna zaroori hota hai Forex mein Meeting Line ek significant candle design hai jo pattern inversion ko show karne mein madad deta hai. Is design ki pehchan aur istemal karne se merchants market ke mukhtalif developments ko samjh sakte hain aur sahi faislay le sakte hain Meeting line aik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed candle hai jabkay doosri aik jarehana negative candle hai jo pehli candle ke qareeb band ho jati hai. candle patteren sadiiyon se merchants maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti hai, jahan chawal ke tajir asal mein inhen istemaal karte thay. aaj, yeh namoonay stomach muscle bhi duniya bhar ke taajiron ke zareya barray pemanay standard istemaal kiye jatay hai negative gathering line taajiron ke liye kya ishara karti hai? Yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. Khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. Mukhtasir job qaim karne se pehlay, commercial center ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. Usay aik tasalsul ke patteren ke pinnacle standard bhi dekha ja sakta hai punch asasa pehlay hey neechay ki taraf barh raha Pattern Formation And Types: Agar Meeting Line Candle Example check hota hai, to get right of section to part tayyar karen. Agar pehle wala style bullish hai, to look for karne ka get admission to detail pehli candle ki inordinate se thoda upar rakha jata hai. Agar style negative hai, to sell karne ka passage part pehli candle ki low se thoda area of interest rakha jata hai.Har exchange mein forestall misfortune aur reason degrees zaroor set karen. Stop misfortune pehli candle ki low ya extreme se thoda neeche ya upar set kiya jata hai. Target certificate pehli candle ki body ke term ya going before swing unnecessary/low standard rakha jata hai.Har exchange mein risk aur acclaim proportion ko compute karen. Agar risk acclaim proportion acha hai, to trade ko execute karen

Meeting line aik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed candle hai jabkay doosri aik jarehana negative candle hai jo pehli candle ke qareeb band ho jati hai. candle patteren sadiiyon se merchants maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti hai, jahan chawal ke tajir asal mein inhen istemaal karte thay. aaj, yeh namoonay stomach muscle bhi duniya bhar ke taajiron ke zareya barray pemanay standard istemaal kiye jatay hai negative gathering line taajiron ke liye kya ishara karti hai? Yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. Khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. Mukhtasir job qaim karne se pehlay, commercial center ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. Usay aik tasalsul ke patteren ke pinnacle standard bhi dekha ja sakta hai punch asasa pehlay hey neechay ki taraf barh raha Pattern Formation And Types: Agar Meeting Line Candle Example check hota hai, to get right of section to part tayyar karen. Agar pehle wala style bullish hai, to look for karne ka get admission to detail pehli candle ki inordinate se thoda upar rakha jata hai. Agar style negative hai, to sell karne ka passage part pehli candle ki low se thoda area of interest rakha jata hai.Har exchange mein forestall misfortune aur reason degrees zaroor set karen. Stop misfortune pehli candle ki low ya extreme se thoda neeche ya upar set kiya jata hai. Target certificate pehli candle ki body ke term ya going before swing unnecessary/low standard rakha jata hai.Har exchange mein risk aur acclaim proportion ko compute karen. Agar risk acclaim proportion acha hai, to trade ko execute karen  Meeting Line design ko substitute karne ke liye kuch methods hain, jinhe aap apni looking for and selling mein istemaal kar sakte hain Meeting Line test ek capacity inversion signal hai, lekin iski certification ke liye aapko aur specialized signs and side effects ka istemaal karna chahiye. Value development, help and obstruction stages, style follows, ya dusre signs ki madad se is design ko affirm kar sakte hain Meeting Line test ke get passage to aur leave factors ko decide karne ke liye aapko appropriate gamble control strategies ka istemaal karna chahiye. Aap forestall misfortune aur point cost ko set kar sakte hain, jisse aap apne exchanges ko control kar sakte hain Meeting Line design ko successfully exchange karne ke liye practice aur assessment zaroori hai. Verifiable charge realities ko have a review karein aur design ke saath sharpen rib rate moves ko check karein. Isse aapko design ke accomplishment rate aur looking out and advancing choices standard higher oversee hoga. Chart Trading: Negative inversion patteren ko meeting line kaha jata hai kyunkay doosri negative light ka band hona pehli become flushed flame ke qareeb se" milta hai ". is liye, negative gathering line taajiron ke liye kya ishara karti hai? yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. mukhtasir position qaim karne se pehlay, market ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. usay aik tasalsul ke patteren ke peak standard bhi dekha ja sakta hai hit asasa pehlay hey neechay ki taraf barh raha ho ik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed flame hai jabkay doosri aik jarehana negative candle hai jo pehli light ke qareeb band ho jati hai. candle patteren sadiiyon se brokers maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti hai, jahan chawal ke tajir asal mein inhen istemaal karte thay. aaj, yeh namoonay stomach muscle bhi duniya bhar ke taajiron ke zareya barray pemanay standard istemaal kiye jatay hain

Meeting Line design ko substitute karne ke liye kuch methods hain, jinhe aap apni looking for and selling mein istemaal kar sakte hain Meeting Line test ek capacity inversion signal hai, lekin iski certification ke liye aapko aur specialized signs and side effects ka istemaal karna chahiye. Value development, help and obstruction stages, style follows, ya dusre signs ki madad se is design ko affirm kar sakte hain Meeting Line test ke get passage to aur leave factors ko decide karne ke liye aapko appropriate gamble control strategies ka istemaal karna chahiye. Aap forestall misfortune aur point cost ko set kar sakte hain, jisse aap apne exchanges ko control kar sakte hain Meeting Line design ko successfully exchange karne ke liye practice aur assessment zaroori hai. Verifiable charge realities ko have a review karein aur design ke saath sharpen rib rate moves ko check karein. Isse aapko design ke accomplishment rate aur looking out and advancing choices standard higher oversee hoga. Chart Trading: Negative inversion patteren ko meeting line kaha jata hai kyunkay doosri negative light ka band hona pehli become flushed flame ke qareeb se" milta hai ". is liye, negative gathering line taajiron ke liye kya ishara karti hai? yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. mukhtasir position qaim karne se pehlay, market ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. usay aik tasalsul ke patteren ke peak standard bhi dekha ja sakta hai hit asasa pehlay hey neechay ki taraf barh raha ho ik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed flame hai jabkay doosri aik jarehana negative candle hai jo pehli light ke qareeb band ho jati hai. candle patteren sadiiyon se brokers maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti hai, jahan chawal ke tajir asal mein inhen istemaal karte thay. aaj, yeh namoonay stomach muscle bhi duniya bhar ke taajiron ke zareya barray pemanay standard istemaal kiye jatay hain Bullish (green) light aur ek negative (red) flame. Dono candles ka close cost comparable ya practically same hota hai. Yani bullish light ki shutting cost negative flame ki opening cost ke paas hoti hai Meeting Line design negative pattern ke baad bullish inversion ya bullish pattern ke baad negative inversion ka sign deta hai. Is design ko perceive karne se pehle, aapko pattern heading ko affirm karna zaroori hai.Meeting Line design ko exchange karne ke liye kuch procedures hain, jinhe aap apni exchanging mein istemaal kar sakte hain Meeting Line design ek potential inversion signal hai, lekin iski affirmation ke liye aapko aur specialized markers ka istemaal karna chahiye. Value activity, backing and obstruction levels, pattern lines, ya dusre markers ki madad se is design ko affirm kar sakte hain.Meeting Line design ke passage aur leave focuses ko choose karne ke liye aapko appropriate gamble the executives procedures ka istemaal karna chahiye. Aap stop misfortune aur target cost ko set kar sakte hain, jisse aap apne exchanges ko oversee kar sakte hain Meeting Line design ko really exchange karne ke liye practice aur examination zaroori hai. Verifiable cost information ko study karein aur design ke saath sharpen grain cost developments ko notice karein. Isse aapko design ke achievement rate aur exchanging choices standard better control hoga

-

#10 Collapse

Piyary friends Forex trading Marketing Mei Meeting's Line Candle forex exchanging mein aik design hai jahan pe do continuous candles, yaani aik ke baad aik, ek greetings cost level standard close karte hain. Agar pehli candle bullish hai aur doosri candle usi range mein open hoti hai, toh yeh upturn ko affirm karta hai. Is design ka istemal pattern course aur passage focuses pehchane mein madad deta lekin affirmations ke saath exchanging faislon ko lena zaroori hota hai.Meeting Line design ka istemal karte waqt, brokers ko aur bhi specialized markers aur cost activity ke saath mila kar samjhna chahiye. Yeh design akela hello there solid nahi hota aur bogus signs bhi dene ka imkan hota hai. Isliye is design ko affirm karne ke liye dusre pointers ka bhi istemal karna zaroori hota hai Forex mein Meeting Line ek significant candle design hai jo pattern inversion ko show karne mein madad deta hai. Is design ki pehchan aur istemal karne se merchants market ke mukhtalif developments ko samjh sakte hain aur sahi faislay le sakte Hei our Traders ko follow karty howy ham success full tradings kr rahy huu piyary dosto eis topic ko bayan karty wakt Trendiness ko dekhna chahta hein. Dear friends Meeting line Candlictick Pattren downtrend Mei bhot ziyada zarori hota ye mukhtalif pannal ko follow karty howy hein our negative Pattren ko meeting line kaha jata hai kyunkay doosri negative light ka band hona pehli become flushed flame ke qareeb negative gathering line taajiron ke liye kya ishara karti hai yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. mukhtasir position qaim karne se pehlay, market ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. usay aik tasalsul ke patteren ke peak standard bhi dekha ja sakta hai hit asasa pehlay hey neechay ki taraf barh raha ho ik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed flame hai jabkay doosri aik jarehana negative candle hai jo pehli light ke qareeb band ho jati hai. candle patteren sadiiyon se brokers maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti jahan chawal ke tajir asal mein inhen istemaal karty hen our Forex Mei Tradings karty howy benifet hasil kar sakty hen.

Dear friends Meeting line Candlictick Pattren downtrend Mei bhot ziyada zarori hota ye mukhtalif pannal ko follow karty howy hein our negative Pattren ko meeting line kaha jata hai kyunkay doosri negative light ka band hona pehli become flushed flame ke qareeb negative gathering line taajiron ke liye kya ishara karti hai yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. mukhtasir position qaim karne se pehlay, market ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. usay aik tasalsul ke patteren ke peak standard bhi dekha ja sakta hai hit asasa pehlay hey neechay ki taraf barh raha ho ik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed flame hai jabkay doosri aik jarehana negative candle hai jo pehli light ke qareeb band ho jati hai. candle patteren sadiiyon se brokers maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti jahan chawal ke tajir asal mein inhen istemaal karty hen our Forex Mei Tradings karty howy benifet hasil kar sakty hen. Dear friends Meeting Line design ko substitute karne ke liye kuch methods hain, jinhe aap apni looking for and selling mein istemaal kar sakte hain Meeting Line test ek capacity inversion signal frahm kiye jaty hen our lekin iski certification ke liye aapko aur specialized signs and side effects ka istemaal karna chahiye. Value development, help and obstruction ya dusre signs ki madad se is design ko affirm kar sakte hain Meeting Line test ke get passage to aur leave factors ko decide karne ke liye aapko appropriate gamble control strategies ka istemaal karna chahiye. Aap forestall misfortune aur point cost ko set kar sakte hain, jisse aap apne exchanges ko control kar sakte hain Meeting Line design ko successfully exchange karne ke liye practice aur assessment zaroori hai. Verifiable charge realities ko have a review karein aur design ke saath sharpen rib rate moves ko check karein. Isse aapko design ke accomplishment rate aur looking out and advancing choices standard higher level pay maojod hoty hen.

-

#11 Collapse

Ûاں یا خواتین کارڈ 10% Ûاں۔ سÙید موم بتی پیٹرن Ú©Û’ ساتھ لائن کا Ù…ÙˆØ§Ø²Ù†Û Ú©Ø±ÛŒÚº اور Ûاں یا موم بتی یا سÙید لمبی دوری Ø³ÛŒØ§Û Ø³ÛŒØ§Û Ø¬ÛŒ Ûاں مارکیٹ تیز ریورس میٹ. درمیانی Ø*د Ú©Û’ ساتھ، لیکن ÛŒÛ Ø¢Ø®Ø±ÛŒ -

#12 Collapse

Meeting Line Candlestick Pattern" ek stock market technical analysis term hai, jo do candlesticks ke combination ko describe karta hai. Yeh pattern doosre candlestick patterns ke saath mil kar use hota hai aur price trend ya reversal ke signals provide karta hai. Meeting Line Candlestick Pattern ek continuation ya reversal pattern ho sakta hai, iske base par, uske components ke combination ke taur par. Is pattern mein, do candlesticks hote hain, jinmein se pehla candlestick ek bearish candle (downward price movement) hota hai aur doosra candlestick ek bullish candle (upward price movement) hota hai.Is pattern ke do components hote hain: Pehla Candlestick: Yeh ek downtrend ya bearish trend ke dauraan dikhta hai. Pehla candlestick typically ek bearish (red or black) candle hota hai, jo price decline ko represent karta hai. Doosra Candlestick: Doosra candlestick, pehle candlestick ke neeche ya uske paas form hota hai. Yeh typically ek bullish (green or white) candle hota hai, jo price increase ko indicate karta hai.Agar yeh pattern ek reversal pattern ki tarah use ho raha hai, to iska matlab hota hai ki bearish trend ke baad ek possible trend reversal ho sakta hai aur price bullish direction mein move kar sakta hai. Yadi yeh ek continuation pattern ki tarah use ho raha hai, to yeh bearish trend ka continuation signal ho sakta hai.Is pattern ko dekhte hue traders aur investors trend ka analysis karte hain aur uske base par trading decisions lete hain. Lekin, jaise ki har technical analysis tool ya pattern mein hota hai, yeh bhi kisi ek pattern ke akele se rely karne se nahi, dusre indicators aur factors ke saath consider karna chahiye.

Meeting Line Candlestick Pattern ek continuation ya reversal pattern ho sakta hai, iske base par, uske components ke combination ke taur par. Is pattern mein, do candlesticks hote hain, jinmein se pehla candlestick ek bearish candle (downward price movement) hota hai aur doosra candlestick ek bullish candle (upward price movement) hota hai.Is pattern ke do components hote hain: Pehla Candlestick: Yeh ek downtrend ya bearish trend ke dauraan dikhta hai. Pehla candlestick typically ek bearish (red or black) candle hota hai, jo price decline ko represent karta hai. Doosra Candlestick: Doosra candlestick, pehle candlestick ke neeche ya uske paas form hota hai. Yeh typically ek bullish (green or white) candle hota hai, jo price increase ko indicate karta hai.Agar yeh pattern ek reversal pattern ki tarah use ho raha hai, to iska matlab hota hai ki bearish trend ke baad ek possible trend reversal ho sakta hai aur price bullish direction mein move kar sakta hai. Yadi yeh ek continuation pattern ki tarah use ho raha hai, to yeh bearish trend ka continuation signal ho sakta hai.Is pattern ko dekhte hue traders aur investors trend ka analysis karte hain aur uske base par trading decisions lete hain. Lekin, jaise ki har technical analysis tool ya pattern mein hota hai, yeh bhi kisi ek pattern ke akele se rely karne se nahi, dusre indicators aur factors ke saath consider karna chahiye.

- Mentions 0

-

سا0 like

-

#13 Collapse

introduction Assalaam.o.alikum dear forex member umeed karta hun k ap sab theek hun gay or achy tariqy sy apna kaam kar rhy hun gay dear jaisa k ap janty hain k Forex trading mein candlestick patterns ka istemal ahem hota hai. Aik aisa pattern hai jo Meeting Line ke naam se jana jata hai. Ye pattern doosre patterns ki tarah trend reversal aur trend continuation mein madadgar ho sakta hai. Is article mein, hum Meeting Line candlestick pattern ki tafseelat ke saath uske pehchan aur istemal par baat karenge. 1. Meeting Line Candlestick Pattern verification Dear member Meeting Line pattern do candlesticks se bana hota hai, jin ka rang aksar ek doosre ke barabar hota hai. Pehli candle bullish (upward) trend mein banti hai jab ke doosri candle bearish (downward) trend mein banti hai. Dono candlesticks ki range kuch hi hadood mein hoti hai. 2. Bullish Meeting Line Pattern. Dear member Agar pehli candle ki body bearish trend mein ho aur doosri candle ki body pehli candle ki body mein aaye aur bullish ho, to ye ek bullish Meeting Line pattern hai. Iska matlab ho sakta hai ke bearish trend ke baad bullish trend shuru hone ki tayyari ho rahi hai. 3. Bearish Meeting Line Pattern. Dear member Agar pehli candle ki body bullish trend mein ho aur doosri candle ki body pehli candle ki body mein aaye aur bearish ho, to ye ek bearish Meeting Line pattern hai. Iska matlab ho sakta hai ke bullish trend ke baad bearish trend shuru hone ki tayyari ho rahi hai. 4. Uses of Meeting Line Pattern Dear member Meeting Line pattern ke istemal se traders trend reversal aur trend continuation ki tafseelat hasil kar sakte hain. Agar pattern sahi tashkhees kiya jaye to yeh ek potential entry ya exit point bhi ban sakta hai. 5. Explanation Dear member Meeting Line pattern ko tafseel se samajhne ke liye, traders ko iski mukhtalif market conditions mein taqreebat karni chahiye. Iske saath hi, doosre technical indicators aur tools ka istemal bhi karke is pattern ki tasdeeq ki jani chahiye. Ending words Dear member Forex trading mein Meeting Line candlestick pattern aik ahem tool hai jo trend reversal aur trend continuation mein madadgar ho sakta hai. Is pattern ki tashkhees aur uske istemal se traders apne trading strategies ko mazeed behtar bana sakte hain. Lekin yaad rahe, kisi bhi trading faislay se pehle mukhtalif maqasid aur market ki halat ka mutala karna zaroori hai. -

#14 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Meeting Line** ek candlestick pattern hai jo traders ko trend continuation aur trend reversals ki signals provide karta hai. Yeh pattern do consecutive candlesticks se bana hota hai, jahan ek bearish candlestick ek bullish candlestick ke saath mil jati hai. Meeting line pattern bullish ya bearish trend mein appear ho sakta hai aur traders ko price movements aur trend changes ko samajhne mein madad deta hai.**Tafseel:** **Bullish Meeting Line:** Agar pehli candlestick bearish hai aur dusri candlestick bullish hai, aur dusri candlestick pehli candlestick ki body mein fit hoti hai aur uski closing price pe close hoti hai, to yeh bullish meeting line pattern hai. Yeh bullish reversal ki signal hoti hai, indicating ke bearish trend khatam ho raha hai aur bullish trend start ho sakta hai. Candlictick Pattren downtrend Mei bhot ziyada zarori hota ye mukhtalif pannal ko follow karty howy hein our negative Pattren ko meeting line kaha jata hai kyunkay doosri negative light ka band hona pehli become flushed flame ke qareeb negative gathering line taajiron ke liye kya ishara karti hai yeh aik surkh jhanda hai ke mojooda oopri rujhaan khatam ho sakta hai aur is ka ulat jana qareeb aa sakta hai. khredar munafe lainay ya stap las request ke sath apni position mehfooz karne ke baray mein soch satke hain. mukhtasir position qaim karne se pehlay, market ke shurka qeemat mein kami ki tasdeeq ka intzaar kar satke hain. usay aik tasalsul ke patteren ke peak standard bhi dekha ja sakta hai hit asasa pehlay hey neechay ki taraf barh raha ho ik negative inversion patteren hai jo do mother btyon se bana hai. pehli lambi become flushed flame hai jabkay doosri aik jarehana negative candle hai jo pehli light ke qareeb band ho jati hai. candle patteren sadiiyon se brokers maliyati mandiyon ka tajzia karne aur bakhabar tijarti faislay karne ke liye istemaal kar rahay hain. dar haqeeqat, mother batii ke namonon ki ibtida 18 win sadi ke Japan se ki ja sakti jahan chawal ke tajir asal mein inhen istemaal karty hen our Forex Mei Tradings karty howy benifet hasil kar sakty hen.

**Bearish Meeting Line:** Agar pehli candlestick bullish hai aur dusri candlestick bearish hai, aur dusri candlestick pehli candlestick ki body mein fit hoti hai aur uski closing price pe close hoti hai, to yeh bearish meeting line pattern hai. Yeh bearish reversal ki signal hoti hai, indicating ke bullish trend khatam ho raha hai aur bearish trend start ho sakta hai.Candle Example check hota hai, to get right of section to part tayyar karen. Agar pehle wala style bullish hai, to look for karne ka get admission to detail pehli candle ki inordinate se thoda upar rakha jata hai. Agar style negative hai, to sell karne ka passage part pehli candle ki low se thoda area of interest rakha jata hai.Har exchange mein forestall misfortune aur reason degrees zaroor set karen. Stop misfortune pehli candle ki low ya extreme se thoda neeche ya upar set kiya jata hai. Target certificate pehli candle ki body ke term ya going before swing unnecessary/low standard rakha jata hai.Har exchange mein risk aur acclaim proportion ko compute karen. Agar risk acclaim proportion acha hai, to trade ko execute karen

candlestick ke neeche ya uske paas form hota hai. Yeh typically ek bullish (green or white) candle hota hai, jo price increase ko indicate karta hai.Agar yeh pattern ek reversal pattern ki tarah use ho raha hai, to iska matlab hota hai ki bearish trend ke baad ek possible trend reversal ho sakta hai aur price bullish direction mein move kar sakta hai. Yadi yeh ek continuation pattern ki tarah use ho raha hai, to yeh bearish trend ka continuation signal ho sakta hai.Is pattern ko dekhte hue traders aur investors trend ka analysis karte hain aur uske base par trading decisions lete hain. Lekin, jaise ki har technical analysis tool ya pattern mein hota hai, yeh bhi kisi ek pattern ke akele se rely karne se nahi, dusre indicators aur factors ke saath consider karna chahiye.market technical analysis term hai, jo do candlesticks ke combination ko describe karta hai. Yeh pattern doosre candlestick patterns ke saath mil kar use hota hai aur price trend ya reversal ke signals provide karta hai.

candlestick ke neeche ya uske paas form hota hai. Yeh typically ek bullish (green or white) candle hota hai, jo price increase ko indicate karta hai.Agar yeh pattern ek reversal pattern ki tarah use ho raha hai, to iska matlab hota hai ki bearish trend ke baad ek possible trend reversal ho sakta hai aur price bullish direction mein move kar sakta hai. Yadi yeh ek continuation pattern ki tarah use ho raha hai, to yeh bearish trend ka continuation signal ho sakta hai.Is pattern ko dekhte hue traders aur investors trend ka analysis karte hain aur uske base par trading decisions lete hain. Lekin, jaise ki har technical analysis tool ya pattern mein hota hai, yeh bhi kisi ek pattern ke akele se rely karne se nahi, dusre indicators aur factors ke saath consider karna chahiye.market technical analysis term hai, jo do candlesticks ke combination ko describe karta hai. Yeh pattern doosre candlestick patterns ke saath mil kar use hota hai aur price trend ya reversal ke signals provide karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:01 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим