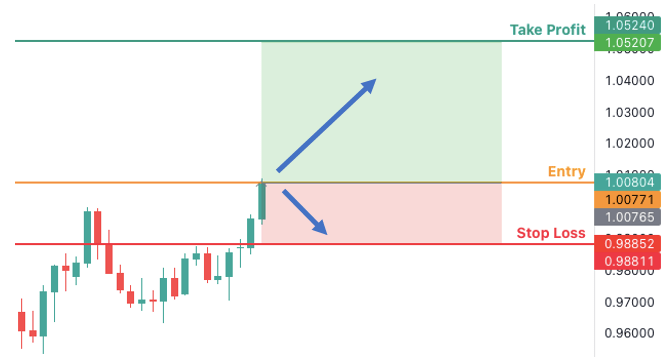

Stop Loss and Take Profit

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Stop Loss and Take Profit Forex mein forestall loss aurIs liye, Stop Loss aur Take Profit levels ko set karte waqt apni funding aur marketplace ki situations ko zaroor take into account karna chahiye. Is se apko apni investment ko manipulate karne me asani hogi aur ap buying and selling me a hit ho sakte hain. Stop loss or take profit ka use karne se buying and selling safe ho jaati hai aur threat Involvement kam ho jaati hai. Take income buying and selling strategies hain jo investors istemal karte hain taake apni trades ko manipulate kar sakein aur nuqsaan se bach sakein. Ye techniques threat control aur buying and selling plan ke essential hissay hain. Stop Loss ka Istemal

Forex mein forestall loss aurIs liye, Stop Loss aur Take Profit levels ko set karte waqt apni funding aur marketplace ki situations ko zaroor take into account karna chahiye. Is se apko apni investment ko manipulate karne me asani hogi aur ap buying and selling me a hit ho sakte hain. Stop loss or take profit ka use karne se buying and selling safe ho jaati hai aur threat Involvement kam ho jaati hai. Take income buying and selling strategies hain jo investors istemal karte hain taake apni trades ko manipulate kar sakein aur nuqsaan se bach sakein. Ye techniques threat control aur buying and selling plan ke essential hissay hain. Stop Loss ka Istemal Risk Management: Stop loss aapko apni buying and selling capital ki hifazat karte hue allow karta hai ke aap zyada nuqsaan se bach sakein. Agar marketplace aapke exchange ke against jaata hai, to aapka nuqsaan manage mein rehta hai. Emotions Control: Stop loss ka istemal karke investors apni trades par feelings ko manage kar sakte hain. Bina prevent Stop Loss aur Take Profit dono stages ko alternate enter karte waqt set karna zaroori hai. Stop Loss level ap apni funding ko nuqsaan se bachane k liye set karte hain aur Take Profit level apni investment ko faiday se exit karne okay liye set karte hain.Loss ke, investors emotionally connected ho jate hain aur trades ko barabar ya zyada loss tak chalne dete hain. Trading Plan Execution: Stop loss aapko apne trading plan ko observe karne mein madad deta hai. Aapne pehle se determine kar liya hota hai ke aap kitna nuqsaan bardasht kar sakte hain, aur forestall loss aapko us had tak nuqsaan hone nahi deta. Stop Loss aur Take Profit Ko Set Karna

Stop loss aur take earnings levels ko set karte waqt, aapko marketplace ki movement aur volatility ko don't forget karna chahiye. Aapko technical analysis aur price charts se records leni chahiye taake For example, agar aap ek long role (buy alternate) le rahe hain aur aap chahte hain ke agar market opposite route mein move karta hai to aapka trade near ho jaye, to aap forestall loss order ko ek rate stage par set kar sakte hain jahan par aapko lagta hai ke marketplace ke contrary movement ka chance hai. Sahi levels set kar saken jo aapke change ki approach aur market situations se healthy karte hain. Stop loss aur take earnings levels ko set karte waqt, aapko apne hazard tolerance aur trading desires ko bhi dhyan mein rakhna chahiye. Agar aap high threat tolerate nahi kar sakte, to aap apne prevent loss degree ko tight rakh sakte hain. Wahi agar aap zyada earnings lena chahte hain, to aap take income stage ko bhi alter kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:30 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим