Flag Pattern In Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Flag Pattern In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

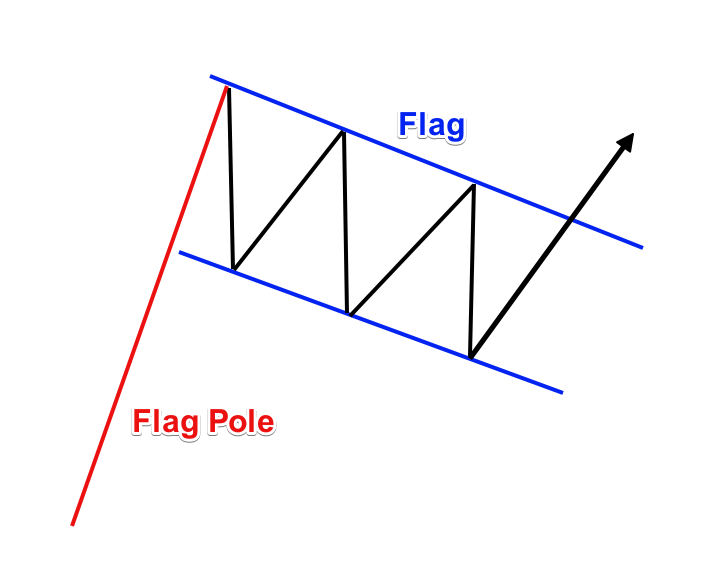

Flag Pattern In ForexFlag pattern aik technical analysis pattern hai jo mazboot aur wazeh trend ke andar hota hai. Isay aik ahem qeemat ki tehqiqi harkat se bana hua aik mustaqil sareshta hissa milta hai, jise flag ka danda (flagpole) kehte hain. Is consolidation ki shakal mein aksar ek flag ya flag ki shakal ati hai, is liye isay flag pattern kehte hain. Flag pattern ko aik continuation pattern tasavur kia jata hai kyun ke aam taur par is se samjha jata hai ke mojud trend barqarar rehne ka imkan hai jahan tak ke consolidation ki muddat guzarne ka. Components of a Flag Pattern

Components of a Flag Pattern- Flagpole: Flag ka danda wo pehli mazboot qeemat ki tehqiqi harkat hai jo flag pattern ki wajah banti hai. Yeh tazz o tareen buland ya pasti harkat ho sakti hai aur is tarah se market ka jazbi phase darj karta hai.

- Flag: Flag khud aik muraba ya parellelogram shakal ki consolidation hai jo flag ka danda ke baad aata hai. Is muddat mein tajarbay karne wale trading ko roknay ke liye market rukti hai, jis se qeemat flag ka danda ke muqablay mein tang rujhan mein aa jati hai.

- Sloping Trendlines: Do tend lines un qeemat ki highs aur lows ko jodne ke liye khenchi jati hain jo flag mein hoti hain. Uper wali tend line ko resistance tend line aur neechi wali tend line ko support tend line kehte hain.

Types of Flag Patterns

Types of Flag Patterns- Bullish Flag Pattern: Yeh pattern tab paida hota hai jab aik mazboot buland qeemat ki tehqiqi harkat hoti hai, jis se ek bullish trend ka izhar hota hai. Flag is tarah ki ek consolidation hoti hai aur traders ise yaksan samajhte hain ke ye temporary rukawat hai pehle se mutaliq bullish trend ke dobara shuru hone se pehle.

- Bearish Flag Pattern: Yeh pattern tab hota hai jab aik mazboot pasti qeemat ki tehqiqi harkat hoti hai, jis se aik bearish trend ka izhar hota hai. Bullish flag ki tarah, bearish flag temporary consolidation ke tour par samjhi jati hai pehle se mutaliq bearish trend ke dobara shuru hone se pehle.

- Entry Point: Traders aksar intezar karte hain ke qeemat flag pattern se bahar nikalne se pehle. Bullish flag ke liye, uper wali resistance tend line ke zariye uper ki taraf breakout ko khareedne ka moqa samjha jata hai. Aksar, bearish flag ke liye traders support tend line se neechi ki taraf breakout ki intezar karte hain ke sell trade shuru karen.

- Confirmation: Traders aksar tasdeeq karne wale candlestick pattern ka intezar karte hain, jaise tazz bullish ya pasti candle, jisse breakout ko tasdeeq kiya jaye. Yeh jhooti signals ko kam aur trade ke kamyabi ke imkanat ko barhata hai.

- Target Calculation: Breakout ke baad mumkin nishana ke tajarba karne ke liye, traders aksar flag ka danda ka lambai ka qaima istemal karte hain. Wo flag ka danda ka fasla dekhte hain jis ko breakout ke point se mutaliq rakhte hain.

- Stop Loss Placement: Risk ka tawazun rakhne ke liye stop loss rakna intehai ehmiyat rakhta hai. Traders aksar apne stop loss orders ko flag pattern se thora sa bahar rakhte hain jis se jhooti breakouts ka khatar kam ho.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:06 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим