Hammer and hanging candlestick pattern Kia h??

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

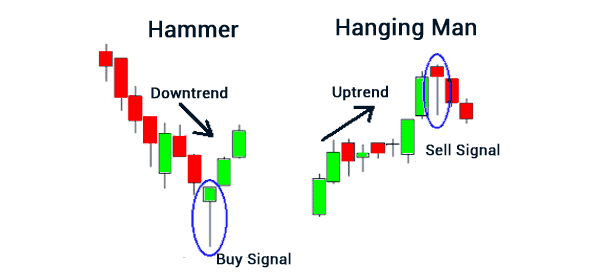

Hello guys! umeed ha ap sb khairiat se hn gy. aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata ha. hum dekhen gy k inko kesy trading main use kia jata ha. Hammer candle stick pattern: Dear members ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti ha. Es lye ye dilhny main hammer jesi hoti ha. eski body bullish ya bearish ho skti ha.laikin agr bullis body ho to string pattern mana jata ha. Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai ha. es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close ho. how to trade using hammer pattern? dear members hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry les skty hain or hmara stop loss hammer candle k low k equal ho ga.Hanging Man candle stick pattern: Dear members ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti ha. eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata ha. es k bad agr nxt candle sell ki close ho or hanging man se nechy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati ha. How to trade it: dear members es pattern main trade leny k lye hmen eski confirmation ka wait krna chahye. Jb dosri candle bearish ho or hanging man k low k nechy close ho to hm sell ki entry le skty hain or hmara stop loss hanging man candle k high tk ho ga.NOTE: ye patterns kisi bhi time frame main ho skty hain phr aap us time frame k mutabiq eski confirmation or trade karen gy. -

#3 Collapse

"Hammer" aur "Hanging Man" candlestick patterns stock market ya financial markets mein use hone wale technical analysis tools hain. Ye patterns candlestick charts mein dikhne wale specific price movements ko represent karte hain, jo traders aur investors ko potential price reversals ke liye indicate kar sakte hain. Hammer Pattern: Hammer pattern ek bullish reversal pattern hota hai, matlab ki iska appearance bearish trend ke baad bullish trend ke indicate ho sakta hai. Is pattern mein ek single candle hoti hai jismein neeche ki taraf ek choti body hoti hai aur iski upper shadow lambi hoti hai, jisse woh ek hammer ki tarah dikhti hai. Hammer pattern ka interpretation yeh hota hai ki sellers initially control mein hote hain aur price neeche jaata hai, lekin phir buyers aa kar price ko upar le jaate hain. Isse market sentiment change ho sakta hai. Hanging Man Pattern: Hanging Man pattern ek bearish reversal pattern hota hai, matlab ki iska appearance bullish trend ke baad bearish trend ke indicate ho sakta hai. Is pattern mein bhi ek single candle hoti hai jismein neeche ki taraf choti body hoti hai, aur iski lower shadow lambi hoti hai. Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata hai, lekin phir sellers aa kar price ko neeche le jaate hain. Isse market sentiment change ho sakta hai.In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota hai. Ye patterns single candles par based hote hain, isliye unke appearance ke saath-saath volume aur market context bhi consider karna important hota hai. In patterns ko confirm karne ke liye traders aur investors usually additional technical indicators ya price patterns ka use karte hain.Dhyan rahe ki financial markets mein trading risk ke saath aata hai, aur candlestick patterns ke bina bhi decisions lene se pehle thorough research aur analysis karna zaroori hai.

Hanging Man Pattern: Hanging Man pattern ek bearish reversal pattern hota hai, matlab ki iska appearance bullish trend ke baad bearish trend ke indicate ho sakta hai. Is pattern mein bhi ek single candle hoti hai jismein neeche ki taraf choti body hoti hai, aur iski lower shadow lambi hoti hai. Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata hai, lekin phir sellers aa kar price ko neeche le jaate hain. Isse market sentiment change ho sakta hai.In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota hai. Ye patterns single candles par based hote hain, isliye unke appearance ke saath-saath volume aur market context bhi consider karna important hota hai. In patterns ko confirm karne ke liye traders aur investors usually additional technical indicators ya price patterns ka use karte hain.Dhyan rahe ki financial markets mein trading risk ke saath aata hai, aur candlestick patterns ke bina bhi decisions lene se pehle thorough research aur analysis karna zaroori hai. -

#4 Collapse

Hammer aur Hanging Man, candlestick chart analysis mein aam istemal hone wale do important single candlestick patterns hain. Ye patterns market sentiment aur price movement ke interpretations ke liye istemal hote hain. Hammer Candlestick Pattern: Hammer ek bullish reversal candlestick pattern hai jo downtrend ke baad dikhai deta hai. Is pattern mein, candle ka body chota hota hai aur wick (shadow) body se lamba hota hai. Yeh wick candle ke neeche extend hota hai aur woh generally 2-3 times body ke size tak ho sakta hai. Hammer ka shape ek hammer jaisa hota hai, jisme handle body ki taraf hota hai.Agar hammer downtrend ke baad form ho, toh iska interpretation hota hai ki sellers ki taraf se pressure kam ho raha hai aur buyers ki taraf se recovery shuru ho sakti hai. Yani, market sentiment change ho raha hai. Hammer ki confirmation ke liye, next candle bullish hona chahiye, aur ideally hammer ke high se start karke close hona chahiye.:max_bytes(150000):strip_icc()/Term-Definitions_Hammer-candlestick-48e69818f6044864a131ce4ebeb40d12.jpg) Hanging Man Candlestick Pattern: ​

Hanging Man Candlestick Pattern: ​Hanging Man ek bearish reversal candlestick pattern hai jo uptrend ke baad form hota hai. Is pattern mein, candle ka body chota hota hai aur wick body se lamba hota hai, lekin yeh wick candle ke upar extend hota hai. Hanging Man ka shape ek hanging man ya inverted hammer jaisa hota hai.Agar hanging man uptrend ke baad form ho, toh yeh indicate karta hai ki uptrend ke baad sellers ki taraf se selling pressure badh rahi hai aur trend change ho sakta hai. Hanging Man ki confirmation ke liye, next candle bearish hona chahiye, aur ideally hanging man ke low se start karke close hona chahiye. In patterns ki samajh se, traders aur investors market movement ko predict karne ki koshish karte hain. Lekin, ek pattern ke base par trading karne se pehle, aapko aur bhi factors jaise current market conditions, trend direction, aur volume ko consider karna chahiye. Iske alawa, risk management ka bhi khayal rakhna zaroori hai, taki trading losses se bacha ja sake.

-

#5 Collapse

Introduction; Asalam o Alikum Dosto umeed ha ap sb khairiat se hn gy aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata Ha hum dekhen gy k inko kesy trading main use kia jata Ha Define Hammer Candlestick pattern; Dear friends ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti Ha Es lye ye dikhny main hammer jesi hoti Ha eski body bullish ya bearish ho skti ha lekin agr bullis body ho to string pattern mana jata Ha Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai Hai es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close Ho Trade By using Hammer Candlestick pattern; Piyary Dosto hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry ley skty hain or hmara stop loss hammer candle k low k equal Ho Connection with Hanging Man Candlestick pattern; Dear friends ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti Ha eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata Ha es k bad agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati Ha Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata Hai lekin phir sellers aa kar price ko neeche le Jaty Hain Isse market sentiment change ho sakta hai In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota Hai Ye patterns single candles par based hote Hain Trade With Hamme candlestick; Dear members Forex me Hum behtreen Triky Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziada asan Hai Es me hum Trading Kr Ke bht ziada profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bearish ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gy -

#6 Collapse

Hammer aur Hanging candlestick patterns technical analysis mein aham rol ada karne wale mumtaz mumkinaat hain jo market trends aur possible reversals ke baray mein maloomat faraham karte hain. Ye patterns single candle formations hote hain aur traders aur investors ke liye market ke future movements ko samajhne mein madadgar sabit ho sakte hain. Hammer Candlestick Pattern Pehchaan Hammer candlestick pattern ek single candle formation hai jo generally downtrend ke baad appear hoti hai. Is pattern ki pehchaan karne ke liye kuch mukhtalif elements ko dekhna zaroori hai: Candle Shape: Hammer pattern ki pehchaan candle ki shape se hoti hai. Is pattern mein candle ka body chota hota hai aur uska shadow (tail) lambe hota hai. Body upper side pe hoti hai aur shadow lower side pe extend hota hai. Shadow Length: Hammer pattern mein shadow ka length body se zyada hota hai. Ideally, shadow ki length body ki 2-3 times tak ho sakti hai. Trend Context: Hammer pattern generally downtrend ke baad appear hoti hai, iska matlab hai ke market down move kar raha hota hai aur trend reversal ka possibility ho sakta hai. Hammer candlestick pattern ek potential trend reversal ka indicator hota hai. Agar yeh pattern downtrend ke baad appear ho aur price up move kare, to iska matlab ho sakta hai ke selling pressure kam ho raha hai aur market uptrend direction mein move kar sakta hai. Hanging Man Candlestick Pattern Hanging Man candlestick pattern bhi ek single candle formation hai jo downtrend ke baad appear hoti hai. Is pattern ki pehchaan karne ke liye ye elements dekhe ja sakte hain: Candle Shape: Hanging Man pattern mein bhi candle ka body chota hota hai aur shadow lamba hota hai. Body upper side pe hoti hai aur shadow lower side pe extend hota hai. Shadow Length: Shadow ki length body se zyada hoti hai, ideally 2-3 times. Trend Context: Hanging Man pattern bhi downtrend ke baad dikhai deti hai aur trend reversal possibility ko indicate karti hai. Hanging Man candlestick pattern bhi ek potential trend reversal indicator hai. Agar yeh pattern downtrend ke baad appear ho aur price up move kare, to iska matlab ho sakta hai ke downtrend ki momentum kam ho rahi hai aur possible hai ke market uptrend direction mein move kare. Hammer Aur Hanging Man Patterns Ke Istemal Hammer aur Hanging Man patterns ko samajh kar traders aur investors apne trading strategies ko mazbooti se implement kar sakte hain. Ye patterns price movements aur trend reversals ke baray mein insights faraham karte hain. In patterns ko confirm karne ke liye, volume aur other technical indicators ka bhi istemal kiya jata hai. Hammer aur Hanging Man candlestick patterns market analysis mein ahem tools hote hain. In patterns ki sahi pehchaan aur unka context samajh kar, traders aur investors market movements ke liye behtar decisions le sakte hain. Lekin, in patterns ko confirm karne ke liye aur bhi technical aur fundamental analysis ka istemal zaroori hai. -

#7 Collapse

Introduction of the postHello Friends, Me umeed karta ho ap sab khairiat se hn gy. aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata ha. hum dekhen gy k inko kesy trading main use kia jata hay. Hammer candle stick pattern: My Dear members ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti ha. Es lye ye dilhny main hammer jesi hoti ha. eski body bullish ya bearish ho skti ha.laikin agr bullis body ho to string pattern mana jata hay.Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai ha. es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close ho. How to trade using hammer pattern. dear members hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry les skty hain or hmara stop loss hammer candle k low k equal ho ga.Hanging Man candle stick pattern. My Dear members ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti ha. eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata ha. es k bad agr nxt candle sell ki close ho or hanging man se nechy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati hay. How to trade it. My dear members es pattern main trade leny k lye hmen eski confirmation ka wait krna chahye. Jb dosri candle bearish ho or hanging man k low k nechy close ho to hm sell ki entry le skty hain or hmara stop loss hanging man candle k high tk ho ga.

-

#8 Collapse

Hammer And Hanging Chart Pattern: Hammer aur Hanging candle designs specialized investigation mein aham rol ada karne ridge mumtaz mumkinaat hain jo market patterns aur potential inversions ke baray mein maloomat faraham karte hain. Ye designs single light developments hote hain aur merchants aur financial backers ke liye market ke future developments ko samajhne mein madadgar sabit ho sakte hain Sledge candle design ek single candle arrangement hai jo by and large downtrend ke baad seem hoti hai. Is design ki pehchaan karne ke liye kuch mukhtalif components ko dekhna zaroori hai Candle Shape: Sledge design ki pehchaan light ki shape se hoti hai. Is design mein candle ka body chota hota hai aur uska shadow (tail) lambe hota hai. Body upper side pe hoti hai aur shadow lower side pe broaden hota hai.Hammer design mein shadow ka length body se zyada hota hai. Preferably, shadow ki length body ki 2-3 times tak ho sakti hai.: Mallet design for the most part downtrend ke baad seem hoti hai, iska matlab hai ke market down move kar raha hota hai aur pattern inversion ka probability ho sakta hai. Candle design ek potential pattern inversion ka marker hota hai. Agar yeh design downtrend ke baad seem ho aur cost up move kare, to iska matlab ho sakta hai ke selling pressure kam ho raha hai aur market upturn course mein move kar sakta hai.Hanging Man candle design bhi ek single candle development hai jo downtrend ke baad seem hoti hai. Is design ki pehchaan karne ke liye ye components dekhe ja sakte hain Hanging Man design mein bhi candle ka body chota hota hai aur shadow lamba hota hai. Body upper side pe hoti hai aur shadow lower side pe expand hota hai.Shadow ki length body se zyada hoti hai, preferably 2-3 times. Hanging Man design bhi downtrend ke baad dikhai deti hai aur pattern inversion probability ko demonstrate karti hai. Chart Pattern Types: Design bhi ek potential pattern inversion pointer hai. Agar yeh design downtrend ke baad seem ho aur cost up move kare, to iska matlab ho sakta hai ke downtrend ki force kam ho rahi hai aur conceivable hai ke market upswing course mein move kare Sledge aur Hanging Man designs ko samajh kar merchants aur financial backers apne exchanging techniques ko mazbooti se execute kar sakte hain. Ye designs cost developments aur pattern inversions ke baray mein bits of knowledge faraham karte hain. In designs ko affirm karne ke liye, volume aur other specialized markers ka bhi istemal kiya jata hai. Hammer aur Hanging Man candle designs market examination mein ahem apparatuses hote hain. In designs ki sahi pehchaan aur unka setting samajh kar, brokers aur financial backers market developments ke liye behtar choices le sakte hain. Lekin, in designs ko affirm karne ke liye aur bhi specialized aur essential examination ka istemal zaroori hai.

Candle design ek potential pattern inversion ka marker hota hai. Agar yeh design downtrend ke baad seem ho aur cost up move kare, to iska matlab ho sakta hai ke selling pressure kam ho raha hai aur market upturn course mein move kar sakta hai.Hanging Man candle design bhi ek single candle development hai jo downtrend ke baad seem hoti hai. Is design ki pehchaan karne ke liye ye components dekhe ja sakte hain Hanging Man design mein bhi candle ka body chota hota hai aur shadow lamba hota hai. Body upper side pe hoti hai aur shadow lower side pe expand hota hai.Shadow ki length body se zyada hoti hai, preferably 2-3 times. Hanging Man design bhi downtrend ke baad dikhai deti hai aur pattern inversion probability ko demonstrate karti hai. Chart Pattern Types: Design bhi ek potential pattern inversion pointer hai. Agar yeh design downtrend ke baad seem ho aur cost up move kare, to iska matlab ho sakta hai ke downtrend ki force kam ho rahi hai aur conceivable hai ke market upswing course mein move kare Sledge aur Hanging Man designs ko samajh kar merchants aur financial backers apne exchanging techniques ko mazbooti se execute kar sakte hain. Ye designs cost developments aur pattern inversions ke baray mein bits of knowledge faraham karte hain. In designs ko affirm karne ke liye, volume aur other specialized markers ka bhi istemal kiya jata hai. Hammer aur Hanging Man candle designs market examination mein ahem apparatuses hote hain. In designs ki sahi pehchaan aur unka setting samajh kar, brokers aur financial backers market developments ke liye behtar choices le sakte hain. Lekin, in designs ko affirm karne ke liye aur bhi specialized aur essential examination ka istemal zaroori hai.  Candle bullish pattern k end fundamental bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti Ha eski body bhi bullish ya negative ho skti ha jb k negative body wali flame major areas of strength for ko jata Ha es k terrible agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es design ki affirmation hoti ha or es k awful market sell primary jati Ha Hanging Man design ka understanding yeh hota hai ki at first purchasers control mein hote hain aur cost upar jaata Hai lekin phir venders aa kar cost ko neeche le Jaty Hain Isse market opinion change ho sakta hai In designs ka sahi tarah se distinguish karna aur unke saath sahi translation karna zaroori hota Hai Ye designs single candles standard based hote Hain Trading View: Hanging Man ek negative inversion candle design hai jo upswing ke baad structure hota hai. Is design mein, light ka body chota hota hai aur wick body se lamba hota hai, lekin yeh wick flame ke upar broaden hota hai. Hanging Man ka shape ek hanging man ya rearranged hammer jaisa hota hai.Agar hanging man upswing ke baad structure ho, toh yeh show karta hai ki upturn ke baad venders ki taraf se selling pressure badh rahi hai aur pattern change ho sakta hai. Hanging Man ki affirmation ke liye, next flame negative hona chahiye, aur in a perfect world hanging man ke low se start karke close hona chahiye.In designs ki samajh se, dealers aur financial backers market development ko foresee karne ki koshish karte hain. Lekin, ek design ke base standard exchanging karne se pehle, aapko aur bhi factors jaise current economic situations, pattern bearing, aur volume ko consider karna chahiye. Iske alawa, risk the executives ka bhi khayal rakhna zaroori hai, taki exchanging misfortunes se bacha ja purpos

Candle bullish pattern k end fundamental bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti Ha eski body bhi bullish ya negative ho skti ha jb k negative body wali flame major areas of strength for ko jata Ha es k terrible agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es design ki affirmation hoti ha or es k awful market sell primary jati Ha Hanging Man design ka understanding yeh hota hai ki at first purchasers control mein hote hain aur cost upar jaata Hai lekin phir venders aa kar cost ko neeche le Jaty Hain Isse market opinion change ho sakta hai In designs ka sahi tarah se distinguish karna aur unke saath sahi translation karna zaroori hota Hai Ye designs single candles standard based hote Hain Trading View: Hanging Man ek negative inversion candle design hai jo upswing ke baad structure hota hai. Is design mein, light ka body chota hota hai aur wick body se lamba hota hai, lekin yeh wick flame ke upar broaden hota hai. Hanging Man ka shape ek hanging man ya rearranged hammer jaisa hota hai.Agar hanging man upswing ke baad structure ho, toh yeh show karta hai ki upturn ke baad venders ki taraf se selling pressure badh rahi hai aur pattern change ho sakta hai. Hanging Man ki affirmation ke liye, next flame negative hona chahiye, aur in a perfect world hanging man ke low se start karke close hona chahiye.In designs ki samajh se, dealers aur financial backers market development ko foresee karne ki koshish karte hain. Lekin, ek design ke base standard exchanging karne se pehle, aapko aur bhi factors jaise current economic situations, pattern bearing, aur volume ko consider karna chahiye. Iske alawa, risk the executives ka bhi khayal rakhna zaroori hai, taki exchanging misfortunes se bacha ja purpos  Hammer ek bullish inversion candle design hai jo downtrend ke baad dikhai deta hai. Is design mein, flame ka body chota hota hai aur wick (shadow) body se lamba hota hai. Yeh wick light ke neeche expand hota hai aur woh for the most part 2-3 times body ke size tak ho sakta hai. Hammer ka shape ek hammer jaisa hota hai, jisme handle body ki taraf hota hai.Agar hammer downtrend ke baad structure ho, toh iska translation hota hai ki merchants ki taraf se pressure kam ho raha hai aur purchasers ki taraf se recuperation shuru ho sakti hai. Yani, market feeling change ho raha hai. Hammer ki affirmation ke liye, next candle bullish hona chahiye, aur in a perfect world mallet ke high se start karke close hona chahiye. design ek bullish inversion design hota hai, matlab ki iska appearance negative pattern ke baad bullish pattern ke show ho sakta hai. Is design mein ek single flame hoti hai jismein neeche ki taraf ek choti body hoti hai aur iski upper shadow lambi hoti hai, jisse woh ek hammer ki tarah dikhti hai. Hammer design ka understanding yeh hota hai ki dealers at first control mein hote hain aur cost neeche jaata hai, lekin phir purchasers aa kar cost ko upar le jaate hain. Isse market opinion change ho sakta ha

Hammer ek bullish inversion candle design hai jo downtrend ke baad dikhai deta hai. Is design mein, flame ka body chota hota hai aur wick (shadow) body se lamba hota hai. Yeh wick light ke neeche expand hota hai aur woh for the most part 2-3 times body ke size tak ho sakta hai. Hammer ka shape ek hammer jaisa hota hai, jisme handle body ki taraf hota hai.Agar hammer downtrend ke baad structure ho, toh iska translation hota hai ki merchants ki taraf se pressure kam ho raha hai aur purchasers ki taraf se recuperation shuru ho sakti hai. Yani, market feeling change ho raha hai. Hammer ki affirmation ke liye, next candle bullish hona chahiye, aur in a perfect world mallet ke high se start karke close hona chahiye. design ek bullish inversion design hota hai, matlab ki iska appearance negative pattern ke baad bullish pattern ke show ho sakta hai. Is design mein ek single flame hoti hai jismein neeche ki taraf ek choti body hoti hai aur iski upper shadow lambi hoti hai, jisse woh ek hammer ki tarah dikhti hai. Hammer design ka understanding yeh hota hai ki dealers at first control mein hote hain aur cost neeche jaata hai, lekin phir purchasers aa kar cost ko upar le jaate hain. Isse market opinion change ho sakta ha

-

#9 Collapse

"Hammer" aur "Hanging Man" candle designs securities exchange ya monetary business sectors mein use sharpen rib specialized investigation apparatuses hain. Ye designs candle graphs mein dikhne grain explicit cost developments ko address karte hain, jo brokers aur financial backers ko potential cost inversions ke liye demonstrate kar sakte hain. Hammer Example: Hammer design ek bullish inversion design hota hai, matlab ki iska appearance negative pattern ke baad bullish pattern ke show ho sakta hai. Is design mein ek single light hoti hai jismein neeche ki taraf ek choti body hoti hai aur iski upper shadow lambi hoti hai, jisse woh ek hammer ki tarah dikhti hai. Hammer design ka translation yeh hota hai ki merchants at first control mein hote hain aur cost neeche jaata hai, lekin phir purchasers aa kar cost ko upar le jaate hain. Isse market feeling change ho sakta hai. Hanging Man Example: Hanging Man design ek negative inversion design hota hai, matlab ki iska appearance bullish pattern ke baad negative pattern ke show ho sakta hai. Is design mein bhi ek single light hoti hai jismein neeche ki taraf choti body hoti hai, aur iski lower shadow lambi hoti hai. Hanging Man design ka translation yeh hota hai ki at first purchasers control mein hote hain aur cost upar jaata hai, lekin phir venders aa kar cost ko neeche le jaate hain. Isse market feeling change ho sakta hai.In designs ka sahi tarah se distinguish karna aur unke saath sahi understanding karna zaroori hota hai. Ye designs single candles standard based hote hain, isliye unke appearance ke saath volume aur market setting bhi consider karna significant hota hai. In designs ko affirm karne ke liye brokers aur financial backers generally extra specialized pointers ya cost designs ka use karte hain.Dhyan rahe ki monetary business sectors mein exchanging risk ke saath aata hai, aur candle designs ke bina bhi choices lene se pehle careful exploration aur examination karna zaroori hai.

Hammer design ek bullish inversion design hota hai, matlab ki iska appearance negative pattern ke baad bullish pattern ke show ho sakta hai. Is design mein ek single light hoti hai jismein neeche ki taraf ek choti body hoti hai aur iski upper shadow lambi hoti hai, jisse woh ek hammer ki tarah dikhti hai. Hammer design ka translation yeh hota hai ki merchants at first control mein hote hain aur cost neeche jaata hai, lekin phir purchasers aa kar cost ko upar le jaate hain. Isse market feeling change ho sakta hai. Hanging Man Example: Hanging Man design ek negative inversion design hota hai, matlab ki iska appearance bullish pattern ke baad negative pattern ke show ho sakta hai. Is design mein bhi ek single light hoti hai jismein neeche ki taraf choti body hoti hai, aur iski lower shadow lambi hoti hai. Hanging Man design ka translation yeh hota hai ki at first purchasers control mein hote hain aur cost upar jaata hai, lekin phir venders aa kar cost ko neeche le jaate hain. Isse market feeling change ho sakta hai.In designs ka sahi tarah se distinguish karna aur unke saath sahi understanding karna zaroori hota hai. Ye designs single candles standard based hote hain, isliye unke appearance ke saath volume aur market setting bhi consider karna significant hota hai. In designs ko affirm karne ke liye brokers aur financial backers generally extra specialized pointers ya cost designs ka use karte hain.Dhyan rahe ki monetary business sectors mein exchanging risk ke saath aata hai, aur candle designs ke bina bhi choices lene se pehle careful exploration aur examination karna zaroori hai. -

#10 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Hammer aur Hanging Candlestick Patterns Hammer aur Hanging Candlestick Patterns technical analysis mein aham istemal hotay hain jin ka maqsad market trends aur price movements ko samajhnay mein madadgar sabit hota hai. Ye patterns traders ko market ki possible reversals aur trend changes ke baray mein maloomat faraham kartay hain. Hamare note mein hum Hammer aur Hanging Candlestick Patterns ke tafseelat Urdu mein bayan karenge Hammer Hathora Hammer, ek bullish reversal candlestick pattern hai jo aksar downtrend ke baad paya jata hai aur price ko upar le jata hai. Is pattern ko isliye Hammer kehte hain kyunki iski shape ek hammer jaisi hoti hai. Hammer mein neeche ki taraf lambi tail hoti hai, jo price ko neeche gaya dikhata hai, aur upper wala chhota sa body hota hai, jo opening aur closing prices ko represent karta hai. Hammer ka mukhtasar tareeqay se tafsila yeh hai Price downtrend mein hoti hai. Candlestick ki body choti hoti hai. Lower shadow ya tail lambi hoti hai. Hammer ki body upper half mein hoti hai. Is pattern ke baad bullish reversal ki ummeed hoti hai. Hanging Man Latka Howa Aadmi Hanging Man, ek bearish reversal candlestick pattern hai jo uptrend ke baad paya jata hai aur price ko neeche le jata hai. Is pattern ka shape ek aadmi jaisa hota hai jo latka hua ho, isliye isay "Hanging Man" kehte hain. Hanging Man mein bhi neeche ki taraf lambi tail hoti hai, jo price ko neeche gaya dikhata hai, aur upper wala chhota sa body hota hai, jo opening aur closing prices ko represent karta hai. Hanging Man ka mukhtasar tareeqay se tafsila yeh hai: Price uptrend mein hoti hai. Candlestick ki body choti hoti hai. Lower shadow ya tail lambi hoti hai. Hanging Man ki body upper half mein hoti hai. Is pattern ke baad bearish reversal ki ummeed hoti hai. In dono patterns ka istemal traders market ke potential reversals ya trend changes ko pehchanne ke liye karte hain. Lekin yaad rahe ke ek hi candlestick pattern par pura bharosa na karen, aur dusri technical analysis tools aur indicators ka bhi istemal karen taake aapke trading decisions mein mukhtasar hone wali ghalat fehmiyan kam ho. -

#11 Collapse

Hammer and hanging candlestick pattern Kia h?? "Lightbulb Hammer" aur "hanging candlestick pattern" trading aur technical analysis mein istemal hone wale do prakar ke candlestick patterns hain jo market mein hone wale price reversals ko darust karne mein madadgar hote hain. Ye patterns traders ko market ka behavior samajhne aur trading decisions lene mein madad karte hain. Hammer (Hathiyaar):Hammer ek bullish (khareedi jaa sakti hai) reversal candlestick pattern hai. Isme candle ka upper shadow (uncha chhaya) chhota hota hai jabki lower shadow (neecha chhaya) lamba hota hai. Candle ka body chhota hota hai aur woh typically upper end par hota hai. Iska matlab hota hai ke sellers initially strong the, lekin phir buyers ne control le liya.

Hammer and hanging candlestick pattern Kia h?? "Lightbulb Hammer" aur "hanging candlestick pattern" trading aur technical analysis mein istemal hone wale do prakar ke candlestick patterns hain jo market mein hone wale price reversals ko darust karne mein madadgar hote hain. Ye patterns traders ko market ka behavior samajhne aur trading decisions lene mein madad karte hain. Hammer (Hathiyaar):Hammer ek bullish (khareedi jaa sakti hai) reversal candlestick pattern hai. Isme candle ka upper shadow (uncha chhaya) chhota hota hai jabki lower shadow (neecha chhaya) lamba hota hai. Candle ka body chhota hota hai aur woh typically upper end par hota hai. Iska matlab hota hai ke sellers initially strong the, lekin phir buyers ne control le liya.  Hanging Man (Latakta Aadmi):Hanging Man candlestick pattern ek bearish (bikri jaa sakti hai) reversal pattern hota hai. Isme candle ka upper shadow chhota hota hai jabki lower shadow lamba hota hai. Candle ka body upper end par hota hai, lekin is pattern mein lower shadow ke niche close hota hai. Iska matlab hota hai ke buyers initially strong the, lekin phir sellers ne control le liya.Ye dono patterns market sentiment ko darust karne mein aur price reversals ke possibilities ko samajhne mein madadgar hote hain. Traders in patterns ko dekhte hain taake unhe ye pata chale ke market mein trend change hone ke chances hai.

Hanging Man (Latakta Aadmi):Hanging Man candlestick pattern ek bearish (bikri jaa sakti hai) reversal pattern hota hai. Isme candle ka upper shadow chhota hota hai jabki lower shadow lamba hota hai. Candle ka body upper end par hota hai, lekin is pattern mein lower shadow ke niche close hota hai. Iska matlab hota hai ke buyers initially strong the, lekin phir sellers ne control le liya.Ye dono patterns market sentiment ko darust karne mein aur price reversals ke possibilities ko samajhne mein madadgar hote hain. Traders in patterns ko dekhte hain taake unhe ye pata chale ke market mein trend change hone ke chances hai.  In patterns ke saath-saath, traders typically aur technical indicators aur analysis tools ka istemal karte hain trading decisions lene ke liye.Please note ke trading risk aur complexity ke saath aata hai, aur aapko trading se judi gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor se salah lena bhi mahatvapurn ho sakta hai.

In patterns ke saath-saath, traders typically aur technical indicators aur analysis tools ka istemal karte hain trading decisions lene ke liye.Please note ke trading risk aur complexity ke saath aata hai, aur aapko trading se judi gahri samajh aur experience hona chahiye. Agar aap trading mein naye hain, toh ek financial advisor se salah lena bhi mahatvapurn ho sakta hai.

-

#12 Collapse

Introduction of the post Asalam o Alikum Meray peyaray dostome umeed karta ho ap sb khairiat se hn gy aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata Ha hum dekhen gy k inko kesy trading main use kia jata Hota hay . Define Hammer Candlestick pattern. My Dear friends ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti Ha Es lye ye dikhny main hammer jesi hoti Ha eski body bullish ya bearish ho skti ha lekin agr bullis body ho to string pattern mana jata Ha Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai Hai es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close Ho Trade By using Hammer Candlestick pattern.Piyary Dosto hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry ley skty hain or hmara stop loss hammer candle k low k equal Hota hay. Connection with Hanging Man Candlestick pattern My Dear friends ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti Hay eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata Ha es k bad agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati Ha Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata Hai lekin phir sellers aa kar price ko neeche le Jaty Hain Isse market sentiment change ho sakta hai In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota Hai Ye patterns single candles par based hote Hay. Trade With Hamme candlestick. Dear members Forex me Hum behtreen Triky Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziada asan Hai Es me hum Trading Kr Ke bht ziada profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bearish ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gay.

eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata Ha es k bad agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati Ha Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata Hai lekin phir sellers aa kar price ko neeche le Jaty Hain Isse market sentiment change ho sakta hai In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota Hai Ye patterns single candles par based hote Hay. Trade With Hamme candlestick. Dear members Forex me Hum behtreen Triky Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziada asan Hai Es me hum Trading Kr Ke bht ziada profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bearish ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gay. -

#13 Collapse

Introduction; Asalam o Alikum Dosto umeed ha ap sb khairiat se hn gy aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata Ha hum dekhen gy k inko kesy trading main use kia jata Ha Define Hammer Candlestick pattern; Dear friends ye candle stick bearish trend k end main appear hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or choti c body hoti Ha Es lye ye dikhny main hammer jesi hoti Ha eski body bullish ya bearish ho skti ha lekin agr bullis body ho to string pattern mana jata Ha Ye trend change honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle nechy se opr gai ha or wick bnai Hai es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close Ho Trade By using Hammer Candlestick pattern; Piyary Dosto hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho to hum buy ki entry ley skty hain or hmara stop loss hammer candle k low k equal Ho Connection with Hanging Man Candlestick pattern; Dear friends ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k nechy se hoti Ha eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata Ha es k bad agr nxt candle sell ki close ho or hanging man se nichy close ho to ye es pattern ki confirmation hoti ha or es k bad market sell main jati Ha Hanging Man pattern ka interpretation yeh hota hai ki initially buyers control mein hote hain aur price upar jaata Hai lekin phir sellers aa kar price ko neeche le Jaty Hain Isse market sentiment change ho sakta hai In patterns ka sahi tarah se identify karna aur unke saath sahi interpretation karna zaroori hota Hai Ye patterns single candles par based hote Hain Trade With Hamme candlestick; Dear members Forex me Hum behtreen Triky Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziada asan Hai Es me hum Trading Kr Ke bht ziada profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bearish ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gy

Dear members Forex me Hum behtreen Triky Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziada asan Hai Es me hum Trading Kr Ke bht ziada profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bearish ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gy

-

#14 Collapse

Hammer and hanging candlestick pattern Kia h?? Hammer aur Hanging candlestick patterns dono technical analysis mein istemal hone wale candlestick patterns hain. In patterns ka istemal financial markets mein price movements ka tajziya karne ke liye kiya jata hai. 1. Hammer Pattern: Hammer pattern ek bullish reversal pattern hai jo downtrend ke bottom par ban jata hai. Is pattern mein candlestick ka body chota hota hai aur woh candlestick ka top ke qareeb hota hai. Iske sath hi, candlestick ka lower shadow body ke kam se kam do guna lamba hota hai. Agar upper shadow maujood hai, toh woh chota ya bilkul na ho. Hammer pattern yeh ishara karta hai keh selling pressure khatam ho chuki hai aur buyers market mein dakhil ho rahe hain. Isse trend reversal ho sakta hai aur price upar ki taraf badhne ka indication ho sakta hai. 2. Hanging Man Pattern: Hanging man pattern ek bearish reversal pattern hai jo uptrend ke top par ban jata hai. Is pattern mein candlestick ka body chota hota hai aur woh candlestick ke bottom ke qareeb hota hai. Iske sath hi, candlestick ka lower shadow body ke kam se kam do guna lamba hota hai. Agar upper shadow maujood hai, toh woh chota ya bilkul na ho. Hanging man pattern yeh ishara karta hai keh selling pressure badh rahi hai aur buyers control kho rahe hain. Isse trend reversal ho sakta hai aur price neeche ki taraf badhne ka indication ho sakta hai. Dono patterns ko tab tak significant samjha jata hai jab woh pehle wale trend ke baad ban jate hain aur unko subsequent price action confirm karta hai. Traders aur analysts aksar in patterns ko dusre technical indicators aur chart patterns ke sath istemal karte hain, taaki informed trading decisions liye ja sakein. Yaad rakhein keh koi bhi single pattern ya indicator 100% accurate predictions nahi deta hai, aur hamesha samjhdaari se comprehensive analysis ka istemal karna chahiye. INKO KAISY TRADE KREIN?? Hammer aur Hanging candlestick patterns ko trade karne ke liye, aap technical analysis ka istemal kar sakte hain. Yahan kuch steps hain jo aapko in patterns ko trade karne mein madad karenge:- Identify the Pattern: Sabse pehle, price charts par hammer aur hanging man patterns ko identify karein. Hammer pattern ko downtrend ke bottom par aur hanging man pattern ko uptrend ke top par dekha ja sakta hai. Iske liye, candlestick charts ka istemal karein aur relevant time frame ko select karein. .

.

- Confirm the Pattern: Pattern ko confirm karne ke liye, dusre technical indicators aur chart patterns ka istemal karein. Price action, trend lines, moving averages, aur oscillators jaise tools ka istemal karke pattern ki validity ko verify karein.

- Entry Point: Jab pattern confirm ho jaye, entry point ko determine karein. Hammer pattern mein, entry point usually hammer candlestick ke high level ke break ke baad hota hai. Hanging man pattern mein, entry point hanging man candlestick ke low level ke break ke baad hota hai. Stop loss aur target levels ko bhi set karein.

- Risk Management: Har trade mein risk management ka dhyan rakhein. Stop loss level ko set karein, jisse aapko potential losses control karne mein madad milegi. Position size ko bhi manage karein, jisse risk spread ho sake.

- Monitor the Trade: Jab aap trade enter kar lein, use closely monitor karein. Price movement ko observe karein aur target levels ko set karein. Agar trade in your favor chal rahi hai, trailing stop loss ka istemal karke profits ko lock karein.

- Exit Strategy: Jab price target levels ko touch kare ya phir trade against aapki expectations move karne lage, exit strategy ko follow karein. Profit booking aur stop loss levels ko adjust karein.

- Identify the Pattern: Sabse pehle, price charts par hammer aur hanging man patterns ko identify karein. Hammer pattern ko downtrend ke bottom par aur hanging man pattern ko uptrend ke top par dekha ja sakta hai. Iske liye, candlestick charts ka istemal karein aur relevant time frame ko select karein. .

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Introduction; Asalam o Alikum Doso umeed ha ap sb khairiat se hn gy aj ki post main hum reversal candlestick patterns ko discuss karen gy jo k hammer khlata Ha hum dekhen gy k inko kesy trading main use kia jata Ha Define the Hammer candlestick pattern; Dear friends ye candle stick bearish trend k end main appeared hoti ha or eski phchan ye ha k eski nechy se lami c wick hoti ha or chotic body hoti Ha Es lye ye dikhny main hammer jesi hoti Ha eski body bullish ya bearish ho skti ha lekin agr bullis body ho to string pattern mana jata Ha Ye change of trend honi ki nishani hoti ha or eski wick zahir karti ha k buyer ny market main entry li ha jiski wja se ye candle let them opr gai ha or wick bnai Hai es pattern ki confirmation ye hoti ha k es candle k bad nect candle bhi buy ki close ho or hammer se opr close Ho Trade using the Hammer Candlestick pattern; Piyary Enough hammer pattern main entry leny k lye eski confirmation lazmi ha jb hammer candle k bad dosri candle bullish close ho hum buy ki entry ley skty hain or hmara stop loss hammer candle k low k straight Ho Connection with the Hanging Man Candlestick pattern; Dear friends ye candle stick bullish trend k end main bnti ha ye b hammer jesi hoti ha choti body or long wich jo k let them be hoti Ha eski body bhi bullish ya bearish ho skti ha jb k bearish body wali candle ko strong smjha jata Haes k bad agr nxt candle sell ki close ho or hanging man nichy close ho k ye es pattern ki confirmation hoti ha or es k bad market sell main jati Ha Hanging Man pattern ka interpretation yeh hota hai ki initially buyers check mein hote hain aur price upar jaata Hai lekin phir sellers aa kar price ko neeche le Jaty Hain Isse market sentiment change ho sakta hai in patterns ka sahi tarah karna is identified aur unke saath sahi interpretation karna zaroori hota patterns hai Ye individual candles par based hote hain Shop with Hamme candlesticks; Dear Members Forex me Hum behtreen Tricks Sy trading Kr sakty Hain Or ye hammer candlestick pattern To Sub Sy ziata asan Hai Es me hum Trading Kr Ke bht ziata profit bna Sakty Hain dear members es pattern main trade leny k lye hmyn eski confirmation ka wait krna Chahiye Jb dosri candle bear ho or hanging man k low k nichy close ho to hum sell ki entry ly sakty hain or hmara stop loss hanging man candle k high tk ho gy

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:57 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим