What is the False breakout

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

False breakout, jo "Asal Toot" ke naam se bhi jaana jaata hai, maali market mein ek tajarba hai jahan kisi maal ki keemat aisa lagta hai ke woh kisi mukarar trading range ya makhsoos darje se bahar nikal rahi hai, lekin thori der baad apni rukh palat leti hai, jisse woh tajarbe karne wale karobarion ko jeb mein daal deti hai jo toot par dakhil hue thay. Asal toot aksar woh waqt paida hota hai jab market mein zyada gharqab hon. Yeh khabrein, maali data ke ikhraajat ya doosre woh asbaab jo trading mein achanak izafa karte hain, asal toot ko utpann kar sakte hain. Karobarion ko aksar aisa lagta hai ke yeh waqiyat qeemat ko mukarar dar se bahar nikalte hue ishaara hai, jis se woh mukhtalif rukhon mein dakhil ho jate hain. Lekin asal toot gumraahi ka bais bhi ban sakta hai. Aksar woh shakhs jo asal toot ke jhase mein khareedne ya bechne mein aata hai, woh khud ko maqrooz thes mein paata hai jab qeemat jaldi hi apna raasta palat leti hai. Yeh achanak tabdeeli mayoosi aur maali nuqsaan ka bais ban sakti hai, khaaskar woh karobarion ke liye jo munasib tor par risk management ke tareeqay nahi rakhte hain. Asal toot se bachne ke liye, karobarion ko aksar takneekiyat ka istemaal karna parta hai, jaise ke sahara aur mukhalifat darje, trend lines aur ishaaraat, taake karobar mein dakhil hone se pehle asal toot ki sahiyat ko tasdeeq kar saken. Is ke ilawa, tasdeeq ka intezaar karna aur asal toot dar se aage barhne wali qeemat mein mustamer harkat ki talaash karne se karobarion ko asal isharaat ko chhanne mein madad milti hai. Ikhtitam mein, asal toot maali market mein aam masla hai jo sadaqat karobarion ke liye wusat mein nuqsaan ka bais bana sakta hai. Takneekiyat ka istemaal karna, tasdeeq ka intezar karna aur mufeed risk management tareeqay rakhna, asal toot ki gumraahi se bachne ke liye ahem qadam hain. -

#3 Collapse

Forex trading mein jahan qeemat ke harkat ko maamooli tor par maandhal, geoplitik tawaqoat aur market ki jazbat ko shamil karne wale kai factors ka asar hota hai, wahaan traders aam tor par technical analysis par bharosa karte hain taake unko sahi faislay karne mein madad mile. Ek aam technical pattern jo traders se guzraar hota hai, woh hai breakout, jo tab hota hai jab kisi currency pair ki keemat aham level ko paar kar jaati hai, jo support ya resistance ka level hota hai. Magar, sabhi breakouts lambe arse tak chalti harkatoon ko hasil nahi karti. Jhooti breakouts, jo fakeouts kehlata hai, traders ko gumraah kar sakti hain aur agar unhe sahi se pehchaana aur manage nahi kiya gaya to nuksaan

bhi pohocha sakti hai.

Breakouts Ki Samajh:

Jhooti breakouts ki samajh se pehle, breakouts ka konsept samajhna zaroori hai. Breakout tab hota hai jab kisi currency pair ki keemat kisi aham level ko paar kar jaati hai, jo support ya resistance ka aham level hota hai, jo market sentiment mein tabdeeli ka nishaan ban sakta hai aur naye trend ka aghaaz ho sakta hai. Breakouts aam tor par zyada volatility aur trading volume ke saath aate hain, jo traders ko bhaari keemat ki harkatoon par faida uthane ke liye maamoolan kheenchte hain.

Breakouts Ke Qisam:

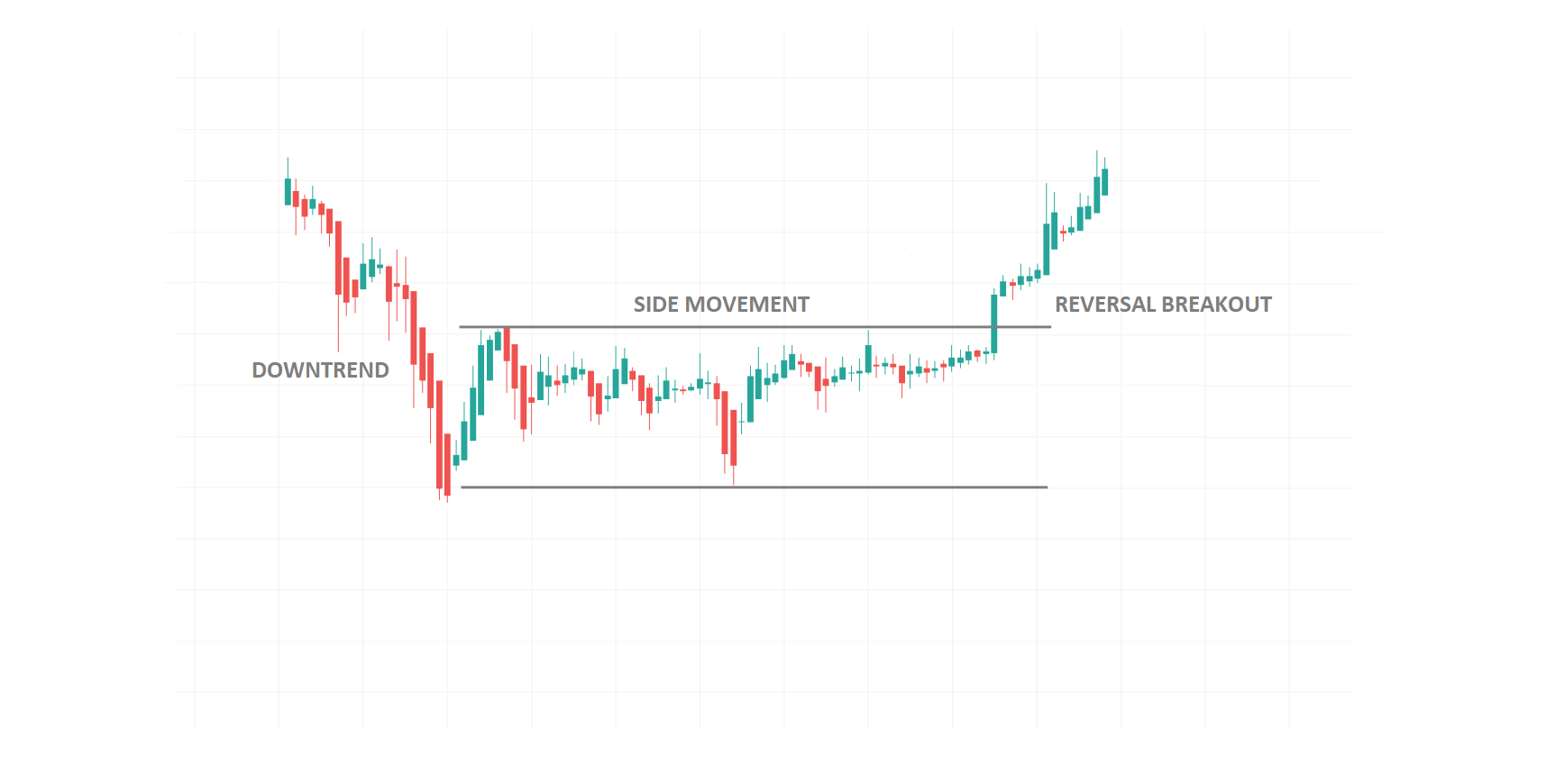

Breakouts ko do mukhya qisam mein taqseem kiya ja sakta hai: jari rahne wale breakouts aur ulte rukh wale breakouts.- Jari Rahne Wale Breakouts: Jari rahne wale breakouts tab hote hain jab keemat uptrend mein kisi resistance level ko paar kar jaati hai ya downtrend mein kisi support level ko neeche karte hain, jo mojooda trend ka jari rakhne ki alamat hoti hai.

- Ulte Rukh Wale Breakouts: Mukhaalif, ulte rukh wale breakouts tab hotay hain jab keemat downtrend mein kisi resistance level ko paar kar jaati hai ya uptrend mein kisi support level ko neeche karte hain, jo mojooda trend ka ulta hone ki nishaan hai.

Jhooti Breakouts Ki Khasusiyat:

Jhooti breakouts tab hoti hain jab keemat aham support ya resistance level ko mukammal tor par paar karne ke bajaye kuch waqt tak yahin rehti hai, jisse pehle trading range mein laut jati hai. Kai khasusiyat jhooti breakouts ko asal breakouts se mukhtalif banati hain:- Follow-Through Ki Kami: Jhooti breakout ki aham khasusiyat mein se ek ye hai ke woh follow-through momentum ki kami hoti hai. Isey aham level ke upar ya neeche tor karne ke baad, keemat jaldi se mukammal tor par palat jaati hai aur pehle trading range mein wapas chali jaati hai.

- Kam Trading Volume: Jhooti breakouts aksar kam trading volume par hoti hain, jo market ke shirkaat karne wale logon mein aham yaqeen ki kami ka ailaan karta hai. Asal breakouts, doosri taraf, aksar buland trading volume ke saath aate hain, jo keemat ki harkat ki jaayazgi ko tasdeeq karte hain.

- Whipsaw Keemat Ki Harkat: Jhooti breakouts whipsaw keemat ki harkat ka nateeja ho sakti hai, jo dono rukh mein tez aur be-inteha harkat ko peida karta hai. Ye volatility stop-loss orders ko trigger kar sakti hai aur traders ko ghalt traf mein pakarwa sakti hai.

- Failed Retests: Jhooti breakout ke baad, keemat aksar breached level ko dobara test karne ki koshish karti hai magar usay mukammal tor par paar nahi kar paati. Ye failed retest jhooti breakout ki taseer ko mazbooti deta hai aur traders ko apni positions ko dobara tay karna ka ishara deta hai.

Jhooti Breakouts Ke Asbaab: Kai factors jhooti breakouts ke hone ka asar daal sakte hain:- Market Manipulation: Kuch cases mein, jhooti breakouts bade institutional players ke market manipulation ka natija ho sakti hai jo stop-loss orders ko trigger karne aur retail traders mein panic selling ya buying ko anjaam dene ki koshish karte hain.

- Lack of Liquidity: Kam liquidity ki sharaetain, khaas tor par off-peak trading hours ya holiday periods mein, jhooti breakouts ke hone ki sambhavna ko bada sakti hain kyunke keemat ki harkat mein momentum mukammal hone ke liye kafi nahi hota.

- Price Data Mein Awaz: Price data mein awaz, be-inteha harkaton ya algorithmic trading activity ki wajah se, jhooti breakouts ko janam de sakti hai jo traders ko jaldi se positions enter karne par dhokha deti hai.

- Economic News Releases: High-impact economic news releases, jaise non-farm payroll data ya central bank announcements, jo keemat ki harkat mein tezi paida kar sakte hain aur jhooti breakouts ko janam de sakte hain jab traders news par turant react karte hain bina bazaar ke pehle se soch-samajh ke.

Jhooti Breakouts Ko Pehchanne Aur Kam Karne Ke Tareeqe: Jhooti breakouts ke asar ko kam karne ke liye kuch tareeqe hain:- Tasdeeqi Isharaat: Breakout par sirf bharosa karne ke bajaye, traders tasdeeqi isharaat ko dhoondh sakte hain taake breakout ki sahiyat ko tasdeeq karein. Ismein trading volume ka analysis karna, follow-through momentum ko monitor karna, aur breached level ko mukammal tor par paar hone ka intezar karna shamil hai.

- Technical Indicators Ka Istemal: Technical indicators jaise ke Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), aur Bollinger Bands market ki dynamics mein madadgar hote hain aur potential jhooti breakouts ko pehchanna mein madadgar ho sakte hain. Misal ke tor par, price aur momentum indicators ke darmiyaan farq jhooti breakout ka saboot ho sakta hai.

- Support aur Resistance Levels: Traders support aur resistance levels ko apni analysis mein shaamil kar sakte hain taake potential breakout points ko pehchan sakein aur asal aur jhooti breakouts ke darmiyaan farq ko samajh sakein. Historical price data ko jaanch karke, traders key levels ko identify kar sakte hain jahan price ko resistance ya support ka samna karna hai aur apni trading strategy ko uske mutabiq adjust kar sakte hain.

- Risk Management: Mazboot risk management practices ka istemal karne ke liye zaroori hai taake jhooti breakouts ka asar trading performance par kam kiya ja sake. Ismein stop-loss orders ko strategic levels par set karna taki potential nuksaan ko had se zyada na hone diya ja sake, trading positions ko diversify karke risk ko multiple currency pairs par taqseem karna, aur financial stability ko barqarar rakhne ke liye over-leveraging se bachna shamil hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#4 Collapse

What is the False breakout

False breakout, market analysis mein ek concept hai jise traders use karte hain jab price ek specific level ko temporarily cross karta hai, lekin phir wapas us level se bahir nikal jata hai. Yeh situation traders ke liye confusing ho sakti hai, kyun ki initially breakout hone ke baad market direction ka change hone ki expectation hoti hai, lekin jab price wapas revert ho jata hai, toh ise false breakout kehte hain.

Tafseelat se samjhein toh false breakout ko kuch key points se describe kiya ja sakta hai:- Breakout Level: False breakout tab hota hai jab price ek important support ya resistance level ko temporarily cross karta hai.

- Temporary Movement: Price breakout hone par market participants assume karte hain ki ab naya trend shuru hoga. Lekin false breakout mein, yeh movement temporary hota hai.

- Reversal: False breakout ke baad agar price wapas original range mein chala jata hai ya opposite direction mein move karta hai, toh ise reversal kehte hain.

- Volume Analysis: False breakout ka pata lagane ke liye traders volume analysis ka istemal karte hain. Agar breakout ke waqt volume kam hoti hai, toh yeh indication ho sakta hai ke movement temporary hai.

- Confirmation: Traders false breakout ko confirm karne ke liye dusre technical indicators aur price patterns ka istemal karte hain, taki unhe sahi trading decisions lene mein madad mile.

False breakouts common hote hain, aur inka asal reason market volatility, news events, ya manipulative trading activities ho sakti hai. Traders ko hamesha attentive rehna chahiye aur false breakouts se bachne ke liye risk management strategies ka istemal karna zaroori hai. Ismein trend confirmation aur multiple indicators ka use karke trading decisions ko validate karna bhi important hota hai.

-

#5 Collapse

What is the false breakout

1. تعارف (Introduction):

False Breakout ka matlab hota hai jab kisi financial instrument ki price kisi important level ko todati hai, lekin phir woh level sirf temporary hota hai aur price wapis usi direction mein move karna shuru kar deti hai. Yeh traders ke liye ek aham mudda ho sakta hai.

2. Breakout Kya Hai?

Breakout wo waqt hota hai jab kisi stock ya anya financial instrument ki price kisi specific level ko paar karke aage badhti hai. Breakout ko traders often ek naye trend ke shuru hone ka sign samajhte hain.

3. False Breakout Kya Hai?

False Breakout, jise kabhi "fakeout" bhi kaha jata hai, tab hota hai jab price kisi important support ya resistance level ko todati hai, lekin phir woh level asli nahi hota aur price wapis usi direction mein reverse ho jati hai.

4. Asbab (Causes) of False Breakouts:

Liquidity Issues:

False breakout mein ek wajah ho sakti hai market mein kam liquidity ki wajah se. Jab market mein kam volume hota hai, to kuch hi trades se prices mein drastic change ho sakta hai.

Market Manipulation:

Kabhi-kabhi big players market ko manipulate karke false breakouts create karte hain, jisse small traders ko trap kiya ja sake.

News Events:

Kuch false breakouts news events ke baad aate hain jab market mein sudden volatility hoti hai. Traders ko lagta hai ke breakout hua hai lekin asal mein temporary movement hoti hai.

5. False Breakout Ka Asar (Impact):

Losses for Traders:

False breakout se traders ko nuksan ho sakta hai, khas kar un logon ko jo breakout par trade karte hain. Agar woh sahi time par exit nahi karte, to nuksan ho sakta hai.

Confusion in Market Analysis:

False breakouts market analysis ko bhi mushkil bana sakte hain. Traders ko sahi trend ka pata lagana mushkil ho jata hai.

6. False Breakouts Se Bachne Ke Tariqe:

Confirmation Indicators:

Traders ko breakout ko confirm karne ke liye technical indicators ka istemal karna chahiye jaise ke moving averages, RSI, ya trendlines.

Wait for Confirmation:

Breakout dekhne ke baad traders ko thoda wait karna chahiye aur confirm hone par hi trade karna chahiye.

Risk Management:

Har trade mein risk management ka dhyan rakhna bahut zaroori hai. Stop-loss orders ka istemal false breakouts se bachne mein madadgar ho sakta hai.

7. Naseehat (Advice):

False breakouts se bachne ke liye traders ko hamesha cautious rehna chahiye aur har trade ko dhyan se analyze karna chahiye. Technical analysis ke sath-sath fundamental factors ka bhi dhyan rakhna important hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

### False Breakout: Tashreeh Aur Trading Mein Impact

Forex aur stock markets mein trading strategies aur patterns ki analysis karte waqt false breakouts ek common aur challenging phenomenon hote hain. False breakout trading signals ko mislead kar sakte hain aur traders ko unnecessary losses ka shikaar bana sakte hain. Aaj hum discuss karenge ke false breakout kya hota hai, iski characteristics kya hain, aur trading mein iska impact kaise manage kiya jata hai.

**False Breakout Kya Hai?**

False breakout tab hota hai jab market price ek key support ya resistance level ko break kar leti hai, lekin uske baad market wapas apne purane range ya trend ke area mein chali jati hai. Is situation ko false breakout kehte hain kyunki initial breakout ka signal misleading hota hai aur price expected direction mein nahi chalti. Yeh pattern trading decisions ko affect kar sakta hai aur risk ko increase kar sakta hai.

**False Breakout Ki Characteristics**

1. **Initial Breakout**: False breakout ke dauran, market price ek key support ya resistance level ko break karti hai. Yeh initial move traders ko signal deta hai ke market trend ya range change ho raha hai.

2. **Quick Reversal**: Breakout ke baad, market price jaldi se wapas apne purane level ya trend ki taraf revert kar jati hai. Yeh reversal indicate karta hai ke initial breakout ek false signal tha.

3. **Volume Analysis**: False breakouts mein volume analysis important hoti hai. Agar breakout ke dauran volume high hoti hai lekin price wapas revert karti hai, to yeh false breakout ko confirm kar sakta hai.

**Trading Mein False Breakout Ka Impact**

1. **Misleading Signals**: False breakouts trading signals ko misleading bana sakte hain. Traders jo breakout signal ke basis par trades enter karte hain, wo false signal ke shikaar ho sakte hain aur losses ka samna kar sakte hain.

2. **Increased Risk**: False breakouts risk ko increase karte hain kyunki traders ko incorrect trading decisions lene par majboor karte hain. Yeh incorrect decisions trading capital ko impact kar sakte hain aur profitability ko affect kar sakte hain.

3. **False Breakout Ke Indicators**: False breakout ko identify karne ke liye additional indicators aur tools ka use zaroori hai. Indicators jaise Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) market ke overall trend aur strength ko verify karne mein madad karte hain.

**False Breakout Ko Manage Karne Ke Tareeqe**

1. **Confirmatory Indicators**: False breakout ko avoid karne ke liye confirmatory indicators ka use karein. Multiple indicators aur tools ka combination aapko breakout ke authenticity ko verify karne mein madad karta hai.

2. **Volume Analysis**: Breakout ke dauran volume analysis ko monitor karna zaroori hai. High volume ke sath breakout agar sustain nahi hota, to yeh false breakout ka indication ho sakta hai.

3. **Risk Management**: Risk management strategies ko implement karna zaroori hai. Stop-loss orders aur position sizing techniques aapko false breakouts ke impact ko minimize karne aur capital ko protect karne mein madad karte hain.

**Nateejah**

False breakout ek common trading phenomenon hai jo traders ko misleading signals aur increased risk ke shikaar bana sakta hai. Is phenomenon ko samajh kar aur additional indicators aur tools ka use karke, aap false breakouts ko identify kar sakte hain aur apne trading decisions ko better manage kar sakte hain. Risk management aur confirmatory analysis ke zariye aap apne trading capital ko protect kar sakte hain aur potential losses ko minimize kar sakte hain. Trading mein success ke liye consistent analysis aur disciplined approach zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:10 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим