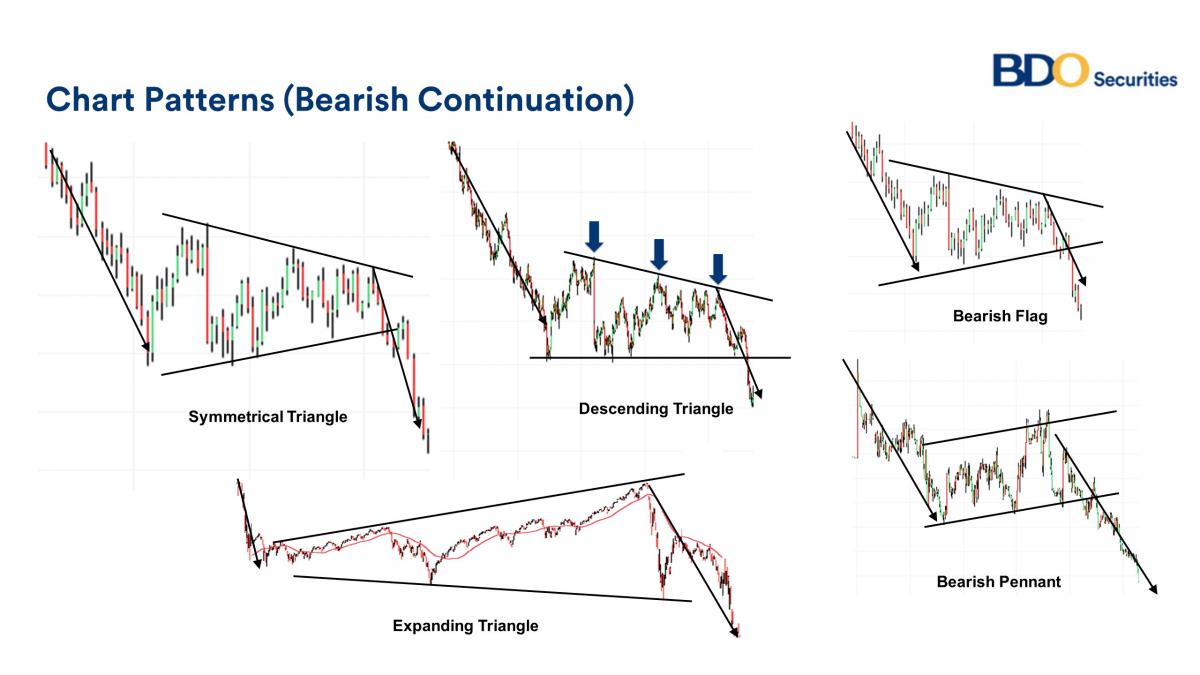

Bearish continuation patterns

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction Assalamu alaikum ummid Karti hun ke Forex ke tamam member se khairiyat se honge aur Apne Apne gharon Mein Apne kamon Mein Lage hue honge inshallah unko unki mehnat ka fal bhi jarur Milega unko chahie kya aap jyada se jyada mehnat Karen Taki aap logon ko bhi mehnat ka fal mile jitna jyada aap mehnat karenge utna hi aapko profit hasil hoga apna sakenge to bhaiyon aur bahanon yah topic Maine aap logon ke liye dhundha tha ki main aap logon ke sath share Karun aur aap isase fayda hasil kar saken aapko bhi chahie ki aap bhi koi topic dhundhe to hamare sath bhi share Karen aur dusre logon ke sath share Karen to ham bhi use kuchh profit hasil kar sake aur dusre log bhi se kuchh profit hasil kar saken ke bare mein batchit karte hain shukriya What is a bearish triangle? Lover member continue pattern wo hoty hain jo ksi trend pik pik bnty hain or es bat ki shishi hoti hain k bazar abhi apna trend rakhi ke continue. Aisy hi small triangle pattern hoti talisman or talisman is the main market that continues the market trend. aisy hi aik pola ko aj hum oku karen gy jo k nechi dya gaya hai. Triangle pattern Es, dscs kar rhi don't know why he betrayed. What is a triangle pattern? Dear members, bnta continues the main trend or reverse the bad bear market trend. deceptive triangle How are they formed? Dear member what is the basic type of market thori retracement lite or chart? or standing bazaar nechi aik support area or top bna k wapis usi support py aa jati enya or barabara obr ja k aik k k k bottom top bnati ha or former top se nehora hota ha. Estraha market can be divided into main line buildings or buildings. agr heights ko heights se milaya jai mun bottom row row ha or nechi base row se Mila diya ji triangle ha ha. how is business? Dear member, honi ka karna kahye jb black fly with full ice pattern still, karen ice waiting for squad ki base jo k hoti ha wahan se hota ha. the range is not expected to be sufficient or bad sales confirm the loss of the main entry, the main amount of the loss of the triangle is the profit target line equal to the main line of trf ho. -

#3 Collapse

-

#4 Collapse

-

#5 Collapse

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Bearish continuation patterns" stock market mein use hone wale technical analysis terms mein se hote hain. Ye patterns aksar ek downtrend mein existing hote hain aur indicate karte hain ki stock ya financial instrument ki down move jari rahegi. Yeh patterns traders aur investors ko market trends ko samajhne aur future price movements ka anumaan lagane mein madad karte hain. Kuch pramukh bearish continuation patterns niche diye gaye hain: Descending Triangle: Is pattern mein stock ka price continuously lower highs (uchitop) aur lower lows (neechot) banata hai, jo ki ek triangle shape mein dikhata hai. Yeh bearish pattern hota hai kyun ki lower levels par selling pressure zyada hota hai. Falling Wedge: Yeh bhi ek triangle pattern hai lekin isme price lines gradually converge hote hain. Yani, price ek narrow range mein move karta hai. Agar wedge ke breakout downward hota hai, to ye bearish continuation pattern hota hai. Bear Flag: Is pattern mein, ek downtrend ke baad price ek small uptrend (flag) banata hai, jise flagpole kehte hain. Yeh flagpole usually sharp downward move hota hai, phir flag ke breakout ke baad firse down move hota hai. Pennant: Pennant pattern bhi flag pattern ki tarah hota hai, lekin yeh short-term consolidation ke baad aata hai aur price lines ek triangle shape mein converge hote hain. Iska breakout bhi usually downward hota hai. Bearish Rectangle: Rectangle pattern ek consolidation phase hota hai, jisme price ek range mein move karta hai. Agar breakout downward hota hai, to ye bearish pattern hota hai. Three Black Crows: Yeh candlestick pattern hai, jisme three consecutive long black (downward) candles hote hain, har candle pehle se zyada neeche close hoti hai. Ye pattern strong selling pressure ko dikhata hai. Bearish Engulfing: Is pattern mein, ek bullish candle ek bearish candle se engulf hoti hai, yani bearish candle pehle wale bullish candle ki body ko completely cover karti hai. Ye reversal pattern bhi ho sakta hai, lekin downtrend mein bearish continuation pattern ke roop mein bhi dekha jata hai. Yeh patterns traders aur investors ke liye ek tool hote hain market trends aur price movements ko analyze karne ke liye. Lekin in patterns ko samajhne ke liye practice aur experience ki zarurat hoti hai, sath hi anya technical indicators aur market ke fundamentals ko bhi consider karna mahatvapurna hota hai.

Descending Triangle: Is pattern mein stock ka price continuously lower highs (uchitop) aur lower lows (neechot) banata hai, jo ki ek triangle shape mein dikhata hai. Yeh bearish pattern hota hai kyun ki lower levels par selling pressure zyada hota hai. Falling Wedge: Yeh bhi ek triangle pattern hai lekin isme price lines gradually converge hote hain. Yani, price ek narrow range mein move karta hai. Agar wedge ke breakout downward hota hai, to ye bearish continuation pattern hota hai. Bear Flag: Is pattern mein, ek downtrend ke baad price ek small uptrend (flag) banata hai, jise flagpole kehte hain. Yeh flagpole usually sharp downward move hota hai, phir flag ke breakout ke baad firse down move hota hai. Pennant: Pennant pattern bhi flag pattern ki tarah hota hai, lekin yeh short-term consolidation ke baad aata hai aur price lines ek triangle shape mein converge hote hain. Iska breakout bhi usually downward hota hai. Bearish Rectangle: Rectangle pattern ek consolidation phase hota hai, jisme price ek range mein move karta hai. Agar breakout downward hota hai, to ye bearish pattern hota hai. Three Black Crows: Yeh candlestick pattern hai, jisme three consecutive long black (downward) candles hote hain, har candle pehle se zyada neeche close hoti hai. Ye pattern strong selling pressure ko dikhata hai. Bearish Engulfing: Is pattern mein, ek bullish candle ek bearish candle se engulf hoti hai, yani bearish candle pehle wale bullish candle ki body ko completely cover karti hai. Ye reversal pattern bhi ho sakta hai, lekin downtrend mein bearish continuation pattern ke roop mein bhi dekha jata hai. Yeh patterns traders aur investors ke liye ek tool hote hain market trends aur price movements ko analyze karne ke liye. Lekin in patterns ko samajhne ke liye practice aur experience ki zarurat hoti hai, sath hi anya technical indicators aur market ke fundamentals ko bhi consider karna mahatvapurna hota hai.

-

#7 Collapse

-

#8 Collapse

"منÙÛŒ تسلسلی پیش روی پیٹرنز" Ùاریکس میں ایسے ٹیکنیکل پیٹرنز Ûیں جو منÙÛŒ اشارات دیتے Ûیں Ú©Û Ù‚ÛŒÙ…Øª Ú©ÛŒ منÙÛŒ ترتیبات جاری Ø±Û Ø³Ú©ØªÛŒ Ûیں۔ ان پیٹرنز کا مطلب Ûوتا ÛÛ’ Ú©Û Ù…ÙˆØ¬ÙˆØ¯Û Ù‚ÛŒÙ…Øª Ú©Û’ بعد بھی قیمت میں اور Ú©Ù…ÛŒ Ú©ÛŒ پیشگوئی Ú©ÛŒ جا سکتی ÛÛ’ØŒ اور انÛیں استعمال کر Ú©Û’ تجارت کار منÙÛŒ مارکیٹ Ú©ÛŒ پوزیشن Ú©Ùˆ مزید مدت Ú©Û’ لئے رکھ سکتے Ûیں۔ -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Assalamu alaikum ummid Karti hun ke Forex ke tamam member se khairiyat se honge aur Apne Apne gharon Mein Apne kamon Mein Lage hue honge inshallah unko unki mehnat ka fal bhi jarur Milega unko chahie kya aap jyada se jyada mehnat Karen Taki aap logon ko bhi mehnat ka fal mile jitna jyada aap mehnat karenge utna hi aapko profit hasil hoga apna sakenge to bhaiyon aur bahanon yah topic Maine aap logon ke liye dhundha tha ki main aap logon ke sath share Karun aur aap isase fayda hasil kar saken aapko bhi chahie ki aap bhi koi topic dhundhe to hamare sath bhi share Karen aur dusre logon ke sath share Karen to ham bhi use kuchh profit hasil kar sake aur dusre log bhi se kuchh profit hasil kar saken ke bare mein batchit karte hain shukriya What is a bearish triangle? Lover member continue pattern wo hoty hain jo ksi trend pik pik bnty hain or es bat ki shishi hoti hain k bazar abhi apna trend rakhi ke continue. Aisy hi small triangle pattern hoti talisman or talisman is the main market that continues the market trend. aisy hi aik pola ko aj hum oku karen gy jo k nechi dya gaya hai. Dear member what is the basic type of market thori retracement lite or chart? or standing bazaar nechi aik support area or top bna k wapis usi support py aa jati enya or barabara obr ja k aik k k k bottom top bnati ha or former top se nehora hota ha. Estraha market can be divided into main line buildings or buildings. agr heights ko heights se milaya jai mun bottom row row ha or nechi base row se Mila diya ji triangle ha ha. how is business? Dear member, honi ka karna kahye jb black fly with full ice pattern still, karen ice waiting for squad ki base jo k hoti ha wahan se hota ha. the range is not expected to be sufficient or bad sales confirm the loss of the main entry, the main amount of the loss of the triangle is the profit -

#10 Collapse

Trading mein technical analysis ek bohot important role play karta hai, aur ismein candlestick patterns ko identify karna ek crucial skill hai. Bearish continuation patterns aise patterns hain jo indicate karte hain ke existing downtrend continue hoga. Ye patterns traders aur investors ko market ke trend ko samajhne aur accordingly apne trading decisions ko align karne mein madad karte hain.

Bearish continuation patterns wo candlestick formations hain jo existing downtrend ke continue hone ki indication dete hain. Yeh patterns market ke temporary pauses ya consolidations ke baad re-emergence of selling pressure ko highlight karte hain. Bearish continuation patterns ka matlub yeh hota hai ke market mein selling pressure abhi bhi strong hai aur prices aur neeche girne ki sambhavana hai.

Common Bearish Continuation Patterns- Bearish Flag

- Bearish Pennant

- Descending Triangle

- Bearish Rectangle

- Bearish Wedge

Bearish flag pattern ek short-term bearish continuation pattern hai jo steep decline ke baad form hota hai. Is pattern mein price ek parallel channel ke andar consolidate hoti hai aur phir breakout karke niche girti hai.

Formation- Pole: Steep decline jo initial selling pressure ko depict karta hai.

- Flag: Parallel channel jisme price temporarily consolidate hoti hai.

- Breakout: Price channel ke neeche breakout karti hai, confirming the continuation of the downtrend.

Bearish flag pattern yeh indicate karta hai ke market mein short-term consolidation ke baad selling pressure wapas dominate kar raha hai. Yeh pattern trend continuation ka strong signal hai, specially jab volume breakout ke dauran increase ho.

Trading Strategy- Bearish flag identify karo.

- Breakout ka wait karo. Jab price channel ke neeche breakout karti hai to sell position open karo.

- Stop loss flag ki upper boundary ke upar lagao.

- Target profit pole ki height ke barabar set karo.

Bearish pennant pattern bhi ek short-term bearish continuation pattern hai jo steep decline ke baad form hota hai. Is pattern mein price ek symmetrical triangle ke shape mein consolidate hoti hai aur phir breakout karke neeche girti hai.

Formation- Pole: Steep decline jo initial selling pressure ko depict karta hai.

- Pennant: Symmetrical triangle jisme price temporarily consolidate hoti hai.

- Breakout: Price triangle ke neeche breakout karti hai, confirming the continuation of the downtrend.

Bearish pennant pattern bhi bearish flag ki tarah hi trend continuation ka strong signal hai. Is pattern ka breakout confirm karta hai ke downtrend continue hoga.

Trading Strategy- Bearish pennant identify karo.

- Breakout ka wait karo. Jab price triangle ke neeche breakout karti hai to sell position open karo.

- Stop loss triangle ki upper boundary ke upar lagao.

- Target profit pole ki height ke barabar set karo.

Descending triangle pattern ek longer-term bearish continuation pattern hai jo downtrend ke dauran form hota hai. Is pattern mein lower highs aur ek horizontal support line form hoti hai.

Formation- Lower Highs: Har high previous high se neeche hota hai, jo selling pressure ko indicate karta hai.

- Horizontal Support: Ek horizontal line jo multiple lows ko connect karti hai.

- Breakout: Price horizontal support ke neeche breakout karti hai, confirming the continuation of the downtrend.

Significance

Descending triangle pattern yeh indicate karta hai ke market mein selling pressure gradually increase ho raha hai aur ek point par price support line ko break karke niche gir sakti hai.

Trading Strategy- Descending triangle identify karo.

- Breakout ka wait karo. Jab price support line ke neeche breakout karti hai to sell position open karo.

- Stop loss triangle ke upper boundary ke upar lagao.

- Target profit triangle ki height ke barabar set karo.

Bearish rectangle pattern ek medium-term bearish continuation pattern hai jo ek defined range mein price ki consolidation ko depict karta hai. Is pattern mein price ek horizontal range ke andar trade karti hai aur phir breakout karke neeche girti hai.

Formation- Consolidation Range: Price ek horizontal range ke andar trade karti hai.

- Breakout: Price range ke neeche breakout karti hai, confirming the continuation of the downtrend.

Significance

Bearish rectangle pattern yeh indicate karta hai ke market mein temporary consolidation ke baad selling pressure wapas dominate kar raha hai. Yeh pattern trend continuation ka clear signal hai.

Trading Strategy- Bearish rectangle identify karo.

- Breakout ka wait karo. Jab price range ke neeche breakout karti hai to sell position open karo.

- Stop loss range ki upper boundary ke upar lagao.

- Target profit range ki height ke barabar set karo.

Bearish wedge pattern ek medium-to-long-term bearish continuation pattern hai jo narrowing price range ko depict karta hai. Is pattern mein price gradually higher lows aur higher highs banati hai magar narrowing range ke andar.

Formation- Narrowing Range: Price gradually higher lows aur higher highs banati hai, lekin range narrow hoti jati hai.

- Breakout: Price wedge ke neeche breakout karti hai, confirming the continuation of the downtrend.

Significance

Bearish wedge pattern yeh indicate karta hai ke market mein selling pressure gradually accumulate ho raha hai aur eventually price niche gir sakti hai. Yeh pattern trend continuation ka reliable signal hai.

Trading Strategy- Bearish wedge identify karo.

- Breakout ka wait karo. Jab price wedge ke neeche breakout karti hai to sell position open karo.

- Stop loss wedge ki upper boundary ke upar lagao.

- Target profit wedge ki height ke barabar set karo.

Combining Bearish Continuation Patterns with Other Indicators

Bearish continuation patterns ko doosre technical indicators ke sath combine karke trading strategies ko aur bhi robust banaya ja sakta hai. Yeh combination traders ko zyada accurate signals provide karta hai aur risk management mein bhi madad karta hai.

1. Moving Averages

Moving averages bearish continuation patterns ke sath use karke trend confirmation aur signal strength ko assess karne mein madad milti hai. Jab price moving average ke neeche trade kar rahi ho aur bearish continuation pattern form ho raha ho to downtrend ke continue hone ka strong signal milta hai.

2. Relative Strength Index (RSI)

RSI ko use karke overbought aur oversold conditions ko assess kiya ja sakta hai. Agar RSI oversold zone mein ho aur bearish continuation pattern form ho raha ho to yeh strong selling pressure ko indicate karta hai.

3. Volume Analysis

Volume analysis se breakout ki strength ko assess kiya ja sakta hai. Bearish continuation patterns ke breakout ke dauran volume zyada ho to yeh strong signal hota hai ke downtrend continue hoga.

Practical Example

Ek practical example se bearish continuation patterns ko samajhna aur bhi aasaan ho jata hai. Chaliye ek stock ABC ka example lete hain jo downtrend mein hai.

Step-by-Step Analysis- Identify the Downtrend: ABC stock pichle kuch weeks se consistently neeche ja raha hai aur downtrend mein hai.

- Spot the Bearish Flag Pattern: Ek din ABC stock ek bearish flag pattern form karta hai jisme steep decline ke baad price ek parallel channel mein consolidate hoti hai.

- Wait for Breakout: ABC stock channel ke neeche breakout karti hai, confirming the continuation of the downtrend.

- Execute the Trade: Breakout ke baad trader ABC stock ko sell karta hai aur stop loss channel ke upper boundary ke upar lagata hai.

- Monitor and Exit: Trader apne target profit levels set karta hai aur position ko accordingly manage karta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

- CL

- Mentions 0

-

سا0 like

-

#11 Collapse

Assalamu alikum Dear friends and fellows Bearish continuation patterns, markyt mein downtrend ky continuation (jaari rehne) ka indication dete hein. Yani, jab markyt pehle se downward trend mein hey aur yeh patterns nazar aate hein, to yeh indicate karte hein ky markyt ka downtrend jaari reh sakta hey. Neeche kuch common bearish continuation patterns hein:

Bearish Flag Pattern:

Bearish flag pattern ik small consolidation phase hota hey jo ik downward trend ky baad nazar aata hey. Yeh pattern ik flag shape ka hota hey jisse ik mast up move ky baad ik gradual downward move hota hey, jise "flagpole" kyhte hein. Isky baad ik small rectangular consolidation phase aata hey jise "flag" kyhte hein. Flag breakout ky baad markyt usually wapas downtrend mein jata hey. Bearish

Pennant Pattern:

Bearish pennant pattern bhi ik consolidation pattern hota hey, jise "pennant" kyhte hein. Is pattern mein bhi pehle ik strong downward move hota hey, usky baad ik small rectangular consolidation phase aata hey. Yeh consolidation phase pennant ky shape ko banata hey. Jab pennant breakout hota hey, markyt typically wapas downtrend mein move karta hey.

Bearish Descending Triangle Pattern:

Descending triangle pattern ik continuation pattern hota hey jo ik downward trend ky baad nazar aata hey. Is pattern mein price lower highs banata hey aur ik horizontal support line form hoti hey. Yeh bearish breakout ky baad typically price down move karta hey.

Bearish Falling Wedge Pattern:

Falling wedge pattern bhi ik bearish continuation pattern hota hey, likin ismein price ik wedge shape mein move karta hey, jisse niche ki taraf narrower hota hey. Yeh pattern typically uptrend ky baad aata hey aur price wedge ky breakout ky baad wapas downtrend mein move karta hey.

Bearish Triple Top Pattern:

Triple top pattern ik sideways trading range hota hey jismein price ik se zyada baar ik certain level par resistance banata hey. Jab price teesri baar se wapas resistance par aata hey aur waha se neeche jaata hey, to yeh bearish continuation pattern ho sakta hey. In patterns ko samajh kar aur confirming signals ky saath trade karte waqt zaroori hey. Har pattern ky liye confirming signals alag ho sakte hein, jaise ki price action, technical indicators, aur markyt sentiment ka istemal karna. Isky alawa, apne trading strategy aur risk management ko bhi maintain karein. Bearish continuation patterns markyt mein downtrend ky continuation (jaari rehne) ka indication dete hein. Yani, jab markyt pehle se downward trend mein hey aur yeh patterns nazar aate hein, to yeh suggest karte hein ky markyt ka downtrend jaari reh sakta hey. Neeche kuch common bearish continuation patterns hein, sath hi unki pehchaan ky tareeqe:- Bearish Flag Pattern

- Pehchaan: Bearish flag pattern mein pehle ik strong downward move hota hey (flagpole). Usky baad ik small rectangular consolidation phase aata hey jo ik flag ky shape ko banata hey. Confirmation: Jab flag ky breakout ky baad price neeche move karta hey, to bearish continuation ki confirmation hoti hey.

- 2. Bearish Pennant Pattern

- : Pehchaan: Bearish pennant pattern mein bhi pehle ik strong downward move hota hey. Usky baad ik small rectangular consolidation phase aata hey jise pennant kyhte hein. Confirmation: Jab pennant ky breakout ky baad price neeche move karta hey, to bearish continuation ki confirmation hoti hey.

- 3. Bearish Descending Triangle Pattern:

- Pehchaan: Descending triangle pattern mein price lower highs banata hey aur ik horizontal support line form hoti hey. Confirmation: Jab triangle ky breakout ky baad price neeche move karta hey, to bearish continuation ki confirmation hoti hey.

- 4. Bearish Falling Wedge Pattern:

- Pehchaan: Falling wedge pattern mein price ik wedge shape mein move karta hey, jisse niche ki taraf narrower hota hey. Confirmation: Jab wedge ky breakout ky baad price neeche move karta hey, to bearish continuation ki confirmation hoti hey.

- 5. Bearish Triple Top Pattern:

- Pehchaan: Triple top pattern mein price teesri baar se wapas resistance level par aata hey aur waha se neeche jaata hey. Confirmation: Jab price teesri baar resistance level par se neeche move karta hey, to bearish continuation ki confirmation hoti hey. Har pattern ky liye confirming signals aur technical indicators ka istemal karky trading strategy ko strengthen kiya ja sakta hey. Isky alawa, price action, volume analysis, aur markyt sentiment bhi important factors hoty hein bearish continuation patterns ko samajhne aur trade karne mein.

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Bearish Continuation Patterns**

Forex trading mein market trends aur movements ko samajhna bohot zaruri hota hai. Jab market ek specific direction mein move kar raha hota hai, traders continuation patterns ka use karke us direction ke further continuation ko predict kar sakte hain. Bearish continuation patterns aise patterns hain jo indicate karte hain ke downtrend continue hoga. Aayein kuch common bearish continuation patterns ko discuss karte hain.

**1. Bearish Flag:**

Bearish Flag pattern ek steep downtrend ke baad banta hai. Yeh pattern do parallel lines ke beech mein hota hai jo ek sloping rectangle banata hai. Is pattern mein price temporarily consolidate hoti hai aur phir downtrend continue karta hai. Flag ka length downtrend ke potential extension ko indicate karta hai. Jab price flag ke lower trendline ko break karti hai, to yeh ek strong sell signal hota hai.

**2. Bearish Pennant:**

Bearish Pennant pattern bhi steep downtrend ke baad form hota hai lekin yeh flag ke mukable mein ek symmetrical triangle banata hai. Yeh pattern market mein short-term consolidation ko indicate karta hai jahan price lower highs aur higher lows banati hai. Pennant ka breakout usually original downtrend ke continuation ko signify karta hai. Jab price lower trendline ko break karti hai, traders sell positions lete hain.

**3. Descending Triangle:**

Descending Triangle pattern ek horizontal support line aur ek descending resistance line ke zariye form hota hai. Is pattern mein price repeatedly support line ko test karti hai lekin har bar lower highs banati hai. Jab price support line ko break karti hai, to yeh downtrend ke continuation ka strong indication hota hai. Descending Triangle ka breakout volume ke sath confirm hota hai.

**4. Bearish Rectangle:**

Bearish Rectangle pattern do horizontal lines ke beech mein price consolidation ko show karta hai. Is pattern mein price ek defined range ke beech mein move karti hai. Jab price lower horizontal line ko break karti hai, to yeh ek bearish signal hota hai aur downtrend continue karta hai. Rectangle ka breakout volume ke sath confirm hota hai.

**5. Bearish Wedge:**

Bearish Wedge pattern ek narrowing channel banata hai jahan price higher lows aur lower highs banati hai. Yeh pattern downtrend ke baad form hota hai aur consolidation ko indicate karta hai. Jab price wedge ke lower trendline ko break karti hai, to yeh downtrend ke continuation ka signal hota hai. Is pattern ka breakout volume ke sath confirm hota hai.

**Conclusion:**

Bearish continuation patterns traders ko market ke downtrend ke continuation ko predict karne mein madad karte hain. In patterns ko sahi tareeke se identify karne ke liye technical analysis aur price action ko samajhna bohot zaruri hai. Jab yeh patterns breakout hote hain, to yeh strong sell signals provide karte hain. Lekin, in patterns ko use karte waqt risk management aur other confirmation tools ko zarur consider karna chahiye taake aapki trading decisions aur zyada accurate aur profitable ho sakein.

-

#13 Collapse

bearish jari rakhne wale pattern

bearish jari rakhne wale pattern ve chart pattern hote hain jo bearish trend ke jari rahane ki sambhavna ka sanket dete hain. ve kai tarah ke hote hain, lekin kuchh sabse aam hain:- bear flag: yah ek bearish pattern hai jo ek downward trend ke bad banta hai . iski visheshta ek lambi, samantra channel hai jiske bad ek teji se girti hui kimat hoti hai. bear flag is baat ka sanket dete hain ki bechne wala dabav jari hai aur kimat men aur girne ki sambhavna hai.

- bearish pendant: yah ek bearish pattern hai jo ek upward trend ke bad banta hai. iski visheshta ek lamba, samantra channel hai jiske bad teji se girti hui kimat hoti hai. bearish pendant is baat ka sanket dete hain ki kharidne wala dabav kam ho raha hai aur kimat men aur girne ki sambhavna hai.

- head and shoulders top: yah ek bearish pattern hai jo ek upward trend ke ant men banta hai. iski visheshta ek lamba, kendriya "sir" hota hai jiske donon taraf chhote, "kandhe" hote hain. sir aur kandheyon ke baad teji se girti hui kimat hoti hai. sir aur kandhe top is baat ka sanket dete hain ki upward trend khatm ho gaya hai aur kimat men girne ki sambhavna hai.

- double top: yah ek bearish pattern hai jo ek upward trend ke ant men banta hai. iski visheshta do lagbhag saman unchai tak pahunchne wali kimaten hoti hain. do shirshon ke baad teji se girti hui kimat hoti hai. double top is baat ka sanket dete hain ki upward trend khatm ho gaya hai aur kimat men girne ki sambhavna hai.

- tripple top: yah ek bearish pattern hai jo ek upward trend ke ant men banta hai. iski visheshta teen lagbhag saman unchai tak pahunchne wali kimaten hoti hain. teen shirshon ke baad teji se girti hui kimat hoti hai. tripple top is baat ka sanket dete hain ki upward trend khatm ho gaya hai aur kimat men girne ki sambhavna hai.

- Ripple

- Mentions 0

-

سا0 like

-

#14 Collapse

**BEARISH CONTINUATION PATTERNS IN FOREX TRADING**

Forex trading mein market trends aur patterns ko samajhna bohot zaroori hota hai. Aaj hum bearish continuation patterns ke bare mein baat karenge. Yeh patterns traders ko signal dete hain ke current downtrend continue rehne wala hai. Bearish continuation patterns ka sahi se analysis aur use karna profitable trading decisions mein madad kar sakta hai.

### Bearish Continuation Patterns Kya Hain?

Bearish continuation patterns aise chart patterns hain jo indicate karte hain ke existing downtrend continue rahega. Yeh patterns typically consolidation phase ke baad form hote hain jahan price temporarily stabilize hoti hai, lekin phir dubara downtrend resume hota hai. In patterns ko pehchan karna aur inke signals ko sahi tarah se use karna traders ke liye bohot faida mand hota hai.

### Common Bearish Continuation Patterns

#### 1. **Bearish Flag:**

Bearish flag ek common continuation pattern hai jo strong downtrend ke baad form hota hai. Is pattern mein price ek parallel channel mein consolidate hoti hai. Flagpole represent karta hai initial sharp move aur flag represent karta hai consolidation phase. Jab price flag ke niche breakout karti hai, toh downtrend continue ho jata hai.

#### 2. **Bearish Pennant:**

Bearish pennant bhi ek continuation pattern hai jo flag ke tarah hota hai, lekin ismein consolidation phase triangular shape mein hoti hai. Pennant ka formation bhi ek sharp decline ke baad hota hai. Jab price pennant ke neeche breakout karti hai, toh downtrend resume ho jata hai.

#### 3. **Descending Triangle:**

Descending triangle pattern ek bearish continuation pattern hai jo lower highs aur horizontal support line se banta hai. Is pattern mein price repeatedly horizontal support ko test karti hai. Jab price support level ko todti hai, toh downtrend continue ho jata hai.

### Kaise Identify Karein Bearish Continuation Patterns

Bearish continuation patterns ko identify karne ke liye kuch specific points ka khayal rakhein:

1. **Strong Downtrend:** Yeh patterns typically strong downtrend ke baad form hote hain.

2. **Consolidation Phase:** Patterns mein ek consolidation phase hota hai jahan price temporarily stabilize hoti hai.

3. **Breakout Confirmation:** Patterns ka breakout signal downtrend continuation ka confirmation deta hai.

### Trading Strategy

Jab bearish continuation pattern identify ho jaye, toh traders typically breakout ka wait karte hain. Breakout ke baad short positions open ki ja sakti hain. Stop-loss typically pattern ke high ke thoda upar set kiya jata hai taake risk manage ho sake. Target levels previous support levels pe set kiye ja sakte hain.

### Risk Management

Koi bhi pattern 100% accurate nahi hota, is liye risk management ka khayal rakhna bohot zaroori hai. Stop-loss aur take-profit levels ko zaroor set karein taake aap apne losses ko minimize kar sakein.

### Conclusion

Bearish continuation patterns ek important tool hain jo traders ko existing downtrend ke continuation ka signal dete hain. In patterns ko samajhna aur effectively use karna trading mein bohot faida mand ho sakta hai. Lekin hamesha yaad rakhein ke kisi bhi pattern ko sirf aik tool ke tor pe use karein aur additional confirmations zaroor consider karein. Trading mein patience aur discipline ka bohot bara role hota hai, is liye market analysis pe focus karein aur apni strategies ko test aur refine karte rahen.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Main Bearish Continuation Patterns

Forex trading main, chart patterns ka analysis karna buhat zaroori hota hai. Inhi chart patterns ke zariye hum price movements ka andaza lagatay hain. Bearish continuation patterns woh patterns hain jo indicate karte hain ke downtrend jaari rehne wala hai. Yeh patterns traders ko market ke trend ko samajhne mein madad karte hain aur trading decisions ko behter banate hain.

1. Bear Flag

Bear flag pattern ek common bearish continuation pattern hai. Yeh pattern tab banta hai jab market ek steep decline ke baad thodi si upward correction dekhti hai, jo ek rectangular shape mein hoti hai. Is correction ke baad price dobara neeche girti hai, jis se ek aur bearish move start hota hai. Is pattern ko samajhne ke liye, pehle steep decline aur phir consolidation phase ko identify karna hota hai. Yeh pattern yeh indicate karta hai ke sellers abhi bhi market mein hain aur price ko aur neeche push kar sakte hain.

Bear flag ko pehchanne ka asaan tareeqa yeh hai ke jab price steep decline ke baad thodi si upward movement kare aur ek rectangular consolidation phase banaye. Phir jab price is consolidation range ko neeche break kare, to yeh ek signal hota hai ke bearish trend continue hoga.

2. Descending Triangle

Descending triangle pattern bhi ek common bearish continuation pattern hai. Yeh pattern tab banta hai jab market mein lower highs aur horizontal support level dekhne ko milte hain. Yeh indicate karta hai ke selling pressure ziada hai aur buyers support level ko hold nahi kar pa rahe. Jab price horizontal support level ko break karti hai, to yeh ek strong bearish signal hota hai.

Is pattern ko pehchanne ke liye, pehle lower highs aur horizontal support line ko identify karna hota hai. Jab price support level ko break karay, to yeh ek bearish trend continuation ka signal hota hai. Descending triangle pattern yeh indicate karta hai ke sellers market mein dominate kar rahe hain aur price ko neeche push kar rahe hain.

3. Head and Shoulders

Head and shoulders pattern, particularly inverse head and shoulders pattern, ek reliable bearish continuation pattern hai. Yeh pattern tab banta hai jab market ek uptrend ke baad reverse ho kar lower highs aur lower lows banata hai. Is pattern mein do shoulders aur ek head hota hai. Shoulder points lower highs ko represent karte hain aur head point ek aur lower high ko represent karta hai jo shoulders ke darmiyan hota hai.

Inverse head and shoulders pattern mein, pehle left shoulder banta hai, phir head aur phir right shoulder. Jab price neckline ko neeche break karti hai, to yeh ek bearish trend continuation ka strong signal hota hai. Is pattern ko pehchanne ke liye shoulders aur head ko identify karna zaroori hai. Inverse head and shoulders pattern yeh indicate karta hai ke buyers ka strength khatam ho chuki hai aur sellers market mein dominate kar rahe hain.

4. Bearish Pennant

Bearish pennant pattern bhi ek popular bearish continuation pattern hai. Yeh pattern tab banta hai jab market ek steep decline ke baad ek symmetric triangle banata hai. Is pattern mein price ek narrow range mein consolidate karti hai. Jab price is narrow range ko neeche break karay, to yeh ek bearish trend continuation ka signal hota hai.

Is pattern ko pehchanne ke liye pehle steep decline aur phir symmetric triangle consolidation ko identify karna hota hai. Jab price is symmetric triangle ko neeche break karay, to yeh indicate karta hai ke bearish trend jaari rehne wala hai. Bearish pennant pattern yeh indicate karta hai ke sellers market mein abhi bhi strong hain aur price ko aur neeche le jaane ka potential rakhte hain.

5. Double Top

Double top pattern bhi ek common bearish continuation pattern hai. Yeh pattern tab banta hai jab price do martaba upper resistance level ko touch kar ke neeche aati hai. Yeh indicate karta hai ke resistance level strong hai aur buyers is level ko break nahi kar pa rahe. Jab price second top se neeche girti hai aur neckline ko break karti hai, to yeh ek bearish trend continuation ka strong signal hota hai.

Is pattern ko pehchanne ke liye do tops aur neckline ko identify karna hota hai. Jab price neckline ko break karay, to yeh indicate karta hai ke bearish trend continue hoga. Double top pattern yeh indicate karta hai ke sellers market mein dominate kar rahe hain aur price ko neeche push kar rahe hain.

Note

Forex trading main bearish continuation patterns ko samajhna aur pehchanna buhat zaroori hai. Yeh patterns humein market ke trend ko samajhne mein madad karte hain aur trading decisions ko behter banate hain. Bear flag, descending triangle, inverse head and shoulders, bearish pennant, aur double top kuch common bearish continuation patterns hain. In patterns ko identify karke aur inka analysis karke hum market mein profitable trading opportunities ko identify kar sakte hain. Forex trading mein successful hone ke liye technical analysis ko samajhna aur apply karna buhat zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:14 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим